Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC & UMC Spreads at Historically Rare Levels

- TSMC: +26.1% Premium; Remains at Level Rarely Maintained for More Than a Week; Good Level to Short the Spread

- UMC: +2.5% Premium; Historically Rare Level is a Short Opportunity

- ASE: +2.9% Premium; Wait Better Short Opportunity at Higher Levels

2. Alphabet. More Of The AI, Less Of The Drama

- Marc Benioff on Gemini 3: I’ve used ChatGPT every day for 3 years. Just spent 2 hours on Gemini 3. I’m not going back. The leap is insane

- Anthropic on expansion of Google Cloud TPU: The expansion is worth tens of billions of dollars and is expected to bring well over a gigawatt of capacity online in 2026.

- DeepMind is Alphabet’s dark horse. AlphaFold is one of the most significant AI-related accomplishments ever. What will they turn their attention to next? Let’s see…

3. Taiwan Tech Weekly: Industry Moves Show Silicon Photonics Becoming Must-Have for Next Gen Compute

- Himax (HIMX US): Silicon Photonics Becomes Strategic Imperative for Foundries, Reinforcing Long View

- Silicon Motion (SIMO US): Multiple Growth Drivers Converging Into 2026E

- Taiwan Dual-Listings Monitor: TSMC & UMC Spreads at Historically Rare Levels

4. Taiwan Dual-Listings Monitor: TSMC Historically High Premium Cracks; ChipMOS & CHT Opportunities

- TSMC: +23% Premium; Has Broken Down from Historically High Level

- ChipMOS: -3.0% Discount; Good Level to Go Long the ADR Spread

- CHT: -1.1% Discount; Good Level to Go Long the ADR Spread

5. Himax (HIMX US): Silicon Photonics Becomes Strategic Imperative for Foundries, Reinforcing Long View

- Latest industry developments show silicon photonics becoming a must-have capability for leading foundries as AI bandwidth needs push the limits of traditional chip interconnect technology.

- Himax is well positioned as a key upstream supplier of CPO optical engines and nano-optics used in TSMC’s silicon-photonics packaging for next-generation NVIDIA platforms.

- Himax’s validated CPO roadmap, proprietary WLO nano-optics platform, and a 2026E-2028E commercialization timeline position the company well. We reiterate our Structural Long rating for Himax into 2026E.

6. Rohm (6963 JP): Renewed Growth, Conservative Guidance & Reasonable Valuation

- Sales are growing again and the company has turned profitable with capacity utilization up and costs down. Guidance for 2H of FY Mar-26 looks conservative.

- Sales of power devices is rising after a long period of weakness, supported by auto, industrial and data center related demand.

- Projected valuations are once again reasonable. The share price should continue to trend upwards.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 2026 (“Year of the Horse”) Major IPOs Pipeline in Asia

- In this insight, we provide a list of 50 prominent companies in Asia that could complete their IPOs in Asia in 2026 (excluding Korea).

- This report is meant to serve as a comprehensive, REFERENCE GUIDE to help clients get a broad view of the major IPOs that could get completed next year in Asia.

- Some of the most prominent potential IPOs in Asia next year include Reliance Jio, Kunlunxin, Shein, Flipkart, and Canva.

2. [Japan Offering] Significant Financial Crossholder Selldown in Okuma (6103)

- Okuma Corp (6103 JP) today announced a secondary offering of 5.0mm shares (including greenshoe) from a relatively large number of financial crossholders.

- That takes out about a third of them and not quite a quarter of the crossholders. There’s more to go. And the register remains “blocked”.

- It looks headed to retail but this stock is very low volatility and is likely to remain that way. A large buyback to start in January offsets the overhang here.

3. Pre-IPO JD Industrials – Thoughts on Valuation, IPO Pricing, and the Outlook

- Based on 2025 revenue forecast of RMB24.1bn and the IPO price range, P/S is about 1.28-1.56x, higher than ZKH but lower than Ww Grainger. This is a reasonable valuation range.

- The median IPO price range (HK$14.1/share) is a more likely/relatively safe outcome.This not only acknowledges JD Industrials’ leading position/growth story, but also partly reflects the market’s perception of its challenges.

- The IPO pricing is the result of seeking a balance between the “premium of industry leaders” and “its shortcomings”.However, future valuation depends on whether JD Industrials can solve fundamental issues.

4. HashKey Holdings Pre-IPO: Volatile Crypto Space, and Volatile Financials

- HashKey Digital Asset Group Lt (2365361D HK) is looking to raise at least US$200m in its upcoming Hong Kong IPO.

- It operates the largest licensed crypto exchange in Hong Kong.

- In this note, we look at the firm’s past performance.

5. ECM Weekly (8 December 2025) – SBI Shinsei, NS Group, Novosense, JD Industrial Meesho, 3SBio, Swiggy

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, busy season remains in full swing going into the year end.

- On the placements front, there were a few large deals and looked at some of the upcoming likely deals.

6. Medline Inc. (MDLN): Hospital Product & Supply Chain Company Sets Terms on Mega IPO, $5b+ Cash Raise

- Medline targets up to $5.4B in its IPO, the largest potential cash-raise since Rivian in 2021.

- Strong anchor and cornerstone commitments signal deep institutional support ahead of one of the year’s most anticipated offerings.

- Medline’s resilient, high-margin med-surg platform delivers consistent organic growth, reinforcing its profile as a mature, scaled issuer.

7. Okuma Corp Placement: Strong Financial Performance in Recent Period

- Sumitomo Mitsui Trust Bank, MUFG and others are looking to sell around US$104m of Okuma Corp (6103 JP) stock.

- This is a slightly large deal to digest, representing 13.2 days of three month ADV and 6.4% of outstanding stock.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Foshan Haitian Flavouring A/H IPO Lockup – US$500m Cornerstone Release

- Foshan Haitian Flavouring & Food Company (3288 HK), China’s leading condiments company, raised around US$1.5bn in its H-share listing. The lockup on its cornerstone investors is set to expire soon.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- In this note, we will talk about the lockup dynamics and possible placement.

9. ICICI Pru AMC IPO – Doesn’t Need to Trade at a Discount

- ICICI Prudential AMC is looking to raise about US$1.2bn in its upcoming India IPO.

- IPru AMC is an asset management company involved in managing mutual funds, providing portfolio management services, managing alternative investment funds, and providing advisory services to offshore clients.

- We have looked at the past performance in our previous note. In this note, we talk about the RHP updates and valuations.

10. Meesho Ltd IPO Trading – Robust Overall Demand

- Meesho (1546271D IN) raised around US$606m in its India IPO.

- Meesho is an e-commerce marketplace, offering a wide assortment of products ranging from low cost unbranded products, regional and national brands at affordable prices to consumers.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. AU Small Finance Bank (AUBANK IN): Increased FOL & Large Passive Flows/ Impact

- AU Small Finance Bank Limited (AUBANK IN) has received approval from the Ministry of Finance to increase its Foreign Ownership Limit from 49% to 74% (the maximum permitted).

- The increased FOL will result in passive inflows from global index trackers in February and March. The inflows are multiple days of ADV.

- There has been little increase in positioning. The increased Foreign Ownership Limit and the passive flows to come could lead to the stock moving higher over the next few weeks.

2. More Detailed Insight into Hynix’s Internal Situation Regarding the ADR Issue

- They’re maxing out M15X ahead of schedule, facing a fab gap until ’27, and now need more capex than their KRW 28tn cash pile comfortably covers.

- SK doesn’t want an Hynix ADR; they’re focused on tapping the KRW 150tn Growth Fund to fill the capex gap while avoiding dilution and protecting their already-fragile control stack.

- ADR noise spiked because Hynix’s near-term capex needs exceed Growth Fund capacity, pushing them toward a 2.4% treasury dump—but I still don’t see SK pulling the ADR trigger.

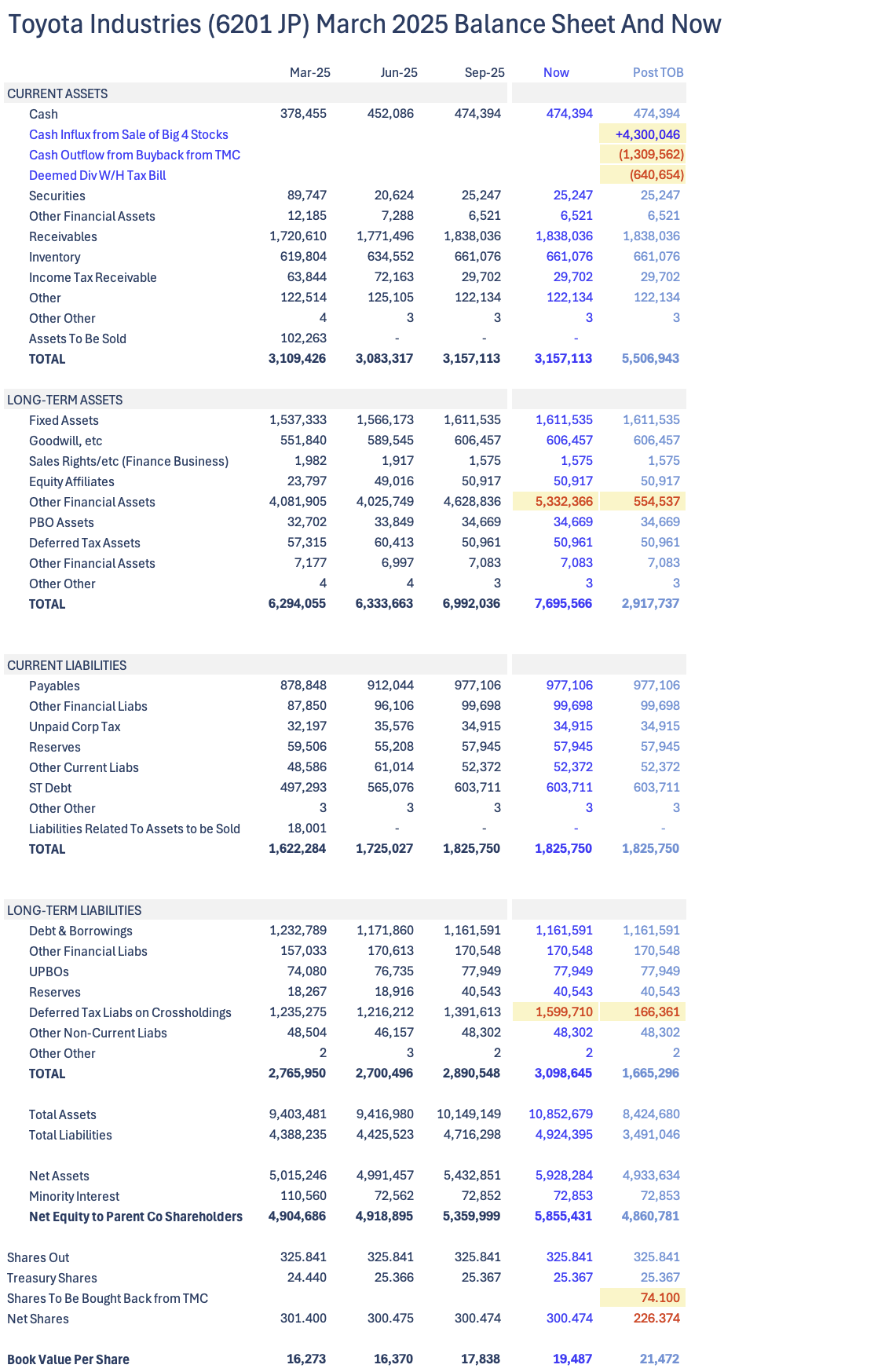

3. Toyota Industries (6201 JP): Elliott Ramps up the Pressure

- Elliott has filed a substantial shareholder notice reporting a Toyota Industries (6201 JP) ownership of 16.3 million or 5.01% of outstanding shares.

- The disclosure is likely a tactic to pressure Toyota Fudosan (offeror) and also a useful signalling tactic to other minorities that Elliott is committed to securing a bump.

- A potential bump could reach JPY19,000. While this would require an additional US$4 billion, financing should not be an issue as the book value (understated) is close to JPY18,000.

4. Makino Milling Machine (6135 JP): Tender Offer Risk/Reward

- Makino Milling Machine Co (6135 JP)’s pre-conditional tender offer from MBK Partners is at JPY11,751 per share. The gross spread has increased to 9.9% due to several concerns.

- The wide gross spread reflects the risk in satisfying the precondition, the fallout from the Homeplus saga and breaching the long stop date (16 January 2026).

- While these concerns have merit, there are mitigating factors. The risk/reward is favourable as the upside (9.9% spread) exceeds the downside (6.3% to my estimated deal break price).

5. Read-Through on the Samsung/Hynix ADR-Listing Noise

- ADR odds are tiny. Both Samsung and Hynix have thin control stakes, making governance risk too high. Neither is willing to chase a valuation pop at the expense of stability.

- Still can’t ignore it, since the ADR chatter is meaningfully swinging the pair trades. Samsung pref spread and Hynix/Square are both getting pushed around.

- ADR noise cooled today, but it can easily resurface and skew the setup. Treat as noise, but be ready to hit aggressive reversion trades when it pops again.

6. [Japan Activism/M&A] Activist Launches Partial Tender to Put Microcap Broadmedia (4347 JP) In Play

- Today after the close, Broadmedia Corp (4347 JP) announced that UK-based Japan activist AVI and one of its funds would launch a tender offer for just over 10% of shares.

- The Tender Offer comes at a 29.5% premium, and it would take the activist to ~40% – close to board-spilling influence.

- This creates an interesting setup. One wonders whether this is meant to spill the Board post-tender, and whether the Company will seek alternate solutions.

7. [Japan M&A] CEO & Chairman Entice GS to Sponsor an MBO for Recently Lackluster Raksul (4384)

- Raksul Inc (4384 JP) is a business roll-up business. They do printing, and advertising, and marketing, and supply. They want to be all things to all SMEs.

- They are pretty good at it. Revenues and EBIT have been growing at 20-30% a year for years, and are scheduled to grow 19% and 26% for several years ahead.

- The bid is up 40% from last, but that gets them to a 30-month high. The register is very open. Lots of active institutional shareholders who have to agree. Maybe.

8. A Potential Listing of ADRs for SK Hynix Using Its Treasury Shares?

- According to numerous local media, SK Hynix is considering on listing its treasury shares (2.4% of outstanding shares representing 17.4 million shares) as ADRs.

- SK Hynix could cancel its treasury shares or list them as ADRs. The bigger bang for the buck will likely be to list them as ADRs.

- By listing its shares as ADRs, the valuation gap between SK Hynix and other listed peers (such as MU and TSMC) could be reduced.

9. Strategy (MSTR US)’s Bitcoin Premium Evaporates. And Then Some

- Strategy (MSTR US)‘s market cap has for near-on five years, traded at a premium to its bitcoin holdings.

- The backbone of Strategy’s levered strategy is issue new shares or debt, acquire more bitcoins, which in turn, boost the share price. Rinse and repeat. Until the music stops.

- That market cap is now at its widest discount in five years. And chairman Michael Saylor scandalously mooted the company may sell some bitcoins IF the discount persists.

10. Hynix & Square L2 Flags Set to Squeeze Spread Near Term

- SK Hynix and SK Square hit L2 flags; cash-only until Dec 24. Margin off, >40% two-day rip triggers halt. L2 lifts if below T-5/+45%, T-15/+75%, and 15-day high.

- L2’s usually a non-event, but this time the margin freeze probably smacks Hynix harder. Key trigger is staying below the 15-day high: Hynix ₩587,000, Square ₩324,000.

- Govt set to roll out AI-semiconductor holdco deregulation this week, boosting AI holdcos like Square and juicing a near-term Square-over-Hynix trade opportunity.

Receive this weekly newsletter keeping 45k+ investors in the loop

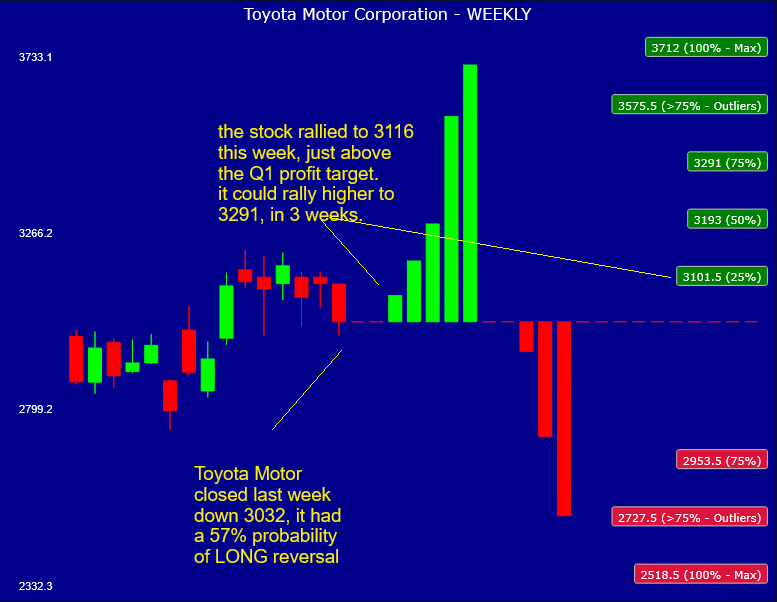

1. Toyota Motor (7203 JP) Tactical Outlook: Undervalued and Rising

- On October 21st we published an insight predicting Toyota Motor’s imminent pullback. The stock started to pullback the following week, the correction lasted for a few weeks.

- After last week’s weakness, Toyota Motor (7203 JP) is rallying again. There’s conflicting sentiment on valuation—some see it as undervalued.

- This insight presents a short-term tactical analysis with a bullisht target at 3291 (75% probability of seeing a new pullback after that target is reached).

2. HSI INDEX Tactical Outlook After the Dec 6 Rebalance

- The Hang Seng Index (HSI INDEX) rally has lost traction since mid-September. The index seems to be approaching a corrective phase.

- Our model signaled a modestly overbought state at the end of last week, but the index went down pretty fast this week: it has already breached the median support (25440).

- This insight will analyze the model to find support entry zones to play short-term rallies or to take profit from hedges.

3. Asian and US Stocks Tactical Outlook Before Fed Meeting

- A tactical snapshot of the Asian and US indices and stocks we cover.

- Many Asian and US stocks are getting overbought. Wednesday’s Fed meeting is a potential volatility trigger, consider hedging or short exposure.

- China Mobile (941 HK), Toyota Motor (7203 JP) , Amazon (AMZN US) are the only stocks a bit oversold, possibly worth considering for LONG trades, at the moment.

4. US Indices (SPX,NDX) Tactical Outlook After After the Fed’s Final Rate Cut

- The Fed cut rates this week—likely the last cut for an extended period—and moved into a wait-and-see stance / monitoring mode, to assess economic conditions ahead.

- Both the S&P 500 INDEX (SPX INDEX) and the Nasdaq-100 Stock Index (NDX INDEX) have suffered very high volatility this week, after the Fed decision, after several flat days.

- This insight will try to forecast what is the next probable direction for the two main US indices in the next few weeks.

5. Samsung Electronics (005930 KS) Tactical Outlook: The Stock Is OVERBOUGHT

- Back on October 24th we forecastedSamsung Electronics (005930 KS)‘s pullback. Samsung pulled back 1 week after, ended in the support BUY zone we predicted and rallied higher from there.

- Now, fast-forward to December 8th, Samsung Electronics (005930 KS) is getting very close to the previous top at 112,400. Our model says the stock is overbought.

- Double top? Not necessarily, but in the short-term the stock is about to pullback again. Our analysis tries to identify when the pullback can happen and where to enter LONG.

6. Hong Kong Single Stock Options Weekly (Dec 08–12): Late Support Emerges as Breadth and Volumes Slide

- Early weakness gave way to a late rebound, leaving HSI modestly lower on the week after a choppy but contained trading pattern.

- Breadth continued to deteriorate, with fewer than one third of optionable names finishing higher for a second consecutive week. Option volumes continue lower trend.

- Pop Mart stood out with a large increase in option volume after heavy selling to start the week.

7. Australia Single Stock Options (Dec 08–12): AS51 Escapes Range as Relative Performance Vs SPX Turns

- AS51 broke out of a tight multi day range Friday with one of the strongest moves of the year.

- Relative performance versus SPX has begun to improve, hinting at a potential shift after prolonged underperformance.

- SPASX200 1-month implied vol remains pinned near historic lows which could provide an interesting setup into year end.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Monetary Policy Tide Is Turning Up

- Markets are already pricing the return of rate hikes in 2026 for Canada, Australia and New Zealand, while policymakers elsewhere are starting to warn of the possibility.

- Transitional support to structural adjustments needs unwinding, as Canada signals most prominently. Broader activity resilience and inflation reveal the risk of overstimulation.

- The BoE already committed a policy mistake by easing too early, and is split by those recognising the persistent danger. Market pricing remains too dovish for 2026.

2. 2026 Politics: Nine Guesses & A Certainty

- In what promises to be another year fraught with uncertainty, politics and markets will again be dominated by the United States in general and Donald Trump in particular.

- Widely differing views of equity market prospects demonstrate this, i.e. the ‘bubble is about to burst’ doomsayers versus the bullish seeming consensus on Wall Street.

- However, the biggest challenge facing investors is focusing on what really matters amid the continuing ‘noise’ emanating from the Trump Administration in particular.

3. China Re-rooting Rather Than Dumping

- China’s rising export growth to Europe in November demonstrates base effects around a steady trend that predates US tariff increases. It isn’t about dumping.

- Avoidance measures remain rife, with transhipping through Vietnam not dented by the provisions in their US trade deal. Effective tariff rates aren’t rising belatedly.

- Profit-maximising companies still seem to be working around US measures, keeping the impact on inflation and growth smaller than many other economists feared.

4. HEW: Packing Festive Presents

- Another hawkish repricing occurred, despite little support from the Fed, although the six members favouring higher rates reveal hawkish discomfort beyond current voters.

- Trade with China is still avoiding the trade war well enough to prevent a massive shock, and UK GDP data kept following its residual seasonality rather than fundamental stories.

- It’s all happening next week as central banks and statistical authorities ram releases in before Christmas. Bailey’s bias to pivot should deliver a BoE cut while the ECB holds.

5. The Art of the Trade War: MUTUALLY ASSURED DISRUPTION

- The U.S. Administration has retreated from the heated rhetoric and trade initiatives at the beginning of its trade war. U.S. officials’ conciliatory approach to China starkly contrasts to earlier policies.

- Going into next year’s midterm elections, the Trump Administration will seek to maintain stable markets and downplay its global trade war, benefiting China.

- Taiwan will continue to present headline risks for markets as the influential neocons use the issue to stoke tensions toward a cold war against China.

6. Asian Equities: Valuation Leaderboard Reshuffle Driven by Market Reforms and Earnings Boost.

- Asia’s forward PE and P/BV peaked in late October and are moderating now. Korea, Taiwan, China rerated the most. But viewed against ROE, Korea looks cheaper than 6 months ago.

- Going by PE viewed against forward EPS growth and P/BV against forward ROE, the well-known conclusion – Korea cheap, India expensive – remains unaltered. Onshore China appears slightly overvalued now.

- Persistent initiatives to improve corporate governance are boosting Korea’s and Taiwan’s valuation. Upward revisions in earnings estimates are getting broad-based, indicating the commencement of improving earnings momentum.

7. US: Inflation Is Dead, Long Live Inflation!

- Without warning, the Fed announced it is restarting a substantial QE program under the pseudonym “Liquidity Management”. Starting immediately, it will purchase $40 billion in Treasuries per month.

- The Fed is using its concept of “ample reserves” to begin its monetary easing policy. Initiated following the 2008 GFC, the ample reserves monetary policy was formally adopted in 2019.

- This new QE program will increase already rising global inflation. Commodity prices are reflecting the anticipated higher inflation rates as the pace of declines in real rates is increasing.

8. A Healing Bull

- While the charts are signaling bull-bear indecision on the surface, technical signals favour a short-term bullish resolution for a rally into year-end and beyond.

- However, the Fed rate decision could be the source of market volatility next week.

- This is consistent with the seasonality pattern of a choppy first half of December, followed by a rally into year-end starting in mid-December.

9. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments -12 Dec 2025

Central banks in the United States, the Philippines, and India delivered rate cuts amid rising inflation pressures and mixed currency responses.

China’s exports rebounded, Japan’s household spending weakened, and Taiwan recorded exceptional AI driven trade growth.

Diverging economic trajectories highlighted inflation risks, export volatility, and the influence of technology related demand on regional performance.

10. Un-Tethered from reality?

The ‘year-end’ book squaring ahead of Thanksgiving caused a mid-month wobble around the November options expiry, which in turn caused some panic among leveraged traders, albeit not of the April variety.

The FOMO trades of unprofitable tech and everything Crypto related were hit particularly hard and while the $ briefly moved back above 100 on the trade weighted index, the pain trade at the broader market level appeared to have gone by end month.

A Rip Van Winkle analysis of November would have concluded that nothing much happened, but a lot did.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NVIDIA Invests $2 Billion In Synopsys. But Why?

- NVIDIA & Synopsys announced a new strategic partnership on Dec 1, mostly covering topics they were already strategically partnering on, with one exception, Cloud-Ready Solutions

- The partnership sees NVIDIA purchase $2 billion worth of Synopsys stock in a private placement. Other, recent, similar strategic partnerships e.g. Siemens & GM, involved no such investment

- They plan to start enabling cloud access for GPU-accelerated engineering solutions. Could this be where that $2 billion finds a home? Is this a new Neocloud in disguise? Let’s see

2. Intel (INTC.US): Apple M-Series in 2027; Intel 18A Is the Key.

- Apple (AAPL US) may outsource iPad CPU production to Intel in 2027.

- U.S. semiconductor reshoring faces fundamental structural barriers, and Trump is trying to blame this by pushing TSMC to move advanced manufacturing technology to the U.S.

- The key variable remains Intel’s 18A execution. However, Intel’s current CEO, Lip-Bu Tan, has not demonstrated an aggressive stance so far.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Mao Geping IPO Lockup – US$4.7bn Lockup Release for Founders and Pre-IPO Investors

- Mao Geping Cosmetics (1318 HK) raised around US$345m in its Hong Kong IPO. The lockup on its founders and pre-IPO investors is set to expire soon.

- Mao Geping Cosmetics (MGC) operates in the premium beauty segment. Via its two brands, MAOGEPING and Love Keeps, the firm offers a wide range of Color cosmetics and Skincare products.

- In this note, we will talk about the lockup dynamics and possible placement.

2. [Japan IPO] The SBI Shinsei Bank (8303 JP) IPO; Cosmetically Pretty, Otherwise Meh

- The SBI Shinsei Bank (8303 JP) IPO is due to be priced on 8 December and start trading on 17 December 2025.

- I have been reluctant to write because of my general lack of excitement regarding the IPO and its after-market prospects. It is, as a friend says, “neither here nor there.”

- But as the bank was my High Conviction Long trade for 2021, 2022, and 2023 and I wrote about the events in the interim, I thought I should opine.

3. SBI Shinsei Bank IPO – Stronger Support, Decent Valuation

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2.1bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- We looked at the company’s past performance in our earlier note. In this note, we talk about valuations.

4. SBI Shinsei Bank (8303 JP) IPO: Price Range Is Attractive

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, has set an IPO price range of JPY1,440 to JPY1,450 per share compared to the reference price of JPY1,440.

- I discussed the relisting in SBI Shinsei Bank (8303 JP) IPO: The Investment Case and SBI Shinsei Bank (8303 JP) IPO: Valuation Insights.

- The relisting has attracted solid interest from several investors. The peers have modestly re-rated, and the IPO price range is attractive.

5. JD Industrials IPO – Valuation Cut Means Its Priced to Go

- JD Industrials (7618 HK) is now looking to raise up to US$421m, in its Hong Kong IPO.

- JDI is a leading industrial supply chain technology and service provider in China in terms of GMV in each year during the Track Record Period, according to CIC.

- We looked at the company’s past performance in our earlier notes. In this note, we talk about valuations.

6. UltraGreen.ai IPO Trading: Attractive Pricing, Strong Tailwinds

- UltraGreen.AI (2594794D SP) raised around US$400m in its Singapore IPO.

- UltraGreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- We have looked at the company’s background and pricing in our earlier note, in this note we talk about the trading dynamics.

7. Pre-IPO JD Industrials (PHIP Updates) – Business Model, Peer Comparison, Forecast and Valuation

- JD Industrials’ business model integrates the advantageous resources of JD Group and follows “self-operated heavy asset” route.The operation model is to rely on JD Logistics network to achieve efficient performance.

- The platform’s openness of JD Industrials is relatively limited. The entry and listing thresholds for merchants are higher than that of peers, which limits the rapid expansion of product richness.

- P/S is more appropriate because net profit fluctuates greatly and is more suitable for growth-oriented supply chain companies.JD Industrials’ valuation could be higher than ZKH but lower than Ww Grainger.

8. NS Group IPO – Deal Downsized; Pricing Looks Digestible Now

- NS Group (471A JP) (NSG) is one of Japan’s leading rent guarantee service providers, offering payment guarantee and rent collection solutions to property owners and management companies.

- NSG aims to raise around US$220m in its Japan IPO via an entirely secondary offering, marking Bain Capital’s full exit from the company.

- In our previous note, we looked at the firm’s past performance and peer comparison. In this note, we talk about the pricing updates and IPO valuations.

9. 3SBio Placement: Partnership with Pfizer Going Well; Digestible Deal

- 3SBio Inc (1530 HK) is looking to raise around US$400m from a primary placement.

- The deal is a small one, representing 2.9 days of the stock’s three month ADV, and 3.9% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

10. Meesho IPO: Garmenting a Mass Market Play for Long-Term Growth

- Meesho IPO will comprise a fresh issue of INR42.5B, and an OFS of 105.5M shares. The price band of the IPO has been fixed between INR105 and INR111 per share.

- Meesho’s IPO will open for subscription on Wednesday, December 3 and close on Friday, December 5. The IPO is scheduled to list on the stock exchanges on Wednesday, December 10.

- Meesho intends to utilize IPO proceeds for investment for cloud infrastructure, paying salaries of technology team, marketing and brand building initiative, and acquisition. The IPO is suitable for risk-seeking investors.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan M&A] Toyota Inds (6201) – Process ALWAYS Bad, Price Bad To Worse; Easily Worth ¥20k+

- In April there was a story suggesting Toyota Group would buy out Toyota Industries (6201 JP). In June, they announced a deal. It was a BAD DEAL.

- The price was low, but it was BAD governance because it was the WRONG DEAL. TICO’s Board declared a valuation fair for a deal not announced, ignoring the ACTUAL DEAL.

- The valuation? Assumed no changes to the business. Actual deal? Sell 90+% of net assets driving 50% of net income, buy back 24+% of shares at discount.

2. [Japan Partial Tender] AEON (8267) Partial Offer for TSURUHA (3391) Announced at ¥2,900/Share

- Tsuruha Holdings (3391 JP) had been planning to release a Medium Term Management Plan this month BUT stock prices are higher, goodwill effects changed, so they announced a “Vision” instead.

- Today post-close, Aeon Co Ltd (8267 JP) announced its Partial Tender Offer on TSURUHA (Japanese) at ¥2,900/share. Slightly lower than hoped. Much better than before.

- AEON obviously really did not want to bump, but they did, considering synergies and the desire to consummate the deal. The Tender Offer shrinks so minimum pro-ration is lower.

3. [Japan M&A] Possible Partial TSURUHA (3391 JP) Tender Changes – More Accretion! Smaller Tender?

- Today, post-close of its first day of trading as MergeCo, Tsuruha Holdings (3391 JP) announced 12 different investors who had voted against the deal filed for dissenting shareholder share repurchase.

- This covers 27.154mm shares – a bit more than what Orbis owned when they last filed (25.5mm shs) and is just over half the AGM dissension.

- This creates some weirdness. A 5+% buyback is strong accretion, but “fair price” is a question, and it could mean smaller tender offer quantity and larger eventual index selldowns.

4. ANE Cayman (9956 HK): Q&A With The FA

- On the 28th October, ANE Cayman Inc (9956 HK), a road freight transportation play, announced a Scheme from Centurium Partners, a pre-IPO investor, Temasek, and Singapore-based asset manager True Light.

- The consortium offered HK$12.18/share, a 48.54% premium to undisturbed. A special dividend was bolted on. All pre-cons, including SAMR’s approval, have been satisfied. Scheme Doc dispatch expected on/before 31st December.

- I had a number of questions concerning the transaction, and yesterday pinned down a one-on-one with the FA to the Offeror.

5. Tsuruha (3391 JP): Aeon (8267 JP) Bumps Its Partial Tender Offer to JPY2,900

- Tsuruha Holdings (3391 JP) announced a partial tender offer from Aeon Co Ltd (8267 JP) at JPY2,900, a 27.2% premium over the previously stated offer price of JPY2,280.

- Aeon will acquire a maximum (upper limit) of 43.2 million shares (9.52% ownership ratio) such that it attains a 50.90% ownership ratio. There is no lower limit.

- The offer is above the midpoint of the IFA DCF valuation range and marginally below the JPY3,100 price Aeon paid in 2024 to acquire Oasis’ stake.

6. StubWorld: Don’t Sell Toyota Inds (6201 JP) – Buy More

- At ¥17,340/share, Toyota Industries (6201 JP) is cheap. Corporate governance supporting this deal is shocking. In Travis Lundy‘s words: “Stay long. Buy more. And make some noise.”

- Preceding my comments on Toyota are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

7. Dongfeng (489 HK): Revisiting VOYAH’s Spin-Off Valuation

- Back on the 22nd August 2025, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH. The two proposals are interconditional.

- In its October application proof, VOYAH turned a profit in 7M25. The market was implying a price-to-trailing-sales of 1.5x for VOYAH, versus the basket average of 2.1x. It’s now ~1.2x.

- Key PRC reg approvals (Mofcom/NDRC/SAFE) remain outstanding. Meanwhile, a basket of peers are down 21% since the dual proposals were announced. And their average price-to-trailing-sales are down to 1.7x.

8. A Review of Tender Offers in Korea in 2025

- In this insight, we review the major tender offers of Korean companies in 2025. Some of the major M&A tender offers in 2025 include HMM, Kolon Mobility Group, and VIOL.

- The tender offers have mostly been profitable for the investors in these targeted companies (especially those shareholders who owned these shares prior to the tender offer announcement).

- What is also impressive is that even after the 1st day of trading (post tender offer announcement), there have been extra alpha for the following week.

9. Korea’s 4th Policy Trade Is Right Around the Corner: Mandatory Tender Offers

- The next policy swing is mandatory tender offers (MTO), with the gov’t + ruling party pushing for passage this session, likely alongside the mandatory treasury-share cancellation.

- 2022 FSS/FSC 50%+1 trigger scrapped; 25% stays. Ruling party favors 50%+ MTO, base case 100%, but pushback may reduce to 70–80%.

- MTOs tighten discounts, benefit minority holders; focus on local holding firms, PE-backed exits, and parent-driven M&A prospects.

10. ANE (9956 HK): Precondition Satisfied

- The precondition for the consortium’s privatisation offer for ANE Cayman Inc (9956 HK) has been satisfied. The right to increase the share alternative cap was also satisfied.

- The consortium has until 12 December to decide whether to increase the share cap. The option helps the consortium gain support from shareholders who would not accept the cash offer.

- The scheme vote remains low risk, as the offer is attractive relative to historical ranges and peer multiples. The de-rating of peers is also helpful.

Receive this weekly newsletter keeping 45k+ investors in the loop

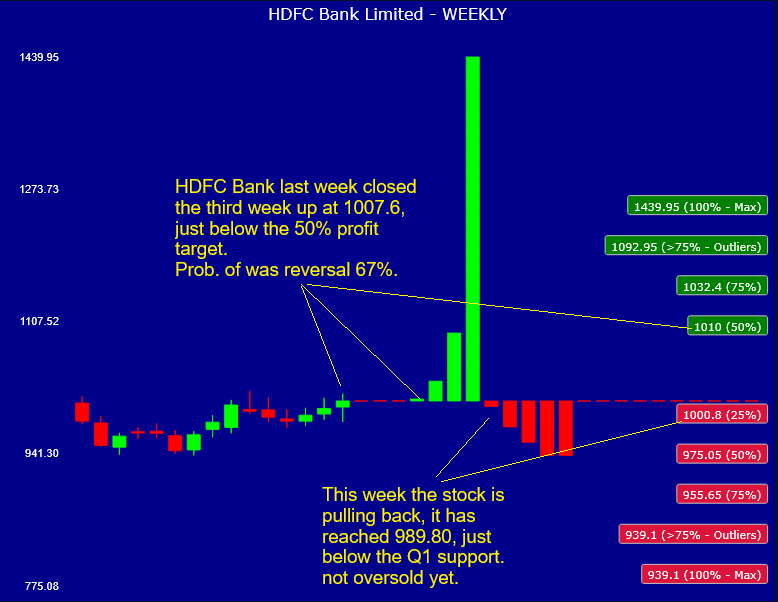

1. HDFC Bank (HDFCB IN): Tactical Outlook Post–NIFTY Bank Index Overhaul

- Brian Freitas has discussed in a recent insight the methodology changes for the NSE Nifty Bank Index that will be implemented starting from December 30.

- HDFC Bank (HDFCB IN) is one of the two stocks that passive trackers need to sell (the other is ICICI Bank Ltd).

- HDFC Bank (HDFCB IN) is falling this week, so we analyze our model’s WEEKLY support entry zones, to evaluate how much HDFC Bank can fall, for hedging or re-entry purpose.

2. [2026 High Conviction] Korean Mega Cap Investment: Samsung’s $310B Tech Spend, the AI-Momentum Trade

- Samsung is positioned as a global hub for the AI Supercycle, driven by a pivot to memory technology, and evidenced by a KRW 450T ($310 billion) local investment plan.

- The Device Solutions division’s Q3 2025 rebound (sales +19% sequentially) and an estimated 43.4% Fwd 2-Yr EPS CAGR support potential upside for the stock

- The company has demonstrated a commitment to enhancing shareholder value by completing its 10T share repurchase program ahead of schedule and maintaining a consistent annual dividend payout through 2026.

3. 2026 High Conviction – Japan’s Triple Play: How PBR Reform, AI, and Banks Unlock Alpha

- Sustained pressure from the JPX initiative targeting firms trading below P/B is forcing enhanced capital returns (buybacks and dividends), creating opportunity across both indices.

- BoJ’s shift to a positive rate environment is fundamentally restoring Net Interest Income and profitability to the Financials sector, positioning the TOPIX, in particular, for outperformance.

- AI/Tech Sector Dominance: The Nikkei 225 is driven by high-tech firms. This concentration, led by high-priced high weighted stocks like Advantest and Softbank Group, provides high-beta AI exposure

4. Hong Kong December 2025 Monthly Covered Call Report

- Top Hong Kong Stock Exchange listed covered call candidates for the month of December.

- The top 10 provide an average ~6.9% premium with a potential ~8.4% upside P&L if exercised.

- Investors with a neutral 1-month view on the underlying can seek to generate income.

5. NVDA Tactical Outlook: Time to BUY?

- NVIDIA Corp (NVDA US) started correcting at the end of October 2025. At the same time, in early November, SoftBank Group announced it was unloading all its NVDA stake.

- SoftBank founder Masayoshi Son, speaking at an investment forum in Tokyo Monday, revealed he was reluctant to sell SoftBank’s Nvidia stake, but needed to raise cash for new AI investments.

- Both companies are very oversold according to our models, NVDA has reached a point where is a good BUY, we present here a new analytics tool, to support this theory.

6. Bitcoin Tactical Outlook After The -35% Drop

- Bitcoin has been selling off since early October 2025 and reached a -35% loss around November 20, then bounced back, the rally is currently ongoing.

- Our focus is always short-term and in this insight we will try to analyze how far the current BTC-USD spot rally can go before a new sell-off begins.

- The alternate hypothesis is that the current downturn is merely a sharp, tactical correction within a larger secular bull market. Under this interpretation, the pullback could be a buying opportunity.

7. Hong Kong Single Stock Options Weekly (Dec 01 – 05): Narrow Range, Low Vols and Weaker Put Flow

- Quiet trade across Hong Kong Single Stock this week with HSI’s weekly range near the lows of the year.

- Implied vols were mixed and are still clinging to the lowest levels of the year.

- Options activity lower week over week, led by declines in Put trading.

8. Macro Monthly (December): Seasonal Strength, Vol Selling Edges and a Notable Nifty Setup

- December seasonals across major markets show a generally positive profile, but the path is uneven, with most gains clustering in the final days of the month.

- Several markets offer appealing vol selling setups, particularly those with consistently positive December vol premiums and elevated implied levels relative to past outcomes.

- Nifty vol appears attractively priced, but its tendency not to monetize in December requires traders to think differently about how they extract value.

9. Australia Single Stock Options (Dec 01 – 05): Narrow Range and Mixed Implieds

- Very quiet trading this week with a weekly closing range near the lows for the year.

- Breadth deteriorated from last week’s elevated readings as the market tries to push higher.

- Quiet earnings calendar with only six companies issuing earnings reports in the coming week.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HEM: Dec-25 Views & Challenges

- Volatile markets and policy guidance washed out, with pricing and forecasts little changed on the month.

- Bailey is biased to ease, but the BoE is awakening to its inflation problem. It should cut less than dovishly priced.

- Higher unemployment could move beyond a structural shift from policy to signal a less elevated neutral rate.

2. BoE Survey Says Stagflation Survives

- CFOs keep telling the BoE their prices will rise by 3.5% in 2026, with wage increases similarly substantial. There has been no significant break lower in over 18 months.

- Employment plans have also deteriorated, lending some support to the dovish case as well. But this side is an unreliable signal, while inflation has proved brutally accurate.

- Doves need the employment aspect to be true, but the transmission to prices not to be. This survey signals upside inflation risks that should discourage rate cuts in 2026.

3. HONG KONG ALPHA PORTFOLIO: (November 2025)

- The Hong Kong Alpha portfolio returned -2.89% in November versus +1.72% for its benchmark index. The HK Alpha portfolio has outperformed Hong Kong indexes by 33% to 45% since inception.

- The portfolio continues to generate 57% of its returns from alpha (idiosyncratic returns) while maintaining a Sharpe ratio of 2.19 YTD.

- We have sold positions in the materials and industrials sectors and added positions in telecom, gold, and insurance industries at the end of November.

4. HEW: Easing Before The Festive Storm

- The BoE FPC cut capital requirements in a surprise macroprudential easing that adds to the less-tight fiscal policy to lessen the need for BoE rate cuts, but one is coming.

- UK CFOs reveal no progress in breaking excessive inflation expectations for 18 months, EA inflation surprisingly rose, and the worst PMIs improved as resilience broadened.

- Another Fed cut is firmly priced, setting it up to be delivered, but members are likely to dissent against it and remain cautious in only forecasting one more cut in 2026.

5. Activity Thaws Into Winter

- The worst services PMIs thawed in November, broadening growth even as averages held steady. Activity in the US services ISM has trended up to exceed the PMI data now.

- A slight fading of stagflationary pressures in the latest US surveys probably balances out in the Fed’s policy trade-off. We still fear that it is easing excessively.

- Rising unemployment rates in the US and UK are concerns not experienced in most of the world. This theme feeds their recent divergence from the global surprise tendency.

6. Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement

- Korean government is likely to increase the mandatory tender offer from current 50% + 1 share requirement (minimum majority stake) to much higher levels (but below the maximum 100% requirement).

- There is an increasing probability that indeed the Korean government is likely to increase the minimum majority stake requirement to 60% to 75% of total shares in 1H26.

- If the minimum maximum stake rises to 60%-75% of outstanding shares, this would have a further beneficial impact on the minority shareholders.

7. Asian Equities: Southbound Zeal Dips; Some Established Themes Looking Tired, Others Rejuvenated.

- From the superlative September (US$24.2 bn net buy), onshore investors’ net Southbound buying dipped in October (US$11.9 bn) and November (US$15.7 bn). Xiaomi, Alibaba, PopMart and Meituan were bought most.

- The most sold stocks during October-November were SMIC, Hua Hong Semi, Innovent Biologics. Enthusiasm for semiconductor and biotech seems to be cooling off, though we believe biotech focus should revive.

- Investors’ sustained preference is for stocks catering to domestic consumption that are able to adopt AI to improve productivity and expand their cash-generating businesses. Internet platforms fall in this silo.

8. Late-Cycle Tension: Rising Volatility Signals a Critical Market Inflection into 2026

- US equities triggered key reversal signals as market breadth deteriorated, crowded AI leaders unwound, and indexes broke trend support, elevating near-term downside risk.

- Macro uncertainty, tighter liquidity, and shifting investor psychology are pressuring high-liquidity growth assets, while gold and quality balance-sheet exposures provide relative resilience.

- Multiple late-cycle timing models align into early 2026, raising the probability of episodic volatility and making disciplined positioning, selective risk-taking, and tactical hedging essential.

9. Asian Equities: Stupendous FII Selling in November; Long-Term Study Foreshadows Structural Recovery.

- In November, FIIs sold a stupendous US$22 bn Asian equities, the second highest in the past 6 years. Bulk of it was in Korea (US$9.7 bn) and Taiwan (US$12 bn).

- Concerns about sustainability of AI capex and doubts about Fed rate trajectory were the key drivers of FIIs’ worries. The latter also depressed the Asian currencies.

- Study of last 6 years cumulative buying/selling reveals massive selling in Taiwan/Korea. Flows in these markets should recover the most as FIIs play catch-up. India is a more difficult call.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 5 Dec 2025

United States shows deepening slowdown with weak ISM manufacturing, falling employment, and declining private payrolls, signaling rising recession risk.

India and China exhibit relatively constructive economic prospects, contrasting with softness in advanced economies.

Asian indicators are mixed, with Indonesia struggling on trade and Hong Kong retail sales recovering gradually but remaining below pre-COVID levels.