This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Offering] Bain Starting Kioxia (285A) Selldown; More to Come Soonish?

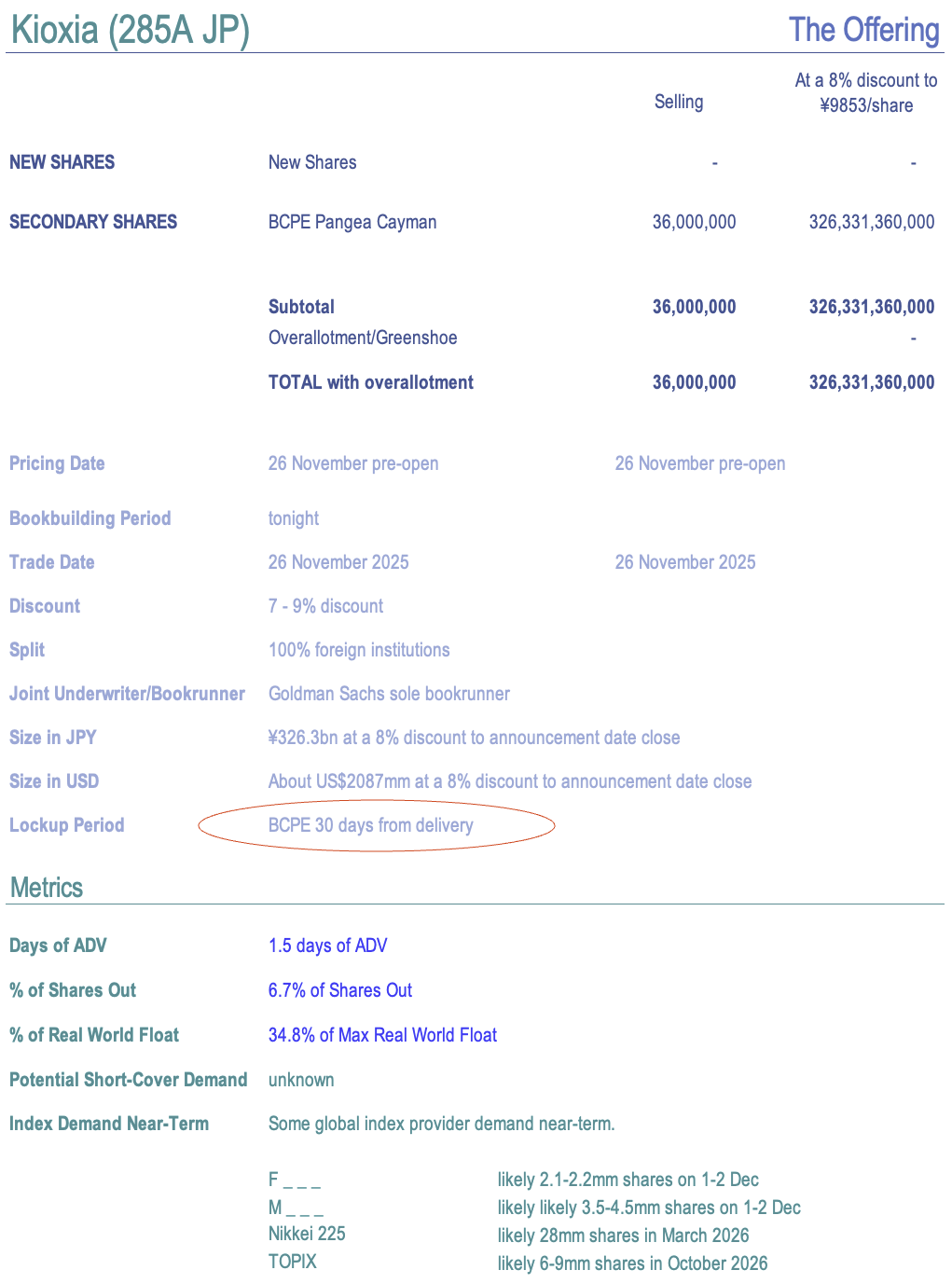

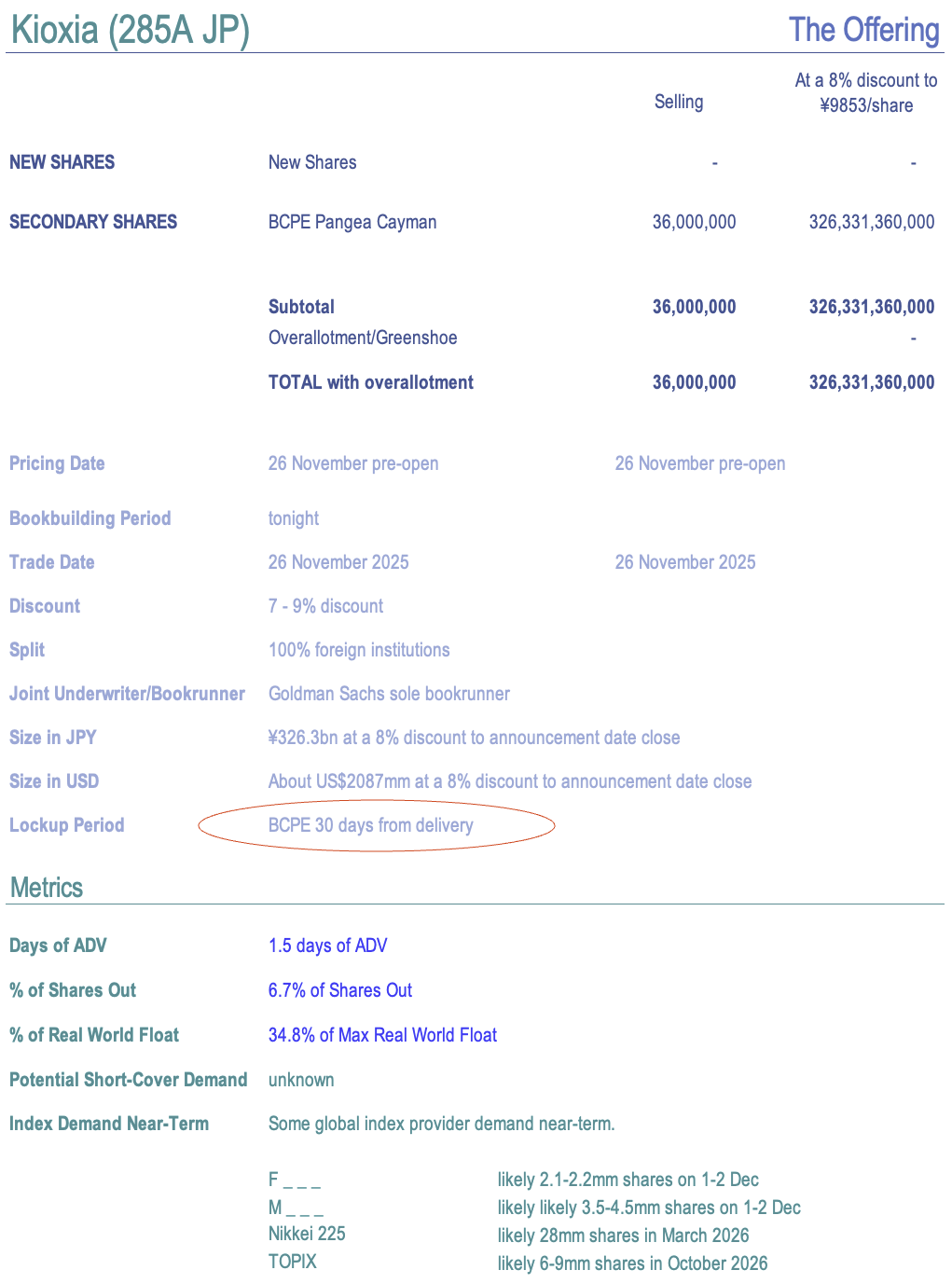

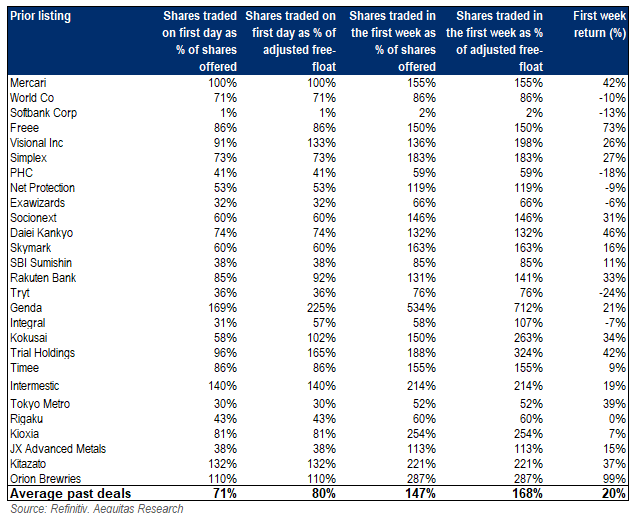

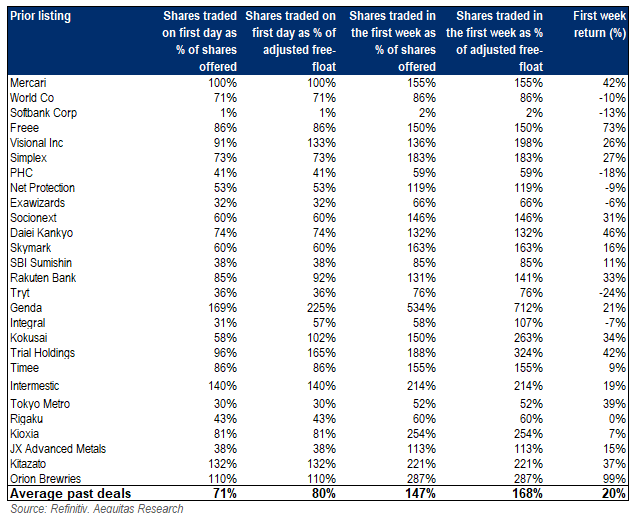

- After the close today, BCPE Pangea Cayman announced plans to sell a stake of 36mm shares of Kioxia Holdings (285A JP) in an overnight block. It trades tomorrow.

- This is 6.7% of shares out, 1.5x ADV. The discount is 7-9%. But it is 35% of Max Real World Float. And probably gets tradable shares to 34+%, not 35%.

- That means another offering is likely near-term. The lockup is only 30 days it appears. There is possibly a fair bit of long-dated index demand.

2. [Japan Offering] Toyota Selling Down Toyoda Gosei (7282) In BIG Offering; 85d ADV, 125% of Max RWF

- Last week, before the long weekend, Toyota Motor (7203 JP) and Sumitomo Mitsui Financial Group (8316 JP) announced a very big secondary selldown of shares in Toyoda Gosei (7282 JP).

- The selldown is 85x 3mo ADV, 27% of shares out. 125% of Max Real World Float. It’s a lot of stock at $750mm. One wonders where demand is.

- They also announced a big buyback, which is some of it, and there are index impacts, BUT this offering needs to find LOTS of new fundamental owners quickly.

3. Kioxia (285A JP): Bain’s US$2.1 Billion Selldown

- Bloomberg reports that Bain Capital is selling 36.0 million Kioxia Holdings (285A JP) shares through a block trade. IFR reports that the offering is worth up to JPY330 billion (US$2.1 billion).

- The offering is unsurprising given the shares are up around 7x since the IPO. The offering is easily digestible as it represents 2.7 days of the average ADV since listing.

- Kioxia is anticipated to return to growth in 3Q, and the underlying margin is recovering from recent lows. However, Kioxia’s EV/EBITDA multiple is full compared to peers and historical ranges.

4. [Japan Offering] Dear Life (3245 JP) – Unusual Offer Dynamics Are Bullish Despite Dilution

- Today after the close, Tokyo-based Dear Life (3245 JP) announced a primary offering to raise approximately ¥7bn through 15% dilution. Implying a 13+% price drop to protect PER.

- But the company plans on growing earnings. It has some projects in inventory, but it obviously plans a lot of turnover this year and needs to replenish.

- The MTMP “slogan” is “2028 – Ride the Wave!” This is a bit what investing in Tokyo real estate is like now. So one rides it until one doesn’t.

5. Kioxia Placement – US$2bn Deal, Relatively Small, Index Upweight but the Shares Have Runup

- Bain aims to raise around US$2bn via selling around 6% of its stake in Kioxia Holdings (285A JP). The IPO linked lockup on its shareholding had expired in Jun 2025.

- Kioxia is a manufacturer and a global leader in flash memory and solid state drives for smartphones, PCs, enterprise servers and data centers.

- In this note, we will talk about deal dynamics and run the deal through our ECM framework.

6. Suzhou Novosense A/H Listing – Growth Has Been Strong but Margins Weak

- Suzhou Novosense Microelectron (688052 CH), an analog chips producer, aims to raise around US$500m in its H-share listing.

- According to Frost & Sullivan, in terms of revenue from analog chips in 2024, SNM ranked fifth among Chinese analog chip companies in the Chinese analog chip market.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Jingdong Industrials (JDI) IPO: The Investment Case

- JD Industrial Technology (2231713D CH), a leading industrial supply chain technology and service provider in China, is seeking to raise US$500 million.

- JDI is the largest industrial supply chain technology and service provider in China in terms of GMV, customer coverage and SKU offerings in 2024, according to CIC.

- The investment case is bearish due to weak market share gains, declining product revenue growth, margin pressures, declining cash generation and factoring of receivables.

8. UltraGreen.ai IPO: High Growth and High Margins, Market Leader

- UltraGreen.AI (2594794D SP) is looking to raise US$400m in its upcoming Singapore IPO.

- UltraGreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

9. SBI Shinsei Bank Pre-IPO – Thoughts on Valuations

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- We have looked at past performance in our earlier notes. In this note, we talk about valuations.

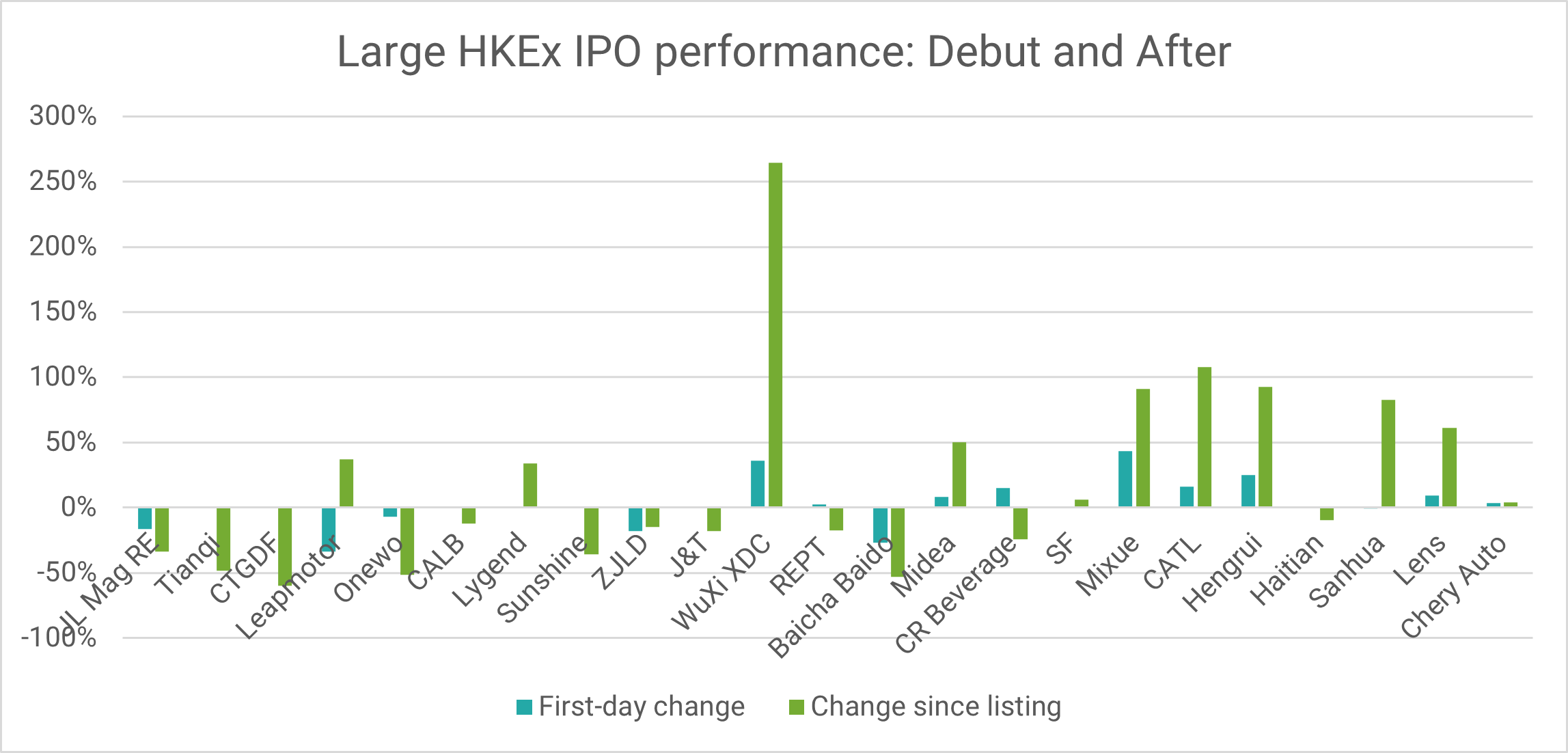

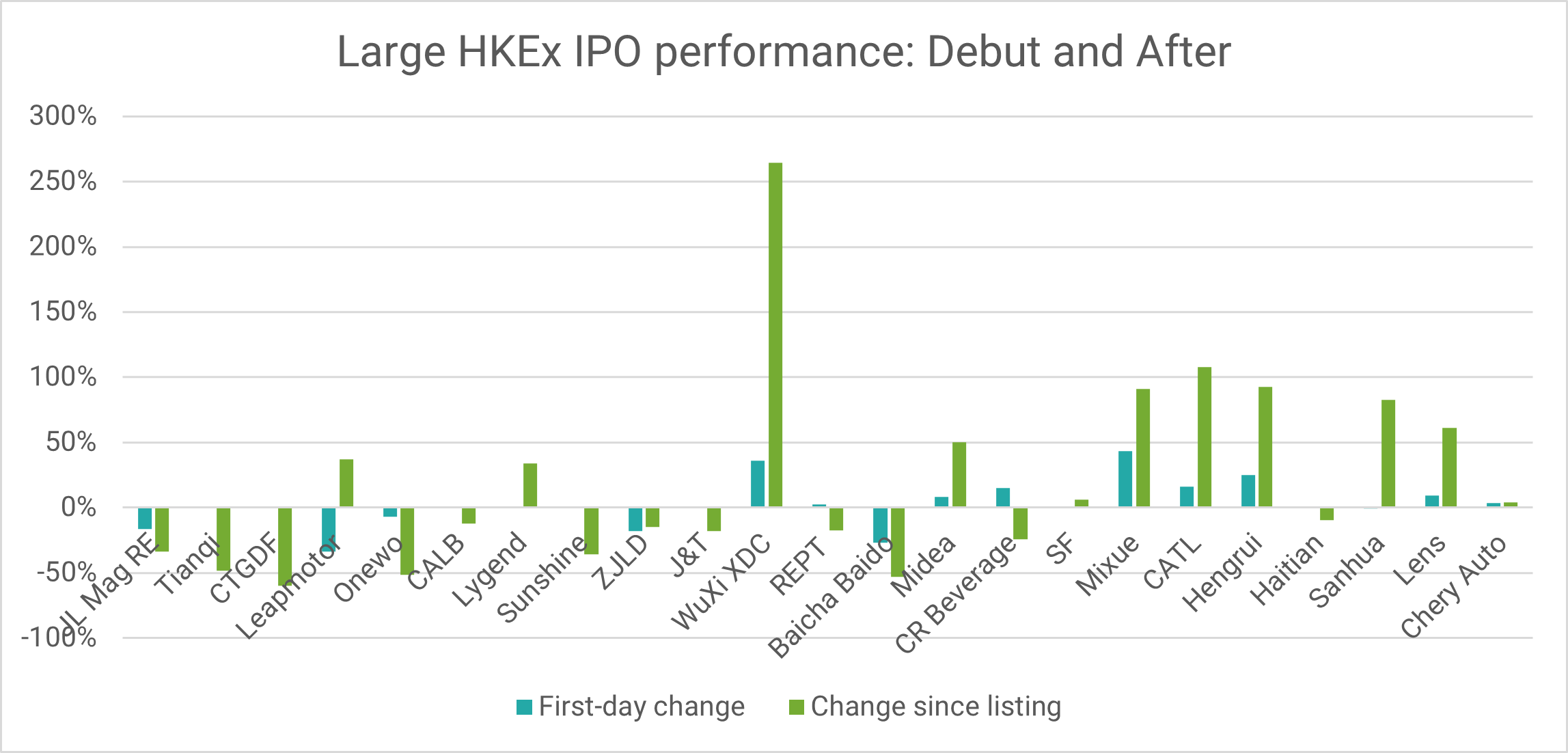

10. Hong Kong: IPO SPOTLIGHT – OVERVIEW 2025

- Hong Kong is the top global destination for IPOs in 2025, with over HK $280 billion raised so far. Large scale A+H dual listings have surged this year.

- Technology and healthcare sectors have dominated IPOs with the materials sector also floating several large listings. With nearly 300 listings in the pipeline, 2026 should be another banner year.

- Zijin Gold (2259 HK) , Chery Automobile (9973 HK) and Mixue Group (2097 HK) were the largest IPOs of the year while PegBio (2565 HK) has had the best return.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. SBI Shinsei Bank (8303 JP) IPO: The Investment Case

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, is looking to relist by raising about US$2 billion. The primary/secondary split is 40%/60%.

- In December 2021, Shinsei Bank was privatised by SBI Holdings (8473 JP) through a contentious tender offer at JPY2,800 per share.

- The investment case rests on growth in accounts/deposits, robust loan book growth, accelerating revenue growth, rising margins and improving asset quality.

2. [Japan Offering] DAIHEN Corp (6622 JP) Sees Crossholders Selling 25% of Max Real World Float

- Yesterday saw the announcement of a secondary offering structured like a delayed pricing ABO.

- 1.5mm shares which is 7.5% of shares out, 25% of Max Real World Float, and 9 days of ADV. There’s more cross-holdings to come out later at some point.

- Though it is not particularly expensive, Momentum is not this stock’s friend right now.

3. Toyoda Gosei (7282 JP): A US$0.8 Billion Secondary Offering

- Toyoda Gosei (7282 JP) has announced a secondary offering of up to 29.7 million shares (34.2 million including overallotment), worth around US$0.7 billion (US$0.8 billion including overallotment).

- Toyoda Gosei’s primary goal with the secondary offering is to reduce Toyota Motor (7203 JP)‘s shareholding to around 20% of outstanding shares.

- The offering as a percentage of outstanding shares and ADV is large compared to recent large placements. The likely pricing date is 1 December.

4. SBI Shinsei Bank Pre-IPO – The Positives – Has Been Growing Well Since SBI Group Took Control

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- In this note, we talk about the positive aspects of the deal.

5. China Hongqiao Placement: Good Valuation but Likely Opportunistic, on the Back of Chuangxin Listing

- China Hongqiao (1378 HK) is looking to raise around US$1.2bn from a primary placement.

- This represents 9.1 days of the stock’s three month ADV, and 2.9% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. SBI Shinsei Bank (8303 JP) IPO: Valuation Insights

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, is looking to relist by raising about US$2 billion. The primary/secondary split is 40%/60%.

- I discussed the investment thesis in SBI Shinsei Bank (8303 JP) IPO: The Investment Case.

- In this note, I discuss valuation. My analysis suggests that SBI Shinsei is fairly valued at the IPO price of JPY1,440 per share.

7. Toyoda Gosei Placement – Somewhat Expected but Relatively Large with Delayed Buyback

- Toyota Motor (7203 JP) and Sumitomo Mitsui Financial Group (8316 JP) plan to raise around US$700m via selling down some of their stake in Toyoda Gosei (7282 JP).

- The deal is a large one to digest at over 20% of the company and 90 days of ADV.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. UltraGreen.ai Pre-IPO: Strong Financials Despite Misleading Branding

- UltraGreen.AI (2594794D SP) is looking to raise US$400m in its upcoming Singapore IPO.

- Ultragreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- In this note, we look at the company’s past performance.

9. Chuangxin Pre-IPO: Increasing Exposure to Volatile Alumina; Offered at Premium to Peers

- Chuangxin Industries (CXI HK) is looking to raise up to US$700m in its upcoming Hong Kong IPO.

- It is focused on alumina refining and aluminum smelting within the upstream of the aluminum industry chain.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

10. SBI Shinsei Bank Pre-IPO – The Negatives – PAT Growth Aided by One-Offs, Margins Under Pressure

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- In this note we talk about the not-so-positive aspects of the deal.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

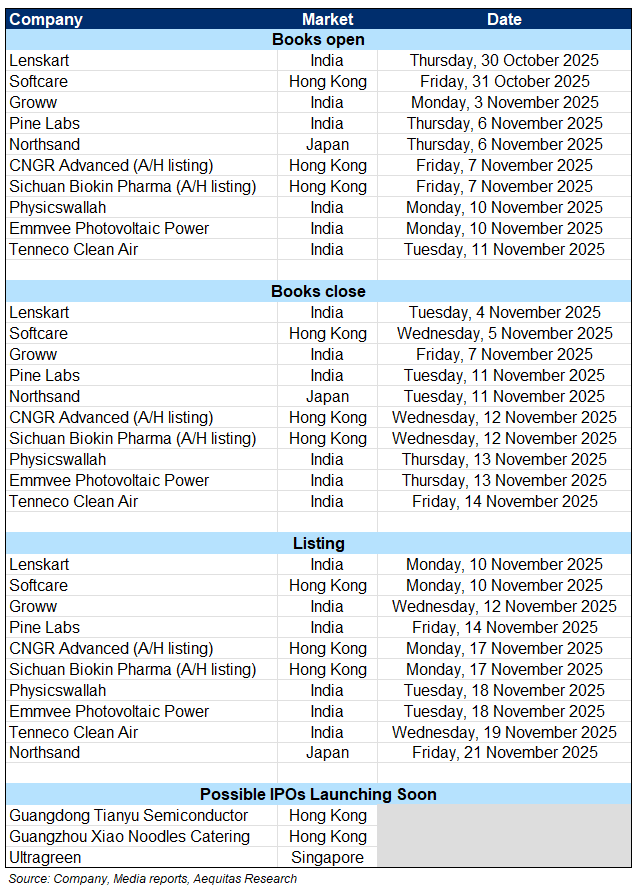

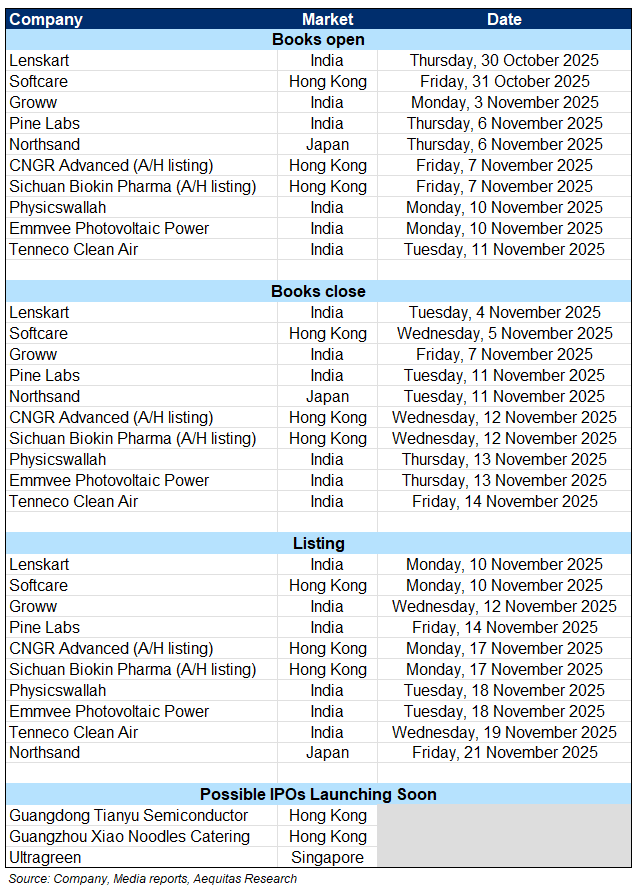

1. ECM Weekly (10 November 2025) – Seres, Pony, WeRide, Joyson, DIY, Maynilad, Northsand, Softcare

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the deal flow continues unabated, although a lot of listing in Hong Kong didn’t do to well last week.

- On the placements front, there were a number of deals, with a few right at lockup expiry.

2. Groww IPO Trading – Decent Overall Demand

- Groww (1573648D IN) raised around US$747m in its India IPO. Groww, officially called Billionbrains Garage Ventures, is a direct-to-customer digital investment platform providing multiple financial products and services.

- With Groww, customers can invest and trade in stocks (including via IPOs), derivatives, bonds, mutual funds and other products. Customers can also avail margin trading facility and personal loans.

- We have looked at the company’s past performance and valuations in our previous notes. In this note, we will talk about the trading dynamics.

3. CNGR Advanced Material H Share Listing (2579 HK): Valuation Insights

- CNGR Advanced Material (2579 HK), a new energy materials company, has launched an H Share listing to raise US$507 million.

- I discussed the H Share listing in CNGR Advanced Material H Share Listing: The Investment Case.

- The proposed AH discount range of 36.9% to 29.9% (based on the 7 November A Share price) is attractive, and I would participate in the H Share listing.

4. Human Made Pre-IPO: A Bathing Ape, Reborn

- Human Made (456A JP) aims to raise around US$116m in its Japan IPO.

- Human Made Inc. is a Japan-based apparel and lifestyle company. Its business model centers on producing high-value, limited-supply apparel and goods.

- In this note, we look at the company’s past performance.

5. CNGR A/H Listing: Healthy A/H Premium and Cheap Valuation

- CNGR Advanced Material (300919 CH) is looking to raise up to US$500m in its upcoming Hong Kong IPO.

- CNGR is a Chinese battery-component producer and a new energy materials company. It is the global leader of nickel-based and cobalt-based pCAM (cathode) for lithium-ion batteries.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

6. Sichuan Biokin Pharmaceutical IPO: Well-Positioned to Ride Oncology Focused Global ADC Wave

- Sichuan Biokin Pharmaceutical has launched HK IPO to raise ~$430M by offering 8.6M shares at HK$389 per share. Subscriptions will close on November 12, with expected listing on November 17.

- Lead candidate, iza-bren is the world’s first and only EGFR × HER3 bispecific ADC to have entered Phase 3 trial. Biokin has co-development and co-commercialization agreement with BMS for iza-bren.

- The company is already listed on China’s A-share market in Shanghai. Biokin shares have been a strong performer since it went public and rose 77% over the last one year.

7. Lenskart Solutions IPO Trading – Very Strong Anchor Facing Weak Markets

- Lenskart Solutions raised around US$825m in its India IPO, with a very strong anchor book.

- Lenskart Solutions Limited (LSL) is a technology-driven eyewear company with integrated operations spanning designing, manufacturing, branding and retailing of eyewear products.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

8. Physicswallah IPO – RHP Updates and Thoughts on Valuation

- Physicswallah Is looking to raise about US$434m in its upcoming India IPO.

- Physicswallah Ltd (PWL) offers test preparation courses for competitive examinations, and other courses such as for upskilling, across 13 education categories, including JEE, NEET, and UPSC, among others.

- We have looked at the company’s past performance in our earlier notes. In this note we talk about the RHP updates and provide our thoughts on valuations.

9. Pine Labs IPO Trading – Low/No Demand

- Pine Labs raised around US$450m in its India IPO. Overall demand was weak.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

10. Klook Pre-IPO – The Positives – Growth Has Been Very Strong

- Klook (KLK US), a pan-regional experiences platform in Asia-Pacific, aims to raise around US$500m in its US listing.

- Klook connects travelers with merchants providing a vast array of activities, tours, attractions and other travel services across the globe.

- In this note, we talk about the positive aspects of the deal.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

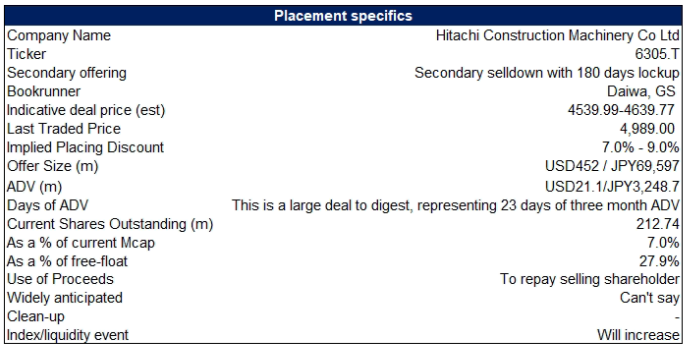

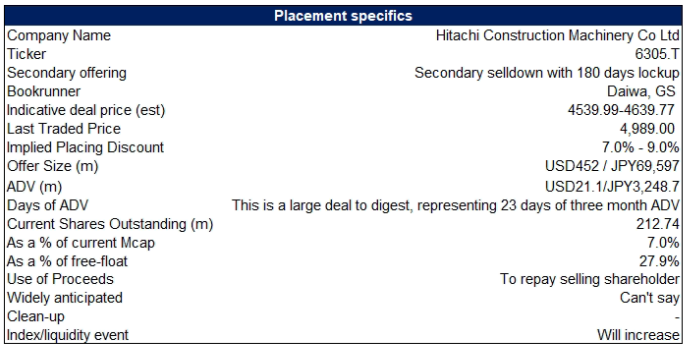

1. Hitachi Construction Machinery Block – US$450m Selldown by Hitachi

- Hitachi Ltd (6501 JP) aims to raise around US$452m via a 6.97% stake sale in Hitachi Construction Machinery Co. Post the selldown, Hitachi’s stake will reduce to 18.4%.

- Hitachi Construction Machinery Co (HCMC) is a Japanese company that designs, manufactures, sells, and services construction and mining equipment.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. ECM Weekly (3 November 2025)-Sany, Seres, CIG, PonyAI, WeRide, Mininglamp, Lenskart, Groww, Softcare

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, there were a flurry of deal launches across Hong Kong and India.

- On the placements front, while the week was rather quiet, we did have a look at the upcoming lockup release.

3. PonyAI and WeRide Secondary HK Trading – Weakish Demand, WeRide Did Better but Trading Lower

- Pony AI (PONY US) raised around US$860m and WeRide (WRD US) raised around US$310m in their HK Secondary offering.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the trading dynamics for the two deals.

4. CNGR A/H Listing: PHIP Update and Thoughts on A/H Premium

- CNGR Advanced Material (300919 CH), a Chinese battery-component producer, aims to raise up to US$700m in its H-share listing.

- CNGR is a Chinese battery-component producer and a new energy materials company.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

5. Seres Group A/H Trading – Demand Wasn’t Very Strong, Close to Fair Value

- Seres Group (601127 CH), a Chinese NEV manufacturer, raised around US$2.1bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about IPO trading dynamics.

6. Pony.AI Hong Kong Public Offering Valuation Analysis

- Pony.ai has finalized the Hong Kong public offering price at HK$139 per share and it expects to raise HK$6.71 billion (US$860 million) from its planned secondary listing in Hong Kong.

- Our base case valuation of Pony.Ai is HK$178.2 per share over the next 6-12 months, which represents 28% higher than the Hong Kong public offering price.

- Given the solid upside, we have a Positive View of Pony.ai. Despite our Positive view, there have been increasing concerns about the overstretched valuations of major AI/tech related companies globally.

7. Seres Group H Share Listing (9927 HK): Trading Debut

- Seres Group (9927 HK) priced its H Share at HK$131.50 to raise HK$14,283 million (US$1.8 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in Seres Group H Share Listing: The Investment Case and Seres Group H Share Listing (9927 HK): Valuation Insights.

- The price momentum is weak, and the international oversubscription rates were below the median of recent large AH listings. Nevertheless, Seres’ AH discount remains attractive.

8. Groww IPO – Peer Comp and Thoughts on Valuation

- Groww (1573648D IN) is looking to raise around US$747m in its India IPO.Groww, officially called Billionbrains Garage Ventures, is a direct-to-customer digital investment platform providing multiple financial products and services.

- With Groww, customers can invest and trade in stocks (including via IPOs), derivatives, bonds, mutual funds and other products. Customers can also avail margin trading facility and personal loans.

- In our earlier notes, we have looked at the company’s past performance. In this note, we talk about the peer comp and implied valuations in the price range.

9. Groww IPO Review – India’s Largest & Fastest Growing Broker / Investment Platform.

- Groww is India’s largest stockbroker with 13mn active users. It is progressing towards a full-stack investment platform, expecting to cross-sell multiple financial products to over 18mn users on its platform.

- It is aggressively expanding into lending (MTF, LAS) and has recently acquired ‘Fisdom’ to offer premiumised wealth solutions (AIF, insurance, tax-filing). It also owns Groww AMC, offering debt/equity/Fixed income products.

- At 33 times FY25 earnings, IPO is priced reasonably considering its deep penetration in the market (customers from 98% Pincodes) and strong ARPU and profitability supported by decent retention metrics.

10. Pre-IPO Softcare (PHIP Updates) – Some Points Worth the Attention

- The rise of Softcare is in line with the logic of “Chinese supply chain going global”.It has solved channel/cost problems through localized production, quickly captured market share with low-price tactic.

- Our forecast benefiting from market penetration/capacity expansion, revenue growth could be 15% YoY in 2025.In 2026-2027, as competition intensifies, revenue growth may slow down to 12% YoY, 10% YoY respectively.

- Given that Softcare’s main market is in Africa, which is characterized by high growth and high risk, a forecasted P/E of 8-12x for 2025 could be a comfortable valuation range.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

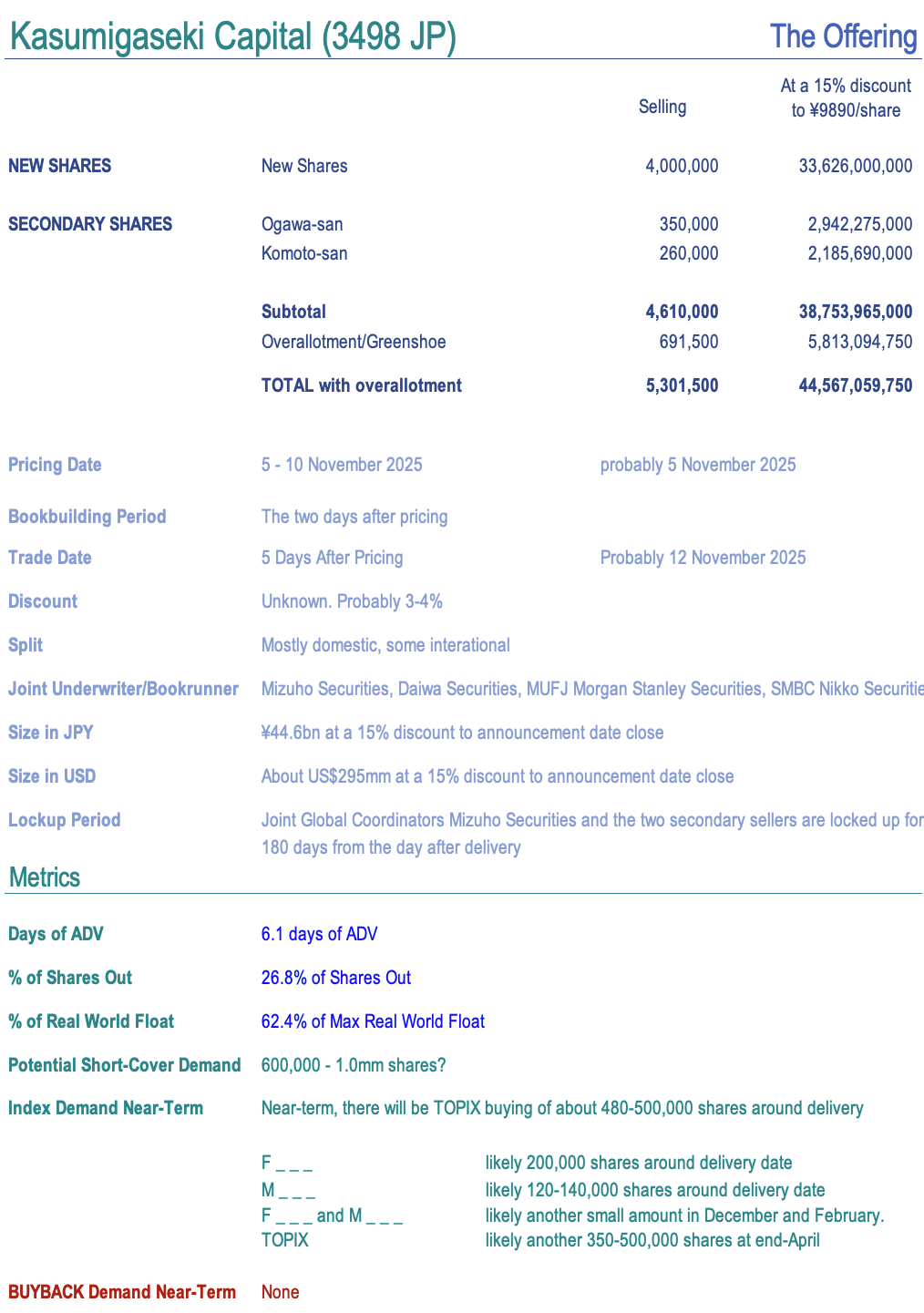

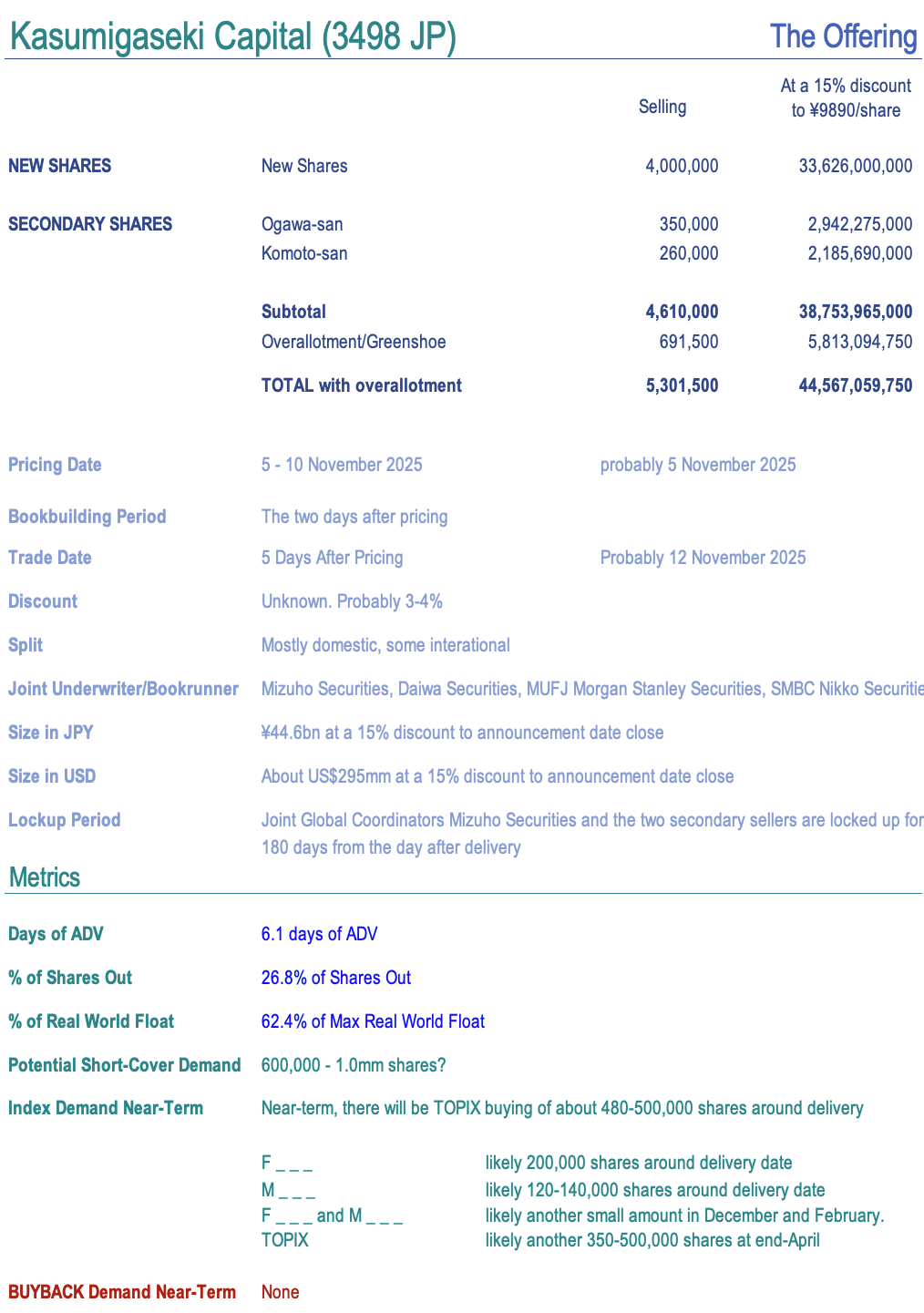

1. [Japan Offering] Kasumigaseki Capital (3498 JP) – BIG Primary for Big Plans

- On Friday, Kasumigaseki Capital (3498 JP) announced Aug-25 earnings and a combination ¥45-50bn primary+secondary offering worth 5.3mm shares, 6x ADV, and a float increase of 37%. Shares fell 15% today.

- 2yrs ago they did a large offering. It went well. They’d had a ridiculous plan to grow OP 6x from ¥3.5bn to ¥20bn in 2yrs to Aug-26. Then by Aug-25.

- They got to ¥8.5bn in Aug-24 and now ¥18.9bn in Aug-25 and now guide to ¥26.5bn in Aug-26 (the original plan having been ¥20bn).

2. WeRide HK Listing: The Investment Case

- WeRide (WRD US), a provider of autonomous driving products and services, is seeking to raise between US$350 million through an HKEx listing.

- It was listed on the Nasdaq on 25 October 2024, raising US$120 million at US$15.50 per ADS. Since listing, the shares are down 31%.

- The investment case centres around accelerating revenue growth, progress towards mass commercialisation and valuation in line with historical averages. However, the path to profitability remains uncertain.

3. Seres Group H Share Listing (9927 HK): Valuation Insights

- Seres Group (601127 CH), a Chinese NEV manufacturer, has launched an H Share listing to raise US$1.7 billion.

- I discussed the H Share listing in Seres Group H Share Listing: The Investment Case.

- The proposed AH discount of 24.8% (based on the 24 October A Share price) is attractive, and I would participate in the H Share listing.

4. Seres Group Hong Kong IPO Preview

- Seres Group is getting ready to complete its IPO on the Hong Kong exchange in the coming weeks that could raise about US$1.7 billion.

- At the high end of the IPO price range of HK$131.50 per share, Seres would have a market capitalization of nearly HK$215 billion (about $27.6 billion).

- Seres Group is one of the largest new-energy vehicle makers in China. There are 22 cornerstone investors that have committed to purchase approximately 49% of the offer.

5. Pony AI Secondary HK Offering – Needs to Correct Some More

- Pony AI (PONY US) plans to raise around US$825m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

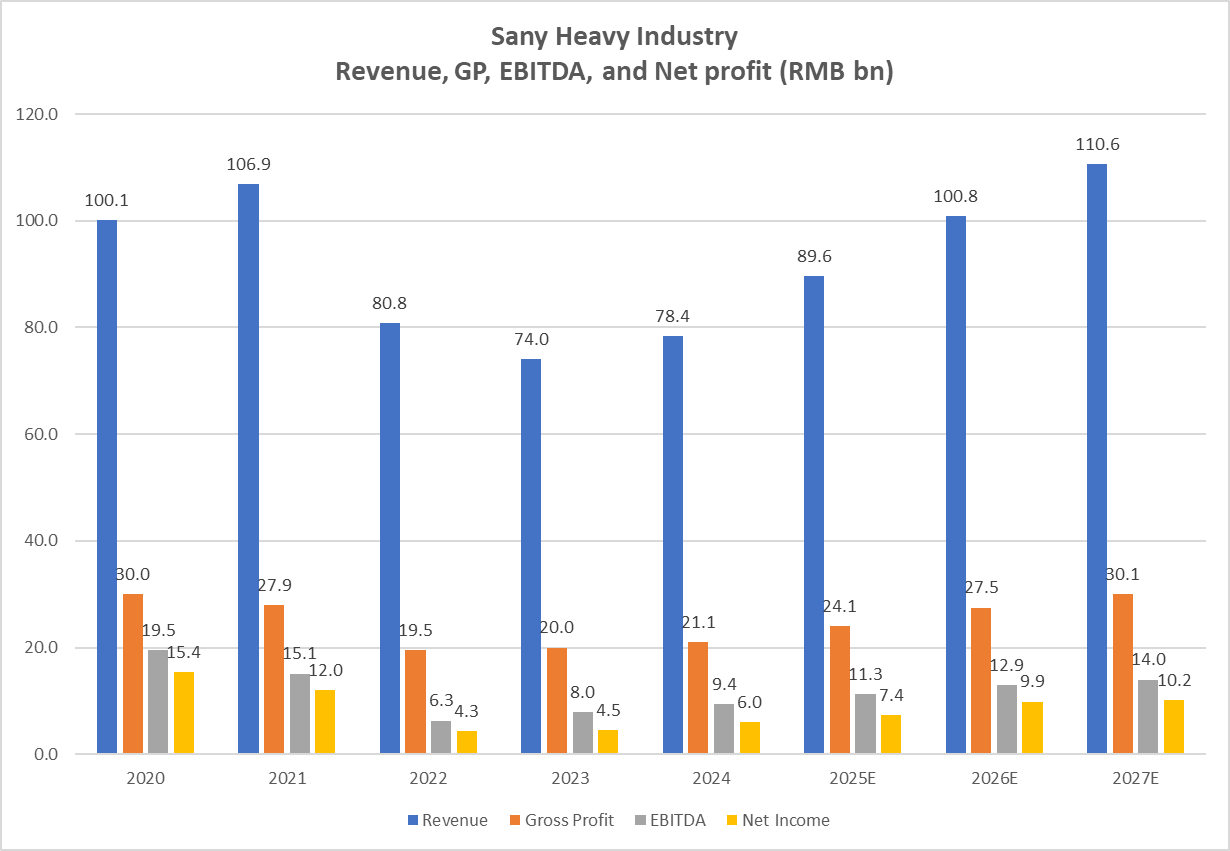

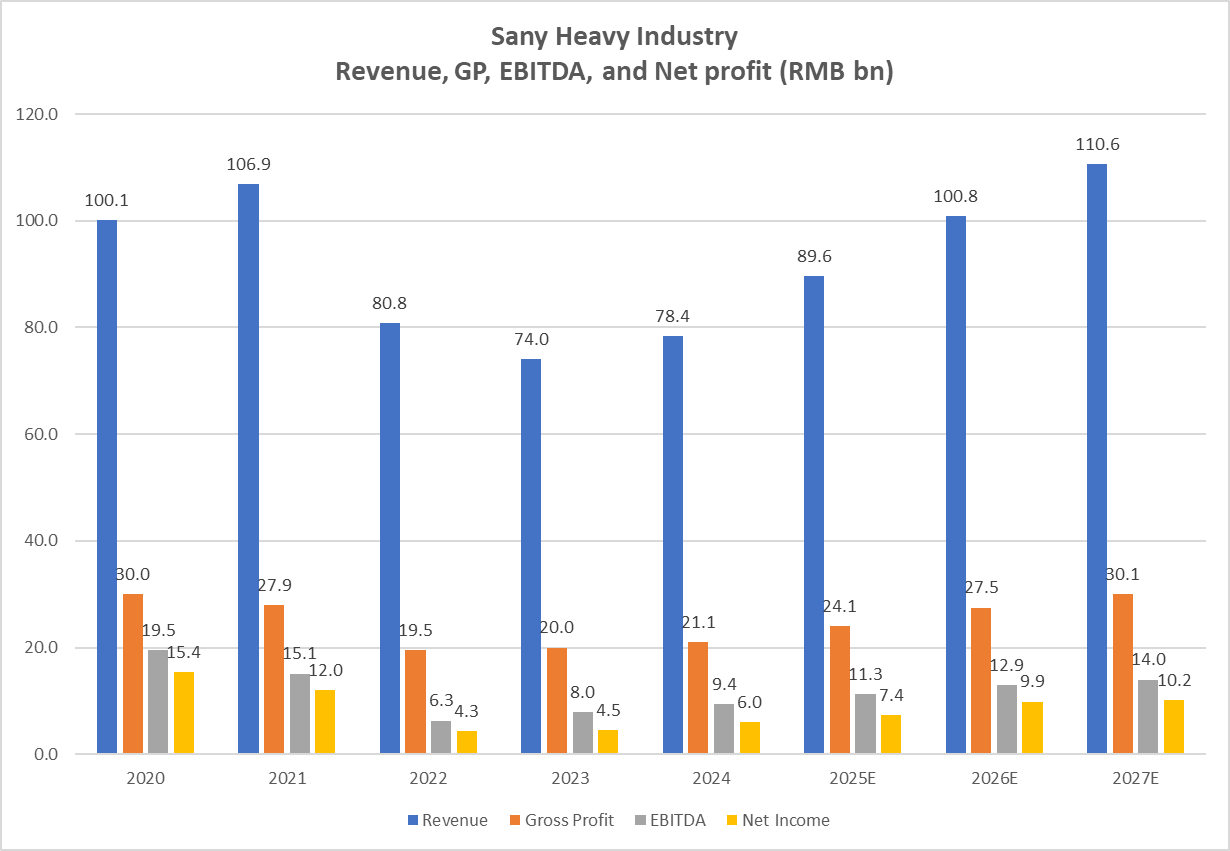

6. SANY Heavy Industry H Share Listing (6031 HK): Trading Debut

- Sany Heavy Industry (600031 CH) priced its H Share at HK$21.30 to raise HK$13,453 million (US$1.7 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case and SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights.

- Sany’s international oversubscription rates were above the median of recent large AH listings. The AH discount remains reasonable.

7. WeRide Secondary HK Offering – Has Been Trading Up, Given the Valuation Gap

- WeRide (WRD US) plans to raise around US$325m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

8. Seres Group A/H IPO Pricing – Thoughts on Valuations

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$1.7bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. ECM Weekly (27 October 2025)- Sany, Seres, PonyAI, WeRide, CIG, JST, Lenskart, Horizon, CRB

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Hong Kong and India markets appear to be gearing up for a year end rush.

- On the placements front, there were no large deals this week but we did have a look at the upcoming lockup expiries.

10. Samsung Electronics Placement: Inheritance Tax Paydown by Family, Widely Telegraphed

- Samsung Electronics (005930 KS) is looking to raise around US$1.2bn from a secondary placement.

- This represents 0.9 days of the stock’s three month ADV, and 0.3% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Sany Heavy Industry IPO Valuation Analysis

- Our base case valuation of Sany Heavy Industry is target price of CNY21.1 per share. This represents 7.6% lower than current price of CNY22.83 per share.

- IPO price of Sany Heavy is expected to be set between HKD20.30 and HKD21.30. Our valuation analysis suggests lack of a meaningful upside for Sany Heavy Industry listing in HK.

- There are still lack of a major turnaround of the property market in China and this could continue to negatively impact the overall construction equipment market in China.

2. SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights

- Sany Heavy Industry (600031 CH), the world’s third-largest construction machinery company, has launched an H Share listing to raise US$1.6 billion.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case.

- The proposed AH discount of 17.2% to 13.1% (based on the 17 October A Share price) is attractive, and I would participate in the H Share listing.

3. WeRide Secondary HK Offering – Is Relatively Cheaper but Lacks Momentum

- WeRide (WRD US) plans to raise around US$350m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 19th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

4. Pony AI Secondary HK Offering – Stock Has Been Volatile, a Look at Possible Trading Setup

- Pony AI (PONY US) plans to raise around US$1bn in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 17th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

5. ECM Weekly (20 October 2025)- Sany, Seres, JST, Fibocom, Tekscend, FineToday, LG India, DIY, Duality

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India saw a host of listing, while HK is gearing up a busy year end.

- On the placements front, we had a look at some of the IPO lockups. There weren’t any large placements this week.

6. CIG Shanghai A/H Listing: Smaller A/H Premium than Larger Peers, Expensive

- Cig Shanghai (603083 CH), telecommunications equipment company, is looking to raise up to US$594m in its upcoming Hong Kong IPO.

- It is a provider of critical infrastructure components for the development of AI.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Sany Heavy Industries A/H IPO Pricing – Thoughts on Valuations

- Sany Heavy Industry (600031 CH) aims to raise around US$1.6bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

8. Sany Heavy Industry IPO: Valuation Assessment

- Sany Heavy Industry (600031 CH)‘s IPO price range is set at HK$20.3-21.3, aiming at raising HK$11.9bn based on the mid-point IPO price.

- Key strengths are excellent growth potential globally, a leading market position, excellent R&D capability, and a solid financial track record.

- Sany Heavy’s fair valuation is a 5-10% discount to its A-share, in our view, implying an H-share price of HK$22.06-23.29, leaving limited upside from the IPO level.

9. Zijin Gold (2259 HK) 25Q3 – Updates on Forecast/Valuation and Potential Risks Behind

- Zijin Gold showed strong growth momentum in 25Q1-Q3, mainly driven by high gold prices and the two major acquisitions of the Ghana Akyem Gold Mine and Kazakhstan Raygorodok Gold Mine.

- Based on 25Q1-Q3 results, we updated our forecast of Zijin Gold, with net profit to reach US$1.5 billion/US$2.3 billion/US$3.5 billion in 2025/2026/2027, respectively.Theoretically speaking, valuation still has positive upside potential.

- However, our greatest concern is not the fundamental factors but the selling caused by liquidity crisis, which may lead to a synchronous correction of Zijin when the global market declines.

10. Pony AI HK Dual Primary Listing: The Investment Case

- Pony AI (PONY US) is a Chinese robotaxi operator and self-driving technology company. It is seeking to raise US$1 billion through a dual primary HKEx listing.

- It was listed on the Nasdaq on 27 November 2024, raising US$260 million at US$13.00 per ADS. Since listing, the shares are up 48%.

- The investment case centres around Pony’s accelerating revenue growth and progress towards positive unit economics. However, the path to profitability is long-dated and the valuation is full.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tekscend Photomask IPO Trading – Priced at the Top, but Still Relatively Cheap

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, raised around US$900m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- In our previous note, we looked at its past performance and valuations. In this note, we will talk about the trading dynamics.

2. Tekscend Photomask (429A JP) IPO: Trading Debut

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. At the IPO price, Tekscend will raise JPY138 billion (US$910 million). The shares will be listed on 16 October.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case, Tekscend Photomask (429A JP) IPO: The Bear Case and Tekscend Photomask (429A JP) IPO: Valuation Insights.

- The peers have re-rated since the release of the prospectus. My analysis suggests that Tekscend is attractively valued at the IPO price.

3. ECM Weekly (13 October 2025)- LG India, Tata Capital, Rubicon, Canara, FineToday, Maynilad, Kokusai

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the year end looks set to see a flurry of listings, with the pace already starting to pick up again.

- On the placements front, markets were back where they left of prior to the October holidays.

4. Top Toy IPO Preview

- Top Toy International is getting ready to complete its IPO in Hong Kong in the next several months.

- Top Toy was last valued at US$1.3 billion in July 2025 when it received a US$59.4 million Series A financing (of which Temasek contributed US$40 million for a 3.2% stake).

- Top Toy is trading at P/E of 32x (2024 net profit) (valuation of US$1.3 billion) versus Pop Mart (P/E of 103x based on its 2024 net profit).

5. FineToday Holdings (420A JP) IPO: Valuation Insights

- FineToday Holdings (420A JP), a Japanese personal care business, is seeking to raise US$280 million. It previously pulled an IPO to raise US$500 million in December 2024.

- I previously discussed the investment thesis in FineToday Holdings (420A JP) IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that FineToday is fully valued at the IPO price.

6. Fibocom A/H Listing: Strong Revenue Growth, Some Margin Pressures

- Fibocom Wireless (300638 CH) a wireless communication modules provider, aims to raise up to US$400m in its H-share listing.

- Fibocom was founded in Nov 1999, and is a leading wireless communication module provider. The firm’s module products include i) data transmission modules, ii) smart modules, and iii) AI modules.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Sany Heavy Industries A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Sany Heavy Industry (600031 CH), aims to raise around US$1.5bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the company’s past performance in our earlier note. In this note, we talk about the updates and likely A/H premium.

8. LG Electronics India IPO Trading – Very Strong Subscription, Won’t Be Chasing if It Pops Too High

- LG Electronics (066570 KS) raised around US$1.3bn via selling 15% of its stake in LG Electronics India IPO.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about the trading dynamics.

9. JST Group (6687 HK): Valuation Insights

- JST Group (6687 HK) is China’s largest e-commerce SaaS ERP provider. It is seeking to raise HK$2,086 million (US$268 million).

- I previously discussed the IPO in JST Group IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive in the context of the revenue growth.

10. Seres Group A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$2bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- In our previous note we had looked at its past performance. In this note, we talk about the recent updates and likely A/H premium.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

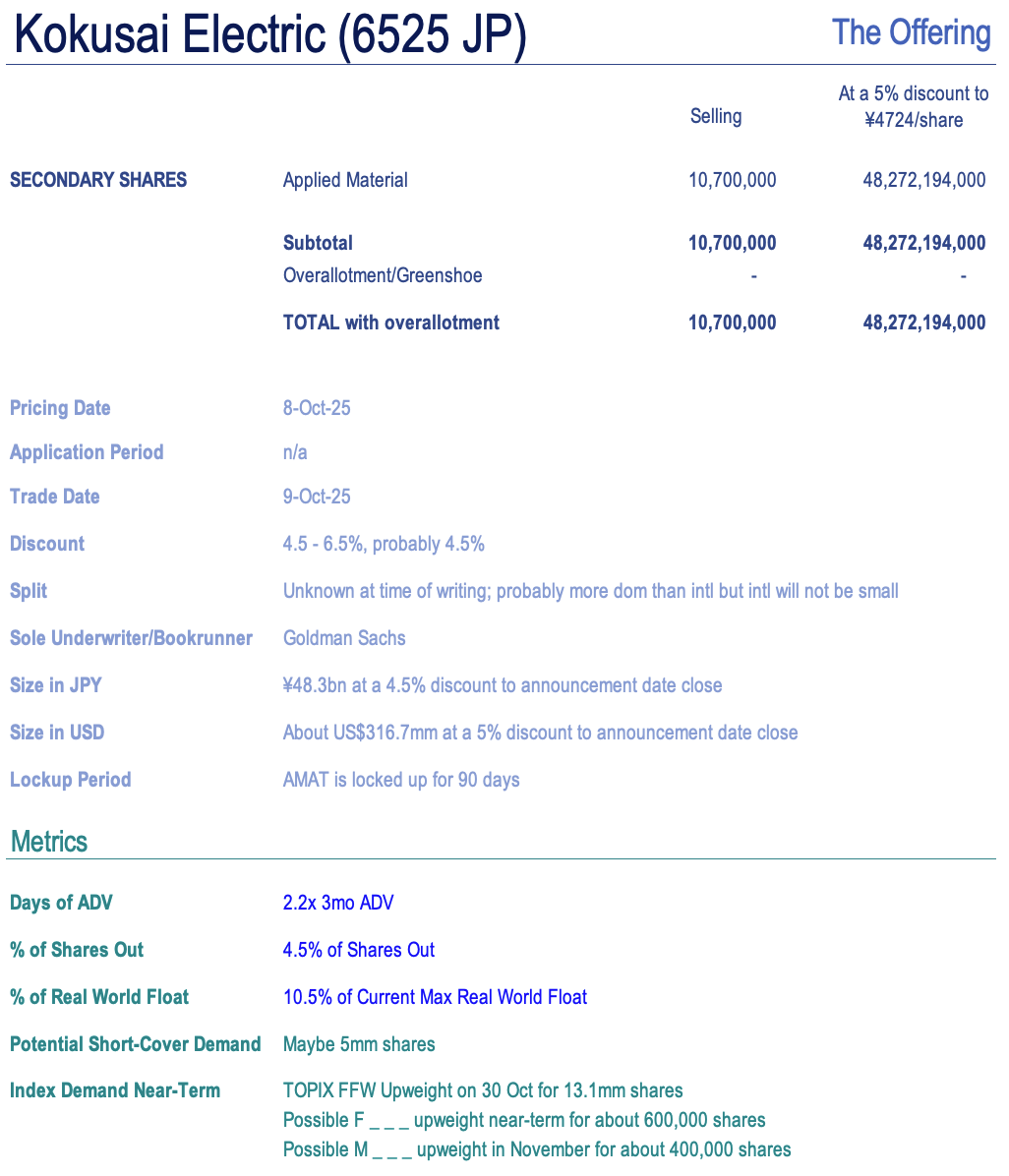

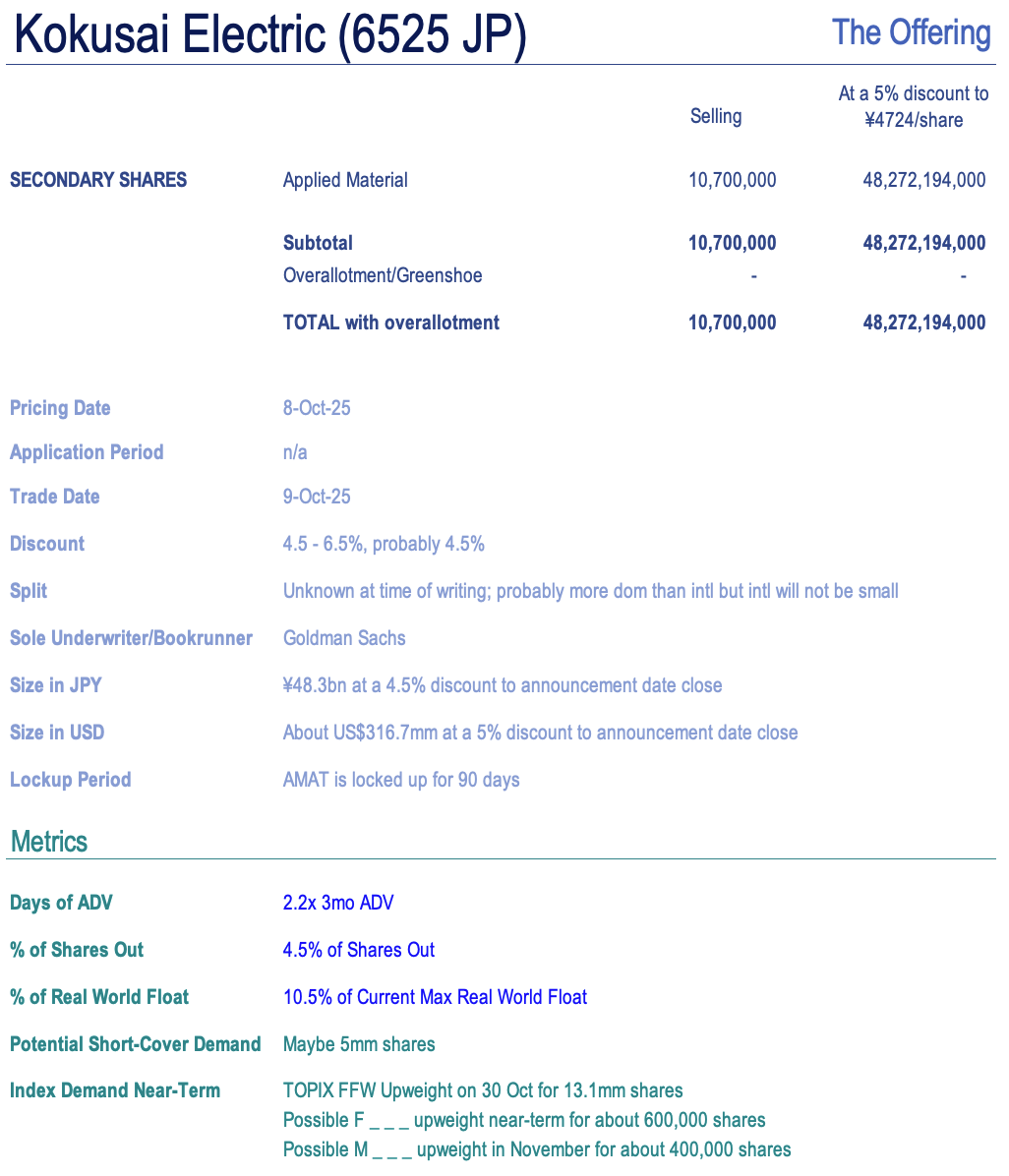

1. [Japan ECM] Kokusai Elec (6525) – Applied Materials $330mm Selldown

- Three weeks ago I wrote that KKR’s lockup would expire about now in [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Today post-close, Applied Materials (AMAT US) announced a 10.7mm share (4.5%) Accelerated Block Offering to be priced tomorrow morning, at an indicated 4.5-6.5% discount. This would put them at 10+%.

- This should be very well taken up. There is index demand on the follow. The question is more about the unwind of KKR’s last bit. Perhaps to come soon?

2. FineToday Holdings (420A JP) IPO: The Investment Case

- FineToday Holdings Co Ltd (289A JP), a Japanese personal care business, is seeking to raise US$286 million. It previously pulled an IPO to raise US$500 million in December 2024.

- FineToday has four product categories: Hair care, Skin care, Body care and others. Hair care is the largest category, accounting for 49.0% of 1H25 revenue.

- The investment case rests on top-tier revenue growth, top-quartile profitability, peer-leading FCF generation and manageable leverage.

3. Kokusai Electric Placement – Unexpected Seller but Relatively Small Deal

- Applied Materials (AMAT US) is looking to raise approximately US$330m through an accelerated secondary offering for around 4.5% of Kokusai Electric (6525 JP) (KE) stock.

- KE had seen two selldown earlier, from KKR, with mixed results. KKR just came out of its last lockup.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. LG Electronics India IPO – Thoughts on Valuation – Better Placed This Time Around

- LG Electronics (066570 KS) is looking to raise US$1.3bn via part-selling its stake in LG Electronics India.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about valuations.

5. Tekscend Photomask IPO: Market Leader with Strong Prospects Ahead

- Established in 2022, Tekscend Photomask (429A JP) (previously Toppan Photomask) is the world’s leading semiconductor photomask supplier, holding a global market share of 38.9%.

- Tekscend provides a diverse portfolio of high-precision photomasks for semiconductors, displays, MEMS, and R&D, including cutting-edge EUV masks, leveraging its expertise in microfabrication.

- The company is planning for a listing on TSE on 16th October and plans to raise proceeds of around US$800m through a combination of existing and new share issues.

6. LG Electronics India IPO: Attractive Upside

- After incorporating the company’s FY25 results, we have tweaked our income statement estimates and valuations of LG Electronics India IPO.

- Our base case valuation is target price of 1,514 INR which is 33% higher than the high end of the IPO price range.

- It appears that the company wants the IPO to be successful and after much review the company has decided to price the IPO at more attractive levels to new investors.

7. Innoscience Suzhou Tech Placement – Selling Ahead of Lockup Expiry, Relatively Small

- InnoScience Suzhou Technology (2577 HK) aims to raise around US$200m in its Hong Kong placement.

- Innoscience was only listed in Dec 2024 and it undertook another primary raising in July 2025, the lockup for which has yet to expire.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. LG Electronics India IPO: Leading Player Priced at a Steep Discount ?

- LG Electronics (066570 KS) will divest a 15% stake in its 100% subsidiary LG Electronics India (123D IN) through an IPO, raising Rs116 billion (USD 1.3 billion).

- The IPO pricing implies a valuation well below that of listed Indian peers and appears to overlook the sector’s underlying near term macro demand tailwinds.

- LGEIL’s 1QFY26 financial performance came in weak, primarily due to a seasonal slowdown in cooling product sales, particularly air conditioners. This follows a strong FY2025.

9. FineToday Pre-IPO – Refiling Updates

- FineToday Holdings (420A JP) (FT) is planning to raise around US$280m via selling a mix of primary and secondary shares.

- FineToday (FT) is a beauty and personal care company in Asia offering a range of products, including hair care, skin care and body care products.

- In our previous note, we had looked at its past performance. In this note, we will talk about the updates from its most recent filings.

10. LG Electronics India IPO- Strained in Legal Heat

- LG Electronics India (123D IN) much awaited INR 116.1 bn IPO is set to open for subscription this week. It’s a complete OFS by the Korean Parent.

- While LG is the market leader, there are huge litigation liabilities ~74% of net-worth which could pose a serious threat to the financials, with particular attention to AMP spends proceedings.

- We also find it disturbing to note that the parent has taken out 175% of the free cash flows in FY23 and FY24 as interim dividends.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO (2259 HK): Trading Debut

- Zijin Gold (2259 HK) priced its IPO at HK$71.59 per share to raise gross proceeds of approximately US$3.2 billion. The shares will begin trading on September 30.

- The IPO was discussed in Zijin Gold IPO: The Investment Case and Zijin Gold IPO (2259 HK): Valuation Insights.

- The market sentiment of the peers has increased since the IPO launch. My analysis suggests that the IPO price range is attractive.

2. Tekscend Photomask (429A JP) IPO: Valuation Insights

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$828 million). Pricing is on 30 September.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case and Tekscend Photomask (429A JP) IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that Tekscend is attractively valued at the IPO price range compared to peer multiples.

3. Tekscend Photomask IPO – Thoughts on Valuation

- Tekscend Photomask (429A JP) (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

4. LG Electronics’ BOD Gives the Green Light for LG Electronics India IPO in 2025 – Updated Valuation

- LG Electronics’ BOD finally approved a plan to sell a 15% stake in LG Electronics India in an IPO to be completed in 2025.

- According to local media, LG Electronics India is now valued at about US$13 billion which is higher than LG Electronics’ market cap of US$8.8 billion.

- Our base case valuation of LG Electronics India is implied market cap of 1,280 billion INR or US$14.4 billion.

5. [Japan ECM] MIGALO Holdings (5535 JP) Offering to Raise Capital, Generate Interest

- Migalo Holdings (5535 JP) is one of the rare TSE Prime-listed companies which got the boot from TOPIX, stayed in Prime, and is clawing its way back.

- As of end-March-25, it met all the criteria to stay in Prime and rejoin TOPIX. Now they are launching a primary offering, and this may presage an effort to rejoin.

- They are adding float and 10% of shares to the pile, in this ¥4.4-5.0bn offering. But instos are net short this stock.

6. ECM Weekly (29 September 2025)- Zijin, Chery, CAREIT, Orion, Butong, Victory Giant, Northern Star

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, this week saw a few good listings across the region while the spotlight will be on Zijin Gold (2259 HK) in the coming week.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

7. Zijin Gold : Listing Pop Likely. Know Your Thresholds. Avoid Valuation Pitfalls.

- Riding on strong investor demand, Zijin Gold (2259 HK) has exercised its over-allotment option, boosting the total IPO size to USD 3.7 billion from USD 3.2 billion previously.

- As Hong Kong’s only pure-play gold miner with global exposure, Zijin Gold may command a premium, though any sharp price gains still depend on sustained gold price strength.

- Investors should define their medium- to-long-term gold price thresholds to shape a clear post-IPO strategy for Zijin Gold.

8. Tekscend Photomask IPO – Peer Comparison

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we will undertake a peer comparison.

9. Zijin Gold (2259 HK) IPO Debut – Some Points Worth the Attention

- Based on DCF model, valuation is about US$28.4 billion. We think this is the valuation bottom line. Conservative investors can take profits at this valuation level.

- Valuation has the potential to reach US$34-42bn (or 18-22x P/E ) if based on 2025 forecast.Optimistic investors can choose to wait for stock price to fall within this valuation range.

- Considering better profitability/shareholder resources, Zijin Gold has more advantage than Shandong Gold Mining. Therefore, market value of Zijin Gold will widen the gap with Shandong Gold Mining in the future.

10. Zijin Gold IPO Trading: Decent Retail but Strong Insti Demand

- Zijin Gold (2259 HK) raised around US$3.2bn in its Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

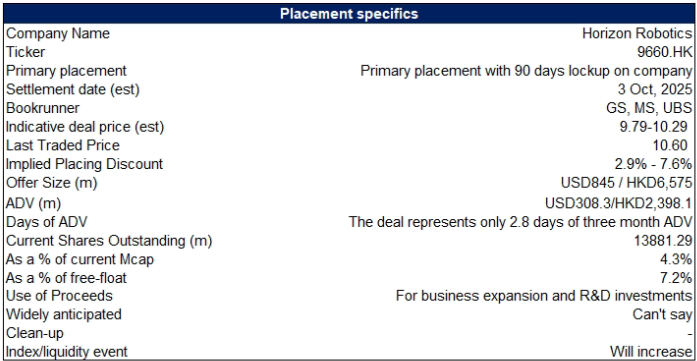

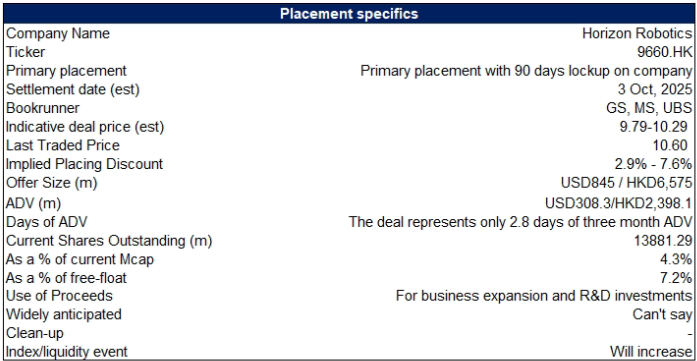

1. Horizon Robotics Placement – Another Opportunistic Raising

- Horizon Robotics (9660 HK) raised around US$800m in its Oct’24 IPO and another US$600m via a placement in June’25. It’s back again to raise another US$834m via a top-up placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. Trading Strategy of Zijin Gold on the First Day of IPO

- Zijin Gold IPO will start trading on 30 September. Zijin Gold is aiming to raise US$3.2 billion (HK$24.98 billion) from its IPO, offering 349 million shares at HK$71.59 each.

- Our base case valuation of Zijin Gold is HK$124.7 per share (74.2% higher than the IPO price). We expect a sharply higher pop on the first day of trading.

- If its share price appreciates more than 30-50% or more, we think it is prudent to take some profits off the table (at least 25%-30% of total investment).

3. Berkshire Hathaway Dumps All Its Stake in BYD – Impact on the Chery Auto IPO

- Warren Buffett’s Berkshire Hathaway completely exited its stake in BYD (1211 HK).

- We highlight four major reasons why Berkshire may have exited its entire position including valuations, tariffs, competition and lower profit margins, and greater risk prospects on economic stagnation in China.

- Berkshire selling all its stake in BYD is likely to have a slightly negative impact on the Chery Auto IPO. However, we maintain a Positive view of Chery Auto IPO.

4. Tekscend Photomask (429A JP) IPO: The Bull Case

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$832 million). Pricing is on 30 September.

- Tekscend, which was carved out of Toppan Printing (7911 JP) in 2022, is owned by Toppan (with a 50.1% stake) and Integral (5842 JP) (with a 49.9% stake).

- The bull case rests on its leading market position, attractive market opportunity, stable underlying margins, net cash position, and attractive dividend policy.

5. Zijin Gold IPO: The Good, The Bad and Valuations. For the Gold Bulls.

- Zijin Gold (2259 HK) IPO offers investors with a bullish outlook on gold prices a timely entry into a pure play gold miner with a globally diversified asset base.

- At HKD71.59/share, Zijin Gold IPO is set to raise US$3.2 billion with cornerstone investors already committing about half the deal (US$1.6 billion).

- At current gold prices, IPO valuations leave a reasonable buffer; however, a pullback toward year-ago levels would pose significant downside.

6. Fermi Inc. (FRMI): Pre-Revenue Data Center REIT Sets Terms Seeking $13.2b Valuation

- Fermi set terms for its IPO on Wednesday afternoon and will offer 25 million shares at $18-$22 and to debut on Wednesday, 10/1.

- One of Fermi’s founders is former energy sector director, Rick Perry.

- The underwriters have reserved for sale at the initial public offering price up to 5% of the shares of common stock for sale through a directed share program.

7. KCC Corp – To Issue 430 Billion Won in EB Using Its Treasury Shares?

- On 23 September, Hankyung Business Daily reported that Kcc Corp (002380 KS) plans to issue about 430 billion won worth of exchangeable bonds (EB) based on its own treasury shares.

- We believe the overall impact on this EB issue on KCC is likely to be more negative as compared to the EB issue it conducted in July 2025.

- Our NAV valuation of KCC Corp suggests NAV per share of 508,467 won, which is 22% higher than current price.

8. ECM Weekly (22 September 2025)- Chery, Zijin Gold, Orion, Myungin, Urban, Avepoint, Dongfang

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Zijin Gold appears to be shining bright.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

9. Zijin Gold IPO: Gold Price Sensitivity Analysis. A High Beta Proxy for Gold

- Zijin Gold (2259 HK) ’s US$3.2 billion IPO closes tomorrow, Wednesday, September 29.

- The pure-play gold miner, backed by Zijin Mining, is priced at an EV/Reserves multiple in the top quartile of global peers.

- With high sensitivity to gold price movements, Zijin Gold offers amplified upside potential — and downside risk — versus bullion itself.

10. Chery Auto IPO (9973.HK): Modest Potential Upside, Geely Auto Screens As a Good Comparison

- Chery Auto, the second largest Chinese domestic brand passenger vehicle company, priced its IPO at the high end of the range at HK$30.75/share.

- High demand for the stock was predictable. Cornerstone investors collectively agreed to acquire ~$588M worth of Chery Auto shares in this offering.

- The Chery Auto stock is set to start trading on Thursday. I see modest potential upside vs. IPO offer price as growth is slowing down and margins compressed.