Why Coverage isn’t the only measure of research depth.

Written by Mark Artherton

Senior Content Strategist, Smartkarma

Read more of Mark’s work by clicking here!

What is your coverage? This question gets asked a lot about investment research. It’s a quick and easy way to figure out the resources that a supplier of research wields. If JP Morgan covers 5,345 stocks and Merrill Lynch covers 6,254 stocks it appears that Merrill has greater resources and would be mining more sources for investment ideas (for clarity these coverage numbers are not the real numbers). This measure becomes more convincing when comparing to a second tier broker. If the second tier broker only covers 3,267 stocks, then clearly JP Morgan and Merrill Lynch have a depth advantage. The two larger firms employ many more analysts and would be able to answer questions on a wider variety of topics from their clients. In theory, they should also be able to unearth many more high-quality investment ideas as they constantly monitor large swathes of the market.

The concept of coverage gives the large investment banks another strong advantage when large global asset managers are looking to source external investment research. As a ‘one stop shop’ they are unparalleled. They can afford to subsidise analysts in favoured sectors and can easily win any arguments about depth of research. This advantage and a number of others factors mean that the large investment banks can be comfortable in generating a lot of revenue from their research departments even in the post MIFID II world. MIFID II is a deeply flawed piece of legislation when it comes to the promotion of independent investment research at the expense of investment banks. MIFID II does help provide some additional clarity on costs, but it fails to dent many of the significant advantages large investment banks hold.

If coverage was the only useful metric of depth and quality, then there would be no complaints about the big investment banks, and certain volume publishers would have cornered the market in investment research. The problem with coverage is that it does not help answer the quality question and is only one of a number of questions that should be asked about depth of research.

When investors consider research quality, the large investment banks trade on their brand and whilst they employ many very smart analysts, the brand may not be a guarantee of uniform quality. The volume research publishing houses have a much more difficult time with branding – especially when selling to professional fund managers. This quality deficiency may just be perceived or founded in fact, but it clearly hampers their ability to attract professional investors as clients. The value of their brand is yet another factor that helps the investment banks retain their entrenched position in the investment research marketplace.

Thankfully, there are some very successful independent research brands that are thriving. These houses offer a high-quality service in niche areas, but no independent provider has been able to truly reach the global scale of the large investment banks. The fact that there are no independent research houses offering global depth shows that the business model is not sustainable or, as is my opinion, there were other barriers working to discourage expansion – not least of which is the phenomenal costs involved.

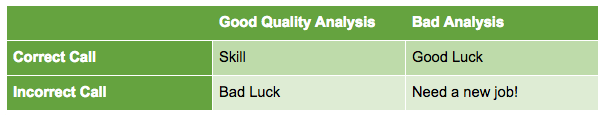

Figure 1 – Quality or luck?

When investors consider an external research provision, post MIFID II, they are looking for value for money, depth and quality of analysis. Some specialised smaller investors will continue to favour niche external investment research providers but it is becoming more difficult to meet the requirements of the larger asset managers. Asking about coverage can help with understanding depth, but there is still no effective third party quality metric. Therefore, the individual portfolio manager has to make their own assessment of quality using their experience and judgement. Additionally, we believe that investors should frame their questions about depth in different ways now that new providers have entered the market.

The new investment research platforms, aggregated or collaborative network, can offer depth and high quality in a different way. Depth is not solely achieved by an army of analysts covering 10 to 15 stocks each. Depth can be achieved in different ways. One way is to act like a supermarket and stack the shelves with as much (perceived) depth as possible – the Walmart aggregated approach. Maybe even offer cheap ‘own label’ research. Coverage but blandness.

A better approach, in my opinion, is to consider the nature of information and build a solution that improves productivity. For example, there is a difference between accumulated knowledge (not inside knowledge) and the opportunity of knowledge. Accumulated knowledge does not have to sit with the individual. Accumulated knowledge can become embedded in a platform. Google is trying its best to make all knowledge available using its search tool but there is a long way to go before the knowledge that is required for an investment is easily codified by Google. Therefore, a platform that acts as a walled garden of investment knowledge can be of immense use for investment professionals and research providers alike.

The opportunity of knowledge means the ability to identify where something interesting is occurring or about to occur and filter that opportunity from the immense amount of noise in the system. This does not require legions of analysts, just individuals who know where and how to look for opportunity in the noise. The collaboration and combination of accumulated knowledge and individuals who know where to look for ideas in the noise mean that roaming analysts can cover more and more, and be more and more productive. These new approaches to investment research not only provide the depth the investor requires but can provide a boost to the global productivity of investment research.

It is rather like running a market that offers seasonal produce from local suppliers. The market stocks fewer goods but you can guarantee that you will leave with something tasty that you have probably not tried before, and if you keep going back the variety and sustainability will be more than a Walmart could offer. Depth without coverage.

Quality is another factor where new entrants have a clean slate and can offer innovative solutions. Basing the understanding of quality around the matrix in figure 1 is a start. In future posts, I will discuss the issue of quality in more detail and offer up some potential solutions.

So, the next time an investor asks about coverage, we should all steer the discussion towards depth. Coverage may be a way towards depth but it is also definitely a route towards blandness. Depth does not necessarily require coverage, it can be achieved in new ways that vary the investor’s diet and always surprise.

Why Coverage isn’t the only measure of research depth.

Written by Mark Artherton

Senior Content Strategist, Smartkarma

Read more of Mark’s work by clicking here!