This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Xiaomi (1810 HK): Top Trades Bet on a Bullish Trend Reversal

- Context: Over the past five trading days, Xiaomi (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: 55% of strategies exhibit a bullish bias, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

2. SoftBank (9984 JP) Tactical Outlook: Extremely Oversold After -11% Plunge

- Softbank Group (9984 JP) crashed nearly -11% between Thursday and Friday close, reaching deeply oversold extremes.

- Softbank Group has declined for three consecutive weeks, posting a cumulative -37% correction over this period.

- Softbank Group‘s entry into the Outliers zone suggests an extreme oversold condition—potentially creating a tactical long setup for risk-tolerant traders.

3. ALIBABA (9988.HK) Earnings: Option Market Expectations and Post-Release Price Behavior

- Alibaba will announce Q2 earnings on after the market close (HK time) November 25.

- Earnings implied jump pricing is similar to the last release, but recent downside skew in past Q2 moves highlights why traders may focus more on potential weakness.

- Recent market patterns, including muted reactions to beats and sharp responses to misses, add weight to risks around Baba’s earnings day move.

4. Comparing the Singapore Next 50 to Its Regional Peers: An Asia Portfolio Context

- This insight compares the iEdge Singapore Next 50 Index with regional next-tier indices, focusing on methodology, sector composition, and historical performance.

- Combining flagship and next-tier indices can broaden sector exposure and balance within an Asia-focused equity portfolio.

- A volatility-driven allocation strategy is presented, showing that dynamic mid-cap exposure can help moderate drawdowns and enhance returns during market cycles.

5. GOLD Tactical Outlook: Profit Targets for December 2025

- Gold (GOLD COMDTY) this week has resumed its uptrend after a brief, shallow setback in mid-November.

- This insight will analyze our Gold Futures Dec 25 model to determine profit targets that could be reached in the next 3 weeks (in December 2025).

- Range: Gold could reach again previous highs, in December, while if it goes down it could reach the 3933 support zone.

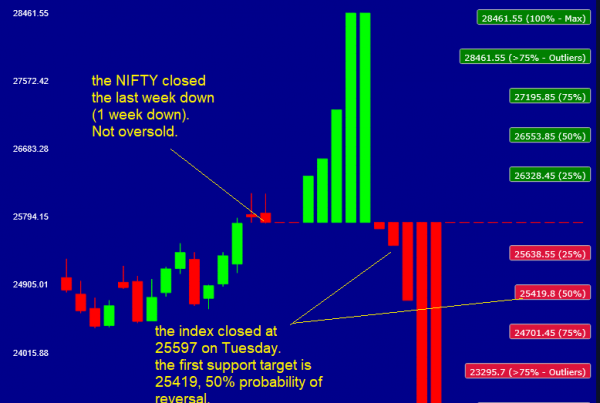

6. Asian Stocks Tactical Outlook (Week Nov 24 – Nov 28)

- A tactical snapshot of the Asian indices and stocks we cover.

- Many Asian stocks we track are flashing very oversold signals—creating tactical long setups worth considering.

- We find no overbought stocks or indices in Asia at present. US equities are aligned with this view, this is a global market pullback, probably about to end.

7. TSMC (2330 TT) Tactical Outlook After November’s Pullback: Further Downside Risk Remains

- TSMC (Taiwan Semiconductor Manufacturing) (2330 TT) delivered stellar returns this year, but after peaking in early November and pulling back all month, we see downside risk persisting.

- We hypothesize the current rally may be a bear rally. If correct, our models indicate TSMC has nearly depleted this rebound and downside risk looms.

- If we are wrong, TSMC could continue this rally to 1483-1581, the details as always are discussed in the insight.

8. Tencent (700 HK): Top Option Trades Reveal a Split in Market Sentiment

- Context: Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Market sentiment is evenly balanced between bullish and bearish strategies, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

9. A Global Portfolio Inflation-Stagflation Hedge: Gold and NK Index Volatility

- Gold’s outlook is strongly supported by a dovish Federal Reserve, structural de-dollarization trends, and increasing central bank demand for a strategic stagflation hedge.

- The Nikkei 225’s high is vulnerable to concentrated risk in the technology sector and geopolitical volatility, necessitating a tactical approach to portfolio protection.

- Deep dive into a two-part portfolio-defensive structure, pairing a strategic long-term inflation asset with a short-term volatility hedge on a key equity index.

10. CSI 300 (SHSZ300) Tactical Outlook After Nov. 28 Rebalance Announcement

- On November 28th China Securities Index Co (CSI) announced the changes to the CSI 300 Index (SHSZ300 INDEX): 11 companies added and 11 deleted.

- The complete list of additions and deletions is available here (or see the attachment at the end of this insight for your convenience).

- We analyze our probabilistic models to forecast short-term market directions for the CSI 300 Index, as passive flows between here and December 12 may affect the index volatility and trend.