This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Index Consultation on DATCos Means MORE Selling Likely, and Another Index Questionable

- In mid-September, global index provider M _ _ _ announced that they were conducting an index consultation on Digital Asset Treasury Cos. I wrote about it here.

- My recommended short at the time is down 30%, despite announcing a large buyback program. Others have lost significant premium vs underlying digital assets.

- The same index provider expanded their list of affected names on 29 Oct. And a DIFFERENT Index provider this week added DATCOs to a US Advisory Panel Meeting Agenda Wednesday.

2. [Japan M&A] Senko Group (9069 JP) Bids for Maruwn (9067 JP) In Deal Which May Trigger Fireworks

- Today, logistics company SENKO Group Holdings Co., Ltd. (9069 JP) announced a bid for logistics company Maruwn Corp (9067 JP) with help from 35% holder JX Advanced Metals (5016 JP).

- The TOB only needs 11+% to get to 50.1%. There are three holders who Senko clearly regard as not necessarily agreeable to the deal. They hold 28.0% between them.

- If someone wanted to thwart this deal, there are a number of ways to do it. This could get interesting.

3. [Quiddity Index] Light & Wonder (LNW US/AU) US Delisting Event – Updating The Assumptions/Estimates

- Light & Wonder (LNW US) will be delisted at the close of tomorrow US time (two trading days left) and shares converted to Australian CDIs.

- After studying the matter we have amended our assumptions on how flows work. More net selling than expected in November, irksome uncertainy in December, more buyback flows in the meantime.

- The stock was higher on earnings in Australia, skipped a day, then skipped another day, then jumped in the US yesterday.

4. ChiNext/ChiNext50 Index Rebalance Preview: Maxing Out the Changes

- With the review period complete, we forecast 10 changes for the ChiNext Index (SZ399006 INDEX) and 5 changes for the ChiNext 50 Index in December.

- The largest flows will be in 2 stocks that are forecast adds for both indices. There are 14 stocks with over 0.5x ADV to trade from passive trackers.

- The forecast adds outperformed the forecast deletes from June to August, but there has been significant underperformance since then. Outperformance could resume as positioning kicks in prior to announcement.

5. [Japan M&A] Taiyo Pacific Offers ¥2,210 for Star Micronics (7718) Completing the Shareholder Ripoff

- Today after the close, well-known Japan engagement fund Taiyo Pacific Partners announced a deal to buy Star Micronics (7718 JP) for ¥2,210/share. They’ve been involved small-big-small for 20yrs.

- The company launched a new capital plan and MTMP in February. Cash-rich, it needed no money to grow aggressively. So TPP proposed buying a third of the company. Board agreed.

- Despite ActionsToImplementManagementConsciousOfSharePriceAndCostOfCapital announced February, in April-November the Board decided to sell the entire company to TPP at <1x book. This is borderline outrageous. It deserves notice and complaint.

6. Hynix L2 Flag Risk: Why Stuck Below ₩620k? Eyes on Nov 17 Pivot

- Hynix tagged L2: cash‑only, no margin. >40% two‑day rip triggers KRX halt. L2 caps distort tape; Square’s Oct 27–Nov 10 run showed the messy playbook.

- Hynix L2 review: five >200% YoY prints since Nov 4, but no fresh 15‑day high—₩620k from Nov 3 still the cap, yesterday stalled just below.

- Break above ₩620k likely triggers L2, leverage caps, volatile tape, Square outperformance; hold below into Monday kills L2 risk, keeps Hynix’s relative bid with retail still piling in.

7. [Japan M&A] Paris Miki Is Indeed an MBO Target; Luxottica May Complain But Tough To Block

- Today after the close, Paris Miki Holdings (7455 JP) announced the Tane family Holdco would buy out the company in an “MBO” at ¥581, or 4.8x current year EBITDA.

- World famous eyeglass/sunglass manufacturer Luxottica bought 13.8% of the company in the low ¥300s almost stopping about a year ago. They might complain, but Paris Miki is a big outlet.

- This looks like it gets done. The family+crossholders+ESOP+warrants have 65% of the expanded share count. Those who would complain would need to do so soon, and loudly.

8. Square’s Level 2 Leverage Caps End Tomorrow — Fresh Near‑term Factor in the Square Vs Hynix Setup

- Square closed ₩290,000, missing all criteria; Level 2 removal effectively confirmed, with KRX disclosure expected ~8 p.m. Seoul, effective from tomorrow’s open.

- Square vs Hynix hinges on retail chase structurally, but near‑term Square’s underperformance worsened by asymmetric leverage shackles.

- Square’s Level 2 setup ends tomorrow; flows normalize, likely giving Square more juice vs Hynix. Key spot to watch from tomorrow’s open.

9. [Japan M&A] KKR and Founder to Take Engineer Staffing Agency Forum Engineering (7088) Private

- Today after the close, KKR announced a deal whereby they and founder OKUBO Izumi-san would take Forum Engineering Inc (7088 JP) private in an LBO.

- The process of this deal ticks most all of the “bad process” boxes but the price is pretty good.

- 52% is locked in. Insiders and cross-holders appear to own another 15-18%. This looks like a done deal to me. Money comes 30 December.

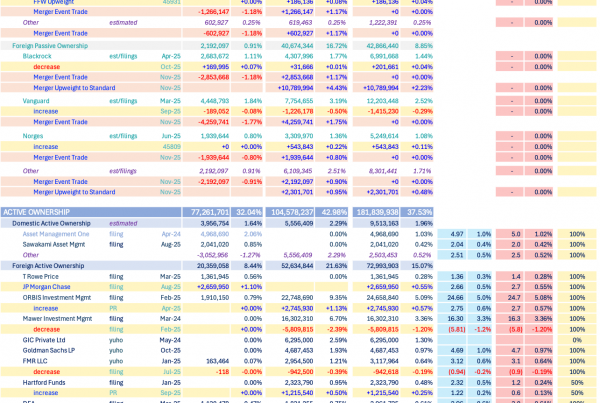

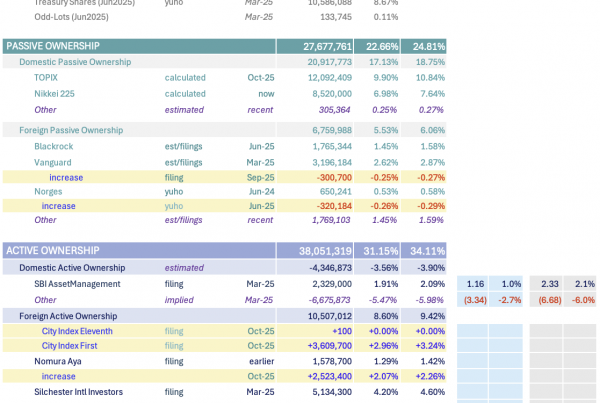

10. Merger Arb Mondays (10 Nov) – Soft99, Digital Holding, Saint-Care, ANE, ENN Energy, Mayne, AUB

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Saint-Care Holding (2374 JP), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Seven West Media (SWM AU), Jinke Smart Services (9666 HK).