This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan M&A] Toyota Inds (6201) Proposed Takeover – It Looks Bad, and It’s Worse Than It Looks

- 2wks ago I said “a deal could be announced near-term.” 2wks later we have a deal. But it is a bad deal for TICO minorities. Low price. Minimal transparency. Awful.

- But if you dig through deal structure and economics, it is worse than it looks. It takes digging to understand how bad, and they could tell you, but they won’t.

- The deal will take time. Things will be in limbo til then. And Toyota Group governance and capital allocation is conditional on this deal getting done, which is also bad.

2. Soul Patts & Brickworks: Index Impact of A$14bn Merger

- Washington H. Soul Pattinson (SOL AU) and Brickworks Ltd (BKW AU) have executed a binding Combination Deed to implement an A$14bn merger that simplifies the company structure by eliminating crossholdings.

- The merger ratio is a good one for Brickworks Ltd (BKW AU) shareholders and the benefits to both sets of shareholders should see the merger approved.

- There will be large passive buying in Washington H. Soul Pattinson (SOL AU) from global and local index trackers and that could lead to short covering.

3. Toyota Industries (6201 JP): After a High, Comes the Low of a Takeunder

- Toyota Industries (6201 JP) disclosed a preconditional tender offer from Toyota Fudosan at JPY16,300, a 23.3% premium to the undisturbed price but a 11.4% discount to last close.

- While representing a pre-rumour all-time high, the offer is below the midpoint of the special committee IFA DCF valuation range. The Board has a neutral recommendation.

- The offer undermines minorities as it lacks split pricing for the Toyota Motor (7203 JP) and its affiliates’ shareholding and likely undervalues the significant real estate holdings.

4. [Japan Activism] Pasona Group (2168 JP) – Three New Things Of Mixed Importance

- Pasona Group (2168 JP) is a “value stock.” It has loads of cash (but less than you think) and significant ongoing governance issues, but they are doing a TINY buyback.

- Several weeks ago we got an announcement which was odd. Not completely odd, just odd. Now in the past week we have market activity/announcements which make one wonder.

- This piece attempts to interpret some of the recent data/info points. One is odd. Another is odd but meaningful (but different than people think). A third is just technical.

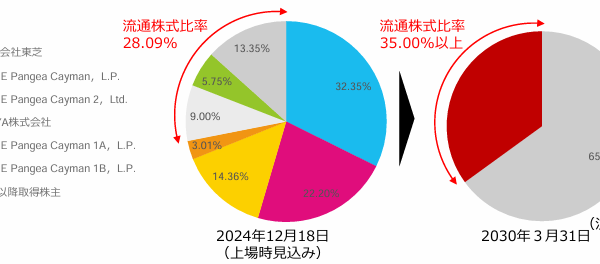

5. ESR (1821 HK): A Shareholder Register Look-Through

- Today, I was the first analyst to gain access to ESR (1821 HK)‘s lesser-known shareholder register, a byproduct of investigative disclosure reports under s329 of the Securities and Futures Ordinance.

- This is the same register discussed in Giordano (709 HK): A Closer Look At The Shareholder Register Ahead Of The SGM and L’Occitane (973 HK): Who Owns What, And When

- It is also used by proxy solicitors. My takeaway, still, is that this Offer is a done deal. But yes; there are a few shareholder activists lurking in the register.

6. [Japan Buyback] Leopalace (8848 JP) – A Giant Buyback To Get Fortress Partially Out

- Leopalace21 Corp (8848 JP) had a giant oopsie in 2018-2021 where they lost ¥180bn over three years because of defective construction requiring repairs.

- Murakami and others got involved. Leopalace got financing from FIG (shares/SARs/loan), Murakami bailed. Eventually Hikari Tsushin got in. Leopalace got FIG out of their loan, doing a refi through Mizuho.

- Cash was up, cashflow is strong. Business is changed/revived. Now Leopalace is buying back SARs it sold to FIG. FIG will still own 26%. The future is potentially interesting. Still.

7. Soul Patts/Brickworks To Unwind Circularity

- The cross-shareholding between Washington H. Soul Pattinson (SOL AU) (Soul Patts) and Brickworks Ltd (BKW AU) was established in 1969 to defend the companies from corporate raiders.

- Perpetual pursued a case in the Federal Court of Australia, alleging that the cross-shareholding was oppressive to minority shareholders; however the claim was dismissed in 2017.

- Today, via inter-conditional Schemes, the circularity is set to be unwound through a merger. Soul Patts currently owns 43.3% in Brickworks, and Brickworks 26% in Soul Patts.

8. Makino Milling Machine (6135 JP): MBK’s Preconditional Offer Is Not the Likely Endgame

- Makino Milling Machine Co (6135 JP) announced a preconditional tender offer from MBK Partners at JPY11,751, a 4.8% premium to last close and a 6.8% premium to Nidec’s withdrawn JPY11,000 offer.

- The offer is broadly in line with the midpoint of the IFA DCF valuation range. The tender offer is expected to commence in early December.

- Despite the offer resulting from an auction, there remains a medium probability that Nidec Corp (6594 JP) or a spurned white knight bidder (Candidate A) emerges with a higher offer.

9. Mayne Pharma (MYX AU): Twists and Turns as Cosette Chases a Get-Out-Of-Jail-Free Card

- Mayne Pharma (MYX AU) disclosed that Cosette served a scheme termination notice. Mayne maintains that a material adverse clause was not breached and considers the termination notice invalid.

- The Cosette MAC breach claims likely hinge on establishing that forecasts provided during due diligence are materially lower than the unaudited management accounts. Precedents do not favour Mayne.

- While the last close price (A$4.48) is below the undisturbed price (HK$5.41), there remains downside. My estimated deal break valuation range is A$3.26-A$4.00.

10. NWD (17 HK): Markets Pricing In A Bust

- 0.052x P/B! That’s New World Development (17 HK)‘s current trailing P/B ratio; roughly a quarter of the next comparable real estate peer.

- What’s new? The latest decline followed an announcement on the 30th May that it would defer payments on its perpetual bonds.

- NWD’s 6.15% and 4.8% perpetuals fell to 23 cents and 15.5 cents on the dollar on 2nd June, suggesting the market is pricing in the possibility of a bust.