This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan M&A] Yutaka Giken (7229 JP) TOB – Possibly the Most Offensively Low TOB Price I’ve Ever Seen

- Honda Motor (7267 JP) and Samvardhana Motherson International Ltd (MOTHERSO IN) have arranged to buy Honda’s 69.7%-owned subsidiary Yutaka Giken (7229 JP) in a Tender Offer.

- The transaction structure means Motherson buys Yutaka for less than net cash but even assuming Motherson pay minority TOB price for everything, TOB ex-net cash = 0.05x PBR, <1x EBITDA.

- But they are paying less. They are paying ¥12.4bn less than net cash, and getting the other ¥58bn of net assets (¥23bn inventory, the rest in hard assets) for free.

2. Holdco NAV Discount Compression Play on Korea’s Next Policy Narrative: Mandatory Tender Offers

- Korean equities are stalled; macro catalysts are absent. Street focus shifts from treasury share cancellations to next year’s mandatory tender offers, now seen as the top policy driver.

- Pre-MTO trades focus on holding companies with wide NAV discounts or low controlling stakes, front-running policy-driven re-ratings before minority shareholders capture control premiums.

- Focus on 32 Korean holding companies >KRW 500B; those with wide NAV discounts and lighter controlling stakes—SK’s holding companies, Samsung C&T, Hanwha, LG, LS—are prime re-rating plays.

3. ZEEKR (ZK US): Widening Scrip Spread Ahead Of Geely EGM Vote

- On the 15th July, Geely Auto (175 HK), China’s second-largest carmaker, firmed a cash or scrip Offer for 62.8%-held ZEEKR (ZK US), a premium Chinese electric vehicle manufacturer

- ZEEKR has traded through the cash terms US$26.87/ADS from the onset; but at a discount to the scrip terms. The scrip spread has widened recently.

- The Offer is low-balled. However, Geely’s stake plus Li Shufu (founder)’s 10.61% holdings push the Offer through. Geely’s EGM is this Friday (7th July). Li (41.34%) is required to abstain.

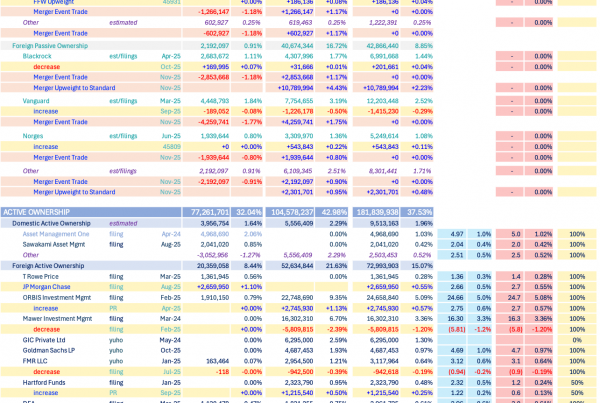

4. Merger Arb Mondays (01 Sep) – Dongfeng, ENN, Joy City, Kangji, Mayne, Santos, Shibaura, CareNet

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ashimori Industry (3526 JP), Carenet Inc (2150 JP), Ainsworth Game Technology (AGI AU).

5. HKBN (1310 HK): Mobile’s Offer Is Done. Now For The Back End

- China Mobile (941 HK)‘s Offer for HKBN Ltd (1310 HK) will be declared unconditional tomorrow (3rd September), the first closing date.

- As I type, 19.03% of shares out have tendered, lifting Mobile’s stake to 48.9%. Additional shares will tip in today and tomorrow, as per your typical last minute flurry.

- It is not Mobile’s intention to delist HKBN. There will be investors playing the backend on the expectation of a higher Offer down the track.

6. HKBN (1310 HK): On the Cusp of Being Declared Unconditional

- HKBN Ltd (1310 HK)’s offer from China Mobile (941 HK) is HK$5.075 with a 50% minimum acceptance condition. The first closing date is September 3.

- Based on CCASS data, including acceptances, China Mobile’s shareholding was 48.93% of outstanding shares as of September 1.

- Therefore, the offer should be declared unconditional by the first closing date. At the last close and for a September 12 payment, the gross/annualised spread is 0.5%/15.7%.

7. Pacific Industrial (7250 JP): Effissimo Rears Its Head

- Effissimo reported a 5.87% ownership ratio in Pacific Industrial (7250 JP). The average buy-in price of JPY2,235.91 per share is 9.1% above the JPY2,050 MBO offer.

- Effissimo buying significantly above terms is justifiable as the offer implied a P/B of 0.71x. Effissimo is agitating for either a bump or an opportunity to participate in the back-end.

- With the offer closing on 8 September and shares trading 16.9% above terms, the Ogawas have little choice but to revise terms.

8. Alipay: Issuing EB Worth 627 Billion Won Backed By Its Shares in Kakao Pay [A Quasi Block Deal Sale]

- Alipay (second largest shareholder of Kakaopay (377300 KS)) is issuing an overseas exchangeable bonds (EB) worth 627 billion won (backed by its shares in Kakao Pay).

- The exchange price of the EB is 54,744 won (4.5% discount to current price). Total amount of EB issue is 627 billion won ($450 million).

- This deal is basically a quasi-block deal. Alipay is trying to unload some of its stake in Kakao Pay to improve its finances.

9. Ashimori Industry (3526 JP): Murakami Outlines His Case

- Takateru Murakami, Yoshiaki Murakami’s son, has increased his Ashimori Industry (3526 JP) to an 18.36% ownership ratio at an average buy-in price of JPY4,154.28 vs. the JPY4,140 tender offer.

- Crucially, in today’s disclosure, Takateru Murakami outlines the rationale for his stake building, which centres on the book value being materially understated if certain land were revalued at market rates.

- Maintaining current terms is increasingly not a viable option. Toyoda Gosei (7282 JP) is likely to pursue a strategy of either increasing its offer or lowering the minimum acceptance condition.

10. Curator’s Cut: Arbs Go A-H, Copper Plays & China’s Property Pulse

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ Insights published over the past two weeks on Smartkarma

- In this cut, we explore A-H share trading dynamics, consider copper market dynamics and plays, and China’s bottoming/stabilizing real estate market

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next