This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Fast Retailing (9983 JP) Tactical Outlook: Turning OVERSOLD, Potential BUY Ahead of Sep-25 Rebalance

- In his recent insight, Brian Freitas stated that Fast Retailing (9983 JP)‘s CPAF will stay the same at the September 25 Nikkei 225 Index rebalance.

- The stock is turning oversold—not yet extreme, but notable. Historically, this short-term downtrend pattern often reversed after two weeks of declines; we are now in the second consecutive week lower.

- Monitor the 47150 support level: the stock is trading at 47810 at the moment of writing, if it goes at or below 47150 it will start to be clearly oversold.

2. Alibaba (9988 HK): Top Trades Ahead of Earnings

- Alibaba (9988 HK) will announce quarterly results on Friday, August 29, 7:30 p.m. Hong Kong Time. In the lead-up, options strategies on the Hong Kong Exchange showcase a variety of approaches.

- Highlights: Recent option trades show a bias towards bullish sentiment. Two strategies using weekly options expiring soon after the earnings announcement are explored.

- Why Read: This review offers real-market insight into how sophisticated participants are positioning ahead of Tencent’s earnings.

3. Toyota (7203 JP // TM US) Hits Overbought: Rich Options for Tactical Shorts

- Context: After three consecutive up weeks, Toyota (7203 JP) / Toyota ADR (TM US) now screens as overbought, with quantitative models signaling a high probability of a trend reversal.

- Trade Idea: Elevated implied volatility (82–83rd percentile) makes short call strategies attractive. Selling near-term calls captures rich premium while aligning with downside risk.

- Why Read: This Insight highlights a timely opportunity where technical overbought signals and historically rich IV converge — ideal for investors seeking a tactical setup.

4. Xiaomi (1810 HK): Earnings Recap & Volatility Dynamics

- Xiaomi (1810 HK) reported 2Q25 results on 19 Aug, beating expectations. This Insight analyzes price reactions in Hong Kong and two overseas markets.

- Highlights: Implied volatility dropped sharply post-earnings, both across the term structure and skew.

- Why it matters: With Xiaomi’s implied volatility now at historically cheap levels, investors may find opportunities in long-volatility strategies ahead of the next earnings in November.

5. Global Markets Tactical Outlook WEEKLY: August 25 – August 29

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 25 – August 29. .XLSX MODEL DATA FILE ATTACHED.

- OVERBOUGHT at the WEEKLY Close: Alphabet, S&P 500 INDEX , Tesla , China Mobile (941 HK) , Toyota Motor (7203 JP) , ASX 200 INDEX , CSI 300 Index , HSI INDEX.

- OVERSOLD at the WEEKLY Close: Meta (META US) , Softbank Group (9984 JP).

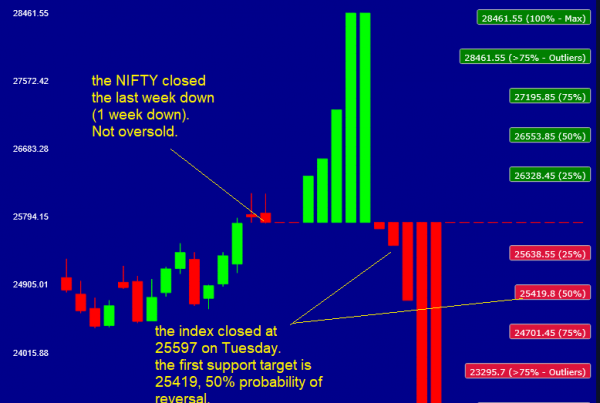

6. NIFTY 50 Tactical View: Risk-Off Scenario Before Sep-30 Rebalance + Tariffs Impact

- As forecasted in our previous insight, the NIFTY Index rallied past 25k, but we said this was a BEARISH pattern – rally was short-lived (2 weeks), then this week down.

- Effective September 30 InterGlobe Aviation (IndiGo) and Max Healthcare Institute will be added to the NIFTY, replacing Hero MotoCorp and IndusInd Bank, in the meanwhile 50% US tariffs kicked in.

- We see a potential continuation of the recent bearishness with a RISK-OFF scenario where the index could drop to much lower prices in September, support target 23819 or below.