A (not so) long time ago, in a galaxy (not so) far away, hedge funds ruled the investment universe. Then, volatility vanished – and with it, the Force to produce those benchmark-crushing returns. Investors fell out of love with hedge funds just as fast as they fell in it.

Now, these former money-making empires are starting to strike back in a bid to win (back) all that lost love.

Inside the Investors’ Psyche

Such is the fair-weathered nature of the modern-day investor.

Those who caught the 2015 Oscar-nominated film The Big Short would recall how angry and panicking clients threatened to sue hedge fund manager Michael Burry when he placed a moratorium on withdrawals. And, how all was forgiven when Burry’s bet against the US housing market paid off.

The fact is, rarely do such Hollywood happy endings play out in reality – even though Burry’s exploits were based on a true story. The bull market that followed the Great Recession made sure of that, as hedge funds found it exceptionally difficult to outperform even plain-vanilla benchmarks.

As a result, investors began divorcing their expensive “two and 20” hedge fund managers for cheaper, passive alternatives.

Throwing in the Towel

“Why pay high fees [to a hedge fund] if you may invest cheaply on a passive index, and beat the hedge fund’s performance at the same time?” says Albert Maass, an independent analyst publishing on Smartkarma.

So serious has been the problem that, in the years following the global financial crisis, some of the world’s most renowned hedge funds have decided to shutter.

One of the latest casualties: Highfields Capital Management (HCM).

Founded in 1998, HCM rose to fame by shorting Enron months before the commodity trader’s 2001 demise. The US$12 billion firm’s decision in October to convert into a family office follows a series of other high-profile exits by former hedge-fund giants. Eton Park’s liquidation in 2017 and Perry Capital’s shut-down in 2016 are good examples.

Hedge Funds Rebound

But are hedge funds really in such dire straits?

Perhaps the real problem is not so much an industry on its dying breaths than it is a lack of tenacity to ride out the perfect storm. In fact, recent findings by Hedge Fund Research suggest a rebound could already be on the cards.

According to HFR, hedge fund launches exceeded liquidations in the second quarter of 2018 for the fourth consecutive quarter. The HFRI Equity Hedge (Total) Index) also posted a 2.3 percent year-to-date gain through August 2018.

Volatility: The Force That Fuels Hedge Funds

This upward march of hedge fund performance and net launches is by no means an accident. To a large extent, it has a lot to do with the return of volatility.

Smartkarma Insight Provider Maass has conducted an in-depth analysis of how hedge funds and stocks perform under different conditions. He found that “when markets are volatile, the S&P [500] loses on average 13 percent annualised, while hedge funds still make on average 5.2 percent.”

Specific hedge fund strategies, like Trend Following and Global Macro, also “make 16.6 percent and 8.4 percent respectively” during such volatile periods.

Based on Monthly Returns from January 2000 to August 2018

Market Condition | S&P 500 Return | Hedge Fund Index Return | Trend Following Return | Global Macro Return |

Volatile Market | -13.0% | 5.2% | 16.6% | 8.4% |

Sources: Eurekahedge.com (Hedge fund indices) and Yahoo Finance (S&P 500 Total Return Index)

Table compiled by Albert Maass

A Safer Bet in Volatile Times

Greater volatility breeds greater insecurity among investors, who have less clarity on whether markets will fall or rise, and at what magnitude.

And since hedge funds typically strive to achieve a total absolute return regardless where markets move, they represent a more viable investment than passively managed index funds under volatile market conditions.

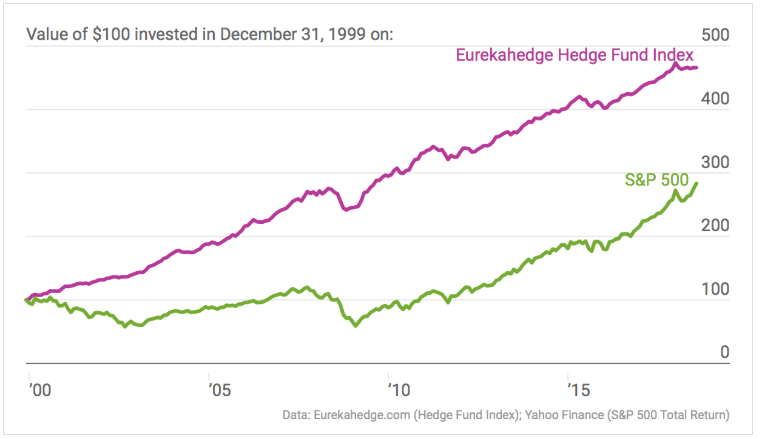

It Pays to Take the Long View

“Patience you must have.” – Master Yoda

Chart compiled by Albert Maass

Volatile Times Ahead

Emerging-market woes across the world, from Turkey in Europe, to Argentina in South America, and Indonesia in Southeast Asia, continue to unnerve investors.

Rising US interest rates and a strengthening dollar are also increasing dollar-denominated borrowing costs in these regions and making it more expensive to service existing debt. Worse, the Fed shows no sign of reversing course, with more tightening almost surely on the horizon.

The resulting fall in liquidity could further exacerbate the already challenging economic conditions in these emerging markets and brew even greater uncertainty.

So, volatility is here to stay, at least in the foreseeable future.

May the Force Be With Hedge Funds

As Master Yoda would say, “Through the Force, things you will see.” Hedge funds now see a golden opportunity to reclaim their status as rulers of the investment universe. They are on a mission with a vengeance to make up for lost time and profits.

May the Force of volatility be with them.