The implementation of MIFIDII will affect both asset managers and providers of investment research operating within the European Union. In the new regulatory landscape, many claim that independent research providers will reap the benefits.

Changes to Pricing May Open Doors for Independent Research Providers

The European Securities and Markets Authority (Esma) has legislated to unbundle research payments from execution costs in an effort to increase transparency in the financial markets.

After MIFIDII comes into effect on January 3, 2017, fund managers must either pay for research out of their own revenues or set up separate research payment accounts. The financial press has reported that the legislation may open the doors for independents to gain a share of the market as the research tap currently funded by multi-million dollar commissions dries up.

In a panel session hosted by Bloomberg in London on January 27, 2016, entitled “Spotlight on Independent Research”, moderated by Sam Fazeli (Director of Bloomberg Intelligence) the role of independent research providers under MIFIDII was discussed.

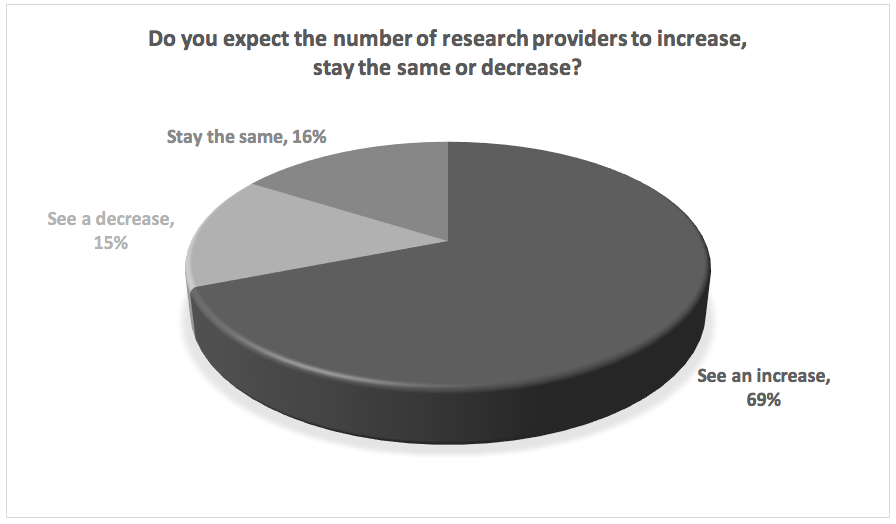

One of the questions posed to the audience at the Bloomberg event was: “Do you expect the number of research providers to increase, stay the same, or decrease?” Sixty-nine per cent said that they expect to see an increase in the number of research providers, with only 15 per cent expecting to see a decrease.

In a report published last month by Deloitte entitled, “Navigating MIFIDII – Strategic decisions for investment managers,” the company stated: “We expect the proposed rules to lead to investment managers increasing their scrutiny of the quality of research, with an accompanying flight to quality, and reducing their research budgets as the cost becomes more explicit.”

Global banks that provide investment research, including Barclays, JPMorgan, Citigroup, Credit Suisse, Deutsche Bank, Nomura and UBS, will likely need to adjust their pricing models to remain competitive when the legislation comes into effect early next year.

Asset managers will be pressured to research multiple research providers before buying research to ensure they are getting the best deal. This will make it easier for independent research providers to compete and gain access to the multibillion-dollar equity research market, which has been under the near-exclusive domain of investment banks and brokers until now.

Bashar Al-Rehany (CEO of independent provider BCA Research), in an article recently published by Markets Media said: “The independent research space is poised for growth. MIFIDII will provide more transparency which is positive for independent research providers.”

The Global Impact of Research Unbundling in Europe and Beyond

The way that investment research is bought and sold in Europe will alter considerably in the wake of MIFIDII. A pertinent concern for industry-insiders is whether the implementation of MIFIDII will have global repercussions.

The legislation might prove to be a catalyst which incentivizes research providers small and large to provide quality, differentiated research to buyers at a cheaper rate.

“Global companies could deploy the EU system on a worldwide basis in order to minimize operational strain,” said Sarah Jane Mahmud (Bloomberg Intelligence analyst) in a recent article by Bloomberg. “This may encourage non-EU regulators to adopt the EU approach.”

Whatever the global impact of MIFIDII over the short term, buyers of investment research within Europe will be forced to scrutinise their existing research portfolios as a result of the legislation, which will likely benefit independents.

For more on MIFIDII and how it will impact the way that investors buy and consume research, read our blog post here.