Sell Side Are From Mars, Buy Side Are From Venus

by Mark Artherton – Senior Content Strategist, Smartkarma

Posted on Smartkarma on 15th December 2017

Read more of Mark’s work by clicking here!

I really enjoyed reading Douglas Kim’s Confessions of an Independent Research Analyst – though in the UK ‘Confessions…’ are more linked to a series of smutty 1970s films – cultural factors play such an important part in headlines! Thankfully we have moved on a lot from the casual misogynism of the 1970s (though maybe not far enough). While Douglas Kim paints a strong and compelling picture from one side of the research divide, the demand side is a curious beast. Prior to starting LR Research, I worked for 17 years on the buy side in institutional long-only firms and hedge funds, reaching a level where I was running GBP7bn across Emerging Markets and Asia as the head of a team of 14 portfolio managers and analysts. Through my career, I have seen a number of buy-side ‘organisational models’ first hand. Fundamental, active portfolio management is not a homogenous entity, there are almost as many processes as there are investment teams. The sell side has developed best to support the largest clients with the biggest voices (and wallets), but the wants and desires of the buy side are still poorly served in my opinion.

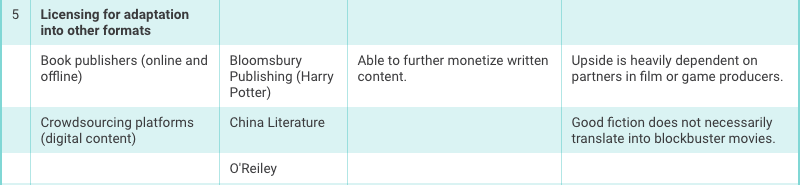

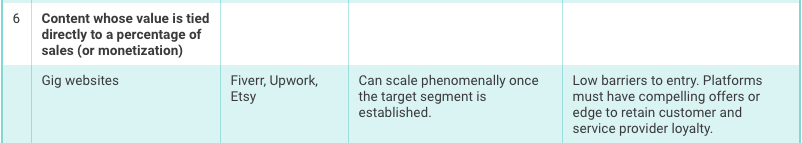

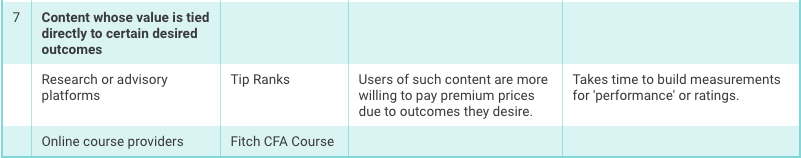

I am a great believer in the power of path dependence in life and markets. Investment research has its own path dependence and therefore it is important to consider the history of investment research. This path dependency has brought the investment industry to a situation where neither side feels fulfilled, but there is a general reluctance to break away from historical mechanisms of research production and consumption.

The development of the buy side/sell side relationship

The way the traditional investment research model developed came from a very narrow set of circumstances existing mainly in the US and to a lesser extent the UK as the capital markets developed through the 19th and 20th centuries.

In the late 19th century and early 20th century, capital markets in the UK and US were well established and Investment Trusts had expanded the pool of investors to include those with lower means. Institutional investors saw strong growth of their assets during the early decades of the 20th century.

A sample of 33,078 shareholders in 261 company share registers relating to 47 UK-registered companies, spread across all sectors for the period 1870 to 1935, reveals that only 505 of the shareholders were institutional investors. They held 4.2% of the value of these securities in the decade of the 1900s, 7.7% in the 1910s, 6.0% in the 1920s, and 23.8% by the 1930s. The remaining securities were held by individual investors either directly or through personal trusts (Rutterford, Green, Maltby, and Owens 2010).

Undoubtedly there was investment research provided by third parties in the first 50 years of the 20th century and this would have been ‘independent’, but personal connections played a much larger part in the ‘research’ process. Stockbrokers would advise high net worth individual investors based upon their contacts in the corporate, political and financial sphere.

Moreover, they said that investment decisions in UK investment trusts relied on ‘the personal judgements of the managers and directors, who … depend to a considerable extent on personal contacts and the advice of brokers … The operation of the law of averages is relied on to minimize the effect of mistaken judgments. (Chamberlain and Hay, 1931)’

In the UK (where the ‘old school tie’ network dominated), the asset management industry had a reputation for long lunches and being populated by the underachieving younger son of a well to do family – there was a need for well-informed research to address this base of customers. That is not to say that there were not talented individuals managing funds in the UK, but in general, the level of professionalism was lower than it is today.

In the US, the Investment Trust industry was purported to be more professional with in-house research departments being well stocked in the early 20th century, but the bull market of the 1920s led to the rapid abandonment of research in favour of blind buying.

Most paradoxical was the early abandonment of research and analysis in guiding investment trust policies. Investment had now become so beautifully simple that research was unnecessary and statistical analysis a mere encumbrance. Hence the sound policy was to buy what everyone else was buying … The man in the street, having been urged to entrust his funds to the superior skill of investment experts—for substantial compensation— was soon reassuringly told that the trusts would be careful to buy nothing except what the man in the street was buying himself. (Graham and Dodd 1934, p. 311)

Prior to the bubble in stocks in the 1920s, common stocks were valued in a way more akin to bonds. Stockbrokers would use their connections to look for the dividend potential and the stability of corporate cash flows and recommend such investments to their clients, capital appreciation was much less important. The bubble in the 1920s changed this and dragged in more and more individual investors and the selling techniques deteriorated rapidly. The subsequent market crash and depression in the 1930s was followed by the second world war.

After the second world war, in the US in the 50s and 60s, the investment landscape had changed again, with most asset managers coming from corporate pension funds, with little or no experience of investment. As the 60s progressed into the 70s in the US there was more professionalism but a lot of trading was led by information that would now be considered inside information (insider trading regulations have been in place in the USA since 1904, but it was the Insider Trading Sanctions Act of 1984 and the Insider Trading and Securities Fraud Enforcement Act of 1988 that put a significant halt on the practice).

The huge growth of corporate pension fund assets in the 1960s led to the search for performance and ways to reduce the reliance on one manager. This search was triggered by underperformance and regulatory change. In the US, the buy side was underperforming in the 60s – a survey by AG Becker & Co. in 1968 found significant underperformance of corporate pension assets (AG Becker actually formed one of the first pension consultancies on the back of this work). In the 1960s, ‘Performance’ funds emerged with ‘film star’ like fund managers and they gathered significant assets. The underperformance of corporate pension funds and the star power of mutual fund ‘performance’ fund managers led to the eventual market crash that began in 1969. These contrasting performance issues and regulatory change led to increased demand for professional research services.

The major regulatory change in the 1970s was the advent of Employment Retirement Income Security Act (ERISA) in 1974, which led to the creation and huge growth in 401K retirement plans. The ‘Prudent Man’ rule in the 1970s led asset managers to look for professional advice, especially in equities.

The brokerage community was not slow to react to the increased demand for third-party investment research. The brokerage community was working under fixed rate commissions in the United States prior to the regulatory change of ‘May Day’ in 1975. In this pre-1975 environment, the only way to compete was by offering bundled services, services paid for by ‘soft dollars’. The research departments set up by brokerages were, in effect, independent. Brokerages did no trading or investment banking on their own book, they acted solely as a middleman with a fixed fee.

Donaldson, Lufkin & Jenrette (DLJ) were amongst the first to offer the services of an analyst/salesman (Interestingly, DLJ’s history is the basis of current wall street, they were the first NYSE member firm to IPO – changing NYSE bylaws along the way – and set up the current situation of taking on risk with other people’s capital).

DLJ and other firm’s analysts were highly regarded and built close relationships with companies and pension funds. The long form report really took off in the late 60s, and financial analysis became easier with the appearance of the first calculator (the first portable calculator came to market in 1970). Investor’s time horizons were longer in the 1970s (chart 1) and there was no real focus upon quarterly returns and earnings.

One could argue that the golden age of independent equity research happened between 1965 and 1975 when DLJ and others started covering mid and small cap equities in the US. DLJ was able to pick up new clients by expanding coverage and this encouraged ‘waterfront’ coverage over time.

Chart 1 – Average equity holding periods

Investment reports now are little changed from this era, but the marketplace has changed dramatically, led by the change in regulation. The first ‘unbundling’ event happened in May 1975. To encourage competition in brokerage fees the SEC forced the unbundling of other services. The industry did manage to successfully argue that investment research should not be ‘unbundled’ and this led to the ‘Safe Harbour’ Regulation, and the eventual embedding of investment research in the large investment banks.

The rapid reduction in brokerage commissions due to competition forced a wave of mergers on Wall Street. Firms combined investment banking, brokerage, trading and research, reducing the independence of research along the way. Research analysts had been offering corporate advice prior to this wave of mergers, but investment bankers more fully exploited the advantages of having an analyst who faced both the buy side and the corporate side.

In the late 1970s and early 1980s, equity analysts fell out of favour due to weak stock markets. Bond analysts were much more in favour. Mutual funds also started to build up their own ‘in-house’ research departments. The resumption of the Bull market in equities in the early 90s, led to the rise of the ‘rock star’ analyst, especially in the tech sector. This was the most recent peak of the sell-side analyst. After the Nasdaq bubble and the scandals surrounding a number of the ‘rock stars’, the market settled into the fairly familiar pattern of today. The vast bulk of research is provided to investment managers ‘for free’ as a bundled service. This research has potential and real conflicts of interest and has not changed in format since the mid-1960s.

The history of investment research is quite US-centric, but the format and structure of the research report were set in the US market and in my experience, other markets have copied this approach for their institutional service. The rules and regulations surrounding the production of research in each jurisdiction may differ but generally, the research has been bundled with commissions for many years. MIFID II changes this for European markets and is forcing a much greater focus on the cost and profitability of investment research. With pressure on active management fees, there is scope for significant disruption to occur in the provision of third-party investment research.

The 20th century shifted through phases with the high point of investment research occurring in the late 60s and early 70s. This model of Research that developed was then co-opted by the large investment banks as a way to drive their agenda. There was little need to change the model as research was not the driving force behind client relationships. Clients had little incentive to press for change as they were, in effect, receiving a free service and the tail began wagging the dog.

Where are we now?

For the past 50 years, the buy and sell side have been growing further apart. Rather like a couple who are forced to consider their relationship and suddenly find that they have little in common. The wealthier couples have found a way to make it work, but the rest are searching for a way to move things forward.

The old standard of ‘give me a well-researched recommendation and if I trust you I will trade with you’ has disappeared in a fog of mistrust and oversupply. There is no way back to those simpler days, things have changed too much and regulators would not allow it. There is still a demand for external investment research. What is important now, is how that research is delivered and how it is monetised. The traditional sell-side is moving with the times, but they have significant baggage. As I have argued previously MIFID II will give investment banks the incentive to invest and innovate in their research product. Independent Investment Research has been around for decades but is yet to provide innovation that disrupts existing solutions in a meaningful way. There are many talented individuals in the Independent Investment Research space but it has proven difficult to move beyond the traditional ‘consultancy’ style model.

The likes of BCA and Ned Davies Research have been around for years, grew in size and been purchased by a larger entity (EuroMoney). Both firms are characterised as being based on standardised templates, charts and quantitative factors as well as the quality of their analysts. Bloomberg has also tried to move in this direction with standardised charting supporting their industry analysis, for example. The large data houses will become more incentivised to sell analysis along with their data and charting capabilities. As publishing converges with data provision in the marketplace this will put more pressure on investment bank research provision and the traditional independent research approach.

The current marketplace for independent research is characterised by:

- the need for best execution and MIFID II delinking trading from investment research;

- chronic over-supply of research in some areas and under-supply in others;

- an explosion in different forms of asset management;

- and a lack of innovation in the production and delivery of investment research due to cost pressures;

- the difficulty of scaling a niche offering.

Is Independent Research any different to Investment Bank research when a fund manager ignores the recommendation?

I am going to stick my head above the parapet and argue that no research analyst can make a correct call all of the time. Back in the 60s, equities were so mispriced that a positive initiation report almost always guaranteed a bump in the stock price. In the 90s ‘rock star’ analysts could move prices on their own but it turns out that the cheerleading nature of that time caught up with the analysts. A smart individual, with a reputation built through their time on the sell side, can build a loyal client following. Certain individuals can build rather lucrative careers, but there are limits. These limits can be self-imposed – the value of insight can be perceived to decline the more it is shared – therefore some providers limit the number of clients. Other limits can come from the nature of the insight provided – there may only be a limited demand for certain kinds of research.

What do fund managers want?

At the risk of sounding pithy, the answer to that question depends on the individual portfolio manager. There are two major reasons why the vast bulk of research reports go unread. The first is that the demand for a particular report is esoteric and fleeting in nature. The second is the oversupply of reports in the marketplace. The much-maligned quarterly earnings report may be read by some fund managers, those who have been away or are trying to come up to speed on a new stock. But once a fund manager has read one or two (and the company’s earnings release) there is limited added utility in reading a third or fourth. What the fund manager may miss is that the 15th one does carry a really useful insight, but it is lost in the noise.

Maybe there are fund managers and in-house analysts who have faith that an individual external analyst makes good recommendations on a consistent basis. That analyst’s work and views will be in demand from that subset of readers. Measuring analyst success is a huge business. Alpha Capture systems, such as Marshall Wace’s TOPS system deliver strong returns, but the system is less about the success of an individual and more about the aggregate screening of the mass of data they obtain. The system will not blindly follow individual recommendations but will work with the data identifying trends and factors. Those buy side houses with access to data capture systems will use the data in a way that fits with their process.

Alpha capture can work really well for quantitative processes and has potential uses for fundamental processes looking at the timing of entry to a position. But simply relying upon the past accuracy of stock recommendations of a single analyst to drive trading is not a solution that will be followed on the buy side. A good level measurable alpha will be used as one indicator to identify quality in a crowded marketplace. Alpha measures are limited, though and can emphasise analysts on a lucky run and work against analysts with high-quality work but bad luck or the inability to turn good analysis into a good recommendation.

I believe that the buy side is responsible for investment decisions and portfolio construction, and should be able to operate without a recommendation from an analyst. If the research fits with the process of the individual portfolio manager, if the independent analyst acts as the eyes and ears of the decision maker then the recommendation becomes moot. Recommendations are measurable, that is why the market is hooked on them. It is much more difficult to measure the quality of input to a process.

The reality is that you can put a hundred fund managers or buy-side analysts in a line and it will be highly unlikely that any two would agree on the use of external research and recommendations. Everyone has there own way of using external research.

This difference in opinion arises because funds have many degrees of freedom to meet their objective. The fund process is the starting point, which may or may not include some initial quantitative screening. There will be a buy decision, a portfolio construction decision, a risk process and a sell discipline – each of which can vary by fund. Within the fund management structure, there may be in-house specialist analysts, there will be portfolio managers who may be portfolio manager/analysts or pure portfolio constructors. There will be a variance in the amount of top down and bottom up work carried out. There will be varying degrees of importance placed upon macroeconomic variables. In each team, the way an individual works within the process structure will differ – in some cases it can differ greatly if a team values a differentiated approach. Funds will hold a varying number of stocks, they will have red lines that they will not cross (no investment in Russia, etc.). It is very clear that each individual buy-side PM or analyst will have a varying requirement from external research, that varies by topic, and approach an through time.

This variety has traditionally been met with ‘waterfront’ coverage by the sell side. There is no way of predicting what a client base wants at any particular point in time, so the sell side provided an ‘all you can eat buffet’ of research. This is grossly inefficient but was self-supporting given the bundling with trading commissions and support from the Capital Markets function.

In the eyes of the buyside, information loses its value the more it is shared. It becomes difficult to grow a business if adding more subscribers dilutes the value of the information and analysis supplied. This is different to a media model, where the utility is not diminished by more subscribers, in fact, network effects work to enhance the value if more people subscribe. This scarcity value works for a small number of independent providers, but it is a difficult model for most to replicate.

An active fundamental portfolio manager shows his/her value by outperforming and attracting inflows. This value is rewarded highly. An independent research analyst shows his/her value by the client base they can attract and the amount they can charge that client base.

Conclusion

There are three main ways to grow a business in independent research. The first is to come to the party with an existing following of clients. The real added value in this business is from personal contact with the analyst. The restriction of time then limits the ability to grow such a business. Adding further analysts within an existing framework can grow the top line, but the cost base in most cases seems to grow equally as fast unless other services are offered (such as agency execution). The Consulting Model.

The second way is to develop a retail following and then charge low value subscriptions to a lot of people. To achieve this, the writings must be in an area with exceptional retail investor interest. This model relies on the quality of the writing and the subject matter rather than access to the individual. Bill Bishop and his Sinocism blog may be the closest example here, but others do exist. The ‘tip sheet’ model.

The third way is to develop a data and chart heavy model run as a high-end publication. Ned Davies and BCA are proponents of this. The clear framework of using charts and data to drive the product supported by analysis. The publishing model.

With the exception of the publishing model, I believe that these models are not currently well served. Both the consulting model and the ‘tip sheet’ model offer significant room for future development in independent investment research.

This does mean that the number of highly paid individuals in the research industry will shrink. The buy side is seeing fee pressure and the traditional fundamental equities business continues to struggle. MIFID II should cut the implicit subsidy offered to investment bank research departments. This is a huge reduction in the actual top line and the potential top line for the investment research industry. If everyone engaged in this industry stays in this industry then the average remuneration must decline. Now, more than ever, the independent research industry needs to provide a truly differentiated service just to survive. Relying solely on the production of great investment ideas will not be enough to ensure survival.

The CFO in asset managers will now be the final arbiter of the monetary value of external investment research. This value will naturally be compared to the cost of an internal analyst, as it is the most easily available comparator. An in-house analyst will be looking for ideas that support the investment process and should sit more comfortably with the existing portfolio construction. This is not necessarily the case within buy-side firms. An analyst may support portfolio managers with very different processes. There can be a lot of tension between portfolio managers and analysts within a firm. It is much easier to veto expenditure on an external supplier than to remove an internal one, however. It is also easier to present a convincing argument that hiring an internal analyst makes sense.

The buy side is slowly moving from ‘an all you can eat buffet’ (paid for by someone else) approach to external investment research, to an a la carte (own account) approach. In this environment spending will decline, consumption will decline but quality will rise. This shift will require fund managers to examine their own needs and desires in much greater detail or live with regret. It will also require the providers of research to adjust their menus significantly and innovate.

There is a fourth way! The use of technology to effect new solutions for the investment research industry. The individual analyst will (mainly) be capped in the revenue they can generate by themselves. The traditional growth approach of bolting on more cost is capped by its own weight and rarely leads to profitable margins. The slew of online libraries or research supermarkets cannot encourage the collaboration that is required to grow. A platform like Smartkarma offers the ability to move in a fresh and new direction. It is early days, but true fintech is the future of investment research in my opinion.

Terminating Analysts: The Rise of the Machines

by Mark Artherton – Founder & CEO of LR Investment Services

Posted on Smartkarma as an independent insight on 3rd November 2017

Read more of Mark’s work by clicking here!

Confessions of a Shipping Analyst: Voyage of the Damned, Asian Equity Research Version

Confessions of a Shipping Analyst: Voyage of the Damned, Asian Equity Research Version

The Profits (And Perils) Of Independent Large Cap Research

The Profits (And Perils) Of Independent Large Cap Research

How Independent Research Can Add Depth to Valuations in High Visibility Sectors like Casinos

How Independent Research Can Add Depth to Valuations in High Visibility Sectors like Casinos