This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

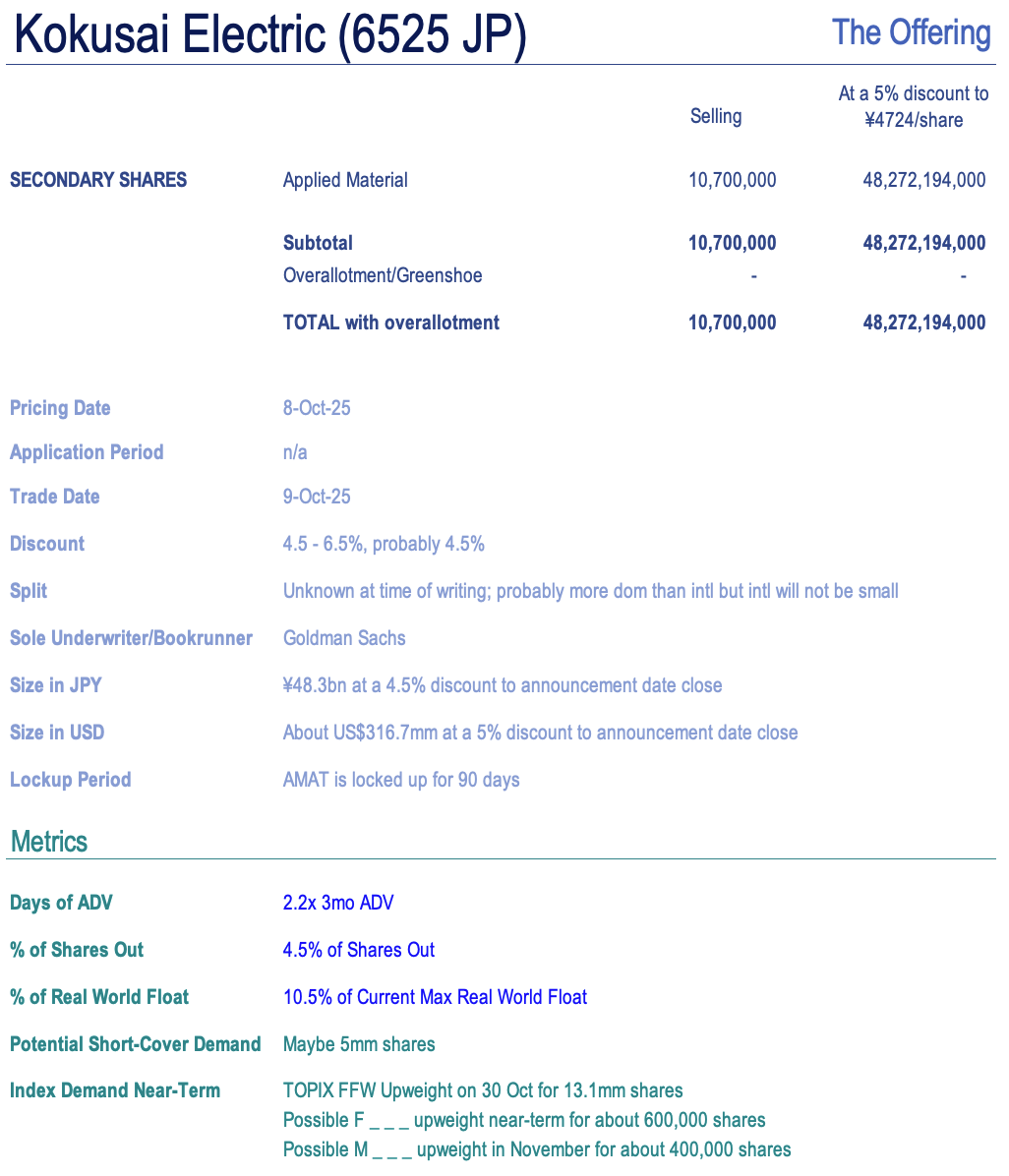

1. [Japan ECM] Kokusai Elec (6525) – Applied Materials $330mm Selldown

- Three weeks ago I wrote that KKR’s lockup would expire about now in [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Today post-close, Applied Materials (AMAT US) announced a 10.7mm share (4.5%) Accelerated Block Offering to be priced tomorrow morning, at an indicated 4.5-6.5% discount. This would put them at 10+%.

- This should be very well taken up. There is index demand on the follow. The question is more about the unwind of KKR’s last bit. Perhaps to come soon?

2. FineToday Holdings (420A JP) IPO: The Investment Case

- FineToday Holdings Co Ltd (289A JP), a Japanese personal care business, is seeking to raise US$286 million. It previously pulled an IPO to raise US$500 million in December 2024.

- FineToday has four product categories: Hair care, Skin care, Body care and others. Hair care is the largest category, accounting for 49.0% of 1H25 revenue.

- The investment case rests on top-tier revenue growth, top-quartile profitability, peer-leading FCF generation and manageable leverage.

3. Kokusai Electric Placement – Unexpected Seller but Relatively Small Deal

- Applied Materials (AMAT US) is looking to raise approximately US$330m through an accelerated secondary offering for around 4.5% of Kokusai Electric (6525 JP) (KE) stock.

- KE had seen two selldown earlier, from KKR, with mixed results. KKR just came out of its last lockup.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. LG Electronics India IPO – Thoughts on Valuation – Better Placed This Time Around

- LG Electronics (066570 KS) is looking to raise US$1.3bn via part-selling its stake in LG Electronics India.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about valuations.

5. Tekscend Photomask IPO: Market Leader with Strong Prospects Ahead

- Established in 2022, Tekscend Photomask (429A JP) (previously Toppan Photomask) is the world’s leading semiconductor photomask supplier, holding a global market share of 38.9%.

- Tekscend provides a diverse portfolio of high-precision photomasks for semiconductors, displays, MEMS, and R&D, including cutting-edge EUV masks, leveraging its expertise in microfabrication.

- The company is planning for a listing on TSE on 16th October and plans to raise proceeds of around US$800m through a combination of existing and new share issues.

6. LG Electronics India IPO: Attractive Upside

- After incorporating the company’s FY25 results, we have tweaked our income statement estimates and valuations of LG Electronics India IPO.

- Our base case valuation is target price of 1,514 INR which is 33% higher than the high end of the IPO price range.

- It appears that the company wants the IPO to be successful and after much review the company has decided to price the IPO at more attractive levels to new investors.

7. Innoscience Suzhou Tech Placement – Selling Ahead of Lockup Expiry, Relatively Small

- InnoScience Suzhou Technology (2577 HK) aims to raise around US$200m in its Hong Kong placement.

- Innoscience was only listed in Dec 2024 and it undertook another primary raising in July 2025, the lockup for which has yet to expire.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. LG Electronics India IPO: Leading Player Priced at a Steep Discount ?

- LG Electronics (066570 KS) will divest a 15% stake in its 100% subsidiary LG Electronics India (123D IN) through an IPO, raising Rs116 billion (USD 1.3 billion).

- The IPO pricing implies a valuation well below that of listed Indian peers and appears to overlook the sector’s underlying near term macro demand tailwinds.

- LGEIL’s 1QFY26 financial performance came in weak, primarily due to a seasonal slowdown in cooling product sales, particularly air conditioners. This follows a strong FY2025.

9. FineToday Pre-IPO – Refiling Updates

- FineToday Holdings (420A JP) (FT) is planning to raise around US$280m via selling a mix of primary and secondary shares.

- FineToday (FT) is a beauty and personal care company in Asia offering a range of products, including hair care, skin care and body care products.

- In our previous note, we had looked at its past performance. In this note, we will talk about the updates from its most recent filings.

10. LG Electronics India IPO- Strained in Legal Heat

- LG Electronics India (123D IN) much awaited INR 116.1 bn IPO is set to open for subscription this week. It’s a complete OFS by the Korean Parent.

- While LG is the market leader, there are huge litigation liabilities ~74% of net-worth which could pose a serious threat to the financials, with particular attention to AMP spends proceedings.

- We also find it disturbing to note that the parent has taken out 175% of the free cash flows in FY23 and FY24 as interim dividends.