Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK CPI Lifts Hawkish Case in June

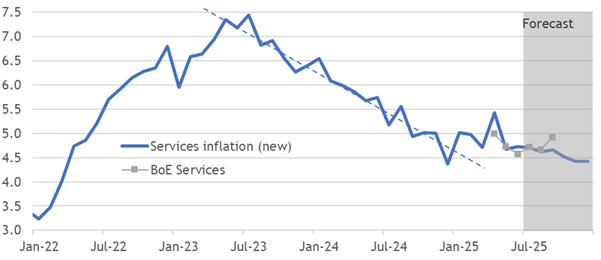

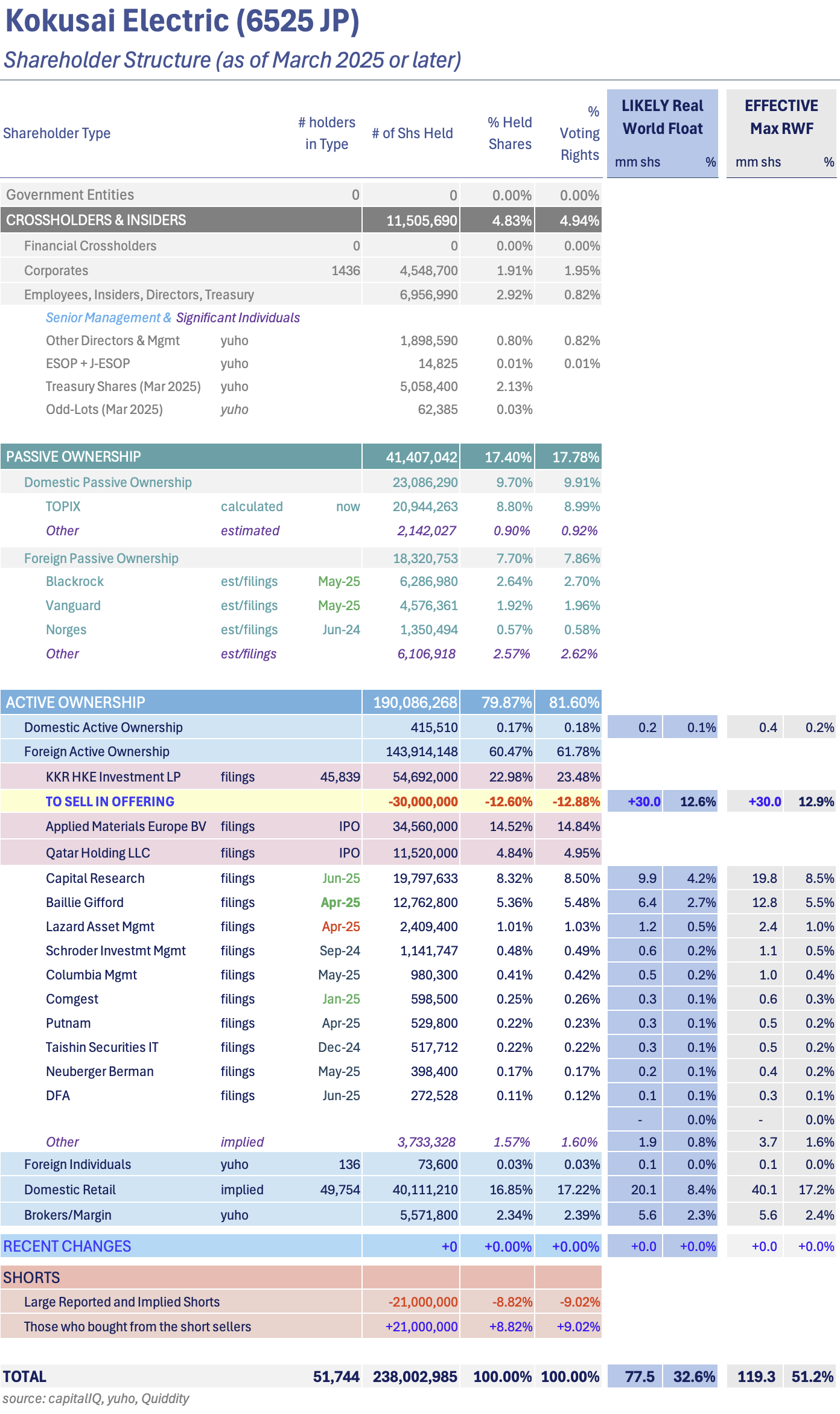

- UK inflation surged 0.2pp beyond the consensus again in June, with underlying inflation measures broadly inconsistent with the target and headlines moving the wrong way.

- The consensus is failing to learn the lesson of intense underlying pressures. The CPI rate rose 0.6pp since Jan instead of falling 0.4pp and is 1.4pp higher than called a year ago.

- Policymakers seem infected with dovish fear about the labour market ahead of August’s meeting. CPI is 0.9pp higher in our year-ahead forecast, and we were right a year ago.

2. UK Jobs Data And The Muddled MPC

- UK payroll revisions removed most of May’s weakness, while wage and price inflation is too fast, yet the BoE probably won’t back down from an August cut as the UR rises.

- Fewer payroll inflows explain its downtrend, with <24yo suffering sustained pain, but the 25-64yo endure the taxation hit, structurally raising unemployment by ~0.5pp.

- Wage growth isn’t showing signs of new disinflationary demand pressures, so we expect excessive underlying wage and price trends to persist, not helped by an August BoE cut.

3. Asia Cross Asset: Liberation Day 2.0 and Asia

- Not surprised by recent events in the equity market, as it aligns with forecasted growth trends in Asia

- Transitory factors such as front loading and transshipment contributing to expected decline in H2 growth

- Expectation for central banks in the region to potentially ease rates in response to current economic conditions

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. US Inflation Creeps In Quietly

- Rebounding headline and core US inflation in June understated the underlying growth, with shelter rising at its slowest pace since August 2021. Tariff pain crept in belatedly.

- Commodities, less food, energy and car prices grew by 0.3% m-o-m, the fastest since Feb-23, and services (ex-shelter) hit 0.4% m-o-m, both inconsistent with the target.

- Less than half of the post-election surge in expectations has survived so far. Further rises remain likely, even if sustained avoidance smooths and reduces the full impact.

5. HEW: Inflation Persists, But Cuts Loom

- Persistent upside inflation surprises and sticky wage growth are lifting hawkish market narratives, defying central bank and consensus hopes for a quick return to target.

- UK inflation jumped well above forecast in June, strengthening the hawkish case, while US core inflation shows tariffs adding to excessive underlying price pressures.

- Next week, attention turns to the ECB decision, July flash PMIs, and UK public finances, as markets weigh central banks’ willingness to ignore resurgent inflation.

6. The Bullish Elephant in the Room

- We have been fairly cautious on equities in the past, but that’s changing. There is a bullish elephant in the room that is becoming evident and can’t be ignored.

- Market psychology had panicked and became overly concerned about left-tail risk. . Better, or less bad, news emerged and price momentum became dominant.

- Our base case scenario calls for the rally to continue into the August–September time frame.

7. Tuning Tariff Impact Estimates

- President Trump’s tariff policy seemingly follows a random walk with a drift towards deals. Path dependency raises risks and uncertainty around his volatile whims.

- Corporate avoidance measures have spared their customers from most of the pain, but Vietnam’s deal as a template could belatedly bring more of the pain to bear.

- We assume most countries stay at 10%. The impact of others rising to 20% may be smaller than the anti-avoidance hit, with the total now worth less than 0.4% to UK GDP.

8. Hong Kong Alpha Portfolio (June 2025)

- The Hong Kong Alpha portfolio has significantly outperformed the Hong Kong indexes in June and since inception. Outperformance range is 17% to 23% since inception.

- At the end of June, we sold positions in the tech sector after substantial gains. The portfolio’s exposure to the consumption sector was also trimmed, both discretionary and staples.

- The portfolio added exposure to the metals refining sector and initiated positions in conglomerates Shanghai Industrial Holdings (363 HK) and Citic Ltd (267 HK) .

9. Korea: Short Selling Data Analysis: 3Q 2025

- We are introducing a new regular series called “Korea: Short Selling Data Analysis.” We will try to provide this insight on a quarterly basis.

- Net short balance ratio for top 20 stocks in KOSPI averaged about 1.7% three months ago, much lower than current levels (3%).

- The average short interest ratio of these top 20 stocks in KOSPI with the highest short balance ratio was 2.6x as of 10 July 2025.

10. Korean Government’s New Task Force for Inclusion in a Major Global Index + IBKR Korea Trading Signal

- In this insight, we discuss Korean government’s new task force for Korea to be included in a major global index.

- Prior to this major market moving event, there will be some important signals.

- One of the most important signals could be major global securities companies (such as IBKR/TD Ameritrade) allowing trading of Korean stocks to customers world-wide.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. TSMC (2330.TT; TSM.US): The 3Q25 Outlook Suggests Modest Growth, but FX Could Pose a Headwind.

- Looking ahead to the third quarter, we estimate that TSMC’s revenue in U.S. dollars could grow by approximately 5–10% quarter-over-quarter.

- Buoyed by the AI boom and the recent increase in U.S. semiconductor investment tax credits to 35%, TSMC will achieve its full-year target of 25% growth in U.S. dollar revenue.

- In the second half of the year, as multiple brands launch flagship smartphone chips, TSMC’s N3P process is fully prepared for volume production.

2. Taiwan Dual-Listings Monitor: Spreads Near Record Highs After U.S. Market Holiday

- TSMC: +26.3% Premium; Near Record High After U.S. 4th of July Holiday

- UMC: +4.7% Premium; One of the Highest Levels in History — Short

- ASE: +4.6% Premium; Wait for More Extreme Level Before Going Long or Short

3. TSMC June Revenue Down 17.7% Mom. What Gives?

- TSMC today reported June 2025 revenues of NT$263.71 billion, a decrease of 17.7 % MoM but an increase of 26.9% YoY

- At the guided exchange rate of 32.5, TSMC’s Q225 revenue amounts to $28.7 billion, up 12.2% QoQ and up 37.6% YoY, but roughly $100 million below the guided midpoint

- However, if we take today’s exchange rate of 29.24, Q225 revenue comes in at $31.9 billion, way above the guide. Take your pick & let’s see this day next week

4. Taiwan Tech Weekly: US Targets Malaysia & Thailand; Wind Power Fuels Taiwan’s AI Infrastructure Push

- US Eyes New AI Chip Restrictions on Malaysia and Thailand

- Chip and AI Boom Driving Taiwan’s Offshore Wind Expansion — Local Stocks to Watch

- China Set to Become World’s Largest Semiconductor Foundry Hub by 2030 — But One Needs to Consider Leading Edge Capacity vs. Mature Capacity

5. TechChain Insights: Zhen Ding – How Next Generation PCBs/Substrates Will Be Critical for AI Devices

- Zhen Ding Technology Holding (4958 TT) is leveraging its full-stack PCB and IC substrate portfolio to position itself as a critical enabler of AI hardware across cloud, channel, and edge applications.

- AI-Linked hardware is expected to account for over 70% of Zhen Ding’s revenue in 2025, up sharply from 45% in 2024 and just 8% in 2023.

- Zhen Ding shares remain substantially below their 52-week highs; we see the company well-placed in terms of long-term drivers. Well placed for an upcoming AI robotics boom.

6. Cerabyte. Forever Data Storage At A Fraction Of Current Costs?

- Cerabyte has a stated vision of achieving $1 per petabyte per month, a cost reduction of 1000x within the next two decades. That’s a bold vision.

- Magnetic tape storage continues to play a crucial role in data centers and its technology continues to advance with the latest LTO-10 cassette announced by Fujifilm in June 2025

- Microsoft’s Project Silica, launched in 2019, appears to take a very similar approach albeit there are as yet no stated plans for commercialisation.

7. Nidec (6594 JP): New Factory in China

- Nidec has opened a new motor factory in China to meet an anticipated increase in demand for home appliances.

- Sensing an opportunity for growth, management is already considering the construction of a second factory.

- This fits with the Chinese government’s efforts to promote domestic demand and with Nidec’s need for a new growth driver in China.

8. MediaTek (2454.TT): 3Q25 Outlook Is Expected to Decline by Approximately 0–6%.

- For Mediatek Inc (2454 TT)’s 3Q25 outlook, its revenue is expected to decline by approximately 0–6% quarter-over-quarter, reflecting a relative low seasonal factors and order adjustments.

- Regarding Mediatek Inc (2454 TT)’s partnership with Alphabet (GOOGL US), the TPU v7e is expected to begin tape-out in September 2025.

- Based on current project developments using TSMC’s 2nm process, MediaTek is highly likely to co-develop the next-generation MTIA v4 ASIC with Meta (META US).

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) Offering – Expect It Very Well Bid, and the Back End Squeezy

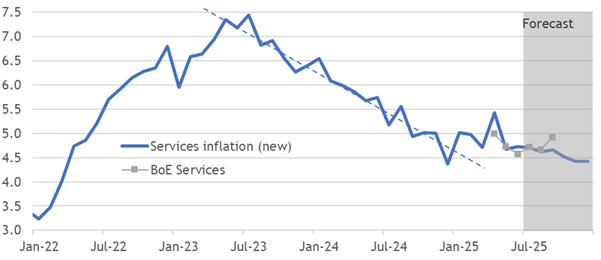

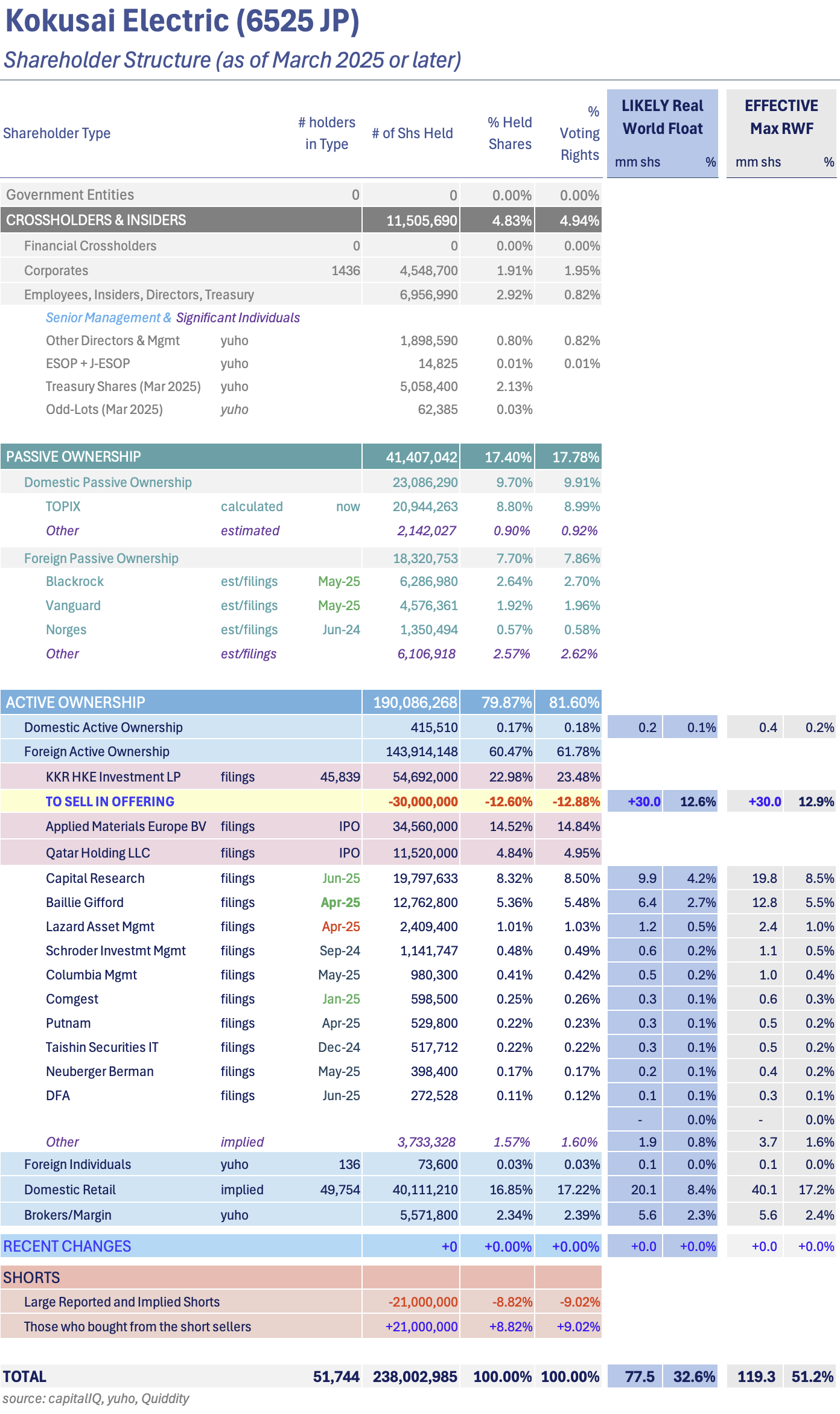

- After the close today, Kokusai Electric (6525 JP) announced that large holder (and original PE owner) KKR HKE Investment LP would sell down 30mm shares or 12.88% of shares out.

- This is not expected, but also not unexpected – it’s exactly a year since the first selldown. There is a decent-sized short position, and it isn’t a huge offering.

- This changes two aspects of the future supply/demand balance. Both are important for how this trades in coming months.

2. FWD IPO Trading – Tepid Demand

- FWD Group Holdings (1828 HK), a pan-Asian life insurer founded by Richard Li, raised around US$442m in its HK IPO.

- FWD is a pan-Asia life insurer operating in ten markets including Hong Kong (and Macau), Thailand (and Cambodia), Japan, the Philippines, Indonesia, Singapore, Vietnam and Malaysia.

- We looked at the company’s past performance and valuations in our previous notes. In this note we talk about the trading dynamics.

3. Kokusai Electric Placement – Well Flagged but past Deal Didn’t Do Well

- KKR is looking to raise approximately US$620m through an accelerated secondary offering for around 13% of Kokusai Electric (6525 JP)‘s (KE) stock.

- KKR had sold in the IPO and undertaken an extended selldown in July 2024 as well. Hence, this deal is somewhat well flagged.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. Curator’s Cut: CC Vs DD, Singapore’s IPO Momentum and Pair Trade Ideas Galore

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,000+ insights published in the past two weeks on Smartkarma

- In this cut, we compare the top two Chinese ride hailing platforms, the recent momentum in Singapore IPOs and the flurry of pair trade ideas on Smartkarma

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

5. SK Square Placement: Clean up by Kakao

- Kakao Corp (035720 KS) is looking to raise US$316m from a clean-up sale in SK Square (402340 KS) .

- The deal is a small one, representing 5.4 days of the stock’s three month ADV, and 1.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. KRX Virtually Locks In Parentco Payout Rules for Spin-Off IPOs

- KRX is set to spotlight Philenergy’s 2023 IPO as the model, pushing spin-off deals to reward parentco holders—like Philoptics’ move to hand out IPO shares.

- Philoptics doubled pre-Philenergy IPO on crazy momentum, then round-tripped post-listing. Setups like this hint at bigger parentco moves ahead in future spin-off IPO plays.

- SK Enmove IPO is scrapped; but SK Plasma (SK Discovery) still live; LS E-Link (LS Corp) also likely to be an early test case for the new parentco compensation framework.

7. ECM Weekly (7 July 2025) – IFBH, HDB, Anjoy, FWD, Lens, Fortior, NTT DC, Daehan, Kanzhun, Nykaa, NH

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, next week will see a large number of listings across the region.

- On the placements front, given the HK and US holidays and approaching earnings season, there were only a few deals in the past week.

8. Travel Food Services IPO – RHP Updates & Thoughts on Valuation

- Travel Food Services Ltd (1450229D IN) is looking to raise about US$233m in its India IPO.

- Travel Food Services Limited (TFS) operates a network of travel quick service restaurants (Travel QSRs) and private lounges in airports.

- We have looked at the company’s past performance in our previous notes. In this note, we will talk about the RHP updates and IPO valuations.

9. Travel Food Services: $250M OFS, Niche Travel QSR but Valuations Seem Full Amidst near Term Weakness

- TFS operates QSRs and lounge in airports. They are present in the top 14 airports in India accounting for 26% of Indian-airport QSR and ~45% of the Indian-airport Lounge revenues

- FY26 performance is expected to be flattish as 1H results will lap impact of Adani operated airports being moved from TFS books to Joint venture with 25% stake.

- FY27 onwards growth is estimated at 15+% with EBITDA margins of 34-37%. We estimate FY27 revenues of ~2,000cr with PAT of 450-500cr implying the deal is being priced at 30-33x

10. Lens Technology A/H Trading – Decent Demand, Helped by A-Share Rally

- Lens Technology (300433 CH), a precision manufacturing solution provider, raised around US$700m in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NTT DC REIT IPO: Global Index Inclusions Later This Year + A Kicker

- NTT DC REIT (NTTDCR SP) could raise up to US$824m in its IPO if the overallotment option is exercised and the stock is expected to start trading on 14 July.

- Cornerstone investors will own 16.8% of shares out following the IPO but there is no lock-up on these shares. The sponsor will own 20%/25% depending on whether overallotment is exercised.

- NTT DC REIT (NTTDCR SP) should be added to the smallcap segment of global indices in November and December while inclusion in local indices will take a lot longer.

2. Kokusai Electric (6525 JP): Small Index Impact for Now, but Could Lead to Something Bigger

- KKR HKE Investment is offering 30m shares (12.86% of shares out) of Kokusai Electric (6525 JP) in a secondary offering that could raise up to JPY 91bn (US$620m).

- Applied Materials (AMAT US) will become the largest shareholder in Kokusai Electric (6525 JP) after the placement.

- There will not be a lot of buying from passive trackers following the placement, but it could ease the way for inclusion of the stock in the Nikkei 225 Index.

3. [Japan Buybacks] – Japan Bank Metrics, Cross-Holdings and Banks Part 1

- Japanese banks have been in a relative sweetspot for a couple of years. Higher rates, higher inflation, more FX volatility, better earnings, stronger buybacks. Cross-holding sales up but not spectacular.

- The BOJ may raise rates but Trump Tariff retaliation/mitigation is a question. Elections the next two weeks and earnings the 2-3 weeks after that may keep things a question.

- But buybacks should pick up. Lots announced in spring end at or before Q1 earnings. And I expect substantial new buybacks to be announced throughout the from Q1 results on.

4. Toyota Industries (6201 JP): Vocal Activism Gathering Pace

- Toyota Industries (6201 JP)’s preconditional tender offer from Toyota Fudosan is susceptible to a bump if there is enough vocal opposition from minorities.

- In July, two public pieces have sharply criticised the offer – the Asian Corporate Governance Association (ACGA) on 2 July and Sloane Robinson Investment Management on 8 July.

- Some of the criticism has merit, while others do not. Nevertheless, these letters are the first and right step to agitate for terms that are closer to TICO’s intrinsic value.

5. Great Eastern (GE SP): SGX The Winner As Shareholders Block Exit Offer

- After OCBC bumped terms for Great Eastern Holdings (GE SP) to $30.15/share via an Exit Offer, I wasn’t confident a 17.8% bump would dislodge Palliser. That appears the case.

- At today’s EGM, 63.49% of minority shareholders – OCBC abstained – were in favour on the Offer, falling short of the 75% condition. There was no blocking % condition.

- Shareholders voted for the resumption of shares via the issuance of shares (one-for-one bonus), satisfying the SGX free float requirement. The SGX, and dissenters, will be happy with the outcome.

6. Merger Arb Mondays (07 Jul) – Seven & I, Shibaura, Insignia, New World, ENN Energy, HKBN, Fengxiang

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads:Mayne Pharma (MYX AU), Yichang HEC Changjiang Pharma (1558 HK), Insignia Financial (IFL AU), ENN Energy (2688 HK), Seven & I Holdings (3382 JP), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities And (1428 HK), Hainan Meilan International Airport (357 HK), New World Resources (NWC AU), Humm Group (HUM AU), Avjennings Ltd (AVJ AU).

7. [Japan LolWut?] Ikuyo (7273) Says “Iku Yo!” – Bitcoin, M&A, Weirdness, More

- Several Japanese companies jumped onto the OBaaBM/TABaaBM (Own/Talk-About-Bitcoin-as-a-Business Model) last fall to this spring as Microstrategy Inc Cl A (MSTR US) shares went up and bitcoin did too.

- Yesterday, resin coating/injection molding product maker Ikuyo Co Ltd (7273 JP) announced an M&A Policy, and a Shareholder Benefits Program where shareholders will “win” amounts of bitcoin by lottery.

- Ikuyo expects revenues +955% this year. Details are sparse. The shareholder structure has red flags. The CEO sold himself half the company in Feb for peanuts. Forewarned. But it’s interesting.

8. Korea’s Next Policy Trade: Locals’ Screens for Dividend Tax Reform Plays

- With the governance trade fading, local desks are rotating into dividend tax reform—bipartisan tailwinds and rising political chatter are driving early positioning ahead of potential rerating.

- Local desks are screening for names with 35%+ payout and 30%+ individual ownership, key thresholds tied to the ruling party’s dividend tax reform bill gaining traction in policy circles.

- The real trade is in names with individual top holders—direct beneficiaries of the tax reform—most exposed to theme flows and likely to lead on dividend hikes if the bill passes.

9. Meituan Possible US$4bn Selldown – Will End up Being Well-Flagged but Sentiment Isn’t Great

- As per news reports, Prosus NV (PRX NA) could look to sell some/all of its Meituan (3690 HK) stake, worth around US$4bn

- Prosus has held its stake for a few years, owing to the dividend payout by Tencent, but Meituan appears to be planning to take on one of its subsidiaries.

- In this note, we will talk about the possible selldown and other deal dynamics.

10. A/H Premium Tracker (To 4 July 2025): “Beautiful Skew” Continues as SB Buys Wide Spread Hs

- AH premia flat among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It has paid well to be long wide H discounts.

- Last week I said, “It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.” Ride on.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers. Technical issue delayed this week’s Monitor.

Receive this weekly newsletter keeping 45k+ investors in the loop

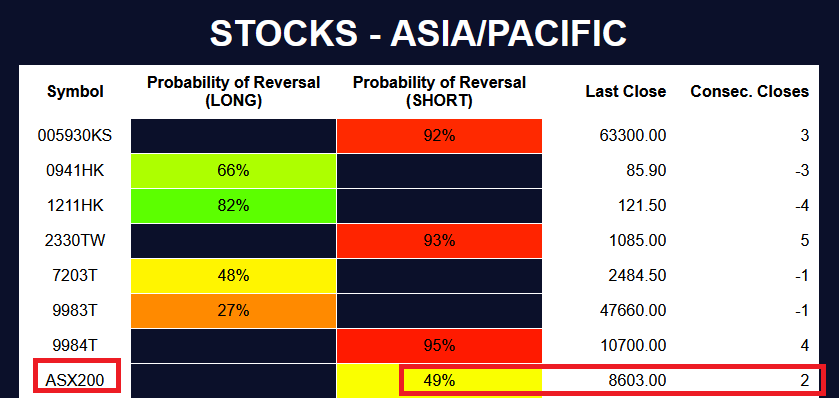

1. S&P/ASX 200 Outlook Following Proposed Index Rule Review

- As reported by Gaudenz Schneider , the 90-Day pause on country-specific reciprocal tariffs was set to expire on July 9, 2025 and Australia and its Minerals sector might suffer indirectly.

- Australia has business with a number of Asian countries, especially China and Japan. Any shock to the growth of other economies in the region could affect the S&P/ASX 200 INDEX.

- This insight will focus on the short-term tactical outlook and possible trend direction for the Australian index for the coming weeks.

2. KOSPI 200: Event-Driven Strategies into the July 10 BoK Decision

- Context: The Bank of Korea will announce its rate decision on July 10, 2025. This Insight compares market and option-implied expectations with historical KOSPI 200 reactions.

- Highlights: While average market reactions to BoK moves are historically muted, options are pricing in elevated volatility. Two event-driven strategies are discussed.

- Why Read: This Insight offers actionable, volatility-focused options strategies grounded in empirical data and current pricing—timely for traders seeking to monetize elevated volatility ahead of central bank and geopolitical events.

3. Samsung Electronics (005930 KS) Outlook After 3.9 Trillion Won Buyback Plan Announcement

- Douglas Kim and Sanghyun Park have discussed Samsung Electronics (005930 KS)‘s 3.9 Trillion Won Share Buyback Plan announced on July 8th. Read the details in their insights.

- Our latest insight maintained our BUY recommendation: the stock rallied during the following 2 weeks, reaching 64,700, then was marked as “very overbought” in our latest Global Tactical Weekly view.

- The stock started to pull back last Friday, after reaching extremely overbought levels (64700). This insight presents a tactical view for Samsung Electronics direction, for the next 2-3 weeks.

4. Global Markets WEEKLY Tactical Outlook: July 7 to July 11

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week July 7 – July 11.

- Since our Global Markets WEEKLY Tactical Outlook published last week, US markets became even more overbought by the end of the week, while some Asian stocks started to pull back.

- Stocks are falling on Monday, the Trump administration is threatening imposing 25% tariffs on a number of nations (including Japan and South Korea), global markets may close the week down.

5. Tariff Risk Returns: Market Signals and Asia’s Volatility Momentum

- Context: The 90-day pause on US reciprocal tariffs expires on July 9, 2025. Japan, South Korea, Taiwan, and India, now face a return to steep US tariffs.

- Highlights: Markets reacted sharply to the original tariff announcement in April, with volatility peaking. While implied volatility eased in May, it has since climbed again, suggesting rising investor concern.

- Why Read: As markets face renewed risk of stress, this Insight helps investors understand which markets and sectors are most exposed, how volatility is evolving, and how best to position.

6. Hong Kong Single Stock Options Weekly (July 07–11): Financials in Focus as Call Volumes Rise

- Sentiment improved modestly, though breadth remains well below recent highs in a subdued price action.

- Option activity climbed steadily, with strong Friday Call demand pushing the Put/Call ratio to lower bound.

- Financials stood out across price action, volatility, and options activity.

7. KOSPI 200 Tactical Outlook Amid Renewed Uncertainty from US Tariff Risks

- As reported by Gaudenz Schneider , South Korea left interest rates unchanged on July 11th, but significant uncertainty from US Tariffs policies pose a challenge for its economy.

- In our previous KOSPI 200‘s insight we flagged an ‘overbought warning’, yet the index extended its rally for four more weeks, closing at 428 — near its all-time highs (449).

- The index is now off the chart on our time model and approaching the upper limit of our SHORT price model. A WEEKLY pullback is imminent, but may be short-lived.

Receive this weekly newsletter keeping 45k+ investors in the loop

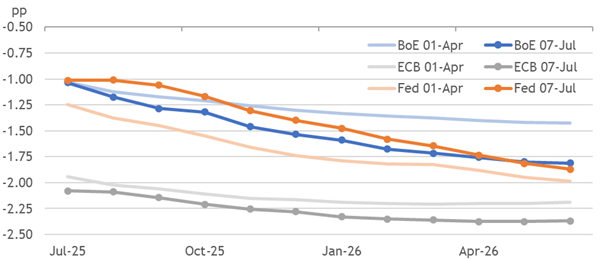

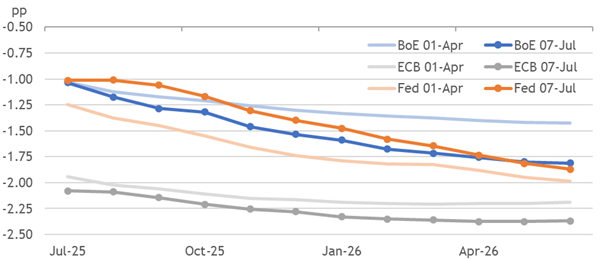

1. Inconsistently Dovish Pricing

- Dovish market fears from April have unwound for the Fed, yet deepened for the BoE, despite broadly resilient data and cautious guidance from policymakers reluctant to cut.

- Equity prices have relied on this resilience to recover, yet expectations for extended rate-cutting cycles imply it breaks. Payrolls only forced half of the gap to close.

- We expect ongoing resilience to keep rolling market pricing for rate cuts later, with the unnecessary easing ultimately never being delivered by the BoE, Fed, or ECB.

2. Labour’s Collapsing Credibility

- Labour failed to campaign on a platform up to the UK’s structural problems, depriving it of the support to deliver change in its first year. Reform UK now lead most polls.

- Spending cut U-turns compound the fiscal hole exposed by the slippage of optimistic assumptions, making further tax hikes and more persistent deficits seem inevitable.

- Far-centrism has been rejected, but challenges to Labour’s right and left break its ability to triangulate back towards success. Investors may not stay so forgiving.

3. Can a New Bull Begin at a Forward P/E of 22?

- It’s official, our long-term market timing model has confirmed a buy signal at the end of June.

- The S&P 500 is trading at a forward P/E of 22. Can a new bull truly begin at such elevated valuations?

- We interpret the buy signal from our long-term market timing model as a buy signal for global equities, and not just the U.S. market.

4. HEM: Rolling Resilience

- Economic activity is robust with a tight labour market.

- Price and wage inflation are generally above 2%.

- Despite predictions of a downturn, the current economic regime remains stable.

5. Why America’s Manufacturing Dreams Might Be Economic Nightmares

- Germany’s GDP declined 0.2% in 2024, Japan’s industrial production contracted 1.1%. Meanwhile, America’s service-focused economy outperforms manufacturing-heavy competitors consistently.

- Tooling costs are 10x higher in America than China. Even 145% tariffs insufficient—need 350% tariffs to make domestic manufacturing viable.

- US services exports surpass lost manufacturing profits. Services employ 84% of private sector, pay more than manufacturing ($36 vs $35/hour).

6. De-Dollarisation Debate : Unmasking USD Over-Valuation

- Despite headlines about BRICS alternatives, gold hoarding, and China’s reduced U.S. Treasury holdings, the data shows no structural shift away from the dollar.

- A 10% decline in the DXY under six months is not an uncommon occurence from a longer term perspective.

- The dollar’s weakness is driven by a historically overvalued real effective exchange rate (REER) and falling oil prices, not a structural decline.

7. HEW: Kicked Can Lands Steady

- Trump kicked the tariff can a few weeks to 1 August, leaving other policymakers and markets in a wait-and-see mode. Pricing was little changed amid little news elsewhere.

- We thematically explored the market implications of resilience rolling cuts later, how healthy the US labour market data is, and dug into the UK’s political problems.

- Next week’s UK labour market and inflation data are critical ahead of an August BoE decision we believe remains finely balanced. US and EA inflation are other highlights.

8. US Claims Continue To Cruise Calmly

- Rising continuing claims in recent months have been heralded as a canary warning of belated suffering in the labour market. But the problem is ending before it ever began.

- US employment growth is still aligned with its long-run average, and the unemployment rate is unchanged on the year. Openings and quits are also steady with averages.

- The Fed needs excess disinflation to cut, and we believe this won’t materialise. That also avoids demand and policy pressure on the BoE and ECB, helping them hold rates.

9. Barbarians with Bandwidth: Why Christina Qi Left the Hedge Fund World to Reinvent Data

- Recap of last week’s events including good inflation news, pressure on Fed to cut interest rates, tensions between Israel and Iran escalating, and market outcomes

- Factors showing risk-on sentiment with sales growth up, EPS growth strong, volatility and quality return on equity fluctuating

- Discussion on factors influencing return on equity and quality, with insights into market trends and data analysis techniques

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

10. Systematic Global Macro: Data, AI, and Models Are Reshaping Investing | New Barbarians AI Agent #05

- The podcast episode discusses the shift towards systematic global macro investing and the advantages of using quantitative models and algorithms.

- The sources highlight the importance of technology and data in driving this shift, but also emphasize the value of human judgment in certain situations.

- Listeners are encouraged to explore the freely available Google Colab Jupyter notebook for replicating sector performance analysis discussed in the episode.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel (INTC.US): Abandon Promoting 18A to Fully Focus on 14A

- Even if Intel Corp (INTC US) ceases marketing 18A to new customers, the company will still fulfill existing foundry commitments.

- In response to the 18A dilemma, Intel’s initial solution is to redirect resources toward the development of 14A, a next-generation process where Intel hopes to gain an edge over TSMC.

- In addition to the strategic realignment of the foundry business, Tan’s broader efforts include refreshing Intel’s leadership team.

2. Taiwan Dual-Listings Monitor: TSMC High Premium Persisting, Record Short Interest in Local

- TSMC: +23.4% Premium; Consider Shorting ADR Spread at Current Level; Record Short Interest in Local

- UMC: +1.1% Premium; Wait for More Extreme Premium to Short

- ASE: +2.9% Premium; Near Level to Go Long the ADR Spread

3. TSMC (2330.TT; TSM.US): Halts GaN Production at Fab 5, Shifting to Advanced Packaging.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) is planning to scale back its presence in the gallium nitride (GaN) market to focus on high-growth areas.

- To meet customer demand, Taiwan Semiconductor (TSMC) – ADR (TSM US) has recently been reallocating resources away from mature process nodes.

- We estimate that Navitas Semiconductor Corp (NVTS US) alone consumes over half of TSMC’s GaN capacity each month, making it TSMC’s largest GaN customer.

4. Kawasaki Heavy Industries (7012 JP): Sell into Strength

- KHI has retreated 12% from its June 30 high, but is still 69% above its April low, despite guiding for a decline in orders and weak profits in FY Mar-26.

- Orders from Japan’s Ministry of Defense are forecast to drop from ¥772.3 billion to ¥400 billion this fiscal year, while the overall profit of the Aerospace division drops 14%.

- The potential impact of U.S. tariffs on Power Sports & Engines is not factored into guidance, offsetting what otherwise seem to be conservative assumptions.

5. Our Thesis: Intel Should Take a Stake in UMC — New Signals Reinforce the Case

- UMC’s renewed push into 6nm, paired with Intel’s strategic overhaul under new CEO Lip-Bu Tan, raises the likelihood of an Intel equity stake in UMC.

- We maintain our Structural Long view on UMC and reiterate our original thesis: a deeper partnership via a stake from Intel would be transformative.

- At 12.5x trailing PER with a net cash position, UMC remains attractively valued as a strategic asset — especially if can essentially have its own ‘Group’ advanced fabs with Intel.

6. Meta Superintelligence Labs. Genius Move Or Desperate Gamble?

- On Monday, June 30, Meta CEO Mark Zuckerberg announced the creation of Meta Superintelligence Labs, staffing it with a host of leading researchers from the likes of OpenAI and Google

- With astronomical hiring bonuses and lucrative compensation packages, this newly assembled team will struggle to gel and likely drive an exodus of existing Meta AI employees elsewhere

- Yann LeCun is sidelined in the MSL memo. He believes LLMs are not the way to achieve human-level AI. It appears that Mark Zuckerberg disagrees. Let’s see…

7. Taiwan Tech Weekly: Has Samsung Given Up Chasing TSMC?; Xiaomi Tesla-Killer EV Using Key TSMC Chips

- Samsung Said to Have Give Up Chasing TSMC at the Leading Edge of Chip Manufacturing

- Xiaomi’s Tesla-Killer YU7 EV Surges in Orders — TSMC Rides the Wave as Core Chip Supplier

- TSMC (2330.TT; TSM.US): Will Rapidus Threaten TSMC’s 2nm Market? We Think It’s Too Early to Say (II)

8. TechChain Insights: Chenbro Micom — How Server Racks Are Evolving With Nvidia’s B-Series & ASICs

- Key Player In Roll-Out of Nvidia’s New Blackwell Solutions. Having followed Chenbro closely over the past year, we’ve seen it steadily increase its exposure to the AI infrastructure cycle.

- Nvidia B200 and B300 Server Builds Are Ramping. Chenbro sees projects based on Nvidia’s B200 and B300 GPUs actively progressing, with B300 projects initiated and shipments starting in 2H25.

- Non-Nvidia ASICs also growing as a contributor. The company also sees AI systems based on custom ASICs as a growing contributor to the business.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NTT DC REIT IPO – Decent Yield, Strong Local Backing, a Few Issues

- Ntt Dc Reit (NTTDCR SP) (NDC), a data center REIT, aims to raise up to US$810m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn.

- In this note, we look at the company’s portfolio and its performance.

2. NTT DC REIT IPO – Thoughts on Valuation

- NTT DC REIT (NTTDCR SP) (NDC), a data center REIT, aims to raise up to US$810m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn

- We have looked at the company’s past performance in our previous note. In this note, we will talk about valuations.

3. Beijing Geekplus Pre-IPO: Expensive Valuation and Mark up from Previous Round

- Geek+ (1678559D CH) is looking to raise up to $300m in its upcoming Hong Kong IPO.

- It is a leader in the global autonomous mobile robots (AMR) market.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

4. NTT DC REIT IPO: The Investment Case

- NTT DC REIT (NTTDCR SP) is the exclusive S-REIT vehicle sponsored by NTT Group. It has launched an SGX IPO to raise proceeds up to US$864 million.

- The IPO portfolio comprises six data centres – three located in California, one in Virginia, one in Vienna, and one in Singapore.

- NTT DC REIT offers an attractive value proposition, comprising a blue-chip tenant base, a staggered lease expiry profile, a robust growth pipeline, and sizable debt headroom.

5. Saint Bella IPO (2508.HK): Pricing and Post-IPO Performance, Wild Price Swings Could Be Short-Lived

- Saint Bella, a leading postpartum care and recovery group in China, priced its upsized IPO at fixed offer price of HK$6.58 per share.

- The offer size adjustment option has been fully exercised. The company issued and allotted 14,313,000 additional offer shares.

- Saint Bella sold 109,733,000 shares and raised net proceeds of ~HK$630M or ~$80M. The stock jumped ~49% on first day as a public company and peaked at HK$11.00 per share.

6. Lens Technology A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Lens Technology (300433 CH), a precision manufacturing solution provider, aims to raise around US$1bn in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Geek+ IPO (2590.HK): Long-Term, Warehouse Automation Story, But IPO Valuation Is Not Cheap

- Geek+, global technology company and provider of scalable and flexible highly efficient solutions for warehouses, aims to raise ~$300M in Hong Kong IPO.

- The company is expected to IPO next week and offer price of HK$16.80 implies a market cap of HK$22B (~$2.8B). Geek+ is set to start trading on July 9, 2025.

- I believe that Geek+ has a large runway for growth in the global AMR solution market, but valuation keeps me from being positive on the name.

8. Lens Technology A/H Listing – Pricing Looks Decent

- Lens Technology (300433 CH), a precision manufacturing solution provider, aims to raise around US$600m in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. Geekplus Technology IPO (2590 HK): The Investment Case

- Geekplus Technology (2590 HK) is a leader in the global autonomous mobile robot (AMR) market. It is seeking to raise US$300 million.

- Geekplus has been the world’s largest warehouse fulfilment AMR solution provider in terms of revenue for the last six consecutive years.

- The investment case is bearish due to declining growth, lower contract liabilities, hints of window dressing relating to reducing losses and ongoing cash burn.

10. Lens Technology H-Share Listing: Thoughts on Valuation

- Chinese iPhone glass supplier Lens Technology (6613 HK) has announced the terms for its H-share listing, and plans to raise around US$600m through issuing 262.3m shares.

- The company’s listing is priced at HK$17.38-18.18 per share, at a 25-28% discount to the last close price of the A-shares as of 27th June.

- Our valuation analysis suggests that the company’s H-share offering is priced reasonably compared to domestic and international peers.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taishin (2887 TT)/Shin Kong (2888 TT) Merger: Index Flows in July

- Taishin Financial Holding (2887 TT) and Shin Kong Financial Holding (2888 TT) announced a Merger of Equals in August 2024 and completion is expected on 24 July.

- Taishin Financial Holding (2887 TT) has underperformed its peers over the last 18 months while Shin Kong Financial Holding (2888 TT) has underperformed its peers following the merger announcement.

- There will be passive flows in the merged entity following the completion of the merger and could help reverse some of Taishin Financial Holding (2887 TT)‘s underperformance.

2. Lens Technology (6613 HK): Offering Details & Index Inclusion

- Lens Technology (6613 HK)‘s global offering opened yesterday, and the raise could reach up to US$800m if the offer-size adjustment option and the overallotment option are exercised.

- The allocation to cornerstone investors is smaller than in other recent AH listings. The discount of over 25% to the A-shares is attractive given the recent trend for large listings.

- Lens Technology (6613 HK) could be added to a global index in December. Inclusion in Southbound Stock Connect in August and HSCI inclusion could take place in March 2026.

3. [Japan M&A] Bain Plays Announcement Games with Nissin (9066) MBO TOB – Noise A Possibility

- On 12 May 2025, Bain Capital announced a deal to buy Nissin Corp (9066 JP). The tender was VERY light in price (Bain’s borrowing more than adjusted EV at TOB Price)

- And it was very long at 41 days. As of Day 1, they announced a long list of “irrevocables” – 16 holders with 5.75% – who had agreed to tender.

- Since then Bain have made 7 separate amendment filings detailing additional irrevocables and one possible additional tender agreement to get to 11.30%. Now it’s extended.

4. A/H Premium Tracker (To 27 June 2025): “Beautiful Skew” Continues as SB Buys, AH Premia Fall Back

- AH premia gives back previous week gains but the “beautiful skew” of wide premia converging more than narrow premia continues. It has paid to be long wide H discounts.

- It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers. Technical issue delayed this week’s Monitor.

5. [Japan M&A] YAGEO Extends Shibaura TOB Limbo at FSA/METI/BOJ Request on FEFTA

- YAGEO’s deal for Shibaura Electronics (6957 JP) had been extended a couple of times – once for Shibaura’s yuho, and once for Taiwan Investment Commission Approval.

- YAGEO had re-filed its notification for FEFTA on 2 June, and the “normal” 30 day waiting period expired 1 July. YAGEO extended by 4 business days to 15 July.

- The TRS amendment was less informative than the TDNET release today. That’s worth reading. More waiting ahead. But the timing may be politically strategic.

6. Nippon Concept (9386 JP): J-STAR-Sponsored MBO a Done Deal

- Nippon Concept (9386 JP) has recommended a J-STAR-sponsored MBO at JPY3,060, a 37.2% premium to the last close price.

- The offer is attractive as it represents an all-time high and is above the midpoint of the IFA DCF valuation range.

- An attractive offer and irrevocables pave the way for deal completion. The tender runs from July 1 to August 13, with payment due on August 20.

7. Merger Arb Mondays (30 June) – Toyota Industries, Santos, Pointsbet, Dickson, HKBN, OneConnect

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Insignia Financial (IFL AU), ENN Energy (2688 HK), Santos Ltd (STO AU), Seven & I Holdings (3382 JP), Ainsworth Game Technology (AGI AU).

- Lowest spreads: Bright Smart Securities And (1428 HK), New World Resources (NWC AU), Avjennings Ltd (AVJ AU), Hainan Meilan International Airport (357 HK), Toyota Industries (6201 JP).

8. HD HCE–Infracore Merger: Deal Mechanics & Trade Playbook

- This event offers two arb plays—merger swap and appraisal rights—but there’s barely any juice left as pricing locked the market into an unusually tight range.

- Yeah, it’s tight. Unless cancel risk flares up, the spread likely stays muted—major holder’s balanced stakes make vote pushback or ratio disputes pretty unlikely.

- One angle to watch: passive flows. HCE likely joins KOSPI 200 post-merger, triggering index buys around Infracore’s halt on Dec 30—potentially a solid year-end positioning play.

9. KCC Corp: EB Issue of $625 Million Of HD KSOE + KCC Corp and KCC Glass Share Swaps

- KCC announced that it is issuing an EB worth $625 million in foreign currency using its stake in HD Korea Shipbuilding & Offshore Engineering as the underlying asset.

- The asset that is used as the underlying asset for the EB is 2.056 million shares of HD Korea Shipbuilding & Offshore Engineering held by the KCC Corp

- We believe this large EB issue by KCC Corp is likely to have a positive impact on KCC Corp but slightly negative impact on HD KSOE.

10. Merger Between HD Hyundai Infracore and HD Hyundai Construction Equipment

- After the market close on 1 July, HD Hyundai Infracore announced that it will be merging with HD Hyundai Construction Equipment.

- The merger ratio is 0.1621707 common shares of HD Hyundai Construction Equipment for each common share of HD Hyundai Infracore.

- We have Negative ratings on both HD Hyundai Infracore and HD Hyundai Construction Equipment.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Global Markets Tactical Outlook: Week of June 30 – July 4

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week June 30 – July 4.

- US Markets will be closed for Independence Day celebrations on July 4th.

- Most stocks and global indices appear to be overbought or nearly overbought. 10-year US Treasuries Futures are also overbought. Commodities like Gold and Crude Oil are down.

2. BYD (1211 HK) Top Trades Highlight Bearish Bias Among HK Option Traders

- Context: Over the past five trading days, BYD (1211 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy huge popularity. Strategies tend to have a short-term horizon of one month, and over 60% of strategies exhibit a bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

3. HSI INDEX Tactical Outlook

- The Hang Seng Index has been rallying since our last BUY recommendation. However the rally may be temporarily stalling.

- The index is not overbought according to our model, around 50% probability of WEEKLY reversal – it could go higher.

- If the index closes this week down, it could be a buy opportunity, depending on the price reached (if the pullback is mild is probably better to hold/wait).

4. Nikkei: Failed Breakout and Summer Seasonals Signal Opportunity

- Seasonal weakness and failure at highs support a tactical short.

- July has historically been weak for the Nikkei in both price and realized vol; Trump-era data showed summer vol was suppressed.

- We propose a tactical trade that aligns with the current setup and supportive price and volatility seasonals.

5. Hong Kong Single Stock Options Weekly (June 30 – July 04): Narrowing Breadth and Rising Put Activity

- Hong Kong single stocks traded lower in a holiday-shortened week.

- Breadth pulled back sharply from the previous week’s extremes and Put activity picked up noticeably across single stock options.

- Intervention in HKD continues to ramp steadily higher with HKD bumping along top of the range.

6. Nifty’s Summer Setup: Quiet Vol and Strong Price Seasonals

- Nifty enters July with supportive seasonal trends in both price and volatility.

- Trump-Era seasonal trends point to subdued summer volatility compared to historically low July volatility.

- Nifty’s proximity to all-time highs sets up attractive strike locations for vol sellers.

7. Global Macro Outlook (July): Trump Volatility Playbook Offers Clues for July Positioning

- Across markets realized volatility generally came in below implied, making June favorable for volatility sellers.

- July has historically rewarded vol sellers; we reference a prior Insight on volatility during Trump’s first term highlighting a large deviation from average in July.

- Average July returns are mixed, but there are clear standouts among the macro markets.

8. NIFTY Index at a Crossroads: Two-Week Tactical Outlook

- The NIFTY Index rally may stop briefly, for 1 or 2 weeks. At the moment the index hast started a very mild pullback, after closing higher for 2 consecutive weeks.

- Usually the rally does not last more than 3 weeks when this pattern is encountered although there has been occasions where it lasted 7 weeks.

- Two scenarios lie ahead: (1) if this week closes higher, expect a near-term pullback; or (2) if it closes lower—possibly continuing into next week—the rally may resume afterward.

9. Commonwealth Bank of Australia (CBA AU) Outlook Amid Overblown Passive Inflows And NIM Pressures

- Commonwealth Bank of Australia (CBA AU)’s shares have surged >80% since November2023, outpacing its underlying profit growth and dividend yields. Passive‐index ETF reallocations are the primary driver of this rally.

- A Reuters poll forecasts the RBA will cut rates by 25 bps to 3.60% on July 8—with further cuts likely into year‐end. This will compress NIMs, a key earnings driver for CBA.

- This insight marks the start of our coverage for CBA: the stock closed this week down (CC -1) reaching oversold levels, it can bounce but the rally potential appears limited.

10. JD.com (9618 HK) Top Option Trades: Bullish Butterfly Stands Out Amond Bearish Sentiment

- Context: Over the past five trading days, JD.com (9618 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy popularity. Plus, an out of the money butterfly at near zero premium demonstrates a creative application of this popular option combination.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,