This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

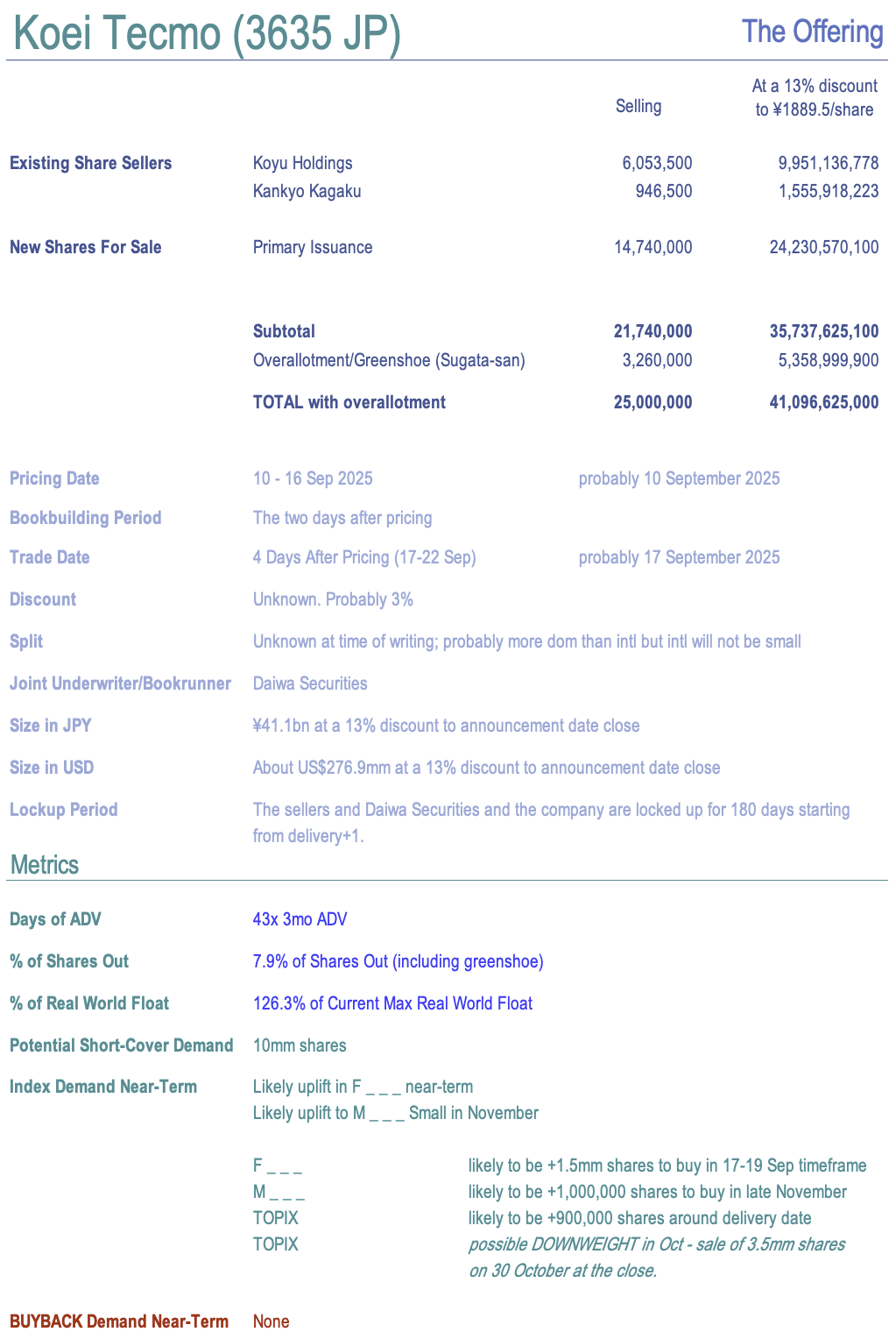

1. [Japan ECM] Koei Tecmo (3635 JP) Needs to Sell Shares To Stay in Prime ($280mm Offering)

- In December 2021, Koei Tecmo Holdings (3635 JP) announced a complex but lower-impact move to increase float share count in order to stay listed on TSE Prime.

- Scheme: buyback from two holders plus CB issuance. Unfortunately, shares did not rise enough to convert the CBs so as of March 2025, the tradable share criteria was not met.

- So now the two main holders are selling more shares and the company is diluting holders with new issuance to get float/tradable shares up with a US$280mm offering.

2. [Japan ECM] Lifedrink (2585) – Fast-Growing Beverage Seller Meets P.E. Firm Selldown

- Today post-close, Lifedrink (2585 JP) announced the Sunrise PE funds which own 22% of the company will sell their stake in a clean-up offering with pricing in 8 days.

- This offering comes 8 trading days after a new post-earnings all-time-high. At 24x ADV, the offering will increase Max Real World Float by 50+%.

- There are some index and buyback supply/demand dynamics to note. It’s a heavy offering, so bullish/bearish may be a matter of horizon.

3. Metaplanet Placement: A Look at Other Treasury Play Issuances and Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.8 days of the stock’s three month ADV, despite being 22.8% of total shares outstanding.

- In this note, we look at Metaplanet and its peers.

4. Shandong Gold Mining Placement – H-Share Running Ahead of A-Shares

- Shandong Gold Mining (1787 HK) aims to raise around US$500m via a primary placement, in order to pay down debt.

- The H-shares are now trading at all-time highs and have been performing better than the A-shares this year.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

5. Hesai Secondary HK Offering – Stock Has Been Recovering, a Look at Possible Trading Setup

- Hesai Group (HSAI US) plans to raise around US$200-300m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 31st August 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

6. ECM Weekly (1 September 2025)- Nissan, Metaplanet, Indigo, Laopu, Akeso, Mixue, Aux, Orion, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of company’s appear to be lining up to launch their IPOs in the coming month.

- On the placements front, there were a number of large deals across the region.

7. Koei Tecmo Placement: Some Non-Fundamental Selling; but Weak Fundamentals

- Koei Tecmo Holdings (3635 JP) is looking to raise around US$270m from a primary and secondary placement.

- The deal is a large one to digest, representing 37.6 days of the stock’s three month ADV and 6.1% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Simcere Pharma Placement – First Primary Raising, past Deals Have Been Mixed

- Simcere Pharmaceutical Group (2096 HK) is looking to raise around US$200m via a top-up placement.

- This is the first primary raising by the company since its listing. There have been a few secondary deals, with mixed results.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

9. Hesai Group H Share Listing: The Investment Case

- Hesai Group (HSAI US), a global leader in LiDAR solutions, is seeking to raise US$300 million through an H Share listing.

- On 9 February 2023, Hesai listed on the Nasdaq, raising US$190 million at US$19.00 per ADS.

- The investment case is based on a solid competitive positioning, high growth, emerging profitability, declining cash burn, and a reasonable valuation.

10. Orion Breweries IPO – Smaller Scale Warrants Discount

- Orion Breweries Limited’s (409A JT) operations span across alcoholic beverages, tourism and hotel businesses, aiming to raise ~US$126m in its Japan IPO via a mix of primary and secondary offerings.

- Orion Breweries (OBL) has a strong Okinawa market position. Share of overseas sales has been growing (~23% of FY25 revenues), while profitability has also largely been steady.

- In our previous note, we looked at the firm’s past performance. In this note, we talk about the peer comparison and IPO valuations.