There was a time, not so long ago, when laptops took ages to boot up. People grew accustomed to these slow speeds and accepted them as part of reality. Then, the SSD (Solid State Drive) laptop came along, powered by NAND flash technology. Suddenly, near-instant boot-ups ushered in a new, wait-free reality.

The aforementioned example illustrates just one of many ways NAND flash has incrementally improved our day-to-day lives. And in more ways than one, this memory chip is growing to become an integral part of the way we work and live.

Countless electronic tools and gadgets that people have come to rely on run on NAND flash technology today. They include everything from laptops and smartwatches to USB flash drives and car infotainment systems.

The Rise and Fall of NAND Flash Prices

Rising NAND flash demand to feed the production of these in-demand devices, coupled with a shortage of 2D NAND chips (due to an ongoing industry transition to 3D NAND), had sent flash prices surging in 2016 and 2017.

The price boom helped semiconductor manufacturers profit immensely, with one estimate putting gross margins at 40-60 percent.

2018, however, took a turn for the worse: NAND flash prices went into freefall. According to data compiled by Objective Analysis, NAND flash spot pricing fell from a three-year high of nearly US$0.30 per gigabyte in mid-2017 to under US$0.10 per gigabyte in the third quarter of this year. That represents about a three-fold decline in a little over a year.

The cause: overcapacity.

Memory Loss

So what are the broader ramifications? For NAND flash makers, Smartkarma Insight Provider Jim Handy says “it indicates that profits are evaporating”.

Samsung Electronics, WDC, Micron and SK hynix all posted negative quarter-on-quarter revenue growth in the first quarter of 2018.

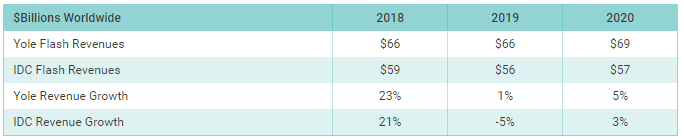

Industry forecasts on flash revenues by Yole and IDC also show growth sliding significantly after 2018. IDC even projects a 5 percent contraction in 2019.

Compiled by Jim Handy

But there is another undesired effect that might result from NAND’s price fall. Handy, who has been closely monitoring price movements, warns that excess NAND flash capacity “will be repurposed into DRAM production and lead to an oversupplied market” (DRAM is a type of memory required by computer processors to function).

Segment Contagion

Samsung Electronics, SK hynix, Toshiba, and Intel all plan to increase their NAND production capacity within the next few years. So, absent additional future demand, the expansions would likely exacerbate current overcapacity and, even possibly, lead to a full-on price collapse.

Given that Memory (NAND flash and DRAM products) formed the biggest segment of total semiconductor sales in 2017, a sector-wide recession could very well be on the cards.

Who Stands to Gain?

That would be the makers of electronic devices, the biggest buyers of semiconductor chips.

Just 10 companies, including the likes of Apple, Samsung Electronics (supplier and buyer), Lenovo, and Huawei, make up close to half of worldwide semiconductor spend, totalling about $144.8 billion in purchases in 2017.

Cheaper memory chips mean cheaper manufacturing costs for these titans of the consumer electronics sector.

Pass on some of these savings to consumers, or not, a lowered COGS (cost of goods sold) would almost certainly bode well for profit margins.