This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NTT (9432) To Overpay To Take Over NTT Data (9613) Subsidiary?

- This morning, the Nikkei says NTT (Nippon Telegraph & Telephone) (9432 JP) has decided, 5 years after taking Docomo private, to buy out minorities in NTT Data Corp (9613 JP).

- NTT owns 58%. The article suggests a “30-40% premium” (¥3,900-4,200) “is likely”, with the parent spending ¥2-3trln (¥3,380-5,060) on the deal. The numbers are a bit all over the place.

- It will go limit up today to ¥3,492. A deal should be announced today after the close when NTT Data reports earnings. There’s a cool index event too.

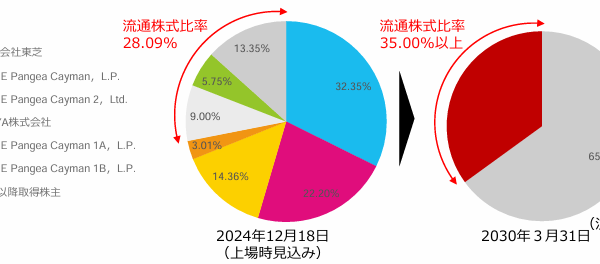

2. CATL (300750 CH): Index Inclusion as Potential Listing Nears

- Reports continue to indicate a US$5bn raise for CATL H-shares with a discount of up to 10% to CATL (300750 CH) and with cornerstone investors taking up half the deal.

- The company is currently gauging investor demand. The IPO could open next week and the H-shares could list later this month.

- Index Fast Entry largely depends on the cornerstone investor allocation. Float higher than 50%/60% is required for Fast Entry to global indices.

3. ShinKong (2888 TT)/Taishin (2887 TT) – Time To Deal Is Shorter, But Risk To Peers Is Higher

- The last couple of days have seen the TWD increase value against the USD extremely sharply. This has caused the Shin Kong/Taishin risk arb spread to widen.

- There is no expectation that the merger will be delayed, but the change in USDTWD rate introduces a new dynamic into the ShinKong-as-Taishin-vs Peers trade.

- Careful consideration of this trade going forward is worthwhile. What may have been the better trade may no longer be the better trade.

4. Laopu Gold (6181 HK): US$300m Primary Placement & Index Inclusion Green Light

- Full circulation implementation at the beginning of April derailed Laopu Gold (6181 HK)‘s chances of global index inclusion in May.

- The company has now launched a US$300m primary placement that will significantly improve chances of inclusion in the same global index in August.

- Laopu Gold (6181 HK) will also be added to another global index in September, so there are a few index inclusions likely for the stock this year.

5. [Japan M&A] NTT (9432) Overpays To Buy Out NTT Data (9613) Minorities

- Pre-Open, we got a Nikkei article which suggested four different prices possible. We got something in the middle. I think NTT is probably overpaying here.

- There is a fair bit of transparency in the documents and valuation. That is encouraging. There are no synergies counted in the fair calculations. That is discouraging.

- This will not trade like a “normal” Japan risk arb situation. There will be nuances.

6. Rare Arb Opportunity from ATS Breakout in Korea: Day-Night Spread

- Local traders are targeting the spread between day and NXT’s after-hours, a classic arb play similar to what Japanese instos used when ATS first launched, now emerging in Korea.

- The gap persists because institutional flow on NXT is still minimal, with recent data showing instos accounting for just 1-2% of total turnover.

- NXT’s night session is seeing heavy retail flow, providing instos with the liquidity to trade. This creates a rare opportunity to capitalize on early inefficiencies before others catch on.

7. [Japan M&A] MitCorp (8058) Buys Out Subsidiary Mitsubishi Shokuhin (7451) – Bad Process, Bad Price

- Mitsubishi Shokuhin (7451 JP) was supposed to announce earnings at 2pm JST. They didn’t. Someone (or people) decided that meant there might be a takeover. There was.

- The stock popped nearly 15% to ¥6,200, paused, was flat for an hour, then popped again, closing at ¥6,150/share. Post-close, we get a deal at ¥6,340/share.

- A disappointing process. At ¥6,240, the Special Committee said it was “far from a standard that takes into account the interests of TargetCo’s minority shareholders.” At ¥6,340, they dealt. Aaaargh.

8. [Japan M&A] YAGEO Overbids Minebea’s Overbid of YAGEO’s Overbid of Minebea’s Overbid – The Endgame

- Yageo Corporation (2327 TT) has now strongly overbid Minebea’s weak overbid of Yageo’s strong overbid of Minebea’s weak overbid of Yageo’s initial hostile offer for Shibaura Electronics (6957 JP).

- We are now 40% higher than the initial bid and the best bid is approaching the top end of Valuation Agent’s top-of-DCF-range prices. There may be a bit more. Maybe.

- The question now is only whether Minebea responds. If it does, there is a little juice left, but if not, that’s it. It should get done.

9. [JAPAN M&A] Shionogi (4507) Bids for Torii Pharma (4551) – Split Price Deal on Weak Transparency

- Today after the close, Shionogi & Co (4507 JP) and Torii Pharmaceutical (4551 JP) announced an agreed deal whereby Shionogi would launch a Tender Offer to take over Torii.

- Torii Pharmaceutical shares rallied sharply after earnings so the actual TOB Price of ¥6,350/share is not a particularly high premium vs undisturbed. Valuation transparency is limited. Synergies are not included.

- But the price is an ATH, the company is heavily de-levered (so a 23% premium to undisturbed is decent) and the minimum threshold is not high.

10. A/H Premium Tracker (To 2 May 2025): AH Premia Fall Small; Spread Torsion Provides Continued Alpha

- A quiet week as most indices – HK and mainland – saw performance hover around zero for the three days both were open at the start of the week.

- For a couple of months I’ve thought warning signs were flashing and spreads could widen. Widening has paused. I am not comfortable it will remain paused or Hs will outperform.

- The Quiddity Portfolio is pretty hunkered down and nearly flat H/A risk. But benefits from spread torsion (wider spreads coming in, small premia widening). Alpha good again this week.