Receive this weekly newsletter keeping 45k+ investors in the loop

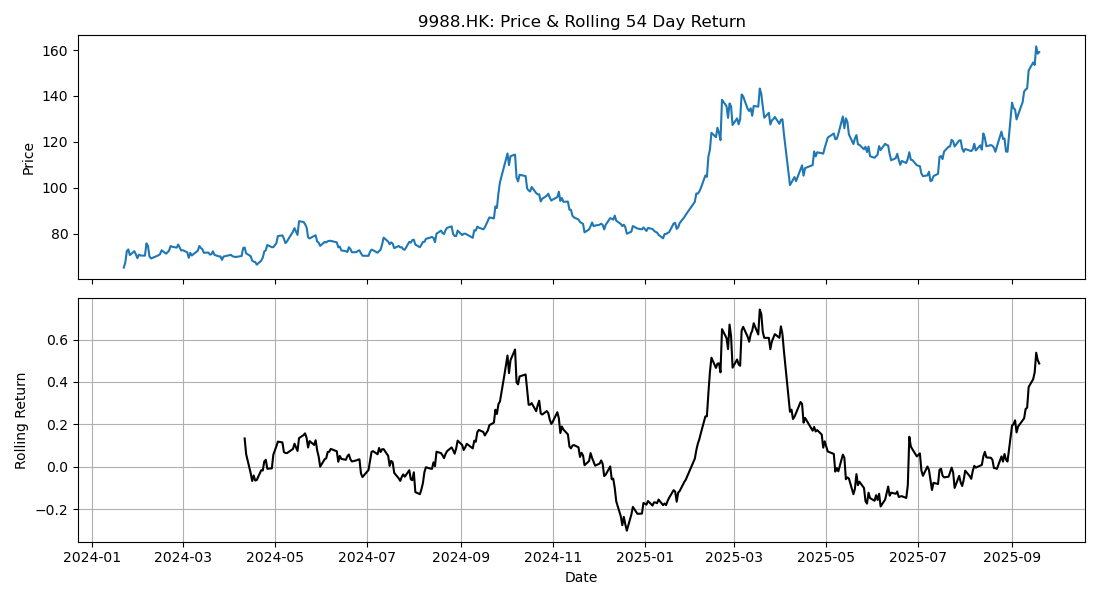

1. Alibaba (9988.HK): Overheated Momentum and Shifting Sentiment – Constructing a Smarter Hedge

- Baba’s recent surge mirrors past rallies, with recent sideways price action raising a caution flag.

- Metrics from the options market suggest that sentiment that was overheated has begun to turn.

- We explore an alternative hedge that will not cap a continued rally but is less expensive than directly buying Puts in Baba.

2. Hang Seng Index (HSI) Tactical Outlook: Small Pulback or Large Pullback?

- As suggested in our previous insight, the Hang Seng Index (HSI INDEX) rally was at risk of pulling back: a small correction began last week.

- The big question now: is this just a minor 1-week pullback (a buy-the-dip opportunity)? or a larger pullback, possibly directed towards 23k?

- This insight discusses the various tactical scenarios, including profit targets for a continuation of the rally from here.

3. Alibaba (9988 HK) Vs. Hang Seng Index (HSI INDEX): Relative Value Options Play with Leverage

- Context: Stat-arb models flag Alibaba (9988 HK) as overvalued versus the Hang Seng Index (HSI INDEX), with the difference between implied volatility and option premium at historically high levels.

- Highlight: An actionable trade setup — long HSI calls vs. short Alibaba calls — that captures relative value and introduces leverage through a ratio structure.

- Why Read: This is a timely opportunity to combine a directional view with favorable volatility dynamics, offering asymmetric payoff potential.

4. Baidu (9888.HK): Overheated Trading and Skew Dynamics Highlight a Distinct Hedge Opportunity

- There are multiple signs of overheating in Baidu trading including accelerating stock and option volumes.

- Skew has been driven higher by strong demand for up-strike Calls.

- We recommend a hedge that tilts the odds in the holder’s favor while establishing the position at a credit.

5. Volatility Cones Spotlight Hedging in Tencent (700 HK) And More

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has broadly risen across most, but not all, HK stocks. Front-month expiries remain historically cheap amid a steepening curve. Opportunities endure, though fewer than in recent weeks.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

6. NVIDIA: An Options Strategy for Riding the AI Data Center Waves

- NVIDIA’s has a strong position in the AI industry, but global trade policies introduce short-term uncertainties. Strong revenues and cash position buffer against policy-driven obstacles, particularly concerning its China revenues.

- We highlight NVIDIA’s technological leadership, including its full-stack computing infrastructure and rapid platform transitions. External pressures weigh on projected revenues, including export restrictions and increasing competition from major tech companies.

- We see potentially overpriced implied volatility. This strategy aims to generate premium while managing risks associated with price movements, especially in the context of evolving geopolitical and competitive landscapes.

7. Softbank Group (9984 JP) Tactical Outlook: Momentum Strong but Stretched, Higher Targets Speculative

- Softbank Group (9984 JP) performed a strong 1-week rally 2 weeks ago, then went marginally higher. The stock is OVERBOUGHT according to our models, but the pattern is bullish.

- We see two possible scenarios: a) the stock stalls and pulls back this week or b) it keeps rallying towards 20850.

- The current pattern had rallies lasting up to 5 weeks in the past, so Softbank Group (9984 JP) could rally 2 more weeks, and get closer to 20850.

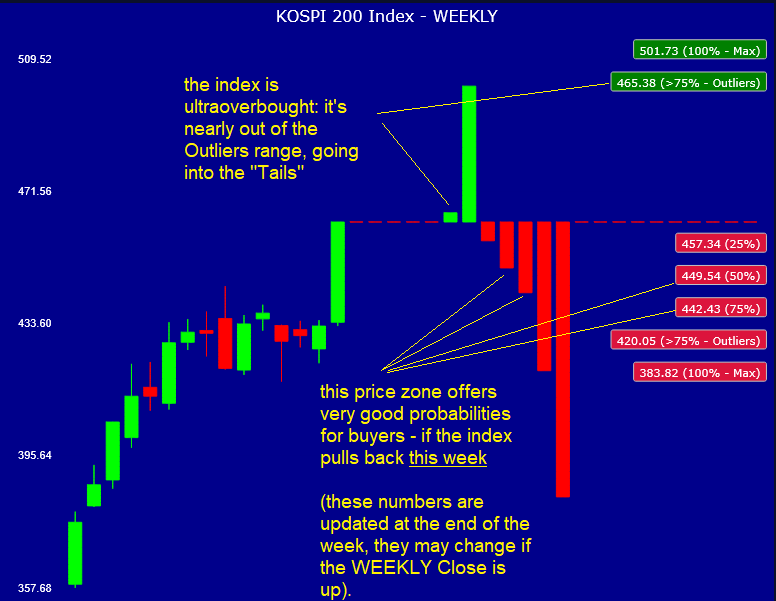

8. Kospi 200: Rally Echoes Pandemic Rebound

- Current gains echo past moves that required lengthy consolidation, suggesting risk management is prudent.

- Volatility trends remain middling, but skew steepness points to cost-effective downside structures.

- Rally momentum slows as Kospi reaches levels where past reversals have occurred versus SPX.

9. HSI: Extended Run Faces Hurdles, Hedge Strategies Recommended

- After a 33.9% rally off the April lows HSI is starting to flash caution across a variety of metrics.

- Weak breadth and option exuberance at the single stock level are additional areas of concern.

- We outline the technical backdrop and recommend hedge strategies given the current level of implied vols.

10. NIFTY 50 Tactical Outlook: Quantifying Downside Risk and Strategic Re-Entry Zones

- In our previousNIFTY Index insight published at the end of August we highlighted two possible scenarios before the Sep-30 rebalance: 1) risk-off pullback or 2) small rally.

- Scenario 2), the small rally is what came true, it lasted 3 weeks (we said 2 weeks), but it was a weak rally. The NIFTY however is not very overbought.

- 3-Week rallies not reaching higher highs usually indicate a weakness in the trend, but this could be a buy opportunity, so let’s have a look at our model’s BUY zones…

Receive this weekly newsletter keeping 45k+ investors in the loop

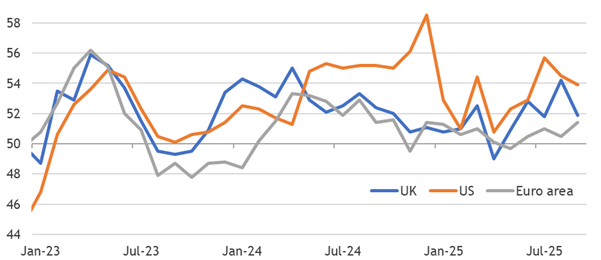

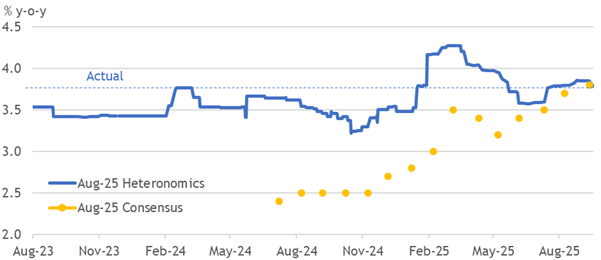

1. Broadly Slower Services PMIs

- PMIs broadly disappointed and declined relative to August, but absolute levels mostly remain robust or at least expansionary. We are not concerned by these noisy moves.

- Such broad slowing seems shocking relative to the past few months, but it is historically a regular occurrence. Five of the previous twelve were at least as broadly bad.

- The labour market remains tight in the euro area, softened in the UK, and steady in the US. Slower activity does not mean disinflationary slack. We stay relatively hawkish.

2. EM Fixed Income: (EM) Credit where credit’s due

- Despite a mixed Fed meeting, EM markets continue to rally in FX and rates

- EM local markets still in a good place with upside potential in growth and improving flow picture

- Sovereign credit markets have had a strong performance year to date, with investors feeling optimistic but also acknowledging the need to be humble in assessing macro risks and valuations.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

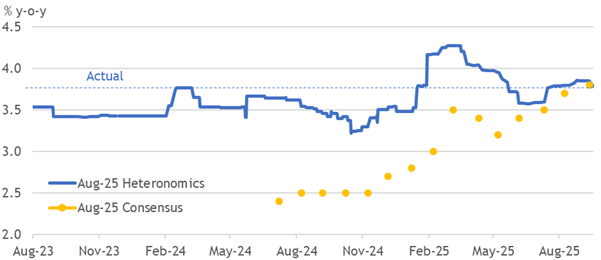

3. HEW: Resilience Reminders Roil Doves

- Bullish GDP revisions and jobless claims provided further reminders that the economy is much more resilient than market pricing has dovishly assumed, causing a hawkish shift.

- Nonetheless, the Riksbank surprised with a 25bp rate cut, but projected that as the terminal rate before hikes start reversing the stimulative setting in 2026.

- Next week’s US payrolls data dominates the calendar, given the potential to break market conviction in an October Fed cut. EA inflation should rise back above the target.

4. Asian Equity: Relative Valuations Have Mostly Converged; Korea the Only Large Rerating Candidate

- Most large Asian markets’ forward PE multiples are significantly higher than their long-term averages. But their valuations relative to Asia-ex-Japan are mostly at the averages, only Korea’s is significantly lower.

- HK/China’s relative PE is slightly lower than average, Taiwan’s is slightly higher. ASEAN markets’ relative PE are sharply lower than their averages, but we think most lack rerating catalysts.

- We think Korea and Philippines deserve to get rerated. India’s relative PE, though at its long-term average, could decline slightly further, to reach its recent bottoms.

5. Will AI save the US Economy?

- European policymakers and investors see Donald Trump’s economic policies harming Republican prospects in the 2026 midterms and the 2028 general election.

- The Trump Administration is placing a good deal of faith in AI as a panacea. But the US may not have the skilled labour or the power-generating capacity to fuel an AI boom.

- Nor is it clear whether the current Administration is preparing for the related socio-economic disruption from which the MAGA faithful would be far from immune.

6. Resilience Is Reinstating

- Falling US jobless claims and bullish GDP revisions are reinstating evidence of ongoing resilience. Underlying GDP only slowed by about 0.1pp in H1, or 15% of 2024’s average.

- Risk management rate cuts to balance the higher costs of being wrong on the downside raise the probability that easing proves premature and swiftly ends.

- The ECB already sees the transmission of its past cuts trending loan growth higher. It may reach pressures consistent with hikes next year, and it already clashes with easing.

7. Asian Equities: Foreign Flows Come Roaring Back in September; India, ASEAN Still Getting Sold

- Fed’s “risk management cut” and a dovish outlook of 2 more cuts in 2025 are driving foreign flows back to Asia. US$11.5bn inflows in September till date underscores the sentiment.

- Korea (US$4.94bn) and Taiwan (US$7.5bn) grabbed the Asian flows entirely, driven by the rejuvenated AI capex theme. India (-US$904m) continues to be sold, though the selling pace has diminished.

- FIIs bought Indonesia (US$672m) in August and sold almost identical amount in Thailand. Philippines, despite being cheap and having a few sectors with upward earnings inflection, continues to be sold.

8. US Tariff Policy: A.K.A. WHACK A MOLE!

- The U.S. continues to play “Whack-A-Mole” using tariffs to threaten and/or negotiate on many economic and geopolitical issues.

- The Trump tariff policy, which may be declared illegal by the Supreme Court next month, has caused manufacturers to hold off on hiring and expansion plans.

- Although tariff revenue for the U.S. government is at an all-time high, the U.S. will still record its highest trade deficit in history this year.

9. SLBs in 2025: Where Step-Ups Create Event-Driven Alpha

- Set-Up and scale: 245 SLBs face 2025 KPI tests; applying a 19% 2024 miss rate implies ~50 step-ups of ~25 bps, worth ~20–60 bps PV. >$80bn notional, heaviest in Q4.

- Trade design, credit and equity: Pre-position where slippage exists and no pre-test calls; run structure pairs; trade post-print drift; for equities, SLB misses flag delivery shortfalls and funding-cost creep.

- Why the market is inefficient: ESG KPIs hide in footnotes and annexes, overlooked by analysts. Verification lags and slow vendor updates delay repricing, so step-up structures stay mis-weighted and mispriced.

10. Indonesia : Sri Mulyani’s Exit Compounds Fiscal Risks

- The exit of Indonesia’s veteran Finance Minister, Sri Mulyani Indrawati, marks a turning point in the country’s fiscal regime.

- With her out of the picture, it is only a matter of time before the government revises the 3% deficit ceiling higher to accommodate Prabowo’s large spending plans.

- This is a slippery slope and an indiscriminate push for spending, without concomitant tax reforms, could put debt on an unsustainable path.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel CFO @ Citi’s 2025 Global TMT Conference: “We Will Use TSMC Forever”

- We will be putting products on TSMC you know, forever, really. TSMC is a great partner for us. Obviously everyone understands that their support and technology are great.

- 18A is actually a good node for us. We want to milk that node We won’t get peak volume on 18A until the 2030 timeframe.

- Kevork Kechichian joined Intel as head of the Data Center Group. He will lead Intel’s data center business across cloud and enterprise, including the Intel Xeon processor family

2. Synopsys Crashes On “Major Foundry Challenges”. Intel, What Have You Done?

- Last week, Synopsys reported Q325 results and guidance both well below expectations causing the share price to collapse over 34% in the immediate aftermath.

- The company revised down full year revenue targets, noting that “challenges at a major foundry customer are also having a sizeable impact on the year”

- That “major foundry customer” is likely Intel. Who’s next in line to face similar revenue impact from Intel’s challenges?

3. MediaTek: Satellite Connectivity the Next Strategic Battleground for Mobile SoCs (Structural Long)

- Starlink’s Direct-to-Phone Semiconductor Integration Push Signals a Major Shift Coming for Telecom

- Direct-To-Satellite Connectivity Could Become Critical for a Market-Competitive Smartphone SoC Design

- Leadership in Satellite Connectivity Will Soon Mean Leadership in Smartphone SoCs

4. NVIDIA Becomes The Latest To Back Intel’s GoFundMe Appeal

- NVIDIA will invest $5 billion in Intel’s common stock at a purchase price of $23.28 per share

- Intel will supply custom x86 server CPUs to NVIDIA, who in turn will sell RTX graphics cores to Intel to combine into an new type SOC for the PC market

- Under sustained questioning during the Q&A, Jensen did a remarkable marketing pitch for TSMC, drowning any hopes of a looming Intel Foundry deal for the foreseeable future

5. TSMC’s COUPE Signals Silicon Photonics Go-Time — Early Winners in Taiwan’s Listed Supply Chain

- Last week at SEMICON, TSMC unveiled COUPE, moving silicon photonics from lab demos into industrial-scale advanced packaging.

- Himax, ASE, Zhen Ding, GlobalWafers, ACON, and Accton form Taiwan’s listed ecosystem for silicon photonics adoption.

- As NVIDIA Corp (NVDA US)-driven AI clusters proliferate, the power and cost of moving data between chips have become as constraining as compute itself.

6. Taiwan Tech Weekly: Starlink Engaging Chipmakers in Direct-To-Phone Push; Intel’s TSMC Dependency

- Starlink Engaged with Chipmakers to Bring Satellite Connectivity Direct to Smartphones — Mediatek Well Placed to Benefit

- Intel CFO @ Citi’s 2025 Global TMT Conference: “We Will Use TSMC Forever”

- TSMC’s COUPE Signals Silicon Photonics Go-Time — Early Winners in Taiwan’s Listed Supply Chain

7. Intel (INTC.US): NVIDIA’s $5B Intel Stake — A Shift in Tech’s Competitive Landscape?

- NVIDIA Corp (NVDA US) surprised the market with its announcement of a $5 billion investment in Intel Corp (INTC US).

- The market seems to read this as the beginning of a deeper Intel–NVIDIA partnership in AI chips.

- We also note that Japan’s push to establish its own foundry industry through Rapidus deserves continued attention, as it could reshape the competitive map in the years ahead.

8. Memory Monitor: The Sticky Era — Memory’s Transition from Spot Pricing to Long-Cycle Commitments

- The Industry Is Moving From Cyclical Volatility Into a Sticky Pricing Era.

- Why Memory Pricing is Becoming Sticky. — HBM Memory is Hard to Swap Out Once Designed Into a GPU Product.

- Investment View: Entering Memory’s Sticky Pricing Era — Structurally Long Micron & SK Hynix; Underperform for Nanya Tech.

9. UK Sovereign AI Proudly Paid For & Made In The USA

- Microsoft CEO Satya Nadella announced his intention to spend $30 billion on AI infrastructure in the UK. NVIDIA, Coreweave, Alphabet and OpenAI are also ponying up further billions

- Jensen Huang declared the UK and AI powerhouse, third in line globally behind the US and China

- Is it really UK sovereign AI when it’s mostly paid for and made in the USA?

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Kokusai Electric (6525 JP) was IPOed too cheap in 2023 after a couple of years in the wilderness and an aborted private sale effort, blocked on antitrust grounds.

- It nearly tripled, there was an offering announced at ¥5,000+ priced ¥4,500+. Shares fell back to IPO price, then bounced, and we got a July follow-on offering at ¥3,000+.

- I suggested here the back end could be squeezy. It was for a hot minute, then it wasn’t. Now the stock is up 50% in 2 weeks. Watch out!

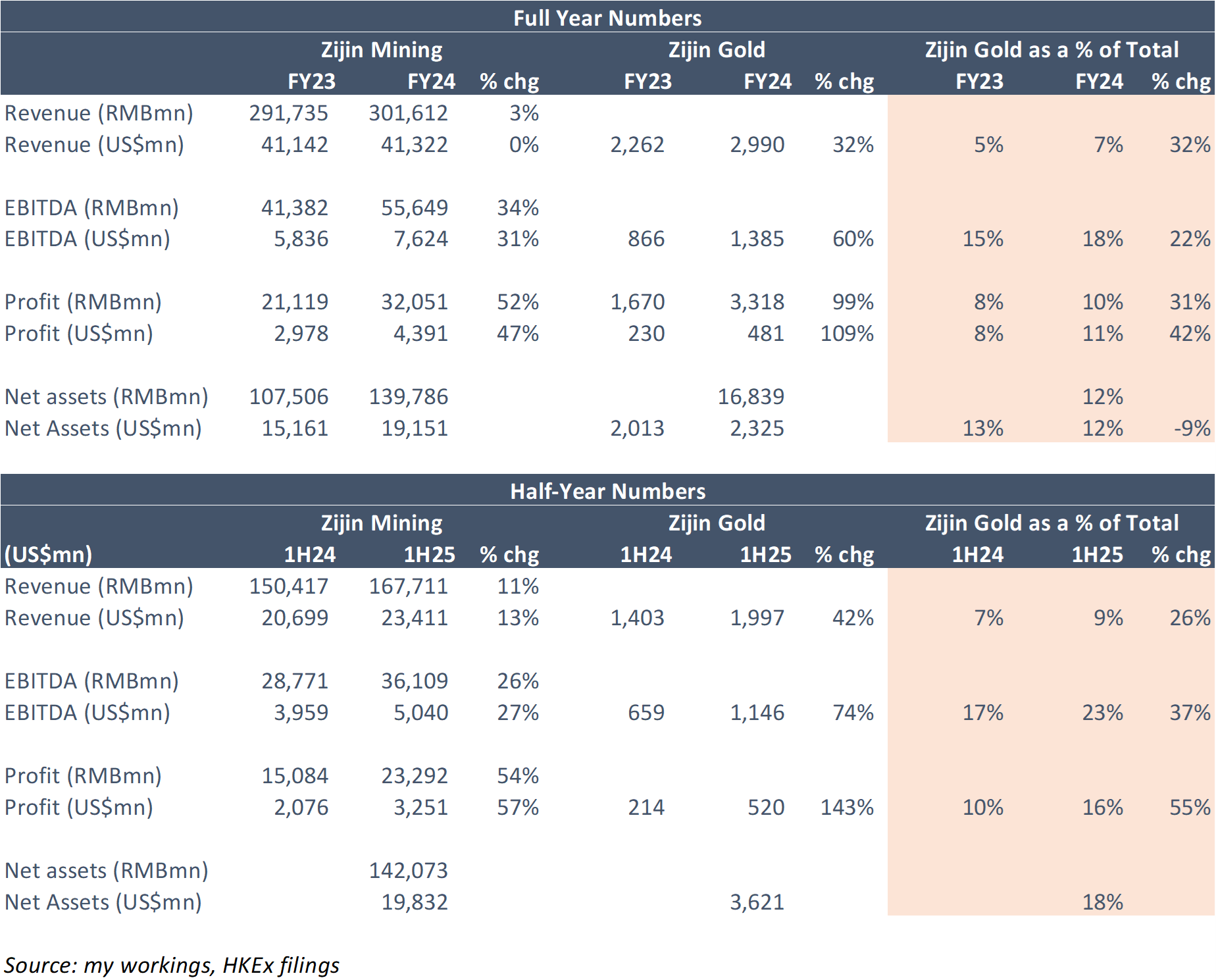

2. Zijin Gold IPO: Strong Cornerstone Book; Should Trade at Premium to Group

- Zijin Gold (2259 HK) is looking to raise US$3.2bn in its upcoming HK IPO.

- It s a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance in our previous notes. In this note, we talk about valuations.

3. Zijin Gold Pre-IPO: Superior to Peers; Should Trade at High End of Group

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance and done a peer comparison in our previous note. In this note, we will look at the firm’s valuation.

4. ECM Weekly (15 September 2025)- Chery, Zijin Gold, Hesai, Orion, Myungin, Urban, Nio, Kotak, Toei

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, things are picking up going into the year end, as is usual, with multiple US$1bn+ deals said to go live over the next few weeks.

- On the placements front, as well, market remains receptive for both primary and secondary offerings.

5. Zijin Gold Pre-IPO: PHIP Update: Acquisition of Raygorodok Mine for a Song

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance, and done a peer comparison in our previous note. In this note, we will provide a PHIP update.

6. Zijin Gold IPO: PHIP Updates Support the Investment Thesis

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is pre-marketing an HKEx IPO to raise US$3bn.

- I previously discussed the IPO and outlined my investment thesis in Zijin Gold IPO: The Investment Case.

- In this note, I take a look at the new information from the PHIP. The 1H25 results and latest developments underscore my previous bullish thesis.

7. Centurion Accomodation REIT IPO – New Asset Class

- Centurion Accomodation REIT (CAREIT SP) (CAREIT) plans to raise around US$600m in its Singapore listing.

- CAREIT plans to invest directly or indirectly, in a portfolio of purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA) or other accommodation, located globally (excluding Malaysia).

- In this note, we look at the REIT’s portfolio and performance.

8. Pre-IPO Zijin Gold (PHIP Updates) – Thoughts on the Business, the Forecast and Valuation Outlook

- The spin-off of Zijin for an independent listing is equivalent to presenting a “pure gold business” to the market. Such “asset revaluation” can unlock the hidden value of gold business.

- For enterprises like Zijin in the upstream of gold industry chain, a sustained high and rising gold price is usually a significant positive factor. However, there are also potential risks.

- Zijin Gold has better growth potential than peers, so we think its valuation range could be P/E of 18-22x. If based on 2025 net profit forecast, valuation is US$36.9-45.1 billion.

9. Chery Automobile IPO (9973 HK): Valuation Insights

- Chery Automobile (9973 HK) is a Chinese automobile manufacturer. It has launched an HKEx IPO to raise up to US$1.2 billion.

- I previously discussed the IPO in Chery Automobile IPO: The Bull Case and Chery Automobile IPO: The Bear Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is reasonable.

10. Hesai Secondary Trading – Decent Demand, Despite Lack of Correction

- Hesai Group (HSAI US) raised around US$530m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the ADS movement and trading dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Mining (2899 HK): This Is A Short

- In my June note, Zijin Mining Group (2899 HK) appeared fully valued; but I (thankfully) stopped short of being outright bearish. Its share price is up 48% since!

- A basket of peers is also up 37% since that note. Gold is up~8%, and 41% YTD. On the 14th September, Zijin released Zijin Gold’s PHIP. 1H25 numbers were solid.

- However, Zijin Gold’s earnings are by no stretch an outlier. Zijin’s Mining’s current share price is now baking in exceptional (unrealistic?) metrics for the gold play spin-off.

2. Zijin Gold (2259 HK) IPO: HSCI Fast Entry; Quick Stock Connect Add; Global Indices Entry in 2026

- Zijin Gold (2259 HK) is looking to raise up to HK$28.7bn (US$3.7bn) in its IPO, valuing the company at HK$191.6bn (US$24.6bn).

- Zijin Mining (2899 HK) will hold between 85-86.7% of Zijin Gold and that will limit the free float of the stock. Half the IPO has been allotted to cornerstones.

- Zijin Gold could be added to the HSCI via Fast Entry and to Stock Connect in October. Global index inclusion should take place in the first half of 2026.

3. [Japan M&A/Activism] SOFT99 MBO Sees Activist EffissimoOverbid by 66%! Will This Set New Precedent?

- In early August, the founder-family announced they would MBO the car care company Soft99 Corp (4464 JP). It was a very cheap MBO. Even 20% higher it would be cheap.

- On Saturday, Kyodo, followed by various other media outlets, announced activist Effissimo Capital Management had announced a TOB to buy the company saying the MBO was “an extremely low level.”

- The Nikkei-reported goal would be “to protect the interests of minority shareholders while ensuring medium- to long-term increases in corporate value.” This is REALLY BIG NEWS.

4. Chery Auto (9973 HK) IPO: No Inclusion in Global Indices; HSTECH Is Interesting

- Chery Automobile Co. Ltd. (9973 HK)‘s IPO range is HK$27.75-HK$30.75/share and will raise up to HK$10bn (US$1.3m) if the oversubscription option is exercised, valuing the company at HK$169bn (US$21.7bn).

- The stock should be added to the HSCI Index in December and that will make the stock eligible for inclusion in Southbound Stock Connect.

- There will be no inclusion in global indexes for the next year, but there is a possibility of inclusion in the Hang Seng TECH Index (HSTECH INDEX) in December.

5. Mori Hills REIT (3234) – Large Sponsor Buy in Market as % of Max Real World Float

- In the past 24 months, J-REIT sponsors have bought units in their REITs at sharp discounts to PNAV to raise PNAV and reduce overhang pressure.

- The goal is, basically transparently, to get PNAV to a level at which the REIT can buy more properties from the sponsor, who carries them at a much higher WACC.

- Mori Building has announced a 4.99% buy on Mori Hills REIT Investment Corporation (3234 JP) which is a Very Big portion of Max Real World Float. This should influence price.

6. HK Connect SOUTHBOUND Flows (To 12 Sep 2025); HUGE Single Stock Trading, ETFs Meh. Tech Bought Bigly

- Gross SOUTHBOUND volumes just under US$20+bn a day this past 5-day week. BIG Net buying. Big BABA trading.

- SOUTHBOUND investors traded US$9bn of Alibaba (9988 HK) in the week. Not shy. It was a big net buy as well (4 of 5 days was +US$500mm or more).

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

7. Soft99 Corp (4464 JP): Effissimo Sheds More Light on Its Hostile Offer

- Effissimo has formally launched its hostile tender offer for Soft99 Corp (4464 JP) at JPY4,100, which is 66.3% higher than the MBO price of JPY2,465.

- The Board stonewalled Effissimo’s attempts to negotiate a friendly offer. The huge premium of Effissimo’s offer relies on lower WACC assumptions compared to the target/special committee IFA.

- Management’s initial approach will be to rely on the Board to oppose the Effissimo offer. There is a good chance that Soft99 will remain listed with two large shareholders.

8. [Japan M&A/Activism] The Nagging Little Detail In the Soft99 MBO Extension Target Doc

- Yesterday, Soft99 Corp (4464 JP) announced a slight change in its “Target Opinion Document” after the MBO Bidco extended its TOB by 8 days the day before.

- The detail was not in the MBO Bidco extension. It was just revealed in an added note on p3 of the Target Opinion.

- That details matters A LOT to people looking at the Effissimo Overbid. The company’s Board has some serious work ahead.

9. Flagging a New Passive Flow Trading Opportunity Triggered by Korea’s Divvy Policy Momentum

- PLUS High Dividend ETF (161510 KS) reshuffle is now a key flow catalyst: June saw GS E&C and HD Hyundai out, Hyundai Motor in, with sharp one-day moves.

- December review shaping up as 2-in/2-out: Seoul Guarantee (031210) and LG Corp (003550) in, Shinhan (055550) and KB (105560) out.

- Passive flows: Shinhan/KB ~0.3–0.4x DTV, LG ~3x, Seoul Guarantee 5–6x. With AUM up 30% since June, upcoming adds face outsized passive impact.

10. Zijin Mining (2899 HK): Zijin Gold Priced At US$24bn

- The global offering doc for Zijin Gold (2259 HK) is out.

- At the IPO Price of HK$71.59/share, Zijin Gold’s implied market cap is HK$187.9bn or US$24bn. Commencement of trading is the 29th September.

- Zijin Mining (2899 HK) will hold 86.7% in Zijin Gold post-IPO (before over-allotment). Even if Zijin Gold trades north of HK$100/share, Zijin Mining is fully valued.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. KOSPI 200 Tactical Call: Positioning for September Pullback

- The KOSPI 200 INDEX reached a new all time high last Friday, closing at 462.74. Let’s be clear: it’s very overbought according to our model.

- Our forecast is that the index will NOT rally for more than another 1 or 2 weeks (i.e. this week and maybe one more week).

- 449-442 is the price support zone with 50%-75% probability of reversal, if it was hit this week (this data will be updated if the index closes up this week).

2. HDFC Bank (HDFCB IN) Tactical Outlook: Will The Rally Continue?

- HDFC Bank (HDFCB IN) has been in a mild pullback since the end of July. The stock closed up for 2 weeks but has not reached any significative overbought level.

- This week HDFC Bank went down a bit, stayed above the Q1 support level but this pattern is very bullish, in the past it gave way to long, profitable rallies.

- We cannot say for sure if the stock will rally up from here, but if it does, consider profit targets north of 1034 (Q3), and it could rally higher.

3. ‘Toppish’ Nikkei 225’s Outlook: Where to Cover, Where to Buy

- The Nikkei 225 (NKY INDEX) reached 44790 on Wednesday, this is the 3rd week up in a row for the index, this market is OVERBOUGHT.

- The outlook remains bullish, the forecast is for a pullback, followed by another leg up.

- This insight’s goal is to help you figure out where to cover your LONG Nikkei 225 positions, and where to add more LONG positions during the pullback.

4. HDFC Bank (HDFCB IN): Ready for the Rally with Tactical Low-Cost Options

- Context:HDFC Bank (HDFCB IN) remains in a bullish setup. Quantitative models highlight further upside potential in the near term and identify key support levels.

- Trade Idea: With implied volatility near multi-year lows (12th percentile), long call strategies are favored. Suitable expiries and strikes are outlined, with an alternative structure discussed for reducing premium outlay.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where low implied volatility and bullish probabilities align, offering investors defined risk/reward.

5. Asia/Pacific Stocks Outlook For the Week Sep 15-19

- 1-Week directional forecast for the Asian indices and stocks we track, based on our proprietary probability model.

- OVERBOUGHT: Samsung Electronics (005930 KS) , Taiwan Semiconductor (TSMC) (2330 TT) , Softbank Group (9984 JP) , HSI Index , KOSPI 200 INDEX , Nikkei 225 .

- OVERSOLD: BYD Company (1211 HK) , S&P/ASX 200 INDEX .

6. HK Volatility Cones: Volatility on the Rise, Meituan and Ping An Historically Cheap

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has increased across the board, but while some stocks recorded a 5-10% increase, other just added 1-2%. Upcoming November earnings start to shape the term structure.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

7. BYD (1211 HK) Tactical Outlook: Rally or Bear Rally?

- In our previous insight from September 2 we suggested if BYD (1211 HK) reached 102 could have been a good BUY signal.

- It took a bit more than a couple of week for the stock to bottom at 102.80 (this week), then rally 10% to 113.50. Impressive, but….

- … it could be a Bear rally, so in this insight we will try to assess BYD upside potential, and suggest some tactical positioning for the next few weeks.

8. Hong Kong Single Stock Options Weekly (Sept 15 – 19): Caution Signs Emerge as HSI Stretches Higher

- HSI tested new highs before fading, as weak breadth and strong option volumes highlighted diverging signals in Hong Kong equities.

- Technically, HSI may have reached a level from which minor corrections have started.

- Option trading activity surged, reaching its busiest day since November, even as overall market momentum faltered.

9. Global Monetary Tides Turn: Fed Cuts, Europe Holds, Japan’s Stance and Market Impacts Explored

- Global central banks are navigating divergent monetary policies, with the Fed initiating rate cuts while European and Japanese counterparts maintain cautious stances amid varying inflation and growth outlooks.

- Significant economic headwinds, including the impact of tariffs and political instability in key regions, are influencing central bank decisions and contributing to a nuanced global economic landscape.

- This environment of diverging policies and persistent economic pressures sets the stage for a strategic market opportunity, focusing on volatility dynamics in developed markets.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK CPI Stickier For Longer

- UK inflation data confirmed the substantial upwards drift in the consensus, worth 0.6pp since May and 1.1pp over the past year, while matching final forecasts for August.

- The consensus has shifted further than usual over the past month. It now aligns with our hawkish forecast until April, when hope again dominates in dragging inflation down.

- Although the MPC won’t be shocked by this outcome, the persistent excess in underlying inflation still seems set to keep it holding rates. We do not expect cuts to resume.

2. UK Jobs Find Their Floor

- Stability in unemployment at 4.66%, while payrolls only marginally decline, suggests the labour market has found its floor before disinflationary pressures accumulate.

- A narrative-breaking improvement could occur next month. Tax rises structurally explain the scale of the previous shock, with weakness seemingly not going beyond that.

- Excess supply is needed to break wage growth to a target-consistent trend. Without that, the MPC should hold rates before potentially reversing by raising them in 2026.

3. Emerging Markets Outlook and Strategy for September 2025

- Global growth has been better than expected, particularly in emerging markets, due to strong export performance and tech cycle strength

- China’s growth is expected to slip below 3% in the second half, with domestic demand slowing sharply

- Despite the growth resilience in EM, central banks are expected to continue their gradual cutting cycle due to weak domestic demand and disinflation trends

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Generative AI in Investment Mgmt: Value Investor’s Perspective w/ Ehsan Ehsani | New Barbarians #035

- Ehsan Ehsani, executive director at Crescendo Partners and adjunct professor at Columbia Business School, joins the discussion with Harmonic Insights and will be organizing the Generative AI and Investment Management Conference at Columbia.

- Futures markets are predicting a 25 basis point cut with more cuts in the future, while volatility and factor returns continue to be influenced by macro factors.

- Quantitative investors typically do not make significant changes to their portfolios based on short-term data, instead focusing on longer-term trends and statistically significant moves.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. BoE Trims QT To Hold Policy Steady

- The MPC unsurprisingly held rates while seeking an answer to its key question around inflation risks amid elevated expectations and a possible structural shift.

- It also trimmed QT by £30bn to £70bn, keeping active sales of long gilts steady in the next three quarterly auctions while skewing QT towards short and medium gilts.

- We still expect the MPC’s presumption of rate cuts resuming to fade out in early 2026 as hawkish pressures persist. Some offsetting fiscal space arises from QT being trimmed.

6. Japan Macro: Restarting Coverage

- Bank of Japan likely to remain on hold till January 2026 with risk of further delay

- Once BoJ resumes hiking cycle, it will likely follow twice a year pace till 1.5%

- With the Fed cutting rates, the long end of the JGB curve is firmly anchored

7. HEW: Cautious Cuts Through The West

- Economic data releases revealed more resilience in labour markets than feared, while inflation remained high. Yet Western central banks broadly cut rates, albeit cautiously.

- The BoE’s caution left only two dovish dissents to its on-hold decision, while it cut QT by £30bn to £70bn to reduce the likelihood of gilt market indigestion.

- Next week’s SNB and Riksbank decisions should join the BoE in holding steady, although they have already cut much further. Flash PMIs are the data focus in a thin calendar.

8. US: You Ain’t Seen Nothin’ yet on the Impact of the Trump Tariffs

- China’s share of US imports will halve in 2025 from Mar’18 peak of 21.8%, and ASEAN’s share (led by Vietnam) will rise to 14%. India, Korea, Taiwan’s shares gain too.

- There was a big surge in Asian exports to the US in Jun-Jul’25 to beat tariffs, but tariffs will alter patterns in 4Q2025, cutting export growth and reducing US disinflation.

- The rebound in US steel production (+4.6%YoY in Jun-Jul’25) and ISM manufacturing new orders suggests select American industries (metals, automobiles, electronics) will gain but downstream users will suffer steadily more.

9. Twilight of the AI Bull?

- The leadership of AI-driven stocks is starting to stumble from bubbly valuation levels, which brings up the warning from Bob Farrell’s Rule #4.

- The debate is ongoing as to whether the AI bull is evolving from hyperscaler leadership to the next phase of companies that can better exploit the technology.

- The lack of cyclical market leadership is concerning from a technical perspective. We are therefore tactically cautious about the short-term outlook for U.S. equities.

10. Dialling down the Noise

- Traders, Quants and Passive Investors have steadily crowded out most earnings signals for long term investors.

- Quarterly reports won’t be missed, and ironically their ending may help restore the role of fundamental analysis.

- However, narrative trading will simply go elsewhere and developments in AI, options and meme stocks are already creating a new asset class we might call ‘Equity as Crypto’.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. @Sama Says There’s An AI Bubble. What’s Going On?

- OpenAI CEO Sam Altman caused quite a stir with his recent comments about an AI bubble, people getting burned and someone on track to lose a phenomenal amount of money

- However, his message would appear to be directed at other AI startups, not OpenAI, which he says plans to spend trillions on data centers in the not very distant future

- Meta’s no-cost-spared talent grab & Palantir’s valuation are bubbly red flags but the AI infrastructure build out currently underway is real & rational, assuming the ROI can follow expeditiously

2. MIT Report Claims 95% of GenAI Projects Fail. How Is This Possible?

- Despite $30–40 billion in enterprise investment into GenAI, this report uncovers a surprising result in that 95% of organizations are getting zero return

- While employees are likely using LLMs in a personal capacity, this mostly isn’t feeding into the KPI’s that are being used to monitor the success of GenAI projects

- The harsh reality is that integrating GenAI tools into existing workflows is time consuming, needs careful planning and likely best done with help from the professionals.

3. Texas Instruments & KLA Signal Continued AI Strength, Foreshadow TSMC’s 2nm Breakout

- TI is experiencing 50%+ YoY growth in data center, showing no signs of AI server demand slowdown.

- KLA calls 2nm a “compelling” node, projecting it could be the industry’s largest over first three years.

- Taiwan Tech positioned to benefit via TSMC N2 ramp, CoWoS packaging, and ABF substrate expansion.

4. UMC (2303.TT; UMC.US): 4Q25 Revenue Is Projected to Decline 5–10% QoQ.

- United Microelectron Sp Adr (UMC US) – 2025 Full-Year and 4Q Outlook.

- The impact of U.S. recent restrictions on United Microelectron Sp Adr (UMC US) appears negligible.

- Customer demand trends are diverging in 2H25, and overall demand is expected to soften in 4Q25.

5. TSMC (2330.TT; TSM.US): TSMC Has Raised Wafer Prices; Rapidus Provides 2nm Milestone.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) has raised wafer prices, with 2nm wafers expected to cost at least 50% more—exceeding USD 30,000 per wafer.

- Rapidus plans to begin 2nm engineering production in 1Q26 and target mass production by 2027, likely one node behind TSMC.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) is expected to be ready for iPhone 17 production.

6. Taiwan Tech Weekly: SEMICON Taiwan Just Started; TSMC August Sales Soar; 2026 to Be Year of Edge AI?

- TSMC August Revenue +34% YoY: AI Demand Remains the Key Driver

- ARM Pushes Edge AI Forward with New “Lumex” Chip Designs — 2026 Could Be a Major Growth Year for Edge AI

- From AI Packaging to AI Edge: Listed Names to Watch at SEMICON Taiwan 2025 Starting Today

7. From AI Packaging to AI Edge: Listed Names to Watch at SEMICON Taiwan 2025 Starting Today

- Defining themes: Packaging, edge AI, and silicon photonics dominate SEMICON Taiwan 2025

- Global heavyweights Applied Materials, Lam, and TEL anchor this year’s industry sponsorship

- Taiwan’s next tier — Zhen Ding, ASE, Advantech, ASPEED, Egis — showcase critical AI enablers beyond TSMC

8. Hitachi Ltd. (6501 JP): Short and Long Term Benefit from New U.S. Investments

- More than $1 billion to be invested in electric power equipment and railway car production, plus a new automation center, to counter tariffs and support long-term expansion in the U.S.

- The rising share of sales accounted for by smart factory and other digital technologies should lead to higher profit margins and ROIC over the next several years.

- The share price has dropped 13% from its recent high to 26x EPS guidance for FY Mar-26. Buy on weakness for long-term growth. The main risk is a slowing economy.

9. Intel (INTC.US): Who Will Adopt Intel’s 14A Technology?

- Why does Intel Corp (INTC US)’s current CFO state “Intel will use TSMC basically forever”?

- From Taiwan Semiconductor (TSMC) – ADR (TSM US)’s perspective, they have always maintained a “no competition with customers” principle.

- Another question remains: who will adopt Intel’s 14A technology in 2027-28?

10. Taiwan Dual-Listings Monitor: TSMC Extreme Level; ASE Spread Hits Parity; ChipMOS Near Long Level

- TSMC: +24.4% Premium: Remains at Level to Short the ADR Spread

- ASE: 0.0% (Parity); Open Fresh Longs Here or at a Discount

- ChipMOS: -1.9% Discount; Near Level to Go Long the Spread

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO: The Investment Case

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is seeking to raise US$3 billion.

- Zijin Gold hold interests in eight gold mines located in gold-rich regions across South America, Oceania, Central Asia and Africa.

- The investment case is bullish due to a diversified mine portfolio, strong growth, an attractive margin profile, robust cash generation, and modest leverage.

2. [Japan ECM] Toei Animation (4816) Not as Interesting An Offering As It Could Have Been

- In Feb 2024, I wrote Toei Animation (4816 JP) – This Offering Could Be Heavy; the NEXT Offering Is More Interesting.

- Today, the company announced another offering where Fuji Media Holdings (4676 JP) is selling 10.575mm shares in an overseas offering priced likely tomorrow.

- It is not as interesting as I had expected. But it means the NEXT offering could be more interesting. But there is index buying long-term anyway.

3. Hesai Secondary Offering – Stock Hasn’t Corrected Yet

- Hesai Group (HSAI US) plans to raise around US$450m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

4. ECM Weekly (8 September 2025)- Metaplanet, Lifedrink, Koei, Hesai, Orion, Myungin, Hesai, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a few US$1bn+ IPOs are said to be looking to launch later this month, across regions.

- On the placements front, deals continue to flow through as the market remains receptive.

5. NIO (NIO US/9866 HK): An Opportunistically Timed US$1 Billion Raise

- NIO (NIO US), a Chinese premium electric vehicle manufacturer, has launched an equity offering to raise around US$1 billion.

- The raise is opportunistically timed to take advantage of the 83% QTD share price rally and comes hot on the heels of a US$513 million raise in April.

- While NIO continues to target a break-even in 4Q25 and reduce its cash burn, the valuation is stretched. A history of false dawns and intensifying competition warrants caution.

6. Toei Animation Placement: Expensive, but Owns Valuable IP

- Toei Animation (4816 JP) ’s shareholder, Fuji Media, is looking to raise around US$210m from a secondary placement.

- The deal is a large one to digest, representing 41.7 days of the stock’s three month ADV and 4.9% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

7. NIO HK/ADS Placement – Slightly Better Placed, but Slightly Bigger Deal at US$1bn

- NIO (NIO US) is looking to raise around US$1bn via a primary placement in Hong Kong and US.

- The company had last raised around US$450m in March 2025. The deal didn’t end up doing well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Zijin Gold IPO Valuation Analysis

- Our base case valuation of Zijin Gold suggests implied EV of US$40.4 billion and market cap of US$42.9 billion.

- Our EV/EBITDA valuation multiple of 14.3x is based on a 50% premium to the comps’ valuation multiple in 2026.

- We believe a 50% premium valuation to the comps’ average EV/EBITDA multiple is appropriate for Zijin Gold mainly due its higher sales growth, EBITDA margins, and ROE than the comps.

9. Chery Automobile IPO: The Bear Case

- Chery Automobile (CH3456 CH), a Chinese automobile manufacturer, has secured HKEx listing approval for a US$1.5-2.0 billion IPO.

- In Chery Automobile IPO: The Bull Case, I highlighted the key elements of the bull case. In this note, I outline the bear case.

- The bear case rests on weakening trends of the primary business, gross margin pressure, declining contract liabilities and factoring of receivables.

10. Zijin Gold IPO Preview

- Zijin Gold is getting ready to complete its IPO in Hong Kong this year. A successful IPO of Zijin Gold could fetch as high as US$3 billion in IPO proceeds.

- Zijin Gold had sales of US$3.0 billion (up 32.2% YoY) in 2024. Net margin increased from 14.2% in 2023 to 20.8% in 2024.

- There has been a sharp increase in the gap between gold AISC (all-in-sustaining cost) and gold price in the past year, leading to higher profit margins of gold producers globally.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event/Buyback] The Sony Financial Spinoff – ‘Maybe’ BUYBACK Complicates Planning

- The Sony Financial Holdings (8729 JP) (now called Sony Financial Group Inc (“SFGI”)) spinoff approaches. It will start trading 20 days from now.

- Yesterday, the TSE confirmed approval (outline, Securities Report (J), Corporate Governance Report (J). The company provided details of a possible ToSTNeT-3 buyback on Day 2 pre-open. That complicates things.

- The introduction of that type of buyback flexibility indicates that supply overhang may be managed better than buyers would hope. Means other strategies may be necessary.

2. [Japan M&A] Mandom (4917 JP) MBO – Light Price, Open-Ish Register, Tough to Take Over, Could Do Fun

- On 10 September, the founding Nishimura family, the PE Firm CVC, and Mandom Corp (4917 JP) agreed that the first two could take over the latter at 4.9x Mar28 EBITDA.

- A cocktail napkin calculation of expected leverage suggests the equity check is buying this at 5x average Mar27-28 free cash flow. That’s cheap for a growing company.

- The register is open enough to cause problems but not open enough to allow a clean hostile bid by a strategic. But still open enough for someone to have fun.

3. Dongfeng (489 HK): Questioning The EV Listing Valuation

- Back on the 22nd August, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- The share price closed up 54% on the first day, ~15% adrift of the independently valued cash + scrip (into VOYAH) under the privatisation.

- Shares have pared back 5% since. VOYAH’s peer basket has fallen ~15% on average. The market is implying a price-to-trailing-sales of 1x for VOYAH versus the basket average of 1.9x.

4. Merger Arb Mondays (08 Sep) – Kangji, OneConnect, Ashimori, Pacific Ind, RPM, Santos, Zeekr

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), Toyota Industries (6201 JP).

5. Mandom (4917 JP): A Light CVC-Sponsored Preconditional MBO

- Mandom Corp (4917 JP) has recommended a CVC-sponsored preconditional MBO at JPY1,960, a 32.1% premium to the last close price.

- The offer is below the midpoint of the IFA DCF valuation range and the special committee’s requested price. It is unattractive compared to precedent transactions and peer multiples.

- The offer is unequivocally light. The setup has the potential for a bump, particularly if an activist emerges as a substantial shareholder.

6. Regarding the Six KRX Sector Names that Ran Ahead of Friday’s Official Review Drop

- Six names stood out with simultaneous volume spikes and sharp pops last Friday; all Semis and Autos additions with big passive impact, while all others showed no tape action.

- Results likely leaked early, prompting front-running on Semis and Autos adds—high passive impact names—causing Friday’s sharp volume and price spikes.

- Early movers are mostly priced in; Thursday momentum plays still work, but Monday–Thursday morning requires caution. Focus on volume-driven flows before loading positions, long-short basket viable for other passive-impact names.

7. [Japan M&A] Pacific Industrial (7250) The MBO Is Extended After Effissimo Buys Above Terms

- Activist-Ish-Y investor Effissimo reported Friday they had a 6.68% stake as of the end of August.

- Their average price is ¥2,253 which is 10% through the price the family Bidco was bidding (¥2,050).

- As this hasn’t traded below terms at any point since announcement, an extension was likely. This morning, we got one. We’ll get another one before it’s done, BUT…

8. Timing the HHI–Mipo Spread Play Around the Passive Inflow Kick

- HHI–Mipo spread holds 3–4%; cancellation risk minimal. Market views HHI as the cleaner MASGA play vs. Mipo, keeping the spread sticky and unlikely to tighten soon.

- Potential kicker for widening comes from passive inflows when Mipo halts, as HHI gains weight in Global Standard vs. Mipo’s Small Cap.

- HHI may see ~4x DTV passive inflow as it absorbs Mipo; pre-announcement flows could start late October, potentially widening the swap spread ahead of the Nov 27 halt.

9. PointsBet (PBH AU) And Mixi Double Down Ahead Of Offer Closing

- On the 29th August, Mixi (2121 JP) cleared 50% of the voting power in PointsBet (PBH AU). It’s Offer was automatically extended, and will now close on the 12th September.

- Mixi has 51.59%. betr Entertainment (BBT AU) said it holds 20.45%, plus 6.5% in the IAF, the instructions for which can be withdrawn. betr said it won’t accept Mixi’s Offer.

- Mixi adds betr will have no PBH board representation “either now or in the future”; and betr will continue to be a clear competitor. Additionally, PBH questions betr’s buyback funding,

10. StubWorld: The Murdoch Succession Into News Corp, Fox & REA

- After a protracted succession stoush, Rupert Murdoch’s son Lachlan is set to take control of News Corp (NWS US) and Fox (FOXA US).

- Preceding my comments on News Corp and 62%-held REA Group Ltd (REA AU) are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.