https://www.vccircle.com/sequoia-india-leads-series-b-funding-round-in-investment-research-firm-smartkarma/

http://www.straitstimes.com/business/companies-markets/smartkarma-raises-another-us13m-in-financing-round-for-overseas-expansion

https://www.bloomberg.com/news/articles/2017-11-06/startup-smartkarma-raises-13-5-million-in-bet-on-mifid-demand

https://www.ft.com/content/159ae17e-c087-11e7-b8a3-38a6e068f464

Terminating Analysts: The Rise of the Machines

by Mark Artherton – Founder & CEO of LR Investment Services

Posted on Smartkarma as an independent insight on 3rd November 2017

Read more of Mark’s work by clicking here!

Independent Research was meant to be the future, MIFID II, scaling problems and tech trends may mean that it is the past.

“I need your clothes, your boots and your calculator”

With apologies to Terminator 2, 1991

There are many, many smart people trying to forge their own path in Independent Investment Research. For the right individual, it will always be possible to forge a lucrative career, as it is possible in journalism or book writing. As the institutional research pie shrinks the Investment Banks (IB) will fight tooth and nail with their exceptional resources to retain market share. If research can generate significant profits, then the IBs will be there. How that translates into individual pay is a different matter.

Many professional service industries are seeing the impact of AI, Machine learning, big data, etc. on their entry-level positions. The audit industry, consultants, investment banking and many others are implementing technology for ‘grunt’ level tasks. The asset management industry and the independent investment research industry will be no different.

I will touch upon two tech trends that are disrupting investment research, the first is robot writers and the second is robot primary research. There are many other technology disruptors in this space, but these are the most important in our opinion.

Robot Writers – they are here already

The world of journalism is already populated by Robots writing copy. Examples are The Washington Post’s use of Heliograf, and USA Today and Associated Press’ use of Wordsmith. Heliograf is described in a recent Wired article;

Editors create narrative templates for the stories, including key phrases that account for a variety of potential outcomes (from “Republicans retained control of the House” to “Democrats regained control of the House”), and then they hook Heliograf up to any source of structured data—in the case of the election, the data clearinghouse VoteSmart.org. The Heliograf software identifies the relevant data, matches it with the corresponding phrases in the template, merges them, and then publishes different versions across different platforms. The system can also alert reporters via Slack of any anomalies it finds in the data—for instance, wider margins than predicted—so they can investigate. “It’s just one more way to get a tip”

The purpose of Heliograf is primarily to target many different small audiences with many stories that are niche or local to grow the overall audience. The second purpose is to improve newsroom efficiency. Only large organisations can effectively lever technology to achieve this. The journalism industry is full of freelance writers but their focus has shifted to counter the rise of the bots. The Washington Post is not going to talk up the demise of traditional journalism, and the technology definitely aids those journalists with huge experience. However, it does create a block for junior reporters, those individuals who historically did most of the grunt work in an organisation. As the technology progresses it will impinge more and more on other journalistic activities. Hopefully, this will lead to a come back for investigative journalism, for example, as the technology led journalism cross subsidises quality journalism. Unfortunately, this may not be the case as the profit imperative will take the lead.

Writing a small piece on local elections or paraphrasing an earnings release is quite different to a robot writing a full in-depth report on a stock investment, but so-called ‘maintenance’ research can be automated relatively easily given the current state of technology. Junior analysts are in the firing line. This research is lowly valued but required. Time-constrained portfolio managers will always need briefings, they may give limited value to them but it does work to retain an audience. Automated report writing based upon conference calls, quarterly releases, and quarterly presentations are not that far away – a business doing this on a global level could carve an attractive niche.

Robot Researchers

The large Investment Banks are already experimenting with Robot writers to help reduce costs. More importantly, they are investing in systems such as Kensho, which provides traders with forecasts based upon its huge database (Kensho is used extensively by Goldman Sachs, for example – see below). As a standalone Independent Research Analyst, this should cause huge concern. MIFID II will push the IBs to implement research technology at an even more rapid pace, and their balance sheets and resources give them a huge edge.

Kensho – A step towards the future

Kensho is disrupting the data market and appears to work in a similar fashion to Wolfram Alpha. This is a direct attack on junior analysts and platforms such as Bloomberg, in my opinion. In fact, it is feasible to build a Bloomberg Killer today with existing technology platforms – though Bloomberg’s existing network effects and path dependency will delay its demise.

Kensho works as follows:

Questions (asked in plain English) can be typed into a simple, Google-style text box. Stuff like: Which cement stocks go up the most when a Category 3 hurricane hits Florida? (The biggest winner? Texas Industries.) Same with which Apple supplier’s share price goes up the most when the company releases a new iPad? (OmniVision, which makes the sensors in the iPad camera.) Until now, answering these types of questions required several analysts and several days. Kensho can do it in a matter of minutes.

Kensho was dreamt up outside of the IBs but the IBs were quick to recognise its use and invest. Initially, investing for traders, the shift into investment in research capabilities will give the IBs a tremendous edge.

Companies on the Smartkarma platform are already addressing some of these issues. Amareos, for example, analyses a huge amount of news articles to generate sentiment and other factors giving insight into asset behaviour. Despite some advances, I believe we are still scratching the surface in the application of technology to investment research and active investment management. Current solutions are not holistic and many fail to account for different consumption patterns in their clients. Retail investors may be hunting for the killer new process that they can follow blindly and make a fortune, professional investors are different, taking a much more evolutionary approach to changes in their process. Institutional Investors have fixed processes, and inputs need to be tailored to those processes. The technology of research delivery is lacking in this space.

The industry will continue to support human research analysts, though. There will always be space for synthesis ( I keep coming back to this concept). A combination of tech tools, internal workflow management and an in-depth understanding of client needs still needs synthesis. It is synthesis that computers will find difficult to replicate. Synthesis is the fallback position for human researchers and active investment management.

Additionally, systems may not be suited to the identifiaction of so-called ‘Black Swans’, the human mindset does throw up the occassional analyst who sheds a completely new light on a problem – Taleb, for example. As such, the role for left field thinking is likely to be occupied by Human Researchers.

The ability to service the career buy-side analyst who is looking to refine their model of warranty expenses at Samsung Electronics (5% of admin expenses), through the thematic manager who is interested in the possible future demand for 3D NAND flash, including the corporate fixed-income manager interested in the impact of future dividend policy on debt ratings, up to the global asset allocator interested in Samsung’s impact on the MSCI index performance and many others along the way is the future of investment research.

Celebrity may also have its place, the consumers of research will always read celebrity writers, though (maybe similar to the movie industry) the draw of the star analyst may be on the wane as interconnectedness reduces the luster of celebrity. Extending this further, while lower-end interaction can be handled by chatbots already, higher-end interaction will still require the human touch.

Conclusions

A combination of Kensho and Heliograph is a stealth killer for the bulk of the analyst community. The much-maligned Investment Banks have a clear edge in the area of technology and already have the client relationships. MIFID II has pushed the IBs to innovate more quickly, and I fear that Independent Research is an endangered species unless we react as a community. We need to get ahead of this wave with more collaboration.

Don’t get me wrong, the current state of AI means that we are decades away from true AI, where a human can be replaced in all ways by a machine. However, entry-level roles will cease to exist as technology does the ‘grunt’ work much more efficiently. The absence of entry-level positions will create huge problems in the future, but we are yet to see a drop off in entry-level hiring in a meaningful way. The other area that the machines will fundamentally change is the delivery and consumption of research. A revolution is underway, if you have got experience chose your path carefully.

Terminating Analysts: The Rise of the Machines

by Mark Artherton – Founder & CEO of LR Investment Services

Posted on Smartkarma as an independent insight on 3rd November 2017

Read more of Mark’s work by clicking here!

https://asia.nikkei.com/Business/Companies/Profit-rises-12-for-Singapore-s-UOB-as-loans-margins-expand

Monetization Models for Digital Content

Independent insight posted on Smartkarma 1st November 2017

Read more of Valerie’s work by clicking here!

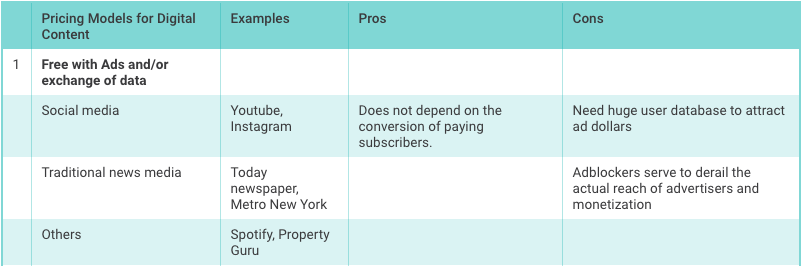

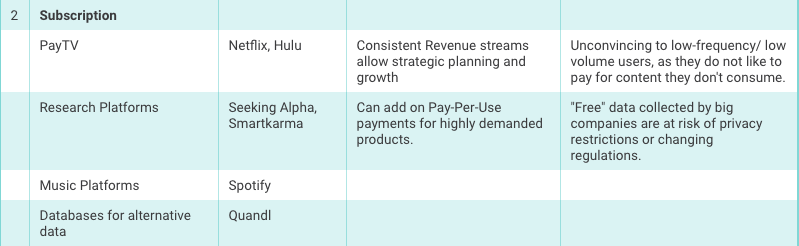

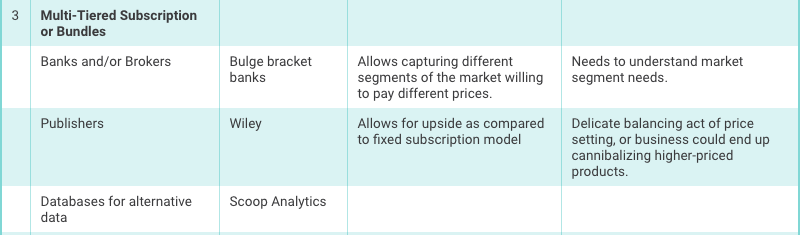

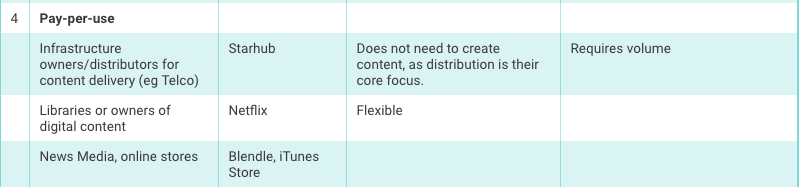

Ever since the rise of the online media industry and increasing pace of content digitization, traditional content creators, owners, and distributors have faced disruptions and declining revenues. Now, they are finding ways to monetize the content that they own or distribute. In this article, we explore seven pricing models that currently exist, but are still evolving. Some businesses could be using a combination of two or more monetization models.

1. Free with ads and/or exchange of data

Many major newspapers have adopted this model as readers moved to online reading, and get ‘accustomed’ to social media interfaces and ‘tailored-for-you’ newsfeeds. Advertisements are either embedded in the middle of the article, within a ‘pop-up box’ or ‘played’ before an article loads. Chatbots are embedded on certain Facebook pages to help with ad conversions.

For commercial websites targeting specific groups of users (eg. property portal), users get free access in exchange for their personal information. Such platforms depend on advertising from property agents/ agencies or other forms of deals with partners.

On video sharing platforms such as Youtube, famous musicians, artists, or vloggers thrive on their followership numbers so they can influence (or directly advertise to) their fans. Although content creators could earn some money by putting their creations on the platform, the big money comes in the form of corporate sponsorships or sales of other accompanying products.

To view the creators’ works, viewers may have to wait for that compulsory 10 to 30-second ads to pass, as in the case of certain free news sites. However, adblockers may be downloaded by viewers, thereby limiting advertisers’ reach (and hence monetization potential). This may be the reason why Youtube is starting to experiment with the subscription model, which leads to our next discussion.

2. Subscription

For this model, we are referring to those businesses that focus on differentiating free-usage versus premium customers. (The multi-tiered subscription model is discussed in the next point.) Newspapers such as the Wall Street Journal and Financial Times use this model. They allow reading of the initial paragraphs by the general public, but the rest of the content is behind a paywall. SmartKarma is on this model too but could add or evolve into other models later.

For video sharing platform Youtube, it has launched YouTube Red, a premium version featuring original content from Youtube’s biggest stars with no ads at all. In the US, it costs $10 per month, but there are no updates as to when this will be available in Asia.

Music streaming services such as Spotify use this model too. The regular subscription is often free or low-priced, but it has such a huge reach. If the subscriber base is too low, operating costs have to be covered through other means. Seeking Alpha, the US-based Investment Research Platform has a wide subscription base that provides early/ exclusive access to PRO subscribers.

3. Multi-tiered Subscription or Bundles

Here, owners or platforms of digital content offer tiered access based on formats, timeliness of access, the frequency of access, or duration of access. Wiley, a well-known publisher, has an online library of articles where one can purchase instant access via a few formats: Rent, Cloud Access, or PDF.

Source: A Page from Wiley’s Online Library

An extension of this model could be the pay-per-use model coupled with a low-priced subscription. This allows the platform to have a wide user base, which the businesses then dangle premium content for additional revenues. One example is Starhub TV, which used to practice compulsory subscription to their basic-tier content before allowing viewers to access premium channels (eg. EPL). However, the rise of online content platforms and changing customer behaviours have led the telco to scrap this model recently (Source: Straits Times).

Source: Straits Times

For brokers or banks providing investment research, a multi-tier subscription is less obvious, due to the bundling of commissions and other fees. However, clients are often internally ‘tiered’ by the sales or account managers based on the clients’ trading commissions or willingness to cut out a separate budget for research. The different tiers that clients are ‘grouped’ under will determine the amount of access to corporates, analysts, or their models.

4. Pay-per-use

This is used commonly by PayTV and the music industry. Use of music for certain events means payment of royalties to artist and recording label. Historically, this had been difficult to implement due to distribution costs or payment processing fees.

In the field of journalism, a new development is evolving to stem the decline in subscription revenues – Blendle has a good headstart which allows consumers to pay per use at around 20 cents per article. They even have a money back guarantee:

Source: Launch.blendle.com

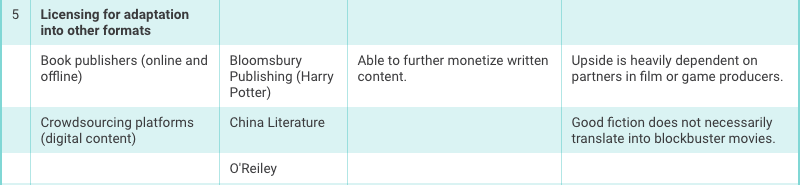

5. Licensing for adaptation into other formats

One way to extend the monetary value of written digital work is to sell them for adaptation into other formats. One case study is China Literature Ltd (772 HK), a platform that aggregates literary works across China and collects subscriptions from readers. The real upside for writers and the platform comes from licensing popular content to film and/or game producers. The challenge for film and game producers lies in choosing the next blockbuster to adapt.

Some publishers may extend services such IP management contracts and/or monetize content for e-learning. The publisher O’Reilly is one such example.

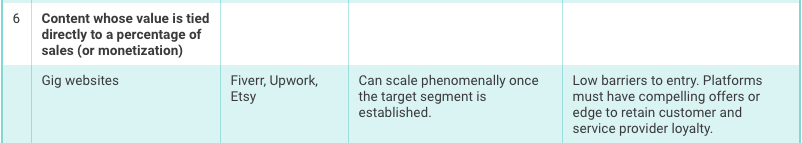

6. Content whose value is tied directly to a percentage of sales (or monetization)

Platforms provide authors and creators to display their works for free. If users like what they see (usually sorted by portfolio or ratings), they can engage the creators. The platform then makes a fee or takes a cut from every transaction. Service aggregator platforms such as Fiverr and Upwork fit into this model. They sign up artists, professionals, and writers and let them display their profiles, portfolios, services, and rates. Once the creators get orders for their services (whether by the gig or by the hour), the platform charges a processing or transaction fee. Fiverr adds a processing fee for every transaction while Upwork charges a percentage of the project fee, hourly fee, or contest fee.

The author or creator can also request additional payments for every round of revision beyond the standard 1 number of revisions (within a time frame), again creating monetization opportunities for the platforms. Such platforms must utilize promotions to drive end-user demand and create supporting features to retain the professionals on their platform.

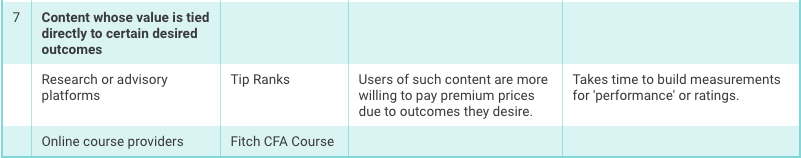

7. Content whose value is tied directly to certain desired outcomes

Specific information can be packaged to help people achieve certain desired outcomes, allowing such information to be priced higher than others. As fellow insight provider Mark Artherton explained in his piece The Future of Investment Research , mere information on its own has little value. However, the synthesis of information and distribution to the right audience can create real value.

Hence, if the information leads to an advantage or time savings in some field, the writer/creator may get a cut of the performance outcome desired by the end user. One such business close to this model is research platform Tip Ranks, which ranks analysts/writers by the overall performance of his/her calls. In this case, the desired outcome by end users is good trading/investment returns.

Another business using this model are online course providers. CFA course provider Fitch is an example. They provide free re-use of its online course materials if the students fail their exams (under certain conditions).

Conclusions

The pricing models mentioned above may not be comprehensive but serve as a discussion point for owners and/or distributors of digital content. Other monetization models also exist but are not discussed in depth. Examples include platform Eri-c which uses auctions to price research, and IBIS World (a kind of aggregator for different industry reports offering tiered subscriptions), which fellow Smartkarma insight provider Mark Artherton kindly pointed out to me.

While monetization models will evolve over time, we both agree that research providers like ourselves must think hard about how best to organize and monetize the ‘synthesis’ part of the information value chain. Below, I summarise some of the pros and cons of each model for further reflection.

Monetization Models for Digital Content

Independent insight posted on Smartkarma 1st November 2017

Read more of Valerie’s work by clicking here!

https://news.efinancialcareers.com/sg-en/299820/singapore-financial-hiring-boom

http://www.assetservicingtimes.com/astimes/ASTimes_issue_177.pdf