This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

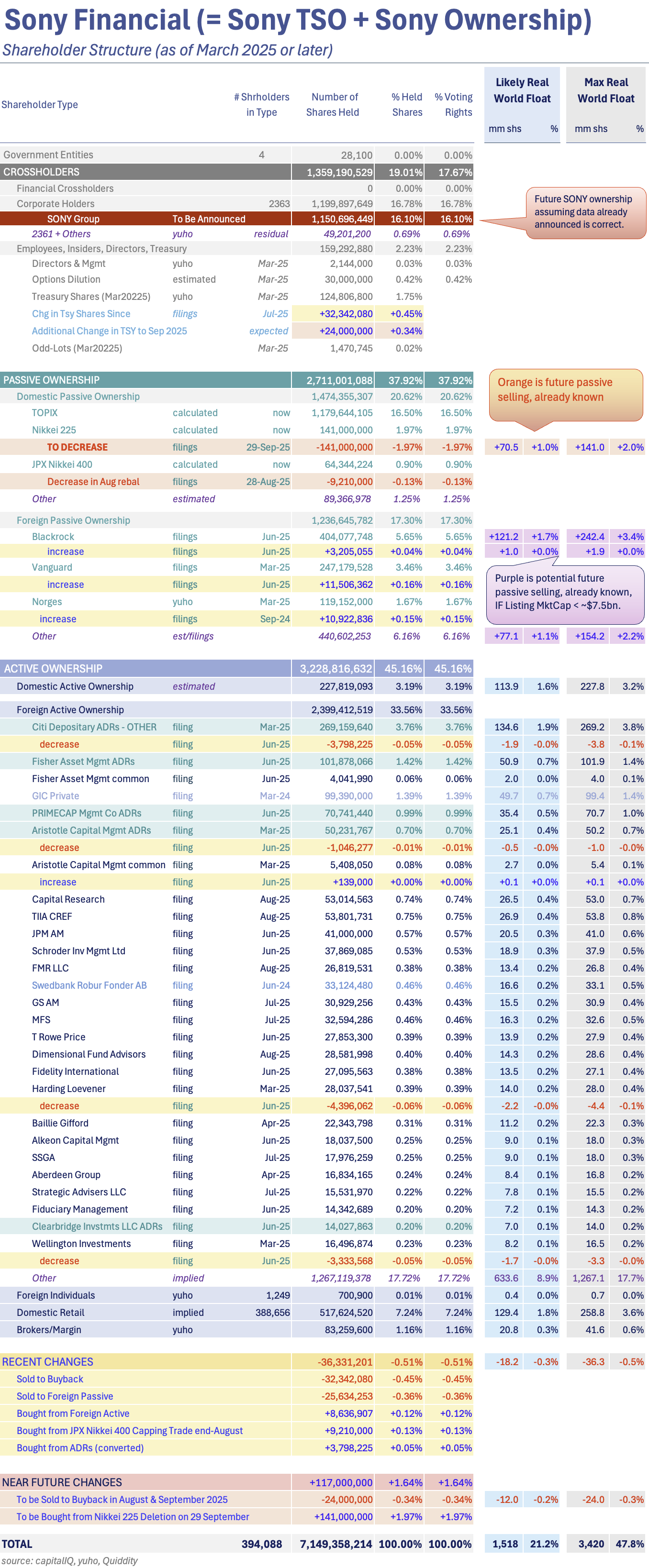

1. [Japan Event] Sony Financial Spin-Off Trades Monday – Fina(Ncia)L Thoughts

- Today is the last day of trading for Sony Corp (6758 JP) with Sony Financial Group (8729 JP) spin-off rights. SFGI starts trading separately on Monday 29 Sep.

- The reference price is ¥150/share. It will likely stay in all major indices except Nikkei 225, and it likely needs low ¥160s to stay in M _ _ _.

- The estimated Div Yield is higher on SFGI than peers by a fair ways, and looks to grow, and there is a big buyback to come. I like it.

2. Shift (3697 JP) – Short-Selling into Nikkei 225 Inclusion = Crowded Register Dynamic = Squeezy

- Shift Inc (3697 JP) runs a software quality assurance testing business. 400% revenue growth in 5 years, but this year to Aug25 is “only” 17.5% according to Q3 results guidance.

- It was a “growth stock” for a long while, and large long-only growth investors flocked to the name. In the past several months many have exited.

- The stock will be included in the Nikkei 225 Average next Tuesday. The supply/demand dynamics here to there are interesting. Afterwards they may be more interesting.

3. [Japan M&A] Paramount Bed (7817 JP) Founding Family Takeout – Too Cheap, Deserves Activist Response

- In a fairly common pattern, the founding family (38% ownership) of Paramount Bed Holdings Co Lt (7817 JP) have launched an MBO.

- It is too cheap at 4.2x adjusted EV/EBITDA (one could argue it is 5.0x but they also have net receivables) for such a ubiquitous brand and growth.

- Soft99 Corp (4464 JP) may have been a one-off. Maybe not. People may look at this situation through that lens. It deserves that look.

4. [Japan M&A/Activism] Soft99 Board Comes Out Against Effissimo Bid 66% Above MBO Price

- Today after the close, the Soft99 Corp (4464 JP) Board of Directors came out AGAINST the Effissimo ¥4,100/share counterbid to the original ¥2,465/share MBO.

- “The Special Committee advised that the Tender Offer would not contribute to the enhancement of the Company Group’s corporate value, nor would it be fair to the Company’s general shareholders.”

- ¥2,465 is fair. ¥4,100 is not fair. Absolute hogwash. Unmitigated blatherskite. Pure trumpery. Codswallop, buncombe, taradiddle, balderdash, and nincompoopery too. I expound below.

5. HK Connect SOUTHBOUND Flows (To 19 Sep 2025); BIG Single Stock Trading Again, Feels Slightly Toppish

- Gross SOUTHBOUND volumes just over US$22+bn a day this past 5-day week. Biggest week in a while. Net Flows not following gross flows. Feels toppish into GW.

- The recommended name last week was Alibaba (9988 HK) was up 2.2% on the week but only +0.7% from Monday close to Friday.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

6. The BOJ Announces the Start of ETF/JREIT Selldowns – Basically a Nothing-Burger

- In Friday’s Monetary Policy Statement, the BOJ announced it would start selling down its holdings in ETFs and J-REITs at the pace of ¥620bn and ¥5.5bn/year, respectively. BIG NEWS!

- That is US$17mm of ETFs and US$150k of J-REITs per day. The BOJ suggests it is 0.05% of volume per day. That’s close. SMALL EFFECT.

- Given ¥15trln of buybacks and ¥5trln+ of dividend reinvestment + NISA account buys, plus ¥trlns of cross-holding selldowns/year, this is a total nothingburger, even if they up the pace.

7. Korea Semicon ETF Rebal October Play: 2 In, 2 Out Long-Short Setup

- MTD screening results with 5 trading days left point to 2 names going out and 2 names coming in: Gemvax and Wonik IPS replace Dongjin Semichem and Jusung Engineering.

- Unlike last April’s tariff-distorted +1.3% rebalance, this time we expect cleaner, more meaningful price action.

- No pre-positioning seen, so I’ll target ETF rebalance day (Oct 10) and maybe take an anticipatory position a day earlier.

8. Sony Spin-off (Sony Financial Group) Spin-off Deep Dive

- Sony Group Corporation (6758) is planning to spin off 80% of its stake in Sony Financial Group Inc. (8729) on September 29, 2025.

- Sony Financial Group Inc. is the financial services arm of Sony, comprised of three main businesses

- The spin-off will generate ~ ¥100BN in the current fiscal year and pay a ¥50BN annual dividend.

9. Merger Arb Mondays (22 Sep) – Technopro, Soft99, Mandom, Pacific Ind, Dongfeng, Shengjing, Smartpay

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Oneconnect Financial Technology (6638 HK), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), PointsBet Holdings (PBH AU), Mandom Corp (4917 JP), Humm Group (HUM AU), Fuji Oil Co Ltd (5017 JP).

10. Soft99 Corp (4464 JP): The Board Opposes Effissimo’s Hostile Offer and Hints the MBO Will Succeed

- The Soft99 Corp (4464 JP) Board has, unsurprisingly, opposed the Effissimo offer for several reasons. Notably, they do address the huge price disparity between the two offers.

- While most of the reasons to justify the opposition are weak, the Board unexpectedly notes that as of 24 September, the MBO retained acceptances to satisfy its minimum tendering condition.

- Despite the significant premium of the Effissimo offer, this development suggests that the current acceptances for the MBO are sticky, thereby increasing the likelihood that Effissimo’s offer will fail.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

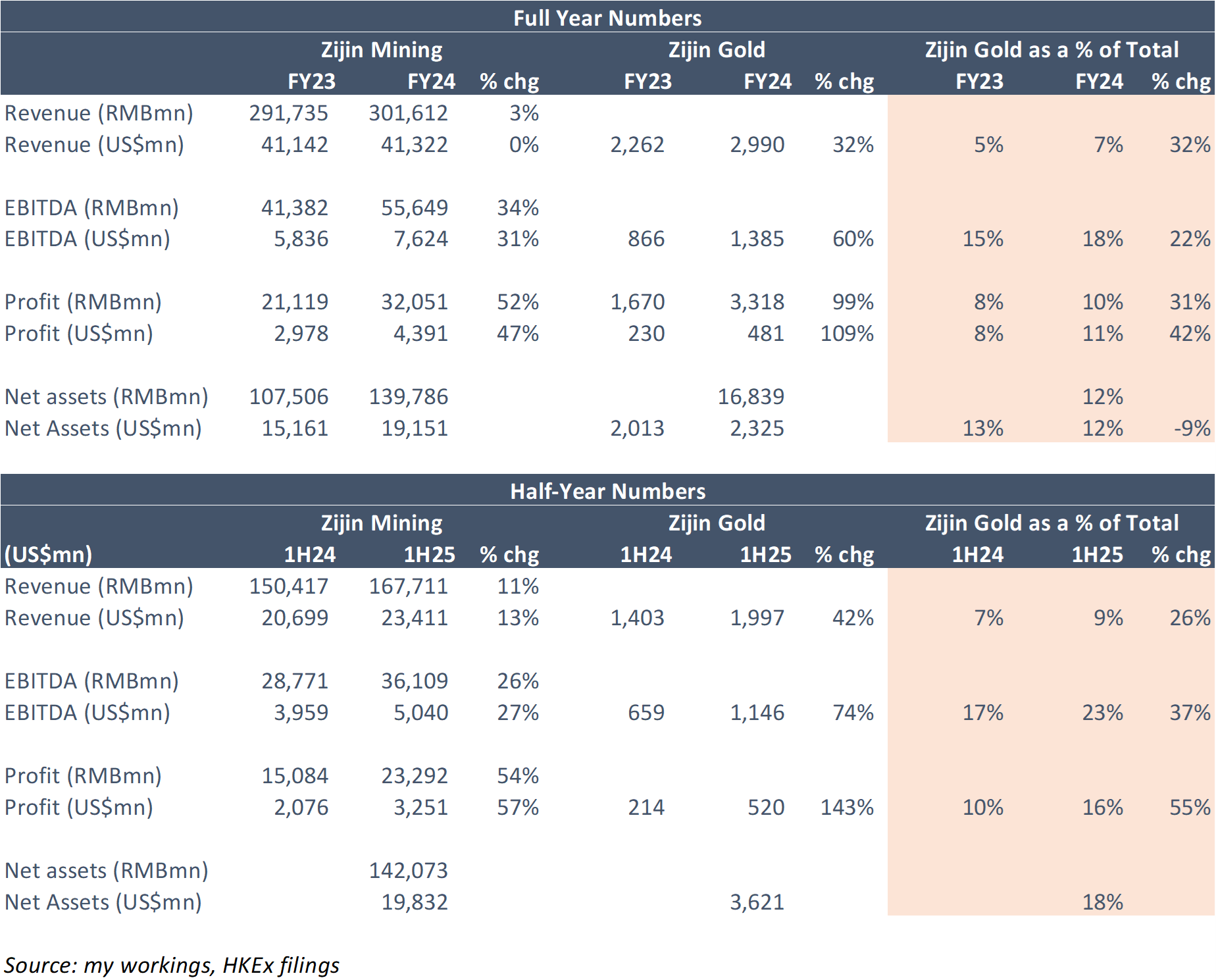

1. Zijin Mining (2899 HK): This Is A Short

- In my June note, Zijin Mining Group (2899 HK) appeared fully valued; but I (thankfully) stopped short of being outright bearish. Its share price is up 48% since!

- A basket of peers is also up 37% since that note. Gold is up~8%, and 41% YTD. On the 14th September, Zijin released Zijin Gold’s PHIP. 1H25 numbers were solid.

- However, Zijin Gold’s earnings are by no stretch an outlier. Zijin’s Mining’s current share price is now baking in exceptional (unrealistic?) metrics for the gold play spin-off.

2. Zijin Gold (2259 HK) IPO: HSCI Fast Entry; Quick Stock Connect Add; Global Indices Entry in 2026

- Zijin Gold (2259 HK) is looking to raise up to HK$28.7bn (US$3.7bn) in its IPO, valuing the company at HK$191.6bn (US$24.6bn).

- Zijin Mining (2899 HK) will hold between 85-86.7% of Zijin Gold and that will limit the free float of the stock. Half the IPO has been allotted to cornerstones.

- Zijin Gold could be added to the HSCI via Fast Entry and to Stock Connect in October. Global index inclusion should take place in the first half of 2026.

3. [Japan M&A/Activism] SOFT99 MBO Sees Activist EffissimoOverbid by 66%! Will This Set New Precedent?

- In early August, the founder-family announced they would MBO the car care company Soft99 Corp (4464 JP). It was a very cheap MBO. Even 20% higher it would be cheap.

- On Saturday, Kyodo, followed by various other media outlets, announced activist Effissimo Capital Management had announced a TOB to buy the company saying the MBO was “an extremely low level.”

- The Nikkei-reported goal would be “to protect the interests of minority shareholders while ensuring medium- to long-term increases in corporate value.” This is REALLY BIG NEWS.

4. Chery Auto (9973 HK) IPO: No Inclusion in Global Indices; HSTECH Is Interesting

- Chery Automobile Co. Ltd. (9973 HK)‘s IPO range is HK$27.75-HK$30.75/share and will raise up to HK$10bn (US$1.3m) if the oversubscription option is exercised, valuing the company at HK$169bn (US$21.7bn).

- The stock should be added to the HSCI Index in December and that will make the stock eligible for inclusion in Southbound Stock Connect.

- There will be no inclusion in global indexes for the next year, but there is a possibility of inclusion in the Hang Seng TECH Index (HSTECH INDEX) in December.

5. Mori Hills REIT (3234) – Large Sponsor Buy in Market as % of Max Real World Float

- In the past 24 months, J-REIT sponsors have bought units in their REITs at sharp discounts to PNAV to raise PNAV and reduce overhang pressure.

- The goal is, basically transparently, to get PNAV to a level at which the REIT can buy more properties from the sponsor, who carries them at a much higher WACC.

- Mori Building has announced a 4.99% buy on Mori Hills REIT Investment Corporation (3234 JP) which is a Very Big portion of Max Real World Float. This should influence price.

6. HK Connect SOUTHBOUND Flows (To 12 Sep 2025); HUGE Single Stock Trading, ETFs Meh. Tech Bought Bigly

- Gross SOUTHBOUND volumes just under US$20+bn a day this past 5-day week. BIG Net buying. Big BABA trading.

- SOUTHBOUND investors traded US$9bn of Alibaba (9988 HK) in the week. Not shy. It was a big net buy as well (4 of 5 days was +US$500mm or more).

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

7. Soft99 Corp (4464 JP): Effissimo Sheds More Light on Its Hostile Offer

- Effissimo has formally launched its hostile tender offer for Soft99 Corp (4464 JP) at JPY4,100, which is 66.3% higher than the MBO price of JPY2,465.

- The Board stonewalled Effissimo’s attempts to negotiate a friendly offer. The huge premium of Effissimo’s offer relies on lower WACC assumptions compared to the target/special committee IFA.

- Management’s initial approach will be to rely on the Board to oppose the Effissimo offer. There is a good chance that Soft99 will remain listed with two large shareholders.

8. [Japan M&A/Activism] The Nagging Little Detail In the Soft99 MBO Extension Target Doc

- Yesterday, Soft99 Corp (4464 JP) announced a slight change in its “Target Opinion Document” after the MBO Bidco extended its TOB by 8 days the day before.

- The detail was not in the MBO Bidco extension. It was just revealed in an added note on p3 of the Target Opinion.

- That details matters A LOT to people looking at the Effissimo Overbid. The company’s Board has some serious work ahead.

9. Flagging a New Passive Flow Trading Opportunity Triggered by Korea’s Divvy Policy Momentum

- PLUS High Dividend ETF (161510 KS) reshuffle is now a key flow catalyst: June saw GS E&C and HD Hyundai out, Hyundai Motor in, with sharp one-day moves.

- December review shaping up as 2-in/2-out: Seoul Guarantee (031210) and LG Corp (003550) in, Shinhan (055550) and KB (105560) out.

- Passive flows: Shinhan/KB ~0.3–0.4x DTV, LG ~3x, Seoul Guarantee 5–6x. With AUM up 30% since June, upcoming adds face outsized passive impact.

10. Zijin Mining (2899 HK): Zijin Gold Priced At US$24bn

- The global offering doc for Zijin Gold (2259 HK) is out.

- At the IPO Price of HK$71.59/share, Zijin Gold’s implied market cap is HK$187.9bn or US$24bn. Commencement of trading is the 29th September.

- Zijin Mining (2899 HK) will hold 86.7% in Zijin Gold post-IPO (before over-allotment). Even if Zijin Gold trades north of HK$100/share, Zijin Mining is fully valued.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

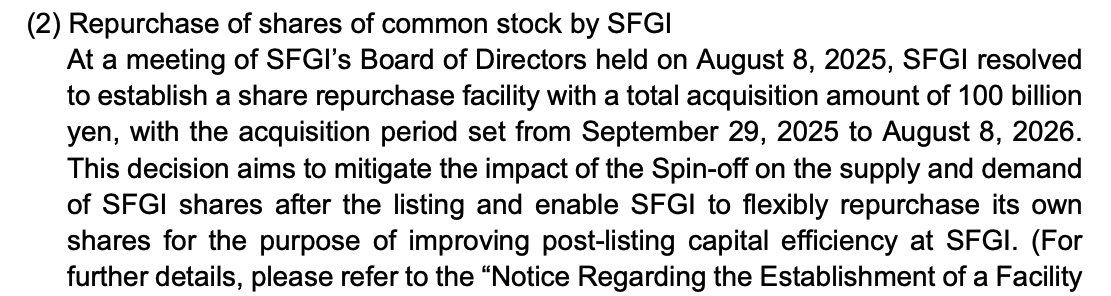

1. [Japan Event/Buyback] The Sony Financial Spinoff – ‘Maybe’ BUYBACK Complicates Planning

- The Sony Financial Holdings (8729 JP) (now called Sony Financial Group Inc (“SFGI”)) spinoff approaches. It will start trading 20 days from now.

- Yesterday, the TSE confirmed approval (outline, Securities Report (J), Corporate Governance Report (J). The company provided details of a possible ToSTNeT-3 buyback on Day 2 pre-open. That complicates things.

- The introduction of that type of buyback flexibility indicates that supply overhang may be managed better than buyers would hope. Means other strategies may be necessary.

2. [Japan M&A] Mandom (4917 JP) MBO – Light Price, Open-Ish Register, Tough to Take Over, Could Do Fun

- On 10 September, the founding Nishimura family, the PE Firm CVC, and Mandom Corp (4917 JP) agreed that the first two could take over the latter at 4.9x Mar28 EBITDA.

- A cocktail napkin calculation of expected leverage suggests the equity check is buying this at 5x average Mar27-28 free cash flow. That’s cheap for a growing company.

- The register is open enough to cause problems but not open enough to allow a clean hostile bid by a strategic. But still open enough for someone to have fun.

3. Dongfeng (489 HK): Questioning The EV Listing Valuation

- Back on the 22nd August, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- The share price closed up 54% on the first day, ~15% adrift of the independently valued cash + scrip (into VOYAH) under the privatisation.

- Shares have pared back 5% since. VOYAH’s peer basket has fallen ~15% on average. The market is implying a price-to-trailing-sales of 1x for VOYAH versus the basket average of 1.9x.

4. Merger Arb Mondays (08 Sep) – Kangji, OneConnect, Ashimori, Pacific Ind, RPM, Santos, Zeekr

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), Toyota Industries (6201 JP).

5. Mandom (4917 JP): A Light CVC-Sponsored Preconditional MBO

- Mandom Corp (4917 JP) has recommended a CVC-sponsored preconditional MBO at JPY1,960, a 32.1% premium to the last close price.

- The offer is below the midpoint of the IFA DCF valuation range and the special committee’s requested price. It is unattractive compared to precedent transactions and peer multiples.

- The offer is unequivocally light. The setup has the potential for a bump, particularly if an activist emerges as a substantial shareholder.

6. Regarding the Six KRX Sector Names that Ran Ahead of Friday’s Official Review Drop

- Six names stood out with simultaneous volume spikes and sharp pops last Friday; all Semis and Autos additions with big passive impact, while all others showed no tape action.

- Results likely leaked early, prompting front-running on Semis and Autos adds—high passive impact names—causing Friday’s sharp volume and price spikes.

- Early movers are mostly priced in; Thursday momentum plays still work, but Monday–Thursday morning requires caution. Focus on volume-driven flows before loading positions, long-short basket viable for other passive-impact names.

7. [Japan M&A] Pacific Industrial (7250) The MBO Is Extended After Effissimo Buys Above Terms

- Activist-Ish-Y investor Effissimo reported Friday they had a 6.68% stake as of the end of August.

- Their average price is ¥2,253 which is 10% through the price the family Bidco was bidding (¥2,050).

- As this hasn’t traded below terms at any point since announcement, an extension was likely. This morning, we got one. We’ll get another one before it’s done, BUT…

8. Timing the HHI–Mipo Spread Play Around the Passive Inflow Kick

- HHI–Mipo spread holds 3–4%; cancellation risk minimal. Market views HHI as the cleaner MASGA play vs. Mipo, keeping the spread sticky and unlikely to tighten soon.

- Potential kicker for widening comes from passive inflows when Mipo halts, as HHI gains weight in Global Standard vs. Mipo’s Small Cap.

- HHI may see ~4x DTV passive inflow as it absorbs Mipo; pre-announcement flows could start late October, potentially widening the swap spread ahead of the Nov 27 halt.

9. PointsBet (PBH AU) And Mixi Double Down Ahead Of Offer Closing

- On the 29th August, Mixi (2121 JP) cleared 50% of the voting power in PointsBet (PBH AU). It’s Offer was automatically extended, and will now close on the 12th September.

- Mixi has 51.59%. betr Entertainment (BBT AU) said it holds 20.45%, plus 6.5% in the IAF, the instructions for which can be withdrawn. betr said it won’t accept Mixi’s Offer.

- Mixi adds betr will have no PBH board representation “either now or in the future”; and betr will continue to be a clear competitor. Additionally, PBH questions betr’s buyback funding,

10. StubWorld: The Murdoch Succession Into News Corp, Fox & REA

- After a protracted succession stoush, Rupert Murdoch’s son Lachlan is set to take control of News Corp (NWS US) and Fox (FOXA US).

- Preceding my comments on News Corp and 62%-held REA Group Ltd (REA AU) are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

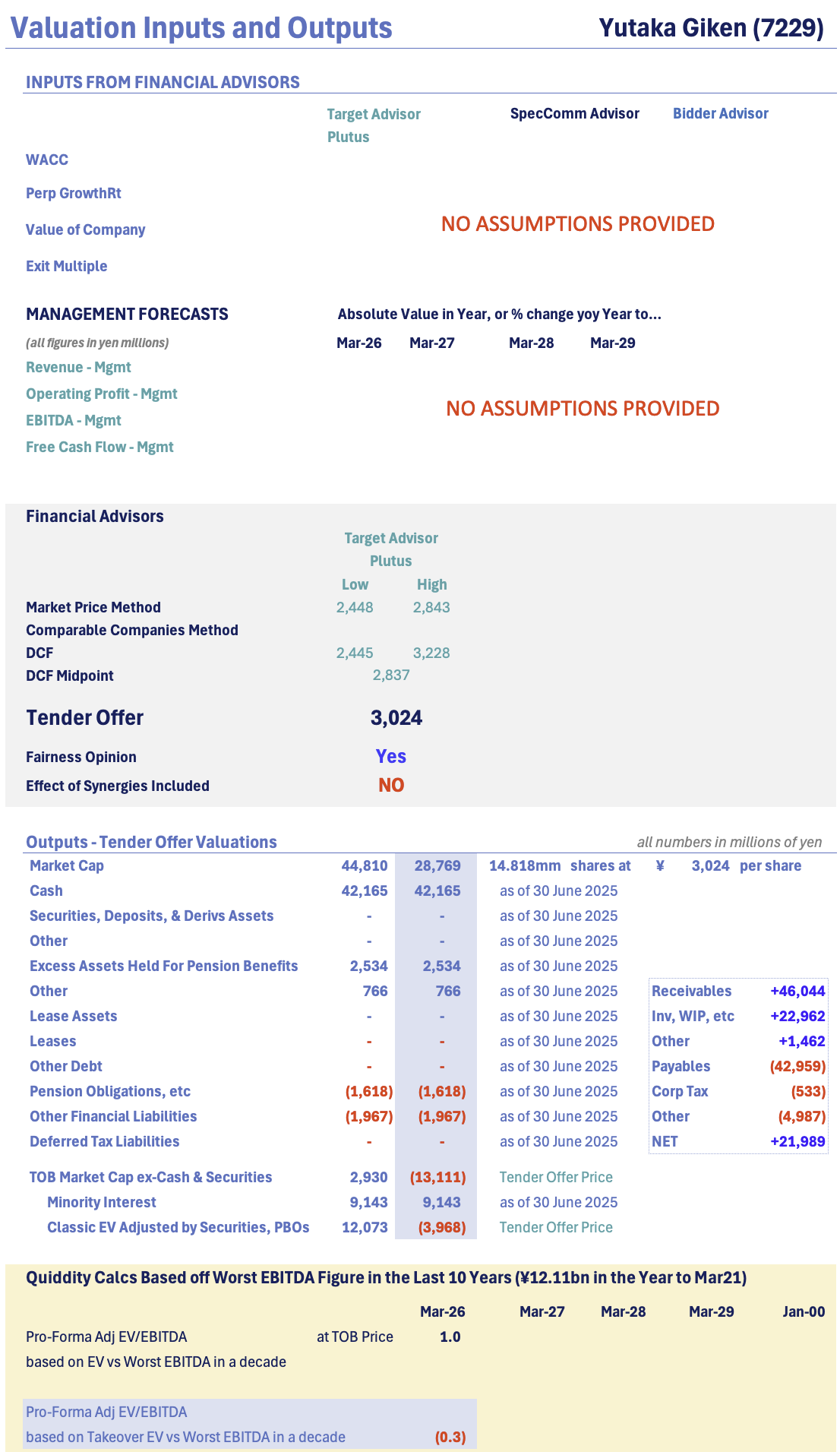

1. [Japan M&A] Yutaka Giken (7229 JP) TOB – Possibly the Most Offensively Low TOB Price I’ve Ever Seen

- Honda Motor (7267 JP) and Samvardhana Motherson International Ltd (MOTHERSO IN) have arranged to buy Honda’s 69.7%-owned subsidiary Yutaka Giken (7229 JP) in a Tender Offer.

- The transaction structure means Motherson buys Yutaka for less than net cash but even assuming Motherson pay minority TOB price for everything, TOB ex-net cash = 0.05x PBR, <1x EBITDA.

- But they are paying less. They are paying ¥12.4bn less than net cash, and getting the other ¥58bn of net assets (¥23bn inventory, the rest in hard assets) for free.

2. Holdco NAV Discount Compression Play on Korea’s Next Policy Narrative: Mandatory Tender Offers

- Korean equities are stalled; macro catalysts are absent. Street focus shifts from treasury share cancellations to next year’s mandatory tender offers, now seen as the top policy driver.

- Pre-MTO trades focus on holding companies with wide NAV discounts or low controlling stakes, front-running policy-driven re-ratings before minority shareholders capture control premiums.

- Focus on 32 Korean holding companies >KRW 500B; those with wide NAV discounts and lighter controlling stakes—SK’s holding companies, Samsung C&T, Hanwha, LG, LS—are prime re-rating plays.

3. ZEEKR (ZK US): Widening Scrip Spread Ahead Of Geely EGM Vote

- On the 15th July, Geely Auto (175 HK), China’s second-largest carmaker, firmed a cash or scrip Offer for 62.8%-held ZEEKR (ZK US), a premium Chinese electric vehicle manufacturer

- ZEEKR has traded through the cash terms US$26.87/ADS from the onset; but at a discount to the scrip terms. The scrip spread has widened recently.

- The Offer is low-balled. However, Geely’s stake plus Li Shufu (founder)’s 10.61% holdings push the Offer through. Geely’s EGM is this Friday (7th July). Li (41.34%) is required to abstain.

4. Merger Arb Mondays (01 Sep) – Dongfeng, ENN, Joy City, Kangji, Mayne, Santos, Shibaura, CareNet

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ashimori Industry (3526 JP), Carenet Inc (2150 JP), Ainsworth Game Technology (AGI AU).

5. HKBN (1310 HK): Mobile’s Offer Is Done. Now For The Back End

- China Mobile (941 HK)‘s Offer for HKBN Ltd (1310 HK) will be declared unconditional tomorrow (3rd September), the first closing date.

- As I type, 19.03% of shares out have tendered, lifting Mobile’s stake to 48.9%. Additional shares will tip in today and tomorrow, as per your typical last minute flurry.

- It is not Mobile’s intention to delist HKBN. There will be investors playing the backend on the expectation of a higher Offer down the track.

6. HKBN (1310 HK): On the Cusp of Being Declared Unconditional

- HKBN Ltd (1310 HK)’s offer from China Mobile (941 HK) is HK$5.075 with a 50% minimum acceptance condition. The first closing date is September 3.

- Based on CCASS data, including acceptances, China Mobile’s shareholding was 48.93% of outstanding shares as of September 1.

- Therefore, the offer should be declared unconditional by the first closing date. At the last close and for a September 12 payment, the gross/annualised spread is 0.5%/15.7%.

7. Pacific Industrial (7250 JP): Effissimo Rears Its Head

- Effissimo reported a 5.87% ownership ratio in Pacific Industrial (7250 JP). The average buy-in price of JPY2,235.91 per share is 9.1% above the JPY2,050 MBO offer.

- Effissimo buying significantly above terms is justifiable as the offer implied a P/B of 0.71x. Effissimo is agitating for either a bump or an opportunity to participate in the back-end.

- With the offer closing on 8 September and shares trading 16.9% above terms, the Ogawas have little choice but to revise terms.

8. Alipay: Issuing EB Worth 627 Billion Won Backed By Its Shares in Kakao Pay [A Quasi Block Deal Sale]

- Alipay (second largest shareholder of Kakaopay (377300 KS)) is issuing an overseas exchangeable bonds (EB) worth 627 billion won (backed by its shares in Kakao Pay).

- The exchange price of the EB is 54,744 won (4.5% discount to current price). Total amount of EB issue is 627 billion won ($450 million).

- This deal is basically a quasi-block deal. Alipay is trying to unload some of its stake in Kakao Pay to improve its finances.

9. Ashimori Industry (3526 JP): Murakami Outlines His Case

- Takateru Murakami, Yoshiaki Murakami’s son, has increased his Ashimori Industry (3526 JP) to an 18.36% ownership ratio at an average buy-in price of JPY4,154.28 vs. the JPY4,140 tender offer.

- Crucially, in today’s disclosure, Takateru Murakami outlines the rationale for his stake building, which centres on the book value being materially understated if certain land were revalued at market rates.

- Maintaining current terms is increasingly not a viable option. Toyoda Gosei (7282 JP) is likely to pursue a strategy of either increasing its offer or lowering the minimum acceptance condition.

10. Curator’s Cut: Arbs Go A-H, Copper Plays & China’s Property Pulse

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ Insights published over the past two weeks on Smartkarma

- In this cut, we explore A-H share trading dynamics, consider copper market dynamics and plays, and China’s bottoming/stabilizing real estate market

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Dongfeng (489 HK)’s Privatisation And EV Backdoor Listing

- Dongfeng Motor (489 HK) has announced a privatisation; together with a concurrent listing of its EV arm.

- The same day as the dual proposals, Dongfeng announced an interim loss (1H25). Evidently, the way forward – from an investor standpoint – is electric, not internal combustion engines.

- The cash terms + scrip (into the EV listing) under the proposals are attractive. Even after this morning’s move (+53.6%) in Dongfeng’s share price.

2. Merger Arb Mondays (25 Aug) – Dongfeng, ENN Energy, Shibaura, Santos, Lynch, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Dongfeng Motor (489 HK), Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Santos Ltd (STO AU), Shibaura Electronics (6957 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), PointsBet Holdings (PBH AU).

3. [Japan M&A] YAGEO Says It Expects FDI Clearance on Shibaura – Minebea Likely To Fold

- Last weekend then post-close Monday, Yageo Corporation (2327 TT) raised its TOB Price for Shibaura Electronics (6957 JP) to ¥7,130 – a full 15% through Minebea’s proposed ¥6,200/share terms.

- Minebea was playing chicken with the result, closing its tender on 28 August, before Japan’s Foreign Direct Investment approval (FEFTA approval) was cleared, expected 1 Sep or later.

- Today post-close, YAGEO announced it had concluded discussions with METI, would make all required regulatory submissions today, and expects to obtain approval “no later than 10 September”

4. PointsBet (PBH AU): Betr’s Dyslexic Bump. Mixi’s Now Holding 42.38%

- Betr Entertainment (BBT AU) has bumped scrip terms to 4.375 betr shares per PointsBet Holdings (PBH AU) share, equivalent to A$1.31/share, based on betr’s last traded price.

- True to form with betr, there’s a typo in its latest announcement stating a 4.735 ratio. betr just issued a Bidder’s Statement with the correct info.

- Apologies: in my last note I mentioned Mixi Inc (2121 JP) had bumped to A$1.30/share. However, that was predicated on Mixi securing 90%, which won’t happen if betr doesn’t tender.

5. A Merger Between HD Hyundai Heavy Industries and HD Hyundai Mipo

- It was announced today that HD Hyundai Heavy Industries will merge with HD Hyundai Mipo. The merger ratio between HD Hyundai Heavy Industries and HD Hyundai Mipo is 1:0.4059146.

- HD Korea Shipbuilding & Offshore Engineering (009540 KS) will own a 66.29% stake in the merged entity.

- HD KSOE is proceeding with this merger of its two major subsidiaries ahead of the full-scale launch of the MASGA (“Make America Shipbuilding Great Again”) project.

6. Near-Term Flows to Watch on Mandatory Treasury Share Cancellation in Korea

- Dems likely to push 3rd package in Q4; near-term flows chasing treasury stock cancellation theme, with locals screening >₩1tn mkt cap, >10% treasury shares of float.

- Little pushback on mandatory treasury cancellations; debate focused on timeline — grace period vs. immediate rollout — highlighting how much leeway government may grant differing governance structures.

- Too early for governance plays; near-term momentum flows likely in names with highest treasury stock relative to float, where cancellation is expected to hit flows hardest.

7. [Japan M&A] CareNet (2150 JP) – Opaque LBO/MBO Garners New Attention from Existing Shareholder

- When EQT launched its deal for Carenet Inc (2150 JP) two weeks ago, I thought it opaque, and light, and strangely lacking in information which should be there.

- It has not gotten clearer, though three days ago, the largest foreign shareholder as of the announcement reported they had lowered their position by 3.77% (4.22% of votes).

- Then yesterday, someone else reported they had gone above 5%. The data implied in that filing suggests this may have legs. I’d buy through terms.

8. ENN Energy (2688 HK): Chipping Away at the Precondition

- ENN Natural Gas (600803 CH) has made steady progress in satisfying the precondition for its ENN Energy (2688 HK) offer. On 22 August, NDRC approval was obtained.

- The appraised offer HK$80.00 value is the key debating point. Based on several methodologies, I estimate a realistic offer value of HK$74.44 (range of HK$67.84 to HK$83.64).

- The protest votes for director re-elections at the 23 May AGM are a risk. On balance, the scheme vote should pass as the offer is reasonable and strategically sensible.

9. HHI–Mipo Merger Swap: Deal Mechanics & Spread Play Opportunities

- HHI–Mipo merger spread looks minimal, but today’s MASGA-driven pop signals momentum flows—likely to mean-revert toward appraisal rights once the theme dissipates.

- Froth lifted prices past fundamentals—once it unwinds, HHI–Mipo could diverge from swap ratio, creating the spread window where traders can get paid.

- This isn’t classic merger arb—it’s about fading a policy-fueled pop, riding the snapback toward appraisal baseline, with flow-driven swings creating short-term tactical arb setups.

10. Shibaura Electronics (6957 JP): Method in the Madness as Yageo Bumps Twice in Two Days

- On 21 August, Yageo Corporation (2327 TT) increased its Shibaura Electronics (6957 JP) offer by 7.0% to JPY6,635. On 23 August, Yageo further increased its offer by 7.5% to JPY7,130.

- The offer is partially in reaction to Minebea’s recent comments around Yageo securing FEFTA approval. Crucially, Yageo finally provided an update suggesting that only a few issues remained.

- Yageo’s JPY7,130 offer is not over-the-top, as Minebea’s 10x EV/EBIT pricing guideline outlined on 18 August potentially justified a JPY7,300 offer. The likelihood of Minebea walking has increased.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. FEFTA Classification Changes Summer 2025

- The Ministry of Finance has published an updated “FEFTA List” of classifications of listed companies as of July 15, 2025.

- 50 names lowered their ranks from the most “core” Type 3 to Type 2(20), or Type 1(30). 104 names raised from Type 1(51) or Type 2(53) to Type 3.

- Smartkarma readers may want to peruse the lists and details to see if they think companies are trying to protect themselves (from threats as yet not known by the public).

2. Merger Arb Mondays (18 Aug) – Santos, Shibaura, ENN Energy, Kangji, OneConnect, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Santos Ltd (STO AU), Joy City Property (207 HK), Oneconnect Financial Technology (6638 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Shibaura Electronics (6957 JP), Ci Medical (3540 JP), Soft99 Corp (4464 JP), Ainsworth Game Technology (AGI AU).

3. Smart Share Global (EM US): Hillhouse Crashes The Party. And Rightfully So

- Nearly seven months after receiving a preliminary non-binding proposal, Smart Share Global (EM US) announced on the 1st August a firm Offer had been entered into.

- The Offeror consortium, led by Mars Guangyuan Cai, Chairman and CEO, made an Offer of US$1.25/ADS, a 74.8% premium to last close; but ~20% below net cash + short-term investments.

- Now Hillhouse has thrown its hat into the ring with a US$1.77/ADS NBIO. Smart Share’s special committee of independent directors should engage.

4. Today’s HMM Tender Follow-Up Disclosure and Hedge Ratio Setup

- KOBC’s core mission hinges on HMM; without it, no real mandate. Structural incentive to hold remains, so its active tender participation is still questionable.

- Still, max proration risk seems base case, with weak Q2, soft Q3 freight outlook, and post-tender skew pointing bearish for HMM.

- Spread >10% makes this too good to pass, but should also watch policy risk — better to lock futures hedge early as flows show players scrambling for cover.

5. HMM Tender Side Play: Targeting a Basis Squeeze Ahead of Sep Expiry

- Most traders are starting in September, rolling into October. Sep/Oct spread volume has picked up unusually fast, clearly reflecting hedge demand linked to the tender

- As September expiry approaches, basis-squeeze risk rises, likely pushing September cheap and October expensive, widening the spread — creating a clear side trade opportunity.

- With a basis squeeze expected near September expiry, we could enter a Sep/Oct spread (short Sep, long Oct) and also watch for spot-futures decoupling to play the cash-futures spread.

6. Hanon Systems Announces a Major Potential Rights Offering

- On 14 August, Hanon Systems (018880 KS) announced a potential rights offering capital raise. The exact amount will be finalized at the EGM next month.

- The significant size of the rights offering is expected to burden its largest shareholder Hankook Tire & Technology (161390 KS) which owns a 54.8% stake in Hanon Systems.

- We believe the potential rights offering is likely to continue to negatively impact Hanon Systems by diluting its existing shareholders.

7. Krungthai Card (KTC TB): Still A Buy As Pledged Shares Further Decline

- Back in May this year, shares in Krungthai Card (KTC TB), XSpring (XPG TB), BEC World Public (BEC TB), and The Practical Solution (TPS TB) all went limit down. Twice.

- This situation was discussed in Krungthai Card (KTC TB): Buying Opportunity After Margin Call. Reportedly Mongkol Prakitchaiwattana had pledged his shares in all four companies, leading to margin calls.

- On the 16th August, the SET released an updated list of securities pledged, with pledged shares in KTC now at 2.3% of shares outstanding, down from 16.3% in May.

8. Curator’s Cut: Singapore Unlocks Value, India’s Jewellery Caution & Taiwan’s Top ETF’s Rebalance

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ Insights published over the past two weeks on Smartkarma

- In this cut, we review value-unlocking moves by Singapore-listed companies, take stock of India’s jewellery retail market, and track how Taiwan’s largest ETF drives flows for its adds and deletes

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

9. [Japan M&A] Minebea Forces a Game of Regulatory Chicken on Shibaura (6957 JP)

- Minebea Mitsumi (6479 JP) has bid ¥6,200/share for Shibaura Electronics (6957 JP). The tender ends 28 August. YAGEO has over bid now to ¥6,635/share.

- YAGEO’s regulatory clearance decision may not arrive before 1 September, after the Minebea tender closes. Minebea now says they will neither bump nor extend.

- Minebea is hoping people will throw in the towel and tender because if their tender ends and Yageo’s fails, it might a long way down. There are possibilities but… scary.

10. US Government May Acquire Equity Stakes in Samsung Electronics and TSMC

- According to Reuters, the US government may be interested in acquiring equity stakes in Samsung Electronics and TSMC in exchange for CHIPS and Science Act grants.

- The US government is exploring ways to take equity stakes in these two Asian tech giants that have been expanding their semiconductor facilities in the United States.

- If the US government decides to invest $10 billion each in Samsung Electronics and TSMC, they would represent about 3% and 1% of Samsung Electronics and TSMC’s market caps, respectively.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Sun Corp (6736) – CLBT Has Round-Tripped, But Now Better ParentCo and a Buyback so Set-Up Is Better

- 12 months on from the Tender Offer which changed the shape of the shareholder register, Sun Corp (6736 JP) is up small and its main asset Cellebrite is -10%.

- The value of the rest of Sun Corp has probably increased to cover that 10% through new business earnings, but the main value is still Cellebrite. An exit still awaited.

- Now Cellebrite is lower, and SunCorp is lower (but recently rising) and SunCorp has announced a buyback which accounts for a big chunk of Real World Float. Hmmm…

2. [Japan M&A] Taisei Corp To Take Toyo Construction (1890 JP) Private – Governance Torture Ends

- In March 2022, Infroneer bid ¥770. The Board said “too low” but then accepted. A month later, YFO offered ¥1,000. Too high, bad owner, not accepted.

- Summer 2023 after a year of palm to the face for YFO, the Board was partly spilled. YFO bid ¥1,255/share and the Board said the premium was too low.

- Now, the Board has accepted a bid from Taisei at a roughly similar premium. But the price is ¥1,750/share. Infroneer and YFO have agreed to sell. Minorities win… -ish

3. Kangji Medical (9997 HK): Consortium’s Light Preconditional Scheme Offer

- Hangzhou Kangji Medical Instrument Co., Ltd. (9997 HK) disclosed a preconditional privatisation from a consortium at HK$9.25, a 9.9% premium to last close and a 21.7% premium to the undisturbed price.

- The precondition relates to SAMR approval. The key condition will be approval by at least 75% disinterested shareholders (<10% of all disinterested shareholders’ rejection). The offer is final.

- The scheme vote risk is medium-to-high due to an unattractive offer, a blocking stake below the substantial disclosure threshold, unfavourable AGM voting patterns, and emerging retail opposition.

4. Identifying the SK Square Vs. Hynix Price Ratio Reversion Alpha Setup

- Hunting the reversion point for Square-Hynix price ratio amid local buzz: need clear pro-business tax signals and Hynix’s downtrend to continue despite today’s bounce.

- Tax tweak likely turns neutral despite gov’s cautious tone today. Hynix’s bounce faces headwinds from supply ramp and yield issues, so fresh rally odds remain slim.

- Focus on hunting SK Square vs. Hynix price ratio reversion, pairing it with Samsung Long/Hynix Short for a strong short-term trade setup to ride the trend.

5. [Japan M&A] Minebea Matches YAGEO for Shibaura Elec (6957) At ¥6,200. Presses on Early Cashout

- After three months of NOT matching YAGEO’s bid for Shibaura Electronics (6957 JP) at ¥6,w00 as YAGEO’s proposal continues its long plod through FEFTA review, Minebea-Mitsumi has now matched ¥6,200.

- Key is that their bid closes before the indicative deadline for YAGEO to receive word on FEFTA approval. They are hoping this bid mollifies the irrevocables and everyone else.

- But if YAGEO cares, it could bump to ¥6,300 tomorrow and extend its tender offer which closes on Monday. But the put option is now struck higher, which de-risks this.

6. Why We’re Eyeing KRX’s Sep 29 KCMC Event for Dividend Momentum Trades

- KCMC 2025 will likely reveal fresh, unpriced stimulus details, potentially sparking a price rally like last year’s 2% KOSPI 200 jump on the value-up ETF rollout.

- The key wildcard at KCMC 2025 is dividends—shifting from Yoon’s Japan-style ROE grind to a Taiwan-style push for bigger shareholder payouts.

- With Sept 29 approaching, dividend policy buzz may drive price moves—smart to prep dividend momentum trades to front-run this catalyst.

7. Current Samsung Biologics Split Dynamics with Alpha Potential Both Ways

- One of the hottest local plays is gauging KRX and FSS leanings on Biologics split, which could drive short-term alpha across the three Samsung names alongside battery and HBM flows.

- Short-Term focus is KRX pre-listing review and FSS registration window. Once approval and lock-up kick in, Biologics and Samsung Electronics could outperform Samsung C&T.

- From a risk-hedge angle, this is a long-short alpha setup: if the split fails, Samsung C&T likely takes the hit, offering alpha potential both ways.

8. Merger Arb Mondays (11 Aug) – Mayne, PointsBet, Infomedia, Ashimori, Toyo Const, HKBN, Joy City

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Ashimori Industry (3526 JP), ENN Energy (2688 HK), Ci Medical (3540 JP), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Ainsworth Game Technology (AGI AU), Welcia Holdings (3141 JP), ZEEKR (ZK US), Soft99 Corp (4464 JP).

9. [Japan M&A] Founder, KEPCO, Try ¥2,750 Bain-Led MBO on Rezil (176A). Light Given Growth – Bumpity?

- To my knowledge, this may be the first Tender Offer takeout proposal on a “new ticker.” Rezil (176A JP) was listed just 16mos ago.

- This takeout is done on a highish-growth stock at 11.7x 1yr forward EV/EBITDA. It’s not expensive, but they have ~60%. BUT… there’s another Potential Player who may have Big Thoughts.

- Slightly long-dated, small-cap, likely to be illiquid. Watch how it trades early for hints.

10. Value Unlock SG: Value Creation Via Corporate Action. May the Wind Carry Many More Sails

- A wave of corporate actions by SGX-listed companies has unlocked substantial shareholder value and re-rated select stocks in recent months. In this note, we spotlight five standout cases.

- Our top picks with the strongest catalysts for further upside after delivering significant shareholder returns over the past year are – Keppel Corp (KEP SP) and Yangzijiang Financial (YZJFH SP).

- The outsized value creation delivered by these companies should serve as a wake-up call for other managements to follow suit and initiate actions to boost returns and unlock shareholder value.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

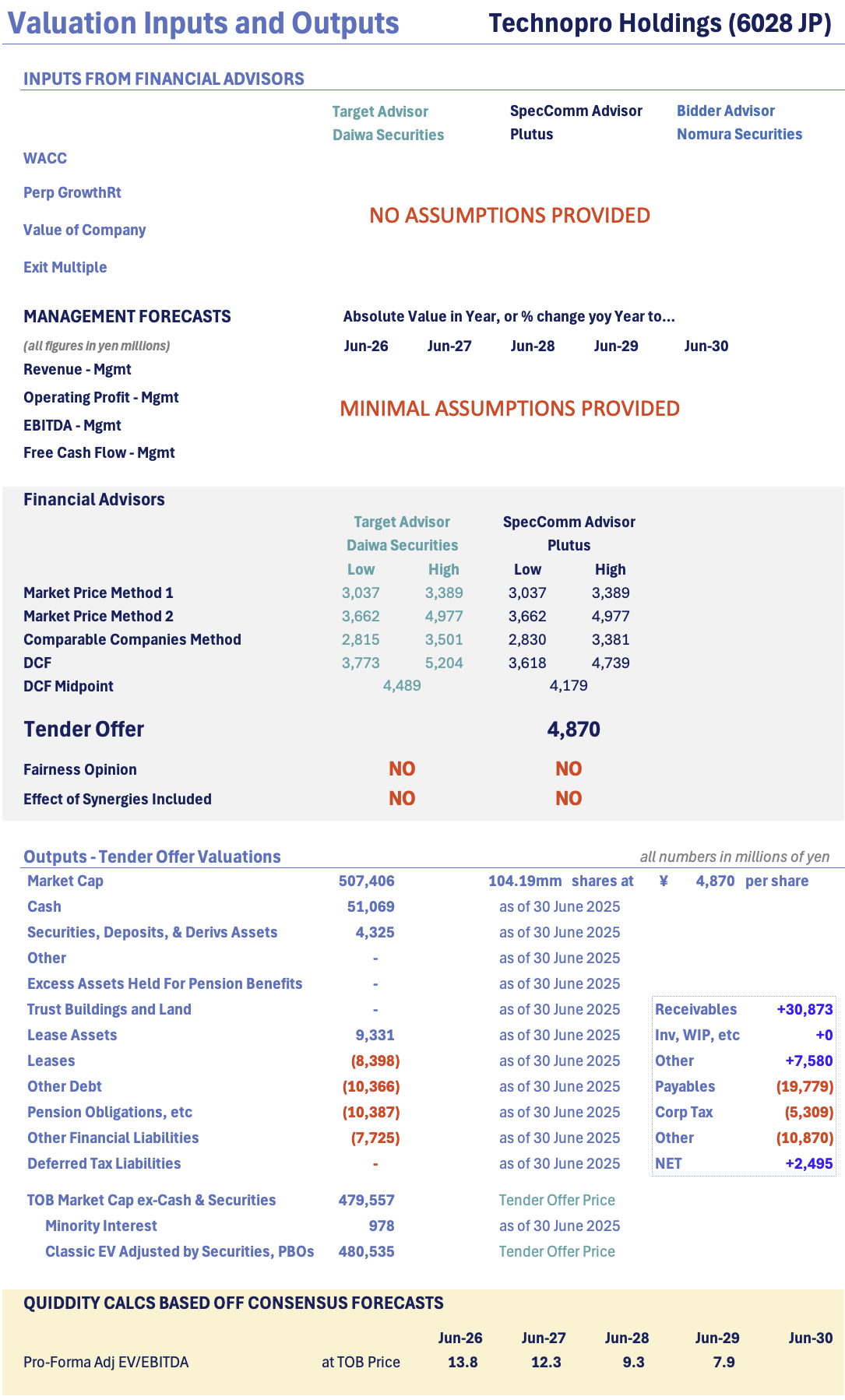

1. [Japan M&A] ¥4,870/Sh Blackstone TOB for Technopro (6028 JP) – Watch the Parameters and Modalities

- This was signaled in May, somewhat confirmed in July, now done. Blackstone buys Technopro at ¥4,870/share which is ~14x EV/EBITDA for next year.

- PE Firms have been scouring the Japanese market to buy companies. The METI Corporate Takeover Guidelines are super-helpful in that regard. This will squeeze the market over time.

- This takeover price is not quite as full as it could have been, and there are some parameters and modalities to this which are worth looking at. Parameters and Modalities.

2. [Japan M&A] Fujitec (6406) PE Bid Not Super High But May Be Tough To Beat

- On 30 July, Fujitec Co Ltd (6406 JP) and Swedish PE Firm EQT announced a deal to acquire the company with the Uchiyama family. Two activists signed tender agreements.

- The deal is not expensive IF you underwrite strong profitability growth and assume the large net receivables position can be better addressed.

- But the stock is trading tight to terms and there are 6+ months until you get your money.

3. [Japan M&A] 99Soft MBO at 52% Premium Is Too Light But A Bump May Be Tough

- Soft99 Corp (4464 JP) is the owner/operator of a set of ubiquitous brands in aftermarket autocare. Anything to do with washing, cleaning, etc.

- The company was founded 70 years ago, and the CEO is 54yrs old. Smells like succession planning.

- This deal is a nice premium, but it is too light. The operating assets with consistent growth and 20% OPMs are being sold at <0.9x book. That’s bad.

4. Merger Arb Mondays (04 Aug) – Santos, Joy City, HKBN, Krosaki Harima, Fujitec, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), ENN Energy (2688 HK), Krosaki Harima (5352 JP), Joy City Property (207 HK), Santos Ltd (STO AU), Smart Share Global (EM US).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), ZEEKR (ZK US), New World Resources (NWC AU), Ainsworth Game Technology (AGI AU), Nippon Concept (9386 JP).

5. [Japan M&A] Furukawa Battery (6937 JP) Take Private – Ugly Then, Ugly Still, But Now It’s On…

- 54 weeks ago Advantage Partners and Furukawa Electric announced a deal to take Furukawa Electric (5801 JP) sub Furukawa Battery (6937 JP) private. The acquisition price was LOW.

- Minorities got more – more than book. But the deal included a payment delay allowing BVPS to rise 8.8% from the announcement date. No synergies.

- Furukawa Electric gets to buy back in at a price below book. And because there are cash and securities and lots of net receivables, the operating assets are well below.

6. [Japan M&A] Krosaki Harima (5352) Takeout by Parent Nippon Steel – Cheapish But Done

- On Friday 1 August, Nippon Steel Corporation (5401 JP) and subsidiary Krosaki Harima (5352 JP) announced the parent would buy out the sub at ¥4,200/share.

- This seems light given the structure of the balance sheet (lots of net receivables – a bunch against the buyer) but it would be awfully tough to see this broken.

- As it is a long-dated deal, I expect it trades too tight early on, then may flatten or fade.

7. [Japan M&A] Nikkei Says Blackstone to Buy TechnoPro Holdings (6028) For “Roughly ¥500bn”

- There was an article in mid-May saying Technopro Holdings (6028 JP) might be privatised. It is an appropriate candidate. The stock popped 20% immediately, and has since risen another 20%.

- Today’s article follows one which came out ~2 weeks ago with non-sourced editorial content suggesting the price might be 20x EBITDA (i.e. a lot higher).

- Today, an article says Blackstone will buy the firm for “Roughly ¥500bn” which would be 3% down from yesterday. Beware the Nikkei. Beware expectations.

8. A Hidden Trading Angle from Dividend Tax Reform: Tax Timing Creates Dividend Trap Risks

- With new tax rules kicking in from FY2026, firms may hold back FY2025 dividends to front-load later, creating potential downside surprise purely from tax-driven deferral, not fundamentals.

- If FY2025 payouts fall short, dividend names could go ex-div on inflated expectations, then trade heavy — setting up mispricing risk around year-end dividend capture trades.

- This may weaken post-ex-div price rebounds, creating dividend trap risks and short-term mispricing that traders can exploit via shorts, dip buys, or dividend swap long-short strategies.

9. A/H Premium Tracker (To 1 Aug 2025): HUGE SOUTHBOUND Buying Helps Beautiful Skew but Premia Up

- AH premia up, erasing the previous week’s gains for Hs. “Beautiful Skew” continues in negative overall performance.

- Last week I said “This is the most significant 60-day AH pair average H outperformance in five years, maybe ever. Remarkable.” This week it unwound some.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

10. Korea’s Next Policy Momentum Play: Rapid Unfolding of the National Growth Fund

- From a trading view, no confirmed new ETFs under the National Growth Fund yet; market expects existing ETFs to be the main liquidity and sector play tools instead.

- Out of the KRW 150tn, ETF flows likely come from the 100tn private pool—conservative case: ~3% (KRW 4.5tn), base case: 5–7%, aggressive: up to 10% (KRW 15tn).

- Even conservatively, about KRW 3 trillion could flow into sector ETFs, a signficant AUM boost, mainly concentrated in AI, defense, aerospace, and biotech—driving notable inflow impact.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

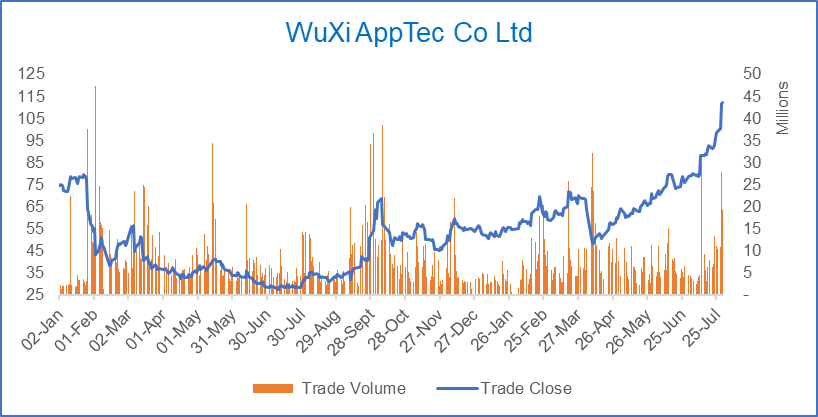

1. WuXi AppTec (2359 HK) Placement: Strong Momentum & Index Flows

- WuXi AppTec (2359 HK) is looking to raise US$650m at a price range of HK$104.16-106.4/share, a 5-7% discount from last close.

- There will be passive buying from global index trackers around the time of settlement of the placement shares. Then there will be some Hang Seng Index buying in August.

- Short interest in WuXi AppTec (2359 HK) has spiked and some shorts could cover into the placement. The AH premium could move higher following the placement.

2. GMO Internet (4784) – GMO Internet Parent Has Been SELLING In The Market

- I have harped on the fact that GMO Internet Group (9449 JP) has to sell GMO Internet (4784 JP) shares with the goal to get 35% tradable shares by end-2025.

- I have written about it here, here, here, and here. The price needs to be lower so the parent can launch a HUGE block. The stock must be less squeeze-able.

- It turns out the parent started selling in the market the day after the Offering was cancelled. The setup is delicious now.

3. NSDL (NSDL IN) IPO: Offering Details & Index Inclusion Timeline

- NSDL (NSDL IN) is looking to list on the exchanges by selling up to INR 40bn (US$464m) of stock at a valuation of up to INR 160bn (US$1.85bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in November.

- Central Depository Services (CDSL IN)‘s stock price has dropped following the announcement of NSDL‘s IPO price band and the muted results could lead to further downside in the stock.

4. Korean Policy Tailwinds: Preferred Shares Rerating Play

- Most expect prefs to be in policy crosshairs soon—watch for tighter rules on dividends, discounts, and liquidity, plus likely incentives for redemption or cancellation ahead of commons.

- If Korea rolls out a pref stock overhaul, long-biased rerate plays could pop—focus on liquid, high-yield large-cap prefs trading at 35%+, yield north of 3%, and solid daily turnover.

- Korea Inv, Kumho Petro, CJ Cheil, CJ Corp prefs already screen well; Doosan and Hanwha 3PB could join if dividend hikes materialize on back of strong sub earnings.

5. [Japan Activism/M&A] Hogy Medical (3593) Reportedly Up For Auction – Totally Unsurprising

- Hogy Medical (3593 JP)‘s founder passed and there was a re-arranging of Hoki family deckchairs in 2021. In 2022 there was a BIG buyback from the family at ¥3,130/share.

- I discussed it here. I suggested that meant accretion, a family willing to sell, and an open register for a cheap company always heavily owned by value investors.

- The stock went nowhere for 18mos as activists dallied. In 2024 it ran from ¥3,500 to ¥5,000 as Dalton bought 20%. Then they got a board seat. Now takeover noise.

6. A/H Premium Tracker (To 25 July 2025): “Beautiful Skew” Raging Onward

- AH premia down again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- This is the most significant 60-day AH pair average H outperformance in five years, maybe ever. Remarkable.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

7. Merger Arb Mondays (28 Jul) – Shibaura, Abacus Storage, Insignia, Mayne, Santos, ENN, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Yichang HEC Changjiang Pharma (1558 HK), ENN Energy (2688 HK), Pacific Industrial (7250 JP), Santos Ltd (STO AU), Smart Share Global (EM US).

- Lowest spreads: Bright Smart Securities (1428 HK), Hainan Meilan International Airport (357 HK), Humm Group (HUM AU), New World Resources (NWC AU), Nippon Concept (9386 JP).

8. ADR Arb on Korean Divvy Names: A Side Play Riding the Policy-Driven Liquidity Wave

- ETF rebalancing’s key, but still too early to front-run — both use FnGuide screens based on FY1 DPS and prices from 20 days before November-end.

- Beyond the rebalance noise, ADR-local spreads have been widening — KB hit +6%, Shinhan’s also drifting. Likely tied to the recent liquidity surge in dividend names.

- ADR arb’s more doable with NXT tightening slippage. With proper FX hedging, it’s a clean side play riding the policy-driven liquidity wave.

9. [Japan M&A] Pacific Industrial (7250) MBO Officially Being Done Dirt Cheap

- The MBO for Pacific Industrial (7250 JP) starts with the father+son Chairman and CEO, – combined stake 2.92% – putting nothing in to buy this, with help from banks.

- The Takeover Price is priced at 0.7x book, and a Net Debt to EBITDA of 2x (when adjusted for securities+pension assets+DTLs) and 5-6x average 2026-2030 FCF.

- This is being done too cheap: Toyota is the main customer, one third of revenues comes from Japan, and the company is set for a transition to EVs.

10. [Japan M&A] – KKR Launches Still-Too-Light Topcon (7732) Deal

- In December-2024, this deal was mooted and it came out as expected. But the implied growth in management forecasts was higher than expected so the price came in quite light.

- In March when the deal was announced, it seemed like a tough call, but three weeks later Value Act decided they would tender, but would reinvest in the back end.

- The deal is now approved, and launches tomorrow. It gets done, I expect, but it is not a model deal other than being one showing the loopholes available to buyers.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. The Final ACT Comedy of Errors Opens the Way for Real Value to Emerge at Seven & I

- ACT’s bid for Seven & I has been withdrawn and Seven will be better off long-term because of it – although we detail here how competitors are catching up fast.

- Once York HD has been split off, the company can at last focus on its crucial local CVS operation: Japan makes up 25% of revenues but almost 50% of profits.

- The potential is real and we are bullish on the long-term value but we would have been more bullish if the former CEO Ryuichi Isaka was still on board.

2. SK Hynix Single-Stock ETF Scheduled for 3Q: Watch for a Repeat of the Samsung ETF Playbook

- When the SK Hynix ETF drops, expect meaningful physical buying shaking up supply-demand. Arb desks and alpha shops could pile in early, pushing the stock higher on flow.

- Going long Hynix near listing could pay off if demand mirrors Samsung’s—ETF flows, NAV arb, and delta hedging drove a 4% jump with a noticeable increase in program buying.

- Get in around the listing, watch flows, and take profits quickly. This is a short 2–3 day tactical play, with sharper front-running expected based on the Samsung ETF template.

3. TSI Holdings (3608) – YET ANOTHER Big Buyback, Still Good, Still Cheap, But B/S Restructuring Slow

- A bit over three years ago I re-wrote on Tsi Holdings (3608 JP). Then? EV/Revenue and EV/EBITDA of 0.03x and 0.5x respectively. I pounded the table.

- My recommended trade: “Buy the stock (preferably from cross-holders interested in selling). Buy with both hands. Buy a lot. Buy more later. Pressure the company to go private.”

- Since then, total return has been +295%. Today they announced another buyback. Tomorrow morning it gets done. Details details details!

4. Anthem Biosciences IPO: Lists Today; Index Inclusion Timing

- Anthem Biosciences raised INR 34bn (US$394m) in its IPO valuing the company at INR 320bn (US$3.7bn). The stock lists today.

- The grey market premium is INR 132/share, so the stock could list 23.2% higher than the IPO price. That will help in getting larger index flows.

- Anthem Biosciences could be added to one global index in November while the stock price gain will determine whether the stock is added to the other global index in December.

5. A/H Premium Tracker (To 18 July 2025): “Beautiful Skew” Continues Some More

- AH premia flat again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- Weeks ago I said, “It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.” Ride on.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

6. Prosus Is Elevated Vs. Tencent As The Accretion Trade Unfolds

- Since unwinding the Naspers (NPN SJ)/Prosus (PRX NA) circularity, Prosus has been selling Tencent shares, and buying back its share. Separately, Tencent is buying its shares to offset Prosus’ selling.

- Prosus’ stake in Tencent has now edged below 23%, a little over seven months since dipping below 24%.

- On an implied stub and relative value, Prosus is elevated to Tencent, suggesting an unwinding of the stub.

7. Dickson Concept (113 HK): More Minority Teeth Bared As Another Scheme Fails

- Three for three. Three low-balled Hong Kong Offers, by way of Schemes, have now lapsed over the past ten weeks.

- Both Goldlion Holdings (533 HK) and Soundwill Holdings (878 HK) spectacularly failed back in May.

- Now Dickson Concepts Intl (113 HK) has followed suit. But the vote was (much) closer than it should have been.

8. Insignia Financial (IFL AU) Accepts CC Capital’s Reduced Terms

- Insignia Financial (IFL AU), a wealth manager and previously known as IOOF, has entered into a Scheme with CC Capital at $A$4.80/share.

- That’s 56.9% premium to undisturbed (11th December 2024), 20% above Bain’s initial indicative tilt last year, but 4% below CC Capital (% Bain’s) A$5.00/share indictive Offer on the 7th March.

- Apart from the Scheme vote, CC Capital’s Offer requires a raft a regulatory approvals. The SID indicates 1H26 completion.

9. StubWorld: Japan Post Holdings (6178 JP) Is “Cheap”

- As short-term rates rise, Japan Post Bank (7182 JP)‘s perceived superior fundamentals may be leading to a short squeeze on the stock versus Japan Post Holdings (6178 JP).

- Preceding my comments on Japan Post – and Silicon Integrated Systems (2363 TT) – are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

10. Two New Tax Tweaks Set to Shake Up Korea’s Local Stock Market: Trading Tax & CGT Threshold

- Trading tax gradually dropped from 0.25% in 2020 to 0.15% in 2025, boosting volatility and short-term trades; a hike to 0.25% could cool momentum but widen arbitrage and basis spreads.

- If the major shareholder tax threshold drops to ₩1B, year-end retail dumps and Jan buybacks will return—but with less wild swings and more measured short-term fade and momentum trades.

- If the tax revamp drops end-July, expect a September Assembly push. Usually effective next January, but like 2023’s cap gains hike, changes might apply immediately in 2025.