This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO (2259 HK): Trading Debut

- Zijin Gold (2259 HK) priced its IPO at HK$71.59 per share to raise gross proceeds of approximately US$3.2 billion. The shares will begin trading on September 30.

- The IPO was discussed in Zijin Gold IPO: The Investment Case and Zijin Gold IPO (2259 HK): Valuation Insights.

- The market sentiment of the peers has increased since the IPO launch. My analysis suggests that the IPO price range is attractive.

2. Tekscend Photomask (429A JP) IPO: Valuation Insights

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$828 million). Pricing is on 30 September.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case and Tekscend Photomask (429A JP) IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that Tekscend is attractively valued at the IPO price range compared to peer multiples.

3. Tekscend Photomask IPO – Thoughts on Valuation

- Tekscend Photomask (429A JP) (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

4. LG Electronics’ BOD Gives the Green Light for LG Electronics India IPO in 2025 – Updated Valuation

- LG Electronics’ BOD finally approved a plan to sell a 15% stake in LG Electronics India in an IPO to be completed in 2025.

- According to local media, LG Electronics India is now valued at about US$13 billion which is higher than LG Electronics’ market cap of US$8.8 billion.

- Our base case valuation of LG Electronics India is implied market cap of 1,280 billion INR or US$14.4 billion.

5. [Japan ECM] MIGALO Holdings (5535 JP) Offering to Raise Capital, Generate Interest

- Migalo Holdings (5535 JP) is one of the rare TSE Prime-listed companies which got the boot from TOPIX, stayed in Prime, and is clawing its way back.

- As of end-March-25, it met all the criteria to stay in Prime and rejoin TOPIX. Now they are launching a primary offering, and this may presage an effort to rejoin.

- They are adding float and 10% of shares to the pile, in this ¥4.4-5.0bn offering. But instos are net short this stock.

6. ECM Weekly (29 September 2025)- Zijin, Chery, CAREIT, Orion, Butong, Victory Giant, Northern Star

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, this week saw a few good listings across the region while the spotlight will be on Zijin Gold (2259 HK) in the coming week.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

7. Zijin Gold : Listing Pop Likely. Know Your Thresholds. Avoid Valuation Pitfalls.

- Riding on strong investor demand, Zijin Gold (2259 HK) has exercised its over-allotment option, boosting the total IPO size to USD 3.7 billion from USD 3.2 billion previously.

- As Hong Kong’s only pure-play gold miner with global exposure, Zijin Gold may command a premium, though any sharp price gains still depend on sustained gold price strength.

- Investors should define their medium- to-long-term gold price thresholds to shape a clear post-IPO strategy for Zijin Gold.

8. Tekscend Photomask IPO – Peer Comparison

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we will undertake a peer comparison.

9. Zijin Gold (2259 HK) IPO Debut – Some Points Worth the Attention

- Based on DCF model, valuation is about US$28.4 billion. We think this is the valuation bottom line. Conservative investors can take profits at this valuation level.

- Valuation has the potential to reach US$34-42bn (or 18-22x P/E ) if based on 2025 forecast.Optimistic investors can choose to wait for stock price to fall within this valuation range.

- Considering better profitability/shareholder resources, Zijin Gold has more advantage than Shandong Gold Mining. Therefore, market value of Zijin Gold will widen the gap with Shandong Gold Mining in the future.

10. Zijin Gold IPO Trading: Decent Retail but Strong Insti Demand

- Zijin Gold (2259 HK) raised around US$3.2bn in its Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

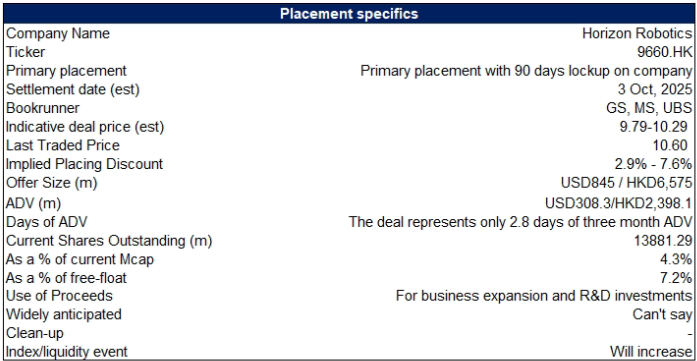

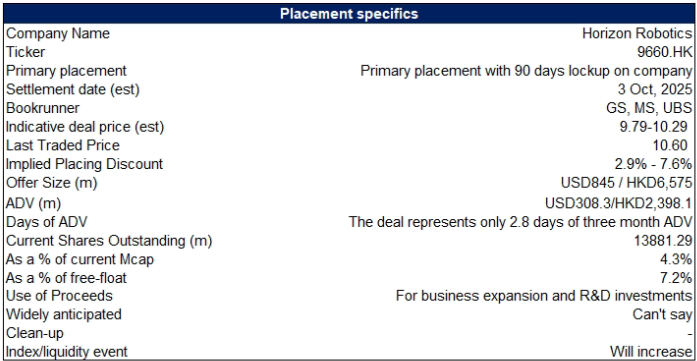

1. Horizon Robotics Placement – Another Opportunistic Raising

- Horizon Robotics (9660 HK) raised around US$800m in its Oct’24 IPO and another US$600m via a placement in June’25. It’s back again to raise another US$834m via a top-up placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. Trading Strategy of Zijin Gold on the First Day of IPO

- Zijin Gold IPO will start trading on 30 September. Zijin Gold is aiming to raise US$3.2 billion (HK$24.98 billion) from its IPO, offering 349 million shares at HK$71.59 each.

- Our base case valuation of Zijin Gold is HK$124.7 per share (74.2% higher than the IPO price). We expect a sharply higher pop on the first day of trading.

- If its share price appreciates more than 30-50% or more, we think it is prudent to take some profits off the table (at least 25%-30% of total investment).

3. Berkshire Hathaway Dumps All Its Stake in BYD – Impact on the Chery Auto IPO

- Warren Buffett’s Berkshire Hathaway completely exited its stake in BYD (1211 HK).

- We highlight four major reasons why Berkshire may have exited its entire position including valuations, tariffs, competition and lower profit margins, and greater risk prospects on economic stagnation in China.

- Berkshire selling all its stake in BYD is likely to have a slightly negative impact on the Chery Auto IPO. However, we maintain a Positive view of Chery Auto IPO.

4. Tekscend Photomask (429A JP) IPO: The Bull Case

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$832 million). Pricing is on 30 September.

- Tekscend, which was carved out of Toppan Printing (7911 JP) in 2022, is owned by Toppan (with a 50.1% stake) and Integral (5842 JP) (with a 49.9% stake).

- The bull case rests on its leading market position, attractive market opportunity, stable underlying margins, net cash position, and attractive dividend policy.

5. Zijin Gold IPO: The Good, The Bad and Valuations. For the Gold Bulls.

- Zijin Gold (2259 HK) IPO offers investors with a bullish outlook on gold prices a timely entry into a pure play gold miner with a globally diversified asset base.

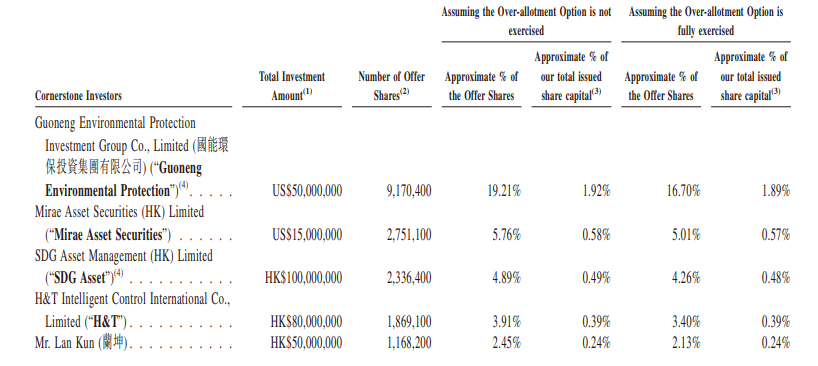

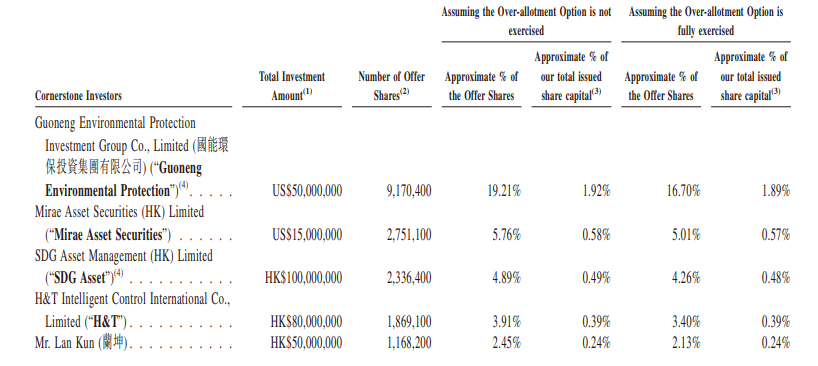

- At HKD71.59/share, Zijin Gold IPO is set to raise US$3.2 billion with cornerstone investors already committing about half the deal (US$1.6 billion).

- At current gold prices, IPO valuations leave a reasonable buffer; however, a pullback toward year-ago levels would pose significant downside.

6. Fermi Inc. (FRMI): Pre-Revenue Data Center REIT Sets Terms Seeking $13.2b Valuation

- Fermi set terms for its IPO on Wednesday afternoon and will offer 25 million shares at $18-$22 and to debut on Wednesday, 10/1.

- One of Fermi’s founders is former energy sector director, Rick Perry.

- The underwriters have reserved for sale at the initial public offering price up to 5% of the shares of common stock for sale through a directed share program.

7. KCC Corp – To Issue 430 Billion Won in EB Using Its Treasury Shares?

- On 23 September, Hankyung Business Daily reported that Kcc Corp (002380 KS) plans to issue about 430 billion won worth of exchangeable bonds (EB) based on its own treasury shares.

- We believe the overall impact on this EB issue on KCC is likely to be more negative as compared to the EB issue it conducted in July 2025.

- Our NAV valuation of KCC Corp suggests NAV per share of 508,467 won, which is 22% higher than current price.

8. ECM Weekly (22 September 2025)- Chery, Zijin Gold, Orion, Myungin, Urban, Avepoint, Dongfang

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Zijin Gold appears to be shining bright.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

9. Zijin Gold IPO: Gold Price Sensitivity Analysis. A High Beta Proxy for Gold

- Zijin Gold (2259 HK) ’s US$3.2 billion IPO closes tomorrow, Wednesday, September 29.

- The pure-play gold miner, backed by Zijin Mining, is priced at an EV/Reserves multiple in the top quartile of global peers.

- With high sensitivity to gold price movements, Zijin Gold offers amplified upside potential — and downside risk — versus bullion itself.

10. Chery Auto IPO (9973.HK): Modest Potential Upside, Geely Auto Screens As a Good Comparison

- Chery Auto, the second largest Chinese domestic brand passenger vehicle company, priced its IPO at the high end of the range at HK$30.75/share.

- High demand for the stock was predictable. Cornerstone investors collectively agreed to acquire ~$588M worth of Chery Auto shares in this offering.

- The Chery Auto stock is set to start trading on Thursday. I see modest potential upside vs. IPO offer price as growth is slowing down and margins compressed.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Kokusai Electric (6525 JP) was IPOed too cheap in 2023 after a couple of years in the wilderness and an aborted private sale effort, blocked on antitrust grounds.

- It nearly tripled, there was an offering announced at ¥5,000+ priced ¥4,500+. Shares fell back to IPO price, then bounced, and we got a July follow-on offering at ¥3,000+.

- I suggested here the back end could be squeezy. It was for a hot minute, then it wasn’t. Now the stock is up 50% in 2 weeks. Watch out!

2. Zijin Gold IPO: Strong Cornerstone Book; Should Trade at Premium to Group

- Zijin Gold (2259 HK) is looking to raise US$3.2bn in its upcoming HK IPO.

- It s a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance in our previous notes. In this note, we talk about valuations.

3. Zijin Gold Pre-IPO: Superior to Peers; Should Trade at High End of Group

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance and done a peer comparison in our previous note. In this note, we will look at the firm’s valuation.

4. ECM Weekly (15 September 2025)- Chery, Zijin Gold, Hesai, Orion, Myungin, Urban, Nio, Kotak, Toei

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, things are picking up going into the year end, as is usual, with multiple US$1bn+ deals said to go live over the next few weeks.

- On the placements front, as well, market remains receptive for both primary and secondary offerings.

5. Zijin Gold Pre-IPO: PHIP Update: Acquisition of Raygorodok Mine for a Song

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance, and done a peer comparison in our previous note. In this note, we will provide a PHIP update.

6. Zijin Gold IPO: PHIP Updates Support the Investment Thesis

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is pre-marketing an HKEx IPO to raise US$3bn.

- I previously discussed the IPO and outlined my investment thesis in Zijin Gold IPO: The Investment Case.

- In this note, I take a look at the new information from the PHIP. The 1H25 results and latest developments underscore my previous bullish thesis.

7. Centurion Accomodation REIT IPO – New Asset Class

- Centurion Accomodation REIT (CAREIT SP) (CAREIT) plans to raise around US$600m in its Singapore listing.

- CAREIT plans to invest directly or indirectly, in a portfolio of purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA) or other accommodation, located globally (excluding Malaysia).

- In this note, we look at the REIT’s portfolio and performance.

8. Pre-IPO Zijin Gold (PHIP Updates) – Thoughts on the Business, the Forecast and Valuation Outlook

- The spin-off of Zijin for an independent listing is equivalent to presenting a “pure gold business” to the market. Such “asset revaluation” can unlock the hidden value of gold business.

- For enterprises like Zijin in the upstream of gold industry chain, a sustained high and rising gold price is usually a significant positive factor. However, there are also potential risks.

- Zijin Gold has better growth potential than peers, so we think its valuation range could be P/E of 18-22x. If based on 2025 net profit forecast, valuation is US$36.9-45.1 billion.

9. Chery Automobile IPO (9973 HK): Valuation Insights

- Chery Automobile (9973 HK) is a Chinese automobile manufacturer. It has launched an HKEx IPO to raise up to US$1.2 billion.

- I previously discussed the IPO in Chery Automobile IPO: The Bull Case and Chery Automobile IPO: The Bear Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is reasonable.

10. Hesai Secondary Trading – Decent Demand, Despite Lack of Correction

- Hesai Group (HSAI US) raised around US$530m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the ADS movement and trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO: The Investment Case

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is seeking to raise US$3 billion.

- Zijin Gold hold interests in eight gold mines located in gold-rich regions across South America, Oceania, Central Asia and Africa.

- The investment case is bullish due to a diversified mine portfolio, strong growth, an attractive margin profile, robust cash generation, and modest leverage.

2. [Japan ECM] Toei Animation (4816) Not as Interesting An Offering As It Could Have Been

- In Feb 2024, I wrote Toei Animation (4816 JP) – This Offering Could Be Heavy; the NEXT Offering Is More Interesting.

- Today, the company announced another offering where Fuji Media Holdings (4676 JP) is selling 10.575mm shares in an overseas offering priced likely tomorrow.

- It is not as interesting as I had expected. But it means the NEXT offering could be more interesting. But there is index buying long-term anyway.

3. Hesai Secondary Offering – Stock Hasn’t Corrected Yet

- Hesai Group (HSAI US) plans to raise around US$450m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

4. ECM Weekly (8 September 2025)- Metaplanet, Lifedrink, Koei, Hesai, Orion, Myungin, Hesai, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a few US$1bn+ IPOs are said to be looking to launch later this month, across regions.

- On the placements front, deals continue to flow through as the market remains receptive.

5. NIO (NIO US/9866 HK): An Opportunistically Timed US$1 Billion Raise

- NIO (NIO US), a Chinese premium electric vehicle manufacturer, has launched an equity offering to raise around US$1 billion.

- The raise is opportunistically timed to take advantage of the 83% QTD share price rally and comes hot on the heels of a US$513 million raise in April.

- While NIO continues to target a break-even in 4Q25 and reduce its cash burn, the valuation is stretched. A history of false dawns and intensifying competition warrants caution.

6. Toei Animation Placement: Expensive, but Owns Valuable IP

- Toei Animation (4816 JP) ’s shareholder, Fuji Media, is looking to raise around US$210m from a secondary placement.

- The deal is a large one to digest, representing 41.7 days of the stock’s three month ADV and 4.9% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

7. NIO HK/ADS Placement – Slightly Better Placed, but Slightly Bigger Deal at US$1bn

- NIO (NIO US) is looking to raise around US$1bn via a primary placement in Hong Kong and US.

- The company had last raised around US$450m in March 2025. The deal didn’t end up doing well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Zijin Gold IPO Valuation Analysis

- Our base case valuation of Zijin Gold suggests implied EV of US$40.4 billion and market cap of US$42.9 billion.

- Our EV/EBITDA valuation multiple of 14.3x is based on a 50% premium to the comps’ valuation multiple in 2026.

- We believe a 50% premium valuation to the comps’ average EV/EBITDA multiple is appropriate for Zijin Gold mainly due its higher sales growth, EBITDA margins, and ROE than the comps.

9. Chery Automobile IPO: The Bear Case

- Chery Automobile (CH3456 CH), a Chinese automobile manufacturer, has secured HKEx listing approval for a US$1.5-2.0 billion IPO.

- In Chery Automobile IPO: The Bull Case, I highlighted the key elements of the bull case. In this note, I outline the bear case.

- The bear case rests on weakening trends of the primary business, gross margin pressure, declining contract liabilities and factoring of receivables.

10. Zijin Gold IPO Preview

- Zijin Gold is getting ready to complete its IPO in Hong Kong this year. A successful IPO of Zijin Gold could fetch as high as US$3 billion in IPO proceeds.

- Zijin Gold had sales of US$3.0 billion (up 32.2% YoY) in 2024. Net margin increased from 14.2% in 2023 to 20.8% in 2024.

- There has been a sharp increase in the gap between gold AISC (all-in-sustaining cost) and gold price in the past year, leading to higher profit margins of gold producers globally.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

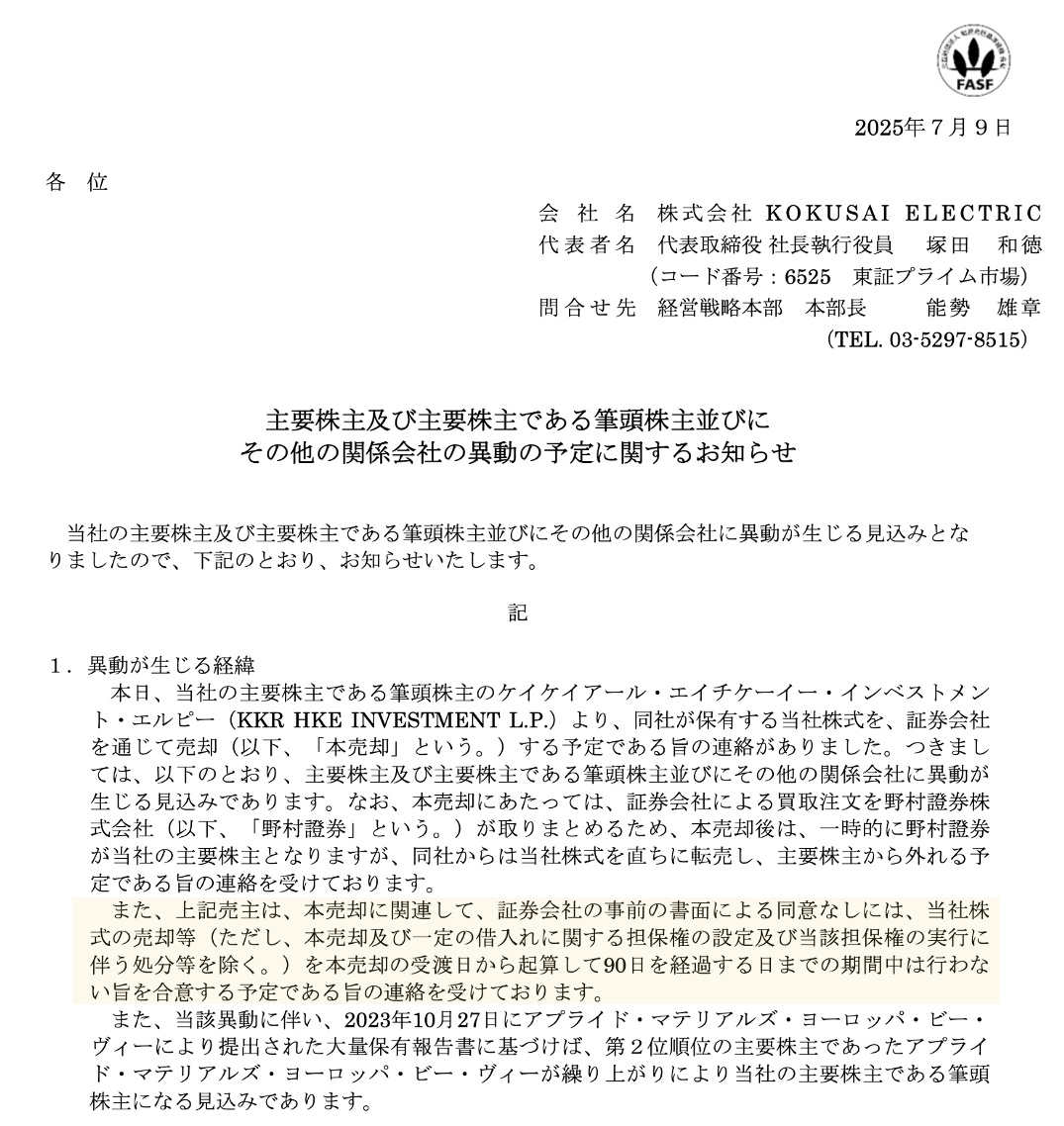

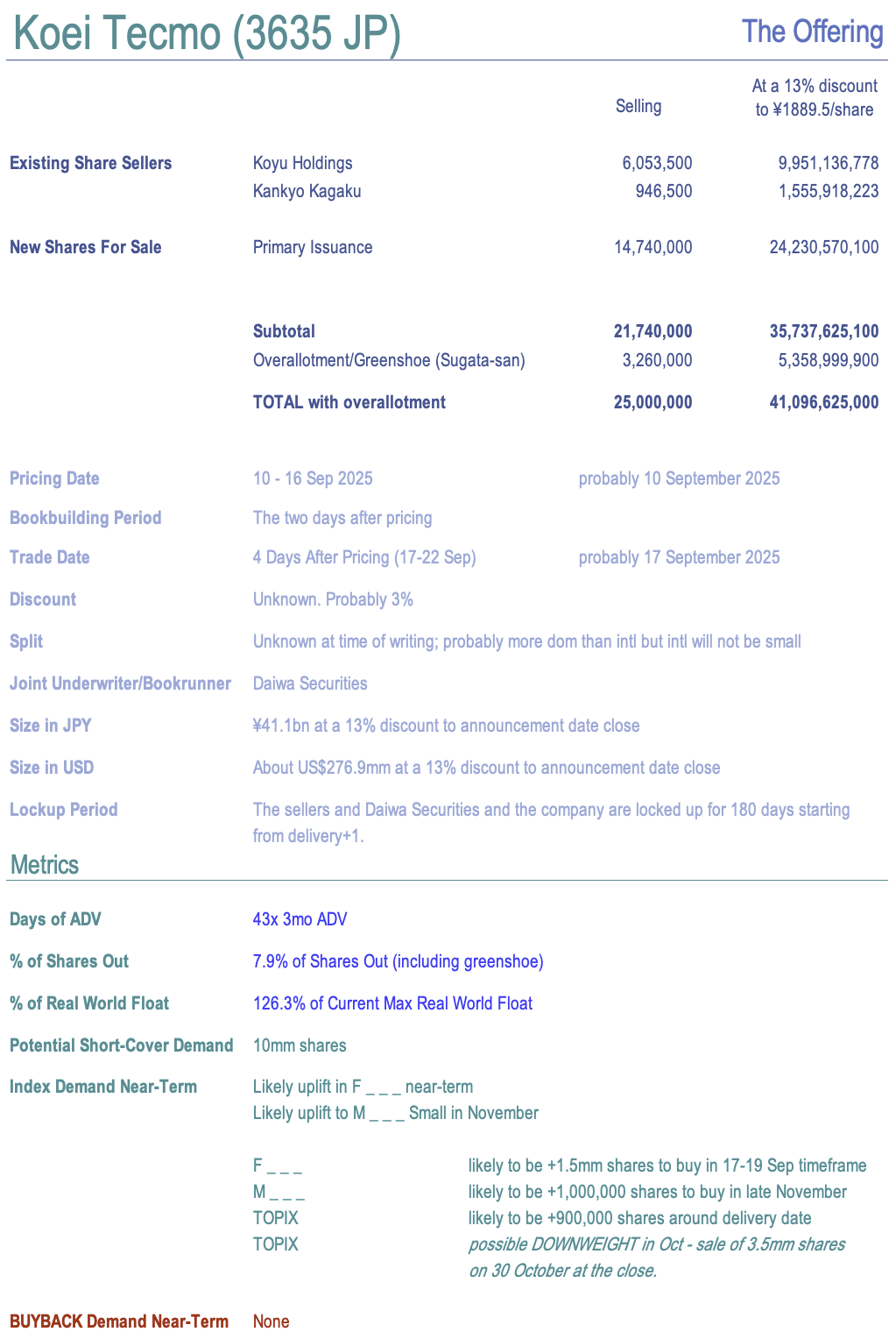

1. [Japan ECM] Koei Tecmo (3635 JP) Needs to Sell Shares To Stay in Prime ($280mm Offering)

- In December 2021, Koei Tecmo Holdings (3635 JP) announced a complex but lower-impact move to increase float share count in order to stay listed on TSE Prime.

- Scheme: buyback from two holders plus CB issuance. Unfortunately, shares did not rise enough to convert the CBs so as of March 2025, the tradable share criteria was not met.

- So now the two main holders are selling more shares and the company is diluting holders with new issuance to get float/tradable shares up with a US$280mm offering.

2. [Japan ECM] Lifedrink (2585) – Fast-Growing Beverage Seller Meets P.E. Firm Selldown

- Today post-close, Lifedrink (2585 JP) announced the Sunrise PE funds which own 22% of the company will sell their stake in a clean-up offering with pricing in 8 days.

- This offering comes 8 trading days after a new post-earnings all-time-high. At 24x ADV, the offering will increase Max Real World Float by 50+%.

- There are some index and buyback supply/demand dynamics to note. It’s a heavy offering, so bullish/bearish may be a matter of horizon.

3. Metaplanet Placement: A Look at Other Treasury Play Issuances and Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.8 days of the stock’s three month ADV, despite being 22.8% of total shares outstanding.

- In this note, we look at Metaplanet and its peers.

4. Shandong Gold Mining Placement – H-Share Running Ahead of A-Shares

- Shandong Gold Mining (1787 HK) aims to raise around US$500m via a primary placement, in order to pay down debt.

- The H-shares are now trading at all-time highs and have been performing better than the A-shares this year.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

5. Hesai Secondary HK Offering – Stock Has Been Recovering, a Look at Possible Trading Setup

- Hesai Group (HSAI US) plans to raise around US$200-300m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 31st August 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

6. ECM Weekly (1 September 2025)- Nissan, Metaplanet, Indigo, Laopu, Akeso, Mixue, Aux, Orion, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of company’s appear to be lining up to launch their IPOs in the coming month.

- On the placements front, there were a number of large deals across the region.

7. Koei Tecmo Placement: Some Non-Fundamental Selling; but Weak Fundamentals

- Koei Tecmo Holdings (3635 JP) is looking to raise around US$270m from a primary and secondary placement.

- The deal is a large one to digest, representing 37.6 days of the stock’s three month ADV and 6.1% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Simcere Pharma Placement – First Primary Raising, past Deals Have Been Mixed

- Simcere Pharmaceutical Group (2096 HK) is looking to raise around US$200m via a top-up placement.

- This is the first primary raising by the company since its listing. There have been a few secondary deals, with mixed results.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

9. Hesai Group H Share Listing: The Investment Case

- Hesai Group (HSAI US), a global leader in LiDAR solutions, is seeking to raise US$300 million through an H Share listing.

- On 9 February 2023, Hesai listed on the Nasdaq, raising US$190 million at US$19.00 per ADS.

- The investment case is based on a solid competitive positioning, high growth, emerging profitability, declining cash burn, and a reasonable valuation.

10. Orion Breweries IPO – Smaller Scale Warrants Discount

- Orion Breweries Limited’s (409A JT) operations span across alcoholic beverages, tourism and hotel businesses, aiming to raise ~US$126m in its Japan IPO via a mix of primary and secondary offerings.

- Orion Breweries (OBL) has a strong Okinawa market position. Share of overseas sales has been growing (~23% of FY25 revenues), while profitability has also largely been steady.

- In our previous note, we looked at the firm’s past performance. In this note, we talk about the peer comparison and IPO valuations.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

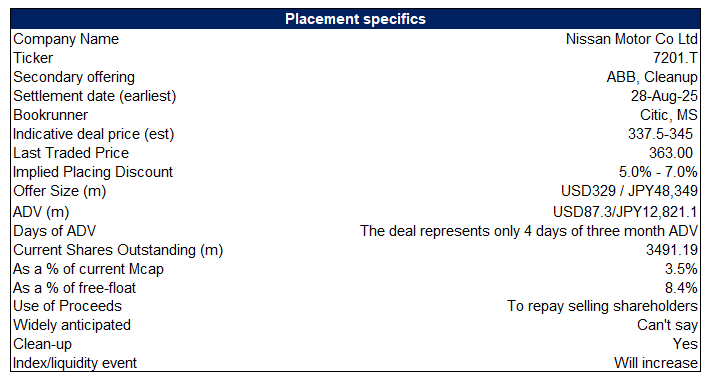

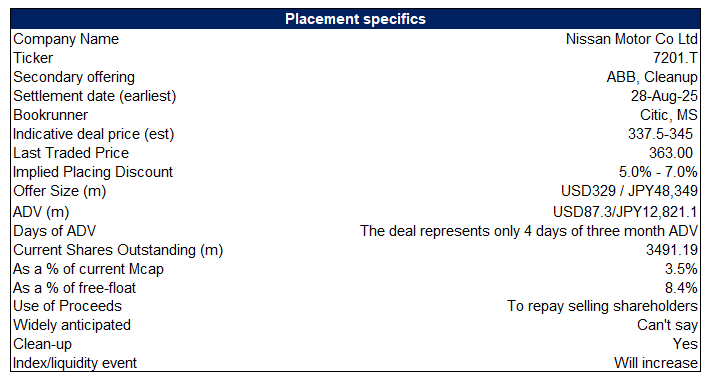

1. Nissan Motor Placement – Discount Is Enticing but Track Record and Momentum Aren’t Great

- Mercedes-Benz Pension Trust aims to raise around US$330m via selling its 3.8% stake in Nissan Motor (7201 JP).

- The discount seems enticing, however, the company’s recent share performance and longer term track record aren’t great.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Akeso Inc Placement – Another Opportunistic Raise, Mixed past Deal but Is Relatively Small

- Akeso Biopharma Inc (9926 HK) is looking to raise around US$460m from a mix of primary placement and selldown by its founders.

- Past deals in the name have been mixed, but the shares have been doing well and the deal size remains small.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

3. Laopu Gold Placement – Relatively Small Deal, past One Did Well

- What seems to be the controlling shareholder of Laopu Gold (6181 HK), aims to raise around US$250m via selling 1.6% of the company.

- The shares have done very well since its listing and the previous deal in the name did well too.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

4. Metaplanet Placement: US$1bn Punt; Dependent on Bitcoin Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.4 days of the stock’s three month ADV, despite being 23.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. MIXUE IPO Lockup – US$480m Cornerstone Lockup Release

- Mixue Group (2097 HK) raised around US$450m in its Hong Kong IPO in March 2025. The lockup on its cornerstone investors is set to expire soon.

- MIXUE Group (MIXUE) is a freshly-made drinks company providing affordable products to consumers, including freshly-made fruit drinks, tea, ice cream and coffee, typically priced at around one USD per item.

- In this note, we will talk about the lockup dynamics and possible placement.

6. Aux Electric IPO: Smallest Player but Superior Growth and Margins

- Aux Electric (2580 HK) is looking to raise up to US$460m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Aux Electric IPO (2580 HK): Valuation Insights

- Aux Electric (2580 HK) is the fifth-largest air conditioner provider globally as measured by volume. It has launched an HKEx IPO to raise up to US$462 million.

- I discussed the investment case in Aux Electric IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive.

8. Ganfeng Lithium Group Co Placement – Past Deals Record Isn’t Great but Deal Is Small

- Ganfeng Lithium (1772 HK) is looking to raise upto US$152m via a primary placement of 40m shares. There is also a concurrent CB offering for ~HKD1.3bn along with the placement.

- The company intends to use the proceeds towards repayment of loans, capacity expansion and construction, replenishment of working capital and other general corporate purposes.

- In this note, we will talk about the placement and run the deal through our ECM framework.

9. Robotis – Rights Offering of 100 Billion Won

- On 28 August, Robotis (108490 KS) announced a rights offering capital increase of 100 billion won.

- Rights offering plan is to allocate 1,349,528 new shares (10% of outstanding shares) to existing shareholders, and then conduct a public offering for general investors once forfeited shares are issued.

- The expected rights offering price is 74,100 won per share (12.8% lower than current price). We are Negative on this rights offering.

10. Interglobe Aviation (Indigo) Placement – Second US$800m+ Deal by Co-Founder This Year

- InterGlobe Aviation Ltd (INDIGO IN) co-founder, Rakesh Gangwal, aims to raise around US$802m via selling around a 3% stake in Indigo.

- He had earlier stated his intention to pare down his stake after a long drawn, and very public battle, with his co-founder Rahul Bhatia. He has sold many times before.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

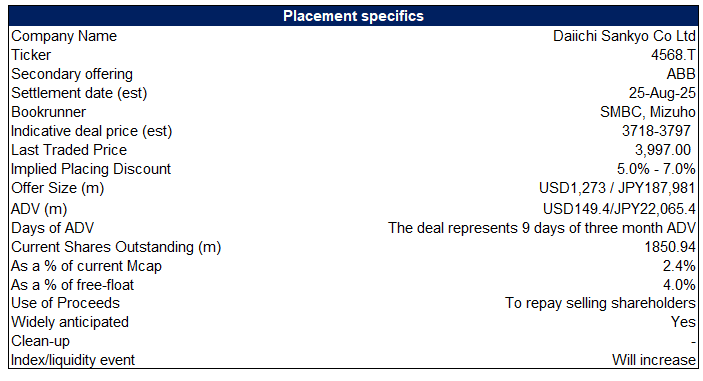

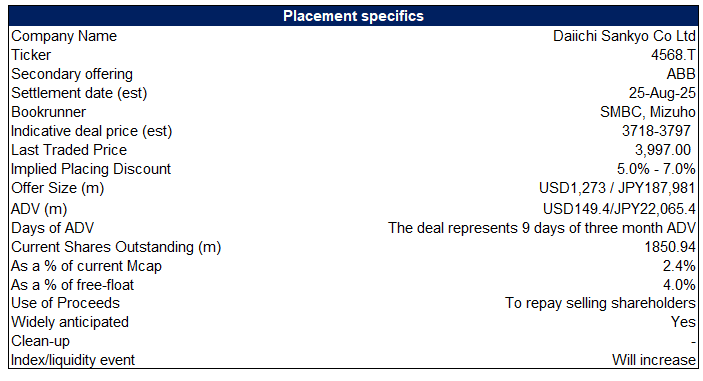

1. Daiichi Sankyo Placement – US$1.2bn Deal but Momentum Isn’t the Best, Last Deal Didn’t Do Well

- A group of shareholders are looking to raise up to US$1.2bn via selling most of their stake in Daiichi Sankyo (4568 JP) .

- While the deal shouldn’t come as a surprise, given the ongoing cross-shareholding unwind, the last deal in the stock didn’t do well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Hansoh Pharma Placement – Somewhat Expected but Still Opportunistic

- Hansoh Pharmaceutical Group (3692 HK) aims to raise around US$500m via a primary placement.

- The stock has done exceptionally well this year but is now trading at near its all-time highs and it doesn’t really need the cash.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

3. [Japan ECM/Index] Japan Business Systems (5036) Offering Triggers Move to TOPIX

- Japan Business Systems (5036 JP) today announced a couple of interesting things. First, admission to TOPIX (contingent on a successful secondary offering of shares, also announced today).

- Then a ¥5/share special commemorative dividend (0.4%) and a “gift” of 4% of the company to a J-ESOP Trust for employees, where the company gifts the shares.

- The latter looks aggressive/generous, but the modalities here are interesting.

4. IFAST Placement – Great Track Record but the Stock Is Toppish

- Temasek aims to raise around US$104m via selling nearly half of its stake in iFAST (IFAST SP).

- The stock has done exceptionally well over the past few years, however, it is now trading at its all time highs.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

5. ECM Weekly (18 August 2025)- Eve Energy, CNGR, Will Semi, 52 Toys, JSW, Bluestone, Tuas, Hexaware

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of companies are lining up to start 2H listing season, which is likely to be one of the busiest over the past few years.

- On the placements front as well, given ongoing earnings annoucement there were only one large placement last week.

6. Hansoh Pharmaceutical (3692 HK): Placing Shares to Fund R&D Amid Stellar 1H Performance

- Hansoh Pharmaceutical Group (3692 HK) is placing 108M shares at the price of HK$36.30 per share. 65% of the proceeds will be used for the R&D of new innovative drugs.

- Hansoh’s late-stage pipeline seems to be interesting, as its key focus areas being oncology and metabolic diseases, which are among the fast-growing therapeutic areas, with huge addressable patient population.

- Hansoh has announced better-than-expected 1H25 result, with both revenue and net profit beating consensus. Innovative drugs revenue increased 22% YoY to RMB6B, contributing 82.7% of total revenue.

7. Shuangdeng Group IPO: Weak Earnings This Year but Potentially Hot Data Centre Trade

- Shuangdeng Group Co Ltd (JISHUZ CH) is looking to raise around US$109m in its upcoming Hong Kong IPO.

- It’s a global leader in energy storage business for big-data and telecommunication industries with a diverse customer base comprising telecom base station operations, data centers, power stations and power grids.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

8. Aux Electric Pre-IPO: Competitive Niche

- Aux Electric Co Ltd (0917839D HK) is looking to raise up to US$600m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we look at the firm’s past performance.

9. Guzman IPO Lockup – Last of the Lockups for a US$750m+ Release

- Guzman Y Gomez (GYG AU) raised around US$221m in its Australian IPO. Its final IPO linked lockup expiry is due soon.

- GYG is a quick service restaurant business with more than 200 restaurants globally. It mainly focuses on fresh, made-to-order, Mexican-inspired food.

- In this note, we will talk about the lockup dynamics and possible placement.

10. SICC A/H Trading – Strong Retail, Lukewarm Insti Demand

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, raised around US$260m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. SICC A/H Listing – Needs a Very Deep Discount

- SICC (688234 CH) , a manufacturer of high-quality SiC substrates, aims to raise up to US$260m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

2. ECM Weekly (11 August 2025)-Bharti, Eternal, Paytm, LG CNS, Guming, JSW, Bluestone, SICC, Roborock

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Inida ECM flows continued unabated with more deals being launched.

- On the placements front as well, India saw over US$2bn worth of deals during the week.

3. Bullish US LLC (BLSH): Digital Asset Platform Delivers One of the Year’s Biggest First-Day Pops

- Bullish US (BLSH US) priced its upsized IPO of 30.0 million shares at $37.00, which was $4 above the already upwardly revised $32–$33 range.

- The stock opened at $90.00, marking a +143.2% gain at first trade, and cementing one of the largest opening day premiums for a U.S. IPO this year.

- The debut pop places Bullish among the standout IPOs of 2025, but the question will be whether the stock can maintain momentum in the aftermarket.

4. Eve Energy A/H Listing – One of the Leaders but Growth Has Been Slowing

- EVE Energy (300014 CH) (EVE), a lithium battery provider, aims to raise around US$1bn in its H-share listing.

- EVE produces lithium batteries which cater to consumer battery, power battery and ESS battery sectors.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

5. Bullish US LLC (BLSH): IPO Range and Size Increased, Next Digital Asset Moonshot on Deck

- The global digital asset platform that provides market infrastructure and information services increased its price range and shares being offered on Monday morning.

- Looking at the prospectus, there is a $200 million anchor order from Ark Investment and BlackRock.

- The Bullish IPO is looking to ride the tailwinds from the regulatory wins in the digital asset space as well as the success of recent IPOs.

6. Tuas Ltd Placement: Cheap Acquisition Funded by Expensive Currency

- Tuas Ltd (TUA AU) is looking to raise around US$239m in its fully underwritten Australian placement.

- The company will use the proceeds to partially fund the acquisition of Singaporean digital network operator M1.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

7. Bluestone Jewellery IPO – Moving from Online to Offline. Thoughts on Valuation

- Bluestone Jewellery and Lifestyle (BJL) is planning to raise about US$176m in its upcoming India IPO.

- BJL offers contemporary lifestyle diamond, gold, platinum, and studded jewellery under its flagship brand. It is a digital-first direct-to-consumer (DTC) brand.

- We have looked at the past performance in our previous note. In this note, we talk about the IPO pricing.

8. Kasumigaseki Hotel REIT IPO: Books Well Covered; Modest Upside from Here

- Kasumigaseki Hotel REIT (401A JP) raised US$193m in its upcoming Japan IPO.

- Kasumigaseki Hotel REIT Investment is a REIT with hotel assets. It is an investment corporation sponsored by affiliated developer, Kasumigaseki Capital.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation

9. Innogen IPO: Competition Mars Outlook, Long Way To Go, Listing Gain Only Incentive For Now

- Guangzhou Innogen Pharmaceutical Group launched its Hongkong IPO aiming to raise up to HK$683M. The company plans to sell 36.6M shares at HK$18.68 per share.

- Innogen discovers, develops, and commercializes innovative therapies for diabetes and other metabolic diseases. Their portfolio currently comprises of one core product, Efsubaglutide Alfa, for treatment of type 2 diabetes.

- The GLP-1 drug market is slowly tending towards an overheated zone with upcoming Ozempic’s patent expiry in 2026.

10. Innogen (银诺医药) IPO Trading Update

- Innogen raised HKD 683m (USD 88m) from its global offering and will list on the Hong Kong Stock Exchange on Friday, August 14th.

- In our previous note, we looked at the company’s operation, management track records and discussed the IPO valuation.

- In this note, we provide an update for the IPO before trading debut.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

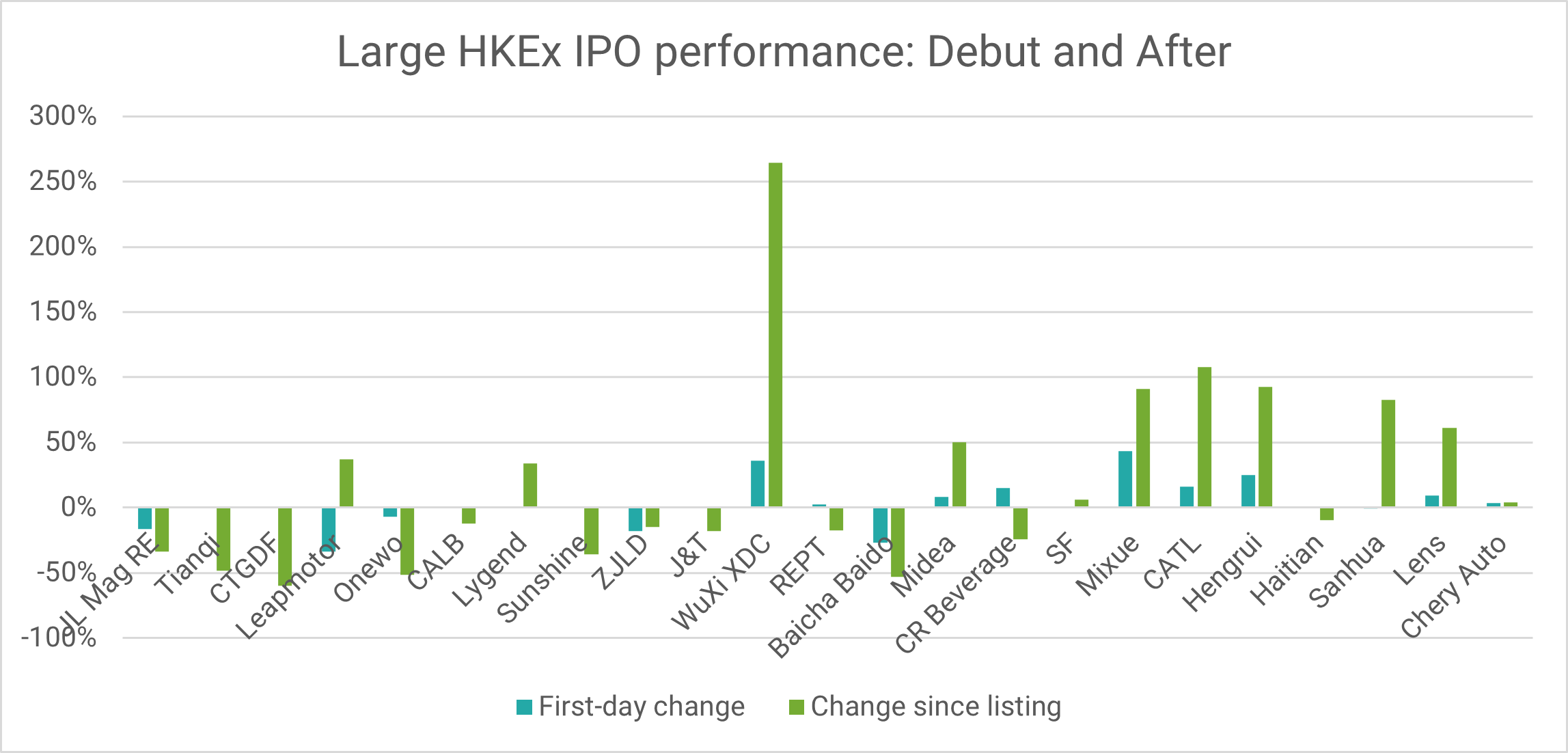

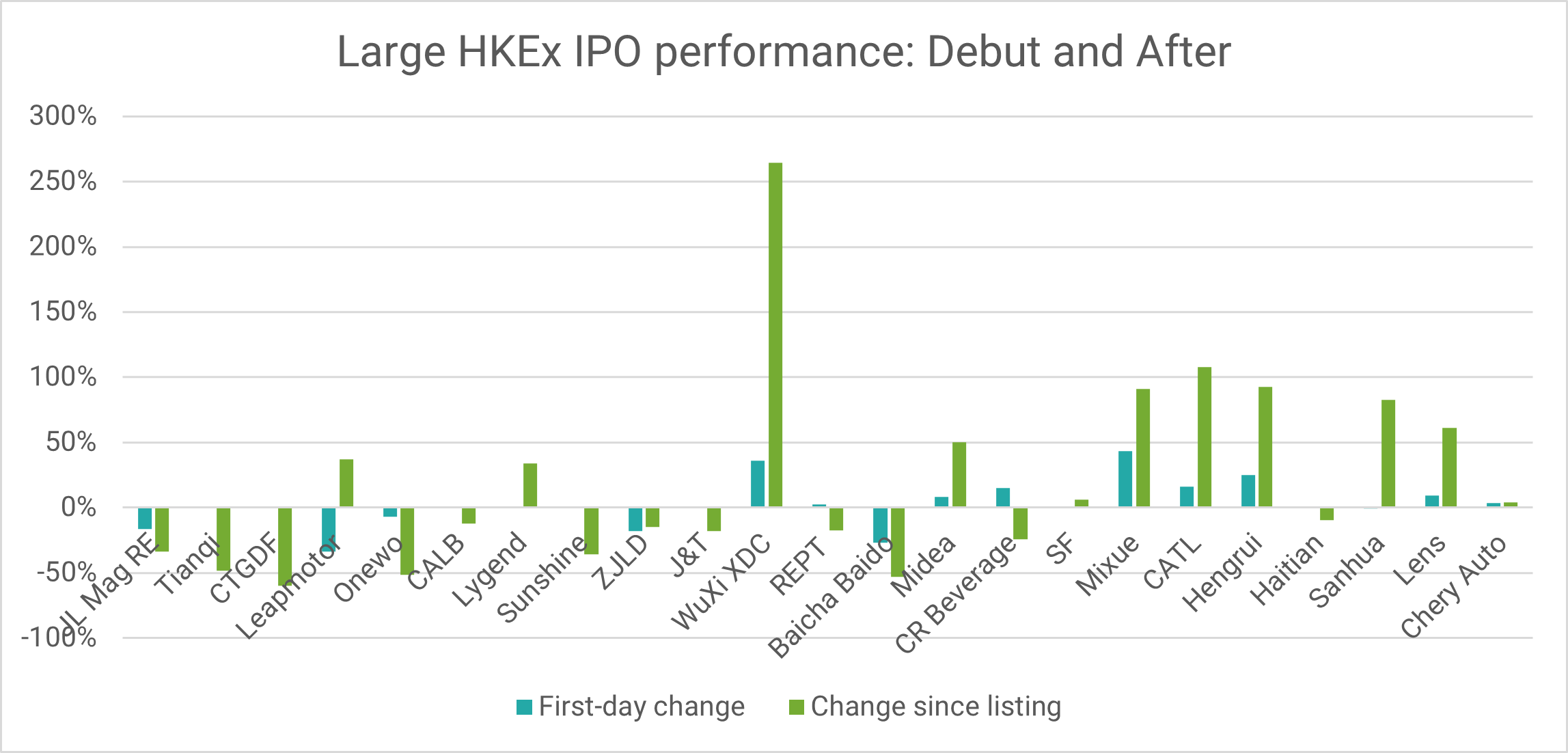

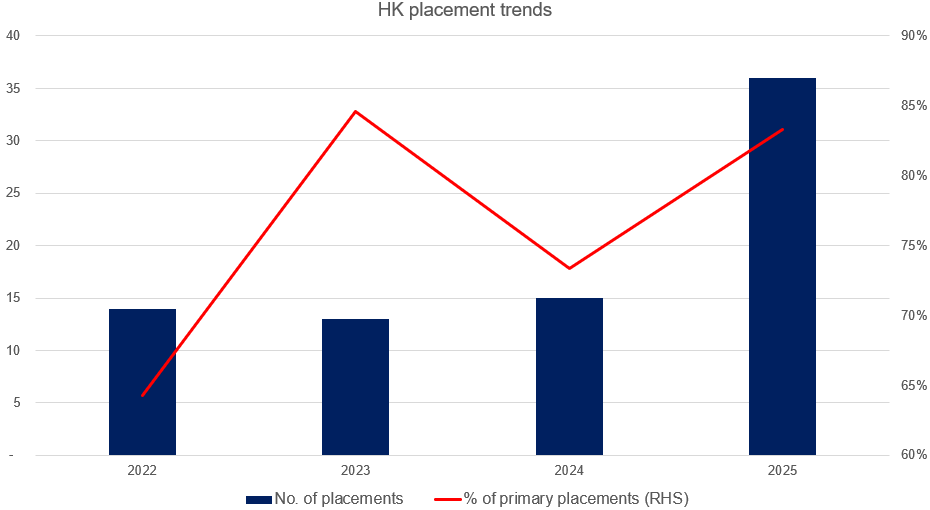

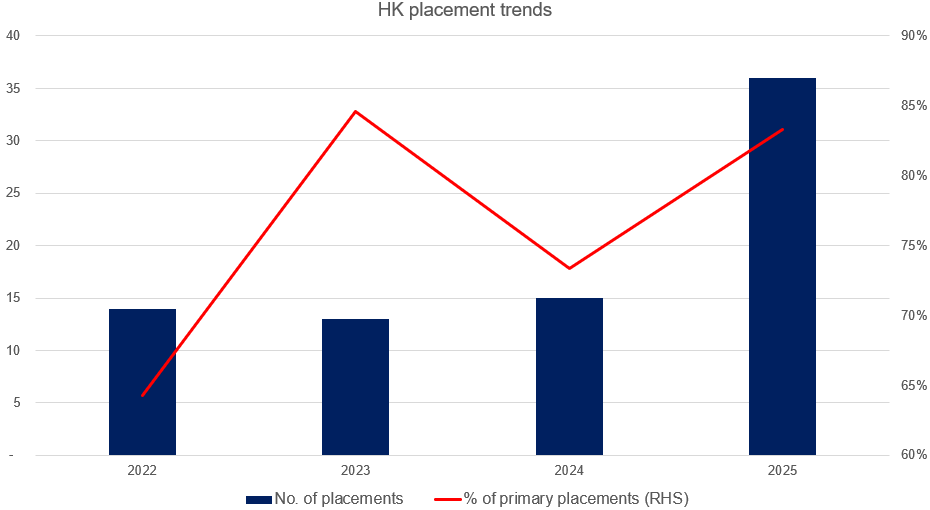

1. Hong Kong 2025 Placements – Year so Far and Trends for Potential Primary Placements

- 2025 has seen a sharp turnaround in HK placements, with 36 US$100m+ deals so far. This compares to only 14 in 2022, 13 in 2023, and 15 in 2024.

- Most of the 2025 placements have been primary raising and have come from a handful of sectors/backdrops.

- In this note, we try to identify the possible primary placements that could take place over the rest of the year.

2. HKEx Consultation Paper (Conclusion) – What Matters for ECM Investors

- The SEHK recently issued an update in response to its consultation paper in December 2025, with new mechanisms proposed for the IPO in the future.

- In this note, we summarize the conclusion by HKEx and the rules to be implemented.

- We are of the view that overall, the changes will benefit ECM investors with greater certainty in allocations.

3. ECM Weekly (4 August 2025)-Meituan, LG CNS, Wuxi AppTec, SICC, NSDL, Aditya Info, GigaDevice, WeWork

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India deal flow remains strong, with HK A/H listing starting to flow in again.

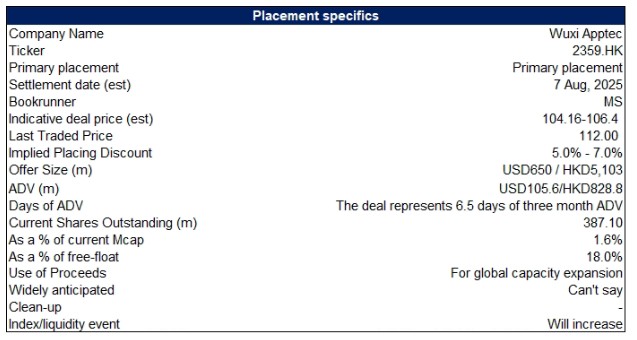

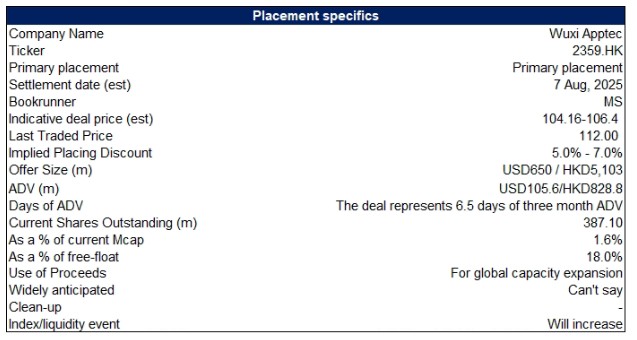

- On the placements front, WuXi AppTec (2359 HK) undertook a mega raising, while Prosus NV (PRX NA) has begun to pare its stake in Meituan (3690 HK).

4. Eternal (Zomato) Placement – Second Clean-Up by Antfin This Week, Will Lift the Overhang

- Antfin (Netherlands) Holding B.V. is looking to raise up to US$612m via a cleanup of its remaining ~2% stake in Eternal (ETERNAL IN) .

- Antfin has been selling off parts of its ~14% stake in the firm since the IPO. The company last sold a 2% stake to raise upto US$400m in Aug 2024.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

5. Bullish US LLC (BLSH): Global Digital Asset Platform Sets Terms Seeking up to $4.2b IPO Valuation

- Bullish US will offer 20.3 million shares at $28-$31 and is scheduled to debut on Wednesday (8/13).

- BlackRock, Inc., and ARK Investment Management, LLC and/or its affiliated entitiesindicated an interest in purchasing up to an aggregate of $200 million in this offering.

- A combination of highly-notable existing shareholder base, anchor orders and tailwinds from the industry will likely have this IPO in high demand.

6. PayTM Block – US$434m Clean-Up by Antfin

- Antfin (Netherlands) Holding B.V. (Antfin) is looking to raise up to US$434 via a cleanup of its remaining 5.8% stake in Paytm (PAYTM IN).

- Antfin has been selling off its stake in PayTM since it pared around 12% in Nov 2021 IPO. It last sold a 4% stake to raise upto US$242m in May2025.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

7. Pre-IPO Guangzhou Innogen Pharmaceutical Group (PHIP Updates) – Some Points Worth the Attention

- Compared to competitors, the competitive advantage of Efsubaglutide Alfa is not obvious.The weight loss effect of single target mechanism could be weaker than that of competing dual and triple agonists

- Before Innogen filed for listing, some pre-IPO investors chose to transfer the Company’s equity they held at a discount, indicating that these investors lack confidence in the Company’s prospects.

- Under the double pressure of a single pipeline and lagging commercialization, pre-IPO valuation of RMB4.65bn is more like a dangerous bubble game.We shared our views on valuation and post-IPO performance.

8. Boston Dynamics – Rights Offering of 1.2 Trillion Won Expected; Potential IPO in 2027/2028 in NASDAQ

- There has been an increasing probability that Boston Dynamics (BD) announces a fourth rights offering capital raise worth about 1.2 trillion won (US$870 million) in the next several weeks.

- All the Hyundai Motor Group related entities are expected to increase their ownership stakes in Boston Dynamics whereas it is expected to decline for Softbank post the capital raise.

- The current valuation estimates of Boston Dynamics (post capital raise) vary widely from about 4 trillion won to 10 trillion won.

9. Curator’s Cut: China Healthcare Rally, Financial Market Infra Moves, and Korea’s Equity Upswing

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published in the past two weeks on Smartkarma

- In this cut, we review the rally in Chinese healthcare in 2025, track some updates in financial markets infrastructure companies, and see how Korean equities have done since end-May

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

10. SICC A/H Listing – PHIP Updates and Thoughts on A/H Premium

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, aims to raise up to US$250m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- In this note, we look at the PHIP updates and talk about the likely A/H premium.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Wuxi AppTec Placement – Momentum Is Very Strong, Though It Is a Bit Opportunistic

- WuXi AppTec (2359 HK) aims to raise around US$650m via its H-share placement.

- The stock has been on a roll this year and recently announced strong earnings as well. Although it’s now trading at its 52-week highs.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. National Securities Depository Limited (NSDL) IPO – Peer Comparison and Thoughts on Valuation

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we undertake a peer comparison and talk about valuations.

3. ECM Weekly (28 July 2025) – MMC, Pine Lags, Prestige, Veritas, Daehan, Kasumigaseki, NSDL, GNI

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, we had a look at a number of deals that are in the pipeline.

- On the placements front, it was a relatively quiet week with a few primary raisings.

4. Kasumigaseki Hotel REIT IPO: Lags in Size but Priced at a Discount

- Kasumigaseki Hotel REIT (401A JP) is looking to raise up to US$192m in its upcoming Japan IPO.

- It is a REIT with hotel assets sponsored by affiliated developer, Kasumigaseki Capital (3498 JP).

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

5. Figma Inc (FIG): Range Boosted As Blow-Out Demand Comes in for High-Profile Software IPO

- Figma increased its range from $25-$28 to $30-$32 on Monday morning. The company is still offering 36.9mm shares and is scheduled to debut on July 31st.

- One of our sources stated that the amount of orders in this software IPO exceed 30-times the offering size.

- The large customer base, excellent margins and revenue growth in combination with management that continues to reinvest in the business gives us strong conviction on this IPO.

6. Firefly Aerospace Inc. (FLY): Space & Defense Company Sets Terms for IPO Seeking $5.5b Valuation

- They will be offering 16.2mm shares at $35-$39 with an expected market cap between $4.9b and $5.5b and to debut on August 7th.

- The company’s principal stockholder is private-equity firm AE Industrial which made its initial investment in Firefly Aerospace in 2022 and is a 47.4% stakeholder.

- Revenue in Q2 is up more around 140% versus the same period in 2024 but the company’s net losses continue to mount.

7. NSDL – New Management, Revised Strategy — The Battle for Market Share Continues

- This insight describes about NSDL (NSDL IN) ‘s complete overhaul in top management team over the last 12 months.

- The mandate for new team is to arrest the market share loss with new age/ discount brokers. The revised strategy seems to be working.

- The IPO provides investors a front-row seat opportunity to witness this turnaround.

8. Samyang Comtech IPO Book Building Results Analysis

- Samyang Comtech completed solid book building results. The IPO price has been finalized at 7,700 won per share, which was at the high end of the IPO price range.

- A 48.4% of the total IPO shares are under various lock-up periods lasting from 15 days to 6 months. This is a bullish signal.

- Our valuation analysis suggests target price of 13,187 won, which represents a 71% upside from IPO price. Given the excellent upside, we have a Positive view of this IPO.

9. National Securities Depository Limited (NSDL) IPO – RHP Updates – Revenue Slowing, Margins Growing

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we talk about the updates from its RHP filing.

10. Ab&B Bio-Tech (中慧生物) Pre-IPO: PHIP Updates Suggest Competition Intensifying

- China-Based vaccine biopharmaceutical company Ab&B is looking to raise at least US$100 million via a Hong Kong listing. The joint book runners are CITIC and CMBI.

- In our previous insight, we looked at the story that the company is trying to sell and the influenza vaccine market.

- In this insight, we look at the latest updates in its PHIP filing.