This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

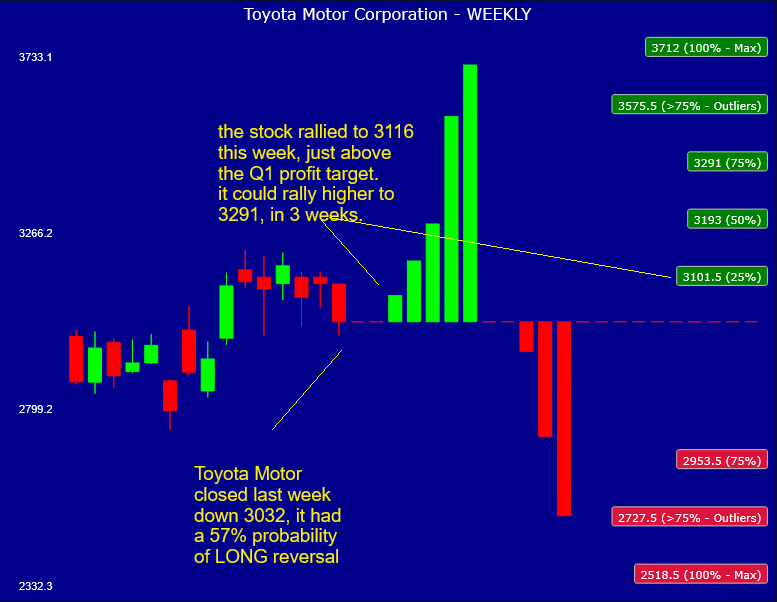

1. Toyota Motor (7203 JP) Tactical Outlook: Undervalued and Rising

- On October 21st we published an insight predicting Toyota Motor’s imminent pullback. The stock started to pullback the following week, the correction lasted for a few weeks.

- After last week’s weakness, Toyota Motor (7203 JP) is rallying again. There’s conflicting sentiment on valuation—some see it as undervalued.

- This insight presents a short-term tactical analysis with a bullisht target at 3291 (75% probability of seeing a new pullback after that target is reached).

2. HSI INDEX Tactical Outlook After the Dec 6 Rebalance

- The Hang Seng Index (HSI INDEX) rally has lost traction since mid-September. The index seems to be approaching a corrective phase.

- Our model signaled a modestly overbought state at the end of last week, but the index went down pretty fast this week: it has already breached the median support (25440).

- This insight will analyze the model to find support entry zones to play short-term rallies or to take profit from hedges.

3. Asian and US Stocks Tactical Outlook Before Fed Meeting

- A tactical snapshot of the Asian and US indices and stocks we cover.

- Many Asian and US stocks are getting overbought. Wednesday’s Fed meeting is a potential volatility trigger, consider hedging or short exposure.

- China Mobile (941 HK), Toyota Motor (7203 JP) , Amazon (AMZN US) are the only stocks a bit oversold, possibly worth considering for LONG trades, at the moment.

4. US Indices (SPX,NDX) Tactical Outlook After After the Fed’s Final Rate Cut

- The Fed cut rates this week—likely the last cut for an extended period—and moved into a wait-and-see stance / monitoring mode, to assess economic conditions ahead.

- Both the S&P 500 INDEX (SPX INDEX) and the Nasdaq-100 Stock Index (NDX INDEX) have suffered very high volatility this week, after the Fed decision, after several flat days.

- This insight will try to forecast what is the next probable direction for the two main US indices in the next few weeks.

5. Samsung Electronics (005930 KS) Tactical Outlook: The Stock Is OVERBOUGHT

- Back on October 24th we forecastedSamsung Electronics (005930 KS)‘s pullback. Samsung pulled back 1 week after, ended in the support BUY zone we predicted and rallied higher from there.

- Now, fast-forward to December 8th, Samsung Electronics (005930 KS) is getting very close to the previous top at 112,400. Our model says the stock is overbought.

- Double top? Not necessarily, but in the short-term the stock is about to pullback again. Our analysis tries to identify when the pullback can happen and where to enter LONG.

6. Hong Kong Single Stock Options Weekly (Dec 08–12): Late Support Emerges as Breadth and Volumes Slide

- Early weakness gave way to a late rebound, leaving HSI modestly lower on the week after a choppy but contained trading pattern.

- Breadth continued to deteriorate, with fewer than one third of optionable names finishing higher for a second consecutive week. Option volumes continue lower trend.

- Pop Mart stood out with a large increase in option volume after heavy selling to start the week.

7. Australia Single Stock Options (Dec 08–12): AS51 Escapes Range as Relative Performance Vs SPX Turns

- AS51 broke out of a tight multi day range Friday with one of the strongest moves of the year.

- Relative performance versus SPX has begun to improve, hinting at a potential shift after prolonged underperformance.

- SPASX200 1-month implied vol remains pinned near historic lows which could provide an interesting setup into year end.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

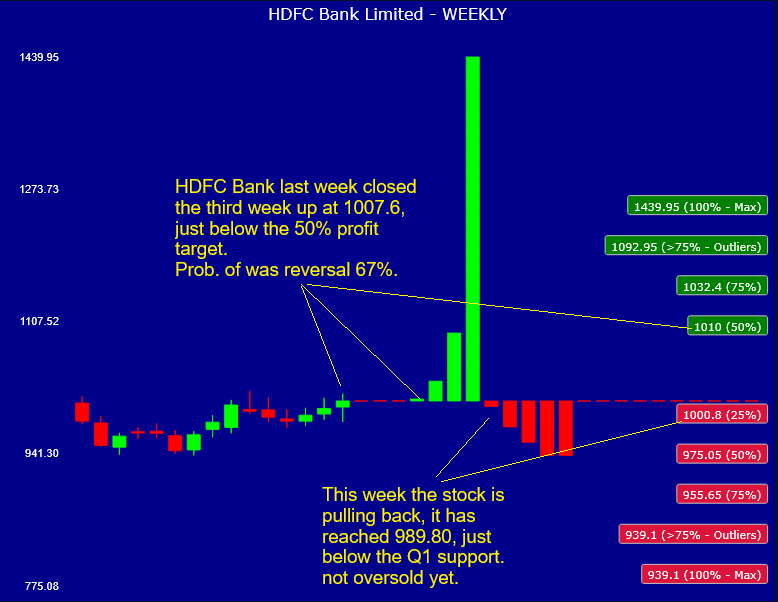

1. HDFC Bank (HDFCB IN): Tactical Outlook Post–NIFTY Bank Index Overhaul

- Brian Freitas has discussed in a recent insight the methodology changes for the NSE Nifty Bank Index that will be implemented starting from December 30.

- HDFC Bank (HDFCB IN) is one of the two stocks that passive trackers need to sell (the other is ICICI Bank Ltd).

- HDFC Bank (HDFCB IN) is falling this week, so we analyze our model’s WEEKLY support entry zones, to evaluate how much HDFC Bank can fall, for hedging or re-entry purpose.

2. [2026 High Conviction] Korean Mega Cap Investment: Samsung’s $310B Tech Spend, the AI-Momentum Trade

- Samsung is positioned as a global hub for the AI Supercycle, driven by a pivot to memory technology, and evidenced by a KRW 450T ($310 billion) local investment plan.

- The Device Solutions division’s Q3 2025 rebound (sales +19% sequentially) and an estimated 43.4% Fwd 2-Yr EPS CAGR support potential upside for the stock

- The company has demonstrated a commitment to enhancing shareholder value by completing its 10T share repurchase program ahead of schedule and maintaining a consistent annual dividend payout through 2026.

3. 2026 High Conviction – Japan’s Triple Play: How PBR Reform, AI, and Banks Unlock Alpha

- Sustained pressure from the JPX initiative targeting firms trading below P/B is forcing enhanced capital returns (buybacks and dividends), creating opportunity across both indices.

- BoJ’s shift to a positive rate environment is fundamentally restoring Net Interest Income and profitability to the Financials sector, positioning the TOPIX, in particular, for outperformance.

- AI/Tech Sector Dominance: The Nikkei 225 is driven by high-tech firms. This concentration, led by high-priced high weighted stocks like Advantest and Softbank Group, provides high-beta AI exposure

4. Hong Kong December 2025 Monthly Covered Call Report

- Top Hong Kong Stock Exchange listed covered call candidates for the month of December.

- The top 10 provide an average ~6.9% premium with a potential ~8.4% upside P&L if exercised.

- Investors with a neutral 1-month view on the underlying can seek to generate income.

5. NVDA Tactical Outlook: Time to BUY?

- NVIDIA Corp (NVDA US) started correcting at the end of October 2025. At the same time, in early November, SoftBank Group announced it was unloading all its NVDA stake.

- SoftBank founder Masayoshi Son, speaking at an investment forum in Tokyo Monday, revealed he was reluctant to sell SoftBank’s Nvidia stake, but needed to raise cash for new AI investments.

- Both companies are very oversold according to our models, NVDA has reached a point where is a good BUY, we present here a new analytics tool, to support this theory.

6. Bitcoin Tactical Outlook After The -35% Drop

- Bitcoin has been selling off since early October 2025 and reached a -35% loss around November 20, then bounced back, the rally is currently ongoing.

- Our focus is always short-term and in this insight we will try to analyze how far the current BTC-USD spot rally can go before a new sell-off begins.

- The alternate hypothesis is that the current downturn is merely a sharp, tactical correction within a larger secular bull market. Under this interpretation, the pullback could be a buying opportunity.

7. Hong Kong Single Stock Options Weekly (Dec 01 – 05): Narrow Range, Low Vols and Weaker Put Flow

- Quiet trade across Hong Kong Single Stock this week with HSI’s weekly range near the lows of the year.

- Implied vols were mixed and are still clinging to the lowest levels of the year.

- Options activity lower week over week, led by declines in Put trading.

8. Macro Monthly (December): Seasonal Strength, Vol Selling Edges and a Notable Nifty Setup

- December seasonals across major markets show a generally positive profile, but the path is uneven, with most gains clustering in the final days of the month.

- Several markets offer appealing vol selling setups, particularly those with consistently positive December vol premiums and elevated implied levels relative to past outcomes.

- Nifty vol appears attractively priced, but its tendency not to monetize in December requires traders to think differently about how they extract value.

9. Australia Single Stock Options (Dec 01 – 05): Narrow Range and Mixed Implieds

- Very quiet trading this week with a weekly closing range near the lows for the year.

- Breadth deteriorated from last week’s elevated readings as the market tries to push higher.

- Quiet earnings calendar with only six companies issuing earnings reports in the coming week.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

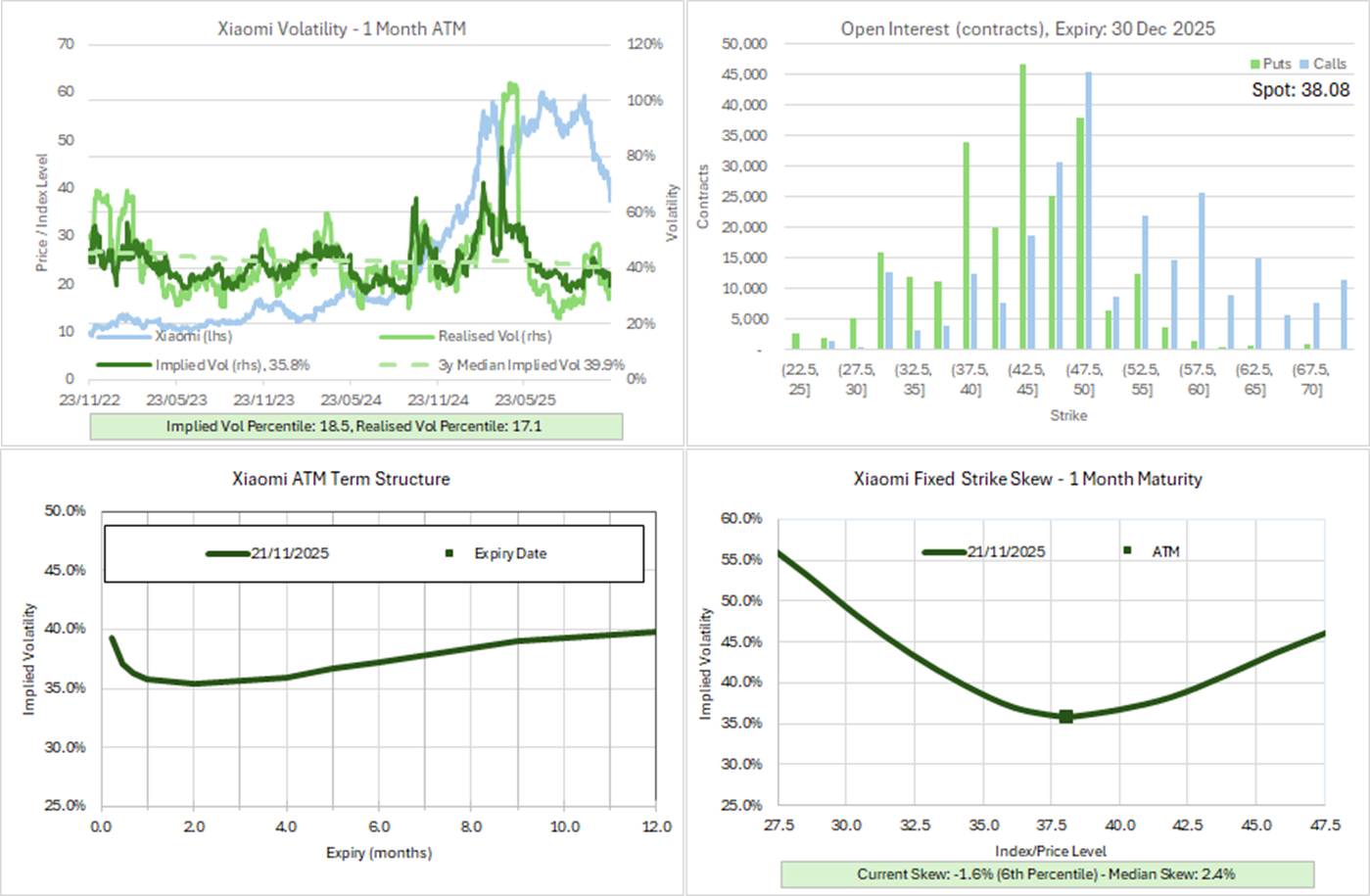

1. Xiaomi (1810 HK): Top Trades Bet on a Bullish Trend Reversal

- Context: Over the past five trading days, Xiaomi (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: 55% of strategies exhibit a bullish bias, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

2. SoftBank (9984 JP) Tactical Outlook: Extremely Oversold After -11% Plunge

- Softbank Group (9984 JP) crashed nearly -11% between Thursday and Friday close, reaching deeply oversold extremes.

- Softbank Group has declined for three consecutive weeks, posting a cumulative -37% correction over this period.

- Softbank Group‘s entry into the Outliers zone suggests an extreme oversold condition—potentially creating a tactical long setup for risk-tolerant traders.

3. ALIBABA (9988.HK) Earnings: Option Market Expectations and Post-Release Price Behavior

- Alibaba will announce Q2 earnings on after the market close (HK time) November 25.

- Earnings implied jump pricing is similar to the last release, but recent downside skew in past Q2 moves highlights why traders may focus more on potential weakness.

- Recent market patterns, including muted reactions to beats and sharp responses to misses, add weight to risks around Baba’s earnings day move.

4. Comparing the Singapore Next 50 to Its Regional Peers: An Asia Portfolio Context

- This insight compares the iEdge Singapore Next 50 Index with regional next-tier indices, focusing on methodology, sector composition, and historical performance.

- Combining flagship and next-tier indices can broaden sector exposure and balance within an Asia-focused equity portfolio.

- A volatility-driven allocation strategy is presented, showing that dynamic mid-cap exposure can help moderate drawdowns and enhance returns during market cycles.

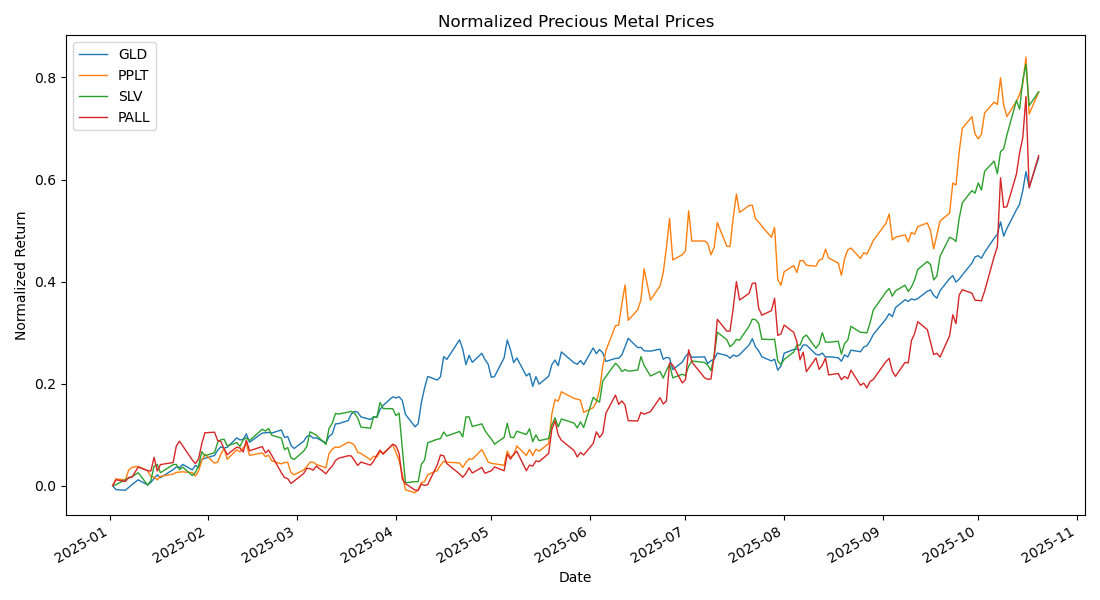

5. GOLD Tactical Outlook: Profit Targets for December 2025

- Gold (GOLD COMDTY) this week has resumed its uptrend after a brief, shallow setback in mid-November.

- This insight will analyze our Gold Futures Dec 25 model to determine profit targets that could be reached in the next 3 weeks (in December 2025).

- Range: Gold could reach again previous highs, in December, while if it goes down it could reach the 3933 support zone.

6. Asian Stocks Tactical Outlook (Week Nov 24 – Nov 28)

- A tactical snapshot of the Asian indices and stocks we cover.

- Many Asian stocks we track are flashing very oversold signals—creating tactical long setups worth considering.

- We find no overbought stocks or indices in Asia at present. US equities are aligned with this view, this is a global market pullback, probably about to end.

7. TSMC (2330 TT) Tactical Outlook After November’s Pullback: Further Downside Risk Remains

- TSMC (Taiwan Semiconductor Manufacturing) (2330 TT) delivered stellar returns this year, but after peaking in early November and pulling back all month, we see downside risk persisting.

- We hypothesize the current rally may be a bear rally. If correct, our models indicate TSMC has nearly depleted this rebound and downside risk looms.

- If we are wrong, TSMC could continue this rally to 1483-1581, the details as always are discussed in the insight.

8. Tencent (700 HK): Top Option Trades Reveal a Split in Market Sentiment

- Context: Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Market sentiment is evenly balanced between bullish and bearish strategies, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

9. A Global Portfolio Inflation-Stagflation Hedge: Gold and NK Index Volatility

- Gold’s outlook is strongly supported by a dovish Federal Reserve, structural de-dollarization trends, and increasing central bank demand for a strategic stagflation hedge.

- The Nikkei 225’s high is vulnerable to concentrated risk in the technology sector and geopolitical volatility, necessitating a tactical approach to portfolio protection.

- Deep dive into a two-part portfolio-defensive structure, pairing a strategic long-term inflation asset with a short-term volatility hedge on a key equity index.

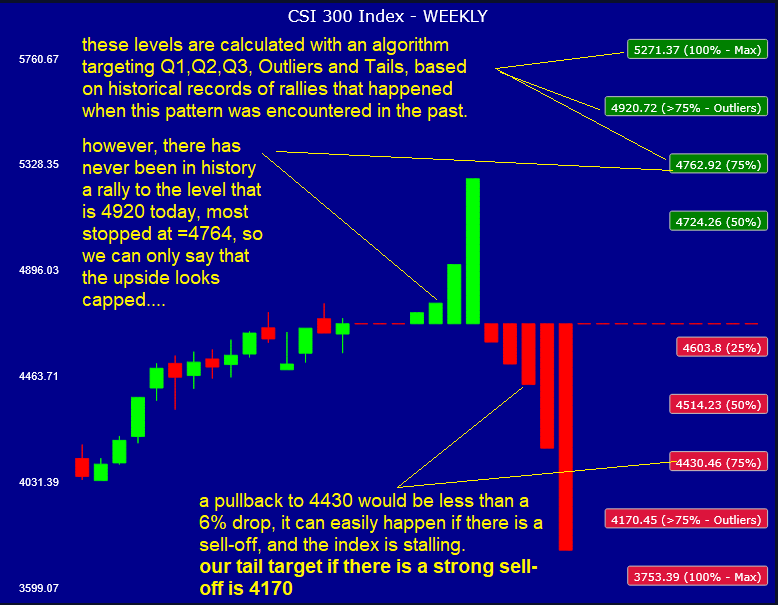

10. CSI 300 (SHSZ300) Tactical Outlook After Nov. 28 Rebalance Announcement

- On November 28th China Securities Index Co (CSI) announced the changes to the CSI 300 Index (SHSZ300 INDEX): 11 companies added and 11 deleted.

- The complete list of additions and deletions is available here (or see the attachment at the end of this insight for your convenience).

- We analyze our probabilistic models to forecast short-term market directions for the CSI 300 Index, as passive flows between here and December 12 may affect the index volatility and trend.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

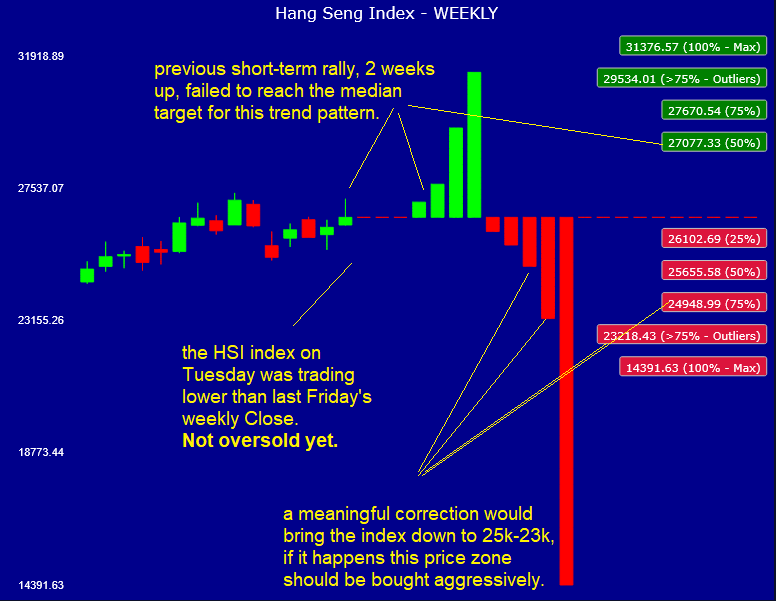

1. HSI INDEX Tactical Outlook Ahead of December 6 Rebalance

- As Brian Freitas recently outlined, the Hang Seng Index (HSI INDEX) changes will be announced November 21st (this Friday) and take effect on December 6th.

- Brian predicted index additions and no deletions. As with all rebalances, inflows, outflows, and adjustments could trigger volatility. Our models, trained on decades of market data, help forecast these moves.

- Currently the HSI INDEX is in a mild WEEKLY correction, after a previous modest 2-week rally. We are still waiting for a meaningful correction, after the recent monster rally.

2. S&P/ASX 200 Outlook Ahead of Dec25 Index Rebalance

- November 21st marks the close of the review period for the S&P/ASX 200 (AS51 INDEX) December rebalance. Changes will be announced on December 5th.

- Implementation of changes begins December 19th, read Brian Freitas‘ recent insight to learn about the 7 possible modifications to the ASX 200.

- Passive tracker flows can significantly move markets around index rebalance dates. In this insight, we leverage our models to identify critical support and resistance zone (the index is very OVERSOLD).

3. NVIDIA’s $500B Order Book: Implications for Valuation, Option Strategies

- NVIDIA has secured unprecedented demand visibility with a reported USD 500 Billion order book for its next-gen AI chips, solidifying its position as the keystone of the AI industrial revolution.

- The company’s financial health highlighted by a USD 48.3 Billion net cash balance and strategic capital return, affirming confidence that structural growth will outweigh geopolitical risks.

- Following a period of short-term volatility and profit-taking, the confluence of long-term structural catalysts suggests the stock is poised to resume a higher trajectory and trading range.

4. The Nikkei Semiconductor Index Rebalance, Kioxia, Nikkei Volatility Hedge

- Kioxia set for inclusion in the Nikkei Semiconductor Index next week, alongside JX Advanced Metals, less than one day’s average daily volume in passive inflow at the close.

- Kioxia’s Q2 2025 results show an accelerating QoQ recovery and solid Q3 2025 forecasts, driven by high demand from data center and smart device products, confirming effective business structure reform.

- Stock is fairly valued after 2025 rally, potential weaknesses being value metrics such as P/E alongside execution of margin and product pipeline targets.

5. Asian Stocks Tactical Outlook (Week Nov 17 – Nov 21)

- A tactical snapshot of the Asian indices and stocks we cover.

- Multiple Asian stocks we track are flashing oversold signals—creating tactical long setups worth considerin.

- We find no overbought stocks or indices in Asia at present. US equities show the same pattern, indicating a synchronized global market pullback

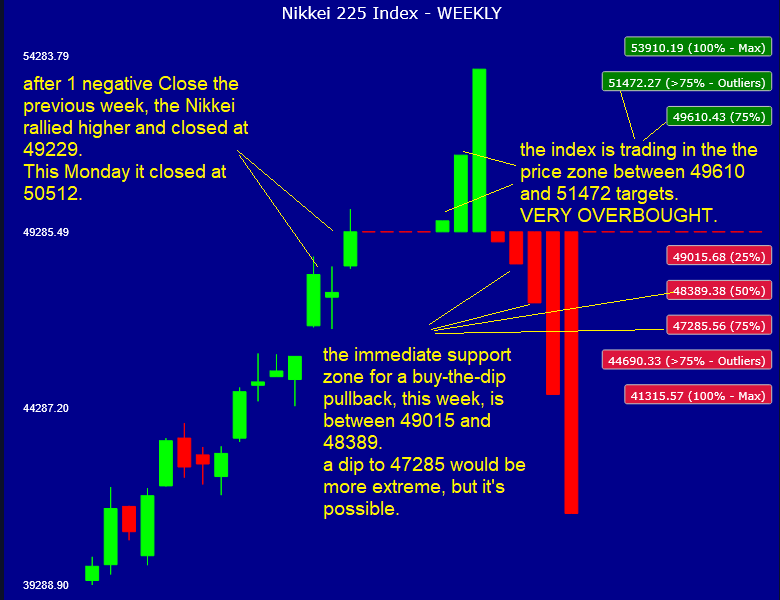

6. Nikkei 225 (NKY) Tactical Outlook After Japan’s Economy Contracts on Tariff Hit

- Japan’s Q3 GDP shrank 1.8% vs forecast 2.5% (annualised), while consumption slowed to 0.1%. This is the first contraction in six quarter.

- The cause is the drop in exports in the face of U.S. tariffs, automakers in particular plummeted, following a period of hiking exports before tariffs came into effect.

- We’ve consistently flagged the Nikkei 225 (NKY INDEX) as overbought. This tactical short-term analysis pinpoints critical support (and resistance, but we think the index may fall).

7. BYD (1211 HK): Leverage Softening Fundamentals with Short Calls

- Bearish fundamental views are strengthening: Recent Smartkarma Insights argue BYD (1211 HK) is overvalued, with slowing sales growth and valuation multiples pointing to limited upside.

- Call overwriting offers efficient yield: Implied volatility in the mid-30s enables attractive income generation.

- Strike and expiry selection matter: Short-dated December options provide the best liquidity, while higher strikes balance premium income with room for near-term upside.

8. 4-Hour Contagion: NVIDIA Q3, Advantest, the AI Flow Footprint on the Global Synchronized Selloff

- Performance was in line with estimates, with total revenue of $57.01B and an expanding Non-GAAP Gross Margin of 73.6%. Management issued robust Q4 revenue guidance of $65B.

- Despite strong fundamentals, the stock’s muted reaction and subsequent slide highlight the risk of unusual, synchronized cross-asset market drops, signaling a need to examine, and hedge against potential systemic vulnerability.

- The synchronized cross-asset market drop on November 20, lacking a clear catalyst, suggests hidden systemic risk driven in part by algorithmic positioning.

9. JD.com (9618 HK / JD US): Top Option Trades Reveal Strong Bearish Sentiment

- Context: Over the past few trading days, JD.com (9618 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Strategies tend to have a short-term horizon, with approximately 40% of all strategies employing weekly options. Bearish views dominate with almost 70% of strategies being put spreads.

- Why read: This Insight breaks down complex option strategies and sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

10. Hong Kong Single Stock Options Weekly (Nov 17 – 21): Breadth Collapses, Put Volumes Rise

- Broad declines set a cautious tone as only a handful of single stocks avoided losses last week amid rising option volumes.

- Market breadth deteriorated sharply, marking the weakest showing of the past year and highlighting the pressure across Hong Kong equities.

- We highlight companies reporting next week in what shapes up as a busy week ahead with Baba and Meituan both reporting.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CSI 300 (SHSZ300) Tactical Outlook Ahead of December Rebalance

- As Brian Freitas recently outlined: the CSI 300 Index (SHSZ300) will undergo its semi-annual review by the end of November 2025, there could be profit-taking as we near that date.

- In our previous insight we flagged potential downside tail risk. While the index hasn’t fallen since our warning, this doesn’t mean the risk has dissipated.

- Our profit target model (the “go SHORT” model) is showing a rare pattern with very few rallies, severely limited upside (less than 1.5%) and an 80% reversal probability.Bearish.

2. Happy Singles’ Day! How Alibaba (9988 HK) And JD.com (9618 HK) Move After 11/11

- Alibaba (9988 HK) and JD.com (9618 HK) often see heightened volatility following Singles’ Day (11 November), though performance varies by year.

- Alibaba’s post-event returns are mixed, averaging nearly twice its normal four-day move, while JD.com has shown stronger and more consistent gains.

- Option markets imply elevated short-term volatility—especially for JD.com—with potential trading opportunities around the 14 November expiry.

3. SoftBank (9984 JP) Tactical Outlook: What’s Next After NVDA Exit, Wild Swings, and Strong Earnings?

- Softbank Group (9984 JP) is swinging wildly. On Nov 11, the stock sank -13% after it said it had sold its entire stake in NVIDIA (NVDA US) for $5.83 billion.

- The stock also posted record Q2 earnings on Nov 12, but closed the day down -3.46% (after a strong rally from the 21k bottom). Most gains come from OpenAI investment.

- For sure it’s not easy to hold this stock at the moment, this insight will analyze the next 2-3 weeks’ outlook, support and resistance, according to our quantitative model.

4. Mitsubishi Electric: Digital Pivot Sparks 60% Profit Surge, What’s Next?

- Mitsubishi Electric is successfully executing a multi-year pivot toward becoming a high-margin digital solutions provider, anchored by its DX strategy and acquisition of OT security leader Nozomi Networks.

- H1 FY26 financial results confirm clear operating strength, showing a strong 60% year-over-year surge in net profit and strong revenue growth, especially within the Infrastructure and Life segments.

- Management’s shift to higher-margin software and services, along with disciplined capital management, is materializing value and helps justify a positive long-term view.

5. Earnings Volatility Preview: Options Price Sharp Swings in China Tech Earnings Week

- Context: Some of Hong Kong’s largest and most prominent companies will report in the coming days, representing 20% of the Hang Seng Index (HSI INDEX)

- Highlight: This Insight quantifies option-implied swings which serve as a gauge for post-earnings reactions.

- Why Read: Prepare for a busy earnings week by understanding where single-stock and broader market volatility may be elevated.

6. Advantest Q2 FY2025, Navigating Post-Earnings Volatility

- Advantest’s updated guidance and MTP3 targets confirm its dominant, long-term growth trajectory as a key supplier for the high-performance computing and AI semiconductor supply chain.

- Despite a strong structural growth story, the stock faces near-term headwinds from a sequential decline in Q2 operating income and an elevated valuation that reflects peak market optimism.

- We suggest a tactical adjustment to vega exposure due to market dynamics, recommending a strategy to monetize the heightened implied and realized volatility following the strong earnings report.

7. Macro Markets and the U.S. Thanksgiving Effect: Shedding Light on Historical Patterns

- November’s seasonal strength extends into the U.S. Thanksgiving period, where macro markets have tended to post positive returns.

- Despite the positive averages, dispersion in returns remains wide, reminding traders that seasonality is no guarantee.

- Positive seasonals can align with favorable trading setups, but timing and risk management remain key.

8. Fast Retailing (9983 JP) Tactical Outlook: Exit or Hedge Your Position

- In our previous, September 29th insight about Fast Retailing (9983 JP) , we flagged the stock for a rally. But boy, we didn’t anticipate how far it would run!

- 6 weeks have passed and the stock has rallied up nearly 30% as of Tuesday’s Close. We think it’s time to sell (or at least hedge your position).

- Rationale: the stock is incredibly overbought according to our model, plus it is one of the few stocks we track in Asia that has not started a pull back (yet).

9. Nintendo Post-Earnings, Pre-Holidays: Are Profit Margins Going to Jump Back?

- Switch 2’s successful launch drives a hyper-growth cycle, which may have been confirmed by the full-year hardware forecast hike to 19 million units for FY26.

- Despite a temporary Gross Profit Margin drop due to the initial low-margin hardware sales mix, a continued rebound could occur fueled by higher-margin software sales, especially during the holiday season.

- The analysis concludes with a leverage-optimized directional trading strategy, utilizing a typical recommended hedge to protect against potential short-term broader market volatility risks.

10. Samsung, SK Hynix, Samsung F&M, Meritz: The Balanced AI-Momentum Korea Portfolio, and KOSPI Options

- AI-Driven KOSPI concentration necessitates a balanced, diversified portfolio (AI/Tech + Defensives) with a tactical hedge.

- KOSPI’s 84% YTD gain is narrowly led by Samsung and SK Hynix (45% of gains), raising concentration risk tied to the volatile global AI capex cycle.

- The strategy is built by blending high-beta AI-linked technology exposure with lower-beta insurance and industrial stocks for ballast and stability.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

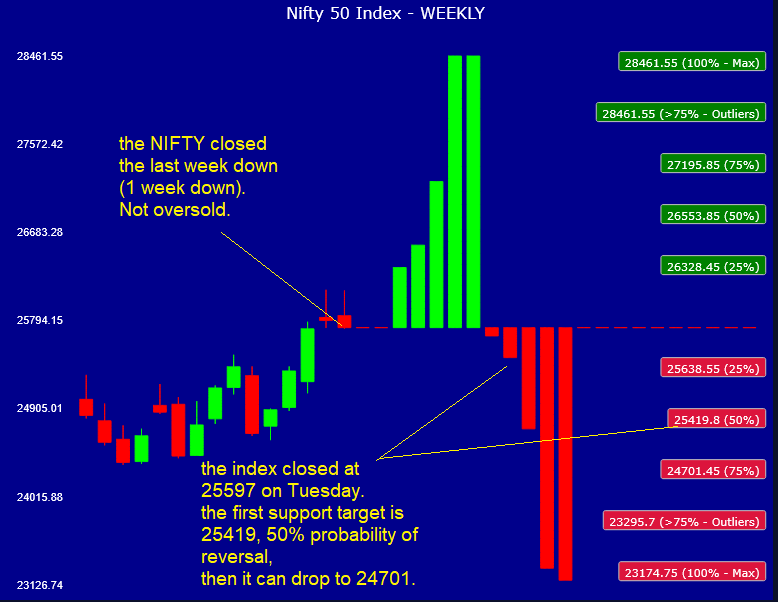

1. NIFTY 50 Tactical Outlook Amidst Potential Passive Flows From Global Trackers

- Brian Freitas posted an insight Monday discussing how Indian stocks may experience significant passive inflows and outflows from global trackers over coming weeks. Read his insight for more detail.

- The changes may start to produce effects soon, so here we are offering an analysis of the NIFTY Index to evalate potential upside and downside.

- Our previous NIFTY 50 insight warned that trend indecision could trigger a pullback—exactly what is unfolding now in the market. The index remains not oversold yet.

2. BYD (1211 HK) Tactical Outlook: Still Downtrending, But OVERSOLD

- BYD (1211 HK) does not seem ready yet to reverse its downtrend, sentiment is still negative (not too negative), Q3 revenues decreased (no surprise, as recently noted by Ming Lu).

- BYD is short-term OVERSOLD, this is a tactical WEEKLY view presenting an actionable opportunity with a 1-3 week trade horizon (probably a 2 weeks rebound, maximum).

- Our quantitative models say the stock will not correct for more than 3 weeks when this pattern is encountered (the stock is currently in its second consecutive week down).

3. Kospi: Rising Volatility and Early Warnings From a Seven-Month Surge

- Kospi’s rally has extended seven months and now shows signs of fatigue, trading with speculative assets and now sharply diverging.

- Implied volatility is elevated, with short-term measures above the 90th percentile on multiple lookbacks.

- We recommend an option trade and hedge given the current setup.

4. Hong Kong Single Stock Options Weekly (Nov 03–07): Growing Split Between Old and New Economy Sectors

- Markets steadied in North America suggesting a firmer open for Hong Kong stock on Monday.

- Hong Kong market breadth improved notably, suggesting broader participation despite uneven performance across sectors.

- Option activity eased slightly, though Call demand remained steady relative to overall volume.

5. Macro Monthly (November): Rising Volatility, Positive Seasonals and a Concerning Trend

- Implied volatility rose across most markets in October, and a continuing trend in vol premium warrants attention.

- November has historically produced strong price returns and positive volatility premiums across global markets.

- Implied volatility displays clustering across markets, with two distinct groupings beginning to take shape.

6. Cross-Market Outlook: US Vs Asia — Who’s Overbought, Who’s Oversold?(Nov 4, 2025)

- A look at our probabilistic tactical models for US and Asian Equities: comparing which stocks are overbought and which ones are oversold.

- Most of the U.S. and Asian stocks we track are overbought, with Asian markets showing the strongest overbought conditions.

- Meta (META US) and the CSI 300 Index (SHSZ300) offer bargain-hunting opportunities for tactical investors.

7. Chevron Volatility: Options-Ready for Investor Day

- Chevron demonstrated strong operational momentum in Q3 2025, with record worldwide production of over 4 million barrels of oil equivalent per day with upside from the Hess integration.

- The stock is trading at a premium valuation with a challenging but achievable growth path in terms of annual growth rates and revenues.

- Given the current valuation and financial outlook, the upcoming Investor Day on November 12, 2025, presents a short-term window to potentially put on a single stock options strategy.

8. Exxon Mobil: Navigating Volatility, Oil Majors

- We examine a strategy to capitalize on anticipated near-term price stability.

- XOM’s strong fundamentals and record production growth support positive outlook.

- Record-Setting production in key basins supports strong cash flow and returns.

9. Trading ConocoPhillips Volatility, Oil Majors

- ConocoPhillips is executing its M&A strategy, achieving major synergy savings and targeting over $2B in run-rate improvements by the end of next year, supporting its fundamental long-term outlook.

- Projection of a $7B increase in incremental Free Cash Flow by 2029 is bullish, noting execution risks.

- The balance of long-term value drivers and near-term market and restructuring risks suggests a strategy that is positioned to benefit from limited price movement.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nikkei 225 (NKY) Outlook After Surprise Nov 5 Rebalance

- As reported by Brian Freitas, the JPX on Oct 27 suddenly announced that Nidec Corp (6594 JP) would be deleted from the Nikkei 225 and replaced by Ibiden (4062 JP).

- The date of replacement is November 5, the Nikkei will experience passive flows, in this insight we want to have a look at the possible moves caused by this catalyst.

- At the moment the index is overbought, according to our models.

2. A Special Cross Asset Morning Update: Nidec, Ibiden, and BoJ This Week

- Japanese markets are seeing significant developments, including Nikkei 225 rebalancing with Nidec’s removal due to alert and Ibiden’s addition, impacting tracking funds, delta one trading strategies, and investors with position.

- The BoJ’s cautious normalization path continues to shape the JGB curve, with a notable steepening in the long end affecting asset-liability management.

- We detail the trades and execution of the trade idea, which may require special attention this week especially on the rebalance.

3. GOLD Tactical Outlook: Correcting After the Run — Where to Step In

- After a 9 weeks rally, Gold (GOLD COMDTY) started to pullback, last week, and the pullback continued into this week.

- Some market watchers argue US retail investors piled into Gold ETFs following the Fed’s late-August shift to rate cuts, potentially fueling the metal’s recent upside exhaustion.

- If Gold (GOLD COMDTY) was fueled by retail buying and is now correcting, retail investors will likely chase the dip—a textbook example of herd behavior, potentially driving a rebound.

4. Advantest Earnings… TPXC30, and Murata…

- Advantest saw a 34% upside after earnings, aligning with previous buy recommendations and its inclusion in the Value Seeker Japan basket for long-term growth.

- A small inclusion into TPXC30 occurs today at the close, with Advantest’s fundamental outlook remaining in line with our recent insights.

- Murata seeing some flows as well today in at the close, and moves to the TPX 70 Large.

5. COMEX Gold: Trading Gold’s Moment in the Options Market Spotlight

- Global monetary shifts and diversification from the U.S. dollar are creating a favorable environment for gold, supported by central bank activity and strong physical demand.

- The market is showing signs of declining volatility after a recent price drop, suggesting an opportune moment for strategic options trading.

- Careful consideration of resistance levels and downside risks is key to optimizing this particular market strategy.

6. Silver: A Fifty-Year Perspective on Bull Markets and Sizing Up the Recent Correction

- After an extraordinary run, SLV’s pullback appears orderly as implied volatility cools yet remains high by historical standards.

- We examine how this bull market in Silver compares with previous bull market spanning 50 years.

- We also look at market participation to identify what’s been driving the recent price action.

7. Selective Volatility Picks Emerge Across HSI Stocks

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the Hang Seng and eight prominent Hong Kong stocks

- Highlight: With a dense earnings calendar ahead, volatility dispersion is widening — BYD trades rich into results, while Tencent and Xiaomi remain notably cheap relative to history.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

8. CBA, ANZ, Westpac, NAB: Volatility Runs High Ahead of Imminent Catalysts

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the S&P/ASX 200 and ten prominent Australian stocks.

- Highlights: Implied volatility across Australia’s major banks remains rich ahead of earnings and the RBA decision.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

9. HKEX Adds Five New Weekly Options on 10 Nov: AIA, China Mobile, Xiaomi Join Fast-Growing Line-Up

- HKEX Expands Weekly Options: Five new single-stock weeklies debut on 10 November, broadening Hong Kong’s fast-growing short-dated options market.

- Why It Matters: Weeklies let traders and investors hedge or speculate around key events with precision, lower premiums, and higher gamma exposure.

- Momentum: Trading volumes in existing weeklies have surged—up nearly fourfold since launch—underscoring rising investor adoption and liquidity.

10. Hong Kong Single Stock Options Weekly (Oct 27 – 31): Market Cools After Busy News Week

- Busy news week with trade and deal headlines taking center stage.

- Stock have been treading water aside from the Materials Sector with breadth reversing from last week’s rebound.

- The thick of earnings season is past with only 15 companies reporting in the next week.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Gold: Reviewing Five Decades of Bull Markets Against an Overextended Backdrop

- Gold’s rally shows signs of overextension but the volatility footprint differs from prior rallies.

- We exam major bull markets over the past 50 years to assess how the current move stacks up.

- Fund flows and the sources of buying pressure are analyzed to gauge the rally’s sustainability.

2. BYD (1211 HK) And JD.com (9618 HK) Lead Expected Swings as 27% of HSI Reports Before Month-End

- Context: Several of Hong Kong’s largest companies will report in the coming days, representing 27% of the Hang Seng Index (HSI).

- Highlight: This Insight identifies which stocks have option-implied swings deviating from historical averages.

- Why Read: Prepare for earnings season by understanding where single-stock and broader market volatility may be elevated.

3. Gold Part 2: Implied Volatility Dynamics Offer Insight into the Tone of This Bull Market

- Gold’s latest surge shows rising implied volatility but little sign of market stress, suggesting limited parallels with the explosive 1980 bull market.

- Tuesday’s correction was the largest selloff in 12 years and marked the end of a series of successively larger positive moves.

- Rising implied vols and strong Call demand reveal active trading but not the manic levels typically seen near a major blowoff.

4. Nintendo and the Switch 2: An Options Menu

- Nintendo is poised for a significant growth phase, driven by its new console and an expansive intellectual property ecosystem, promising sustained financial performance.

- Strategic capacity expansion and a robust balance sheet position Nintendo to capitalize on strong demand, mitigating risks and reinforcing its market leadership.

- Despite potential market volatility and competitive pressures, aggressive production targets and a strong financial foundation suggest a compelling investment opportunity.

5. Cross-Market Outlook: US Vs Asia — Who’s Overbought, Who’s Oversold?

- A look at our probabilistic tactical models for US and Asian Equities: comparing which stocks are overbought and which ones are oversold.

- Between the US Stocks we track, all seems to have room to rally, short-term, and Amazon (AMZN US) is actually oversold (buy opportunity).

- The Asian Stocks we track instead show a less homogeneous picture, but several Asian stocks are incredibly overbought. Same as Gold.

6. Toyota Motor (7203 JP) Tactical Outlook: Awaiting Imminent Pullback

- Toyota Motor (7203 JP) has been going nowhere since July 2025 and before that it dropped from its highest peak. Long-term bullish, but short term we expect a pullback.

- Our model shows that the current trend pattern for Toyota Motor (7203 JP) is not bullish, usually the stock pulls back after 2 weeks up, i.e. end of this week.

- We propose this analysis of the pullback as an opportunity to buy at higher prices, or otherwise to hedge your holdings, if you want to tactically optimize returns.

7. BYD (1211 HK) Earnings on 30 Oct: Options Price in Larger-Than-Usual Move

- Context:BYD (1211 HK) reports Q3 2025 results on 30 October after market close.

- Options markets imply a ±4.7% move, notably larger than the historical ±3.0% average. The stock has shown asymmetric reactions, with fewer but stronger upside moves.

- Why Read: Understand how implied swings compare with history and how the earnings-linked volatility peak offers tactical opportunities around BYD’s 31 Oct weekly expiry.

8. HDFC Bank (HDFCB IN) Tactical Outlook: Time to Lock In Gains

- Despite good earnings results, HDFC Bank (HDFCB IN) does not seem to be going anywhere. The stock did rally for the past 3 weeks but after the earnings stayed flat.

- Our quantitative probabilistic model indicates HDFC Bank usually does not rally for more than 4 weeks when this pattern is encountered (we are in the 4th week, this week).

- From a price perspective, our model shows a mildly overbought stock, confirming the slow pace. The pullback should be short-lived (1-2 weeks), but it’s imminent.

9. Toyota (7203 JP) Up 3.2% Today: Tactical Bearish Option Strategies as Pullback Looms

- Context: Toyota Motor (7203 JP) rallied 3.2% in Wednesday’s morning session. Quantitative models highlight potential for a short-term pull-back.

- Trade Idea: Three actionable option strategies with a bearish tilt are presented, taking advantage of current implied volatility levels and skew.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where high implied volatility and bearish probabilities align, offering investors defined risk/reward.

10. Otsuka, Hirose Electric, Screen, Advantest: The Value Seeker Portfolio and NK Options

- A compelling investment strategy focused on high-quality Japanese equities, selected for strong financial health and growth prospects. This approach targets companies offering stability and long-term appreciation.

- The portfolio emphasizes industrial, automation, pharma, and technology hardware sectors, balanced with a tactical volatility trading approach. This strategy aims to enhance returns while managing short-term market fluctuations.

- Otsuka Holdings is highlighted as a core pharma pick. Screen and Hirose Electric are strong value picks in manufacturing and electronic tech, contributing to the portfolio’s quality and value focus.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

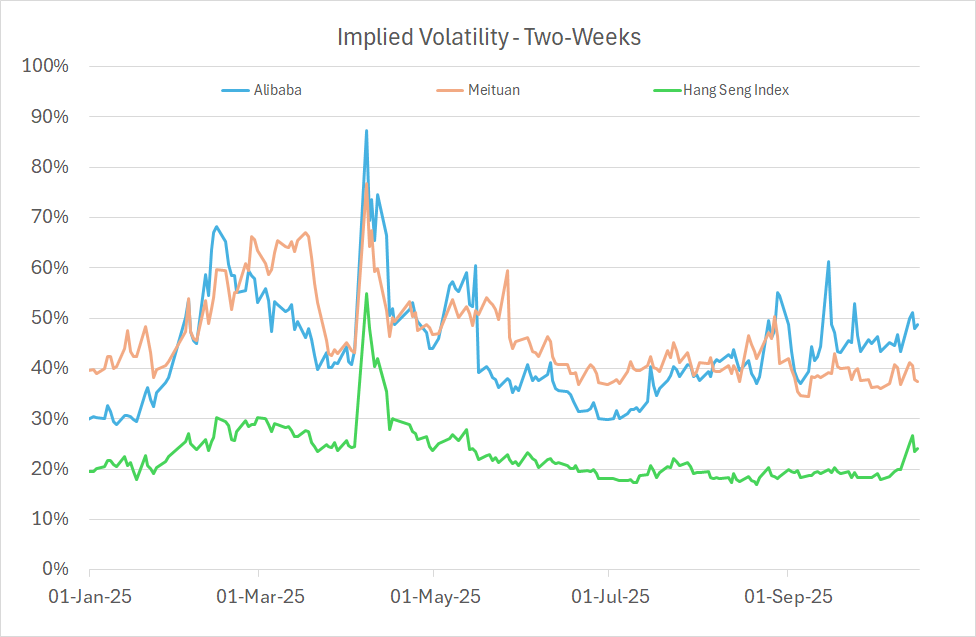

1. Tariff Shock Sends HK Volatility Higher: Meituan (3690 HK) Looks Cheap, Alibaba (9988 HK) Stays Rich

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for eight prominent Hong Kong stocks and the HSI Index.

- Highlights: Recent market turbulence moderately lifted implied volatility for many stocks, but not to extreme levels. The approaching earnings season impacts October and November implied volatility.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

2. Nikkei 225 (NKY) Tactical Setup: BUY The Bottom, Not the Dip!

- The Nikkei 225 (NKY INDEX) dived to 46544 on Tuesday, after peaking at 48.5k last week. It was ultra-overbought.

- This correction offers an opportunity to re-enter the rally (or enter the rally, if you missed it), but don’t be too eager to enter early.

- The Nikkei could correct easily for 2,3 or even 4 weeks when this pattern is encountered, according to our TIME MODEL. 43.5k may be the right area, details in insight.

3. Pop Mart (9992 HK): New Options Listing Poised for a Volatile Start

- Context:Pop Mart (9992 HK) begins trading monthly options on the Hong Kong Exchange (HKEX) on Monday, 13 October 2025, marking its debut in the derivatives market.

- This Insight examines expected implied volatility, referencing both realized volatility trends and peer valuations for context.

- Why Read: Gain early insight into Pop Mart’s option launch, including option specifications and how implied volatility could set the tone for first-day trading.

4. BYD (1211 HK) Tactical Outlook: Bottoming, But Wait to Buy The Dips…

- As discussed in our previous BYD insight on October 3, the stock is oversold and could start a rally soon.

- BYD (1211 HK) was heavily overbought at its peak in mid-2025, then declined >30% in a few months. It’s oversold.

- However at the moment our model has identified the current short-term trend pattern as bearish: a 1-2 weeks rally can happen, but then the stock will pullback again. Caution advised.

5. Advantest: Tests Are the Unsung Hero of the AI Chip Rally

- Advantest, a leader in semiconductor testing, is uniquely positioned to capitalize on the AI chip rally, driven by increasing complexity and the critical need for stringent testing in next-generation devices.

- Record-Breaking financial performance and strategic capacity expansions signal long-term growth, despite anticipated near-term revenue fluctuations, setting the stage for future market outperformance.

- Technological dominance in areas like chiplet architecture and advanced digital solutions further solidifies Advantest’s structural advantage, hinting at a compelling opportunity for discerning investors.

6. NIFTY 50 Tactical Outlook: Indecision May Lead to Pullback

- The NIFTY Index has been stuck in the 25k price zone since May 2025. The index is going nowhere.

- Our quantitative model indicates a 62.5% probability of reversal next week, if the index closes around 25300 (if the close is positive).

- If the index closes this week down, a pullback may be under way, entry zones details are discussed in detail in the insight.

7. CSI 300 (SHSZ300) Tactical Outlook: Severe Downside Tail Risk

- The CSI 300 Index (SHSZ300) has began a small correction. Our model has identified the current trend pattern as bearish. The pullback could reach the 4.3k/4.1k support zone.

- These corrections can last up to 4 weeks, but usually they resolve after 2-3 weeks (the index has already closed 1 week down, so there could be 1-2 more weeks).

- According to our model, the key support area is 4300: if the index breaks that support, it can fall quickly to 4100 or 4000. Read detailed tactical analysis in the insight.

8. The Volatility Playbook: Japan Vs. Developed Markets

- Amidst US-China tariff uncertainties and divergent central bank policies, a strategic approach to volatility across key global indices is being considered, aiming to capitalize on anticipated market shifts.

- The evolving political landscape in Japan, alongside a unique monetary policy trajectory, presents distinct volatility opportunities compared to volatility markets in the US and Europe.

- Part I explores a multi-leg volatility strategy, designed to leverage specific market conditions. Part II is a deep dive into VIX, VNKY, VSTOXX trading.

9. Hong Kong Single Stock Options Weekly (Oct 13 – 17): Option Stress Builds, Breadth Weakens

- Single stock options showed early signs of stress, with both volumes and implied vols moving higher as Put trading outpaced Calls.

- Breadth was weak across single names, with only 3 of 11 sectors trading higher.

- We provide a table of earnings events for the week ahead.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

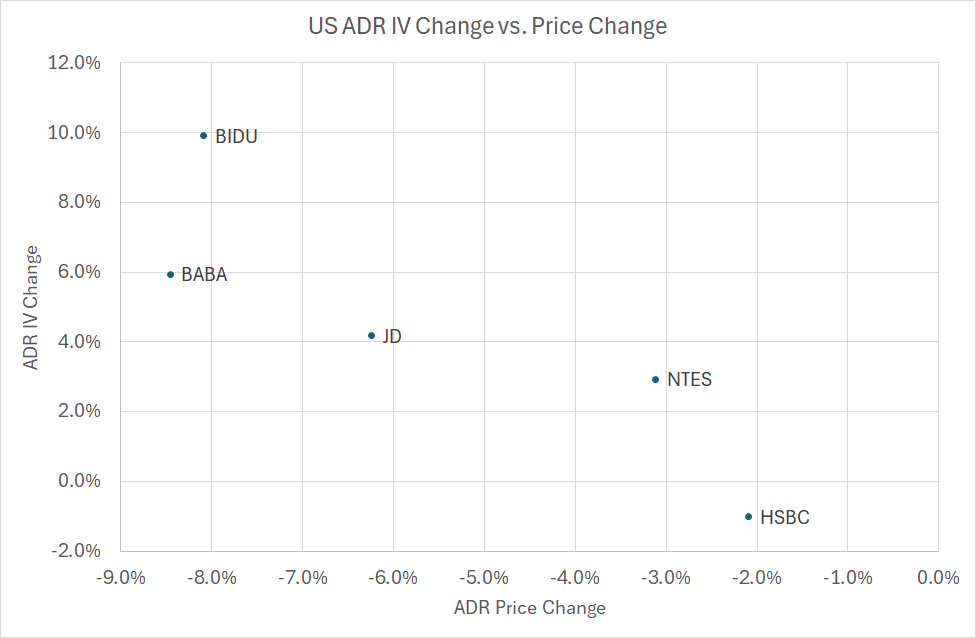

1. Alibaba Drops 8%: What Friday’s U.S. Sell-Off Means for Hong Kong Stocks

- Context: Friday’s sell-off occurred after the Hong Kong market closed, but several Hong Kong–listed companies were caught up in the rout through their U.S.-listed ADRs.

- This Insight details the impact on 15 prominent Hang Seng Index constituents — including Alibaba, Tencent, and HSBC. Implied volatility in U.S.-traded options on these ADRs moved sharply in response.

- Why Read: Understand what to expect when the Hong Kong market reopens after the weekend — both in terms of price performance and implied volatility.

2. Market Sell-Off (Oct 10): How Asian Index ETFs Responded to Market Slide

- A renewed tariff threat from Trump sparked a sharp, sell-off across North American Equity markets.

- The sell off was broad based and accordingly we look at the performance of Asian Index ETF’s that trade in North America to help prepare for Monday’s price action.

- Implied volatility, price and option volume are displayed for each symbol.

3. Nikkei 225 (NKY) Tactical Outlook: Flying Too High…

- The Nikkei 225 (NKY INDEX) has reached eye-popping valuations, a 20% rally from the end of June into early October (40k to 48k).

- Our forecast is always short-term, 3-5 weeks horizon, so we cannot say if the index will continue to rally in 2026, but right now it’s OVERBOUGHT.

- We expect a pullback soon, you can buy the pullback, we discuss the support areas in the insight.

4. HSI Tactical Outlook: Maybe It Is a Large Pullback…

- In our previous insight dedicated to the Hang Seng Index we formulated a key question: is this going to be a small pullback or a large pullback?

- The HSI pulled back just for 1 week, small pullback, our models were reset. But this week the index pulled back again, almost reaching Q2 support (mildly oversold).

- Then, on Friday, Trump tweeted something against China, after the Asian markets closed and all hell broke loose. The HSI Oct. futures tanked to 25300. Let’s discuss support zones…

5. Amazon: Still Riding the Tech Volatility Wave

- Amazon is navigating a dynamic tech landscape, leveraging its strong position in AI infrastructure and cloud services to drive long-term value creation and maintain a premium valuation in the market.

- The company is making strategic investments in AI chips and foundational AI companies like Anthropic, aiming to optimize efficiency and scalability in its AWS segment.

- Despite a current range-bound stock price, Amazon’s financial metrics and company culture approach underscore its commitment to growth and competitive advantage in the evolving tech ecosystem.

6. Cheap Vs. Rich Volatility: Diverging Signals Across Alibaba (9988 HK), Tencent (700 HK) & The HSI

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for 8 prominent Hong Kong stocks and the benchmark index.

- Highlights: In contrast, Alibaba’s IV remains rich, while Hang Seng Index IV is cheap across the curve, offering attractive hedge entry points.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

7. Monthly Macro Markets (October): Diverging Volatility Trends Highlight Risk Sensitivity

- October seasonals, despite their reputation, show most markets with better than 60% odds of finishing higher albeit with meager returns.

- Volatility trends have diverged, with implied vols climbing even as realized vols fell, raising questions about early signs of risk sensitivity.

- Implied vols on most markets have been trending higher vs the SP500 despite the US being ground zero for policy uncertainty.

8. Hong Kong Single Stock Options Weekly (Oct 06 – 10): Options Calm But Stormy Seas Ahead

- Hong Kong equities erased last week’s gains, with further losses on Monday likely after Trump’s social media post Friday morning.

- Weakness was not widespread, though there was a sharp reversal in breadth week over week.

- Option volumes and ratios suggest there’s little concern in the market at this point.

9. Tactical Alert: Undervalued Stocks Poised to Rally This Week

- China Mobile (941 HK) and Meta (META US) are both oversold according to our quantitative tactical models.

- We have been discussing China Mobile (941 HK) before, in early September, we said the pattern was bearish (“brief rally then down again”) , but now this has changed.

- Meta (META US) is a different story, looks like a bearish pattern but it is very oversold, it could rally 2 weeks before going lower.

10. From Banks to Miners: Cheap Vs. Rich Volatility Across Australia

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for ten prominent Australian stocks and the benchmark.

- Highlights: December implied volatility tends to be rich for the banks and cheap for the miners. S&P/ASX 200 (AS51 INDEX) implied volatility is cheap across the curve.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.