Entity | Insights | Analytics | News | Discussion | Filings | Reports |

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Apple Intelligence. What’s Another Year?

- Apple failed to deliver on the highly anticipated Siri makeover, noting that it didn’t meet their quality standards and effectively pushing it out for another full year

- Internal rivalries, divided opinions on the direction AI should take, organizational restructuring, unwillingness to do meaningful acquisitions would all appear to be contributing to Apple’s AI woes

- Apple’s peers are advancing their AI ambitions at warp speed, investing heavily, taking bold risks and mostly delivering on their promises. Apple is the polar opposite. What’s another year? Failure.

2. Micron Q325 Earnings: NAND’s Surprising Rebound While HBM Already @$6 Billion Annual Run Rate.

- Q325 revenues of $9.3 billion, up 15% QoQ and up 37% YoY and $500 million above the guided midpoint. This represented a new quarterly revenue record for the company

- Micron forecasted current quarter revenues of $10.7 billion, up 15% QoQ, with gross margin of 42%, up 300 basis points sequentially

- HBM negotiations for 2026 supply & pricing still ongoing. Could Micron be holding out for a better deal?

3. TSMC (2330.TT; TSM.US): Will Rapidus Threaten TSMC’s 2nm Market? We Think It’s Too Early to Say (II)

- Japan’s Fujitsu Ltd (6702 JP) is currently developing a 2nm CPU named “MONAKA” (link). The CPU is planned to be manufactured by Taiwan Semiconductor (TSMC) – ADR (TSM US).

- Rapidus has to deal with high technical barriers, tight timelines, heavy R&D costs, market and profitability challenges.

- Talent shortage in Japan: A lingering pain for the Semiconductor industry

4. Coatue Doubles Down On An AI Supercycle @ EMW 2025

- Cloud 2025 CapEx consensus increased 70% from January 2024 to the present day $365 billion

- Google page views declined 8% since the launch of ChatGPT

- Apart from the Mag7, Coatue is heavily focusing investment on companies involved in AI-required power delivery, AI software and AI semiconductors

5. Taiwan Dual-Listings Monitor: TSMC Historically High Spread Persisting; UMC High Premium

- TSMC: +22.1% Premium; Consider Shorting ADR Spread at Current Level

- UMC: +3.5% Premium; Extreme vs. History, Consider Shorting ADR Spread

- ASE: +2.4% Premium; Approaching Level to Long the ADR Spread

6. Memory Monitor: Micron Reinforces AI Memory Tailwinds, But Broader Supply Chain Recovery Gradual

- Micron Results Beat Across the Board, AI Product Mix Drives Gross Margin Upside

- No Evidence Yet of Hyperscaler Pullback, But No Significant Increase in Outlook Either

- Conclusion: AI-Driven Strength Continues, But Divergence Across the Memory Supply Chain Persists

7. Taiwan Tech Weekly: 1.4nm Slips from Samsung’s Grip? Why Intel May Be TSMCs Sole Next Gen Competitor

- Samsung’s 1.4nm Technology Delay Highlights Potential That Intel Could End Up the Only Viable Alternative to TSMC — Maintain Structural Long for TSMC

- Micron Results Today Will Provide Insight Into Resilience of AI/HPC Equipment Demand

- TechChain Insights: Himax Threatened by China Auto Chip Push? CPO Tech with TSMC Remains Bright Spot

8. TechChain Insights: Himax Threatened by China Auto Chip Push? CPO Tech with TSMC Remains Bright Spot

- China’s push for 100% auto chip localization by 2027 poses risk to Himax, which derived 75% of 1Q25 revenue from China. We engaged the company for comments./

- Himax may avoid direct targeting due to Taiwanese roots and local production via CN Nexchip, and we believe is less vulnerable than Western firms like NXP, TI, and Wolfspeed.

- Copackaged Optics (CPO) industry momentum continues to build as Himax continues role alongside TSMC and FOCI; industry moves from Nvidia, AMD validate long-term optical interconnect opportunity Himax is positioned for.

9. Mediatek Rising in Smartphones and Beyond – Q1 Market Share, Nvidia Partnership, TSMC Node Advantage

- 1Q25 Smartphone Chipset Market Share Data — Shows Growth Outperformance for Mediatek

- Nvidia Partnership Helping Mediatek Break Into PCs and Handheld Gaming Devices — High End Graphics Performance for Small Form Factors

- Smartphones Expected to Rapidly Switch to Advanced Node Chipsets by 2026 — This Plays to Mediatek’s TSMC Advantage

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HDB Financial IPO: The Investment Case

- HDB Financial Services Ltd (0117739D IN) is India’s seventh-largest non-banking financial company (NBFC). It is seeking to raise Rs125 billion (US$1.4 billion).

- The proposed IPO comprises a primary raise of Rs25 billion (US$388 million) and a secondary raise of Rs100 billion (US$1.2 billion) by the parent.

- The fundamentals are average at best, as HDB does not outperform its NBFC peers on key performance indicators.

2. Anjoy Foods Group A/H Listing – Isn’t Great but Can’t Ask for It to Cheaper

- Anjoy Foods Group (603345 CH), a quick-frozen food company in China, aims to raise around US$336m in its H-share listing.

- AFG was the largest quick-frozen food company in China in terms of revenue in 2023, with a market share of 6.2%, according to the Frost & Sullivan report.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

3. Innovent Biologics Placement – Second for the Month, Stock Has Doubled but Momentum Is Strong

- Innovent Biologics Inc (1801 HK) aims to raise around US$500m for R&D and marketing.

- The company has undertaken a number of deals in the past, with the overall results being mixed but recent deals have done well.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

4. IFBH Ltd IPO: Heavy on Coconut and Light on Asset Makes the IPO Juicy

- IFBH Ltd launched its Hongkong IPO aiming to raise up to HK$1,160 million. The company plans to sell 41.7 million shares at HK$25.3–27.8 per share.

- IFBH is a ready-to-consume beverage and food company based in Thailand. It enjoys market leader position in the ready to drink coconut water segment in Mainland China.

- The growth momentum is expected to continue in the near term. IFBH’s leadership position would help garner volume strength. We would recommend the investors to subscribe to the issue.

5. HDB Financial IPO: Valuation Insights

- HDB Financial Services Ltd (0117739D IN) is India’s seventh-largest non-banking financial company (NBFC). It is seeking to raise Rs125 billion (US$1.4 billion).

- I discussed the fundamentals in HDB Financial IPO: The Investment Case. The shares will be listed on 2 July.

- My valuation analysis suggests the HDB is fully priced at the IPO price range of Rs 700- 740 per share. I would avoid the IPO.

6. IFBH IPO – Leading Position in a High Growth F&B Segment Driving Valuations

- IFBH (IFBH HK) is looking to raise about US$148m in its HK IPO.

- IFBH specializes in ready-to-consume beverages and food, with a focus on coconut water and plant-based products.

- In our previous note, we looked at the firm’s past performance. In this note, we talk about the IPO valuations.

7. EB Event Trade Setup: HD KSOE Lining up a New Deal with HD Hyundai Heavy as the Underlying

- HD KSOE plans a second EB similar to earlier this year: a zero-coupon, 2% HD Hyundai Heavy stake with 13–15% premium, aiming to raise around ₩850 billion.

- With Korea’s Commercial Act revision expected by July 4, EB deals risk director liability; HD KSOE aims to raise cash now before stricter rules limit easy board-approved EB issuance.

- Targeting a short in HD Hyundai Heavy triggered by HD KSOE’s board approval before July 4; consider hedging with a long position in HD KSOE due to ongoing sector catalysts.

8. FWD Pre-IPO – PHIP Updates – Growth Slowing, Metrics Evolution Continues

- FWD Group Holdings (FWD HK), a pan-Asian life insurer founded by Richard Li, now aims to raise around US$500m in its HK IPO.

- FWD is a pan-Asia life insurer operating in ten markets including Hong Kong (and Macau), Thailand (and Cambodia), Japan, the Philippines, Indonesia, Singapore, Vietnam and Malaysia.

- We looked at the company’s 2018-21 performance in our past notes. In this note, we will talk about the updates since then.

9. Zhejiang Sanhua Intelligent Controls A/H Trading – Strong Demand, Weakening Sentiment

- Zhejiang Sanhua Intellignt Controls (002050 CH) (ZSIC), a manufacturer of refrigeration and air-conditioning control components, raised around US$1.4bn in its H-share listing.

- ZSIC is a market leader in a number of products, with commanding market share both domestically and globally.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

10. Xero US1.2bn Placement – Trying to Jump Start US, Again. Might Not Be a Game Changer.

- Xero Ltd (XRO AU) plans to raise around US$1.2bn via an institutional placement to partly fund the US$2.5bn acquisition for Melio.

- The US market has been a growth dampener for Xero for a while. The acquisition is large but might not be a game changer.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Hygon/Sugon Merger: BIG Index Flows on Completion

- On 26 May, Hygon Information Technology (688041 CH) and Dawning Information Industry (603019 CH) announced a merger in a sign of consolidation in China’s chipmaking industry.

- For each share of Dawning held, shareholders will receive 0.5525 shares of Hygon. With uncertainty on the timeline for merger completion, Dawning is trading at a 10% discount.

- On completion of the merger, passive trackers will need to buy over US$1.1bn of Hygon Information Technology C (688041 CH) with nearly of that from local index trackers.

2. Greatland Resources (GGP AU): Big Index Inclusions for Recent IPO

- Greatland Resources (GGP AU) started trading on the ASX Ltd (ASX AU) on 24 June after selling shares worth A$504m in a primary and secondary offering across Australia/UK.

- Greatland has a full market cap of A$4.9bn and a high free float since Greatland Gold Plc (GGP LN) was listed on the AIM market of the London Stock Exchange.

- Given the large market cap and high float, the stock could be added to multiple indices over the next few months.

3. Xero (XRO AU): Index Flows Following the Capital Raise

- Xero Ltd (XRO AU) has entered into a binding agreement to acquire Melio Limited for an upfront cash consideration of US$2.5bn in cash and Xero Ltd (XRO AU) stock.

- The cash consideration is being funded mainly through a fully underwritten A$1.85bn (US$1.2bn) institutional placement. There is also a non-underwritten Share Purchase Plan to raise around A$200m.

- Given the large size of the institutional placement, there will be an increase in index shares and the passive buying that follows should mop up over 20% of the placement.

4. Gemlife (GLF AU): Index Inclusions Start Later This Year

- Gemlife (GLF AU) is looking to raise A$750m in a primary offering, valuing the company at A$1.58bn. The stock is expected to start trading on 3 July.

- The Puljich family and Thakral Corp (THK SP) are escrowed on their shares till mid 2026 at the earliest.

- Gemlife (GLF AU) could be added to global indexes in November and December this year, but S&P/ASX 300 Index inclusion could take place only in March 2026.

5. FWD Group (1828 HK): Offering Details & Index Entry Timeline

- FWD Group Holdings (FWD HK) is looking to raise up to HK$3.99bn (US$508m) in its IPO, valuing the company at HK$48.82bn (US$6.22bn).

- Cornerstone investors will take up more than half the base offering and that will delay index inclusion to well into 2026.

- FWD Group Holdings (FWD HK) could be added to the HSCI Index and Southbound Stock Connect in December. That could bring some buying into the stock from mainland investors.

6. Contact Energy/Manawa Energy: Index Flows as Deal Nears Completion

- Contact Energy (CEN NZ) is acquiring Manawa Energy Ltd (MNW NZ) for NZ$1.12/share in cash and 0.583 Contact Energy shares for each share of Manawa Energy.

- Manawa Energy (MNW NZ) is expected to stop trading after the close on 7 July. There will be passive inflows for Contact Energy (CEN NZ) due to increased index shares.

- As a replacement for Manawa Energy Ltd (MNW NZ), there will be an ad hoc inclusion to the S&P/NZX 50 Index at the close of 7 July.

7. Fresh Low-PBR Policy Color Hitting the Local Tape Today

- The ruling party’s KOSPI 5,000 task force is now eyeing low PBR names with talk of direct penalties — a sharper shift from the prior admin’s soft-touch value-up approach.

- Low PBR penalties may bypass the Assembly, fast-tracked via KRX or enforcement rule tweaks — rollout could follow swiftly post commercial code passage, possibly within 2–3 months.

- Market’s zeroing in on low PBR, high ROE large caps — with 0.8x flagged as the penalty line, 56 KRW 1T+ names screen as potential re-rating plays.

8. Krungthai Card (KTC TB): Buying Opportunity After Margin Call

- Mongkol Prakitchaiwattana is the second largest shareholder in Krungthai Card (KTC TB), behind Krung Thai Bank Pub (KTB TB).

- He also holds stakes in XSpring Capital (XPG TB), BEC World Public (BEC TB), and The Practical Solution (TPS TB).

- All four companies went limit down on the 23rd June. And again the next day. Both KTC and TPS say nothing has fundamentally changed. The cause? Margin calls.

9. Korea Holdco Rerating Pullback Risk: No Retroactive Treasury Cancellation

- Mandatory treasury cancellation isn’t in the current bill, but FSC and MOJ have started internal reviews; enforcement decree could drop as early as Q4.

- An internal policy paper suggests mandatory cancellation will apply only to newly acquired treasury shares, with tight limits on existing ones to curb owner control abuse.

- Lack of retroactive cancellation weakens the bull case, and while holdco sentiment stays upbeat, momentum may fade, opening the door to a tactical pullback.

10. PointsBet (PBH AU): Betr’s “Superior Offer”? In An Alternate Reality

- BETR Entertainment (BBT AU) has now tabled an all scrip off-market offer for PointsBet (PBH AU) – no minimum acceptance condition – which they consider superior to MIXI (2121 JP)‘s.

- Really? 3.81 new betr shares is currently equivalent to A$1.143/share versus MIXI’s A$1.20/share all-cash Offer. Terms backed out just A$1.086/share at the start of trading last Friday.

- PointsBet quite rightly states the obvious – betr’s Offer is materially below MIXI’s.

Receive this weekly newsletter keeping 45k+ investors in the loop

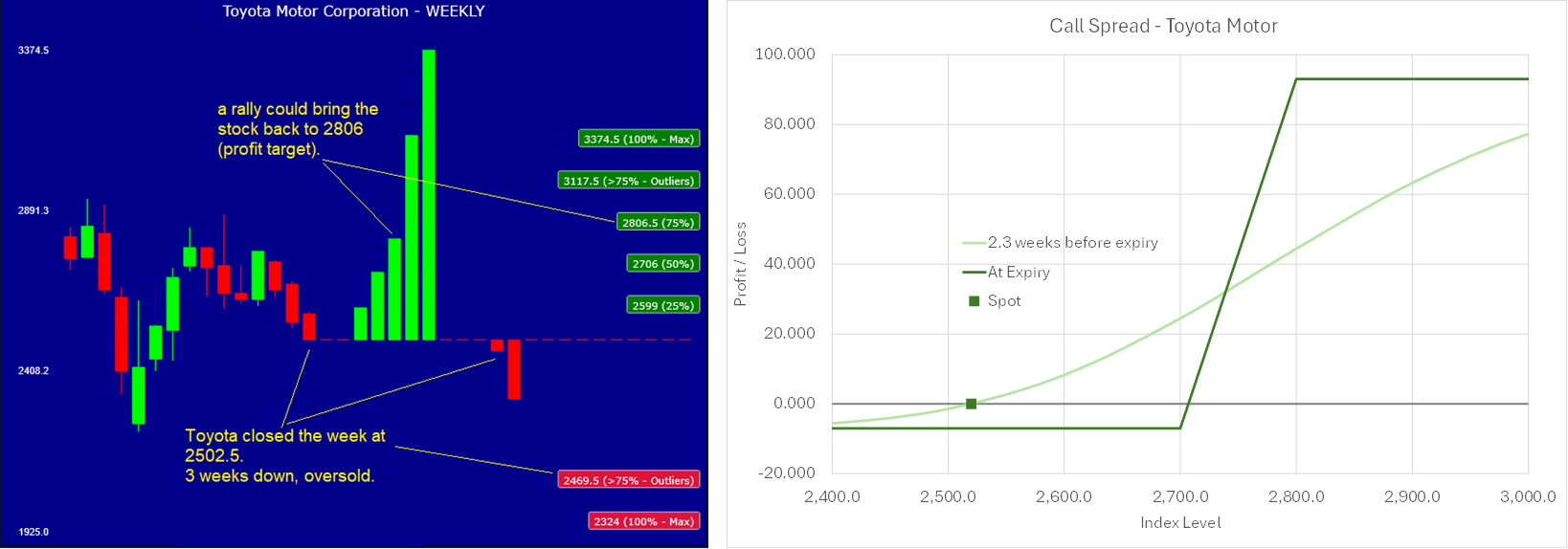

1. Toyota (7203 JP // TM US) Hits Oversold: Your High-Potential Options Strategy

- Context: After three consecutive down weeks, Toyota Motor (7203 JP) has entered oversold territory, triggering a potential upside signal in quantitative models.

- Trade Idea: With signs pointing to a short-term reversal, a Bull Call Spread strategy offers high return potential (~12x premium) with limited upfront cost.

- Why Read: This Insight presents a timely, actionable trade idea with a well-defined risk/reward profile—ideal for investors seeking tactical exposure. Details Provided.

2. S&P/ASX 200 Outlook Following Proposed Index Rule Review

- As reported by Brian Freitas and Janaghan Jeyakumar, there are potential methodology changes for the S&P/ASX family of indices in sight, read their insights for more details.

- If approved, the changes could take effect with the September index review and could bring in signficant reshaping for the S&P/ASX 200 (AS51 INDEX).

- In our previous insight on June 9th we signaled how the ASX 200 was overbought. The index close last week down. This insight discusses our new forecast and outlook.

3. Toyota Motor (7203 JP) Tactical Outlook: Uncertainty Persists, But Rebound Likely

- We continue our coverage of Toyota Motor. In our last insight we flagged overbought conditions and a likely pullback—Toyota declined as expected. Our model now flashes an “upcoming rebound” signal.

- Toyota Motor (7203 JP) has been falling for 3 weeks. At the end of last week our WEEKLY model flagged the stock as “very oversold“: 83% probability of WEEKLY reversal.

- We cannot say if this rebound will become a rally, at the moment: uncertainty around the stock persists, and this particular pattern usually sees more selling, after the bounce.

4. Tencent (700 HK): Top Trades and Strategy Insights from Options Trading

- Context: Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: With 20% of all strategies traded being Diagonal or Calendar Spreads, this remains a popular strategy. Directional positioning does not exhibit a bullish or bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

5. SoftBank (9984 JP) Is Flying High, But It May Be Time to Take Some Off the Table

- Softbank Group (9984 JP) is seeing solid short-term momentum, bolstered by asset sales and AI-led strategic narratives. Key triggers to monitor: deleveraging moves, AI investment updates, and broader macro sentiment.

- The stock is very overbought according to our WEEKLY model, there could be a pullback soon.

- Another perspective: what if this is just a bold rebound rally—and the next move takes SoftBank back down toward the 5,000 level? Just an hypothesis worth considering.

6. Kospi200: Where Implied Vol Stands After 33% Surge

- Kospi200 posted a strong weekly gain, advancing every day and extending a powerful rally off the April lows.

- The percentage of positive trading days since early April reflects strong momentum.

- A divergence is emerging, with implied volatility no longer reacting to spot moves as before.

7. NVIDIA (NVDA US) At All-Time High Acquires CentML: Weekly Tactical Outlook (June 30 – July 4)

- NVIDIA Corp (NVDA US) stock keeps climbing towards an hypothetical 5 trillion $ market cap, as the artificial intelligence (AI) trade accelerates.

- Unconfirmed rumors say NVIDIA has acquired CentML, a machine learning startup that provides an optimization platform to enhance the efficiency and cost-effectiveness of AI model training and deployment.

- After 5 weeks up in a row and a furious, vertical rally, the stock begins to appear OVERBOUGHT, according to our model.

8. Kospi200: Elevated Returns, Historical Extremes and Optionality Opportunity

- We assess whether recent returns have been extreme and put yesterday’s sharp rally in context.

- The evolution of volatility following past extreme states is examined.

- Rationale for using optionality in this stretched price environment is outlined.

9. Hong Kong Single Stock Options Weekly (June 23 – 27): Breadth Snaps Back and Option Volumes Surge

- Breadth rebounded sharply after last week’s weakness, with most single stocks posting gains.

- Single stock option volumes surged, reaching the highest levels seen since early April.

- Xiaomi stood out this week across multiple contract and volume statistics.

10. Hang Seng Index (HSI INDEX) Top Trades: Recent Option Flow Reveals Strategic Positioning

- Context: Over the past five trading days, Hang Seng Index (HSI INDEX) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Yield-extracting strategies prove more popular in the index than in single stocks. Two such examples, a Ratio Put Spread and an Iron Condor, are presented.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC Spread Remains at Historically Extreme Level; UMC Breaks Higher

- TSMC: +21.5% Premium; Consider Shorting ADR Spread at Current Level

- UMC: +2.3% Premium; Can Consider Shorting ADR Premium at Current Level

- ASE: +3.8% Premium; Wait for More Extreme Premium Before Going Long or Short the Spread

2. TSMC (2330.TT; TSM.US): Germany Fab Delayed for European Budget Crisis; Fab 21 Project in Arizona.

- Taiwan Semiconductor (TSMC) – ADR (TSM US)’s Plan to Build a Plant in Germany Faces Delays.

- TSMC’s Fab 21 Project in Phoenix, Arizona: Progress, Challenges, and Future Plans.

- There remains uncertainty about whether political factors — such as U.S. President Trump’s tariff threats targeting the semiconductor industry— might impact or even reverse TSMC’s investment decision.

3. Taiwan Tech Weekly: TSMC’s 2nm Node to Generate Largest Revenue Ever; US Bottleneck in Adv Packaging

- TSMC’s Next Generation 2nm Node Gathers Momentum as Intel Lags Behind

- TSMC’s Arizona Plant Ships First AI Chips — But Taiwan Remains Core to Packaging

- MediaTek (2454.TT): Chinese Stimulus Program Might Lose Actively; Google DPU Project Delay to 2026.

4. MHI (7011 JP): Take Profits

- MHI is up nearly 60% year-to-date to 46x management’s EPS guidance for FY Mar-26 and 27x our EPS estimate for FY Mar-30.

- By then, we expect Air, Defense & Space revenues to double and the division’s operating margin to rise from 10% to 15%, which is the likely cap on profitability.

- Given Japan’s uncertain finances and the long time horizon that should already be discounted, we recommend profit taking.

5. Vanguard (5347.TT): The 3Q25 Outlook Is Expected to Improve by Around 5% QoQ.

- Vanguard Intl Semiconductor (5347 TT)’s 3Q25 outlook shows slight improvement over 2Q25, potentially around +5%.

- Vanguard Intl Semiconductor (5347 TT) overall utilization expected to reach around 75–80% in 3Q25, with 0.18µm loading is nearly full.

- Progress on Vanguard’s Singapore 12” fab is still in early stages, with the main constraint being the equipment move-in schedule.

6. AMD Advancing AI 2025: Key Takeaways

- AMD snagged Sam Altman as a guest speaker and advocate for the company’s next generation MI450 accelerator product

- Oracle announced their intention to create a zetascale AI cluster based on AMD’s MI355X GPUs

- Marvell announced its custom Ultra Accelerator Link (UALink) scale-up offering. Astera Labs will be next in line.

7. Towa (6315): Buy for Orders Rebound

- After nearly two years of decline, TOWA’s new orders appear to have hit bottom this quarter and should start to recover in the three months to September.

- Sales and profits should follow a similar trajectory with management expecting nearly 60% of FY Mar-26 sales and more than 80% of operating profit to be recorded in 2H.

- Rising demand for AI-related high-bandwidth memory (HBM) and GPU packaging should drive growth for the next 2-3 years, bringing the projected P/E ratio for FY Mar-28 down to 12X.

8. MediaTek (2454.TT): Chinese Stimulus Program Might Lose Actively; Google DPU Project Delay to 2026.

- We anticipate that 2H26 may not be strong for Mediatek Inc (2454 TT), and a typical peak season demand is unlikely.

- Chinese National Development and Reform Commission (NDRC) and the Ministry of Finance issued an urgent response: the current unified deadline for the 2025 national subsidy policy remains December 31, 2025.

- Mediatek Inc (2454 TT) recently underperforms among large-cap stocks due to delay in Google’s Tensor Processing Unit (TPU) project, affecting next year’s revenue and profit.

9. Defense Tech: Taiwan Advanced Submarine Trial & Global Turmoil Puts CSBC in the Investor Spotlight

- Submarine Milestone Validates CSBC’s Strategic Role: Taiwan’s June 17 maiden sea trial of the Hai Kun-class submarine highlights CSBC as the sole builder of Taiwan’s Indigenous Defense Submarine (IDS) program.

- Scale of Program Is Significant vs. Market Cap: Seven additional submarines are expected to follow, with a reported program budget of NT$284bn (~US$9.5bn), over 12x CSBC’s current US$760m market cap.

- Emerging Naval, Drones, & Energy Platforms Provide Optionality: Beyond submarines, CSBC is expanding into unmanned surface vessels (USVs) and offshore wind engineering, offering long-term exposure to Taiwan’s asymmetric defense.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. ECM Weekly (16 June 2025) – Haitian, Sanhua, Kitazato, Primo, Kioxia, Xtalpi, Horizon, Keymed, Wuxi

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) launched its IPO, while Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) has been pre-marketing.

- On the placements front, there were a number of large deals acros the region, along with some large lockup expiries.

2. Foshan Haitian Flavouring A/H Trading – Very Strong Demand, Weak Price Momentum

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, raised around US$1.5bn (including over-allocation) in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

3. Cao Cao Pre-IPO: Grossly Overvalued

- CaoCao (2643 HK) is looking to raise up to $236m in its upcoming Hong Kong IPO.

- It is a ride hailing platform in China originally incubated by Geely Group connecting passengers and drivers to deliver consistent and high-quality ride experiences.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

4. CaoCao IPO (2643 HK): Valuation Insights

- CaoCao (2643 HK) has launched its IPO to raise US$236 million at HK$41.94 per share. The shares will be listed on 25 June.

- I previously discussed the IPO in CaoCao IPO: The Bull Case and CaoCao IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that CaoCao is at best fairly valued at the offer price. Therefore, avoid the IPO.

5. Eternal Beauty IPO – Not Expensive but Its Not Enticing Either

- Eternal Beauty Holdings Limited is looking to raise around US$144m in its Hong Kong IPO.

- Eternal Beauty is the largest brand management company of perfumes in the combined markets of Mainland China, Hong Kong and Macau, in terms of retail sales in 2023.

- We have looked at the company’s past performance in our previous note. In this note we talk about valuations.

6. MakeMyTrip Placement – Basically a Selldown by Trip.com

- Makemytrip Ltd (MMYT US) is looking to raise upto US$2.66bn via an equity combo of a 14m share selldown, which could raise around US$1.41bn and US$1.25bn five-year put-three convertible bonds.

- The company plans to use the proceeds to buy back Class B shares from Trip.com to lower Trip.com’s voting power in MakeMyTrip to 19.99%.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

7. CaoCao IPO: The Bear Case

- CaoCao Inc (1646553D CH) is the second-largest ride-hailing player in China. It has filed its PHIP to raise US$200-300 million.

- In CaoCao IPO: The Bull Case, I highlighted the key elements of the bull case. In this note, I outline the bear case.

- The bear case rests on low net take rates, unfavourable trends of key cost items, expected losses in the current year and a stretched balance sheet.

8. Foshan Haitian Flavouring H Share Listing (3288 HK): Trading Debut

- Foshan Haitian Flavouring & Food Company (3288 HK) priced its H Share at HK$36.30 to raise HK$10,128.9 million (US$1.3 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in Foshan Haitian Flavouring H Share Listing: The Investment Case.

- Haitian had the highest oversubscription rates among recent large AH listings. The AH discount implied by the offer is attractive.

9. Foshan Haitian Flavouring & Food Company Hong Kong IPO Preview

- Foshan Haitian Flavouring & Food Company is the largest listed condiments producer in mainland China which is seeking to raise up to HK$9.56 billion (US$1.22 billion) in Hong Kong listing.

- It is offering 263.2 million shares at HK$35 to HK$36.30 each. The final offer price is expected to be announced on 17 June.

- Foshan Haitian Flavouring & Food is the largest condiments company in China with strong brand power with loyal customers.

10. Biocon Ltd QIP – Well Flagged US$522m QIP; Largely Towards Clearing Debt

- Biocon Ltd (BIOS IN) Biocon Ltd is looking to raise up to US$522m in its qualified institutional placement (QIP).

- The deal is well flagged, having gone through rounds of board/shareholder approvals. The QIP has also been covered by domestic media reports.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Santos Ltd (STO AU): FIRB Approval For XRG’s Tilt Will Be No Pushover

- Aussie O&G producer Santos Ltd (STO AU) has announced a non-binding Scheme from XRG, which comprises Abu Dhabi’s National Oil Company, Abu Dhabi Development Holding Company, and Carlyle

- The consortium is offering US$5.76 (A$8.89)/share, a 28% premium to last close. Initial Offers were pitched at US$5.04/share, followed by US$5.42/share.

- Confirmatory due diligence has been afforded. A firm bid would require a multitude of reg approvals in Australia, PNG, and the US.

2. [Japan Event] Potentially Interesting Dynamics of Post-Tender NTT Data (9613) Trading. $8bn+ One Way

- The NTT Data Corp (9613 JP) Tender Offer closed today. Results will come out tomorrow. I expect it will have been successful.

- That will mean some US$8bn+ of passive tracking flows to sell and $8bn+ to buy related to this event alone in the next 3 months.

- And there are some very interesting dynamics to consider in the meantime.

3. Shin Kong (2888 TT)/Taishin (2887 TT) – Short Timer, FX Risk, Index Flows – Time To Buy Vs Peers

- Shin Kong Financial Holding (2888 TT) and Taishin Financial Holding (2887 TT) are scheduled to merge in less than 6 weeks.

- The recent TWD strength has meant sharp losses for Shin Kong Life, but the merger agreement the FSC agreed has Taishin explicitly supporting Shin Kong Life.

- There are near-term flows and technical limitations which make this situation interesting again. Grab your shorts! It could be a bumpy ride!

4. Santos (STO AU): XRG Consortium’s Big Offer; Index Impact

- A consortium comprising ADNOC and Carlyle have offered US$5.76/share (A$8.8807/share) to take Santos Ltd (STO AU) private. That values Santos equity at A$28.8bn and an Enterprise Value of A$36bn.

- With the offer price at a premium of 28%-44% to last and VWAPs, and the Board supporting the offer, this looks like a done deal.

- Santos Ltd (STO AU) is a member of all the major S&P/ASX indices and there will be ad hoc inclusions to the indices at the time of the delisting.

5. Vishal Mega Mart (VMM IN) Placement: PE Selling Will Lead to Large Passive Buying

- Reports indicate that Kedaara Capital Fund is looking to sell 22% of Vishal Mega Mart at a floor price of INR 110/share, a 11.9% discount to the last close.

- The placement will lead to a huge increase in the free float for the stock and Vishal Mega Mart could be added to a global index in August.

- Vishal Mega Mart is also an inclusion to another global index at the close on Friday and we could see more buying in the stock following the increase in float.

6. [Japan Event] Seven Bank (8410) To Buy Back Up to 17.0% of Shares Out Tomorrow

- Today after the close, Seven Bank Ltd (8410 JP) announced a MASSIVE ToSTNeT-3 transaction to buy back up to 200,000,000 shares (17.0% of shares out) for ¥52.4bn. Tomorrow AM.

- There is a complex iterative calculation on the part of Seven Eleven Japan to figure out how many shares they should put into the buyback.

- I see a minimum buyback of 10.8%. 17% would be great. But there is a potential issue on the back end of which investors should be aware.

7. HDB Financial IPO: Offer Details & Index Entry Timing

- HDB Financial Services Ltd (0117739D IN) is looking to list on the exchanges by selling up to INR125bn (US$1.46bn) of stock at a valuation of around INR 620bn (US$7.2bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in December.

- HDB Financial Services Ltd‘s peers have traded well over the last 6 months and that could spill over into demand for the stock. Grey market premium is pretty high.

8. [Japan Activism] Mitsui Matsushima (1518) Ups Buyback Tender to 35.8%, Murakami-San Group To Sell

- Today after the close, Mitsui Matsushima (1518 JP) announced it would increase its buyback from 3.5mm shares to 4.0mm shares (31.3% to 35.8%). It also announced a Tender Offer Buyback.

- The tender offer starts tomorrow and goes til mid-July, paid 8 August. Murakami Group will tender a minimum of 3.3mm shares (more likely 4.2mm).

- This is not a huge immediate win, but it’s OK. And it changes the structure of the company’s balance sheet, ROE, effective ROE, and possibly its dividend.

9. ENN Energy (2688 HK): ENN Natural Gas’ Application Proof Is Out. Interesting For What Is Not Present

- On the 26th March, ENN Energy (2688 HK) announced a cash/scrip Offer from ENN Natural Gas (600803 CH) (ENN-NG), its largest shareholder.

- The pushback is that the scrip portion pivots off the value of newly-listed ENN-NG H-shares. And the IFA’s theoretical assessment on such leaves a lot to be desired.

- A redacted version of ENN-NG’s application proof is now out. Curiously, the share ratio – new ENN-NG H Shares for each ENN shares – is noticeably absent

10. [Japan M&A] NTT Docomo Buys Out Carta Holdings (3688) Minorities – Done Deal

- On 16 June 2025, NTT (Nippon Telegraph & Telephone) (9432 JP) sub NTT Docomo and Dentsu Inc (4324 JP) announced Docomo would buy out minorities in Dentsu sub Carta Holdings.

- It’s an OK price, not a great price. But while they are not calculated by advisors, at least the Target Board talks about the value of synergies to minorities.

- The price is light, but the combined irrevocables and large individual shareholders not brought over the wall get this over the line.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BYD (1211 HK) Outlook Following Regulatory Pushback on Market Dominance

- As reported by Ming Lu, Chinese regulators are pushing back against BYD (1211 HK)’s dominance, which has strained smaller domestic EV competitors. Read his latest BYD insight for more details.

- In a recent insightwe signaled BYD was tactically overbought. The stock fell rapidly right after.

- The stock is currently mildly oversold according to our WEEKLY model: it could fall a bit more, but if this week closes in negative territory there could be a rebound.

2. Nikkei 225 Outlook And Profit Targets Amid Uncertainty Over Japan-US Tariff Negotiations

- Japan PM Ishiba says disagreements remain with US on tariff talk. This is probably the main catalyst that could slow down the current Nikkei 225 (NKY INDEX) rally.

- Our WEEKLY Nikkei 225 model signals a mildly overbought status, the index could go higher, but will face harder resistance in 1-2 weeks from now.

- We don’t see the Nikkei pulling back this week, we think it will close this week up.

3. Xiaomi (1810 HK): Strategic Insights and Top Option Trades

- Over the past five trading days, Xiaomi Corp (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Popular Strategies: Diagonal Spreads account for 27%of all strategies. This versatile strategy allows for many different profiles in terms of upfront premium (positive or negative), and time horizon.

- This Insight of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies.

4. Alibaba (9988 HK) Options Insights: Navigating Contango and Skew for Profitable Trades

- Context: Analysis of Alibaba’s (9988 HK) implied volatility surface as of June 20, 2025, examining implied volatility patterns, skew structures, and open interest distribution across various expiry dates.

- Highlights: One-month implied volatility at 31.6% is trading at historically cheap levels (13th percentile), while the skew shows a pronounced volatility smile favoring spreads.

- Why Read: Essential for options traders and volatility strategists looking to capitalize on the historical cheapness of current implied volatility levels, particularly given the favorable skew structure for spread strategies.

5. Alibaba (9988 HK): Top Trades and Strategic Insights from Options Trading

- Context: Over the past five trading days, Alibaba Group Holding (9988 HK) live multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy popularity. Strategies tend to have a short-term horizon and exhibit a slightly bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

6. Samsung Electronics (005930 KS) Outlook as Foundry Spin-Off Gains Momentum

- Sanghyun Park has reported in detail about what seems to be going on behind closed doors at Samsung in regard to the foundry spin-off: read his insight – highly recommended.

- We maintain our BUY recommendation for Samsung Electronics (005930 KS) and although we have not yet seen a strong rally, we see the stock slowly drifting upward from its bottom.

- Our short-term tactical perspective covering the next 2–3 weeks is presented in this insight.

7. HKEX (388 HK) Options: Unpacking the Top Trades of the Week

- Be inspired by sophisticated, live, multi-leg options strategies on HKEX (388 HK), executed over the period from 9 to 13 June.

- Highlights: Discover a range of noteworthy strategies, for example a self-financing Diagonal Put Spread using weekly options, or a Diagonal Call Spread generating 3.9% upfront yield.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

8. Hong Kong Oil Stocks: Surge in Oil Volatility Creates Opportunity

- Oil has surged on geopolitical headlines, with a sharp increase in both price and implied volatility.

- Implied vols in Hong Kong-listed oil names have lagged sharply behind the move in Oil.

- The relative dislocation in volatility opens the door to tactical pair trade and hedging ideas.

9. KOSPI 200 Tactical Warning: OVERBOUGHT

- The KOSPI 200 INDEX has been rising > 30% since its 303-low in early April 2025: a vertical rally after Lee Jae-myung’s won the Presidential Elections in South Korea.

- Our most extreme profit target set in our latest insight was 392. The KOSPI 200 reached 394 on June 16th. It is now ultra-overbought.

- Our short-term WEEKLY tactical view is the following: the index could go maybe a bit higher or it could pullback soon (more likely). Not bearish, will be a buy opportunity.

10. Hong Kong Single Stock Options Weekly (June 16 – 20): Breadth Erodes, Vol Slips, Hedges Worth a Look

- Single stocks were softer on the week, with breadth continuing to weaken.

- Put volumes surged to their highest levels since April; Put open interest continues to rise.

- Implied volatility declined on the week despite elevated demand for downside protection.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Course-Corrected CPI Stays High

- UK inflation unsurprisingly slowed in May as a correction to vehicle excise duty knocked 0.1pp from the rate, reversing all the upside to our above-consensus April forecast.

- Services inflation aligns with the BoE’s forecast from its May forecast, where MPC members were biased towards slowing their easing. Underlying rates remain too high.

- Inflation keeps trending above the consensus, cumulating a 1pp error since rate cuts began, but aligning with our forecast from 1yr and 2yrs ago. We remain hawkish.

2. BoE Still Seeking Evidence

- Guidance around an unsurprisingly unchanged BoE rate preserved the necessary uncertainty about when it might ease again, albeit with a broad bias to do more later.

- Dave Ramsden joined the dovish dissent, taking it to three for a 25bp cut, but none of them are in the MPC majority revealed in May as leaning towards a slower pace of cuts.

- We believe the August decision remains finely balanced for the majority. Ongoing data resilience, discouraging the Fed and ECB from easing, should also keep the BoE on hold.

3. US/China: Sprint vs Stamina

- The recent US/China trade talks highlighted Beijing’s superior leverage and determination.

- Beijing is in a stronger position in terms of both leverage and willingness to persist.

- Avoiding a re-escalation after the current 90-day truce relies on Washington making more concessions.

4. HEW: Playing For Time

- US diplomacy with Iran has been given two weeks, bringing it close to the reciprocal tariff deferral date. Both may roll later, while central bankers wait to see the impact.

- Unsurprising UK and EA inflation data offered little direction, nor did the BoE or Fed. Brazil and Norway delivered opposite surprises outside a flood of cautious statements.

- Next week is much quieter for data and decisions (TH and MX). The flash PMIs are the main global highlight, although some HICP and PCE data are notable on Friday.

5. Euro Area Wage Costs Closer To Target

- Non-wage labour costs rebounded in Q1, damping the overall slowdown to a surprisingly modest extent after the crash in negotiated wage growth revealed in May.

- Unit labour cost growth has encouragingly slowed below 3%, with the latest impulse only 0.6% q-o-q. Any further easing here could encourage monetary easing to resume.

- Stability at a low unemployment rate still suggests the policy setting is close to neutral, so we doubt disinflationary pressures will mount further and forecast no more rate cuts.

6. EA Inflation Predictably Near The Target

- Disinflationary news from May’s flash inflation release was confirmed in the final print, although a rebound in some underlying inflation measures damped the initial signal.

- Resurgent oil prices could rapidly reverse the dovish space expanded by past falls. Our forecast bumps around the target through 2026 and 2027, settling at 2%.

- Other forecasts are a little lower and only suffer a slight bias to be exceeded. The ECB can remain reassured by an outlook close to 2% without cuts, and not deliver any more.

7. China – Where To Invest?

- Overweight AI, high tech, robotics, renewables and bio-tech. Underweight on consumer discretionary, property and export cyclicals.

- China has become even more vital to its green transition. At the same time the shift in government mindset means that domestic innovation is advancing at a breathtaking pace.

- That said the economy is yet bottom. The profit cycle downturn is worsening; As of April 30% of manufacturing companies were loss making, up from 25% in November

8. Steno Signals #201 – The Mullahs Are Toast – Re-Inflation Is Back!

- Happy Monday from Copenhagen.

- What a comeback by JJ Spaun at Oakmont yesterday (sorry to the non-golfers), and what a comeback risk is about to make this week.

- Iran’s mullah-tocracy is on the brink, and it could be a catalyst for a big bounce in risk appetite.

9. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 20 June 2025

US interest rate cuts expected soon as economic data deteriorates across sectors.

Indonesia delays rate cuts; Philippines eases but risks peso weakness.

China retail sales rise, but property sector continues to underperform.

10. Cancellation of Existing Treasury Shares in Korea – Government Likely to Provide a GRACE PERIOD

- The Korean government may not force the listed companies to suddenly cancel all their treasury shares all at once.

- Rather, a GRACE PERIOD is likely to be given for companies with existing treasury shares by which they need to cancel them.

- Going forward, the Korean government is likely to decide to allow acquisition new of treasury stocks only when the purpose is to cancel them, excluding bonus payments or stock compensation.