Receive this weekly newsletter keeping 45k+ investors in the loop

1. Inconsistently Dovish Pricing

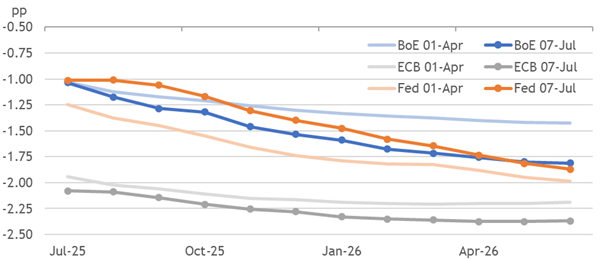

- Dovish market fears from April have unwound for the Fed, yet deepened for the BoE, despite broadly resilient data and cautious guidance from policymakers reluctant to cut.

- Equity prices have relied on this resilience to recover, yet expectations for extended rate-cutting cycles imply it breaks. Payrolls only forced half of the gap to close.

- We expect ongoing resilience to keep rolling market pricing for rate cuts later, with the unnecessary easing ultimately never being delivered by the BoE, Fed, or ECB.

2. Labour’s Collapsing Credibility

- Labour failed to campaign on a platform up to the UK’s structural problems, depriving it of the support to deliver change in its first year. Reform UK now lead most polls.

- Spending cut U-turns compound the fiscal hole exposed by the slippage of optimistic assumptions, making further tax hikes and more persistent deficits seem inevitable.

- Far-centrism has been rejected, but challenges to Labour’s right and left break its ability to triangulate back towards success. Investors may not stay so forgiving.

3. Can a New Bull Begin at a Forward P/E of 22?

- It’s official, our long-term market timing model has confirmed a buy signal at the end of June.

- The S&P 500 is trading at a forward P/E of 22. Can a new bull truly begin at such elevated valuations?

- We interpret the buy signal from our long-term market timing model as a buy signal for global equities, and not just the U.S. market.

4. HEM: Rolling Resilience

- Economic activity is robust with a tight labour market.

- Price and wage inflation are generally above 2%.

- Despite predictions of a downturn, the current economic regime remains stable.

5. Why America’s Manufacturing Dreams Might Be Economic Nightmares

- Germany’s GDP declined 0.2% in 2024, Japan’s industrial production contracted 1.1%. Meanwhile, America’s service-focused economy outperforms manufacturing-heavy competitors consistently.

- Tooling costs are 10x higher in America than China. Even 145% tariffs insufficient—need 350% tariffs to make domestic manufacturing viable.

- US services exports surpass lost manufacturing profits. Services employ 84% of private sector, pay more than manufacturing ($36 vs $35/hour).

6. De-Dollarisation Debate : Unmasking USD Over-Valuation

- Despite headlines about BRICS alternatives, gold hoarding, and China’s reduced U.S. Treasury holdings, the data shows no structural shift away from the dollar.

- A 10% decline in the DXY under six months is not an uncommon occurence from a longer term perspective.

- The dollar’s weakness is driven by a historically overvalued real effective exchange rate (REER) and falling oil prices, not a structural decline.

7. HEW: Kicked Can Lands Steady

- Trump kicked the tariff can a few weeks to 1 August, leaving other policymakers and markets in a wait-and-see mode. Pricing was little changed amid little news elsewhere.

- We thematically explored the market implications of resilience rolling cuts later, how healthy the US labour market data is, and dug into the UK’s political problems.

- Next week’s UK labour market and inflation data are critical ahead of an August BoE decision we believe remains finely balanced. US and EA inflation are other highlights.

8. US Claims Continue To Cruise Calmly

- Rising continuing claims in recent months have been heralded as a canary warning of belated suffering in the labour market. But the problem is ending before it ever began.

- US employment growth is still aligned with its long-run average, and the unemployment rate is unchanged on the year. Openings and quits are also steady with averages.

- The Fed needs excess disinflation to cut, and we believe this won’t materialise. That also avoids demand and policy pressure on the BoE and ECB, helping them hold rates.

9. Barbarians with Bandwidth: Why Christina Qi Left the Hedge Fund World to Reinvent Data

- Recap of last week’s events including good inflation news, pressure on Fed to cut interest rates, tensions between Israel and Iran escalating, and market outcomes

- Factors showing risk-on sentiment with sales growth up, EPS growth strong, volatility and quality return on equity fluctuating

- Discussion on factors influencing return on equity and quality, with insights into market trends and data analysis techniques

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

10. Systematic Global Macro: Data, AI, and Models Are Reshaping Investing | New Barbarians AI Agent #05

- The podcast episode discusses the shift towards systematic global macro investing and the advantages of using quantitative models and algorithms.

- The sources highlight the importance of technology and data in driving this shift, but also emphasize the value of human judgment in certain situations.

- Listeners are encouraged to explore the freely available Google Colab Jupyter notebook for replicating sector performance analysis discussed in the episode.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HEW: Payrolls Waking Up Rates Pricing

- Dovish rate pricing had been ignoring resilient data until US payrolls delivered a rude awakening. We believe rates remain too dovish relative to reality and equity prices.

- BoE surveys also revealed resilience in defiance of dovish pricing, while the rise in EA unemployment merely matched ECB forecasts and was heavily reliant on Italy.

- Next week’s deadline for US tariffs is the main risk event, as not all countries will likely get an extension. Monetary policy decisions come from the RBA, RBNZ, BNM, and BOK.

2. Mid-Year Themes Review – Part I

- How did our major investment themes do so far in 2025?

- Review of the performance of the major markets and asset classes we focus on

- We revisit our outlook for each of those asset classes for H2 25

3. BoE Surveys Sustain Resilience

- The Decision Maker Panel and Credit Conditions Surveys remained resilient. Price and wage inflation are stuck at excessive levels, and US trade policy makes little difference.

- Default rates are falling while the availability and demand for credit are rising to reveal a loosening of monetary conditions. There is no evidence of policy being too tight.

- Inflation and labour market data matched BoE forecasts from May, when most members were biased to slow easing. Resilient surveys should discourage it from cutting again.

4. Oil: Revisiting My Forecast

- Oil supply is projected to outpace demand growth through 2026, leading to rising inventories and sustained downward pressure on Brent crude to below USD60pb.

- Opec+ output increases, quota disputes (especially with the UAE), and the potential unwinding of voluntary cuts could further flood the market.

- US shale producers and international oil companies are reducing investment due to lower prices, but current Brent levels are not yet low enough to force significant cuts.

5. Korean Holdcos Vs Opcos Gap Trading Opportunities in 3Q 2025

- In this insight, we highlight the recent pricing gap divergences of the major Korean holdcos and opcos which could provide trading opportunities in 3Q 2025.

- A whopping 87% (33 out of 38) holdcos/quasi holdcos outperformed their opco counterparts in the past three months, which is one of the best ever in the past two decades.

- This appears to be one of the classic “buy the rumor, sell the news” trading opportunities.

6. Gap Trade Opportunities in Korean Prefs Vs Common Share Pairs in 3Q 2025

- In this insight, we discuss numerous gap trade opportunities involving Korean preferred and common shares in 3Q 2025.

- In particular, five pairs of common and preferred stocks have experienced more than 20% widening of their share prices in the past six months.

- These companies (Doosan Corp, Mirae Asset Securities, KIS Holdings, Daishin Securities, and LG Chem) are more likely to revert to closing their gaps in the coming weeks.

7. EA: Calm At The Inflation Target

- An unsurprising achievement of the 2% target might urge a celebration at the ECB, but it does not demand policy action. Energy price declines can’t be relied upon to repeat.

- The early consensus forecast was surprised on the upside, but raised by last week’s releases in France and Spain. So, while reassuring, this outcome is not dovish.

- We expect inflation to stay close to the target, whereas the ECB forecasts a substantial drop below it, while calling policy well-positioned. We still see no more rate cuts.

8. Calm Before the Currency War? Central Banks Go Their Separate Ways

- European central banks have embraced a more preemptive approach compared to the Fed in responding to the looming arrival of tariffs under the Trump administration.

- The Bank of Japan refuses to raise interest rates, despite rising core consumer price inflation, due to uncertainty about tariff negotiations with the US. Quantitative tightening will pared in 2026.

- The People’s Bank of China (PBoC) has only modestly lowered policy rates. The Fed’s future policy rate cuts could determine the timing and scope of future PBoC policy easing.

9. Mid-Year Themes Review – Part II

- How did our major investment themes do so far in 2025?

- Review of the performance of the major markets and asset classes we focus on

- We revisit our outlook for each of those asset classes for H2 25

10. H2 ’25 Outlook: Modest H2 After Strong H1. Themes: Trade, Consumption, Tech Spending, Yields

- In H1, Asia climbed several walls of worry. Valuations are slightly higher than long-term average. H2 could be more modest, as export driven growth moderates and trade agreements become contentious.

- Our end-2025 targets are: MXASJ 850, SHCOMP 3760, Sensex 85000, HSI 26000, KOSPI 3400, TWSE 23500, Strait Times 4200, JCI 7450, SET 1150. Overweights on Korea, HK/China, India, continue.

- Asian currencies should continue to appreciate, driving more FII flows. Benign inflation and headroom for monetary easing are key tailwinds. We expect two rate cuts by the Fed in 2025.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Defence Spending Is Not Stimulative

- NATO raised its target for defence spending to 5% of GDP, with Spain opting out. This increases pressure for tighter monetary conditions than were otherwise appropriate.

- Defence spending offers weak growth multipliers, so the policy is more likely to stoke deficits than productivity. Central banks may respond with a more hawkish stance.

- With debt levels already high, the move risks crowding out other spending and lifting sovereign risk premiums. Bond yields suffer from higher deficits and future rates.

2. Israel/Iran/US: Ten Pointers

- Recent events have highlighted the difficulty in predicting the progression of the Iran/Israel conflict.

- Despite this, the volatility caused by these headlines has not significantly impacted market perspectives.

- The supply/demand equation remains the primary influence on market thinking regarding oil.

3. Top 10 Korean Stock Picks and Key Catalysts Bi-Weekly (20 June to 4 July 2025)

- In this insight, we provide the top 10 stocks picks and key catalysts in the Korean stock market for the two weeks (20 June to 4 July 2025).

- Kakaopay was the best performing stock in KOSPI in the past two weeks. It could be a key potential beneficiary of the increased use of stablecoin based system in Korea.

- The top 10 picks in this bi-weekly include S&T Holdings, Samsung Life Insurance, Samsung SDS, Samsung Securities, Hyundai Elevator, SK Hynix, Paradise, Hanwha System, Hanwha Aerospace, and Korea Kolmar.

4. The New OS for Quant Finance: OpenBB, AI Agents & the Death of Legacy Terminals | New Barbarians …

- Isan Sarakil is the Chief Product Officer at OpenBB, a platform that provides advanced analytics to every investor.

- OpenBB is tearing down old walls of legacy market data systems and utilizing AI to change the way markets are understood and traded.

- Isan discusses OpenBB’s journey and how new tools can give investors an edge in analyzing complex financial data, such as the Fed’s communications.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. Asian Equities: Absolute and Relative Valuations – Spotting Mean Reversion Opportunities

- We take a detailed look at forward PE multiples, absolute and relative to Asia, of all Asia ex Japan markets. North Asia is in line with average valuations, India expensive.

- Juxtaposing valuations in comparison to history with the earnings environment of each market, we arrive at conclusions about which market should rerate and which should derate.

- We posit continued rerating for Korea and Philippines. India should derate. HK, Taiwan, Indonesia and Singapore could rerate modestly. Malaysia and Thailand are cheap but seem destined to remain so.

6. A Sharp Increase in the Lending Balance of Korean Stock Market Suggests A Pull-Back

- In our view, the sharp increase in the lending balance is one of the signs of many investors preparing for a pull-back in the Korean stock market.

- The lending balance of the Korean stock market surged from 47.3 trillion won on 2 January 2025 to 90.4 trillion won as of 20 June 2025.

- The rising lending balance in the Korean stock market could be construed as a bearish sign.

7. India – Reasons To Overweight

- Overweight, Indian equities with a bias towards industrials, property and consumer stocks.

- Trading Post hopes you took advantage of last year’s correction to buy into India, as recommended. If not, there is time.

- Investing in India is ultimately about the domestic story. Business cycle indicators are improving, and the multi-year structural growth narrative remains compelling.

8. Steno Signals #202 – Peak WW3 Fears Return!

- Over the weekend, oil traders dusted off their Strait of Hormuz crisis playbooks—and once again, they overplayed their hand.

- Saturday’s U.S. strike inside Iran sparked a sharp wave of geopolitical anxiety, turbocharged by Iran’s retaliatory missile barrage and the familiar threat from Tehran’s Parliament to shut down the Strait.

- Add a few “Hormuz closed?” headlines and prediction markets went into meltdown, briefly treating a full blockade as the base case.

9. Global Rates: Monthly Inflation Outlook

- U.S. inflation expected to accelerate over the next few months, with core inflation forecasted to rise to 3.8% by December

- Trade policy and geopolitical risks, such as the potential for oil prices to spike, are factors supporting front end tips breakevens

- Euro area inflation data shows softening trend, with core inflation falling to 2.3% in May, impacted by factors like timing of Easter holidays

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

10. Growth Broadly Back In The Black

- PMI recoveries extended in June, taking averages above 50 as manufacturing is its strongest since Sep-22, and services almost align with its averages of recent years.

- The UK survey balances suffered from bad vibes, so they are the primary beneficiary of sentiment improving. Their recovery can extend further as vibes improve.

- Broad expansion helps labour demand to keep pace with supply, denying doves proof of a disinflationary demand shock. Without that, cuts roll later and may not resume.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Course-Corrected CPI Stays High

- UK inflation unsurprisingly slowed in May as a correction to vehicle excise duty knocked 0.1pp from the rate, reversing all the upside to our above-consensus April forecast.

- Services inflation aligns with the BoE’s forecast from its May forecast, where MPC members were biased towards slowing their easing. Underlying rates remain too high.

- Inflation keeps trending above the consensus, cumulating a 1pp error since rate cuts began, but aligning with our forecast from 1yr and 2yrs ago. We remain hawkish.

2. BoE Still Seeking Evidence

- Guidance around an unsurprisingly unchanged BoE rate preserved the necessary uncertainty about when it might ease again, albeit with a broad bias to do more later.

- Dave Ramsden joined the dovish dissent, taking it to three for a 25bp cut, but none of them are in the MPC majority revealed in May as leaning towards a slower pace of cuts.

- We believe the August decision remains finely balanced for the majority. Ongoing data resilience, discouraging the Fed and ECB from easing, should also keep the BoE on hold.

3. US/China: Sprint vs Stamina

- The recent US/China trade talks highlighted Beijing’s superior leverage and determination.

- Beijing is in a stronger position in terms of both leverage and willingness to persist.

- Avoiding a re-escalation after the current 90-day truce relies on Washington making more concessions.

4. HEW: Playing For Time

- US diplomacy with Iran has been given two weeks, bringing it close to the reciprocal tariff deferral date. Both may roll later, while central bankers wait to see the impact.

- Unsurprising UK and EA inflation data offered little direction, nor did the BoE or Fed. Brazil and Norway delivered opposite surprises outside a flood of cautious statements.

- Next week is much quieter for data and decisions (TH and MX). The flash PMIs are the main global highlight, although some HICP and PCE data are notable on Friday.

5. Euro Area Wage Costs Closer To Target

- Non-wage labour costs rebounded in Q1, damping the overall slowdown to a surprisingly modest extent after the crash in negotiated wage growth revealed in May.

- Unit labour cost growth has encouragingly slowed below 3%, with the latest impulse only 0.6% q-o-q. Any further easing here could encourage monetary easing to resume.

- Stability at a low unemployment rate still suggests the policy setting is close to neutral, so we doubt disinflationary pressures will mount further and forecast no more rate cuts.

6. EA Inflation Predictably Near The Target

- Disinflationary news from May’s flash inflation release was confirmed in the final print, although a rebound in some underlying inflation measures damped the initial signal.

- Resurgent oil prices could rapidly reverse the dovish space expanded by past falls. Our forecast bumps around the target through 2026 and 2027, settling at 2%.

- Other forecasts are a little lower and only suffer a slight bias to be exceeded. The ECB can remain reassured by an outlook close to 2% without cuts, and not deliver any more.

7. China – Where To Invest?

- Overweight AI, high tech, robotics, renewables and bio-tech. Underweight on consumer discretionary, property and export cyclicals.

- China has become even more vital to its green transition. At the same time the shift in government mindset means that domestic innovation is advancing at a breathtaking pace.

- That said the economy is yet bottom. The profit cycle downturn is worsening; As of April 30% of manufacturing companies were loss making, up from 25% in November

8. Steno Signals #201 – The Mullahs Are Toast – Re-Inflation Is Back!

- Happy Monday from Copenhagen.

- What a comeback by JJ Spaun at Oakmont yesterday (sorry to the non-golfers), and what a comeback risk is about to make this week.

- Iran’s mullah-tocracy is on the brink, and it could be a catalyst for a big bounce in risk appetite.

9. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 20 June 2025

US interest rate cuts expected soon as economic data deteriorates across sectors.

Indonesia delays rate cuts; Philippines eases but risks peso weakness.

China retail sales rise, but property sector continues to underperform.

10. Cancellation of Existing Treasury Shares in Korea – Government Likely to Provide a GRACE PERIOD

- The Korean government may not force the listed companies to suddenly cancel all their treasury shares all at once.

- Rather, a GRACE PERIOD is likely to be given for companies with existing treasury shares by which they need to cancel them.

- Going forward, the Korean government is likely to decide to allow acquisition new of treasury stocks only when the purpose is to cancel them, excluding bonus payments or stock compensation.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK: Some Workshy Start Looking

- A broadly softer labour market report could easily be used to overstate the fundamental significance. Unemployment’s rise was expected and only 0.2pp on the year.

- Employment is growing and redundancies are low, but when the inactive look for work, long-term unemployment rises. Yet the workshy will struggle to compete for jobs.

- Wage growth slowed despite a 0.5% m-o-m impulse. Costs are rising excessively fast, so the BoE still doesn’t have space to keep easing, and we expect no more rate cuts.

2. UK: Retreating To Trend Again

- Residual seasonality shocked the consensus again, this time on the downside, as the spurious surge is replaced with stagnation for the rest of the year in our view.

- The 0.3% m-o-m decline dragged GDP back toward its trend, wiping out the highly supportive statistical carryover effect for Q2, which we now forecast at 0.1% q-o-q.

- BoE forecasts are on track, allowing the MPC’s bias to slow easing to materialise with a pause. We expect cuts to keep being rolled later, with no more delivered in this cycle.

3. US Consumer Pricing Still Ignores Tariffs

- Another downside surprise in headline US inflation reflected the lack of pass-through from tariff increases, with headline and core rates of only 0.1% m-o-m in May.

- Commodities, less food, energy and car prices stalled as airfares and apparel fell again. But services (ex-shelter) inflation stayed too high to be consistent with the target.

- Low headline rates raise dovish political pressure and the risk of a cut, but the tight labour market should encourage the Fed to keep rolling potential cuts later.

4. HEW: Geopolitics Blow Hot And Warm

- Israel’s attack on Iran squeezes supply in an unwelcome shock that is harder for central bankers to look through post-pandemic. Warming US-China relations had less impact.

- Avoidance measures have helped mitigate the tariff shock so far, with US CPI holding steady. The importance of recent disappointing UK demand data is easy to overstate.

- The BoE is set to hold rates, probably with two dovish dissents and no commitment to August. UK inflation should slow with airfares normalising and a vehicle tax correction.

5. Why “Sell America” Isn’t Equity Bearish

- We have been fairly cautious in our U.S. equity outlook in these pages, but that doesn’t mean we are equity bearish.

- We are embracing the “Sell America” trade because of a combination of deteriorating U.S. fiscal position and the trade war policy pivot that’s contributing to falling confidence in USD assets.

- The key risk to our “Sell America” thesis is whether the U.S. can sustain its technology dominance in the next investment cycle.

6. US Treasuries: YOU BREAK IT YOU BOUGHT IT!

- The US Administration is undermining foreign demand for dollar assets at the same time, supply for US treasury debt is rapidly expanding.

- The Fed is constrained from lowering the Fed Funds rate due to rising yields in the long end of the treasury market.

- The long end of the US Treasury market is feeling the effects of Trump’s tariff policies. The US equity market will follow as risk premiums rise.

7. Asian Equities: Southbound Flows Turning to Dividends and Beaten Down Sectors

- In May, onshore Chinese investors bought US$5.85bn of HK-listed stocks, down sharply from the $19-21 bn net buying range of the past three months. The favorite stocks also changed sharply.

- The hitherto Southbound favorites, Tencent, Alibaba and Xiaomi were sold down. Onshore investors’ current favorites seem to be the high dividend yield stocks, particularly China Mobile, CNOOC, China Construction Bank.

- Competitive pressures crashed food delivery and EV share prices. But Southbound investors seem to see these share price drawdowns as buying opportunities. Meituan, Li Auto were bought in significant measure.

8. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 13 June 2025

India cuts interest rates as currency pressure eases, aiming to boost private investment without triggering inflation concerns.

China’s exports rise overall despite a sharp drop to the US, showing strength through trade diversification.

Regional trade flows shift sharply, with Taiwan and Vietnam surging ahead of potential tariffs, while uncertainty clouds second-half investment outlook.

9. Inflation Concerns Overdone

- For Trading Post a global recession has never been on the cards, nor a resurgence in inflation.

- If mainstream economists continue to raise alarms about a tariff induced inflation surge, it reflects a fundamental misunderstanding of how inflation works and what drives it.

- Current trends in broad money growth, credit cycles and monetary policy settings simply don’t support the prevailing inflation narrative.

10. Trade Avoidance Easing Shocks

- China’s crashing exports to the US partly reflect avoidance measures, including rerouting through other countries and marking down import prices to subsidiaries.

- Exports to the EU and UK are only trending slightly higher, making little difference to disinflation. ASEAN countries, and especially Vietnam, are seeing trade surge again.

- The US may clamp down on avoidance measures that have eased the shock so far. It could make a painful example of one to encourage concessions from all trade partners.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. US vs EU: Mutually Assured Destruction?

- Section 899 is generally understood to be about leverage and deterrence.

- It is unlikely to be fully implemented due to the potential harm it could cause to the US.

- There are concerns about what could happen if the EU challenges this approach or if it is partially intended as a method to raise revenue.

2. Lee Jae-Myung Becomes the New South Korean President – Four Investment Themes That Could Outperform

- Now that Lee Jae-Myung has become new South Korean President, the uncertainty revolving who will lead South Korea in the next five years is now over.

- In this insight, we discuss four investment themes (related to Lee Jae-Myung becoming the new South Korean President) that could outperform the market for the remainder of 2025.

- The four investment themes include Korean Holdcos/Quasi Holdcos, Korean Cultural Contents, Securities, and SK Group Companies.

3. EA: May Be Disinflation’s Return

- Negative payback in services inflation dragged the headline EA rate down to 1.92% in the May flash. Although only 7bps low on the day, releases last week had cut 0.1pp.

- Inflation now looks set to spend a few months below the target rather than at or even above it, as had seemed likely until recently. This is not because of re-rooted imports.

- Euro appreciation and low energy prices have expanded the ECB’s room to cut rates, but we still see June as the final one amid tight labour markets and peers backing away.

4. HEW: Poorly Positioned Doves

- The ECB was even more hesitant to signal cuts than we expected, with the level after the unsurprising cut now deemed well-positioned. Cuts will require downside news.

- Disinflationary surprises across the Euro area in the May flash releases are already embedded in that assessment. Doves are poorly positioned for this reaction function.

- US inflation data may be the most crucial global release next week, although the signal may not be clear. Statistical issues affect the UK labour market and GDP data.

5. The Art of the Trade War: XI WATCHES AS TRUMP SERVES TACOS

- President Xi agreed to discuss issues including rare earths, chip design restrictions, and Chinese student visas with President Trump. China warns the US on its increased arms shipments to Taiwan.

- The auto industry is facing disruptions in production due to shortages of rare earth metals.

- The headline noise is starting to lose its luster as soft and hard data signals begin to pressure markets again.

6. HONG KONG ALPHA PORTFOLIO (May 2025)

- The Hong Kong Alpha portfolio underperformed its benchmark in May by 3%, however it has outperformed Hong Kong indexes by 3 to 19% since its launch 8 months ago.

- We continue to increase portfolio exposure to the consumption sector. We have added Alibaba Pictures (1060 HK), ZhongAn Online P&C Insurance C (6060 HK) & Sun Art Retail (6808 HK).

- At the end of May we sold positions in Kingsoft Corp (3888 HK) and Topsports International Holdings (6110 HK). We reduced Lingbao Gold Co Ltd H (3330 HK) .

7. Lee Jae-Myung’s 20 Trillion Won+ Supplementary Budget: Free Money, Don’t Worry and Be Happy

- One of the major policies that Lee Jae-Myung’s new administration is likely to push through is the 20 trillion won (US$15 billion)+ supplementary budget.

- The aim of this policy is to revive the sluggish domestic economy. It is a classic “spend first, worry later” government policy.

- The supplementary budget is basically sacrificing the balance sheet of the entire South Korea at the expense of short term economic stimulus which may have just limited impact.

8. Don’t Buy That TACO Just Yet

- The U.S. Court of International Trade unanimously ruled against the Trump Administration and struck down a whole range of tariffs by citing a lack of authority.

- In reaction, President Trump doubled down by opposing and appealing the decision. The government has workaround options in light of the court decision: The trade war will continue.

- Investors should continue to tilt toward the “Sell America” trade by avoiding USD assets. The court decision prolongs and exacerbates the uncertainty over the effects of the trade war.

9. US – Buy On Dip

- We maintain a buy. The sectoral weightings favour industrials, tech hardware, banks, traditional energy, defence and going into the second half of the year consumer discretionary and AI software companies.

- The US is neither headed for a full-blown recession nor another cost-of living crisis.

- Neither updated business cycle indicators nor broad money growth trends signal a downturn and a resurgence in inflation.

10. HEM: Better Never Than Late

- Companies are adapting to fluctuating trade policies while maintaining strong activity and tight labour markets.

- Despite these positive trends, underlying price and wage inflation remains high.

- While markets anticipate future cuts, the potential for rate hikes in 2026 is often overlooked.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. US vs EU: Crying ‘Wolf’?

- Ursula von der Leyen had a call with Donald Trump on 25 May.

- The call can be interpreted as a ‘win’ for Trump as he had threatened to impose 50% tariffs on the EU from 1 June.

- Another perspective could be that Trump’s reversion is a new manifestation of the TACO principle.

2. More USD Depreciation on the Cards – Who Wins, Who Loses.

- US is focusing on propelling growth with tax cuts, ignoring the debt problem. The obvious consequence, more USD depreciation, could drive more money from US assets into Asia and Europe.

- If 1% of US free float market cap flows into Asia, it would constitute 7.2% of Asia’s market cap. That’s more than 5x the highest ever annual Asian FII inflow.

- Taiwan, Korea and India have seen the biggest FII flow revival. To sidestep the deleterious effect of sharp USD appreciation on Asian exports, investors should play China, India, Indonesia, Philippines.

3. Steno Signals #198 – A 20–25% Weaker USD May Solve All Trump’s Problems

- Morning from Europe.

- Trump’s classical stop-and-go approach to negotiations is starting to get baked into markets, but we’re still surprised by the extent of market moves when these impulsive threats are announced on Truth Social — and markets remain poor at assessing the “realistic outcomes” of this approach.

- On Friday, markets at one point priced in a 40–60% probability that 50% tariffs on the EU would actually take effect on June 1.

4. The Week Ahead – Big and Beautiful

- Yield steepenings may be linked to fears of fiscal profligacy and concerns of inflation expectations

- US Exceptionalism theme unraveling, dollar facing downward pressure

- US tax bill moving through House, expected to have modest stimulative economic impact

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. Biggest One Day Move in Higher Share Performance YTD in 2025 for Major Korean Holdcos Today – Why?

- In this insight, we provide five major factors that may have caused higher share price movements (up 7.6%) of 10 major Korean holdcos/quasi holdcos today.

- This is the best one day share price performance on average for these stocks so far in 2025.

- Emphasis on improving corporate governance by both leading Presidential candidates and potential mandatory cancellation of treasury shares are among the five major factors.

6. Overview #27 – The Big Beautiful Tragi-Comedy Continues

- A review of recent events/data impacting our investment themes and outlook

- What are major global bond markets telling us about the world?

- We look at potential beneficiaries of the next wave of inflation

7. Texas Power Play: Grid Sovereignty, Bitcoin, and the Future of AI

- The speaker discusses events surrounding the downgrade of the US economy and the response from government officials

- The speaker highlights the increasing adoption and performance of bitcoin compared to traditional assets like gold

- The discussion transitions to the business efforts and partnership of Lisa and Dan, who met at a Houston bitcoin meetup in 2021.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

8. KOSPI 200 and KOSDAQ 150 Constituent Changes Announced: A Few Surprises

- Korea Exchange announced its KOSPI200 rebalance changes on 27 May. It added 8 companies and deleted 8 companies. KRX also added 9 companies and deleted 9 companies in KOSDAQ 150.

- These 8 new inclusions in KOSPI200 are up on average 49.8% in the past one year. The 8 deletions to KOSPI200 are down on average 45.2% in the past one year.

- There were numerous surprises to the KOSDAQ150 rebalances. In particular, three companies are relative surprises to the KOSDAQ150 additions including Solid Inc, Zeus Co, and Wemade Max.

9. Asian Equities: To Sidestep ASEAN’s China Problem, Focus on Select Pockets

- ASEAN’s underperformance could continue. The low growth region is facing the additional risk of increasing Chinese exports, which could dent domestic companies’ revenues and margins and engender a deflationary spiral.

- China exports more to ASEAN than to the US or EU. Margin pressure in consumer and industrials is palpable. Thailand is in deflation and inflation is nosediving in the region.

- We recommend playing the region through markets with low China import intensity (Indonesia, Philippines) and through consumer services and select banks. We have Digiplus, DBS, BCA in our model portfolio.

10. Sell America = Buy Gold

- The Sell America investment theme is becoming as a dominant market narrative, and it’s bullish for gold.

- It is driven by the combination of rising deficits, shaky bond markets, an increasingly hawkish Fed and policy uncertainty.

- For a long-term perspective of the upside potential in gold, a point-and-figure chart of monthly gold prices shows a measured objective of almost $7,000.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Market Intel from a Commodity Trader & China Analyst

- Discussion shifts towards the market consensus on China, highlighting a cyclical stabilization within a structural slowdown.

- China’s credit cycle, green shoots in the economy, and property market are discussed.

- Speaker shares insights on the Chinese real estate sector, mentioning a contraction and the need for new areas of investment.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. UK Inflation Flies Hawkish Pressures

- Our above-consensus forecast was exceeded by UK inflation flying higher in April amid administered price rises and postponed price increases due to the late Easter in 2025.

- Airfares still soared 10pp more than the norm for a late Easter, and 20pp above the April average. This stoked service and core inflation, although the median was steadier.

- We expect inflation to grind up until October, whereas the consensus assumes stability until then. Persistently excessive inflation should discourage the BoE from cutting again.

3. Top 100 Korean Firms with Highest Treasury Shares as % of Market Cap (Tender Offer and M&A Targets)

- We provide an analysis of the top 100 companies with the highest percentage of treasury shares as a percentage of market cap.

- These 100 companies are prime targets of tender offers and M&As. Many of these companies have low PBR ratios.

- Number five in this list is Telcoware (078000 KS) which just announced a tender offer by the CEO who is trying to take the company private.

4. Trump Doctrine: All Talk And No Trousers

- The US has been extremely active in the international arena in recent weeks, particularly in trade and diplomacy.

- Showmanship is currently taking precedence over substance in these activities.

- This approach poses significant risks for both policymakers and investors.

5. “What-Ifs”

- What if the proportion of core CPI categories experiencing upward inflation momentum is on the rise?

- What if the improvement in the more persistent categories of CPI inflation has more-or-less stalled?

- What if longer-term inflation expectations are no longer wiggling sideways or actually creeping higher?

6. Steno Signals #197 – The Mood(Y)’s Is Bad in the Fiat

- Morning from Copenhagen ahead of a big week.

- I was coincidentally sitting in front of the screens when Moody’s announced its downgrade of the US late in the Friday session, and the timing was admittedly peculiar—with just 5–10 minutes left of futures trading before the closing bell.

- Back in August 2023, when Fitch downgraded the US, it did spark a mild risk-off environment, with the long end of the yield curve continuing its upward trend.

7. Asian Equities: Relative Valuation Divergence Opens up Index Trade Opportunities

- A glance at the growth-adjusted valuations of the Asian markets reveals that Korea and China are undervalued and India, Thailand, Singapore and Malaysia are overvalued.

- We take a granular look at long histories of each market’s relative valuations, and their medium-term trends relative to long term averages. We combine the conclusions with growth-adjusted valuation outlook.

- We conclude that HK/China, Korea, Indonesia and Philippines could be in for rerating in the near term. Derating could be on the cards for India, Singapore and Thailand.

8. HEW: Fiscal Anxiety As Rates Rise

- Jitters over the sustainability of US fiscal easing knocked equities and the dollar over the past week. Dovish BoE pricing was pared back further towards our contrarian call.

- UK inflation exceeded our already elevated forecast, while the manufacturing PMIs were broadly resilient again in May. UK retail data were also sensationally strong.

- Next week is relatively quiet and shortened by a bank holiday. Flash inflation for some euro member states, updated US GDP data, and the RBNZ decision are our highlights.

9. Asian Equities: Taking Stock After the Result Season: Where Are EPS Estimates Rising and Falling?

- As the earnings season draws to a close, we look at Asian markets’/sectors’ EPS estimate progression during the reporting season and earlier. Specifically, we search for upward or downward inflections.

- Korea and Taiwan had the strongest EPS upgrades during this reporting season, despite the trade uncertainties. Philippines, Indonesia, Malaysia also had decent upgrades. HK/China and India continue to be downgraded.

- Korean and Taiwanese technology, Korean industrials, HK Technology Services had strong upgrades. So did Singapore and Philippines financials, and Thailand Communications – the latter two with a long upgrade history.

10. Korea Value Up Index Rebalance Announcement Next Week

- Korea Exchange plans to announce the first rebalance of the “Korea Value Up Index” next week on 27 May. The actual rebalance is expected to take place on 13 June.

- Korea Exchange plans to reduce the constituents to 100 (from 105 currently) and change 30% of the included stocks in this index to better reflect the Value Up program incentives.

- In this insight, we provide a list of 20 potential exclusion candidates and 20 inclusion candidates in the Value Up index rebalance.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 173: The End of US Equity Dominance? With Chris Wood, Global Strategist and Author of ‘Greed and …

- US stock market dependency on world index has increased significantly, reaching around 65-67%

- Tariffs implemented by Trump have had a bearish impact on stock market

- Small cap underperformance in US market is at its highest in 25 years, leading to interesting valuation opportunities

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. UK: Spurious H1 Surge Again

- GDP’s resurgence caught the consensus off guard, as it failed to recognise the residual seasonality still skewing activity growth into the first half of the year.

- The 0.7% q-o-q outcome for Q1 matched our forecast and leaves a powerful carry-over to Q2, where GDP seems set to exceed the BoE’s 0.1% forecast at about 0.4% q-o-q.

- Strength discourages another policy rate cut. Disappointment in H2 is the hangover, but we doubt it will motivate renewed easing amid excessive price and wage inflation.

3. USD Bears Broke The Bandwagon

- Investors ask whether threats to the USD’s reserve currency status are resting or dead, whereas we wonder if it was ever alive. Commentators routinely overextend narratives.

- The USD share of allocated FX reserves is already trending downward. A potential acceleration from smaller deficits and higher tariffs would partly offset the impact.

- Fuller hedging of USD asset holdings abroad may have already reached its limit. We still see more attractive mispricing elsewhere, such as excessively dovish rate curves.

4. HEW: Dovish Arguments Ageing Poorly

- Equity and rates market prices normalised further as data remains too resilient to prompt cuts, and US trade policy still seems to be reversing its destructive aspects.

- UK GDP boomed beyond expectations again, albeit amid residual seasonality. US CPI data were soft and stable, as companies appeared to have smoothed the tariff shock.

- Next week’s UK inflation data could compound the pressure by exceeding the consensus to reach 3.4% on the CPI. The flash PMIs and RBA decision are other timely highlights.

5. 100 days later: are all countries emerging markets now?

- Bob Gilhooly, a senior emerging markets economist at Aberdeen, joins the podcast to discuss Trump’s first 100 days in office and his key outcomes

- Trump’s focus on trade deficits and tariffs has raised concerns about revenue raising and potential impact on the U.S. deficit

- Uncertainty surrounding trade negotiations and potential outcomes continues to be a key feature of Trump’s presidency

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. Bitcoin, Buffett, and the Barbarians at the Gate | Ep. #020 – The New Barbarians Podcast

- Market experiencing steepening yield curve, potentially indicating higher inflation and stronger growth

- Stocks rallying, with significant moves in earnings yield and small caps

- Asia and Europe markets up, Dow, S&P, Nasdaq, and Russell all posting gains; Gold and Bitcoin down, Oil up, Vix down

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. UK: Tax Not Breaking Cost Pressures

- Underlying unemployment rates are broadly stable, despite higher headline and underemployment rates, where the latter lacks relevance to disinflationary pressures.

- Activity levels are expanding healthily and redundancies fell in April, suggesting no substantial jobs impact from the NICs rise, contrary to dovish fears.

- Wage growth should slow to accommodate some of the tax cost increase, but there isn’t much evidence yet. Total pay growth is little changed in recent years.

8. Steno Signals #196 – What’s next for inflation given the US/China pause?

- On the heels of the US/China “pause” announcement in the trade war, here’s a quick take on market implications and what to watch next:The initial market reaction has probably been more muted than many anticipated.

- Bond yields ticked slightly higher, gold softened, and there were modest tailwinds for regions and countries previously hammered by tariff exposure following yesterday’s “deal” in Geneva.

- But beneath the surface, several dynamics warrant a closer look.

9. The Drill – When the Facts Change, So Do We

- Greetings from Copenhagen.

- The global macro landscape is shifting rapidly, with U.S. policy priorities evolving just as quickly.

- The administration is now 1) refocusing on the Middle East, 2) signaling that a Ukraine–Russia deal is inching closer, and 3) initiating currency policy discussions with Asian nations—many of which are active FX manipulators.

10. US Inflation Trends Stick Against Tariffs

- A marginal downside surprise in headline US inflation measures preserves uncomfortably excessive trends, even without a significant tariff shock and with ongoing airfare falls.

- Companies may have helpfully smoothed out the tariff shock such that volatile policy never hits consumers. Services (ex-shelter) continued to grow too rapidly for rate cuts.

- Being in the right ballpark of the target isn’t good enough when the labour market remains tight. At least core price and wage inflation in the US isn’t as bad as in the UK.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Don’t Swim Naked: TIME TO PUT YOUR SHORTS ON!

- The bear market rally in the US stock market continues as investors try to justify the tariffication of global trade and ignore its economic consequences. A FREE LUNCH.

- Soft and hard economic indicators in the US are falling, with some alarming numbers in the travel industry.

- US companies face potential blowback from Chinese consumers that provide 7% of S&P revenue.

2. HEM: Dovish Prices Deranged

- Despite concerns, activity continues to be robust with stable manufacturing and tight labour markets.

- There is a persistent issue of high underlying price and wage inflation.

- The Bank of England’s rate cut ahead of the Federal Reserve is seen as highly irrational, as rates do not reflect the rebounding risk sentiment.

3. HEW: Doves Disappointed By Patience

- The BoE and Fed decisions disappointed dovish hopes for action by sensibly waiting to see some signs that easing is appropriate. Caution reduces the risk of a policy mistake.

- Inflation in the US, plus unemployment and GDP in the UK, are the scheduled economic highlights for us next week. The UK data may prove more resilient than feared again.

- An absence of bad news can allow the good vibes to keep flowing from recent resilient data and trade policy progress, but investors seeking to sleep easy may wish to hedge.

4. BoE Closer To Slowing Cuts

- The shockingly divided MPC’s offsetting votes weren’t the most hawkish signal alongside its 25bp rate cut. Most of the five backing it were only recently convinced.

- Maintained guidance for a gradual and careful approach not only disappoints dovish hopes, but signals a 5:2:2 bias between a slower, constant and faster pace of cuts.

- We still expect this gradualism to help the BoE resist cutting in August (and June) while waiting for dovish evidence that never emerges, making this the last cut.

5. The Coming Global Trade Re-Ordering

- China’s exports to the US dropped $7bn in April from March as the impact of tariffs kicked in.

- But its overall exports were barely impacted due to a jump in shipments to the rest of the world.

- This should ring a few alarm bells as to how the world will absorb the coming flood of Chinese imports, given Beijing’s struggles to lift consumption at home.

6. Steno Signals #195 – Wait, what? Did China just start buying Treasuries again?

- Morning from a sunny Copenhagen! Many pundits have (rightfully) struggled to find a coherent logic behind the Trump administration’s trade policy.

- However, quietly—but increasingly noticeably—the administration is beginning to make progress on a few of the core objectives outlined in the so-called “Mar-a-Lago Accord.” This accord seeks to leverage the U.S. defense umbrella to compel major trade partners to accept:a weaker USD, and increased purchases of U.S. Treasuries (USTs) in exchange for continued security guarantees— with tariffs serving as the primary tool in this negotiation strategy.

- While this approach has clearly sparked outrage globally—and while one can certainly question the strategic coherence and execution—the first signs are emerging that suggest it might be achieving some of its intended effects.

7. Assessing Trump’s Shock and Awe Move in Apr 2025

- April 2025 saw extreme market volatility after President Trump announced sweeping reciprocal tariffs, mainly aimed at China.

- Subsequent delays and complex exemptions fueled market swings, sparking fears of recession and inflation. First quarter 2025 US GDP contraction is not a trend.

- Despite headline risks, deeper analysis suggests a more balanced global economy over the longer term. Both China and the US will do whatever it takes to avoid a recession

8. Trust the Thrust, or Sell in May?

- We are seeing a resurgence of buy signals, or at least constructive signs for stock prices.

- Against that, the stock market is also facing a number of bearish headwinds, such as the “Sell in May” negative seasonality influence.

- We believe the intermediate path of equity prices is down. However, the reflex rally is a much-hated one and the short-term pain trade may be up.

9. HONG KONG ALPHA PORTFOLIO (April 2025)

- The Hong Kong Alpha portfolio underperformed its benchmark index during April by 1.1%. Since its inception last year, the portfolio has outperformed its benchmark by 18%.

- Although the tech sector was hit after April 2nd, the portfolio made 2% in its tech exposure for the month. We reduced the portfolio’s volatility & increased its Sharpe ratio.

- At the end of April, sold positions that are at risk from the tariff uncertainty and increased our exposure to China domestic consumption.

10. The Drill – The Gold(en) Era Continues!

- Greetings from Copenhagen.

- There’s plenty of geopolitical tension to unpack this week, with three major developments over just the past few days: 1) an Indian attack on Pakistan, 2) new events in the Middle East, and 3) the launch of U.S.–China trade talks.

- India attacked Pakistan in the Kashmir region overnight, and Pakistan swiftly retaliated.