This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

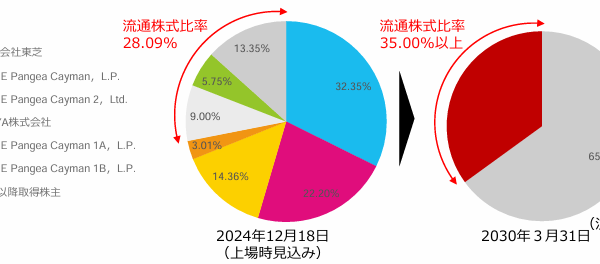

1. The Final ACT Comedy of Errors Opens the Way for Real Value to Emerge at Seven & I

- ACT’s bid for Seven & I has been withdrawn and Seven will be better off long-term because of it – although we detail here how competitors are catching up fast.

- Once York HD has been split off, the company can at last focus on its crucial local CVS operation: Japan makes up 25% of revenues but almost 50% of profits.

- The potential is real and we are bullish on the long-term value but we would have been more bullish if the former CEO Ryuichi Isaka was still on board.

2. SK Hynix Single-Stock ETF Scheduled for 3Q: Watch for a Repeat of the Samsung ETF Playbook

- When the SK Hynix ETF drops, expect meaningful physical buying shaking up supply-demand. Arb desks and alpha shops could pile in early, pushing the stock higher on flow.

- Going long Hynix near listing could pay off if demand mirrors Samsung’s—ETF flows, NAV arb, and delta hedging drove a 4% jump with a noticeable increase in program buying.

- Get in around the listing, watch flows, and take profits quickly. This is a short 2–3 day tactical play, with sharper front-running expected based on the Samsung ETF template.

3. TSI Holdings (3608) – YET ANOTHER Big Buyback, Still Good, Still Cheap, But B/S Restructuring Slow

- A bit over three years ago I re-wrote on Tsi Holdings (3608 JP). Then? EV/Revenue and EV/EBITDA of 0.03x and 0.5x respectively. I pounded the table.

- My recommended trade: “Buy the stock (preferably from cross-holders interested in selling). Buy with both hands. Buy a lot. Buy more later. Pressure the company to go private.”

- Since then, total return has been +295%. Today they announced another buyback. Tomorrow morning it gets done. Details details details!

4. Anthem Biosciences IPO: Lists Today; Index Inclusion Timing

- Anthem Biosciences raised INR 34bn (US$394m) in its IPO valuing the company at INR 320bn (US$3.7bn). The stock lists today.

- The grey market premium is INR 132/share, so the stock could list 23.2% higher than the IPO price. That will help in getting larger index flows.

- Anthem Biosciences could be added to one global index in November while the stock price gain will determine whether the stock is added to the other global index in December.

5. A/H Premium Tracker (To 18 July 2025): “Beautiful Skew” Continues Some More

- AH premia flat again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- Weeks ago I said, “It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.” Ride on.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

6. Prosus Is Elevated Vs. Tencent As The Accretion Trade Unfolds

- Since unwinding the Naspers (NPN SJ)/Prosus (PRX NA) circularity, Prosus has been selling Tencent shares, and buying back its share. Separately, Tencent is buying its shares to offset Prosus’ selling.

- Prosus’ stake in Tencent has now edged below 23%, a little over seven months since dipping below 24%.

- On an implied stub and relative value, Prosus is elevated to Tencent, suggesting an unwinding of the stub.

7. Dickson Concept (113 HK): More Minority Teeth Bared As Another Scheme Fails

- Three for three. Three low-balled Hong Kong Offers, by way of Schemes, have now lapsed over the past ten weeks.

- Both Goldlion Holdings (533 HK) and Soundwill Holdings (878 HK) spectacularly failed back in May.

- Now Dickson Concepts Intl (113 HK) has followed suit. But the vote was (much) closer than it should have been.

8. Insignia Financial (IFL AU) Accepts CC Capital’s Reduced Terms

- Insignia Financial (IFL AU), a wealth manager and previously known as IOOF, has entered into a Scheme with CC Capital at $A$4.80/share.

- That’s 56.9% premium to undisturbed (11th December 2024), 20% above Bain’s initial indicative tilt last year, but 4% below CC Capital (% Bain’s) A$5.00/share indictive Offer on the 7th March.

- Apart from the Scheme vote, CC Capital’s Offer requires a raft a regulatory approvals. The SID indicates 1H26 completion.

9. StubWorld: Japan Post Holdings (6178 JP) Is “Cheap”

- As short-term rates rise, Japan Post Bank (7182 JP)‘s perceived superior fundamentals may be leading to a short squeeze on the stock versus Japan Post Holdings (6178 JP).

- Preceding my comments on Japan Post – and Silicon Integrated Systems (2363 TT) – are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

10. Two New Tax Tweaks Set to Shake Up Korea’s Local Stock Market: Trading Tax & CGT Threshold

- Trading tax gradually dropped from 0.25% in 2020 to 0.15% in 2025, boosting volatility and short-term trades; a hike to 0.25% could cool momentum but widen arbitrage and basis spreads.

- If the major shareholder tax threshold drops to ₩1B, year-end retail dumps and Jan buybacks will return—but with less wild swings and more measured short-term fade and momentum trades.

- If the tax revamp drops end-July, expect a September Assembly push. Usually effective next January, but like 2023’s cap gains hike, changes might apply immediately in 2025.