In this briefing:

- Nissan/Renault: French State Intervention Continues

- TRACKING TRAFFIC/Chinese Express & Logistics: Inter-City Pricing -9.1%

- Galaxy Entertainment Bullish Set up for a Breakout

- Pinduoduo (PDD US): Lock-Up Expiry – Keep Calm, Keep Going

- Aristocrat Leisure Ltd near 52 Week Low Has Runway Based on Positive Earnings Outlook Through 2021

1. Nissan/Renault: French State Intervention Continues

This past week saw some interesting news out of the ongoing saga of governance and control that is the Renault SA (RNO FP)Nissan Motor (7201 JP) Alliance.

- A week ago, former Nissan Chief Performance Officer and onetime potential successor to Ghosn and/or Saikawa-san – Jose Munoz – who was put on leave to help Nissan deal with its internal investigation – resigned effective immediately. Some suggest this is the start of a bloodbath of Ghosn loyalists.

- Former Nissan CEO and still-CEO at Renault Carlos Ghosn was in court to appeal the decision to not allow him bail. I expect that will end up at the Supreme Court in not too long, but for the moment he might stay in detention for another 7-8 weeks.

- Nissan sources said (according to a Reuters report) earlier in the week they would be looking to file suit for damages against Ghosn.

- Nissan and Mitsubishi officially announced Friday that as a result of a joint investigation by Nissan and Mitsubishi Motors (7211 JP) into the Nissan-Mitsubishi Alliance entity (Nissan Mitsubishi BV), it was discovered that “Ghosn entered into a personal employment contract with NMBV and that under that contract he received a total of 7,822,206.12 euros (including tax) in compensation and other payments of NMBV funds. Despite the clear requirement that any decisions regarding director compensation and employment contracts specifying compensation must be approved by NMBV’s board of directors, Ghosn entered into the contract without any discussion with the other board members, Nissan CEO Hiroto Saikawa and Mitsubishi Motors CEO Osamu Masuko, to improperly receive the payments.” Saikawa and Masuko were not informed and did not also get paid by the company. The NMBV entity will attempt to recoup the funds from Ghosn. Nissan and Mitsubishi are thinking of dissolving their Dutch alliance entity.

- The Nissan panel reviewing Nissan’s governance structure, made up of three independent directors and four external members, met for the first time Sunday. The proposals are due end-March, upon which the board will propose a new management system/structure for approval at the shareholder meeting at end-June 2019. The co-chair said in a comment after today’s meeting that Ghosn perhaps had questionable ethics.

- French business newspaper Les Echos carried an “exclusive” interview with Nissan CEO Hiroto Saikawa which was reasonably enlightening, or should have been from a French point of view. In the interview, Saikawa is adamant that he fully supports the Renault-Nissan Alliance saying that it was not just important but “crucial” and he “would do nothing to render it harm”, and that the French state’s stake in Renault “posed no problem at all” because the “French state does not impose in any way on Nissan.” Saikawa-san also noted that he had no intention of ridding Nissan of French/foreign employees.

- Renault Director Martin Vial visited Japan with French officials including Emmanuel Moulin – chief of staff to Bruno Le Maire, who is French Minister of the Economy – to meet with Hiroto Saikawa and Japanese officials Wednesday and Thursday. This trip was first reported by Le Figaro in the early hours of Wednesday morning (15 Jan) Asia time, and the point of the trip was reportedly to discuss the changes in governance at the top of Renault which might be coming – i.e. a new chairman as the French state and Renault’s independent directors appear to have decided that another two months of detention for Carlos Ghosn is enough to warrant a change even if they still presume his innocence in the charges brought in Japan. They were also to inquire after Ghosn’s case, though that seemed to have been secondary.

- As a sidebar to this trip, Bruno Le Maire came out Wednesday saying that the State had asked the Renault board to hold a board meeting to replace Ghosn, and said that the French state would leave it to Renault’s directors to choose, but also came out and said that Cie Generale Des Etablissement MIchelin (ML FP) CEO Jean-Dominique Senard would be a great choice (though other suggestions are that he might take the role of Chairman as others note that Renault Interim CEO Thierry Bolloré’s role could be made permanent). His comments about Mr. Senard included those suggesting that Mr. Senard adheres to certain ideas of the “social responsibilities” of the company – ideas which Mr. Le Maire shares.

Mr Le Maire also said this week…

“Nous souhaitons la pérennité de l’alliance. La question des participations au sein de l’alliance n’est pas sur la table.”

Another quote from an article which came out Saturday night at midnight Paris time was similar.

“Un rééquilibrage actionnarial, une modification des participations croisées entre Renault et Nissan n’est pas sur la table”, déclare Bruno Le Maire. “Nous sommes attachés au bon fonctionnement de cette alliance qui fait sa force.”

Both quotes say “we” (the French state) seek for the Alliance to continue functioning in a stable manner and changes of the crossholding relationship or ownership rates between the companies were not on the table.

The second appears to be a quote from the Journal du Dimanche (article linked above) which was probably conducted a day or two earlier – and it makes a reference to it having been conducted just after his return from Tokyo (it was not revealed earlier this week that he had made the trip with Mssrs. Vial and Moulin so this is something of a question mark).

All of this was out by Friday. It was all very measured and reassuring.

Then Sunday saw a bombshell dropped… again…

In the Nikkei and Bloomberg, it was revealed that the French visitors to Tokyo had informed Japanese officials of their intention to have Renault appoint the next chairman of Nissan (as apparently the Alliance agreement allows) and of the French State’s intention to seek to integrate Nissan and Renault under the umbrella of a single holding company.

This is interesting for three reasons…

- A holding company where the two companies stay listed does nothing that the Alliance does not do now except put a single board in place on top of both companies. That would be a Dutch Foundation structure. A holding company where one of the two companies loses its listing (because it is taken over) would require one of those companies lose a set of shareholders.

- A Dutch Foundation (which is effectively the same thing if the two companies stay listed) was an idea which a year ago in the previous kerfuffle last spring about merging was “not an option acceptable to the government” (Les Echos, 7-Mar-18)

- This is, once again, the French state seeking to intervene in the governance of Nissan. That’s a no-no according to the Alliance Agreement as modified in December 2015.

This is widely reported in English, Japanese, and French on Sunday.

There is a conciliatory article in Bloomberg with a headline suggesting a French official (Le Maire) downplayed the French comments about a holding company, but that refers to the JDD article, which is probably days old and repeated the same comment he made publicly earlier this week, reported by Les Echos and Le Figaro about a lack of change in cross-holding, but a careful read of the timeline suggests his comments were made in France before someone leaked this to the Nikkei.

Saikawa-san was reported to have said this morning (Monday 21 Jan 2019) that he had not heard about this, but that now was not the time to consider revising capital ties.

One should note, once again, that this is not the CEO or independent Chairman of Renault saying this. It is not the board or Nissan saying this. It is the French state.

What does this all mean? What are the possibilities and ramifications? Read on…

2. TRACKING TRAFFIC/Chinese Express & Logistics: Inter-City Pricing -9.1%

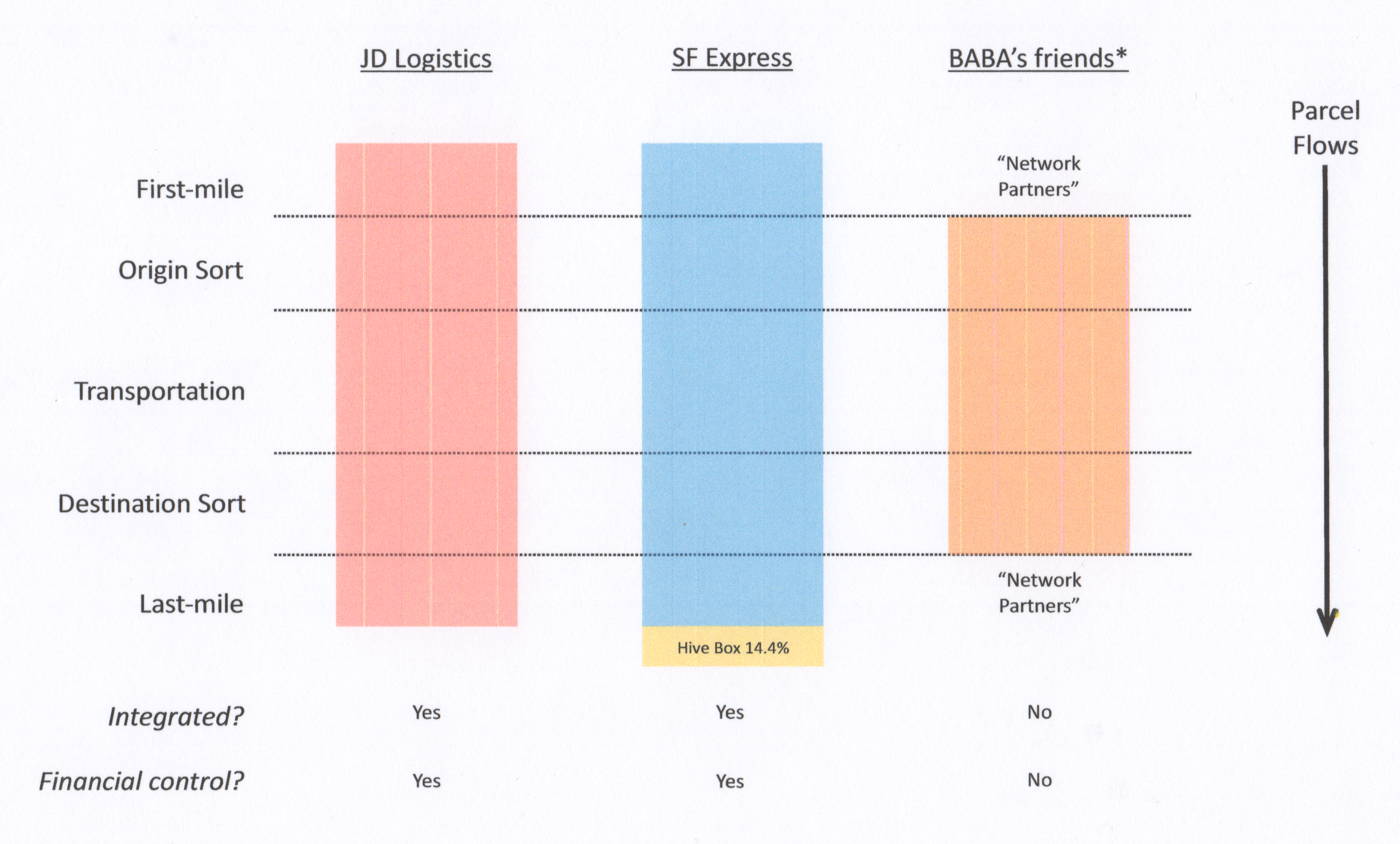

Tracking Traffic/Chinese Express & Logistics is the hub for our research on China’s express parcels and logistics sectors. Tracking Traffic/Chinese Express & Logistics features analysis of monthly Chinese express and logistics data, notes from our conversations with industry players, and links to company and thematic notes.

This month’s issue covers the following topics:

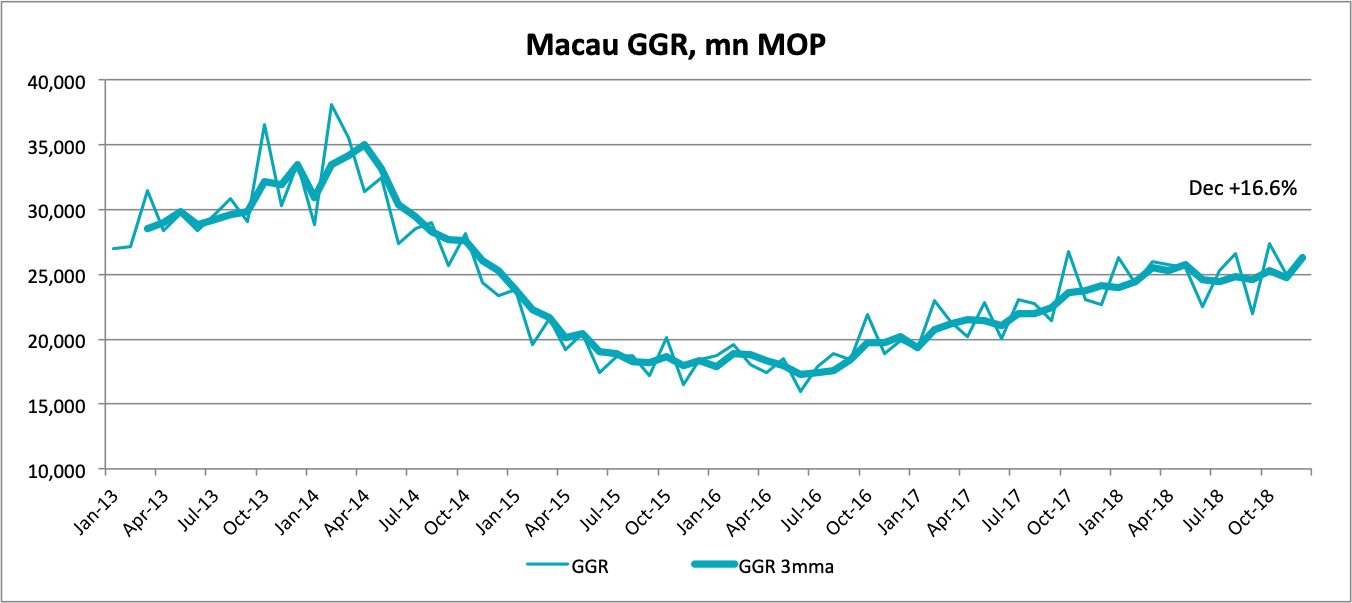

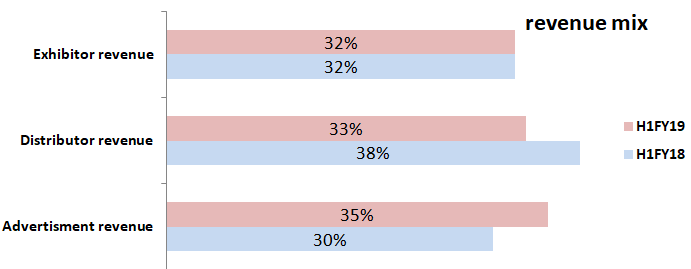

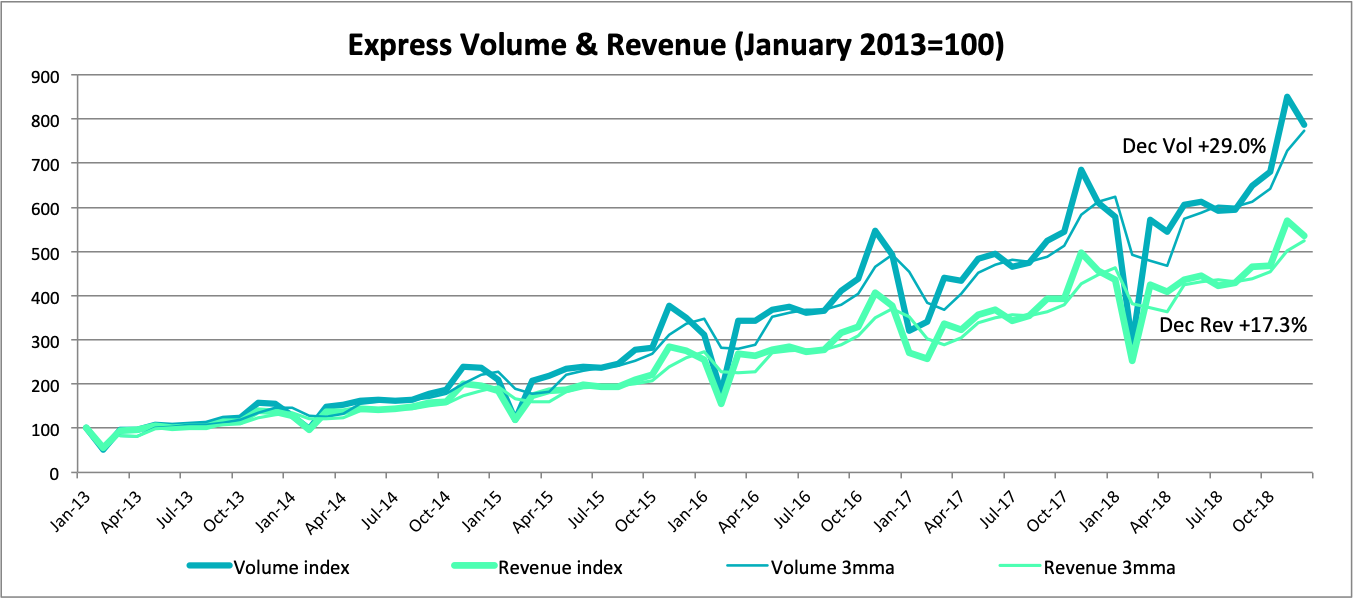

- December express parcel pricing fell by over 9% Y/Y. Average pricing per express parcel fell by 9.1% Y/Y, the worst decline since Q216 (excluding January/February figures distorted by the Lunar New Year holiday).

- Express parcel revenue growth remained well below 20% last month. Weak pricing dragged sector revenue growth down to 17% in December, the 4th consecutive month of sub-20% growth.

- Intra-city pricing (ie, local delivery) was strong in 2018. Relative to weak inter-city pricing (down 3.1% Y/Y in 2018), pricing for intra-city express shipments was firm, rising by 0.1% last year. In fact, average pricing for intra-city express shipments has risen in four of the last five years.

- Underlying domestic transport demand remained firm in December. Although demand for inter-city express shipments appears to be moderating (from high levels), underlying transportation activity in December remained firm. The three modes of freight transport we track (rail, highway, air) in aggregate rose 6.6% Y/Y in December, even as the growth of air freight slowed.

We retain a negative view of China’s express industry’s fundamentals: demand growth is slowing and pricing for inter-city shipments appears to be falling faster than costs can be cut, leading to margin compression.

3. Galaxy Entertainment Bullish Set up for a Breakout

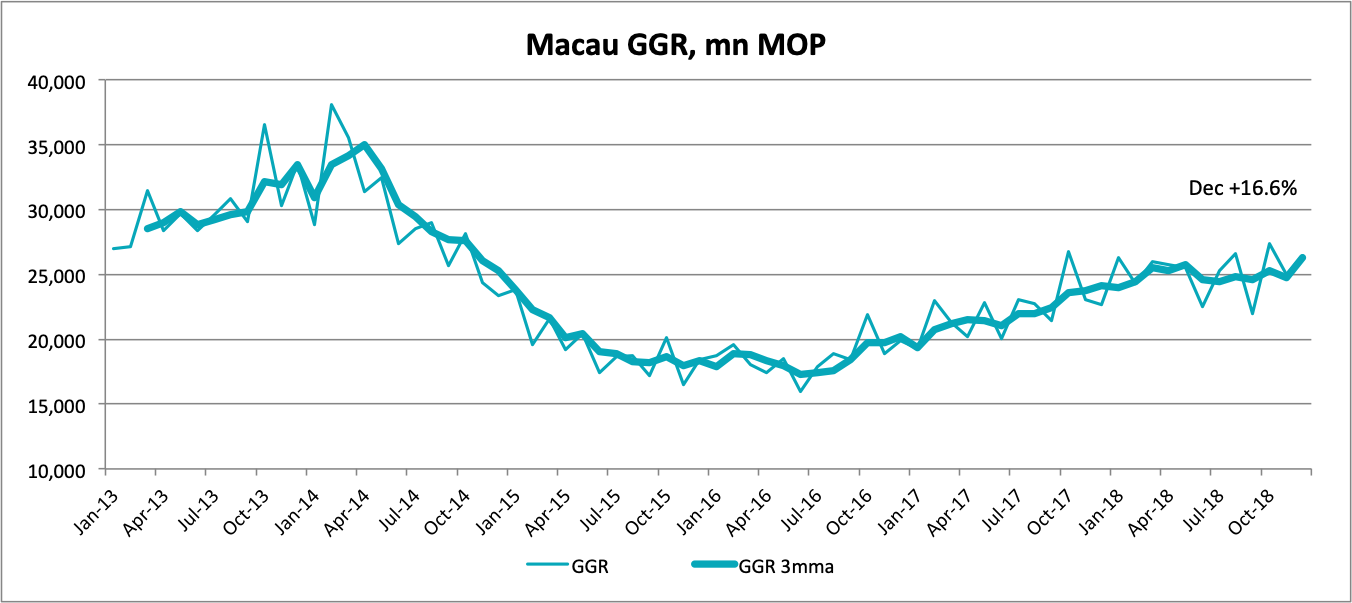

Galaxy Entertainment Group (27 HK) exhibits some valid chart support in the form of a key low at 61.8% retracement and physical price support at the 40 level. This low should stay in place for 2019.

Price and RSI wedge formations are building steam for an upside breakout. MACD bull divergence and the triangle breakout back in November will provide forward upside energy. MACD triangles are some of the most powerful chart set ups.

Currently at an attractive risk to reward support zone for an entry with a reasonably tight stop.

4. Pinduoduo (PDD US): Lock-Up Expiry – Keep Calm, Keep Going

The recent collapse of Xiaomi Corp (1810 HK)’s shares after the end of its six-month lock-up period has focused minds on upcoming lockup expirations. Pinduoduo (PDD US) is the next major Chinese tech company with an upcoming lock-up expiration – its six-month lock-up period expires on 22 January.

We have been bulls on Pinduoduo with the shares up 32% since its IPO. While we are not privy to the shareholding plans of Pinduoduo’s shareholders, we believe that Pinduoduo will likely not mirror Xiaomi’s share price collapse after the end of its six-month lock-up period.

5. Aristocrat Leisure Ltd near 52 Week Low Has Runway Based on Positive Earnings Outlook Through 2021

- Australia’s big gaming tech maker spurs organic growth with its entry into the digital gaming space.

- A balance of a strong international footprint and big US presence in the casino sector show up in dramatic forward earnings estimates by analysts.

- Sharp decline in entire gaming sector since last summer has kept the ARISTOCRAT story below the radar.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.