This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CATL (3750 HK) H-Share IPO: Fast Entry to Global Indices Is Touch & Go

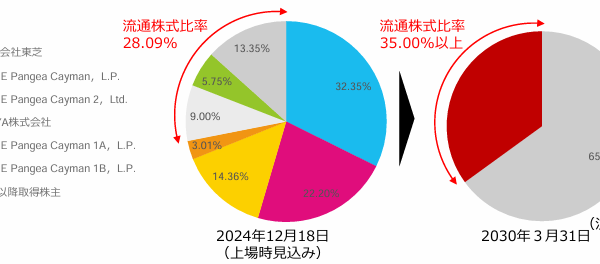

- Contemporary Amperex Technology (CATL) (300750 CH) could raise up to US$5.1bn in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a huge allocation to cornerstone investors that is locked up for 6 months. That significantly reduces float and the probability of Fast Entry inclusion to global indexes.

- CATL (3750 HK) will be added to Southbound Stock Connect from the open of trading on 16 June following the end of the Price Stabilisation period.

2. Renesas Electronics (6723 JP): Denso Exits as Stock Price Falters

- Denso Corp (6902 JP) is looking to raise up to JPY137bn (US$940m) by selling 73.9m shares of Renesas Electronics (6723 JP) to international investors.

- The indicative price range is JPY 1,812-1,848/share, a discount of 1-2.95% to Monday’s close. The placement is 4.1% of shares outstanding and is 4.7 days of ADV.

- We do not expect any passive buying at the time of settlement of the placement shares. The earliest passive buying will take place in August and September.

3. Mayne Pharma (MYX AU): MAC Musings

- Back on the 21st Feb 2025, Mayne Pharma (MYX AU), a leader in dermatology and women’s health, entered into a Scheme with US-based pharmaceutical outfit, Cosette Pharmaceuticals, at A$7.40/share.

- The transaction is progressing – the HSR Act condition was satisfied last week. A Scheme Booklet should be issued shortly, with an expected vote mid-June and late-June/early-July implementation.

- Shares declined 3.1% yesterday over concerns a MAC could be triggered on the back of the Trump’s executive order on pharma. The impact is likely mixed, but leans neutral.

4. Korean Market Election Setup: Locals’ Low PBR Trading Trends

- Quick screen shows ₩1T+ names under 0.4x PBR — mostly retail, financials, and holdcos. Locals are keeping an eye on these with the election theme in play.

- This isn’t just hopeful chatter — both parties are seriously leaning into value-up policies. With dividend tax reform and solid sector catalysts, locals see real potential in the post-election trade.

- Long regional banks, hedge with KB and Shinhan. In retail, long domestic names, short China-dependent ones. For holdcos, long Hanwha and Doosan, short CJ and Kolon.

5. [Japan M&A] Son of Chairman/55%Owner Taking Imagica (6879) Private at 10x FCF, 4+x EBITDA. CHEAP.

- This deal should not come as a surprise. Bloomberg has an article out saying tycoons are taking companies private to avoid shareholder activism. It’s not just that.

- The stated reasons (competitive environment requiring faster decision-making and significant restructuring) are all kinda hot garbage. This is being done at adjusted EV/EBITDA of 4x and 10x FCF.

- And there are no synergies counted, and half of the Adjusted EV is net receivables+inventory equal to about 2mos of revenues. This is being done too cheaply. But…. TIJ baby…

6. Goldlion Holdings (533 HK): An Unexpected HK Arbageddon

- Goldlion Holdings (533 HK) shareholders have voted against Mr Tsang’s HK$1.5232 per share offer. The minority participation rate was high, and the NO vote comfortably cleared the threshold.

- The Goldlion deal break was unexpected, and the HKEx merger arb rulebook will be rewritten. This deal break offers several lessons.

- Goldlion had the highest premium of the pre-deal break price to the undisturbed price compared to previous deal breaks. My estimated deal-break price is HK$0.953, 36.0% below last close.

7. [Japan Activism] Murakami Owns ~42% and Company Announces 31.3% Buyback

- With earnings today (which beat guidance), Mitsui Matsushima (1518 JP) announced upbeat guidance for next year, a very large dividend hike from ¥130/share to ¥230/share, and a Very Large Buyback.

- The buyback is ¥20bn (vs ¥47bn market cap) or 3.5mm shares (31.3%). It starts 2 June. Astute Murakami trackers may recognise the potential pattern here.

- If the company buys back all 3.5mm shares at just below book, EPS of ¥756 = 12.9% ROE and PER of 7.8x. Even up 30% from here that isn’t super-rich.

8. [Japan M&A] Bain Deal for Nissin (9066) Is Still Light Vs Comparable Deals

- The deal price is higher than the Bloomberg article insinuated. The closing date is earlier than the Bloomberg article suggested. But that doesn’t mean it’s enough.

- The Large ToSTNeT-3 buyback last year changed the shareholder structure significantly, but many holders who sold are unknown. I would expect they were cross-holders.

- For that, this deal is NOT a done deal. There may be games played on this deal.

9. [Japan M&A] TechnoPro Holdings (6028) May Be Up For Grabs

- Technopro Holdings (6028 JP) is a temp/contract staffing platform which specialises in engineering staff (IT engineers far more than machinery, construction, chemicals). The company has been growing.

- Overnight, an article appeared in MergerMarket – a high-dollar M&A-related news service – saying the company was going through a sale process. The company confirmed it was one possibility.

- The stock went limit up. This quick writeup looks at the framework of the idea, and possibilities.

10. Jiangsu Hengrui (1276 HK) H-Share IPO: Index Inclusion Later This Year

- Jiangsu Hengrui Medicine (600276 CH) could raise up to US$1.6bn in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the possibility of Fast Entry inclusion to global indexes.

- Jiangsu Hengrui (1276 HK) should be added to Southbound Stock Connect from the open of trading on 20 June following the end of the Price Stabilisation period.