This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

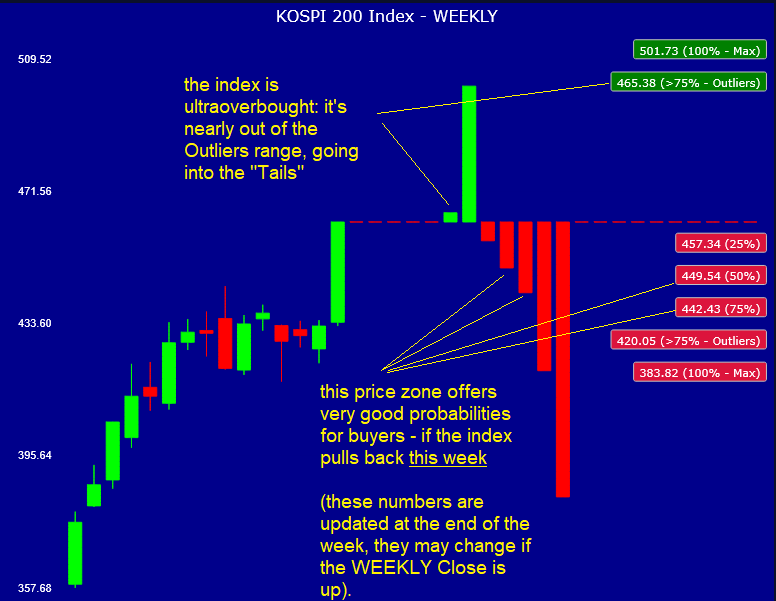

1. KOSPI 200 Tactical Call: Positioning for September Pullback

- The KOSPI 200 INDEX reached a new all time high last Friday, closing at 462.74. Let’s be clear: it’s very overbought according to our model.

- Our forecast is that the index will NOT rally for more than another 1 or 2 weeks (i.e. this week and maybe one more week).

- 449-442 is the price support zone with 50%-75% probability of reversal, if it was hit this week (this data will be updated if the index closes up this week).

2. HDFC Bank (HDFCB IN) Tactical Outlook: Will The Rally Continue?

- HDFC Bank (HDFCB IN) has been in a mild pullback since the end of July. The stock closed up for 2 weeks but has not reached any significative overbought level.

- This week HDFC Bank went down a bit, stayed above the Q1 support level but this pattern is very bullish, in the past it gave way to long, profitable rallies.

- We cannot say for sure if the stock will rally up from here, but if it does, consider profit targets north of 1034 (Q3), and it could rally higher.

3. ‘Toppish’ Nikkei 225’s Outlook: Where to Cover, Where to Buy

- The Nikkei 225 (NKY INDEX) reached 44790 on Wednesday, this is the 3rd week up in a row for the index, this market is OVERBOUGHT.

- The outlook remains bullish, the forecast is for a pullback, followed by another leg up.

- This insight’s goal is to help you figure out where to cover your LONG Nikkei 225 positions, and where to add more LONG positions during the pullback.

4. HDFC Bank (HDFCB IN): Ready for the Rally with Tactical Low-Cost Options

- Context:HDFC Bank (HDFCB IN) remains in a bullish setup. Quantitative models highlight further upside potential in the near term and identify key support levels.

- Trade Idea: With implied volatility near multi-year lows (12th percentile), long call strategies are favored. Suitable expiries and strikes are outlined, with an alternative structure discussed for reducing premium outlay.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where low implied volatility and bullish probabilities align, offering investors defined risk/reward.

5. Asia/Pacific Stocks Outlook For the Week Sep 15-19

- 1-Week directional forecast for the Asian indices and stocks we track, based on our proprietary probability model.

- OVERBOUGHT: Samsung Electronics (005930 KS) , Taiwan Semiconductor (TSMC) (2330 TT) , Softbank Group (9984 JP) , HSI Index , KOSPI 200 INDEX , Nikkei 225 .

- OVERSOLD: BYD Company (1211 HK) , S&P/ASX 200 INDEX .

6. HK Volatility Cones: Volatility on the Rise, Meituan and Ping An Historically Cheap

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has increased across the board, but while some stocks recorded a 5-10% increase, other just added 1-2%. Upcoming November earnings start to shape the term structure.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

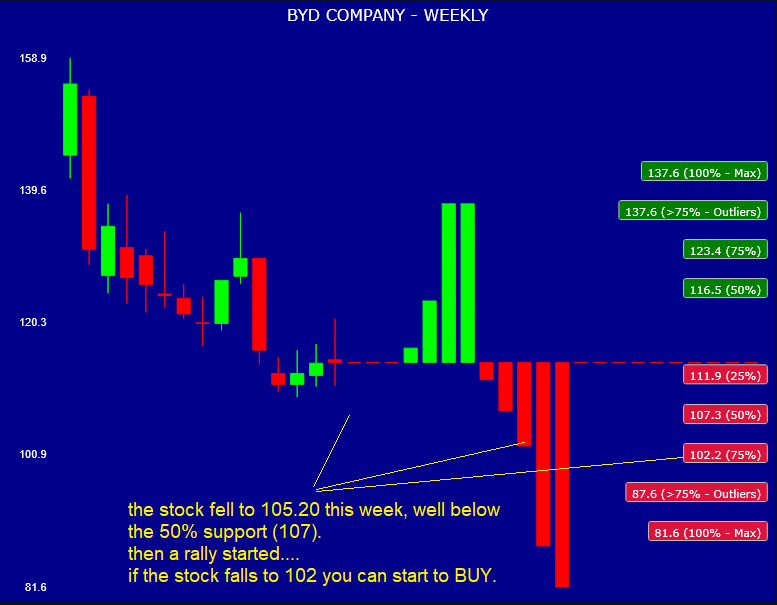

7. BYD (1211 HK) Tactical Outlook: Rally or Bear Rally?

- In our previous insight from September 2 we suggested if BYD (1211 HK) reached 102 could have been a good BUY signal.

- It took a bit more than a couple of week for the stock to bottom at 102.80 (this week), then rally 10% to 113.50. Impressive, but….

- … it could be a Bear rally, so in this insight we will try to assess BYD upside potential, and suggest some tactical positioning for the next few weeks.

8. Hong Kong Single Stock Options Weekly (Sept 15 – 19): Caution Signs Emerge as HSI Stretches Higher

- HSI tested new highs before fading, as weak breadth and strong option volumes highlighted diverging signals in Hong Kong equities.

- Technically, HSI may have reached a level from which minor corrections have started.

- Option trading activity surged, reaching its busiest day since November, even as overall market momentum faltered.

9. Global Monetary Tides Turn: Fed Cuts, Europe Holds, Japan’s Stance and Market Impacts Explored

- Global central banks are navigating divergent monetary policies, with the Fed initiating rate cuts while European and Japanese counterparts maintain cautious stances amid varying inflation and growth outlooks.

- Significant economic headwinds, including the impact of tariffs and political instability in key regions, are influencing central bank decisions and contributing to a nuanced global economic landscape.

- This environment of diverging policies and persistent economic pressures sets the stage for a strategic market opportunity, focusing on volatility dynamics in developed markets.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

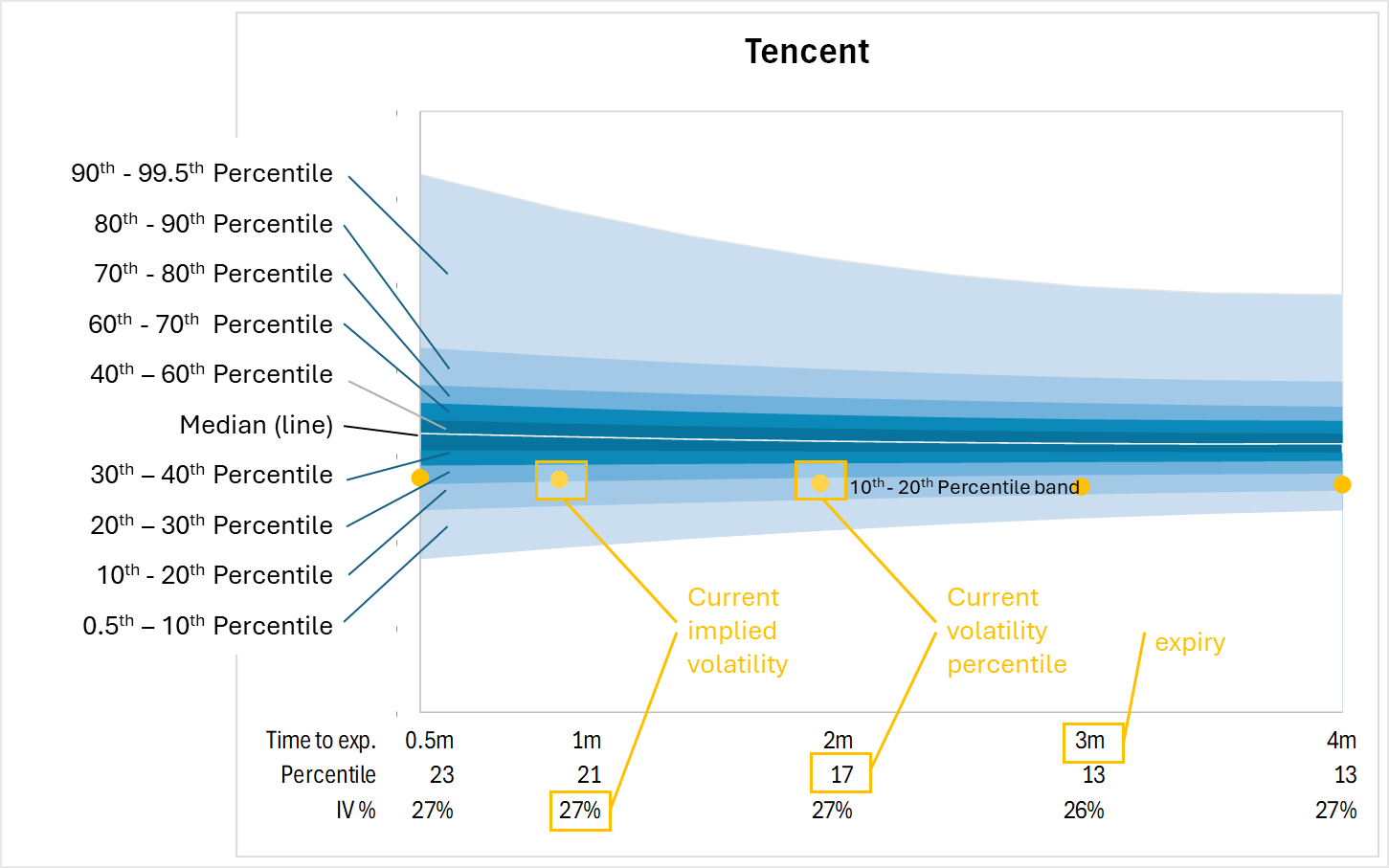

1. Volatility Cones: Spotting Opportunities in Tencent, JD.com, Ping An & More

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Major stocks, including Tencent (700 HK), Xiaomi (1810 HK), and Meituan (3690 HK), trade at historically cheap implied volatility. Upcoming earnings are starting to be reflected in November IV.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

2. China Mobile (941 HK): Tactical Outlook as HKBN Deal Unfolds

- As you all know China Mobile (941 HK) has strategically ramped up its ownership in HKBN Ltd (1310 HK) aiming at full control/takeover, while navigating regulatory approvals and competitive bids.

- The stock suffered a pretty big drop in the last 2 weeks, especially last week, when it reached 85.1. This week the stock started a small recovery rally.

- Our model finds China Mobile oversold (short-term) but we cannot rule out a further drop to/below 83.2 (Q3 support), the current pattern is bearish: brief rally then down again.

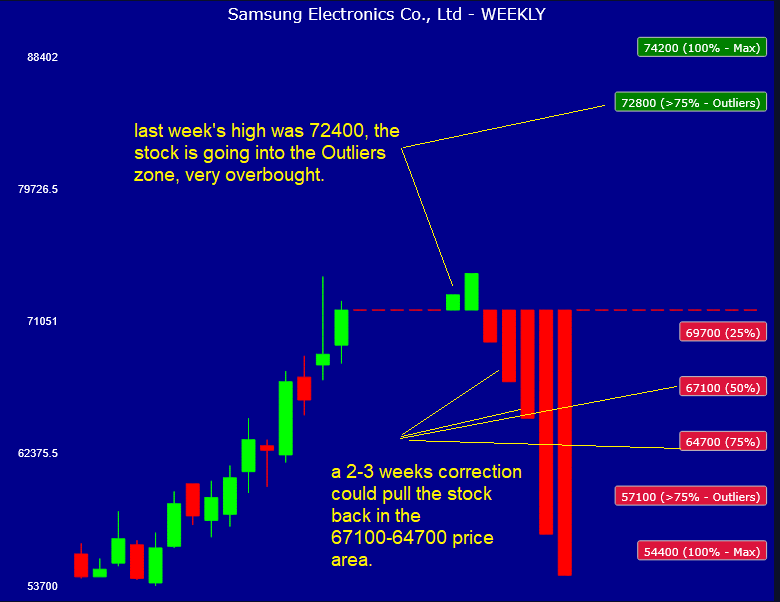

3. Samsung Electronics (005930 KS): Tactical Outlook and Profit Targets

- Samsung Electronics (005930 KS) has been in a downtrend for 4 weeks, but it was only mildly oversold (60% prob. of reversal last Friday, at the Close).

- After 4 weeks down, this week the stock re-started its rally, touching 71200 on Tuesday at the Close.

- This insight will try to define the short-term profit targets for this rally (spoiler: they are not far, at least from the TIME MODEL perspective…).

4. Mitsubishi Electric’s Nozomi Networks Acquisition, a Potential Catalyst

- Mitsubishi Electric’s $1 billion acquisition of Nozomi Networks is a strategic move to continue its transition from hardware manufacturing to a leading solutions provider in the expanding industrial cybersecurity market.

- This significant deal is expected to create growth and synergy by combining complementary strengths in operational technology (OT) security.

- The acquisition represents a major commitment to digital transformation, which is anticipated to have a positive impact on Mitsubishi Electric’s stock performance in the 5-10 year horizon.

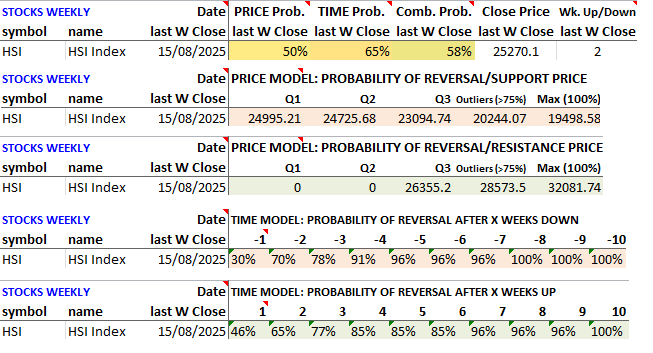

5. Hang Seng Index (HSI) Profit Targets: Has The Rally Topped?

- The Hang Seng Index (HSI INDEX) has been rallying +37% since its plunge to 19260 on April 7th. It is +6% higher than its previous high in mid-March.

- The sentiment towards the index remains positive lately, and our model indicates the HSI is a bit overbought but could go higher.

- The HSI INDEX starts to be toppish around 26874 (75% prob. of reversal). Covering past that point is not a bad idea, especially if the index is up 3-4 weeks.

6. Hong Kong Single Stock Options Weekly (Sept 08 – 12): Alibaba Surge Helps Push HSI to Four-Year High

- HSI broke out to fresh four-year highs, driven by Alibaba’s surge, with broad-based gains and rising single stock option activity.

- Market breadth strengthened across both price action and single stock options flows.

- Spot-Up/Vol-Up dynamics defined the week, as sectors with strong gains also posted the largest implied vol increases.

7. Global Markets Tactical Outlook: WEEKLY Recap (Sep 8 – Sep 12)

- A synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, week September 1 – September 5. The MODEL’s SUPPORT/RESISTANCE data file is attached.

- OVERBOUGHT at the WEEKLY Close: Alphabet (GOOG US) , Taiwan Semiconductor (TSMC) (2330 TT) , Gold (GOLD COMDTY) , 10-Year US Treasuries (ZN Futures)

- OVERSOLD at the WEEKLY Close: NVIDIA Corp (NVDA US) , Samsung Electronics (005930 KS) , China Mobile (941 HK) , Softbank Group (9984 JP)

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BYD (1211 HK) Tactical Outlook: Maybe Soon Is Time to BUY…

- In our previous insight we correctly forecasted a short-lived, 2-3 weeks relief rally for BYD (1211 HK) , followed by a new downtrend (started this week).

- The stock went into OVERSOLD territory according to our model, this week. It’s however a bit early to BUY, the stock could fall more.

- If BYD reaches 102 next week, or the following week, that would be a very good place to BUY. A catalyst could bring the stock back to 140-150.

2. Index Changes and Rate Cuts: Key Events in September 2025

- September brings heavy index rebalancing activity. Pop Mart (9992 HK) will join both the Hang Seng Index (HSI INDEX) and the Hang Seng China Enterprises Index (HSCEI INDEX).

- The Fed is widely expected to cut rates and Asia-Pac peers (BoJ, RBA, RBI) are also meeting.

- Why Read: Plan ahead and take into account known market events when making investment and trading decision.

3. Cheap Vs. Rich Volatility: What Cones Reveal in Tencent, HSBC, Meituan & More

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights:Tencent (700 HK), HSBC (5 HK),Meituan (3690 HK), Ping An (2318 HK), and JD.com (9618 HK) all display historically cheap implied volatility. Read on for trade suggestions.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

4. GOLD Outlook: Still a Good Time to BUY? Or Too Late?

- Gold (GOLD COMDTY) has been flat since April but started to take off after mid-August.

- Question: from a purely tactical perspective, is it still a good time to buy Gold? The precious metal is massively overbought at the moment, according to our model.

- Our tactical forecast: Gold (GOLD COMDTY)could go a bit higher, but it is so overbought that the short-term upside is probably limited.

5. Alibaba (9988 HK): Stock Surges Post-Earnings, Options Market Reprices

- Context:Alibaba (9988 HK) reported Q1 results on 29 Aug. Despite a revenue miss, strong cloud growth and its AI chip announcement drove the stock up double digits.

- Highlight: Implied volatility deflated sharply post-earnings, with the September contract down 8.5% and back months also lower, while skew shifted down in parallel.

- Why it matters: Put the current volatility surface into context. This insight can serve as a case study of how earnings-driven repricing can inform positioning ahead of future events.

6. Global Macro Outlook (September): Cheap Vols Meet Seasonal Weakness Across Key Assets

- Macro assets reveal shifting volatility landscapes, with inexpensive implied vols, seasonal headwinds, and notable divergences across key markets.

- Seasonal pressures are turning negative, with September historically weaker, while risk-reward spreads highlight CSI300 strength and SPASX200 vulnerability.

- Implied vols remain inexpensive across most assets, with NKY, Nifty, and SPASX200 near historic lows despite shifting market dynamics.

7. Hong Kong Single Stock Options Weekly (Sep 01–05): Option Activity Eases, Speculation In Focus

- Market breadth remained weak as option activity slowed and speculation concerns lingered around speculative trading.

- Option demand cooled, led by waning interest in Calls, while heavyweights in Consumer Discretionary kept overall volumes supported.

- Trading momentum slowed, but sector heavyweights maintained dominance, with implied vols drifting lower across much of the market.

8. S&P/ASX 200 Tactical Outlook Ahead of Sep-25 Rebalance

- In our latest ASX200 insight, posted on Aug 22nd, we wrote: “The index could rally one more week (next week), that should be the end of this rally“.

- The rally ended last week, as predicted: the S&P/ASX 200 (AS51 INDEX) is falling this week, it has already reached OVERSOLD support levels according to our model.

- Attached you can find an Excel file with all the data (key supp/res level with probabilities, check row # 12), our new forecast in detailed in the insight.

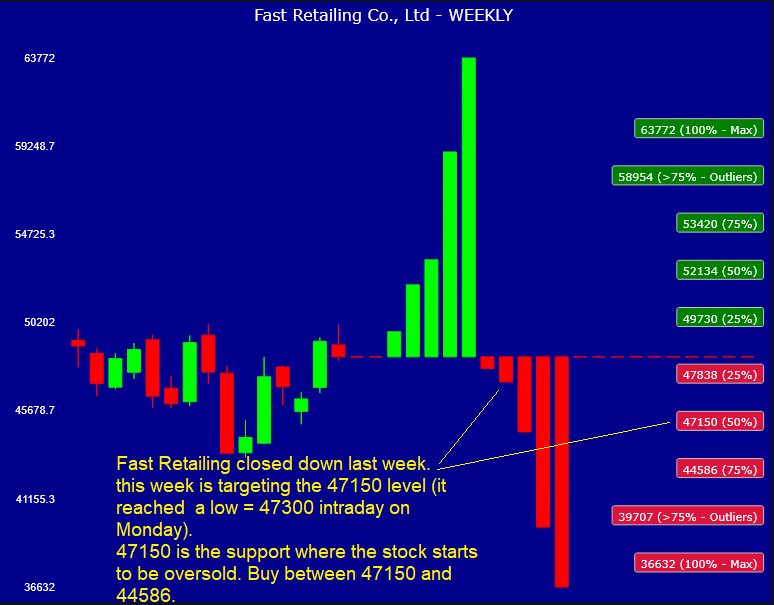

9. Global Markets Tactical Outlook WEEKLY: September 1 – September 5

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, week September 1 – September 5. The MODEL SUPPORT/RESISTANCE data file is attached.

- OVERBOUGHT at the WEEKLY Close: Alphabet (GOOG US) , BYD (1211 HK) , S&P/ASX 200 , CSI 300 Index (SHSZ300) , Gold (GOLD COMDTY)

- OVERSOLD at the WEEKLY Close: Meta (META US) , Nasdaq-100 , NVIDIA Corp (NVDA US) , Fast Retailing (9983 JP)

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Fast Retailing (9983 JP) Tactical Outlook: Turning OVERSOLD, Potential BUY Ahead of Sep-25 Rebalance

- In his recent insight, Brian Freitas stated that Fast Retailing (9983 JP)‘s CPAF will stay the same at the September 25 Nikkei 225 Index rebalance.

- The stock is turning oversold—not yet extreme, but notable. Historically, this short-term downtrend pattern often reversed after two weeks of declines; we are now in the second consecutive week lower.

- Monitor the 47150 support level: the stock is trading at 47810 at the moment of writing, if it goes at or below 47150 it will start to be clearly oversold.

2. Alibaba (9988 HK): Top Trades Ahead of Earnings

- Alibaba (9988 HK) will announce quarterly results on Friday, August 29, 7:30 p.m. Hong Kong Time. In the lead-up, options strategies on the Hong Kong Exchange showcase a variety of approaches.

- Highlights: Recent option trades show a bias towards bullish sentiment. Two strategies using weekly options expiring soon after the earnings announcement are explored.

- Why Read: This review offers real-market insight into how sophisticated participants are positioning ahead of Tencent’s earnings.

3. Toyota (7203 JP // TM US) Hits Overbought: Rich Options for Tactical Shorts

- Context: After three consecutive up weeks, Toyota (7203 JP) / Toyota ADR (TM US) now screens as overbought, with quantitative models signaling a high probability of a trend reversal.

- Trade Idea: Elevated implied volatility (82–83rd percentile) makes short call strategies attractive. Selling near-term calls captures rich premium while aligning with downside risk.

- Why Read: This Insight highlights a timely opportunity where technical overbought signals and historically rich IV converge — ideal for investors seeking a tactical setup.

4. Xiaomi (1810 HK): Earnings Recap & Volatility Dynamics

- Xiaomi (1810 HK) reported 2Q25 results on 19 Aug, beating expectations. This Insight analyzes price reactions in Hong Kong and two overseas markets.

- Highlights: Implied volatility dropped sharply post-earnings, both across the term structure and skew.

- Why it matters: With Xiaomi’s implied volatility now at historically cheap levels, investors may find opportunities in long-volatility strategies ahead of the next earnings in November.

5. Global Markets Tactical Outlook WEEKLY: August 25 – August 29

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 25 – August 29. .XLSX MODEL DATA FILE ATTACHED.

- OVERBOUGHT at the WEEKLY Close: Alphabet, S&P 500 INDEX , Tesla , China Mobile (941 HK) , Toyota Motor (7203 JP) , ASX 200 INDEX , CSI 300 Index , HSI INDEX.

- OVERSOLD at the WEEKLY Close: Meta (META US) , Softbank Group (9984 JP).

6. NIFTY 50 Tactical View: Risk-Off Scenario Before Sep-30 Rebalance + Tariffs Impact

- As forecasted in our previous insight, the NIFTY Index rallied past 25k, but we said this was a BEARISH pattern – rally was short-lived (2 weeks), then this week down.

- Effective September 30 InterGlobe Aviation (IndiGo) and Max Healthcare Institute will be added to the NIFTY, replacing Hero MotoCorp and IndusInd Bank, in the meanwhile 50% US tariffs kicked in.

- We see a potential continuation of the recent bearishness with a RISK-OFF scenario where the index could drop to much lower prices in September, support target 23819 or below.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Hang Seng Index (HSI) Outlook Ahead of Sep25 Rebalance

- Brian Freitas has highlighted in his August 18th’s insight the details of what to expect in the upcoming, September 5, index rebalance for the Hang Seng Index (HSI INDEX) .

- The HSI started a modest pullback this week, outlook for the index remains bullish, this insight will try to determine both buy-the-dip and profit targets areas for the coming weeks.

- We have attached at the end of the insight an Excel file with all our price and time model’s data for the HSI INDEX. Check it out.

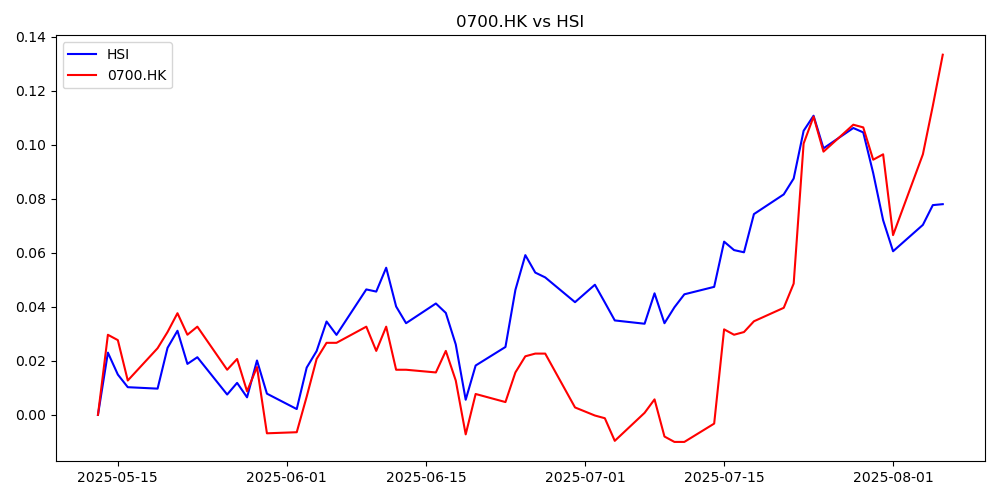

2. Tencent (700 HK): Positioning After 41% YTD Rally with Collar Strategies

- Context:Tencent (700 HK) has performed strongly this year, gaining 41% YTD, including 5.5% last week around its earnings release.

- Volatility Skew: A rare setup shows calls trading rich versus puts, creating favorable conditions for protective collar strategies.

- Actionable Trade Ideas: Three variations of a protective collar — with charts, pricing, and Greeks — illustrate how to position in the current market.

3. S&P/ASX 200: Profit Targets After Sep-25 Rebalance Methodology Finalized

- As reported by Brian Freitas , 2 days ago S&P DJI confirmed that the proposals in the market consultation will be implemented at the September 25 rebalance. Details here.

- The S&P/ASX 200 (AS51 INDEX) is currently OVERBOUGHT according to our models: the index reached an 83% probability of reversal at the intraweek high (9025). Incoming pullback.

- The index could rally one more week (next week), that should be the end of this rally (short-term forecast), but could also pull back this week, checkour modelkey-supports.

4. Tencent (700 HK): Rally Before Results, Options Market Repricing After

- Context:Tencent (700 HK) reported 2Q25 results last week, beating expectations and fueling a 5.5% move in the stock.

- Market Reaction: Shares rallied while front-end options saw a pronounced volatility crush, rotating the term structure back into contango.

- Why Read: This note unpacks Tencent’s price action and the evolving volatility setup.

5. Nikkei 225 Index Outlook: Key Buy Targets To Watch

- As predicted in our July 15th insight, the Nikkei 225 (NKY INDEX) rallied past 41k (reached near 44k) and now, as predicted by our latest WEEKLY HEAT MAP, went down.

- The index reached a low of 42724 this week, it is only mildly oversold so far, probability of reversal is around 52% at the moment.

- Key support levels to watch are 42577 (Q2) and 41606 (Q3). A file with all our PRICE/TIME model dataset for the Nikkei 225 is attached at the end, for your reference.

6. Global Markets Tactical Outlook WEEKLY: August 18 – August 22

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 18 – August 22. .XLSX MODEL DATA FILE ATTACHED.

- OVERBOUGHT at the WEEKLY Close: AAPL US , GOOG US , META US , China Mobile (941 HK) , Toyota Motor (7203 JP) , Softbank Group (9984 JP) , Nikkei 225

- OVERSOLD at the WEEKLY Close: Commonwealth Bank of Australia (CBA AU) , Crude Oil (CL1 COM COMDTY)

7. Volatility Cones: Opportunities Across 8 Hong Kong Stocks

- Context: Volatility cones chart implied volatility against historical percentiles across the term structure, providing a clear framework to evaluate whether options are trading cheap or rich.

- Highlight: Several high-profile HK stocks currently show historically cheap implied volatility. With some of them trading near 52-week highs, now may be an opportune time to hedge.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Samsung Electronics (005930 KS) Tactical Outlook : New Rally After Large Pullback?

- Samsung Electronics (005930 KS) has been rallying for quite a while in the last few weeks, and we have been bullish on the stock since the start of the year.

- At the moment the stock is very overbought according to our model, we see potential for a pullback, possibly something larger than a buy the dip.

- A 2 or even a 3 weeks correction should not be ruled out at this stage, 64700 is the limit support zone we are looking at, the short profit target.

2. Global Markets Tactical Outlook WEEKLY: August 11 – August 15

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 11 – August 15.

- OVERBOUGHT at the WEEKLY Close: NVIDIA Corp (NVDA US), Meta (META US) , Samsung Electronics (005935 KS) , Softbank Group (9984 JP) ,

- OVERSOLD at the WEEKLY Close: BYD (1211 HK) , NIFTY Index (NIFTY INDEX)

3. BYD (1211 HK)’s Current Relief Rally May Lead to Another Pullback

- After an explosive rally in the first part of the year BYD (1211 HK) started to sputter in mid-May and has been downtrending since.

- BYD was starting to be oversold at the end of last week, as shown in our latest Global Markets Tactical Outlook WEEKLY insight, but this week started a relief rally.

- However, the current trend pattern is NOT BULLISH according to our model, the stock could fall again after a 1-2 weeks bounce. Profit target: 116-123 price zone.

4. Xiaomi (1810.HK) Q2 Earnings: Setup Features Low Volatility and Recent Underperformance

- The setup for this earnings release is interesting as Xiaomi has underperformed HSI since the end of June.

- Xiaomi’s Q2 earnings setup features low vols a strong beat record and interesting Q2 dynamics.

- Implied vol sits near historic lows despite the approaching earnings.

5. TSMC’s Outlook After Trump’s 300% Semiconductor Tariff Bombshell

- Our model recently signaled that Taiwan Semiconductor (TSMC) (2330 TT) is overbought. Strangely, it is overbought on the TIME model but not on the PRICE model, a bearish divergence.

- On Friday Trump announced that next week he will slap 300% import tariffs on semiconductors imports. TSMC has factories in the United States so in theory it’s exempt.

- South Korea, Malaysia and Philippines’ semiconductor industries are going to be affected the most, leaving TSMC in a very good position BUT TSMC IS OVERBOUGHT and will pulback soon.

6. Hong Kong Single Stock Options Weekly (Aug 11 – 15): Market Breadth Expands, Options Activity Grows

- Broad-Based strength across sectors pushed HSI higher despite late-week weakness.

- Option trading accelerated into week’s end, with Calls showing a modest uptick.

- The HKD pulled back from the top end of its trading range after prior interventions.

7. BHP (BHP AU) Annual Results: Options Market Bets on Post-Earnings Upside

- Timing: BHP (BHP AU) reports annual results on Tuesday, 19 August 2025, 8:00 AM AEST. Corresponding local times for its international listings are detailed in the Insight.

- Highlight: Options positioning ahead of the results suggests at least one trader is making a sizeable bet on post-earnings upside.

- Why Read: Gain insight into BHP’s earnings-day price history , volatility setup, and options market positioning to be ready for the upcoming announcement.

8. CBA (CBA AU): FY 2025 Results Drive Sharp Intraday Moves – Insights for Options Traders

- Context: Commonwealth Bank of Australia (CBA AU)’s FY 2025 results delivered record profits but missed analyst expectations, prompting a sharp share price adjustment.

- Insights: Detailed review of intraday price action and implied volatility behavior following the announcement shows how the market digested the results and how implied volatility established a new equilibrium.

- Why Read: Offers a concise, data-driven view of how Australia’s largest bank’s results influenced market dynamics. Gain practical perspective on intraday trading patterns and where implied volatility might be heading

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tencent (700.HK) Q2 Earnings: Rally Into Earnings on Historically Low Volatility

- Tencent approaches earnings with low volatility and steady outperformance versus HSI.

- Volatilities are historically low with an earnings release on tap.

- Options market expects a modest move despite recent Tencent momentum.

2. Softbank Group (9984 JP) Outlook (Pre-Earnings Price Range Forecast)

- Softbank Group (9984 JP) is about to release its earnings on August 7th.

- The stock pulled back last week but this week is rallying. The rally can easily reach Q2 (12416) and Q3 (13003) resistance zones, if the earnings are good.

- If the earnings are disappointing, look for initial support at 11145 (Q3). If earnings are really disappointing, look at 10086 (outliers zone).

3. Tencent (700 HK): How Traders Are Positioning Into Earnings

- Context: Tencent (700 HK) is set to release Q2 earnings on 13 April 2025. In the lead-up, options strategies on the Hong Kong Exchange showcase a variety of approaches.

- Highlights: Recent option trades show a mix of bullish and bearish sentiment. Calendar Spreads, Strangles, and Spreads using weekly options are explored.

- Why Read: This review offers real-market insight into how sophisticated participants are positioning around Tencent’s earnings — providing actionable reference points for structuring trades or assessing market expectations.

4. NIFTY 50 Index Outlook: Rebound Rally in Sight? (Profit Targets)

- The NIFTY Index has been falling for 5 straight weeks: it is extremely oversold, according to our model.

- The index should rebound this week, or the next, in any case the downside should be limited at this point.

- A rally could bring the index back to 25398, but we are witnessing a BEARISH pattern at the moment, so any rebound rally will be short-lived.

5. Global Macro Outlook (Aug): Risk Builds Amid Uneven Macro Picture

- Seasonal patterns shift in August, with weaker average returns and greater downside skew supporting a case for selective hedging.

- Most markets are at or near 52-week highs, further strengthening the argument for protective positioning.

- Unlike July’s consistent vol-selling setup, August presents a more mixed environment for volatility strategies.

6. Global Markets Tactical Outlook: Week of August 4 – August 8

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week August 4 – August 8.

- OVERSOLD: China Mobile (941 HK) , NIFTY Index , KOSPI 200 INDEX

- OVERBOUGHT: NVIDIA Corp (NVDA US) is the only stock clearly overbought.

7. The Story of Serendie, Mitsubishi Electric’s Digital Innovation in the Era of AI

- Mitsubishi Electric’s Serendie platform marks a decisive shift toward AI-powered, customer-centric services, with tangible cost savings, ecosystem expansion, and a tripling of Digital Innovation workforce planned by FY2031.

- AI Leadership: The company showcased advanced automation and optimization capabilities at AWS Summit Japan, positioning itself as a leader in applied AI.

- Punchline is the Japan beta vol trade. Macro risks remain pivotal, as navigating tariff shocks, labor distortions, and central bank policy shifts could shape both performance and volatility exposure.

8. Hong Kong Single Stock Options Weekly (Aug 04–08): HSI Rebounds, Single Stock Option Activity Fades

- Hang Seng Index back in the green with broad based gains across optionable names.

- Single stock option volumes were very lackluster and Call enthusiasm continues to be muted.

- Full slate of earnings announcements on tap for the upcoming week.

9. Toyota Motor (7203 JP) Tactical Outlook After $10B Profit Cut on Tariff Impact

- Toyota Motor (7203 JP) on Thursday announced it expected a profit hit of nearly $10 billion from US tariffs on cars imported into the USA.

- Toyota cut its full-year profit forecast by 16%, citing rising US tariffs on cars, parts, steel, aluminum, uncertainty in market outlook and supplier impacts.

- Our model does not see an overbought state at the moment and the stock was rallying on Friday, the forecast is: higher prices next week.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Global Markets Tactical Outlook: Week of July 28 – August 1

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week July 28 – August 1.

- OVERSOLD: China Mobile (941 HK) , Commonwealth Bank of Australia (CBA AU) are just mildly oversold, NIFTY Index (NIFTY INDEX) is oversold.

- OVERBOUGHT: Amazon (AMZN US) , Alphabet (GOOG US) , NVIDIA (NVDA US) , Toyota Motor (7203 JP) , Softbank Group (9984 JP) , Hang Seng Index , Nikkei 225 INDEX

2. Rio Tinto (RIO AU) 1H25 Results on 30 July: Earning Yield from Volatility Premium

- Rio Tinto Ltd (RIO AU) / (RIO LN) / (RIO US) is scheduled to report its 2025 half year results on Wednesday, 30 July 2025 at 16:15 AEST.

- Actionable Option Strategy: Options imply a move noticeably larger than the historical average, opening up a potential short-term yield opportunity. Trade setup discussed in detail.

- Why Read: The Insight outlines yield-focused short-vol strategies, the expected volatility crush, and a forecast for Rio’s interim dividend based on payout policy and timing.

3. AAPL Q3 Earnings: Misses Are Rare, But Performance a Red Flag

- AAPL has been an underperformer since its last earnings report which stands out against the backdrop of a stock that rarely misses earnings expectations.

- We take a closer look at implied volatility and the earnings-day move priced by the options market.

- Volatility metrics and historical earnings reactions are analyzed to help frame expectations.

4. META Profit Target UPDATED (Pre-Earnings July 30th)

- Meta (META US) will report its earnings today July 30th, after the Close.

- If the earnings are positive, we predict a rally that could last up to 3 weeks and bring Meta (META US) at 758, above its recent all time high peaks.

- The rally could last up to 3 weeks – this is a short-term tactical forecast, it doesn’t offer a view of where the stock could be several weeks from now.

5. Hong Kong Single Stock Options Weekly (July 28–Aug 01): Reversal Hits, Breadth Collapses, Vol Steady

- HSI reversed course with four straight down days to close the week sharply lower.

- Breadth collapsed, with only a small fraction of names finishing higher; option volumes rose into the decline with Puts taking more than their usual share of activity.

- Implied vols fell on the week, erasing last week’s gains and not showing signs of stress at this point.

6. MSFT Q4 Earnings: Exceedingly Calm Trading Drags Implied Vol Lower

- MSFT is set to report Q4 earnings after the market close on Wednesday, July 30.

- We examine the implied volatility and projected earnings-day move following a near 30% rally since the last report.

- Volatility metrics and historical earnings reactions are analyzed to help frame expectations.

7. Samsung Electronics (005930 KS) Tactical Outlook After Disappointing Earnings

- Samsung Electronics (005930 KS) 2Q earnings have been somehow disappointing for investors.

- We don’t dissect the earnings details, as market reactions—regardless of headlines—almost always fall within the behavioral range defined by our model.

- What we see right now is FEAR: Samsung Electronics was rallying hard, reached the tails area in our model, then retreated back sharply after the earnings.

8. S&P/ASX 200 Tactical Outlook Ahead of Australia’s Earnings Season Kickoff

- The Australian Earnings Season will begin in early August. The S&P/ASX 200 (AS51 INDEX) suffered a minor setback last week, closed the week down but it’s already rallying higher.

- Our profit target for this rally is 8824 (Q2 resistance target). It could go a bit higher than that but we think it will not reach Q3 resistance at 8996.

- If for some reason the index returns below last week’s Close, the next support level to watch is 8605 (Q2).

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NIFTY50 Index Outlook Amid Ongoing Rebalance Review

- As outlined by Brian Freitas , the NIFTY Index ‘s September rebalance ends July 31st, the announcement of the changes will take place end August and implemented on September 29th.

- The index has been pulling back for 3 weeks, it’s oversold according to our model, 75% probability of reversing up this week.

- Lower support limit would be 24319, while a rally could take the index to 25642 across a couple of weeks. The rally won’t last more than 2 weeks probably.

2. HSI Index Tactical View: How Much Further Can the Rally Run?

- The Hang Seng Index (HSI INDEX) has reached new highs (25538). Our quantitative model says the index has reached a 75% probability of reversal.

- Let’s break down the model’s info: PRICE MODEL 75%, TIME MODEL 75%, combined prob. of reversal is 75%. The fact that both model’s factors are overbought is “bearish”.

- Can the index climb higher? Our detailed analysis is in the insight below, together with screenshots from the model.

3. Toyota (7203 JP) Surges 14% — A Contrarian Option Strategy

- Context: On 23 July 2025, Toyota Motor (7203 JP) surged 14.3%, driven by macro factors tied to tariffs. This Insight examines how that sharp move affected the stock’s volatility surface.

- Key Observations: Implied volatility spiked to extreme percentiles, with two-week IV hitting the 99th–100th percentile. Skew dynamics show otm calls becoming historically rich relative to puts.

- Opportunity: Elevated implied volatility and historically flat skew present an attractive setup for a zero-cost option strategy.

4. Global Markets Tactical Outlook: Week of July 21 – July 25

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week July 21 – July 25.

- OVERSOLD: Meta (META US) , HDFC Bank (HDFCB IN) , NIFTY Index (NIFTY INDEX)

- OVERBOUGHT: Alphabet (GOOG US) , Amazon.com Inc (AMZN US) , NVIDIA Corp (NVDA US) , Taiwan Semiconductor (2330 TT) , CSI 300 Index (SHSZ300 INDEX) , KOSPI 200 (KOSPI2 INDEX)

5. India’s Energy Exchanges: Market Coupling, the Next Big Disruption

- India’s CERC has approved the implementation of Market Coupling in the DAM(Day Ahead Market) by Jan-26, with Real Time Market (RTM) coupling to follow after operational experience is gained.

- IEX currently commands 99.8% market share in both DAM and RTM. With MC, price discovery will be centralized, eroding IEX’s platform advantage and likely resulting in loss of market share.

- If MC had been implemented in FY25, IEX’s earnings would have been 20% lower. This regulatory shift poses a clear structural risk to IEX’s volume dominance and earnings growth.

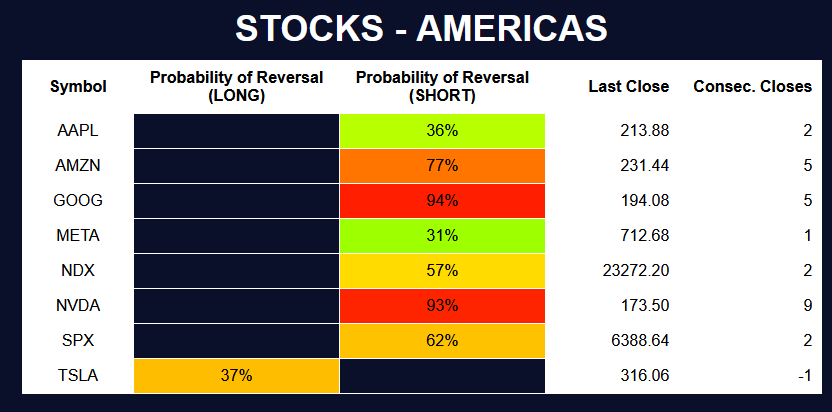

6. US Stocks Earnings Tactical Outlooks: GOOG, AMZN, META, AAPL, TSLA, NVDA

- Some of the US Stocks we cover have already reported their earnings: Tesla (TSLA US) and Alphabet (GOOG US) .

- Others will report next week: Amazon.com Inc (AMZN US) , Meta (META US) , Apple (AAPL US), while NVIDIA Corp (NVDA US) will report on August 28th.

- We dive into each stock potential for upside or downside at this junction, based on tactical analysis of our quantitative trend forecast models.

7. HSBC (5 HK) Earnings on 30 July: Price Action and Option Strategies

- Context: Index heavyweight HSBC (5 HK) / HSBC (HSBA LN) is set to report Interim Results 2025 on 30 July at 12:00 HKT — during the Hong Kong trading lunch break.

- Expected Move: Historical data reveals HSBC‘s announcement-day moves are significantly larger than average, with options currently pricing in a remarkably aligned ± 2.2% implied move.

- Actionable Strategies: Understand the potential for amplified volatility and explore actionable option strategies leveraging the distinctive term structure around earnings.

8. Hong Kong Single Stock Options Weekly (July 21–25): Materials and Energy Lead, Option Volumes Surge

- Materials and Energy led the week, with single stocks in both sectors posting standout gains.

- Breadth was broad-based, and average returns among winners were unusually strong.

- Single stock option volumes surged, with pronounced Call activity mid-week.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nikkei225 and Election: Hedging Activity and Implieds Flag Opportunity

- Upper House elections are drawing increased scrutiny due to heightened focus on fiscal finances.

- We examine how risk is being priced across Japanese markets and in particular in Nikkei225 options.

- Volatility risk appears asymmetric, and we outline ways to mitigate or potentially profit from it.

2. Meituan (3690): Full Round-Trip, Surge in Call Volumes Provide Strong Trade Setup

- Meituan has completed a full roundtrip from its 2024 rally and is now back near key support.

- Option traders have taken notice, with a notable pickup in activity—especially for Calls.

- We outline two trade structures depending on directional or vol views.

3. BYD (1211 HK) Outlook Under Pressure as Sales Momentum Fades

- BYD (1211 HK) fell for longer than expected since our last insight was published. We said that if BYD was going to fall below 120, the trend would become bearish.

- The stock did not fall a lot, it briefly reached below our 120 support level (75% probability of reversal), but has been down for 5 weeks. It is oversold.

- The big question now is: can BYD recover and start to trend up again? Or are we going to see a small bounce from oversold levels, followed by lower prices?

4. Hong Kong Financials in Focus: Sub-Sector Option Volumes Reveal Emerging Themes

- Volume trends and sub-sector splits highlight where interest is most concentrated.

- We revisit top names that appeared prominently in last week’s active lists

- Trading patterns suggest a mix of positioning motives across Financial names.

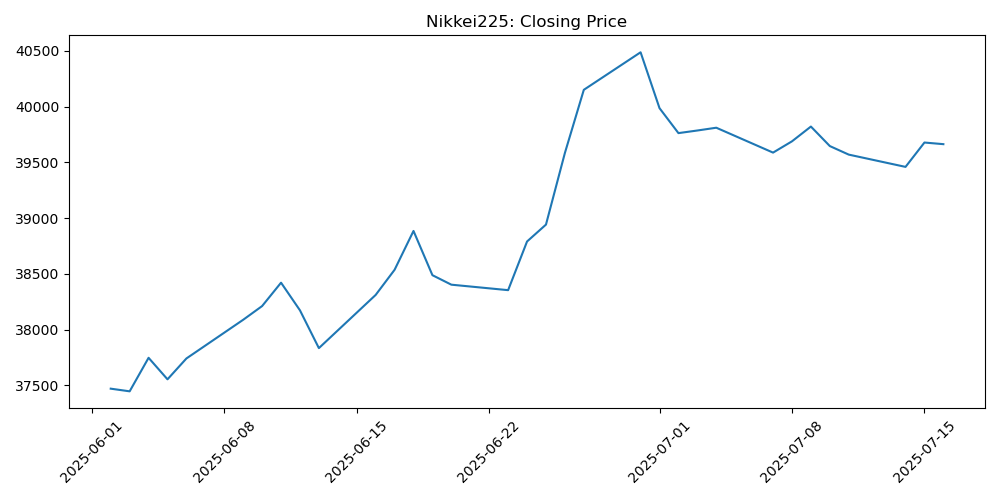

5. Nikkei 225 Index Outlook: Bullish, Possibly Directed Past 41k

- The Nikkei 225 (NKY INDEX) bounced this week, after 2 weeks down, after previously reaching a peak at 40852, the area above 41k has been a strong barrier since 2024.

- Our model says the current Nikkei 225 trend could rise to 41k, or even above 41k.

- The index’s latest 2-week pullback was shallow and did not even reach our model’s Q2 support level, this is a bullish behavior (buy the dip).

6. Global Markets Tactical Outlook: Week of July 14 – July 19

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week July 14 – July 19.

- The most noticeable highlights are: all US markets and stocks we cover sold off last week, apart from Amazon.com (AMZN US) , Alphabet (GOOG US) and NVIDIA Corp (NVDA US)

- In Asia, BYD (1211 HK) is very oversold, and Fast Retailing (9983 JP) is also oversold. Gold (GOLD COMDTY) and Crude Oil (CL1 COM COMDTY) start to be overbought.

7. TSMC (2330.TT) Outlook Post Strong Q2: Our Model Says “EXTREME OVERBOUGHT CONDITION”

- As reported by Patrick Liao and William Keating , Taiwan Semiconductor (2330 TT) is currently in very good shape, for multiple reasons, I invite you to read their insights.

- The problem is: the stock closed at 1155 on Friday, blowing past through the roof of what our model has identified as a very extremely overbought “Tails” move.

- We said BUY in June, and know market euphoria can defy models when sentiment takes over, but our tools consistently flag overstretched conditions — a clear caution to late-stage buyers!

8. BSE Derivative Volumes Hit by Jane Street Ban, Volatility Slump: EPS Cuts & Near-Term Downgrade

- BSE’s Option Premium ADTO in July MTD is down 25% MoM to INR 105bn amid lower market volatility and regulatory overhang from SEBI’s ban on Jane Street.

- This weakness has triggered another 6–8% volume cut assumption in the market, on top of the 4–5% volume cut in June 2025.

- BSE will face pressure in the near-term due to lower volume and valuation pressure, but long-term optimism tied to earnings if volumes normalize and reforms push investors toward cash equities.

9. GOOGL: Q2 Vol Pricing, Performance Trends, and Earnings Setup

- GOOGL is set to release Q2 earnings on Wednesday, July 23 after the close, having rallied 15.39% since Q1 results.

- Q2 has historically delivered strong average returns and the largest average absolute 1-day move.

- We explore how volatility and past earnings reactions frame expectations for the upcoming release.

10. HDFC Bank (HDFCB IN) Outlook: Any Rally From Here May End Quickly

- HDFC Bank (HDFCB IN) has been rallying strongly since early January 2025, a rally we predicted back then. After 2 weeks down, the stock this week is rising.

- However, according to our model the current uptrend pattern does not lead to long-lasting rallies, but rather to new, short-term corrections.

- The time horizon for this rally is 1-2 weeks, when this trend pattern is encountered, so we could expect the stock to rally briefly and then pull back again.