This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

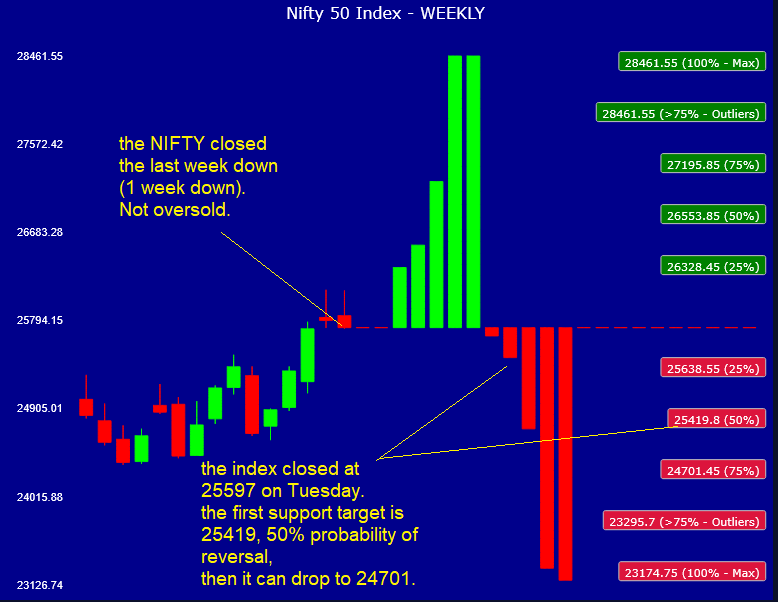

1. NIFTY 50 Tactical Outlook Amidst Potential Passive Flows From Global Trackers

- Brian Freitas posted an insight Monday discussing how Indian stocks may experience significant passive inflows and outflows from global trackers over coming weeks. Read his insight for more detail.

- The changes may start to produce effects soon, so here we are offering an analysis of the NIFTY Index to evalate potential upside and downside.

- Our previous NIFTY 50 insight warned that trend indecision could trigger a pullback—exactly what is unfolding now in the market. The index remains not oversold yet.

2. BYD (1211 HK) Tactical Outlook: Still Downtrending, But OVERSOLD

- BYD (1211 HK) does not seem ready yet to reverse its downtrend, sentiment is still negative (not too negative), Q3 revenues decreased (no surprise, as recently noted by Ming Lu).

- BYD is short-term OVERSOLD, this is a tactical WEEKLY view presenting an actionable opportunity with a 1-3 week trade horizon (probably a 2 weeks rebound, maximum).

- Our quantitative models say the stock will not correct for more than 3 weeks when this pattern is encountered (the stock is currently in its second consecutive week down).

3. Kospi: Rising Volatility and Early Warnings From a Seven-Month Surge

- Kospi’s rally has extended seven months and now shows signs of fatigue, trading with speculative assets and now sharply diverging.

- Implied volatility is elevated, with short-term measures above the 90th percentile on multiple lookbacks.

- We recommend an option trade and hedge given the current setup.

4. Hong Kong Single Stock Options Weekly (Nov 03–07): Growing Split Between Old and New Economy Sectors

- Markets steadied in North America suggesting a firmer open for Hong Kong stock on Monday.

- Hong Kong market breadth improved notably, suggesting broader participation despite uneven performance across sectors.

- Option activity eased slightly, though Call demand remained steady relative to overall volume.

5. Macro Monthly (November): Rising Volatility, Positive Seasonals and a Concerning Trend

- Implied volatility rose across most markets in October, and a continuing trend in vol premium warrants attention.

- November has historically produced strong price returns and positive volatility premiums across global markets.

- Implied volatility displays clustering across markets, with two distinct groupings beginning to take shape.

6. Cross-Market Outlook: US Vs Asia — Who’s Overbought, Who’s Oversold?(Nov 4, 2025)

- A look at our probabilistic tactical models for US and Asian Equities: comparing which stocks are overbought and which ones are oversold.

- Most of the U.S. and Asian stocks we track are overbought, with Asian markets showing the strongest overbought conditions.

- Meta (META US) and the CSI 300 Index (SHSZ300) offer bargain-hunting opportunities for tactical investors.

7. Chevron Volatility: Options-Ready for Investor Day

- Chevron demonstrated strong operational momentum in Q3 2025, with record worldwide production of over 4 million barrels of oil equivalent per day with upside from the Hess integration.

- The stock is trading at a premium valuation with a challenging but achievable growth path in terms of annual growth rates and revenues.

- Given the current valuation and financial outlook, the upcoming Investor Day on November 12, 2025, presents a short-term window to potentially put on a single stock options strategy.

8. Exxon Mobil: Navigating Volatility, Oil Majors

- We examine a strategy to capitalize on anticipated near-term price stability.

- XOM’s strong fundamentals and record production growth support positive outlook.

- Record-Setting production in key basins supports strong cash flow and returns.

9. Trading ConocoPhillips Volatility, Oil Majors

- ConocoPhillips is executing its M&A strategy, achieving major synergy savings and targeting over $2B in run-rate improvements by the end of next year, supporting its fundamental long-term outlook.

- Projection of a $7B increase in incremental Free Cash Flow by 2029 is bullish, noting execution risks.

- The balance of long-term value drivers and near-term market and restructuring risks suggests a strategy that is positioned to benefit from limited price movement.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC Near Fresh Spread Short Level; ChipMOS Rare Discount

- TSMC: +23.4% Premium; Near Levels to Open Fresh ADR Spread Short

- ASE: +0.3% Premium; Good Level to Long the ADR Spread

- ChipMOS: -7.5% Discount; Local Shares Rally Makes ADR Deeply Discounted

2. Taiwan Tech Weekly: Apple’s Macbook Windfall; Yageo’s Rally; TSMC’s Massive Rare Earth Stockpile

- Windows 10’s End-of-Life Becomes Apple’s Windfall as Second Fastest Growing Computer Brand

- Eyes on Yageo Results Coming October 30 After 35% 1-Week Surge

- China Tightens Rare Earth Grip: TSMC Says It’s Prepared with Inventory

3. SK Hynix Q325. HBM, DRAM, NAND All Sold Out Through 2026

- SK Hynix reported Q325 revenues of ₩34.45 trillion, up +10% QoQ and up 39% YoY representing an all time quarterly revenue record

- Now given the customers demand and the company’s capacity for next year not only HBM but DRAM and NAND capacity has essentially been sold out.

- DRAM margin could rise closer to HBM but the company does not plan to immediately adjust the capacity mix based on what can be a short-lived change in profitability

4. MediaTek (2454.TT): 4Q25 GM Eases on Mix; 2025 Record Revenue; 2026 AI Upswing Begins

- 4Q25 Guidance: Revenue is NT$142.1 – 150.1 bn (+0 – 6% QoQ, +3 – 9% YoY); Gross margin is 46% ± 1.5ppt; Opex ratio is 31% ± 2ppt.

- Cloud ASIC TAM: Raised from US$40bn → ≥ US$50bn by 2028; MediaTek targeting ≥ 10–15% share; Gross Margin: 4Q dip from mix; 2026 to benefit from repricing + high-value allocation

- MediaTek continues to execute on a dual-engine AI strategy. Despite near-term margin pressure from mix and FX, the company is building a foundation for sustainable profit growth.

5. Realtek Results Readthrough: Normalization Marks Pause Before Next PC Wave

- PC upgrade mini-cycle front-loaded: Realtek 3Q25 results reflected normalization after Windows 10-related demand pulled forward into 1H25, with revenue and margins easing sequentially but remaining solid.

- Diversification offsets softness: Communications infrastructure and automotive Ethernet continued to expand, with stronger growth outside China and resilient contribution from next-gen connectivity and Wi-Fi 7 adoption.

- Cautious near term, constructive on 2026E: Inventory build and tariff uncertainty temper 4Q outlook, but management expects a strong 1Q26 rebound as PC inventories normalize and AI-driven peripherals lift ASPs.

6. UMC (UMC US / 2303 TT): Adeptly Navigating Foundry Industry Transition From Scale to Specialization

- UMC’s 3Q25 results reaffirm its strategic shift toward specialty foundry leadership.

- Revenue was stable at NT$59.13bn with improving utilization and 22nm technology now contributing over 10% of sales. Gross margins remain robust.

- UMC’s growing 22/28nm portfolio, Intel partnership in Arizona, and focus on power-efficient packaging highlight how the maturing foundry sector is moving away from pure node competition and towards application-specific differentiation.

7. ASEH (3711.TT; ASX.US): 3Q25 ATM Record High; 4Q25 Modest Growth; 2025 ATM Revenue +20% YoY (USD)

- 4Q25 Outlook: Revenue is expected to grow by 1% to 2% QoQ. Both of GM and OPM are projected to increase by 0.70 to 1 percent QoQ.

- Growth continues to be driven by AI and HPC demand, with testing revenue exceeding expectations and offsetting minor shortfalls in packaging due to geopolitical uncertainties.

- With 2025 test revenue expected to grow at roughly twice the pace of packaging revenue. Investment priorities are focused on wafer probing capacity for both AI and non-AI devices

8. UMC (2303.TT; UMC.US): 4Q25 Upbeat; 1Q26 May Be a Challenging Quarter Due to Expected Seasonality.

- 4Q25 Guidance: Wafer shipment will remain flat. ASP in US dollars will remain firm. Gross margin will be approximately in the high 20% range.

- Expect interposer technology capabilities to serve the market when volume comes in late 2026 or sometime in 2027.

- 12nm PDK is expected to be ready for the first wave of customers in January 2026. Customer product takeout is expected at the beginning of 2027.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

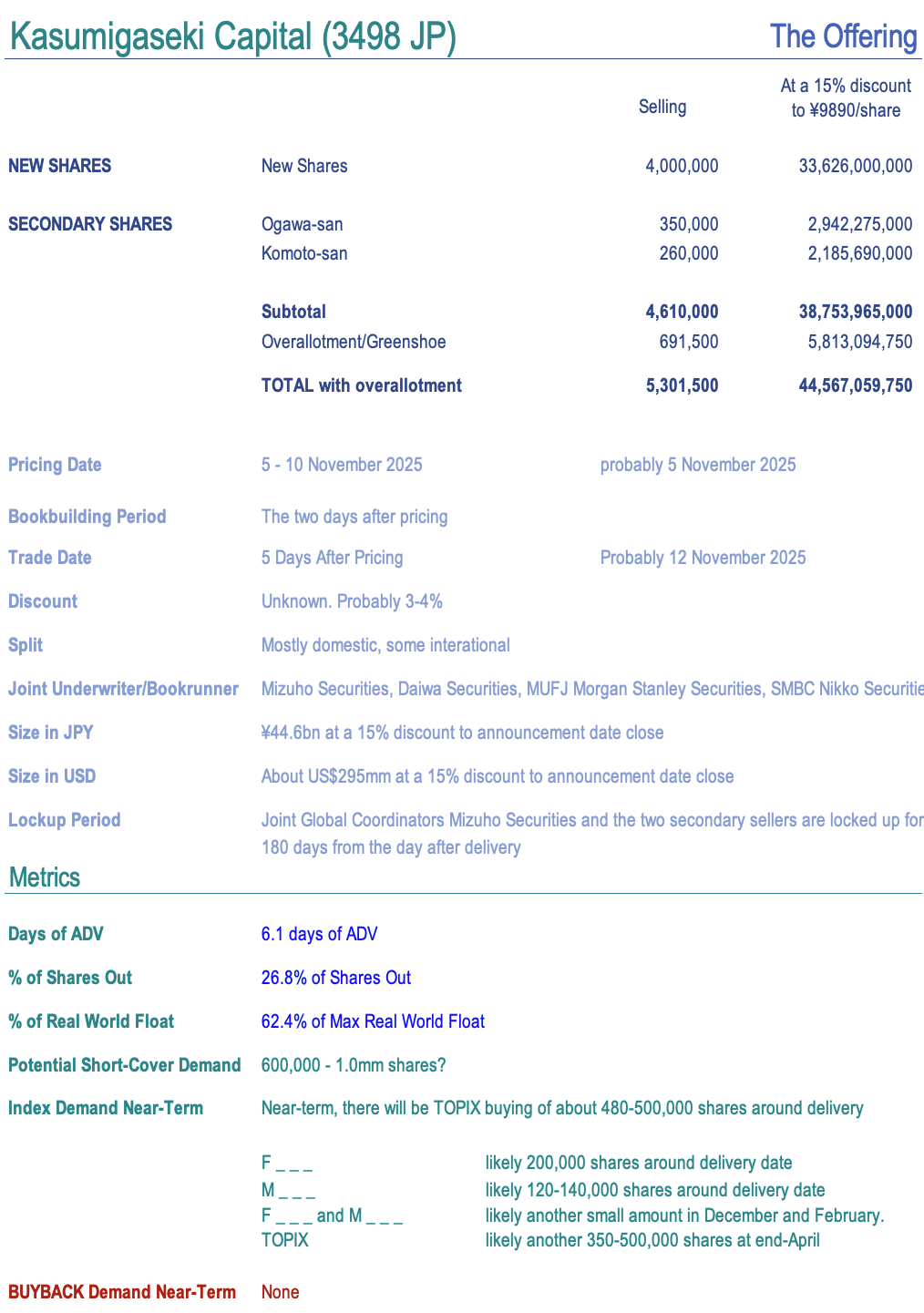

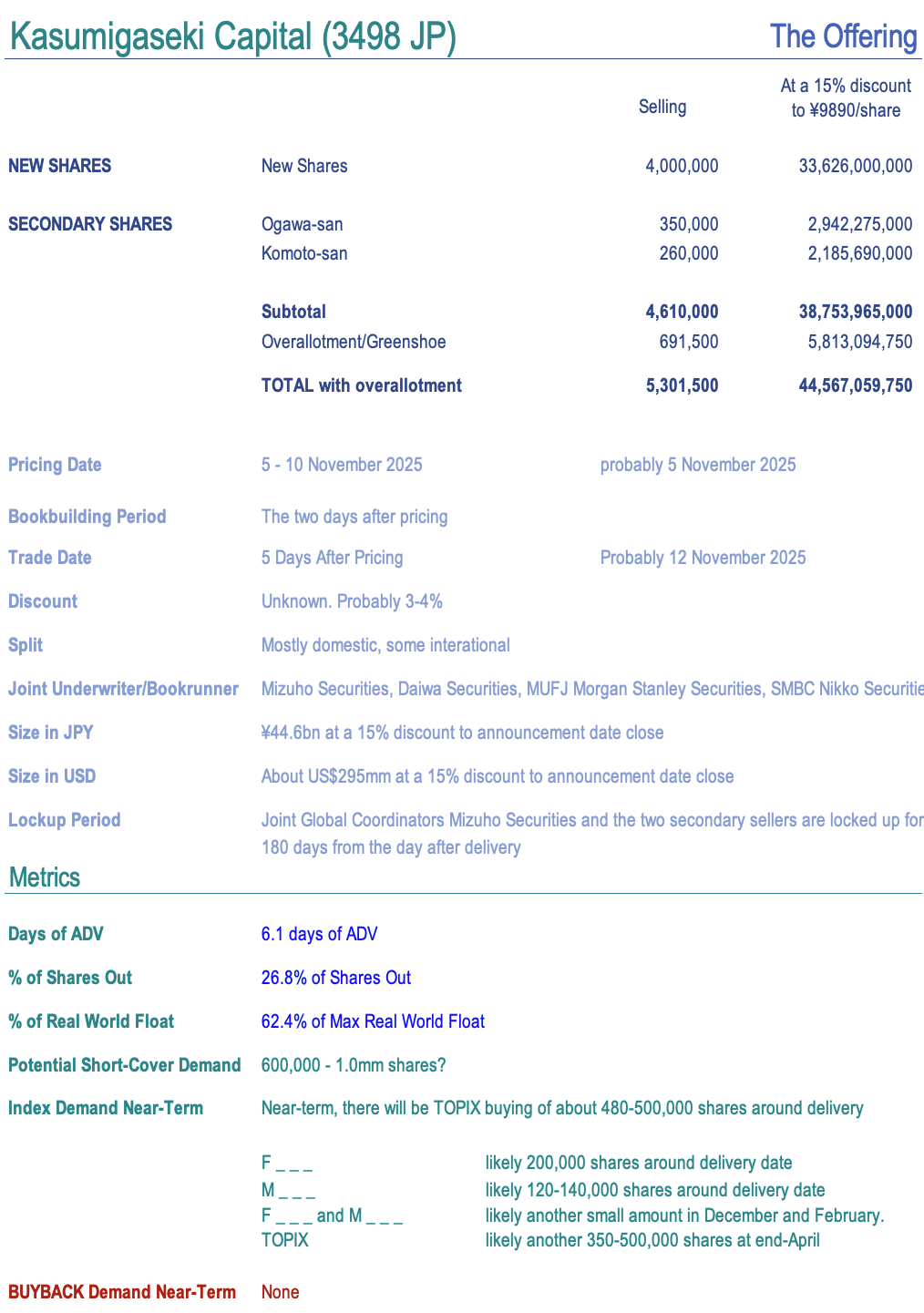

1. [Japan Offering] Kasumigaseki Capital (3498 JP) – BIG Primary for Big Plans

- On Friday, Kasumigaseki Capital (3498 JP) announced Aug-25 earnings and a combination ¥45-50bn primary+secondary offering worth 5.3mm shares, 6x ADV, and a float increase of 37%. Shares fell 15% today.

- 2yrs ago they did a large offering. It went well. They’d had a ridiculous plan to grow OP 6x from ¥3.5bn to ¥20bn in 2yrs to Aug-26. Then by Aug-25.

- They got to ¥8.5bn in Aug-24 and now ¥18.9bn in Aug-25 and now guide to ¥26.5bn in Aug-26 (the original plan having been ¥20bn).

2. WeRide HK Listing: The Investment Case

- WeRide (WRD US), a provider of autonomous driving products and services, is seeking to raise between US$350 million through an HKEx listing.

- It was listed on the Nasdaq on 25 October 2024, raising US$120 million at US$15.50 per ADS. Since listing, the shares are down 31%.

- The investment case centres around accelerating revenue growth, progress towards mass commercialisation and valuation in line with historical averages. However, the path to profitability remains uncertain.

3. Seres Group H Share Listing (9927 HK): Valuation Insights

- Seres Group (601127 CH), a Chinese NEV manufacturer, has launched an H Share listing to raise US$1.7 billion.

- I discussed the H Share listing in Seres Group H Share Listing: The Investment Case.

- The proposed AH discount of 24.8% (based on the 24 October A Share price) is attractive, and I would participate in the H Share listing.

4. Seres Group Hong Kong IPO Preview

- Seres Group is getting ready to complete its IPO on the Hong Kong exchange in the coming weeks that could raise about US$1.7 billion.

- At the high end of the IPO price range of HK$131.50 per share, Seres would have a market capitalization of nearly HK$215 billion (about $27.6 billion).

- Seres Group is one of the largest new-energy vehicle makers in China. There are 22 cornerstone investors that have committed to purchase approximately 49% of the offer.

5. Pony AI Secondary HK Offering – Needs to Correct Some More

- Pony AI (PONY US) plans to raise around US$825m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

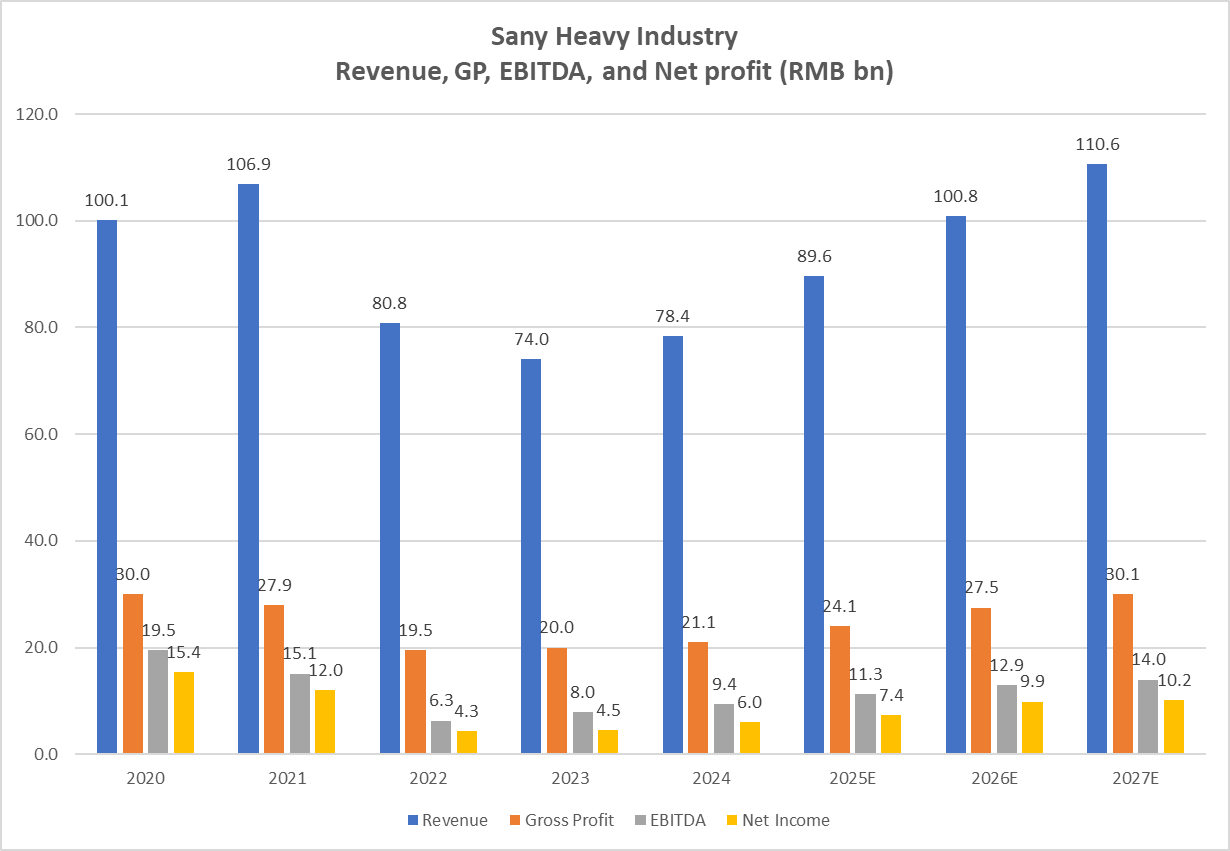

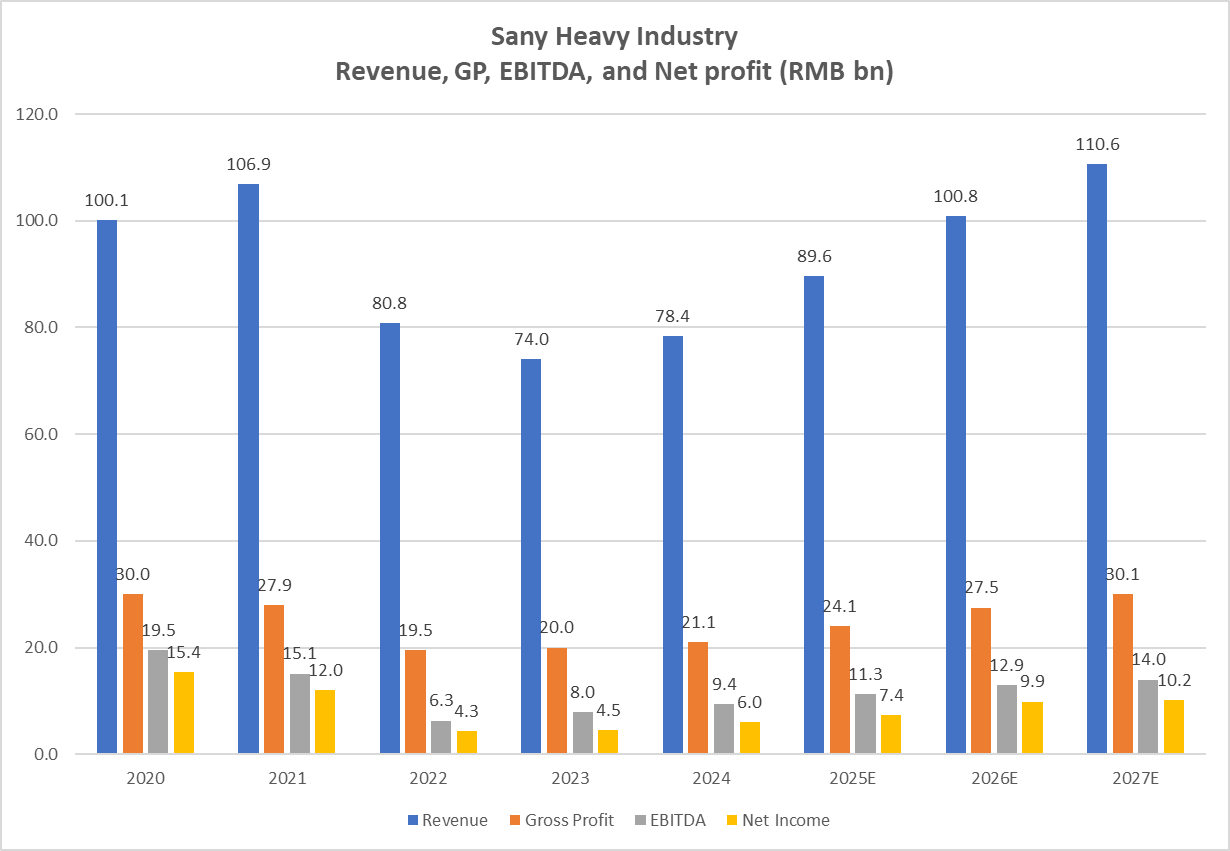

6. SANY Heavy Industry H Share Listing (6031 HK): Trading Debut

- Sany Heavy Industry (600031 CH) priced its H Share at HK$21.30 to raise HK$13,453 million (US$1.7 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case and SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights.

- Sany’s international oversubscription rates were above the median of recent large AH listings. The AH discount remains reasonable.

7. WeRide Secondary HK Offering – Has Been Trading Up, Given the Valuation Gap

- WeRide (WRD US) plans to raise around US$325m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

8. Seres Group A/H IPO Pricing – Thoughts on Valuations

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$1.7bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. ECM Weekly (27 October 2025)- Sany, Seres, PonyAI, WeRide, CIG, JST, Lenskart, Horizon, CRB

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Hong Kong and India markets appear to be gearing up for a year end rush.

- On the placements front, there were no large deals this week but we did have a look at the upcoming lockup expiries.

10. Samsung Electronics Placement: Inheritance Tax Paydown by Family, Widely Telegraphed

- Samsung Electronics (005930 KS) is looking to raise around US$1.2bn from a secondary placement.

- This represents 0.9 days of the stock’s three month ADV, and 0.3% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tsuruha (3391 JP)/Welcia (3141 JP): Index Promotion & Passive Flows Likely Priced In

- Tsuruha Holdings (3391 JP) acquires Welcia Holdings (3141 JP) in just over 4 weeks. Aeon Co Ltd (8267 JP)‘s tender offer for Tsuruha Holdings (3391 JP) could commence in December/January.

- The enlarged Tsuruha Holdings (3391 JP) could migrate upward in the MGlobal Index and that will bring in large passive flows. But there is one thing to watch out for.

- Tsuruha Holdings (3391 JP) and Welcia Holdings (3141 JP) have outperformed peers over the last 6 months and now trade at a higher forward PE.

2. Seres (9927 HK): Index Inclusion Timeline for a Max Offering of US$2.2bn; Big Discount to A-Shares

- Seres Group (601127 CH) could raise up to HK$17.4bn (US$2.24bn) in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the already small possibility of Fast Entry inclusion to global indexes.

- Seres (9927 HK) should be added to Southbound Stock Connect from the open of trading on 1 December following the end of the Price Stabilisation period.

3. Lenskart IPO: Earliest Index Inclusion in June

- Lenskart Solutions (0370405Z IN) is looking to list on the exchanges by selling 181.05m shares via a primary and secondary offering to raise US$829m at a valuation of US$7.95bn.

- The price band has been set at INR 382-402/share, and the issue is likely to price at the top end of the range.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

4. Groww IPO: Growwing Fast; Index Inclusions Will Be Sloww; Small Floww

- Groww (1573648D IN) is looking to list on the exchanges by selling 663.23m shares via a primary and secondary offering to raise US$752m at a valuation of US$7bn.

- The price band has been set at INR 95-100/share, and the issue is likely to price at the top end of the range.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

5. [Japan M&A/Activism] Ashimori Industry (3526 JP) Minimum Lower, May Be a Tough Call

- In August, Toyoda Gosei (7282 JP) announced a deal for Ashimori Industry (3526 JP) at 1.000x book value after writedowns. That was not a coincidence.

- The takeover is cheap for what it is. No synergies were counted. But it wasn’t truly offensive. MURAKAMI Takateru aimed an activist broadside, bought 19.73% across four entities. Then stopped.

- The Bidder lowered the Tender Offer Minimum from 2.3081mm shares (38.29%) to 1.8001mm shares (29.86%). Shares dropped. As of 24-Sep, 2,111,226 shares had been tendered. This looks done. Maybe.

6. [Japan M&A] Sumitomo Corp To Buy Out Minorities in SCSK (9719 JP)

- Yesterday after the close, Sumitomo Corp (8053 JP) announced it would buy out minorities in Scsk Corp (9719 JP) at ¥5,700/share.

- As a “parent takes out subsidiary” deal, this was not unexpected at some point in time. The register looks like there may be a number of people who expected that.

- This gets done pretty easily. It is not a bad price.

7. Sanil Electric Poised for Pop on Nov 20 KOSPI200 Ad‑Hoc (HD Hyundai Merger)

- HD Hyundai merger: both legs in index, Mipo delists, slot opens — one new name gets added to KOSPI200 via ad‑hoc.

- Sanil Electric (062040 KS) to replace HD Mipo pre‑Dec review. If DTV settles back into the 500–600k range, then KS200 ETFs will need to scoop ~0.3–0.4x DTV on Nov 26.

- Better to front‑run KRX; with AI power trade still hot, Nov 20 announcement likely sparks outsized price action vs waiting for rebalance print.

8. ANE (9956 HK): Centurium/Temasek’s Clean Offer

- After ANE Cayman Inc (9956 HK), a road freight transportation play, was suspended pursuant to the Takeovers Code, an Offer from PE outfit Centurium Partners, a pre-IPO investor, was expected.

- And this is what unfolded. Centurium, together with Temasek and Singapore-based asset manager True Light, are offering HK$12.18/share (best & final) via a Scheme, a 48.54% premium to undisturbed.

- A scrip alternative is present (mix & match). This is a pre-conditional Offer: it requires SAMR signing off. The FA is JPM. This should help smooth over the reg process.

9. ANE (9956 HK): Consortium’s Attractive Preconditional Offer

- ANE Cayman Inc (9956 HK) has disclosed a preconditional scheme privatisation offer from a consortium. The offer is cash (HK$12.18) or scrip (One TopCo Class A Share per scheme share).

- The precondition relates to SAMR approval. The scheme vote is low risk, as the offer is attractive relative to historical ranges and peer multiples.

- The offer price is final. Mr Wang Yongjun, the former chairman, holds a blocking stake but should be supportive. Timing is the key risk.

10. Jardine Matheson’s Underperformance Post Mandarin Offer

- Concurrent with the sale of 13 floors of OCB to Alibaba, Jardine Matheson (JM SP) announced on the 17th October an Offer for Mandarin Oriental (MAND SP)‘s minorities at US$3.35/share.

- This is a clean, full, “dull” Offer. And MAND is trading super tight to terms at ~2.1% gross, with possible payment (my estimate) late Feb 2026.

- Proceeds from the OCB sale will be US$925mn. And taking out MAND’s minorities will set Matheson back ~US$1bn. Yet the market is now assigning US$2.1bn less for Matheson’s stub ops.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

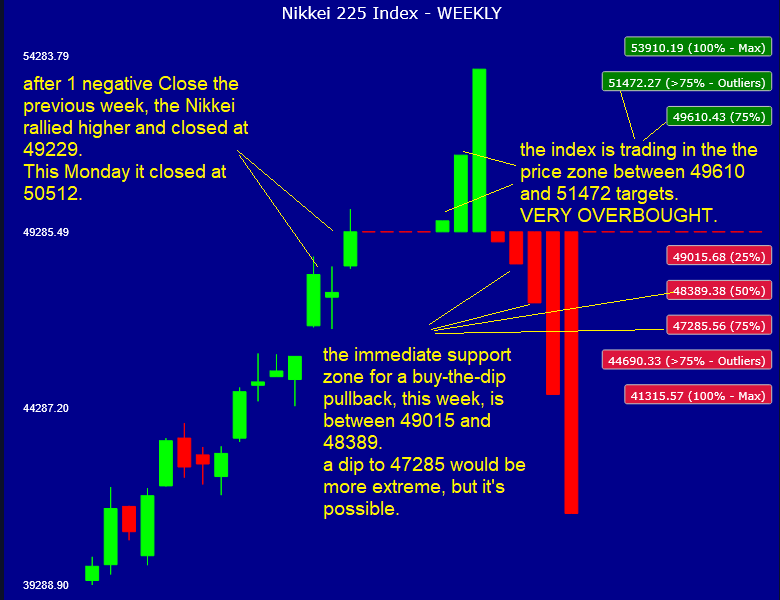

1. Nikkei 225 (NKY) Outlook After Surprise Nov 5 Rebalance

- As reported by Brian Freitas, the JPX on Oct 27 suddenly announced that Nidec Corp (6594 JP) would be deleted from the Nikkei 225 and replaced by Ibiden (4062 JP).

- The date of replacement is November 5, the Nikkei will experience passive flows, in this insight we want to have a look at the possible moves caused by this catalyst.

- At the moment the index is overbought, according to our models.

2. A Special Cross Asset Morning Update: Nidec, Ibiden, and BoJ This Week

- Japanese markets are seeing significant developments, including Nikkei 225 rebalancing with Nidec’s removal due to alert and Ibiden’s addition, impacting tracking funds, delta one trading strategies, and investors with position.

- The BoJ’s cautious normalization path continues to shape the JGB curve, with a notable steepening in the long end affecting asset-liability management.

- We detail the trades and execution of the trade idea, which may require special attention this week especially on the rebalance.

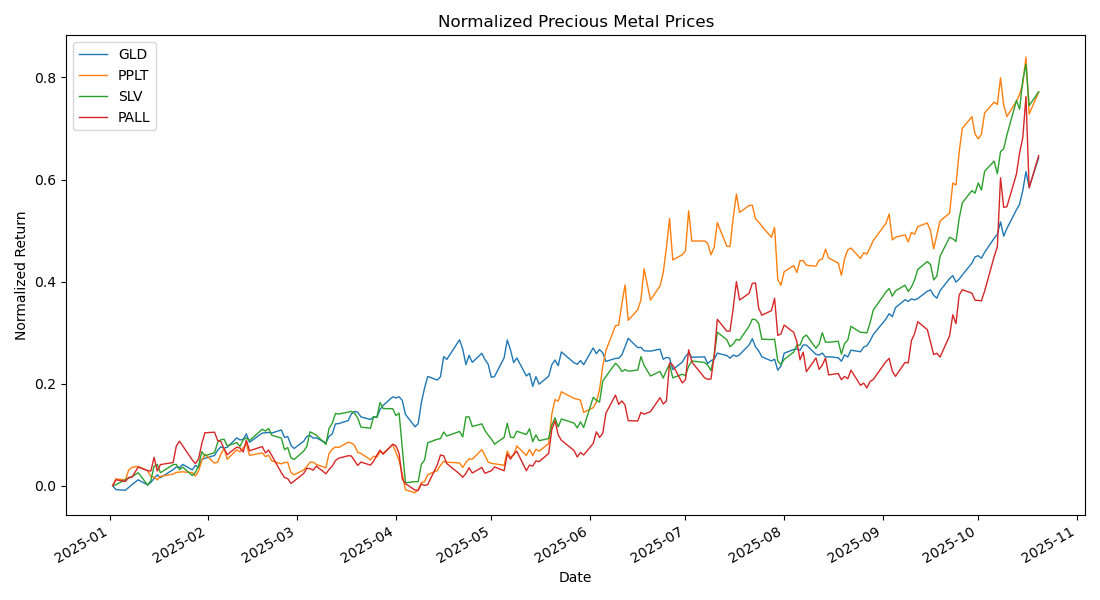

3. GOLD Tactical Outlook: Correcting After the Run — Where to Step In

- After a 9 weeks rally, Gold (GOLD COMDTY) started to pullback, last week, and the pullback continued into this week.

- Some market watchers argue US retail investors piled into Gold ETFs following the Fed’s late-August shift to rate cuts, potentially fueling the metal’s recent upside exhaustion.

- If Gold (GOLD COMDTY) was fueled by retail buying and is now correcting, retail investors will likely chase the dip—a textbook example of herd behavior, potentially driving a rebound.

4. Advantest Earnings… TPXC30, and Murata…

- Advantest saw a 34% upside after earnings, aligning with previous buy recommendations and its inclusion in the Value Seeker Japan basket for long-term growth.

- A small inclusion into TPXC30 occurs today at the close, with Advantest’s fundamental outlook remaining in line with our recent insights.

- Murata seeing some flows as well today in at the close, and moves to the TPX 70 Large.

5. COMEX Gold: Trading Gold’s Moment in the Options Market Spotlight

- Global monetary shifts and diversification from the U.S. dollar are creating a favorable environment for gold, supported by central bank activity and strong physical demand.

- The market is showing signs of declining volatility after a recent price drop, suggesting an opportune moment for strategic options trading.

- Careful consideration of resistance levels and downside risks is key to optimizing this particular market strategy.

6. Silver: A Fifty-Year Perspective on Bull Markets and Sizing Up the Recent Correction

- After an extraordinary run, SLV’s pullback appears orderly as implied volatility cools yet remains high by historical standards.

- We examine how this bull market in Silver compares with previous bull market spanning 50 years.

- We also look at market participation to identify what’s been driving the recent price action.

7. Selective Volatility Picks Emerge Across HSI Stocks

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the Hang Seng and eight prominent Hong Kong stocks

- Highlight: With a dense earnings calendar ahead, volatility dispersion is widening — BYD trades rich into results, while Tencent and Xiaomi remain notably cheap relative to history.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

8. CBA, ANZ, Westpac, NAB: Volatility Runs High Ahead of Imminent Catalysts

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the S&P/ASX 200 and ten prominent Australian stocks.

- Highlights: Implied volatility across Australia’s major banks remains rich ahead of earnings and the RBA decision.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

9. HKEX Adds Five New Weekly Options on 10 Nov: AIA, China Mobile, Xiaomi Join Fast-Growing Line-Up

- HKEX Expands Weekly Options: Five new single-stock weeklies debut on 10 November, broadening Hong Kong’s fast-growing short-dated options market.

- Why It Matters: Weeklies let traders and investors hedge or speculate around key events with precision, lower premiums, and higher gamma exposure.

- Momentum: Trading volumes in existing weeklies have surged—up nearly fourfold since launch—underscoring rising investor adoption and liquidity.

10. Hong Kong Single Stock Options Weekly (Oct 27 – 31): Market Cools After Busy News Week

- Busy news week with trade and deal headlines taking center stage.

- Stock have been treading water aside from the Materials Sector with breadth reversing from last week’s rebound.

- The thick of earnings season is past with only 15 companies reporting in the next week.

Entity | Insights | Analytics | News | Discussion | Filings | Reports |

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. TSMC Q325. Today, The Numbers Are Insane

- Q3 2025 revenues of $33.1 billion, slightly exceeding the upper end of the guided range, up 10.1% QoQ and up 40.8% YoY.

- On track for 35% YoY revenue growth in 2025, with revenue likely to exceed $120 billion

- No QoQ revenue growth this quarter suggests either AI demand growth has stalled or TMSC is maxed out at the leading edge. Methinks it’s the latter..

2. Taiwan Dual-Listings Monitor: TSMC Spread Sinks Sharply; ASE Near Parity Again

- TSMC: +22.1% Premium; Continue to View 24% or Higher as Level to Short From

- UMC: +0.4% Premium; Results Coming… Wait for More Extreme Spread Levels

- ASE: +0.4% Premium; Near Good Level to Go Long the ADR Spread

3. Intel Q325. Solid Quarter But Still No Coherent AI Strategy & 18A Yields Won’t Mature Until 2027

- Intel announced Q325 revenues of $13.7 billion, above the high end of the guided range, up 6% QoQ and up 2.8% YoY

- Intel forecasted current quarter revenues of $13.3 billion at the midpoint, down $1 billion YoY and down $400 million QoQ

- 18A yields are not where we need them to be, by the end 2026 they probably will be, and they should be “industry acceptable” by 2027

4. Taiwan Tech Weekly: Mediatek & Nvidia Announce GB10 Partnership; TSMC’s Prices Spur Samsung Interest

- MediaTek Joins Forces with NVIDIA on the GB10 Superchip — Locally-Run AI Models Are Coming to Your Desktop

- TSMC’s 2nm Price Hike Spurs Interest in Samsung, But Underscores Its Strength

- Latest for Smartphone Demand 3Q25: A Little Bit Better, Just a Little

5. Intel (INTC.US): 3Q25 Results Slightly Beat; Emphasized AI Importance; Seeking New Foundry Clients.

- Intel Corp (INTC US) 3Q25 slightly exceeded consensus estimates in both revenue and EPS.

- CEO Lip-Bu Tan emphasized the growing importance of AI, while CFO David Zinsner highlighted the accelerated funding from the U.S. government and strategic investments from NVIDIA and SoftBank

- Intel’s foundry business still relies primarily on internal orders and continues to seek external customers.

6. LRCX Q325. Solid Results, Outlook But China Exposure Is A Glaring Red Flag

- LRCX reported September 2025 quarter revenues of $5.32 billion, marginally above the guided midpoint, up 3% QoQ and up 27.7% YoY.

- LRCX is forecasting current quarter revenues of $5.2 billion at the midpoint, slightly down sequentially, but up 18% YoY. In other words, the AI boost is coming, just not yet.

- The elephant in the room was once again revenue mix from China which accounted for a whopping 43% of sales, up from 35% in the prior quarter. Oh my!

7. IHI (7013 JP): SAR Satellite Deal Adds to Takaichi Trade

- New Japanese Prime Minister Sanae Takaichi aims to raise defense spending to 2% of GDP this fiscal year, two years ahead of the original schedule.

- Takaichi also wants to accelerate investment in advanced defense technologies. IHI, which recently signed an agreement with ICEYE to build earth observations satellites, should be among the beneficiaries.

- IHI’s sales and profit comparisons should turn positive during FY Mar-26. A 7-for-1 stock split effective October 1, 2025, makes the shares more attractive to retail investors.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Sany Heavy Industry IPO Valuation Analysis

- Our base case valuation of Sany Heavy Industry is target price of CNY21.1 per share. This represents 7.6% lower than current price of CNY22.83 per share.

- IPO price of Sany Heavy is expected to be set between HKD20.30 and HKD21.30. Our valuation analysis suggests lack of a meaningful upside for Sany Heavy Industry listing in HK.

- There are still lack of a major turnaround of the property market in China and this could continue to negatively impact the overall construction equipment market in China.

2. SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights

- Sany Heavy Industry (600031 CH), the world’s third-largest construction machinery company, has launched an H Share listing to raise US$1.6 billion.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case.

- The proposed AH discount of 17.2% to 13.1% (based on the 17 October A Share price) is attractive, and I would participate in the H Share listing.

3. WeRide Secondary HK Offering – Is Relatively Cheaper but Lacks Momentum

- WeRide (WRD US) plans to raise around US$350m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 19th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

4. Pony AI Secondary HK Offering – Stock Has Been Volatile, a Look at Possible Trading Setup

- Pony AI (PONY US) plans to raise around US$1bn in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 17th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

5. ECM Weekly (20 October 2025)- Sany, Seres, JST, Fibocom, Tekscend, FineToday, LG India, DIY, Duality

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India saw a host of listing, while HK is gearing up a busy year end.

- On the placements front, we had a look at some of the IPO lockups. There weren’t any large placements this week.

6. CIG Shanghai A/H Listing: Smaller A/H Premium than Larger Peers, Expensive

- Cig Shanghai (603083 CH), telecommunications equipment company, is looking to raise up to US$594m in its upcoming Hong Kong IPO.

- It is a provider of critical infrastructure components for the development of AI.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Sany Heavy Industries A/H IPO Pricing – Thoughts on Valuations

- Sany Heavy Industry (600031 CH) aims to raise around US$1.6bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

8. Sany Heavy Industry IPO: Valuation Assessment

- Sany Heavy Industry (600031 CH)‘s IPO price range is set at HK$20.3-21.3, aiming at raising HK$11.9bn based on the mid-point IPO price.

- Key strengths are excellent growth potential globally, a leading market position, excellent R&D capability, and a solid financial track record.

- Sany Heavy’s fair valuation is a 5-10% discount to its A-share, in our view, implying an H-share price of HK$22.06-23.29, leaving limited upside from the IPO level.

9. Zijin Gold (2259 HK) 25Q3 – Updates on Forecast/Valuation and Potential Risks Behind

- Zijin Gold showed strong growth momentum in 25Q1-Q3, mainly driven by high gold prices and the two major acquisitions of the Ghana Akyem Gold Mine and Kazakhstan Raygorodok Gold Mine.

- Based on 25Q1-Q3 results, we updated our forecast of Zijin Gold, with net profit to reach US$1.5 billion/US$2.3 billion/US$3.5 billion in 2025/2026/2027, respectively.Theoretically speaking, valuation still has positive upside potential.

- However, our greatest concern is not the fundamental factors but the selling caused by liquidity crisis, which may lead to a synchronous correction of Zijin when the global market declines.

10. Pony AI HK Dual Primary Listing: The Investment Case

- Pony AI (PONY US) is a Chinese robotaxi operator and self-driving technology company. It is seeking to raise US$1 billion through a dual primary HKEx listing.

- It was listed on the Nasdaq on 27 November 2024, raising US$260 million at US$13.00 per ADS. Since listing, the shares are up 48%.

- The investment case centres around Pony’s accelerating revenue growth and progress towards positive unit economics. However, the path to profitability is long-dated and the valuation is full.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Sany Heavy (6031 HK) IPO: Big Cornerstone Allocation to Delay Global Index Inclusion

- Sany Heavy Industry (600031 CH) could raise up to HK$16.35bn (US$2.1bn) in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the already small possibility of Fast Entry inclusion to global indexes.

- Sany Heavy (6031 HK) should be added to Southbound Stock Connect from the open of trading on 24 November following the end of the Price Stabilisation period.

2. Mandarin Oriental (MAND SP): Matheson’s Full Offer

- A sale – partial or otherwise – of Mandarin Oriental International (MAND SP)‘s One Causeway Bay (OCB) was always on the cards. But I didn’t see an Offer coming.

- Concurrent with the sale of 13 floors of OCB to Alibaba (9988 HK), Jardine Matheson (JM SP) is seeking to take out MAND’s minorities at US$3.35/share by way of a Scheme.

- That’s a 52.3% premium to undisturbed, and a 53.7% premium to NAV. Unlike the 2021 Jardine Strategic (JS SP) Offer, Matheson is required to abstain from voting on this takeover.

3. [Japan M&A/Activism] Digital HD (2389 JP) Gets a Counter + 20% – Tough But Not Impossible

- Today, in something of a surprise but not a complete surprise, Silvercape came out with its own bid for Digital Holdings Inc (2389 JP) at +20% from the Hakuhodo bid.

- They make it clear that the original bid does not protect minority shareholders or give them sufficient value. This one would. Which means that is Hakuhodo’s bogey.

- It would not be impossible for Silvercape to get to its minimum hurdle, but despite being lower than Hakuhodo’s it’s not a gimme.

4. [Japan M&A/Activism] – Activism Wins as MBO Bidder Pays 42.4% More for Pacific Industrial (7250 JP)

- When the Pacific Industrial (7250 JP) deal was announced in late July, I said it needed to be done 20-40% higher. I hadn’t expected someone to push so hard.

- But Effissimo pushed. They bought 12.5% of shares out, and 13+% of votes at an average price of ¥2,365/share – 15% through terms.

- Three months later after multiple extensions, Bidco bid up. +42.4%, to 1.002x March 2025 BVPS. A raging win for activists and minority investors. I’m genuinely surprised by the quantum.

5. Palliser Capital Goes Activist on LG Chem

- Palliser Capital started to go activist on LG Chem. According to Palliser Capital, LG Chem’s share price is trading at a 74% discount to its NAV.

- Palliser Capital proposed improving the composition of the board of directors, restructuring the executive compensation system to align with shareholder interests, and higher share buybacks.

- Our updated NAV analysis of LG Chem suggests implied price of 613,438 won per share, which represents a 57% higher levels than current levels.

6. Dec KS200 Review: Kakao Pay Poised for Breakout

- Names with the biggest float bumps relative to their old float saw the sharpest moves — Hanwha Ocean and Ecopro Materials were the standout examples.

- Kakao Pay looks set for Dec review spotlight: float likely jumping from 21% to 34% (+13ppt, 60%+ surge), even bigger than Hanwha Ocean/Ecopro last round.

- Kakao Pay’s 13ppt float hike implies ~0.7–1.0x DTV passive inflows; with little pre‑positioning, flows may hit raw and drive outsized intraday impact.

7. Korea’s Next Policy Play: NAV Discount Squeeze on Low‑Float Large Caps

- Market sniffing policy push; low-float names flagged as junk risk with skewed control. Desks circling, Palliser hit early—LG Chem trade popped, timing spot on.

- Trade setup: screen >₩1tn caps with low float, parent stakes 60–80%. Policy push likely forces stake cuts, driving float higher and squeezing NAV discounts—LG Chem shows the play.

- Screening >₩1tn caps flags 11 names: parents hold 60–80%. All potential stake-sale plays to boost float, squeeze NAV discount.

8. Merger Arb Mondays (20 Oct) – ENN Energy, Joy City, Kangji, Mandarin, Soft99, Mandom, Makino

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mandarin Oriental International (MAND SP), Smart Share Global (EM US), Soft99 Corp (4464 JP), ENN Energy (2688 HK), Mayne Pharma (MYX AU), Dongfeng Motor (489 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Mandom Corp (4917 JP), Humm Group (HUM AU), Seven West Media (SWM AU), Toyota Industries (6201 JP).

9. Horizon Robotics IPO Lockup – Last of the Lockups, Large Pre-IPO Investors Still Holding On

- Horizon Robotics (9660 HK) raised around US$800m in its Hong Kong IPO in October 2024. Its first set of lockups expired in April 2025. The next one is due soon.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note, we will talk about the lockup dynamics and possible placement.

10. Fresh Policy Momentum Hitting Korea Tape: Trade Is Lining up Around 13 Holdcos with CVC Exposure

- Gov’t likely to ease CVC rules; street chatter sees high odds. Tied to KRW150tn Growth Fund push, with corporates lobbying—cleanest path to juice capital flow.

- Holdcos at center of CVC‑easing; scrapping disclosure rule unlocks external capital. Street read: fast flip from control towers to re‑rating plays as real investment shops with growth portfolios.

- KFTC flags 177 holdcos, 14 with CVCs (13 listed). Street sees momentum flows hitting these 13 names; play via basket/overweight, with Doosan, Hyosung, LX as preferred plays.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Gold: Reviewing Five Decades of Bull Markets Against an Overextended Backdrop

- Gold’s rally shows signs of overextension but the volatility footprint differs from prior rallies.

- We exam major bull markets over the past 50 years to assess how the current move stacks up.

- Fund flows and the sources of buying pressure are analyzed to gauge the rally’s sustainability.

2. BYD (1211 HK) And JD.com (9618 HK) Lead Expected Swings as 27% of HSI Reports Before Month-End

- Context: Several of Hong Kong’s largest companies will report in the coming days, representing 27% of the Hang Seng Index (HSI).

- Highlight: This Insight identifies which stocks have option-implied swings deviating from historical averages.

- Why Read: Prepare for earnings season by understanding where single-stock and broader market volatility may be elevated.

3. Gold Part 2: Implied Volatility Dynamics Offer Insight into the Tone of This Bull Market

- Gold’s latest surge shows rising implied volatility but little sign of market stress, suggesting limited parallels with the explosive 1980 bull market.

- Tuesday’s correction was the largest selloff in 12 years and marked the end of a series of successively larger positive moves.

- Rising implied vols and strong Call demand reveal active trading but not the manic levels typically seen near a major blowoff.

4. Nintendo and the Switch 2: An Options Menu

- Nintendo is poised for a significant growth phase, driven by its new console and an expansive intellectual property ecosystem, promising sustained financial performance.

- Strategic capacity expansion and a robust balance sheet position Nintendo to capitalize on strong demand, mitigating risks and reinforcing its market leadership.

- Despite potential market volatility and competitive pressures, aggressive production targets and a strong financial foundation suggest a compelling investment opportunity.

5. Cross-Market Outlook: US Vs Asia — Who’s Overbought, Who’s Oversold?

- A look at our probabilistic tactical models for US and Asian Equities: comparing which stocks are overbought and which ones are oversold.

- Between the US Stocks we track, all seems to have room to rally, short-term, and Amazon (AMZN US) is actually oversold (buy opportunity).

- The Asian Stocks we track instead show a less homogeneous picture, but several Asian stocks are incredibly overbought. Same as Gold.

6. Toyota Motor (7203 JP) Tactical Outlook: Awaiting Imminent Pullback

- Toyota Motor (7203 JP) has been going nowhere since July 2025 and before that it dropped from its highest peak. Long-term bullish, but short term we expect a pullback.

- Our model shows that the current trend pattern for Toyota Motor (7203 JP) is not bullish, usually the stock pulls back after 2 weeks up, i.e. end of this week.

- We propose this analysis of the pullback as an opportunity to buy at higher prices, or otherwise to hedge your holdings, if you want to tactically optimize returns.

7. BYD (1211 HK) Earnings on 30 Oct: Options Price in Larger-Than-Usual Move

- Context:BYD (1211 HK) reports Q3 2025 results on 30 October after market close.

- Options markets imply a ±4.7% move, notably larger than the historical ±3.0% average. The stock has shown asymmetric reactions, with fewer but stronger upside moves.

- Why Read: Understand how implied swings compare with history and how the earnings-linked volatility peak offers tactical opportunities around BYD’s 31 Oct weekly expiry.

8. HDFC Bank (HDFCB IN) Tactical Outlook: Time to Lock In Gains

- Despite good earnings results, HDFC Bank (HDFCB IN) does not seem to be going anywhere. The stock did rally for the past 3 weeks but after the earnings stayed flat.

- Our quantitative probabilistic model indicates HDFC Bank usually does not rally for more than 4 weeks when this pattern is encountered (we are in the 4th week, this week).

- From a price perspective, our model shows a mildly overbought stock, confirming the slow pace. The pullback should be short-lived (1-2 weeks), but it’s imminent.

9. Toyota (7203 JP) Up 3.2% Today: Tactical Bearish Option Strategies as Pullback Looms

- Context: Toyota Motor (7203 JP) rallied 3.2% in Wednesday’s morning session. Quantitative models highlight potential for a short-term pull-back.

- Trade Idea: Three actionable option strategies with a bearish tilt are presented, taking advantage of current implied volatility levels and skew.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where high implied volatility and bearish probabilities align, offering investors defined risk/reward.

10. Otsuka, Hirose Electric, Screen, Advantest: The Value Seeker Portfolio and NK Options

- A compelling investment strategy focused on high-quality Japanese equities, selected for strong financial health and growth prospects. This approach targets companies offering stability and long-term appreciation.

- The portfolio emphasizes industrial, automation, pharma, and technology hardware sectors, balanced with a tactical volatility trading approach. This strategy aims to enhance returns while managing short-term market fluctuations.

- Otsuka Holdings is highlighted as a core pharma pick. Screen and Hirose Electric are strong value picks in manufacturing and electronic tech, contributing to the portfolio’s quality and value focus.