This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Activism/M&A] Thinking About the Partial Tender Trade Coming in Dec25

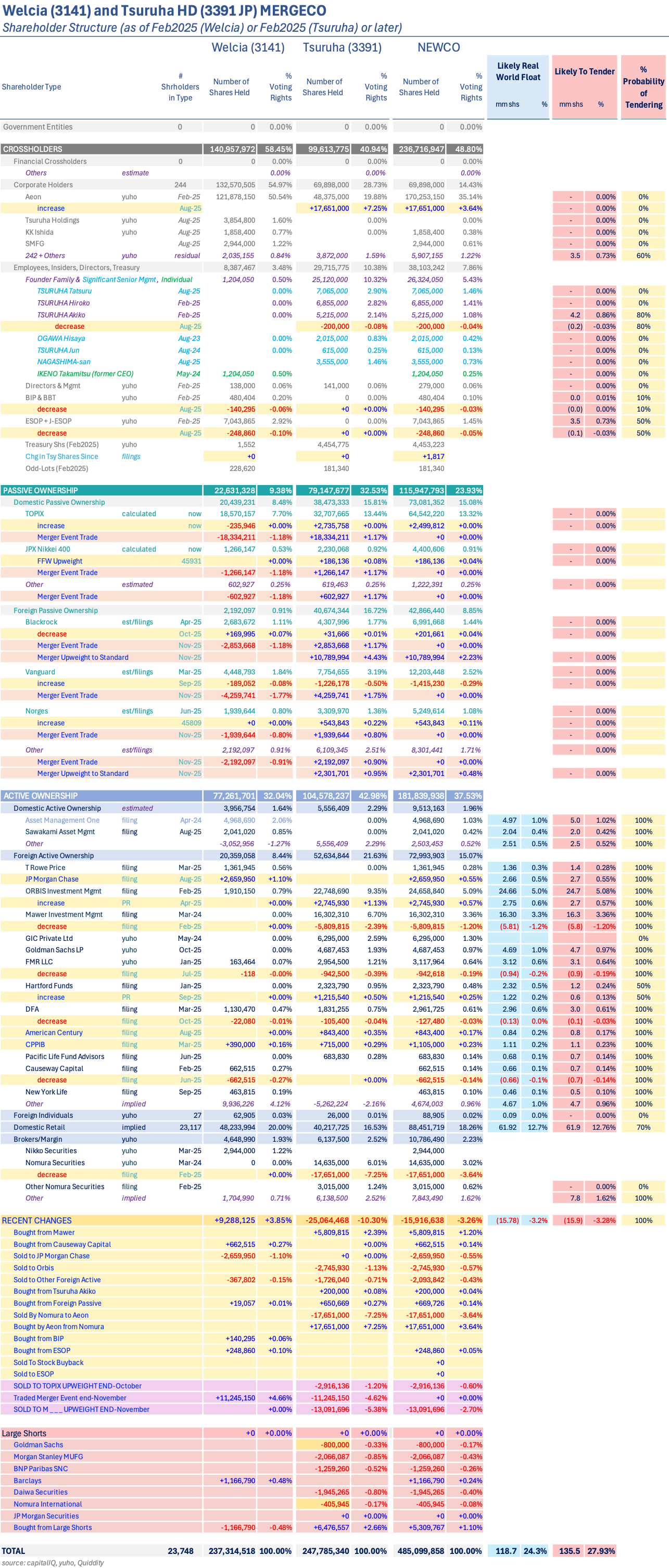

- A month ago I wrote [Japan Activism/M&A] – Closing In On the Tsuruha Partial Tender – Likely Needs To Be Higher. Now we are <2wks to the deal.

- At the time, I said the Partial Tender Offer Price needed to be higher than the mooted ¥2,280. Tsuruha Holdings (3391 JP) shares are up 10.0% in that month.

- The three largest peers are -2.0% on average in that period. The average of 8 peers is +0.5%. I still expect the partial offer price needs to be near ¥3,100

2. China Hongqiao (1378 HK): Index Impact of US$1.2bn Placement

- China Hongqiao (1378 HK) is looking to raise US$1.2bn via a top-up placement at an indicative price of HK$29.2/share, a 9.6% discount from the last close.

- There will be limited passive buying from global index trackers at the time of settlement of the placement shares. However, there are a couple of potential index inclusions in December.

- Then there will be more passive buying from trackers of a global index, Hang Seng Index (HSI INDEX) and Hang Seng China Enterprises Index (HSCEI INDEX) next year.

3. CATL IPO Lockup – US$5.3bn Lockup Release, with H-Shares at Significant Premium to A-Shares

- CATL (3750 HK) raised around US$5.2bn in its H-share listing in May 2025. The lockup on its cornerstone investors is set to expire soon.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research.

- In this note, we will talk about the lockup dynamics and possible placement.

4. SBI Shinsei Bank (8303 JP) IPO: TPX Add in Jan; Global Index: One in May; One in June

- SBI Shinsei Bank (8303 JP)‘s listing has been approved by the JPX and the stock is expected to start trading on the Prime Market from 17 December.

- At the indicated IPO price of ¥1,440/share, the IPO will raise up to ¥367.6bn (US$2.38bn) and value SBI Shinsei Bank (8303 JP) up to ¥1,290bn (US$8.34bn).

- The stock should be added to the TOPIX INDEX at the close on 29 January while inclusion in global indices should take place in May and June.

5. [Japan Activism/M&A] Hakuhodo DY Lowers Digital Holdings (2389 JP) TOB Threshold, Bumps a Tiny 2.2%

- Today after the close, Hakuhodo Dy Holdings (2433 JP) announced changes to the terms of its Tender Offer for Digital Holdings Inc (2389 JP), which faces an overbidder in SilverCape.

- Hakuhodo had bid ¥1,970. Silvercape came over the top with a proposed ¥2,380 but a delay for approvals. DH is fighting against SilverCape because of “remaining minority shareholder risk.”

- That’s garbage. Utter blatherskite. Trumpworthy trumpery. Now Hakuhodo DY has lowered the minimum threshold making it hard to miss, and raised the price 2.3% to ¥2,015.

6. Alibaba (9988 HK / BABA US): Brace for a Big Earnings Move

- Alibaba (9988 HK) / Alibaba (BABA US) will announce quarterly results on Tuesday, November 25, 8:30 p.m. HKT (7:30 a.m. U.S. Eastern Time)

- Options markets anticipate an above average move with a bearish bias in traders’ expectations. Implied volatility is expected to drop significantly after the event.

- Get ready for Alibaba‘s earnings announcement. Potential above-average volatility in Alibaba has the potential to impact the wider market and Chinese benchmark indices.

7. Merger Arb Mondays (17 Nov) – Mandom, Paramount Bed, Maruwn, Paris Miki, Mayne, AUB, Genting

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), AUB Group Limited (AUB AU), Dongfeng Motor (489 HK), ENN Energy (2688 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Seven West Media (SWM AU), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Jinke Smart Services (9666 HK).

8. Grindr (GRND US)’s Wide Spread As Majority Owners Court Delisting

- Back on the 24th October, Ray Zage (director) and James Lu (chairman), collectively holding ~60% in Grindr (GRND US), proposed to take the company private in a US$3.5bn deal.

- The non-binding cash Offer of $18/share, is a 51% premium to undisturbed. A condition to a firm Offer may incorporate a majority of minority vote.

- While the Special Committee considers the proposal, James Lu has unusually opted to step down. Currently trading at a ~30% gross spread to indicative terms.

9. Tsuruha-Welcia Merger to Form Biggest Drugstore Alliance, +Aeon TOB

- The Tsuruha-Welcia merger creates Japan’s largest drugstore alliance, poised for long-term growth and market dominance, driven by an expected JPY 50B in synergies over three years.

- A two-step corporate action—share exchange (Dec 1, 2025) followed by an Aeon TOB—provides structural certainty and strategic backing, securing the combined entity’s market leadership.

- These catalysts establish a large market leader in the consumer staples space, suggesting a timely opportunity to gain exposure to the new entity.

10. Webjet (WJL AU): Helloworld Steps Up As Weiss/BGH Seek Board Spill

- In Webjet (WJL AU): Undisclosed Buyer Buying, rumours surfaced earlier this year of an undisclosed buyer with ~5%. On the 12th May, Helloworld (HLO AU) emerged with a 5.015% stake.

- On the same day, Gary Weiss/BGH, collectively holding 10.76%, launched a A$0.80/share NBIO, which was subsequently rejected. Undeterred, Weiss/BGH has called for an EGM (21st November) to spill the board.

- Helloworld has now tabled a A$0.90/share non-binding Offer, by way of Scheme. The 1H26 dividend of A$0.002/share will be added. Helloworld currently holds 17.27%. Weiss/BGH hold 17.75%.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

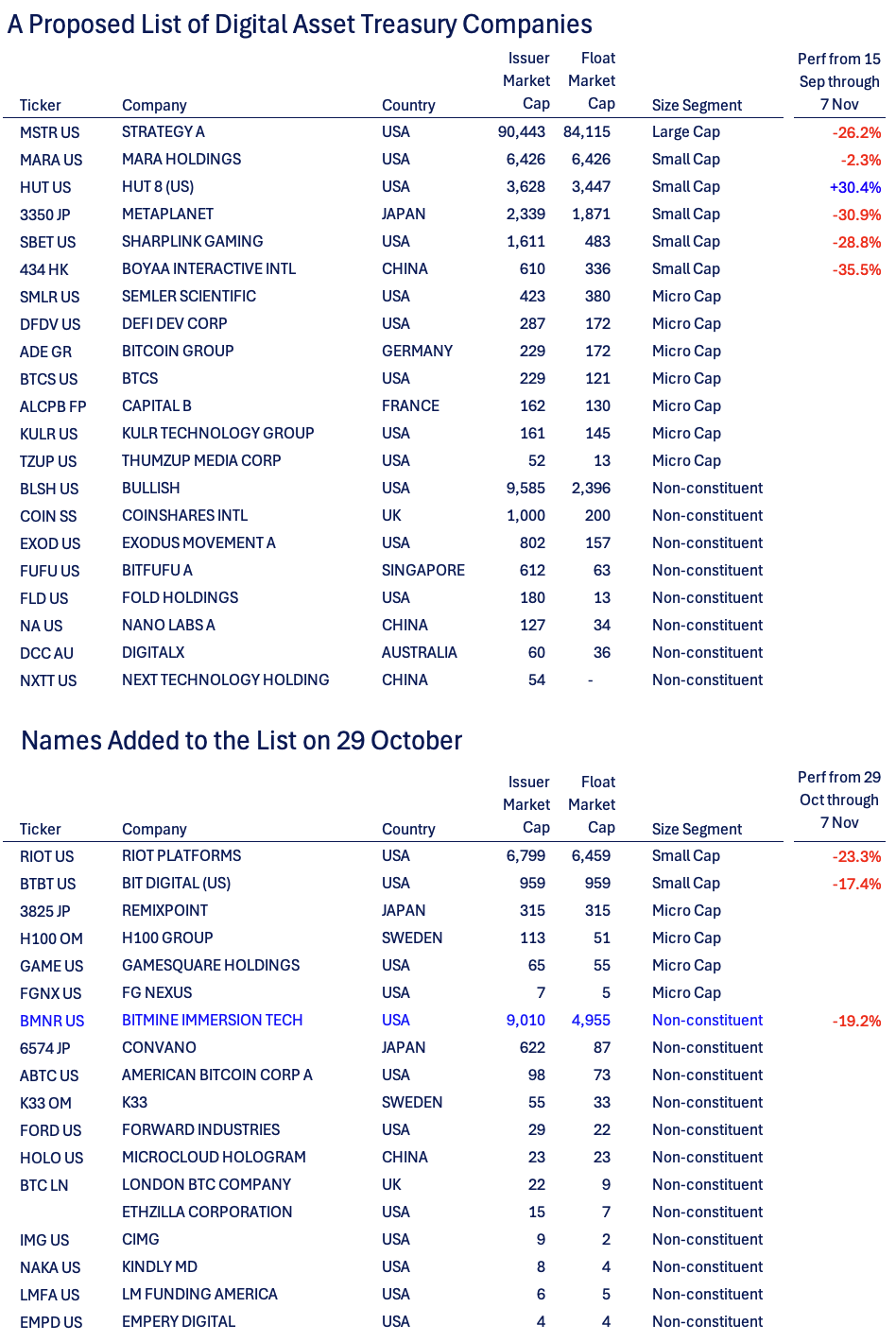

1. Index Consultation on DATCos Means MORE Selling Likely, and Another Index Questionable

- In mid-September, global index provider M _ _ _ announced that they were conducting an index consultation on Digital Asset Treasury Cos. I wrote about it here.

- My recommended short at the time is down 30%, despite announcing a large buyback program. Others have lost significant premium vs underlying digital assets.

- The same index provider expanded their list of affected names on 29 Oct. And a DIFFERENT Index provider this week added DATCOs to a US Advisory Panel Meeting Agenda Wednesday.

2. [Japan M&A] Senko Group (9069 JP) Bids for Maruwn (9067 JP) In Deal Which May Trigger Fireworks

- Today, logistics company SENKO Group Holdings Co., Ltd. (9069 JP) announced a bid for logistics company Maruwn Corp (9067 JP) with help from 35% holder JX Advanced Metals (5016 JP).

- The TOB only needs 11+% to get to 50.1%. There are three holders who Senko clearly regard as not necessarily agreeable to the deal. They hold 28.0% between them.

- If someone wanted to thwart this deal, there are a number of ways to do it. This could get interesting.

3. [Quiddity Index] Light & Wonder (LNW US/AU) US Delisting Event – Updating The Assumptions/Estimates

- Light & Wonder (LNW US) will be delisted at the close of tomorrow US time (two trading days left) and shares converted to Australian CDIs.

- After studying the matter we have amended our assumptions on how flows work. More net selling than expected in November, irksome uncertainy in December, more buyback flows in the meantime.

- The stock was higher on earnings in Australia, skipped a day, then skipped another day, then jumped in the US yesterday.

4. ChiNext/ChiNext50 Index Rebalance Preview: Maxing Out the Changes

- With the review period complete, we forecast 10 changes for the ChiNext Index (SZ399006 INDEX) and 5 changes for the ChiNext 50 Index in December.

- The largest flows will be in 2 stocks that are forecast adds for both indices. There are 14 stocks with over 0.5x ADV to trade from passive trackers.

- The forecast adds outperformed the forecast deletes from June to August, but there has been significant underperformance since then. Outperformance could resume as positioning kicks in prior to announcement.

5. [Japan M&A] Taiyo Pacific Offers ¥2,210 for Star Micronics (7718) Completing the Shareholder Ripoff

- Today after the close, well-known Japan engagement fund Taiyo Pacific Partners announced a deal to buy Star Micronics (7718 JP) for ¥2,210/share. They’ve been involved small-big-small for 20yrs.

- The company launched a new capital plan and MTMP in February. Cash-rich, it needed no money to grow aggressively. So TPP proposed buying a third of the company. Board agreed.

- Despite ActionsToImplementManagementConsciousOfSharePriceAndCostOfCapital announced February, in April-November the Board decided to sell the entire company to TPP at <1x book. This is borderline outrageous. It deserves notice and complaint.

6. Hynix L2 Flag Risk: Why Stuck Below ₩620k? Eyes on Nov 17 Pivot

- Hynix tagged L2: cash‑only, no margin. >40% two‑day rip triggers KRX halt. L2 caps distort tape; Square’s Oct 27–Nov 10 run showed the messy playbook.

- Hynix L2 review: five >200% YoY prints since Nov 4, but no fresh 15‑day high—₩620k from Nov 3 still the cap, yesterday stalled just below.

- Break above ₩620k likely triggers L2, leverage caps, volatile tape, Square outperformance; hold below into Monday kills L2 risk, keeps Hynix’s relative bid with retail still piling in.

7. [Japan M&A] Paris Miki Is Indeed an MBO Target; Luxottica May Complain But Tough To Block

- Today after the close, Paris Miki Holdings (7455 JP) announced the Tane family Holdco would buy out the company in an “MBO” at ¥581, or 4.8x current year EBITDA.

- World famous eyeglass/sunglass manufacturer Luxottica bought 13.8% of the company in the low ¥300s almost stopping about a year ago. They might complain, but Paris Miki is a big outlet.

- This looks like it gets done. The family+crossholders+ESOP+warrants have 65% of the expanded share count. Those who would complain would need to do so soon, and loudly.

8. Square’s Level 2 Leverage Caps End Tomorrow — Fresh Near‑term Factor in the Square Vs Hynix Setup

- Square closed ₩290,000, missing all criteria; Level 2 removal effectively confirmed, with KRX disclosure expected ~8 p.m. Seoul, effective from tomorrow’s open.

- Square vs Hynix hinges on retail chase structurally, but near‑term Square’s underperformance worsened by asymmetric leverage shackles.

- Square’s Level 2 setup ends tomorrow; flows normalize, likely giving Square more juice vs Hynix. Key spot to watch from tomorrow’s open.

9. [Japan M&A] KKR and Founder to Take Engineer Staffing Agency Forum Engineering (7088) Private

- Today after the close, KKR announced a deal whereby they and founder OKUBO Izumi-san would take Forum Engineering Inc (7088 JP) private in an LBO.

- The process of this deal ticks most all of the “bad process” boxes but the price is pretty good.

- 52% is locked in. Insiders and cross-holders appear to own another 15-18%. This looks like a done deal to me. Money comes 30 December.

10. Merger Arb Mondays (10 Nov) – Soft99, Digital Holding, Saint-Care, ANE, ENN Energy, Mayne, AUB

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Saint-Care Holding (2374 JP), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Seven West Media (SWM AU), Jinke Smart Services (9666 HK).

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

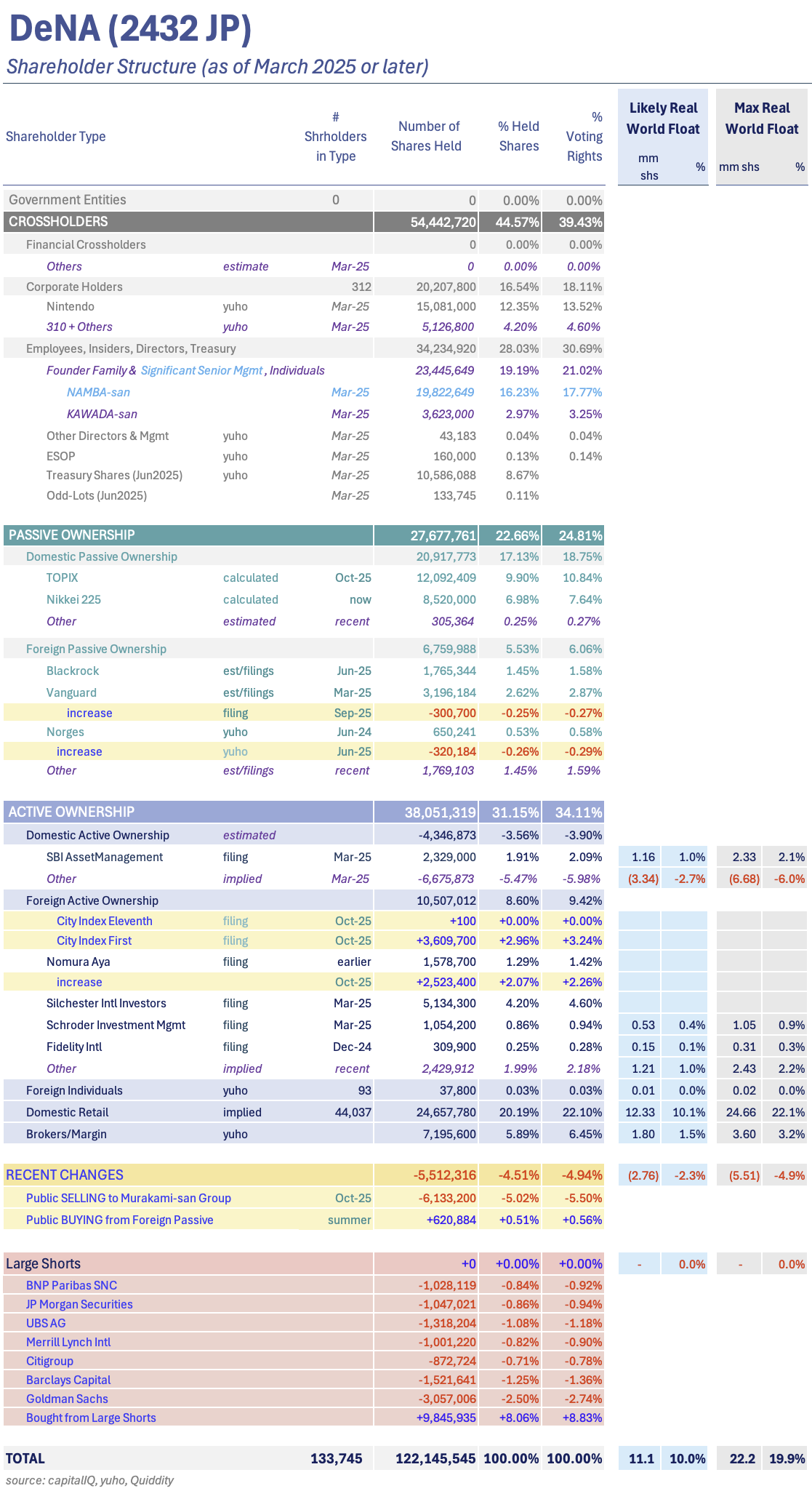

1. [Japan Activism] DeNA Attracts Murakami Group – Potentially Squeezable With Reason

- Last week, “Murakami Group” (a group of investors who jointly file large shareholder filings) announced a 5+% stake in DeNA (2432 JP). The stock popped. Then they filed again.

- This was not surprising. It has long been known as a “value” name (and has the requisite short balance to prove it). The question is how much value IS there

- The question is how much value IS there. And to whom? It’s an interesting question which deserves a look, so we take a look.

2. Pine Labs IPO: Slashed Offering Size & Lower Valuation

- Pine Labs (0568874D IN) is looking to list on the exchanges by selling 176.5m shares via a primary and secondary offering to raise US$439m at a valuation of US$2.86bn.

- The price band has been set at INR 210-221/share and could price at the top end of the range. The IPO raise and valuation are sharply lower than earlier reports.

- Inclusion at regular rebalances will commence in May but flow will be small given the low float and the Smallcap indices that it is added to.

3. Toyota Industries (6201 JP): Market Movements Support the Case of a Higher Offer

- Last month, nearly two dozen global asset managers, through ACGA, submitted a joint letter to the boards of Toyota Industries (6201 JP) and Toyota Motor regarding the tender offer.

- The letter outlined five issues, which distilled down to concerns about a low-balled offer. Their cause is increasingly supported by market movements, which support the case for the bump.

- Recent activism against several low-balled tenders signals that TICO, despite its size, is not immune. My SoTP valuation is JPY19,607, which is 20.3% above the offer price.

4. [Quiddity Index] Light & Wonder (LNW US/AU) US Delisting / ASX Relisting Index Event

- In August, Light & Wonder (LNW AU) / Light & Wonder (LNW US) announced that the company would give up its US listing and move to an ASX Primary Listing.

- The NASDAQ delisting has been confirmed (as expected) for 12 November. October saw significant CDI conversions. More have come in the last few days.

- This creates a significant, and interesting set of index events to track.

5. Matheson’s Motive For Avoiding MAND’s Dissentient Shareholders

- Back in 2021, Jardine Matheson (JM SP) took 84.89%-held Jardine Strategic (JS SP) private by way of an Amalgamation. As Matheson was permitted to vote, the outcome was assured.

- Less clear are “fair value” appraisal rights afforded Strategic’s dissentient shareholders, the outcome of which navigates the Bermuda/UK courts. To date, dissenters have mostly had their way.

- Which may have precipitated Matheson opting for a (full value) Scheme for Mandarin Oriental International (MAND SP), in which appraisal rights are not afforded.

6. Merger Arb Mondays (03 Nov) – ANE, Dongfeng, Mayne, AUB, Digital Holdings, Makino, Soft99, SCSK

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Brainpad Inc (3655 JP), Smart Share Global (EM US), AUB Group Limited (AUB AU), ENN Energy (2688 HK), Dongfeng Motor (489 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Pacific Industrial (7250 JP), Seven West Media (SWM AU), Humm Group (HUM AU), Toyota Industries (6201 JP).

7. [Japan Activism] Mandom (4917 JP) – Murakami at 20% and Mandom Offers A Sweet Poison Pill

- Mandom Corp (4917 JP) yesterday decided to launch a question-response effort for the Murakami-san Group ownership of Mandom shares up to and above 20%. This is a Poison Pill precursor.

- There’s a drawn out set of questions, answers, etc, at the end of which, the Independent Committee will decide that Murakami is a Bad Person and the Poison Pill proceeds.

- Murakami Group is apparently now over 20%. That’s a little tricky. But this looks like a Good Poison Pill.

8. Mandom (4917 JP): Countermeasures Ostensibly to Buy Time for a Higher Offer

- Mandom Corp (4917 JP) has proposed countermeasures in response to Murakami’s 18.87% voting stake and to ostensibly secure time for an alternative, viable (higher) offer.

- The read-across from the proposal is that CVC’s offer at current terms will fail, CVC is unwilling to match Murakami/Hibiki’s expectations, and there could be genuine interest from third-party bidders.

- Nevertheless, countermeasures are unnecessary as the share price and presence of activists provide the time needed for the Board’s purported aim to secure a higher offer.

9. Physicswallah IPO: Index Inclusion Possibilities & Timing

- Physicswallah Limited (2076103D IN) is looking to list on the exchanges by selling 319.26m shares via a primary and secondary offering to raise US$392m at a valuation of US$3.5bn.

- The price band has been set at INR 103-109/share, and the issue is likely to price at the top end of the range.

- The stock will be added to the AMFI Smallcap segment and inclusion in the Nifty Smallcap 250 index is likely in March. Global index inclusion could commence in June.

10. StubWorld: Sumitomo Chemical/Sumitomo Pharma, Hyundai Motor/ Kia Corp, Ecopro Co/Ecopro BM

- For a change of pace, this insight briefly canvasses a clutch of Holdco’s trading at extreme levels, in both “set-up” and “unwind” territory.

- Preceding the chart/table-heavy insight are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

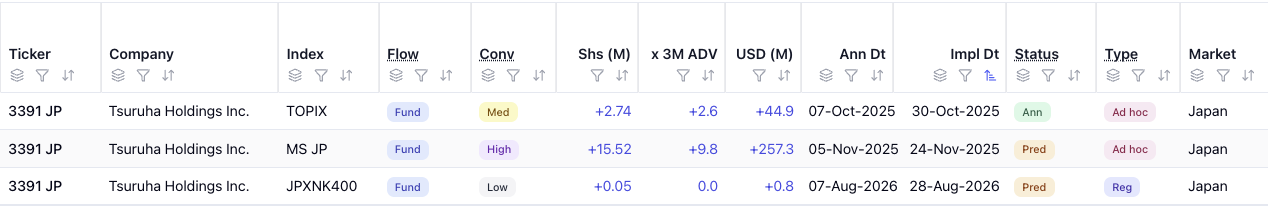

1. Tsuruha (3391 JP)/Welcia (3141 JP): Index Promotion & Passive Flows Likely Priced In

- Tsuruha Holdings (3391 JP) acquires Welcia Holdings (3141 JP) in just over 4 weeks. Aeon Co Ltd (8267 JP)‘s tender offer for Tsuruha Holdings (3391 JP) could commence in December/January.

- The enlarged Tsuruha Holdings (3391 JP) could migrate upward in the MGlobal Index and that will bring in large passive flows. But there is one thing to watch out for.

- Tsuruha Holdings (3391 JP) and Welcia Holdings (3141 JP) have outperformed peers over the last 6 months and now trade at a higher forward PE.

2. Seres (9927 HK): Index Inclusion Timeline for a Max Offering of US$2.2bn; Big Discount to A-Shares

- Seres Group (601127 CH) could raise up to HK$17.4bn (US$2.24bn) in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the already small possibility of Fast Entry inclusion to global indexes.

- Seres (9927 HK) should be added to Southbound Stock Connect from the open of trading on 1 December following the end of the Price Stabilisation period.

3. Lenskart IPO: Earliest Index Inclusion in June

- Lenskart Solutions (0370405Z IN) is looking to list on the exchanges by selling 181.05m shares via a primary and secondary offering to raise US$829m at a valuation of US$7.95bn.

- The price band has been set at INR 382-402/share, and the issue is likely to price at the top end of the range.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

4. Groww IPO: Growwing Fast; Index Inclusions Will Be Sloww; Small Floww

- Groww (1573648D IN) is looking to list on the exchanges by selling 663.23m shares via a primary and secondary offering to raise US$752m at a valuation of US$7bn.

- The price band has been set at INR 95-100/share, and the issue is likely to price at the top end of the range.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

5. [Japan M&A/Activism] Ashimori Industry (3526 JP) Minimum Lower, May Be a Tough Call

- In August, Toyoda Gosei (7282 JP) announced a deal for Ashimori Industry (3526 JP) at 1.000x book value after writedowns. That was not a coincidence.

- The takeover is cheap for what it is. No synergies were counted. But it wasn’t truly offensive. MURAKAMI Takateru aimed an activist broadside, bought 19.73% across four entities. Then stopped.

- The Bidder lowered the Tender Offer Minimum from 2.3081mm shares (38.29%) to 1.8001mm shares (29.86%). Shares dropped. As of 24-Sep, 2,111,226 shares had been tendered. This looks done. Maybe.

6. [Japan M&A] Sumitomo Corp To Buy Out Minorities in SCSK (9719 JP)

- Yesterday after the close, Sumitomo Corp (8053 JP) announced it would buy out minorities in Scsk Corp (9719 JP) at ¥5,700/share.

- As a “parent takes out subsidiary” deal, this was not unexpected at some point in time. The register looks like there may be a number of people who expected that.

- This gets done pretty easily. It is not a bad price.

7. Sanil Electric Poised for Pop on Nov 20 KOSPI200 Ad‑Hoc (HD Hyundai Merger)

- HD Hyundai merger: both legs in index, Mipo delists, slot opens — one new name gets added to KOSPI200 via ad‑hoc.

- Sanil Electric (062040 KS) to replace HD Mipo pre‑Dec review. If DTV settles back into the 500–600k range, then KS200 ETFs will need to scoop ~0.3–0.4x DTV on Nov 26.

- Better to front‑run KRX; with AI power trade still hot, Nov 20 announcement likely sparks outsized price action vs waiting for rebalance print.

8. ANE (9956 HK): Centurium/Temasek’s Clean Offer

- After ANE Cayman Inc (9956 HK), a road freight transportation play, was suspended pursuant to the Takeovers Code, an Offer from PE outfit Centurium Partners, a pre-IPO investor, was expected.

- And this is what unfolded. Centurium, together with Temasek and Singapore-based asset manager True Light, are offering HK$12.18/share (best & final) via a Scheme, a 48.54% premium to undisturbed.

- A scrip alternative is present (mix & match). This is a pre-conditional Offer: it requires SAMR signing off. The FA is JPM. This should help smooth over the reg process.

9. ANE (9956 HK): Consortium’s Attractive Preconditional Offer

- ANE Cayman Inc (9956 HK) has disclosed a preconditional scheme privatisation offer from a consortium. The offer is cash (HK$12.18) or scrip (One TopCo Class A Share per scheme share).

- The precondition relates to SAMR approval. The scheme vote is low risk, as the offer is attractive relative to historical ranges and peer multiples.

- The offer price is final. Mr Wang Yongjun, the former chairman, holds a blocking stake but should be supportive. Timing is the key risk.

10. Jardine Matheson’s Underperformance Post Mandarin Offer

- Concurrent with the sale of 13 floors of OCB to Alibaba, Jardine Matheson (JM SP) announced on the 17th October an Offer for Mandarin Oriental (MAND SP)‘s minorities at US$3.35/share.

- This is a clean, full, “dull” Offer. And MAND is trading super tight to terms at ~2.1% gross, with possible payment (my estimate) late Feb 2026.

- Proceeds from the OCB sale will be US$925mn. And taking out MAND’s minorities will set Matheson back ~US$1bn. Yet the market is now assigning US$2.1bn less for Matheson’s stub ops.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Sany Heavy (6031 HK) IPO: Big Cornerstone Allocation to Delay Global Index Inclusion

- Sany Heavy Industry (600031 CH) could raise up to HK$16.35bn (US$2.1bn) in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the already small possibility of Fast Entry inclusion to global indexes.

- Sany Heavy (6031 HK) should be added to Southbound Stock Connect from the open of trading on 24 November following the end of the Price Stabilisation period.

2. Mandarin Oriental (MAND SP): Matheson’s Full Offer

- A sale – partial or otherwise – of Mandarin Oriental International (MAND SP)‘s One Causeway Bay (OCB) was always on the cards. But I didn’t see an Offer coming.

- Concurrent with the sale of 13 floors of OCB to Alibaba (9988 HK), Jardine Matheson (JM SP) is seeking to take out MAND’s minorities at US$3.35/share by way of a Scheme.

- That’s a 52.3% premium to undisturbed, and a 53.7% premium to NAV. Unlike the 2021 Jardine Strategic (JS SP) Offer, Matheson is required to abstain from voting on this takeover.

3. [Japan M&A/Activism] Digital HD (2389 JP) Gets a Counter + 20% – Tough But Not Impossible

- Today, in something of a surprise but not a complete surprise, Silvercape came out with its own bid for Digital Holdings Inc (2389 JP) at +20% from the Hakuhodo bid.

- They make it clear that the original bid does not protect minority shareholders or give them sufficient value. This one would. Which means that is Hakuhodo’s bogey.

- It would not be impossible for Silvercape to get to its minimum hurdle, but despite being lower than Hakuhodo’s it’s not a gimme.

4. [Japan M&A/Activism] – Activism Wins as MBO Bidder Pays 42.4% More for Pacific Industrial (7250 JP)

- When the Pacific Industrial (7250 JP) deal was announced in late July, I said it needed to be done 20-40% higher. I hadn’t expected someone to push so hard.

- But Effissimo pushed. They bought 12.5% of shares out, and 13+% of votes at an average price of ¥2,365/share – 15% through terms.

- Three months later after multiple extensions, Bidco bid up. +42.4%, to 1.002x March 2025 BVPS. A raging win for activists and minority investors. I’m genuinely surprised by the quantum.

5. Palliser Capital Goes Activist on LG Chem

- Palliser Capital started to go activist on LG Chem. According to Palliser Capital, LG Chem’s share price is trading at a 74% discount to its NAV.

- Palliser Capital proposed improving the composition of the board of directors, restructuring the executive compensation system to align with shareholder interests, and higher share buybacks.

- Our updated NAV analysis of LG Chem suggests implied price of 613,438 won per share, which represents a 57% higher levels than current levels.

6. Dec KS200 Review: Kakao Pay Poised for Breakout

- Names with the biggest float bumps relative to their old float saw the sharpest moves — Hanwha Ocean and Ecopro Materials were the standout examples.

- Kakao Pay looks set for Dec review spotlight: float likely jumping from 21% to 34% (+13ppt, 60%+ surge), even bigger than Hanwha Ocean/Ecopro last round.

- Kakao Pay’s 13ppt float hike implies ~0.7–1.0x DTV passive inflows; with little pre‑positioning, flows may hit raw and drive outsized intraday impact.

7. Korea’s Next Policy Play: NAV Discount Squeeze on Low‑Float Large Caps

- Market sniffing policy push; low-float names flagged as junk risk with skewed control. Desks circling, Palliser hit early—LG Chem trade popped, timing spot on.

- Trade setup: screen >₩1tn caps with low float, parent stakes 60–80%. Policy push likely forces stake cuts, driving float higher and squeezing NAV discounts—LG Chem shows the play.

- Screening >₩1tn caps flags 11 names: parents hold 60–80%. All potential stake-sale plays to boost float, squeeze NAV discount.

8. Merger Arb Mondays (20 Oct) – ENN Energy, Joy City, Kangji, Mandarin, Soft99, Mandom, Makino

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mandarin Oriental International (MAND SP), Smart Share Global (EM US), Soft99 Corp (4464 JP), ENN Energy (2688 HK), Mayne Pharma (MYX AU), Dongfeng Motor (489 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Mandom Corp (4917 JP), Humm Group (HUM AU), Seven West Media (SWM AU), Toyota Industries (6201 JP).

9. Horizon Robotics IPO Lockup – Last of the Lockups, Large Pre-IPO Investors Still Holding On

- Horizon Robotics (9660 HK) raised around US$800m in its Hong Kong IPO in October 2024. Its first set of lockups expired in April 2025. The next one is due soon.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note, we will talk about the lockup dynamics and possible placement.

10. Fresh Policy Momentum Hitting Korea Tape: Trade Is Lining up Around 13 Holdcos with CVC Exposure

- Gov’t likely to ease CVC rules; street chatter sees high odds. Tied to KRW150tn Growth Fund push, with corporates lobbying—cleanest path to juice capital flow.

- Holdcos at center of CVC‑easing; scrapping disclosure rule unlocks external capital. Street read: fast flip from control towers to re‑rating plays as real investment shops with growth portfolios.

- KFTC flags 177 holdcos, 14 with CVCs (13 listed). Street sees momentum flows hitting these 13 names; play via basket/overweight, with Doosan, Hyosung, LX as preferred plays.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Activism/M&A] – Closing In On the Tsuruha Partial Tender – Likely Needs To Be Higher

- The merger between Tsuruha Holdings (3391 JP) and Welcia Holdings (3141 JP) will go through in about 6 weeks. In the interim, there are interesting events.

- After, there is a Partial Tender Offer. I expect Aeon Co Ltd (8267 JP) will have to pay up.

- Furthermore, the stock is not overly expensive vs Peers AND there are synergies to come from the merger, making it relatively cheaper. It’s not squeezy, but it’s skewed.

2. Hang Seng (11 HK)’s Offer: HSBC Investors Are Not Sold On The Strategic Benefits

- Since announcing HSBC (5 HK)‘s Offer, Hang Seng Bank (11 HK) has traded tight-ish to terms, at a ~3.9% gross spread (including dividends). Or ~10% annualised if a five month offramp.

- Annualised spreads for clean liquid deals in Asia-Pac, do tend to widen after day 1. Meaning, the gross spread remains roughly static as investors hit their full quota early on.

- HSBC shareholders are questioning the deal merits. For Hang Seng minorities, this is a great exit. Inside this report, I take a deeper dive into Hong Kong bank takeover precedents.

3. Merger Arb Mondays (13 Oct) – Dongfeng, Hang Seng, Soft99, Toyota Industries, Pacific Ind, Mandom

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Soft99 Corp (4464 JP), Dongfeng Motor (489 HK), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Mandom Corp (4917 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Seven West Media (SWM AU).

4. Genting Malaysia (GENM MK): Genting (GENT MK)’s Curious Offer

- Genting Malaysia (GENM MK), the owner of Resort World Genting, has announced a conditional offer from controlling parent Genting Bhd (GENT MK).

- GENT is offering RM2.35/share, an uninspiring 9.81% premium to last close, for the 50.64% of shares out not held. The Offer has a 50% acceptance threshold.

- GENT already consolidates GENM (AFAIK). At this price, compulsory acquisition won’t be afforded (you’d think). GENT should have launched the Offer back in April when the share price was floundering.

5. Korea’s Div Tax Story Suddenly Hits a Radical Inflection: Targeting Samsung Elec & Hyundai Motor

- Kim Yong-beom proposed cutting eligibility to 25%+ payout firms and hinted the Presidential Office may slash the dividend tax ceiling to 25%, potentially the boldest move yet.

- Short-Term spotlight: large-cap 25–40% payout stocks, led by Samsung Elec and Hyundai Motor. Kim Yong-beom hinted the Presidential Office wants them included to drive dividend growth.

- Big-Cap 25–40% payout stocks, especially Samsung Elec and Hyundai Motor, could see heavy flows, with their preferred shares poised to outperform in the near term.

6. [Quiddity Index] Index Consultation Anncmt Suggests The Big M Will Delete 1 LargeCap, 5 Small.

- Global Index Provider M _ _ _ announced an index consultation on Digital Asset Treausry Companies on 27 August. Friday, they extended til year-end, but gave a clear proposal update.

- They propose to exclude companies where digital asset holdings represent >50% of assets. They seek input. They also seek input on whether a company self-defines as a DAT…

- And also look at stated reasons for capital raising. A preliminary list suggests Strategy (MSTR US) and Metaplanet (3350 JP) are obvious targets. Others will be too.

7. Genting Malaysia (GENM MK): Genting’s Conditional Voluntary Offer at RM2.35

- Genting Malaysia (GENM MK) disclosed a conditional voluntary offer from Genting Bhd (GENT MK) at RM2.35, a 9.8% premium to the last close price of RM2.14.

- The 50% minimum acceptance condition is easily met as Genting is the largest shareholder, representing 49.36% of outstanding shares.

- Genting’s preferred endgame is to delist GENM, thereby fully benefiting if GENM successfully bids for a downstate New York casino licence. Therefore, there is a good chance of a bump.

8. Mayne Pharma (MYX AU): Court Rules Cosette Cannot Walk

- In a watershed decision, the Supreme Court of NSW ruled Cosette cannot terminate its Scheme for Mayne Pharma (MYX AU).

- The hearings were the first time a material adverse change clause had been considered by an Australian court under such circumstances.

- The transaction still requires FIRB signing off. Concerns linger over whether Cosette intends to close a South Australian plant. Mayne has previously dispelled these concerns.

9. StubWorld: Genting (GENT MK)’s U.S. Expansion Is A Gamble

- Genting (GENT MK)‘s Offer for Genting Malaysia (GENM MK) is further evidence of the gaming group’s move for even greater U.S. exposure.

- Preceding my comments on GENT are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

10. Value Partners: Supports Samyang Holdings’ Equity Spin-Off Plan But Must Cancel Treasury Shares

- On 13 October, Value Partners has come out in support of Samyang Holdings (000070 KS)’s equity spin-off plan but on the condition that the company must cancel its treasury shares.

- Value Partners believes Samyang Holdings is currently severely undervalued, trading at a P/B of 0.34x. A shareholders meeting for Samyang Holdings is scheduled for 14 October.

- We have a positive view of this equity spin-off. Our NAV valuation of Samyang Holdings suggests an implied price per share of 127,138 won (28.6% higher than current price).

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

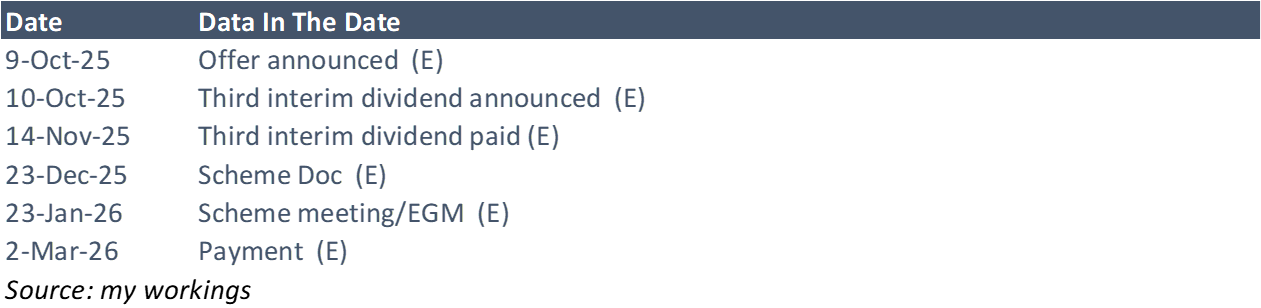

1. HSBC (5 HK)’s Clean Offer for Hang Seng (11 HK)’s Minorities

- Hang Seng Bank (11 HK) has announced an Offer from controlling parent (63.3551%), HSBC Holdings (5 HK), by way of a Scheme, in a HK$106bn (US$13.6bn) deal.

- The Scheme Consideration is HK$155/share, a 30.3% premium to last close. The price is final. A “third interim dividend” will be added. Optically, the price is bang on.

- The long stop for conditions is the 30th September 2026. I think this transaction can be wrapped up in around five months.

2. Tata Motors (TTMT IN) Demerger: Interesting Index Implications

- Tata Motors (TTMT IN) is demerging the company into two separate listed entities that will focus on the Passenger Vehicle business and the Commercial Vehicle businesses.

- Based on the estimated valuation for the two entities, both stocks will continue to remain in the MGlobal Index and the FGlobal Index.

- NIFTY and SENSEX trackers will need to sell their Commercial Vehicle business holdings soon after listing. There could be selling in the Passenger Vehicle business holdings at a later rebalance.

3. [Japan Event] Sony Financial (8729 JP) Moves On From ToSTNeT-3 Buybacks, Now In the Market

- Sony Financial Group (8729 JP) started ToSTNeT-3 buybacks last week and did one this week to jumpstart the buyback, cushioning the Nikkei 225 deletion on 29 Sep and subsequent overhang.

- In three ToSTNeT-3 buybacks in 6 trading days spending ¥28.9bn, the company bought back 177.513mm shares or 2.5% of shares out, or about 6.2% of Max Real World Float (MRWF).

- With ¥71.1bn left, at last that’s 460mm shares, or 16.2% of MRWF. Over 10mos that is 1.62%/month. That will boost Mar26 DPS, Mar27 DPS projections, EPS, etc.

4. Dongfeng Motor (489 HK): VOYAH Listing Docs Underscore the Upside

- On 22 August, Dongfeng Motor (489 HK) disclosed a pre-conditional privatisation by merger by absorption by Dongfeng Motor Corporation, along with a proposed distribution and listing of VOYAH shares.

- The VOYAH application proof, filed on 2 October, points to strong fundamentals and suggests that the appraised value of VOYAH and the offer are conservative.

- Based on the data points from the application proof, I calculate that the implied offer is HK$12.11-12.25 per H Share, a 11.6%-12.9% premium to the appraised value of HK$10.85.

5. Korea’s Mandatory Treasury Share Cancellation Situation Creates New Passive Flow Dynamics

- KRX may preemptively adjust KOSPI 200 screening, switching from full market cap to market cap excluding treasury shares for index inclusion.

- With treasury-share cancellation likely this quarter, KRX may act before June ’26. For December KOSPI 200, we should run both full-cap and ex-treasury screens; flows could behave unusually.

- Focusing on Hanssem (009240 KS) and Taekwang (003240 KS); borderline, high treasury shares, potential KOSPI 200 exclusion, making them key flow-sensitive setups for December reshuffle.

6. Dongfeng (489 HK): On VOYAH’s Updated Financials

- On the 22nd August 2025, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- Dongfeng has now released the application proof for VOYAH, with finances through to July 2025. Of interest, VOYAH is in the black for 7M25.

- The market is implying a price-to-trailing-sales of 1.5x for VOYAH versus the basket average of 2.1x.

7. [Japan Activism] Sun Corp (6736) Gets ANOTHER Public Activist – ValueAct Reports 7.9%

- Today after the close, Value Act reported that it owned 7.87% of shares outstanding in Sun Corp (6736 JP) and it may make proposals to management.

- This has been trading cheaply (and I pointed it out on 13 Aug and 12 Sep). Cellebrite DI (CLBT US) is up 35% in those 8 weeks. Sun Corp +50%.

- ValueAct had owned 4.9+% for at least a few months before, but now it has gone public. They were likely in already under a different name in March, now public.

8. Merger Arb Mondays (06 Oct) – Kangji, Soft99, I-Net, Daiseki, Mandom, Changhong, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Soft99 Corp (4464 JP), I Net Corp (9600 JP), Daiseki Eco. Solution (1712 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Mandom Corp (4917 JP), Seven West Media (SWM AU), Ainsworth Game Technology (AGI AU).

9. [Japan M&A/Activism] Soft99 Board Rebuts Effissimo’s Rebuttal. Still An Awful “Fiduciary” Response

- Today after the close, Soft99 Corp (4464 JP)‘s Board issued a statement on “Our View” of Effissimo’s “Our View” Press Release. It’s bad.

- But it points out the “weaknesses” that Effissimo’s Tender Offer Press Release had as it concerns a counterbid. And that tells you how Effissimo should amend their Tender Offer docs.

- Soft99 Board’s response is interesting. It asks Effissimo to not be coercive (i.e. bid for 50%+) in response to the MBO Bid’s coerciveness. Not a winning argument but not impossible.

10. [Japan Activism] Mandom (4917 JP) MBO Sees Murakami Pushing Harder, Now at 16.59%

- Four weeks ago, CVC announced a family-led MBO of hair care and cosmetics company Mandom Corp (4917 JP) at a price which was decidedly too light, well below company plans.

- One activist wrote a letter clearly calling them out for accepting a low-ball price well below the Medium Term Management Plan target. Another bought a lot of shares.

- On 25 September, Murakami-san and affiliates reported an 8.39% position. Seven trading days later it is 16.59% and the shares are up small from my last piece + 1.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event] Sony Financial (8729 JP) Overhang Hangs Over, Company Buys Back, ADR Selldown Awaits?

- Sony Financial Group (8729 JP) listed on Monday with a “Reference Price of ¥150. It opened at ¥205, quickly running to ¥210, then fell to ¥198 by lunch. Close? ¥173.8.

- That got a big ToSTNeT-3 buyback at ¥173.8. It traded lower on Day 2, closing at ¥164. Then lower still on Weds with another TN-3 buyback now ¥159.4.

- Neither buyback was full. SFGI has bought back 124mm shares. But the stock has fallen hard. ADRs/ADSs start trading Tuesday. That could see more selling.

2. Tekscend Photomask (429A JP) IPO: TPX Add in Nov; Global Index: One in Feb; One in June

- Tekscend Photomask (429A JP)‘s listing has been approved by the JPX and the stock is expected to start trading on the Prime Market from 16 October.

- At the top end of the IPO range at JPY 3000/share, Tekscend Photomask (429A JP) will be valued at JPY 298bn (US$2bn).

- The stock should be added to the TOPIX INDEX at the close on 27 November while inclusion in global indices should take place in February and June.

3. [Japan M&A] Mitsubishi Logisnext (7105) – This Deal Looks Mighty Bad

- JIP and MitHeavy have announced a takeunder to buy out MitHeavy sub Mitsubishi Logisnext Co., Ltd. (7105 JP) at a weighted average price 42% lower than Target Advisor DCF range midpoint.

- No/Minimal transparency. A sales process interrupted by Trump tariffs, leaving one low-ball bidder. And the sellers goes ahead with it BUT gets to reinvest on the back end. You don’t.

- The Board “supports” the Tender Offer, but leaves it to the opinion of the shareholders as to whether they tender. MitHeavy has 64.4% already so that basically gets done. But…

4. Mitsubishi Logisnext (7105 JP): JIP’s Takeunder Offer

- Mitsubishi Logisnext Co., Ltd. (7105 JP) announced a pre-conditional tender offer from Japan Industrial Partners (JIP) at JPY1,537 per share, representing a 15.3% discount to the last close price.

- The offer resulted from an auction process. The offer is light in comparison to peer multiples and is below the midpoint of the target IFA DCF valuation.

- While Mitsubishi Heavy Industries (7011 JP) irrevocable has a competing proposal clause, it is unlikely that a bidding war will transpire. The low required tendering rate suggests a done deal.

5. Merger Arb Mondays (29 Sep) – Soft99, Ashimori, Mandom, Paramount, OneConnect, Dongfeng, Spindex

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Soft99 Corp (4464 JP), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Mandom Corp (4917 JP), Paramount Bed Holdings Co Lt (7817 JP).

6. Curator’s Cut: BABA Hedges, Substantive Spin-Offs & Japanese Activist Situations

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,000+ Insights published over the past two weeks on Smartkarma

- In this cut, we review strategies to hedge Alibaba (9988 HK) exposure, examine signficant Asian spin-offs, and explore engaging activist situations in Japan

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

7. LG Electronics India IPO: Big Market Cap, Small Float -> Small Passive Flows

- LG Electronics India (123D IN) is looking to list on the exchanges by selling 101.8m shares at a valuation of US$8.7bn and raising around US$1.3bn in its IPO.

- The new valuation is around 24% lower than the rumoured valuation at the time of the DRHP filing last December.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

8. Jardine Matheson (JML SP): Additional Office Recycling Speculated

- The prior MO for the Jardines group was never sell your commercial buildings. This year marks a paradigm shift in that line of thinking.

- First Hongkong Land (HKL SP) sold nine floors of One Exchange Square to HKEX (388 HK). The first such sale since 1988.

- Now Mandarin Oriental (MAND SP) is negotiating the sale of “certain office space” at One Causeway Bay. Jardine Matheson (JM SP)‘s NAV discount and implied stub are at 12-month lows/highs.

9. Tata Capital IPO: Big Listing, Big Valuation, Small Float

- Tata Capital Limited (TATACAP IN) is looking to list on the exchanges by selling up to INR155bn (US$1.75bn) of stock at a valuation of around INR 1,384bn (US$15.6bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in June 2026.

- The stock should be added to the Large Cap segment in the AMFI Classification in January and to the Nifty Next 50 Index in March.

10. LG Chem: Announces a PRS Worth 2 Trillion Won Using Its Shares in LG Energy Solution as Base Asset

- LG Chem announced that it plans to complete a price return swap worth about 2 trillion won (US$1.4 billion) using its stake in LG Energy Solution as the base asset.

- This 2 trillion won PRS is likely to have a slightly positive impact on LG Chem and slightly negative impact on LG Energy Solution.

- Our NAV valuation of LG Chem suggests implied NAV per share of 369,187 won, which is 31% higher than current levels.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event] Sony Financial Spin-Off Trades Monday – Fina(Ncia)L Thoughts

- Today is the last day of trading for Sony Corp (6758 JP) with Sony Financial Group (8729 JP) spin-off rights. SFGI starts trading separately on Monday 29 Sep.

- The reference price is ¥150/share. It will likely stay in all major indices except Nikkei 225, and it likely needs low ¥160s to stay in M _ _ _.

- The estimated Div Yield is higher on SFGI than peers by a fair ways, and looks to grow, and there is a big buyback to come. I like it.

2. Shift (3697 JP) – Short-Selling into Nikkei 225 Inclusion = Crowded Register Dynamic = Squeezy

- Shift Inc (3697 JP) runs a software quality assurance testing business. 400% revenue growth in 5 years, but this year to Aug25 is “only” 17.5% according to Q3 results guidance.

- It was a “growth stock” for a long while, and large long-only growth investors flocked to the name. In the past several months many have exited.

- The stock will be included in the Nikkei 225 Average next Tuesday. The supply/demand dynamics here to there are interesting. Afterwards they may be more interesting.

3. [Japan M&A] Paramount Bed (7817 JP) Founding Family Takeout – Too Cheap, Deserves Activist Response

- In a fairly common pattern, the founding family (38% ownership) of Paramount Bed Holdings Co Lt (7817 JP) have launched an MBO.

- It is too cheap at 4.2x adjusted EV/EBITDA (one could argue it is 5.0x but they also have net receivables) for such a ubiquitous brand and growth.

- Soft99 Corp (4464 JP) may have been a one-off. Maybe not. People may look at this situation through that lens. It deserves that look.

4. [Japan M&A/Activism] Soft99 Board Comes Out Against Effissimo Bid 66% Above MBO Price

- Today after the close, the Soft99 Corp (4464 JP) Board of Directors came out AGAINST the Effissimo ¥4,100/share counterbid to the original ¥2,465/share MBO.

- “The Special Committee advised that the Tender Offer would not contribute to the enhancement of the Company Group’s corporate value, nor would it be fair to the Company’s general shareholders.”

- ¥2,465 is fair. ¥4,100 is not fair. Absolute hogwash. Unmitigated blatherskite. Pure trumpery. Codswallop, buncombe, taradiddle, balderdash, and nincompoopery too. I expound below.

5. HK Connect SOUTHBOUND Flows (To 19 Sep 2025); BIG Single Stock Trading Again, Feels Slightly Toppish

- Gross SOUTHBOUND volumes just over US$22+bn a day this past 5-day week. Biggest week in a while. Net Flows not following gross flows. Feels toppish into GW.

- The recommended name last week was Alibaba (9988 HK) was up 2.2% on the week but only +0.7% from Monday close to Friday.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

6. The BOJ Announces the Start of ETF/JREIT Selldowns – Basically a Nothing-Burger

- In Friday’s Monetary Policy Statement, the BOJ announced it would start selling down its holdings in ETFs and J-REITs at the pace of ¥620bn and ¥5.5bn/year, respectively. BIG NEWS!

- That is US$17mm of ETFs and US$150k of J-REITs per day. The BOJ suggests it is 0.05% of volume per day. That’s close. SMALL EFFECT.

- Given ¥15trln of buybacks and ¥5trln+ of dividend reinvestment + NISA account buys, plus ¥trlns of cross-holding selldowns/year, this is a total nothingburger, even if they up the pace.

7. Korea Semicon ETF Rebal October Play: 2 In, 2 Out Long-Short Setup

- MTD screening results with 5 trading days left point to 2 names going out and 2 names coming in: Gemvax and Wonik IPS replace Dongjin Semichem and Jusung Engineering.

- Unlike last April’s tariff-distorted +1.3% rebalance, this time we expect cleaner, more meaningful price action.

- No pre-positioning seen, so I’ll target ETF rebalance day (Oct 10) and maybe take an anticipatory position a day earlier.

8. Sony Spin-off (Sony Financial Group) Spin-off Deep Dive

- Sony Group Corporation (6758) is planning to spin off 80% of its stake in Sony Financial Group Inc. (8729) on September 29, 2025.

- Sony Financial Group Inc. is the financial services arm of Sony, comprised of three main businesses

- The spin-off will generate ~ ¥100BN in the current fiscal year and pay a ¥50BN annual dividend.

9. Merger Arb Mondays (22 Sep) – Technopro, Soft99, Mandom, Pacific Ind, Dongfeng, Shengjing, Smartpay

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Oneconnect Financial Technology (6638 HK), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), PointsBet Holdings (PBH AU), Mandom Corp (4917 JP), Humm Group (HUM AU), Fuji Oil Co Ltd (5017 JP).

10. Soft99 Corp (4464 JP): The Board Opposes Effissimo’s Hostile Offer and Hints the MBO Will Succeed

- The Soft99 Corp (4464 JP) Board has, unsurprisingly, opposed the Effissimo offer for several reasons. Notably, they do address the huge price disparity between the two offers.

- While most of the reasons to justify the opposition are weak, the Board unexpectedly notes that as of 24 September, the MBO retained acceptances to satisfy its minimum tendering condition.

- Despite the significant premium of the Effissimo offer, this development suggests that the current acceptances for the MBO are sticky, thereby increasing the likelihood that Effissimo’s offer will fail.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

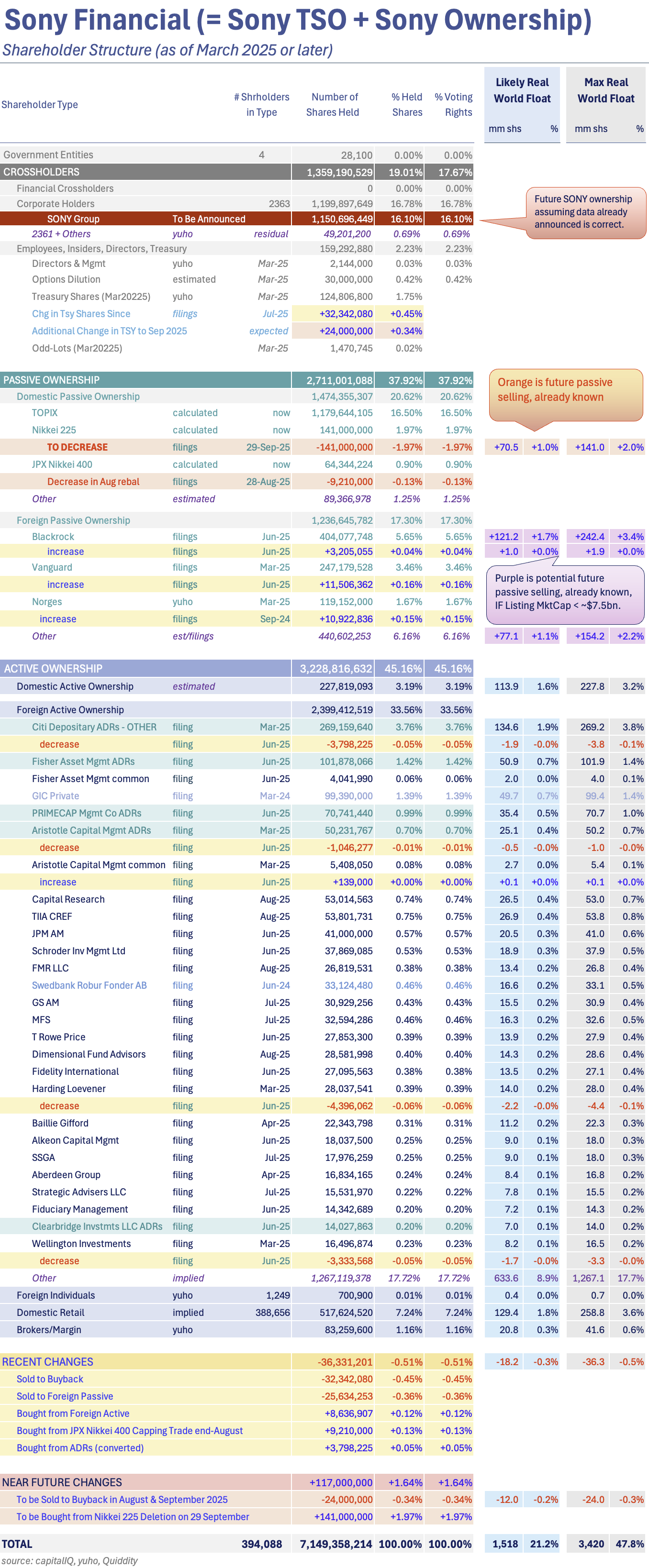

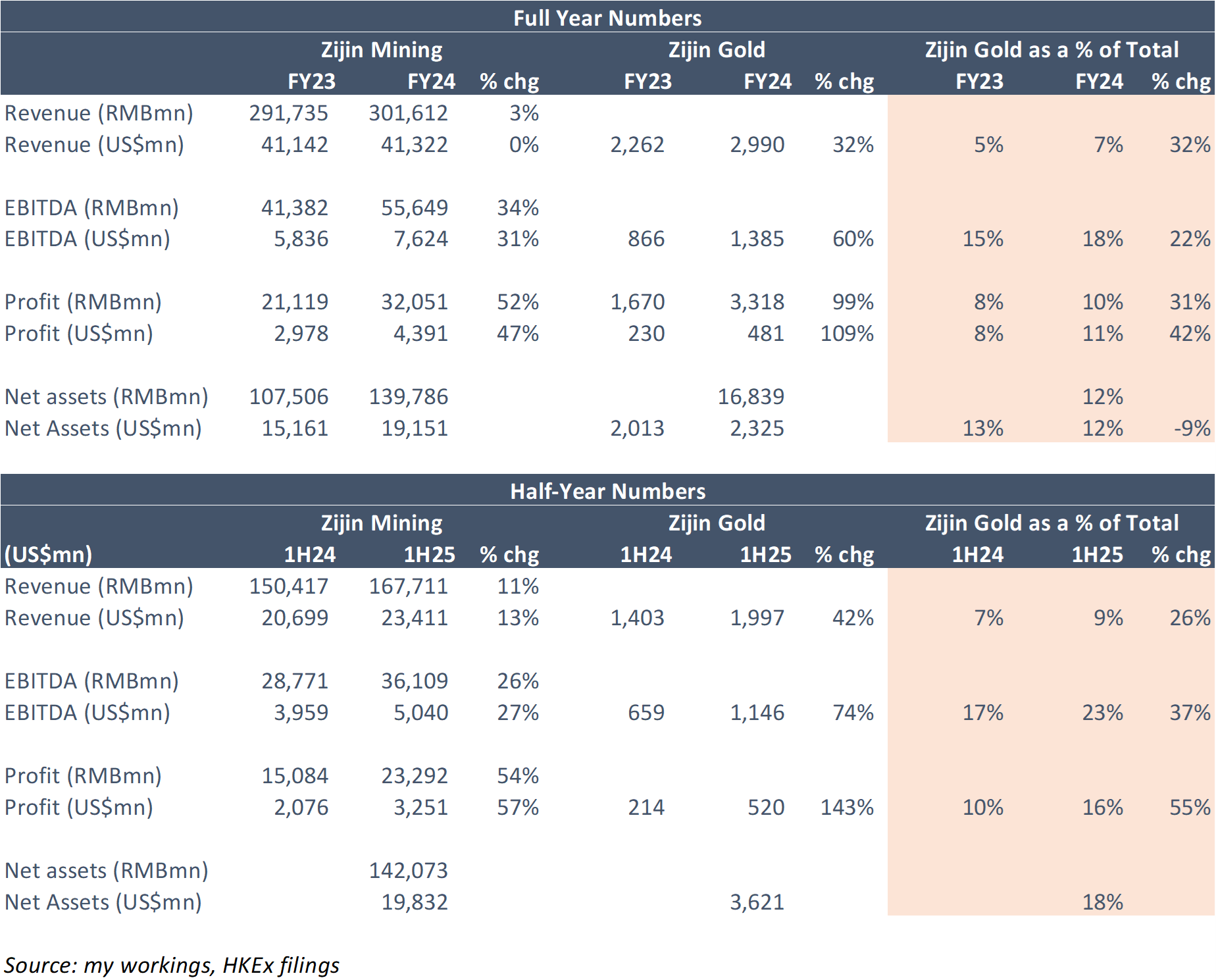

1. Zijin Mining (2899 HK): This Is A Short

- In my June note, Zijin Mining Group (2899 HK) appeared fully valued; but I (thankfully) stopped short of being outright bearish. Its share price is up 48% since!

- A basket of peers is also up 37% since that note. Gold is up~8%, and 41% YTD. On the 14th September, Zijin released Zijin Gold’s PHIP. 1H25 numbers were solid.

- However, Zijin Gold’s earnings are by no stretch an outlier. Zijin’s Mining’s current share price is now baking in exceptional (unrealistic?) metrics for the gold play spin-off.

2. Zijin Gold (2259 HK) IPO: HSCI Fast Entry; Quick Stock Connect Add; Global Indices Entry in 2026

- Zijin Gold (2259 HK) is looking to raise up to HK$28.7bn (US$3.7bn) in its IPO, valuing the company at HK$191.6bn (US$24.6bn).

- Zijin Mining (2899 HK) will hold between 85-86.7% of Zijin Gold and that will limit the free float of the stock. Half the IPO has been allotted to cornerstones.

- Zijin Gold could be added to the HSCI via Fast Entry and to Stock Connect in October. Global index inclusion should take place in the first half of 2026.

3. [Japan M&A/Activism] SOFT99 MBO Sees Activist EffissimoOverbid by 66%! Will This Set New Precedent?

- In early August, the founder-family announced they would MBO the car care company Soft99 Corp (4464 JP). It was a very cheap MBO. Even 20% higher it would be cheap.

- On Saturday, Kyodo, followed by various other media outlets, announced activist Effissimo Capital Management had announced a TOB to buy the company saying the MBO was “an extremely low level.”

- The Nikkei-reported goal would be “to protect the interests of minority shareholders while ensuring medium- to long-term increases in corporate value.” This is REALLY BIG NEWS.

4. Chery Auto (9973 HK) IPO: No Inclusion in Global Indices; HSTECH Is Interesting

- Chery Automobile Co. Ltd. (9973 HK)‘s IPO range is HK$27.75-HK$30.75/share and will raise up to HK$10bn (US$1.3m) if the oversubscription option is exercised, valuing the company at HK$169bn (US$21.7bn).

- The stock should be added to the HSCI Index in December and that will make the stock eligible for inclusion in Southbound Stock Connect.

- There will be no inclusion in global indexes for the next year, but there is a possibility of inclusion in the Hang Seng TECH Index (HSTECH INDEX) in December.

5. Mori Hills REIT (3234) – Large Sponsor Buy in Market as % of Max Real World Float

- In the past 24 months, J-REIT sponsors have bought units in their REITs at sharp discounts to PNAV to raise PNAV and reduce overhang pressure.

- The goal is, basically transparently, to get PNAV to a level at which the REIT can buy more properties from the sponsor, who carries them at a much higher WACC.

- Mori Building has announced a 4.99% buy on Mori Hills REIT Investment Corporation (3234 JP) which is a Very Big portion of Max Real World Float. This should influence price.

6. HK Connect SOUTHBOUND Flows (To 12 Sep 2025); HUGE Single Stock Trading, ETFs Meh. Tech Bought Bigly

- Gross SOUTHBOUND volumes just under US$20+bn a day this past 5-day week. BIG Net buying. Big BABA trading.

- SOUTHBOUND investors traded US$9bn of Alibaba (9988 HK) in the week. Not shy. It was a big net buy as well (4 of 5 days was +US$500mm or more).

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

7. Soft99 Corp (4464 JP): Effissimo Sheds More Light on Its Hostile Offer

- Effissimo has formally launched its hostile tender offer for Soft99 Corp (4464 JP) at JPY4,100, which is 66.3% higher than the MBO price of JPY2,465.

- The Board stonewalled Effissimo’s attempts to negotiate a friendly offer. The huge premium of Effissimo’s offer relies on lower WACC assumptions compared to the target/special committee IFA.

- Management’s initial approach will be to rely on the Board to oppose the Effissimo offer. There is a good chance that Soft99 will remain listed with two large shareholders.

8. [Japan M&A/Activism] The Nagging Little Detail In the Soft99 MBO Extension Target Doc

- Yesterday, Soft99 Corp (4464 JP) announced a slight change in its “Target Opinion Document” after the MBO Bidco extended its TOB by 8 days the day before.

- The detail was not in the MBO Bidco extension. It was just revealed in an added note on p3 of the Target Opinion.

- That details matters A LOT to people looking at the Effissimo Overbid. The company’s Board has some serious work ahead.

9. Flagging a New Passive Flow Trading Opportunity Triggered by Korea’s Divvy Policy Momentum

- PLUS High Dividend ETF (161510 KS) reshuffle is now a key flow catalyst: June saw GS E&C and HD Hyundai out, Hyundai Motor in, with sharp one-day moves.

- December review shaping up as 2-in/2-out: Seoul Guarantee (031210) and LG Corp (003550) in, Shinhan (055550) and KB (105560) out.

- Passive flows: Shinhan/KB ~0.3–0.4x DTV, LG ~3x, Seoul Guarantee 5–6x. With AUM up 30% since June, upcoming adds face outsized passive impact.

10. Zijin Mining (2899 HK): Zijin Gold Priced At US$24bn

- The global offering doc for Zijin Gold (2259 HK) is out.

- At the IPO Price of HK$71.59/share, Zijin Gold’s implied market cap is HK$187.9bn or US$24bn. Commencement of trading is the 29th September.

- Zijin Mining (2899 HK) will hold 86.7% in Zijin Gold post-IPO (before over-allotment). Even if Zijin Gold trades north of HK$100/share, Zijin Mining is fully valued.