Receive this weekly newsletter keeping 45k+ investors in the loop

1. Samsung Electronics (005930 KS) Tactical Outlook : New Rally After Large Pullback?

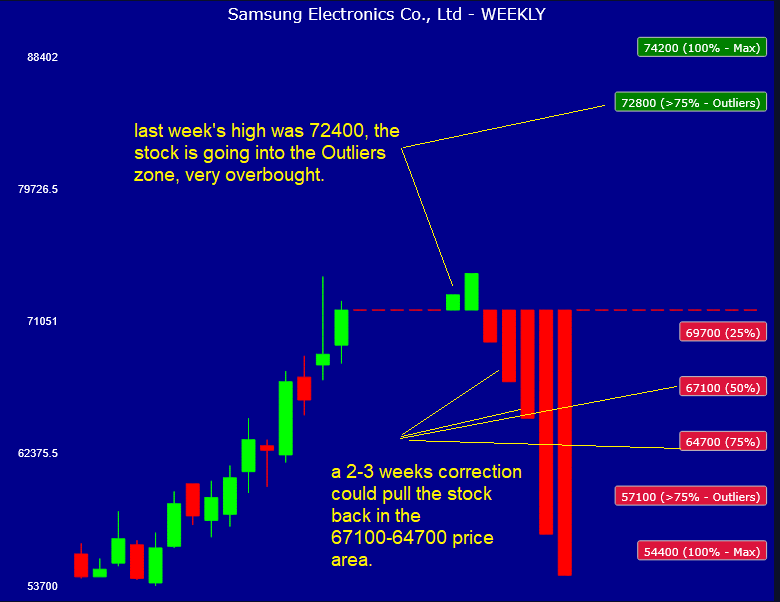

- Samsung Electronics (005930 KS) has been rallying for quite a while in the last few weeks, and we have been bullish on the stock since the start of the year.

- At the moment the stock is very overbought according to our model, we see potential for a pullback, possibly something larger than a buy the dip.

- A 2 or even a 3 weeks correction should not be ruled out at this stage, 64700 is the limit support zone we are looking at, the short profit target.

2. Global Markets Tactical Outlook WEEKLY: August 11 – August 15

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 11 – August 15.

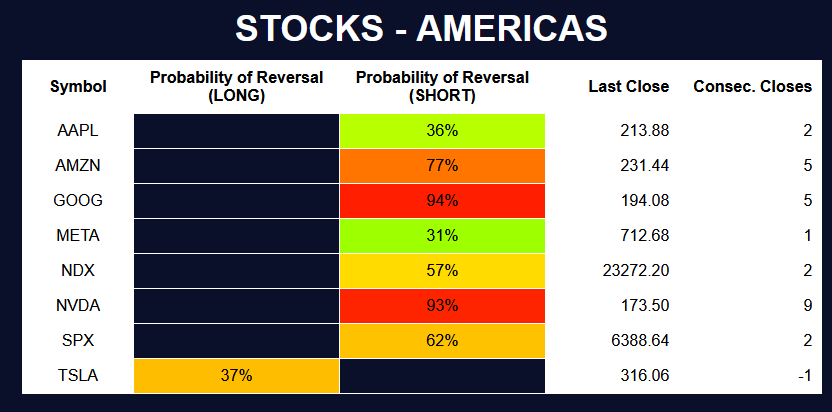

- OVERBOUGHT at the WEEKLY Close: NVIDIA Corp (NVDA US), Meta (META US) , Samsung Electronics (005935 KS) , Softbank Group (9984 JP) ,

- OVERSOLD at the WEEKLY Close: BYD (1211 HK) , NIFTY Index (NIFTY INDEX)

3. BYD (1211 HK)’s Current Relief Rally May Lead to Another Pullback

- After an explosive rally in the first part of the year BYD (1211 HK) started to sputter in mid-May and has been downtrending since.

- BYD was starting to be oversold at the end of last week, as shown in our latest Global Markets Tactical Outlook WEEKLY insight, but this week started a relief rally.

- However, the current trend pattern is NOT BULLISH according to our model, the stock could fall again after a 1-2 weeks bounce. Profit target: 116-123 price zone.

4. Xiaomi (1810.HK) Q2 Earnings: Setup Features Low Volatility and Recent Underperformance

- The setup for this earnings release is interesting as Xiaomi has underperformed HSI since the end of June.

- Xiaomi’s Q2 earnings setup features low vols a strong beat record and interesting Q2 dynamics.

- Implied vol sits near historic lows despite the approaching earnings.

5. TSMC’s Outlook After Trump’s 300% Semiconductor Tariff Bombshell

- Our model recently signaled that Taiwan Semiconductor (TSMC) (2330 TT) is overbought. Strangely, it is overbought on the TIME model but not on the PRICE model, a bearish divergence.

- On Friday Trump announced that next week he will slap 300% import tariffs on semiconductors imports. TSMC has factories in the United States so in theory it’s exempt.

- South Korea, Malaysia and Philippines’ semiconductor industries are going to be affected the most, leaving TSMC in a very good position BUT TSMC IS OVERBOUGHT and will pulback soon.

6. Hong Kong Single Stock Options Weekly (Aug 11 – 15): Market Breadth Expands, Options Activity Grows

- Broad-Based strength across sectors pushed HSI higher despite late-week weakness.

- Option trading accelerated into week’s end, with Calls showing a modest uptick.

- The HKD pulled back from the top end of its trading range after prior interventions.

7. BHP (BHP AU) Annual Results: Options Market Bets on Post-Earnings Upside

- Timing: BHP (BHP AU) reports annual results on Tuesday, 19 August 2025, 8:00 AM AEST. Corresponding local times for its international listings are detailed in the Insight.

- Highlight: Options positioning ahead of the results suggests at least one trader is making a sizeable bet on post-earnings upside.

- Why Read: Gain insight into BHP’s earnings-day price history , volatility setup, and options market positioning to be ready for the upcoming announcement.

8. CBA (CBA AU): FY 2025 Results Drive Sharp Intraday Moves – Insights for Options Traders

- Context: Commonwealth Bank of Australia (CBA AU)’s FY 2025 results delivered record profits but missed analyst expectations, prompting a sharp share price adjustment.

- Insights: Detailed review of intraday price action and implied volatility behavior following the announcement shows how the market digested the results and how implied volatility established a new equilibrium.

- Why Read: Offers a concise, data-driven view of how Australia’s largest bank’s results influenced market dynamics. Gain practical perspective on intraday trading patterns and where implied volatility might be heading

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BoE: Policy Mistake Diagnosis

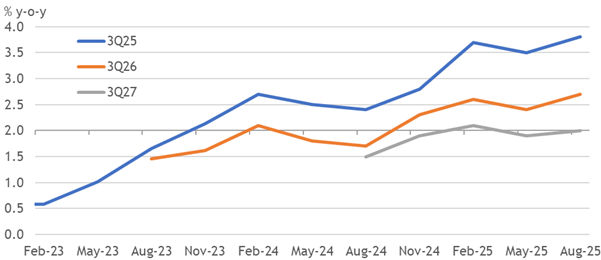

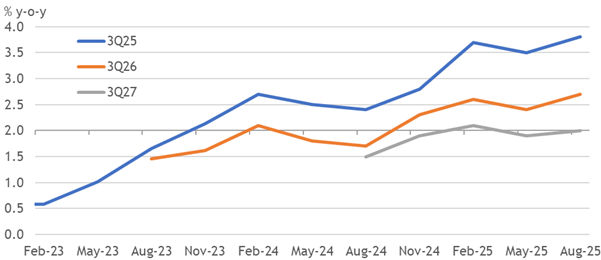

- Inflation expectations have been persistently too high, while productivity trends poorly, driving wage and price inflation forecasts to grind higher in recent years.

- The BoE’s cutting cycle contributed to reversing the trend decline in expectations, and in turning a slight overshoot into a massive one, with a 3.2pp revision since Feb-23.

- We forecasted this excess for these reasons, so it was predictable and therefore a policy mistake to cut so soon. Further surprise should prevent the MPC from cutting again.

2. US Inflation Skips Several Months

- July’s US inflation print reversed all of the increase built in from tariffs over the past several months, despite matching expectations prevailing into the release.

- Core goods inflation eased slightly, suggesting ongoing corporate success in avoiding the tariff shock. But service inflation is stuck too high to be consistent with the target.

- Anti-avoidance measures and belated pass-through will drive further rises. We doubt they will be as severe as many fear, yet still not create much space to cut rates.

3. UK: Slowdown Softened In Q2

- June’s remarkable rebound compounded the resilience revealed by April’s upwards revision, which also broke flimsy fundamental stories blaming tariffs for a slowdown.

- IP no longer declined in April, but the broader growth profile still matches the residual seasonality that spuriously drives GDP dynamics in our forecast. H2 will be weaker.

- The BoE discounts headline GDP volatility without blaming seasonality, so another surprisingly strong quarter will be hard for hawks to ignore, reducing the rate cut risk.

4. US/Taiwan: Xi Calls The Shots

- In stark contrast to its dealings with other trade partners, Washington is firmly in the position of supplicant in its dealings with Beijing.

- This reflects not only Xi Jinping’s carefully prepared and strong hand but also Donald Trump’s seeming determination to strike a deal with China at more or less any cost.

- Increasingly, therefore, Taiwan stands to be “a pawn in a bigger game”.

5. UK Jobs Suggest Summer Stabilisation

- Unemployment broke a four-month streak of increases at 4.66%, with favourable cohort effects risking a fall soon. Payrolls may also be revised to grow again from July.

- The structural hit from tax increases is matched by the cumulative fall in payrolls so far. Fundamental explanations for its divergence from the LFS aren’t supported yet.

- Ongoing resilience in wage growth stokes unit labour cost pressures alongside taxes that are beyond the target. We still expect the MPC to resist cutting rates again.

6. Tradesmen’s Collective: Fixing the Trades with Tech, Transparency & Boots-on-the-Ground

- Discussion between Jonathan, CEO of Tradesmen Collective, and Ed, Director of Investor Relations, on tech startups and market trends

- TTC USA’s integrated platform addresses industry inefficiencies with cutting edge software, escrow services, and legal support

- Insight on leading assets like gold, Bitcoin, and Nvidia; mentions of success stories like MicroStrategy integrating Bitcoin and Nvidia integrating software for business growth

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Poised for a Volatility Spike

- We remain long-term bullish on equities. In the short run, realized volatility declined since the “Liberation Day” panic, but conditions are setting up for a near-term volatility spike.

- Uncertainty over Fed policy and government credibility are possible catalysts for a disorderly increase in volatility and market correction.

- As well, the signs of narrow leadership, weak breadth and stretched risk sentiment elevates the risks of a pullback.

8. Another View of American Exceptionalism

- We believe global equity investors should adopt a barbell strategy of overweighting U.S. large cap growth and non-U.S. value stocks in their global equity portfolios

- The trend is your friend: Both are undergoing multi-year uptrends in relative performance.

- The key question is the length and sustainability of U.S. AI leadership.

9. HONG KONG ALPHA PORTFOLIO (July 2025)

- The Hong Kong Alpha portfolio outperformed its benchmark and all Hong Kong indexes in July. The portfolio achieved these results while increasing its Sharpe ratio and reducing beta and volatility.

- The shift to the healthcare and materials sectors since Liberation Day in April has aided the portfolio’s performance. The consumer staples sector lost momentum, and we exited some positions there.

- The HSI now trades above its long-term resistance levels for the first time since 2022. This signals a good time to rotate back into market leaders in tech.

10. HEW: Wrong Policy Turnings

- As soon as a data point calms nerves around a theme, a hawkish challenge seems to appear. This week, that was US CPI into PPI and UK unemployment into GDP.

- A bias to ease, triggered by a one-touch round of bad news, has consequences when not sustained. The BoE’s early start to its easing cycle has proved to be a policy mistake.

- Next week is a prime opportunity for Chair Powell to calm dovish excitement about Fed easing. UK inflation seems set to rise by another tenth, while the EA rate sticks at 2%.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC Spread Short Setup, ASE ADR at Historically Rare Discount

- TSMC: +23.9% Premium; Continued Opportunity to Short the ADR Premium

- UMC: -0.4% Discount; Wait for More Extreme Levels Before Going Long or Short

- ASE: -1.5% Discount; Historically Rare Discount Presents Opportunity to Long the ADR Spread

2. TechChain Insights: Taiwan’s Battery Cell Moment? USA & EU Supply Chain Under Strategic Pressure

- Battery cells are the new chokepoint in the global clean energy supply chain, with China still controlling 75%+ of global capacity and exporting under increasingly restrictive terms.

- Taiwan is emerging as a high-trust, high-precision hub for advanced cell manufacturing, applying its semiconductor model to batteries.

- With pouch cells gaining traction across drones, robotics, and compact mobility, Taiwan’s lab-to-fab advantage positions it as a future anchor of the U.S. and European energy ecosystems.

3. Intel. Was Tesla’s Deal With Samsung The Death Knell For IFS?

- Tesla & Samsung just inked an eight year, $16.5 billion foundry deal set to run from July 24, 2025 through December 31, 2033.

- Had Intel snagged this deal, it would have been a lifesaver for the company. Not getting it likely triggered the updated “Risk Factors” section in their latest 10K.

- This isn’t Intel playing politics, there’s no point. It’s LBT laying it on the line for investors. Continued investment in 14A is no longer a given. It’s that simple…

4. Taiwan Tech Weekly: TSMC’s Arizona Surprise – 2nm by 2026?; Signs of Hyperscaler Growth Acceleration

- U.S. 2nm Production May Begin Sooner Than Expected — Is TSMC Responding to Unprecedented N2 Demand?

- Hyperscalers 2Q25: Revenue Growth Accelerates, Cloud Revenues Accelerate, Capex Higher

- TechChain Insights: Taiwan’s Battery Cell Moment? USA & EU Supply Chain Under Strategic Pressure

5. Intel. Crisis Mode All Over Again

- President Trump wants Intel CEO Lip Bu Tan to resign immediately because he claims that he is “highly CONFLICTED”

- The President’s concerns likely relate to a recent DoJ case against Cadence as well an investigation by the Select Committee on the CCP into Walden International’s Chinese investments

- That both these topics weren’t comprehensively addressed and mitigated prior to Mr. Tan’s appointment beggars belief. Where was the due diligence Mr. Yeary?

6. Intel (INTC.US): Changing the CEO Could Save This Company? Probably the Wrong Direction.

- US President Trump urged Intel Corp (INTC US) yesterday to replace its current CEO, Mr. Lip-Bu Tan.

- We believe Intel Foundry Services (IFS) could be a highly challenging — or even misguided — strategy

- Intel Corp’s share price has declined about 23% since Mr. Lip-Pu Tan took office.

7. SMIC (981.HK): 2Q25 Results in Line; 3Q25 May Offer Mild Upside, but GM Is Expected to Be Flattish.

- Semiconductor Manufacturing International Corp (SMIC) (981 HK) reported in-line 2Q25 results, while its 3Q25 guidance appears somewhat cautious, particularly in terms of gross margin.

- The Americas continued to contribute a low-teens percentage to revenue, accounting for 12.9% in 2Q25, while China and Eurasia comprised the remaining majority.

- Our top questions for the upcoming SMIC’s 3Q25 earnings conference call.

8. Novatek (3034.TT): 3Q25 Outlook Is Expected; Weaker Demand from China Due to Subsidy Tapering.

- 3Q25 Outlook & Guidance- Revenue: NT$23.7–24.7bn( down 9.5~5.7% QoQ); Gross Margin: 34–37%; Operating Margin: 15–18%; USD/TWD Assumption: 29.5

- Weaker demand from China due to subsidy tapering in 3Q25, but seasonal stocking in non-China markets.

- 2025 foldable penetration estimated at ~1.6% (~19mn units); Large foldables: higher internal display resolution and ASP; OLED TDDI advantage: fewer components, more space-efficient, enabling thinner phones.

9. Novatek (3034.TT): FX Impact Persists; 3Q25 May Be a Down Quarter.

- We expect Novatek Microelectronics Corp (3034 TT)‘s 3Q25 might be decline 5-10% QoQ, reflecting 2H25 US tariffs impacts and Chinese opponent’s competition.

- The Foldable handset may be indicated a new era to come, and we believe Novatek Microelectronics Corp (3034 TT) shall be one of the DDIC winners.

- The stock price of Novatek Microelectronics Corp (3034 TT) is long staying with NT$450~650 since the beginning of 2024, and the current price is at the relative low point.

Receive this weekly newsletter keeping 45k+ investors in the loop

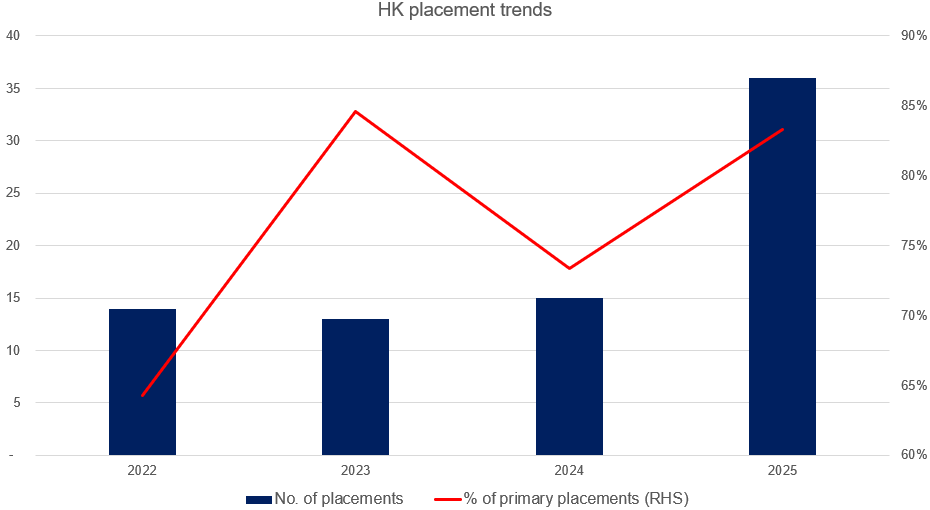

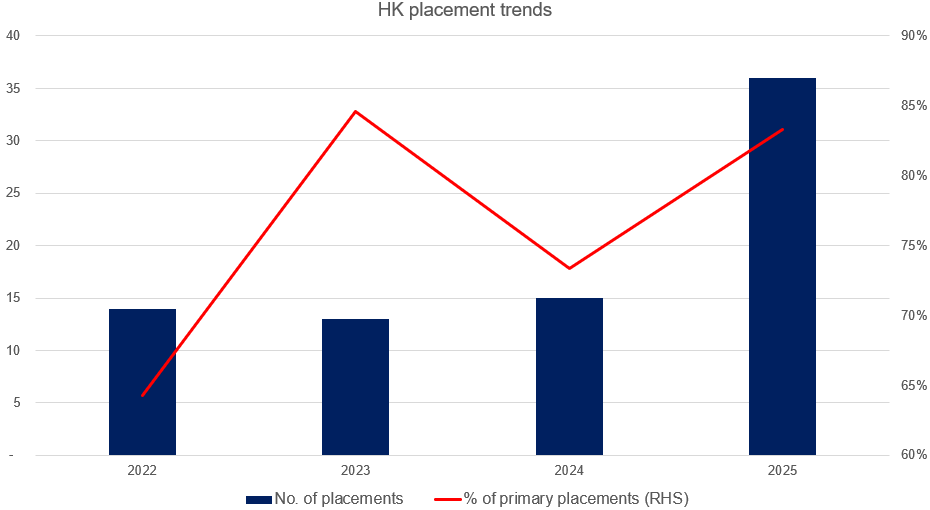

1. Hong Kong 2025 Placements – Year so Far and Trends for Potential Primary Placements

- 2025 has seen a sharp turnaround in HK placements, with 36 US$100m+ deals so far. This compares to only 14 in 2022, 13 in 2023, and 15 in 2024.

- Most of the 2025 placements have been primary raising and have come from a handful of sectors/backdrops.

- In this note, we try to identify the possible primary placements that could take place over the rest of the year.

2. HKEx Consultation Paper (Conclusion) – What Matters for ECM Investors

- The SEHK recently issued an update in response to its consultation paper in December 2025, with new mechanisms proposed for the IPO in the future.

- In this note, we summarize the conclusion by HKEx and the rules to be implemented.

- We are of the view that overall, the changes will benefit ECM investors with greater certainty in allocations.

3. ECM Weekly (4 August 2025)-Meituan, LG CNS, Wuxi AppTec, SICC, NSDL, Aditya Info, GigaDevice, WeWork

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India deal flow remains strong, with HK A/H listing starting to flow in again.

- On the placements front, WuXi AppTec (2359 HK) undertook a mega raising, while Prosus NV (PRX NA) has begun to pare its stake in Meituan (3690 HK).

4. Eternal (Zomato) Placement – Second Clean-Up by Antfin This Week, Will Lift the Overhang

- Antfin (Netherlands) Holding B.V. is looking to raise up to US$612m via a cleanup of its remaining ~2% stake in Eternal (ETERNAL IN) .

- Antfin has been selling off parts of its ~14% stake in the firm since the IPO. The company last sold a 2% stake to raise upto US$400m in Aug 2024.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

5. Bullish US LLC (BLSH): Global Digital Asset Platform Sets Terms Seeking up to $4.2b IPO Valuation

- Bullish US will offer 20.3 million shares at $28-$31 and is scheduled to debut on Wednesday (8/13).

- BlackRock, Inc., and ARK Investment Management, LLC and/or its affiliated entitiesindicated an interest in purchasing up to an aggregate of $200 million in this offering.

- A combination of highly-notable existing shareholder base, anchor orders and tailwinds from the industry will likely have this IPO in high demand.

6. PayTM Block – US$434m Clean-Up by Antfin

- Antfin (Netherlands) Holding B.V. (Antfin) is looking to raise up to US$434 via a cleanup of its remaining 5.8% stake in Paytm (PAYTM IN).

- Antfin has been selling off its stake in PayTM since it pared around 12% in Nov 2021 IPO. It last sold a 4% stake to raise upto US$242m in May2025.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

7. Pre-IPO Guangzhou Innogen Pharmaceutical Group (PHIP Updates) – Some Points Worth the Attention

- Compared to competitors, the competitive advantage of Efsubaglutide Alfa is not obvious.The weight loss effect of single target mechanism could be weaker than that of competing dual and triple agonists

- Before Innogen filed for listing, some pre-IPO investors chose to transfer the Company’s equity they held at a discount, indicating that these investors lack confidence in the Company’s prospects.

- Under the double pressure of a single pipeline and lagging commercialization, pre-IPO valuation of RMB4.65bn is more like a dangerous bubble game.We shared our views on valuation and post-IPO performance.

8. Boston Dynamics – Rights Offering of 1.2 Trillion Won Expected; Potential IPO in 2027/2028 in NASDAQ

- There has been an increasing probability that Boston Dynamics (BD) announces a fourth rights offering capital raise worth about 1.2 trillion won (US$870 million) in the next several weeks.

- All the Hyundai Motor Group related entities are expected to increase their ownership stakes in Boston Dynamics whereas it is expected to decline for Softbank post the capital raise.

- The current valuation estimates of Boston Dynamics (post capital raise) vary widely from about 4 trillion won to 10 trillion won.

9. Curator’s Cut: China Healthcare Rally, Financial Market Infra Moves, and Korea’s Equity Upswing

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published in the past two weeks on Smartkarma

- In this cut, we review the rally in Chinese healthcare in 2025, track some updates in financial markets infrastructure companies, and see how Korean equities have done since end-May

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

10. SICC A/H Listing – PHIP Updates and Thoughts on A/H Premium

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, aims to raise up to US$250m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- In this note, we look at the PHIP updates and talk about the likely A/H premium.

Receive this weekly newsletter keeping 45k+ investors in the loop

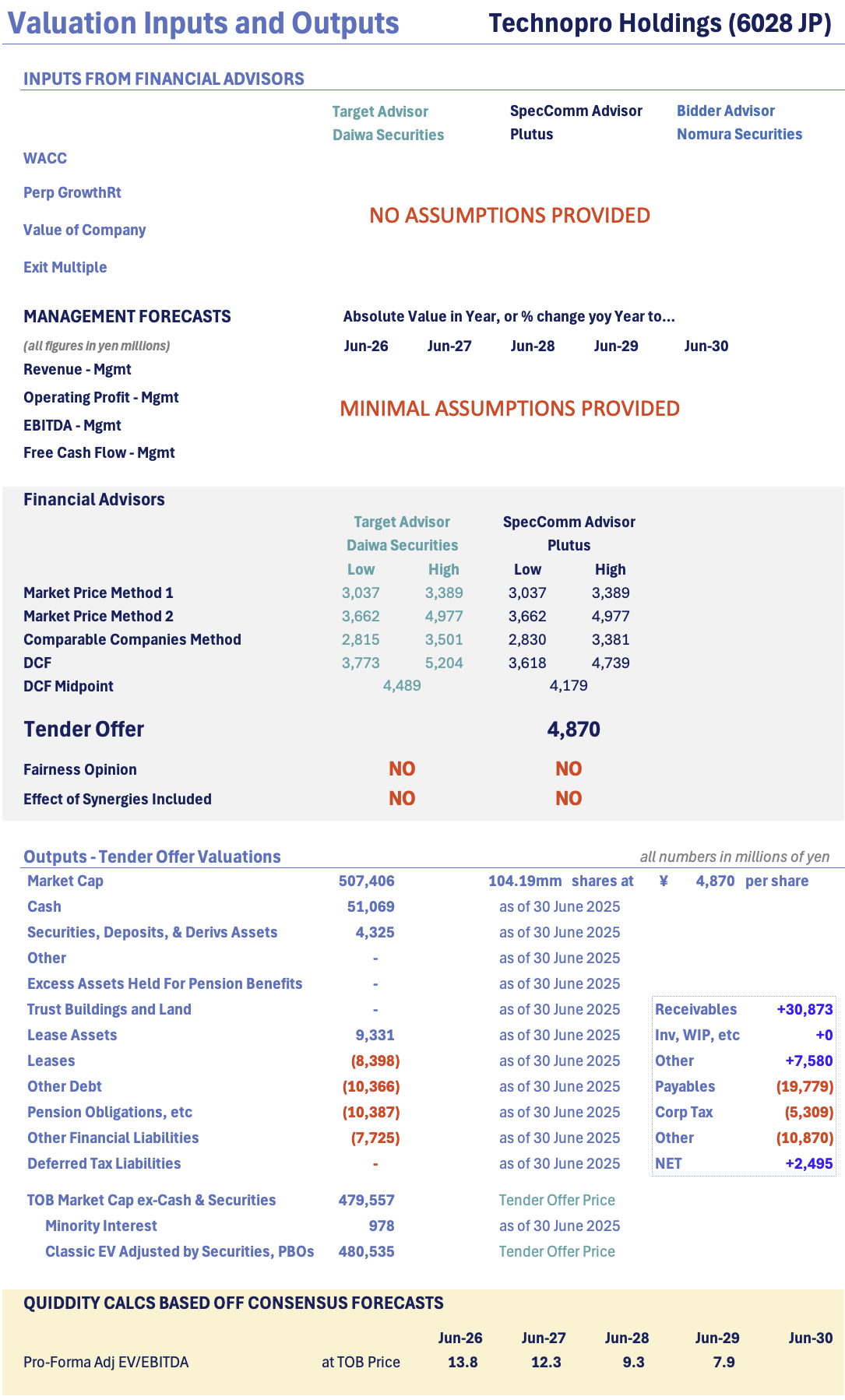

1. [Japan M&A] ¥4,870/Sh Blackstone TOB for Technopro (6028 JP) – Watch the Parameters and Modalities

- This was signaled in May, somewhat confirmed in July, now done. Blackstone buys Technopro at ¥4,870/share which is ~14x EV/EBITDA for next year.

- PE Firms have been scouring the Japanese market to buy companies. The METI Corporate Takeover Guidelines are super-helpful in that regard. This will squeeze the market over time.

- This takeover price is not quite as full as it could have been, and there are some parameters and modalities to this which are worth looking at. Parameters and Modalities.

2. [Japan M&A] Fujitec (6406) PE Bid Not Super High But May Be Tough To Beat

- On 30 July, Fujitec Co Ltd (6406 JP) and Swedish PE Firm EQT announced a deal to acquire the company with the Uchiyama family. Two activists signed tender agreements.

- The deal is not expensive IF you underwrite strong profitability growth and assume the large net receivables position can be better addressed.

- But the stock is trading tight to terms and there are 6+ months until you get your money.

3. [Japan M&A] 99Soft MBO at 52% Premium Is Too Light But A Bump May Be Tough

- Soft99 Corp (4464 JP) is the owner/operator of a set of ubiquitous brands in aftermarket autocare. Anything to do with washing, cleaning, etc.

- The company was founded 70 years ago, and the CEO is 54yrs old. Smells like succession planning.

- This deal is a nice premium, but it is too light. The operating assets with consistent growth and 20% OPMs are being sold at <0.9x book. That’s bad.

4. Merger Arb Mondays (04 Aug) – Santos, Joy City, HKBN, Krosaki Harima, Fujitec, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), ENN Energy (2688 HK), Krosaki Harima (5352 JP), Joy City Property (207 HK), Santos Ltd (STO AU), Smart Share Global (EM US).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), ZEEKR (ZK US), New World Resources (NWC AU), Ainsworth Game Technology (AGI AU), Nippon Concept (9386 JP).

5. [Japan M&A] Furukawa Battery (6937 JP) Take Private – Ugly Then, Ugly Still, But Now It’s On…

- 54 weeks ago Advantage Partners and Furukawa Electric announced a deal to take Furukawa Electric (5801 JP) sub Furukawa Battery (6937 JP) private. The acquisition price was LOW.

- Minorities got more – more than book. But the deal included a payment delay allowing BVPS to rise 8.8% from the announcement date. No synergies.

- Furukawa Electric gets to buy back in at a price below book. And because there are cash and securities and lots of net receivables, the operating assets are well below.

6. [Japan M&A] Krosaki Harima (5352) Takeout by Parent Nippon Steel – Cheapish But Done

- On Friday 1 August, Nippon Steel Corporation (5401 JP) and subsidiary Krosaki Harima (5352 JP) announced the parent would buy out the sub at ¥4,200/share.

- This seems light given the structure of the balance sheet (lots of net receivables – a bunch against the buyer) but it would be awfully tough to see this broken.

- As it is a long-dated deal, I expect it trades too tight early on, then may flatten or fade.

7. [Japan M&A] Nikkei Says Blackstone to Buy TechnoPro Holdings (6028) For “Roughly ¥500bn”

- There was an article in mid-May saying Technopro Holdings (6028 JP) might be privatised. It is an appropriate candidate. The stock popped 20% immediately, and has since risen another 20%.

- Today’s article follows one which came out ~2 weeks ago with non-sourced editorial content suggesting the price might be 20x EBITDA (i.e. a lot higher).

- Today, an article says Blackstone will buy the firm for “Roughly ¥500bn” which would be 3% down from yesterday. Beware the Nikkei. Beware expectations.

8. A Hidden Trading Angle from Dividend Tax Reform: Tax Timing Creates Dividend Trap Risks

- With new tax rules kicking in from FY2026, firms may hold back FY2025 dividends to front-load later, creating potential downside surprise purely from tax-driven deferral, not fundamentals.

- If FY2025 payouts fall short, dividend names could go ex-div on inflated expectations, then trade heavy — setting up mispricing risk around year-end dividend capture trades.

- This may weaken post-ex-div price rebounds, creating dividend trap risks and short-term mispricing that traders can exploit via shorts, dip buys, or dividend swap long-short strategies.

9. A/H Premium Tracker (To 1 Aug 2025): HUGE SOUTHBOUND Buying Helps Beautiful Skew but Premia Up

- AH premia up, erasing the previous week’s gains for Hs. “Beautiful Skew” continues in negative overall performance.

- Last week I said “This is the most significant 60-day AH pair average H outperformance in five years, maybe ever. Remarkable.” This week it unwound some.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

10. Korea’s Next Policy Momentum Play: Rapid Unfolding of the National Growth Fund

- From a trading view, no confirmed new ETFs under the National Growth Fund yet; market expects existing ETFs to be the main liquidity and sector play tools instead.

- Out of the KRW 150tn, ETF flows likely come from the 100tn private pool—conservative case: ~3% (KRW 4.5tn), base case: 5–7%, aggressive: up to 10% (KRW 15tn).

- Even conservatively, about KRW 3 trillion could flow into sector ETFs, a signficant AUM boost, mainly concentrated in AI, defense, aerospace, and biotech—driving notable inflow impact.

Receive this weekly newsletter keeping 45k+ investors in the loop

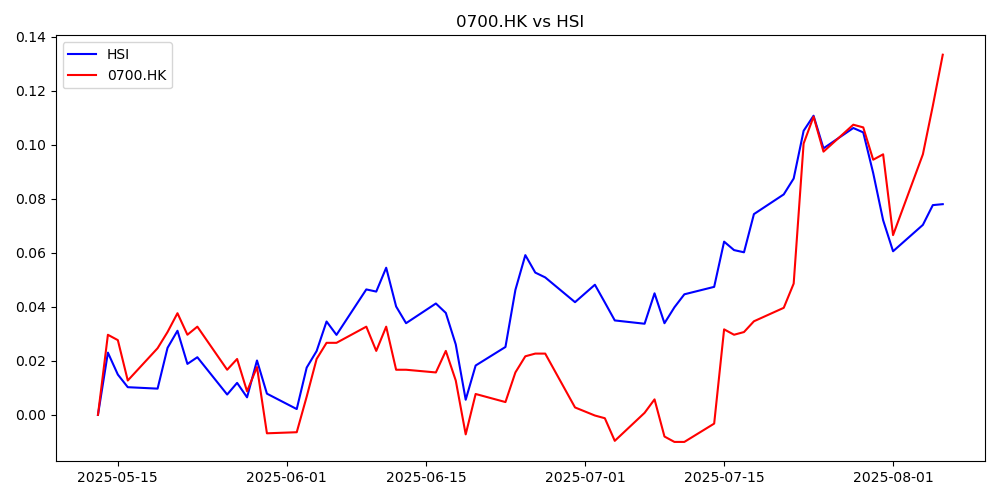

1. Tencent (700.HK) Q2 Earnings: Rally Into Earnings on Historically Low Volatility

- Tencent approaches earnings with low volatility and steady outperformance versus HSI.

- Volatilities are historically low with an earnings release on tap.

- Options market expects a modest move despite recent Tencent momentum.

2. Softbank Group (9984 JP) Outlook (Pre-Earnings Price Range Forecast)

- Softbank Group (9984 JP) is about to release its earnings on August 7th.

- The stock pulled back last week but this week is rallying. The rally can easily reach Q2 (12416) and Q3 (13003) resistance zones, if the earnings are good.

- If the earnings are disappointing, look for initial support at 11145 (Q3). If earnings are really disappointing, look at 10086 (outliers zone).

3. Tencent (700 HK): How Traders Are Positioning Into Earnings

- Context: Tencent (700 HK) is set to release Q2 earnings on 13 April 2025. In the lead-up, options strategies on the Hong Kong Exchange showcase a variety of approaches.

- Highlights: Recent option trades show a mix of bullish and bearish sentiment. Calendar Spreads, Strangles, and Spreads using weekly options are explored.

- Why Read: This review offers real-market insight into how sophisticated participants are positioning around Tencent’s earnings — providing actionable reference points for structuring trades or assessing market expectations.

4. NIFTY 50 Index Outlook: Rebound Rally in Sight? (Profit Targets)

- The NIFTY Index has been falling for 5 straight weeks: it is extremely oversold, according to our model.

- The index should rebound this week, or the next, in any case the downside should be limited at this point.

- A rally could bring the index back to 25398, but we are witnessing a BEARISH pattern at the moment, so any rebound rally will be short-lived.

5. Global Macro Outlook (Aug): Risk Builds Amid Uneven Macro Picture

- Seasonal patterns shift in August, with weaker average returns and greater downside skew supporting a case for selective hedging.

- Most markets are at or near 52-week highs, further strengthening the argument for protective positioning.

- Unlike July’s consistent vol-selling setup, August presents a more mixed environment for volatility strategies.

6. Global Markets Tactical Outlook: Week of August 4 – August 8

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week August 4 – August 8.

- OVERSOLD: China Mobile (941 HK) , NIFTY Index , KOSPI 200 INDEX

- OVERBOUGHT: NVIDIA Corp (NVDA US) is the only stock clearly overbought.

7. The Story of Serendie, Mitsubishi Electric’s Digital Innovation in the Era of AI

- Mitsubishi Electric’s Serendie platform marks a decisive shift toward AI-powered, customer-centric services, with tangible cost savings, ecosystem expansion, and a tripling of Digital Innovation workforce planned by FY2031.

- AI Leadership: The company showcased advanced automation and optimization capabilities at AWS Summit Japan, positioning itself as a leader in applied AI.

- Punchline is the Japan beta vol trade. Macro risks remain pivotal, as navigating tariff shocks, labor distortions, and central bank policy shifts could shape both performance and volatility exposure.

8. Hong Kong Single Stock Options Weekly (Aug 04–08): HSI Rebounds, Single Stock Option Activity Fades

- Hang Seng Index back in the green with broad based gains across optionable names.

- Single stock option volumes were very lackluster and Call enthusiasm continues to be muted.

- Full slate of earnings announcements on tap for the upcoming week.

9. Toyota Motor (7203 JP) Tactical Outlook After $10B Profit Cut on Tariff Impact

- Toyota Motor (7203 JP) on Thursday announced it expected a profit hit of nearly $10 billion from US tariffs on cars imported into the USA.

- Toyota cut its full-year profit forecast by 16%, citing rising US tariffs on cars, parts, steel, aluminum, uncertainty in market outlook and supplier impacts.

- Our model does not see an overbought state at the moment and the stock was rallying on Friday, the forecast is: higher prices next week.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel (INTC.US): 18A May Have Been Too Rushed; Now All Hopes Rest on 14A.

- On July 24, chip giant Intel announced that its latest 18A advanced process is progressing smoothly. However, the next-generation 14A process will be developed “based on confirmed customer commitments.”

- Apple (AAPL US) adopt Intel’s 14A process for its future M-series chips, while NVIDIA Corp (NVDA US) is expected to use the same process for its entry-level gaming GPUs.

- U.S. President Trump is imposing tariffs on countries around the world, which is indirectly pressuring some manufacturers to accelerate the establishment of U.S.-based production facilities.

2. Taiwan Dual-Listings Monitor: TSMC ADR Premium Remaining Unusually High; UMC & ASE Headroom Changes

- TSMC: +26.3% Premium; Opportunity to Go Short the ADR Premium

- UMC: -1.2% Discount; ADR Headroom Falls Yet Again by a Significant Amount

- ASE: +0.7% Premium; Opportunity to Go Long the ADR Premium — ADR Headroom Has First Change in a Long Time

3. Microsoft FYQ425. Who Says Elephants Can’t Dance?

- Q425 revenues of $76.4 billion, up 5.5% QoQ, 18% YoY and handily beating guidance of $73.8 billion.

- Azure surpassed $75 billion in revenue in FY25, up 34% YoY, driven by growth across all workloads.

- Contracted backlog grew by $53 billion QoQ to reach $368 billion. Wow!

4. Yageo’s AI-Driven Momentum and Strategic Expansion Through Shibaura Acquisition

- 2Q25 Results Summary: Reports Broad-Based Growth with Specialty Margin Strength

- Yageo Inventory Recovery Marks a Demand-Led Inflection for Hardware Components

- Update on Shibaura Acquisition: Still on Track, Strategic Synergy in Focus

5. Taiwan Tech Weekly: Mediatek Reportedly Bests Broadcom for Meta Custom Chip Win; Semi Key Indicators

- MediaTek Reportedly Wins Meta’s 2nm AI Chip Order Over Broadcom

- Memory Monitor: SK Hynix Vs. Micron — Different Speeds & Focus, Same Structural Shift

- Semi Key Indicators Q2 2025: PC, Smartphone Unit Shipments, Global Semi & WFE Sales All Looking Good

6. Intel Q225. GM Obfuscation, Red Flags & 14A Now Officially A Risk Factor

- Intel reported Q225 revenues of $12.9 billion, up $200 million QoQ, flat YoY but $1.1 billion above the guided midpoint. After that revenue beat, things went downhill from there.

- CEO Lip Bu Tan said he will review and approve all future company product designs prior to tape out. Sounds like a vote of no confidence in the design team.

- Intel’s 10 Q now lists the possibility of pausing or abandoning 14A as a risk factor with doomsday details about the implications for the company

7. ASEH (3711.TT): FX Impact; AI Gains Attention; 3Q25 Grows, but GM and OPM Decline QoQ.

- 3Q25 guidance (Assuming US$1 = NT$29.2.): Consolidated US$ revenue: +12-14% QoQ; NT$ revenue: +6-8% QoQ; Gross margin: -1 to -1.2ppts QoQ; OPM: -0.1 to -0.3ppts QoQ.

- Still keep US$1bn advanced packaging guidance despite AI boom (TSMC revised up).

- Long-Term success definition for ASE: Transition from OSAT model to foundry-aligned scale.

8. Vanguard (5347.TT): FX Impact; Mild Recovery, Slightly Better Than 3Q25 Preview.

- 3Q25 Outlook (based on USD/TWD = 28.7): Wafer Shipments: +7–9% QoQ; ASP: +1–3% QoQ; Gross Margin: 25–27%.

- Revenue Mix (Industrial, Auto, 3C): Industrial + Automotive: 40%+ (majority industrial; automotive in teens) ; Communication & Computing: 20%+ each ; Consumer: 10%+.

- 2025 Dividend Policy : Will maintains NT$4.5 per share dividend.

9. Hon Hai(2317.TT): Form Strategic Alliance Via Share Swap with TECO (1504) For Global AI Data Center

- Hon Hai Precision Industry (2317 TT) and Teco Electric & Machinery (1504 TT) held a joint press conference this afternoon to announce the formation of alliance through a share swap.

- Teco (1504) TT and Hon Hai (2317 TT) stated their target markets extend beyond Taiwan and Asia, to include substantial business opportunities in the U.S. and the Middle East.

- Foxconn Chairman Mr. Young Liu also noted that as AI data centers scale up rapidly and demand surges, modular design is increasingly favored.

10. Tokyo Electron (8035 JP): Why the Big Downward Revision?

- Tokyo Electron’s share price dropped 18% on Friday following the announcement of weak Q1 results and a huge downward revision to H2 FY Mar-26 guidance.

- Push-Outs and/or cancellations of orders due to the uncertainty caused by President Trump apparently caught managment by surprise. Costs also rising as management ramps up capex and R&D.

- Impact of Trump’s yet-to-be-announced tariffs on semiconductors is still unknown, but 15% base rate on Japan already a negative.

Receive this weekly newsletter keeping 45k+ investors in the loop

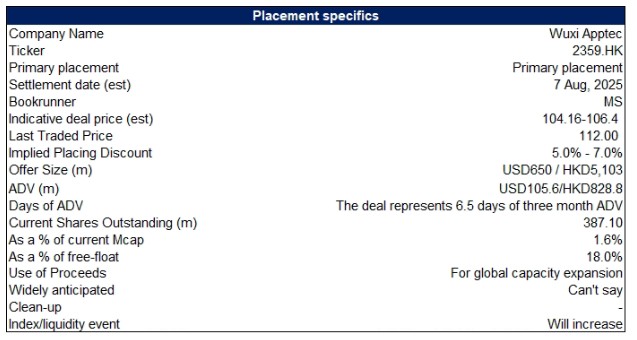

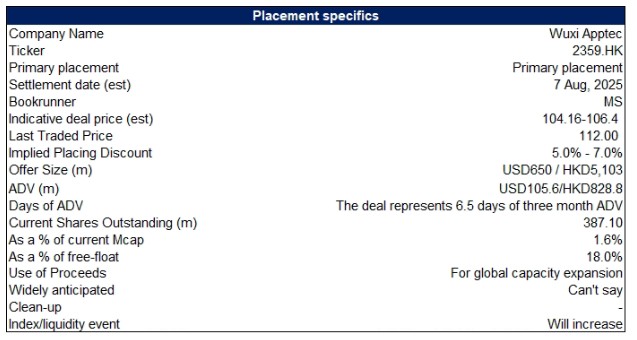

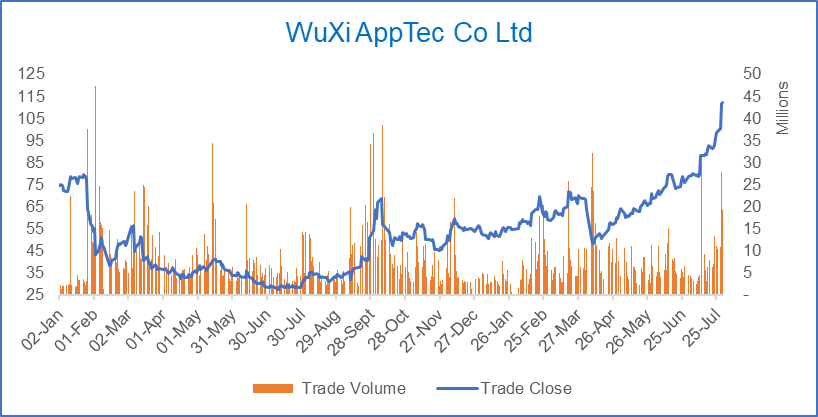

1. Wuxi AppTec Placement – Momentum Is Very Strong, Though It Is a Bit Opportunistic

- WuXi AppTec (2359 HK) aims to raise around US$650m via its H-share placement.

- The stock has been on a roll this year and recently announced strong earnings as well. Although it’s now trading at its 52-week highs.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. National Securities Depository Limited (NSDL) IPO – Peer Comparison and Thoughts on Valuation

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we undertake a peer comparison and talk about valuations.

3. ECM Weekly (28 July 2025) – MMC, Pine Lags, Prestige, Veritas, Daehan, Kasumigaseki, NSDL, GNI

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, we had a look at a number of deals that are in the pipeline.

- On the placements front, it was a relatively quiet week with a few primary raisings.

4. Kasumigaseki Hotel REIT IPO: Lags in Size but Priced at a Discount

- Kasumigaseki Hotel REIT (401A JP) is looking to raise up to US$192m in its upcoming Japan IPO.

- It is a REIT with hotel assets sponsored by affiliated developer, Kasumigaseki Capital (3498 JP).

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

5. Figma Inc (FIG): Range Boosted As Blow-Out Demand Comes in for High-Profile Software IPO

- Figma increased its range from $25-$28 to $30-$32 on Monday morning. The company is still offering 36.9mm shares and is scheduled to debut on July 31st.

- One of our sources stated that the amount of orders in this software IPO exceed 30-times the offering size.

- The large customer base, excellent margins and revenue growth in combination with management that continues to reinvest in the business gives us strong conviction on this IPO.

6. Firefly Aerospace Inc. (FLY): Space & Defense Company Sets Terms for IPO Seeking $5.5b Valuation

- They will be offering 16.2mm shares at $35-$39 with an expected market cap between $4.9b and $5.5b and to debut on August 7th.

- The company’s principal stockholder is private-equity firm AE Industrial which made its initial investment in Firefly Aerospace in 2022 and is a 47.4% stakeholder.

- Revenue in Q2 is up more around 140% versus the same period in 2024 but the company’s net losses continue to mount.

7. NSDL – New Management, Revised Strategy — The Battle for Market Share Continues

- This insight describes about NSDL (NSDL IN) ‘s complete overhaul in top management team over the last 12 months.

- The mandate for new team is to arrest the market share loss with new age/ discount brokers. The revised strategy seems to be working.

- The IPO provides investors a front-row seat opportunity to witness this turnaround.

8. Samyang Comtech IPO Book Building Results Analysis

- Samyang Comtech completed solid book building results. The IPO price has been finalized at 7,700 won per share, which was at the high end of the IPO price range.

- A 48.4% of the total IPO shares are under various lock-up periods lasting from 15 days to 6 months. This is a bullish signal.

- Our valuation analysis suggests target price of 13,187 won, which represents a 71% upside from IPO price. Given the excellent upside, we have a Positive view of this IPO.

9. National Securities Depository Limited (NSDL) IPO – RHP Updates – Revenue Slowing, Margins Growing

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we talk about the updates from its RHP filing.

10. Ab&B Bio-Tech (中慧生物) Pre-IPO: PHIP Updates Suggest Competition Intensifying

- China-Based vaccine biopharmaceutical company Ab&B is looking to raise at least US$100 million via a Hong Kong listing. The joint book runners are CITIC and CMBI.

- In our previous insight, we looked at the story that the company is trying to sell and the influenza vaccine market.

- In this insight, we look at the latest updates in its PHIP filing.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. WuXi AppTec (2359 HK) Placement: Strong Momentum & Index Flows

- WuXi AppTec (2359 HK) is looking to raise US$650m at a price range of HK$104.16-106.4/share, a 5-7% discount from last close.

- There will be passive buying from global index trackers around the time of settlement of the placement shares. Then there will be some Hang Seng Index buying in August.

- Short interest in WuXi AppTec (2359 HK) has spiked and some shorts could cover into the placement. The AH premium could move higher following the placement.

2. GMO Internet (4784) – GMO Internet Parent Has Been SELLING In The Market

- I have harped on the fact that GMO Internet Group (9449 JP) has to sell GMO Internet (4784 JP) shares with the goal to get 35% tradable shares by end-2025.

- I have written about it here, here, here, and here. The price needs to be lower so the parent can launch a HUGE block. The stock must be less squeeze-able.

- It turns out the parent started selling in the market the day after the Offering was cancelled. The setup is delicious now.

3. NSDL (NSDL IN) IPO: Offering Details & Index Inclusion Timeline

- NSDL (NSDL IN) is looking to list on the exchanges by selling up to INR 40bn (US$464m) of stock at a valuation of up to INR 160bn (US$1.85bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in November.

- Central Depository Services (CDSL IN)‘s stock price has dropped following the announcement of NSDL‘s IPO price band and the muted results could lead to further downside in the stock.

4. Korean Policy Tailwinds: Preferred Shares Rerating Play

- Most expect prefs to be in policy crosshairs soon—watch for tighter rules on dividends, discounts, and liquidity, plus likely incentives for redemption or cancellation ahead of commons.

- If Korea rolls out a pref stock overhaul, long-biased rerate plays could pop—focus on liquid, high-yield large-cap prefs trading at 35%+, yield north of 3%, and solid daily turnover.

- Korea Inv, Kumho Petro, CJ Cheil, CJ Corp prefs already screen well; Doosan and Hanwha 3PB could join if dividend hikes materialize on back of strong sub earnings.

5. [Japan Activism/M&A] Hogy Medical (3593) Reportedly Up For Auction – Totally Unsurprising

- Hogy Medical (3593 JP)‘s founder passed and there was a re-arranging of Hoki family deckchairs in 2021. In 2022 there was a BIG buyback from the family at ¥3,130/share.

- I discussed it here. I suggested that meant accretion, a family willing to sell, and an open register for a cheap company always heavily owned by value investors.

- The stock went nowhere for 18mos as activists dallied. In 2024 it ran from ¥3,500 to ¥5,000 as Dalton bought 20%. Then they got a board seat. Now takeover noise.

6. A/H Premium Tracker (To 25 July 2025): “Beautiful Skew” Raging Onward

- AH premia down again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- This is the most significant 60-day AH pair average H outperformance in five years, maybe ever. Remarkable.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

7. Merger Arb Mondays (28 Jul) – Shibaura, Abacus Storage, Insignia, Mayne, Santos, ENN, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Yichang HEC Changjiang Pharma (1558 HK), ENN Energy (2688 HK), Pacific Industrial (7250 JP), Santos Ltd (STO AU), Smart Share Global (EM US).

- Lowest spreads: Bright Smart Securities (1428 HK), Hainan Meilan International Airport (357 HK), Humm Group (HUM AU), New World Resources (NWC AU), Nippon Concept (9386 JP).

8. ADR Arb on Korean Divvy Names: A Side Play Riding the Policy-Driven Liquidity Wave

- ETF rebalancing’s key, but still too early to front-run — both use FnGuide screens based on FY1 DPS and prices from 20 days before November-end.

- Beyond the rebalance noise, ADR-local spreads have been widening — KB hit +6%, Shinhan’s also drifting. Likely tied to the recent liquidity surge in dividend names.

- ADR arb’s more doable with NXT tightening slippage. With proper FX hedging, it’s a clean side play riding the policy-driven liquidity wave.

9. [Japan M&A] Pacific Industrial (7250) MBO Officially Being Done Dirt Cheap

- The MBO for Pacific Industrial (7250 JP) starts with the father+son Chairman and CEO, – combined stake 2.92% – putting nothing in to buy this, with help from banks.

- The Takeover Price is priced at 0.7x book, and a Net Debt to EBITDA of 2x (when adjusted for securities+pension assets+DTLs) and 5-6x average 2026-2030 FCF.

- This is being done too cheap: Toyota is the main customer, one third of revenues comes from Japan, and the company is set for a transition to EVs.

10. [Japan M&A] – KKR Launches Still-Too-Light Topcon (7732) Deal

- In December-2024, this deal was mooted and it came out as expected. But the implied growth in management forecasts was higher than expected so the price came in quite light.

- In March when the deal was announced, it seemed like a tough call, but three weeks later Value Act decided they would tender, but would reinvest in the back end.

- The deal is now approved, and launches tomorrow. It gets done, I expect, but it is not a model deal other than being one showing the loopholes available to buyers.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Global Markets Tactical Outlook: Week of July 28 – August 1

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week July 28 – August 1.

- OVERSOLD: China Mobile (941 HK) , Commonwealth Bank of Australia (CBA AU) are just mildly oversold, NIFTY Index (NIFTY INDEX) is oversold.

- OVERBOUGHT: Amazon (AMZN US) , Alphabet (GOOG US) , NVIDIA (NVDA US) , Toyota Motor (7203 JP) , Softbank Group (9984 JP) , Hang Seng Index , Nikkei 225 INDEX

2. Rio Tinto (RIO AU) 1H25 Results on 30 July: Earning Yield from Volatility Premium

- Rio Tinto Ltd (RIO AU) / (RIO LN) / (RIO US) is scheduled to report its 2025 half year results on Wednesday, 30 July 2025 at 16:15 AEST.

- Actionable Option Strategy: Options imply a move noticeably larger than the historical average, opening up a potential short-term yield opportunity. Trade setup discussed in detail.

- Why Read: The Insight outlines yield-focused short-vol strategies, the expected volatility crush, and a forecast for Rio’s interim dividend based on payout policy and timing.

3. AAPL Q3 Earnings: Misses Are Rare, But Performance a Red Flag

- AAPL has been an underperformer since its last earnings report which stands out against the backdrop of a stock that rarely misses earnings expectations.

- We take a closer look at implied volatility and the earnings-day move priced by the options market.

- Volatility metrics and historical earnings reactions are analyzed to help frame expectations.

4. META Profit Target UPDATED (Pre-Earnings July 30th)

- Meta (META US) will report its earnings today July 30th, after the Close.

- If the earnings are positive, we predict a rally that could last up to 3 weeks and bring Meta (META US) at 758, above its recent all time high peaks.

- The rally could last up to 3 weeks – this is a short-term tactical forecast, it doesn’t offer a view of where the stock could be several weeks from now.

5. Hong Kong Single Stock Options Weekly (July 28–Aug 01): Reversal Hits, Breadth Collapses, Vol Steady

- HSI reversed course with four straight down days to close the week sharply lower.

- Breadth collapsed, with only a small fraction of names finishing higher; option volumes rose into the decline with Puts taking more than their usual share of activity.

- Implied vols fell on the week, erasing last week’s gains and not showing signs of stress at this point.

6. MSFT Q4 Earnings: Exceedingly Calm Trading Drags Implied Vol Lower

- MSFT is set to report Q4 earnings after the market close on Wednesday, July 30.

- We examine the implied volatility and projected earnings-day move following a near 30% rally since the last report.

- Volatility metrics and historical earnings reactions are analyzed to help frame expectations.

7. Samsung Electronics (005930 KS) Tactical Outlook After Disappointing Earnings

- Samsung Electronics (005930 KS) 2Q earnings have been somehow disappointing for investors.

- We don’t dissect the earnings details, as market reactions—regardless of headlines—almost always fall within the behavioral range defined by our model.

- What we see right now is FEAR: Samsung Electronics was rallying hard, reached the tails area in our model, then retreated back sharply after the earnings.

8. S&P/ASX 200 Tactical Outlook Ahead of Australia’s Earnings Season Kickoff

- The Australian Earnings Season will begin in early August. The S&P/ASX 200 (AS51 INDEX) suffered a minor setback last week, closed the week down but it’s already rallying higher.

- Our profit target for this rally is 8824 (Q2 resistance target). It could go a bit higher than that but we think it will not reach Q3 resistance at 8996.

- If for some reason the index returns below last week’s Close, the next support level to watch is 8605 (Q2).