This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CSI 300 Index Outlook After Trump’s Threat of 50% Tariff on China

- The Shanghai Shenzhen CSI 300 Index (SHSZ300 INDEX EQUITY) was less impacted than other indices by the global sell-off: on Monday it was down only -10% from the recent top.

- On Monday Donald Trump posted that if China does not withdraw immediately its +34% tariffs increase, the United States will impose ADDITIONAL Tariffs on China of +50%, effective April 9th!

- Although the CSI 300 Index is more insulated than other indices from global market volatility, it is not completely immune and remains vulnerable to the impact of US’s tariff threats.

2. Nikkei 225 Bounce: Setting Up for Tactical Shorts

- From Monday’s gloom to Tuesday’s euphoria, the Nikkei 225 (NKY INDEX) staged one of the strongest rebounds — but tariff risks haven’t gone away. Still there.

- Here are some tactical analysis and ideas specific for the Nikkei 225 Index to prepare for the key risk ahead: another brutal sell-off.

- The targets highlighted by our models (below) come with low reversal probabilities — ranging from just 25% to 50% — this is consistent with weak market rebound dynamics.

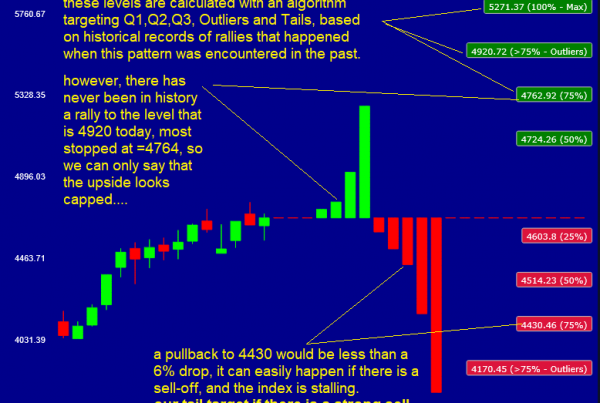

3. NIFTY Index Rally Outlook After Trump’s Tariffs PAUSE

- The NIFTY Index (NIFTY INDEX) post-crash bounce peaked around 4.4% before stalling—mirroring the fading rebounds seen across global indices.

- The index has yet to reach levels attractive for shorting, but with two days remaining before the weekend, any positive tariff-related news will push the index towards the targets.

- This insight highlights key price levels for initiating tactical shorts or exiting longs, depending on the tariffs scenario that, once again, changed dramatically from one day to the next.

4. Global Markets: Why This Sell-Off Is Different. UPDATE

- We revisit key cross-asset signals as traditional safe havens fail to respond in familiar ways.

- The past 8 days have delivered a combination of asset moves with few, if any, historical parallels.

- With trust in U.S. safe haven assets under pressure, we explore emerging themes and ramifications.

5. The Beat Ideas: Jindal Steel & Power, A 31000Cr Mega Capex Plan

- The company is in the final stages of commissioning its INR 31,000 crore capex plan, accompanied by strong promoter buying in recent months

- The new capacity is expected to improve margins through deeper backward integration while also expanding its value-added product mix.

- With secured fuel, captive power, and value-added downstream capacity, it is poised to emerge as an infrastructure powerhouse. A steel price recovery would further amplify gains.

6. Nifty Index Options Weekly (Apr 01 – 04): Lowest Implied Vol Amid a Global Meltdown

- Nifty remains the global market with the lowest implied volatility and has been outperforming its peers in this sell off.

- We assess where Nifty is likely to open on Monday and the expected impact on implied vol and discuss whether hedging should be considered.

- We highlight the absence of a flight-to-quality bid in this global meltdown and what that could mean for relative returns vs. the SP500.

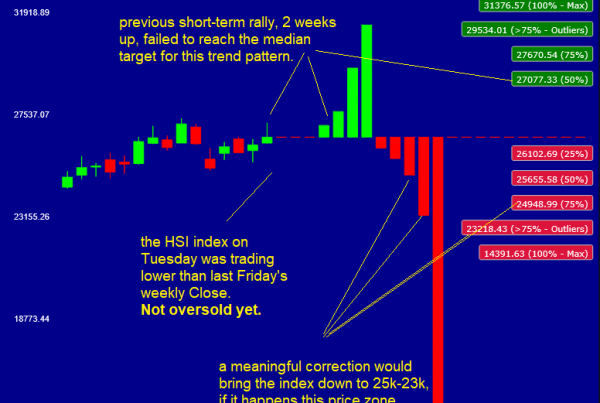

7. HSCEI Index Options Weekly (Apr 7-11): Vol Reset, Skew Reprices, and 8,000 Strike in Focus

- Brutal start to the week, with the holiday-shortened calendar and continued global weakness weighing on Monday’s open.

- Implied vol surged early, with skew steepening and tail demand reflected in out-of-the-money Put pricing

- We highlight significant activity at the 8,000 strike and its implications for near-term spot and vol dynamics.

8. Reliance’s Campa Cola Comeback: Disrupting India’s Soft Drink Market

- Reliance Industries (RIL IN) has relaunched Campa Cola with a disruptive INR 10 price tag, targeting Bharat through regional branding, aggressive retail margins, and deep distribution.

- Campa’s revival is shaking up India’s INR 50,000 crore soft drink market, challenging Pepsi and Coke with rapid share gains and frenzied rural demand.

- This is not nostalgia, it’s Ambani’s Jio-style FMCG disruption. Expect more brand revivals, deeper pricing wars, and a new cola war driven from the grassroots.

9. Fast Retailing (9983 JP) Profit Targets After Q2 Results

- Mark Chadwick highlighted Fast Retailing (9983 JP) ‘s outlook in 2 recent insights, before and after Q2 earnings: his DCF model for this stock suggests roughly a +13% upside.

- This week the stock rallied from the crash at the start of the week, closing a bit higher than the previous week (it had closed 1 week down, CC=-1).

- Assuming the stock may rally further from here, pushed by good Q2 results, let’s have a look to our model to analyze some profit targets.

10. #1 Leadership Bytes(07-Apr-25)

- Dixon Technologies India Ltd (DIXON IN), Metropolis Healthcare Limited (METROHL IN), Hitachi Energy India (POWERIND IN) have shared major updates on expansion plans, acquisitions, order growth, and strategic shifts across sectors.

- Each company is taking strategic steps to expand market share, strengthen operations, and tap into emerging growth sectors.

- These updates highlight diverse growth strategies, from Dixon’s manufacturing expansion to Apollo’s focus on defense, suggesting a balanced approach across market leaders.