This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) Offering – Expect It Very Well Bid, and the Back End Squeezy

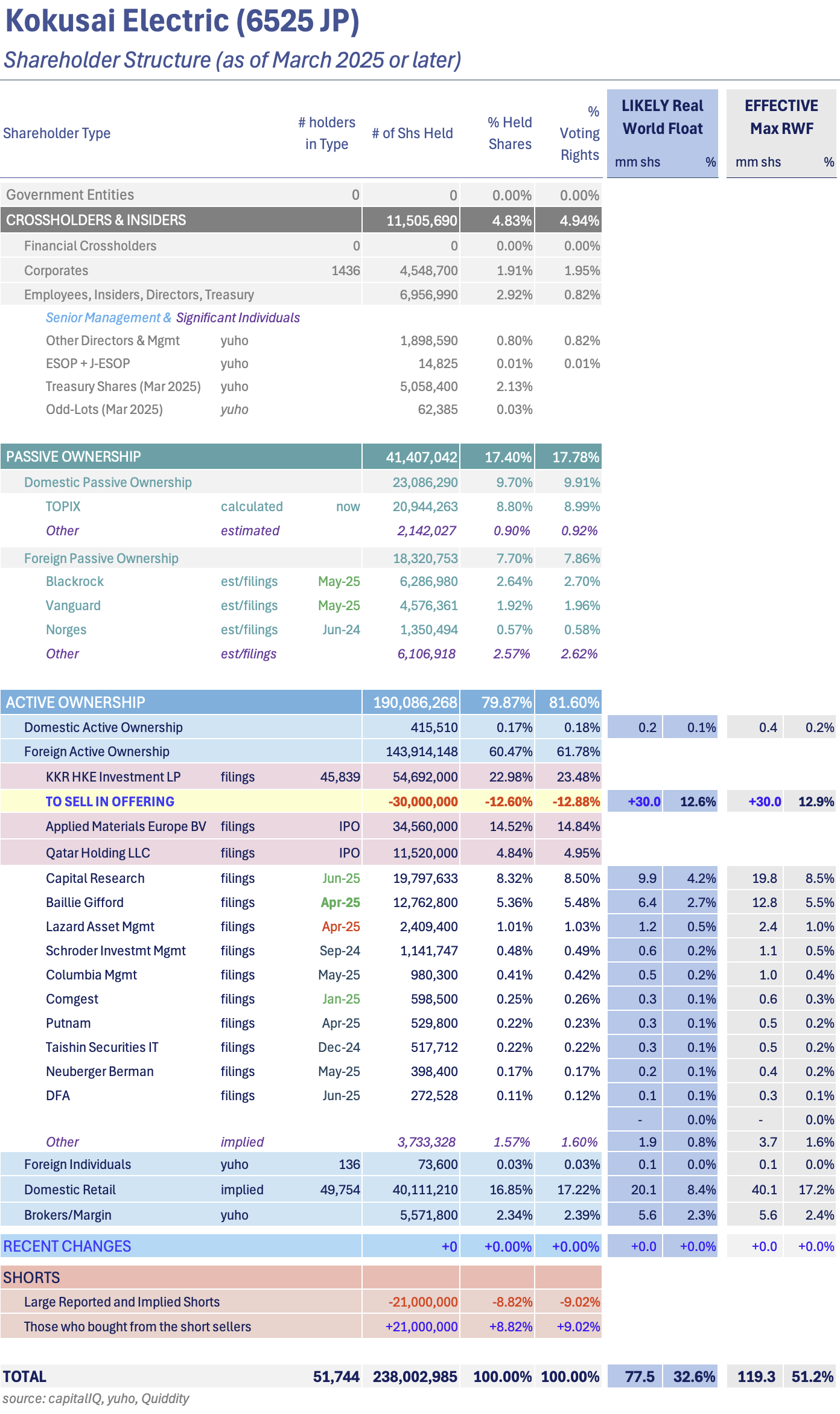

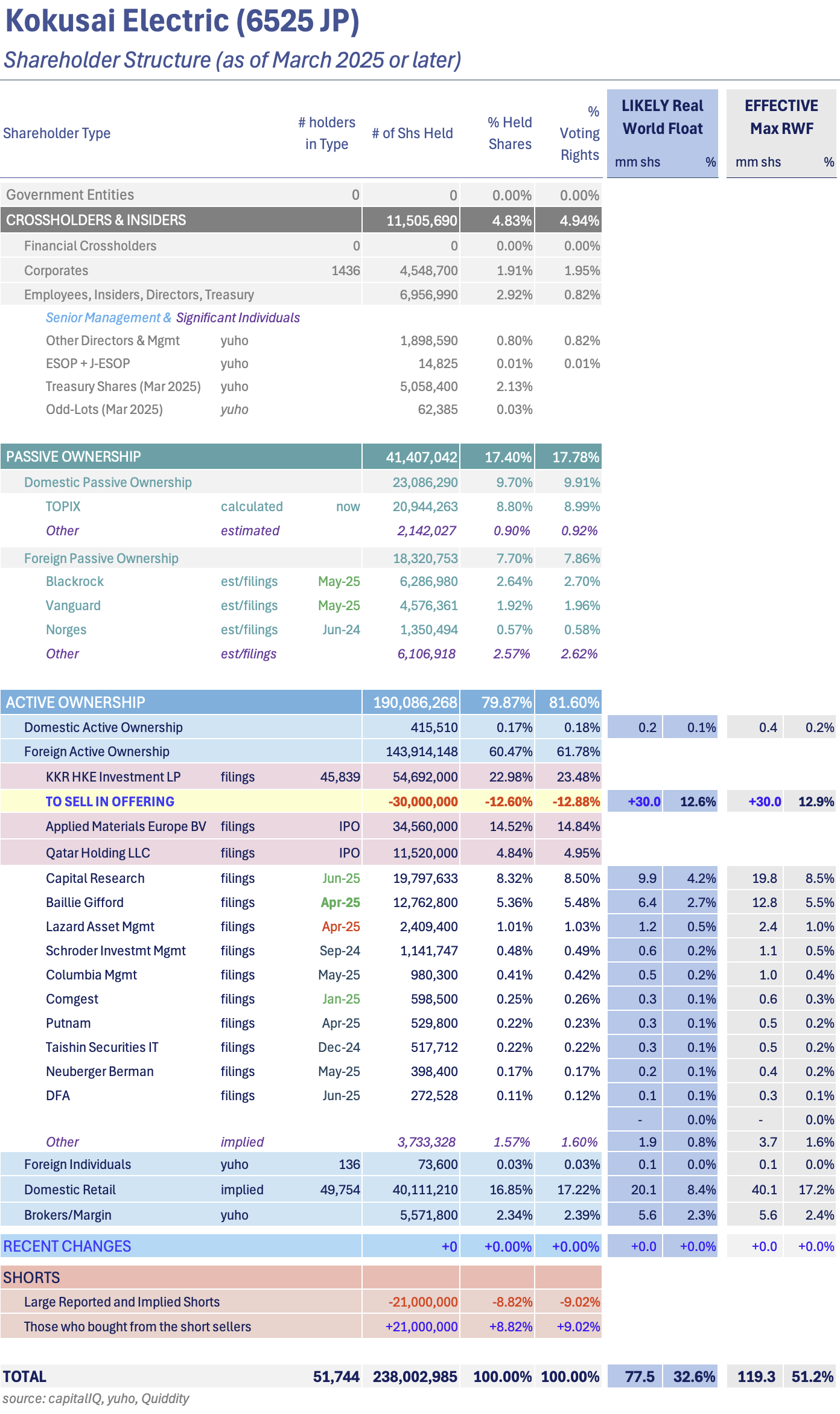

- After the close today, Kokusai Electric (6525 JP) announced that large holder (and original PE owner) KKR HKE Investment LP would sell down 30mm shares or 12.88% of shares out.

- This is not expected, but also not unexpected – it’s exactly a year since the first selldown. There is a decent-sized short position, and it isn’t a huge offering.

- This changes two aspects of the future supply/demand balance. Both are important for how this trades in coming months.

2. FWD IPO Trading – Tepid Demand

- FWD Group Holdings (1828 HK), a pan-Asian life insurer founded by Richard Li, raised around US$442m in its HK IPO.

- FWD is a pan-Asia life insurer operating in ten markets including Hong Kong (and Macau), Thailand (and Cambodia), Japan, the Philippines, Indonesia, Singapore, Vietnam and Malaysia.

- We looked at the company’s past performance and valuations in our previous notes. In this note we talk about the trading dynamics.

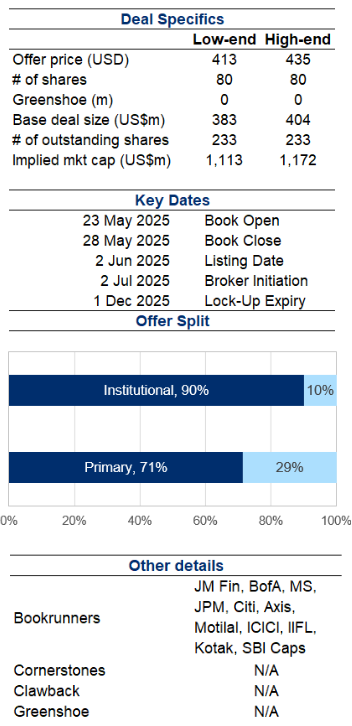

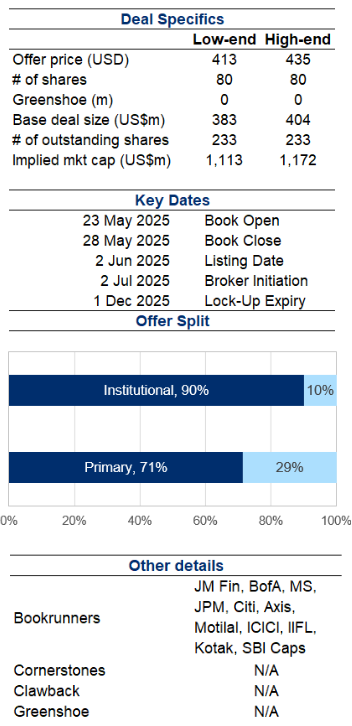

3. Kokusai Electric Placement – Well Flagged but past Deal Didn’t Do Well

- KKR is looking to raise approximately US$620m through an accelerated secondary offering for around 13% of Kokusai Electric (6525 JP)‘s (KE) stock.

- KKR had sold in the IPO and undertaken an extended selldown in July 2024 as well. Hence, this deal is somewhat well flagged.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. Curator’s Cut: CC Vs DD, Singapore’s IPO Momentum and Pair Trade Ideas Galore

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,000+ insights published in the past two weeks on Smartkarma

- In this cut, we compare the top two Chinese ride hailing platforms, the recent momentum in Singapore IPOs and the flurry of pair trade ideas on Smartkarma

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

5. SK Square Placement: Clean up by Kakao

- Kakao Corp (035720 KS) is looking to raise US$316m from a clean-up sale in SK Square (402340 KS) .

- The deal is a small one, representing 5.4 days of the stock’s three month ADV, and 1.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. KRX Virtually Locks In Parentco Payout Rules for Spin-Off IPOs

- KRX is set to spotlight Philenergy’s 2023 IPO as the model, pushing spin-off deals to reward parentco holders—like Philoptics’ move to hand out IPO shares.

- Philoptics doubled pre-Philenergy IPO on crazy momentum, then round-tripped post-listing. Setups like this hint at bigger parentco moves ahead in future spin-off IPO plays.

- SK Enmove IPO is scrapped; but SK Plasma (SK Discovery) still live; LS E-Link (LS Corp) also likely to be an early test case for the new parentco compensation framework.

7. ECM Weekly (7 July 2025) – IFBH, HDB, Anjoy, FWD, Lens, Fortior, NTT DC, Daehan, Kanzhun, Nykaa, NH

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, next week will see a large number of listings across the region.

- On the placements front, given the HK and US holidays and approaching earnings season, there were only a few deals in the past week.

8. Travel Food Services IPO – RHP Updates & Thoughts on Valuation

- Travel Food Services Ltd (1450229D IN) is looking to raise about US$233m in its India IPO.

- Travel Food Services Limited (TFS) operates a network of travel quick service restaurants (Travel QSRs) and private lounges in airports.

- We have looked at the company’s past performance in our previous notes. In this note, we will talk about the RHP updates and IPO valuations.

9. Travel Food Services: $250M OFS, Niche Travel QSR but Valuations Seem Full Amidst near Term Weakness

- TFS operates QSRs and lounge in airports. They are present in the top 14 airports in India accounting for 26% of Indian-airport QSR and ~45% of the Indian-airport Lounge revenues

- FY26 performance is expected to be flattish as 1H results will lap impact of Adani operated airports being moved from TFS books to Joint venture with 25% stake.

- FY27 onwards growth is estimated at 15+% with EBITDA margins of 34-37%. We estimate FY27 revenues of ~2,000cr with PAT of 450-500cr implying the deal is being priced at 30-33x

10. Lens Technology A/H Trading – Decent Demand, Helped by A-Share Rally

- Lens Technology (300433 CH), a precision manufacturing solution provider, raised around US$700m in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NTT DC REIT IPO – Decent Yield, Strong Local Backing, a Few Issues

- Ntt Dc Reit (NTTDCR SP) (NDC), a data center REIT, aims to raise up to US$810m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn.

- In this note, we look at the company’s portfolio and its performance.

2. NTT DC REIT IPO – Thoughts on Valuation

- NTT DC REIT (NTTDCR SP) (NDC), a data center REIT, aims to raise up to US$810m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn

- We have looked at the company’s past performance in our previous note. In this note, we will talk about valuations.

3. Beijing Geekplus Pre-IPO: Expensive Valuation and Mark up from Previous Round

- Geek+ (1678559D CH) is looking to raise up to $300m in its upcoming Hong Kong IPO.

- It is a leader in the global autonomous mobile robots (AMR) market.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

4. NTT DC REIT IPO: The Investment Case

- NTT DC REIT (NTTDCR SP) is the exclusive S-REIT vehicle sponsored by NTT Group. It has launched an SGX IPO to raise proceeds up to US$864 million.

- The IPO portfolio comprises six data centres – three located in California, one in Virginia, one in Vienna, and one in Singapore.

- NTT DC REIT offers an attractive value proposition, comprising a blue-chip tenant base, a staggered lease expiry profile, a robust growth pipeline, and sizable debt headroom.

5. Saint Bella IPO (2508.HK): Pricing and Post-IPO Performance, Wild Price Swings Could Be Short-Lived

- Saint Bella, a leading postpartum care and recovery group in China, priced its upsized IPO at fixed offer price of HK$6.58 per share.

- The offer size adjustment option has been fully exercised. The company issued and allotted 14,313,000 additional offer shares.

- Saint Bella sold 109,733,000 shares and raised net proceeds of ~HK$630M or ~$80M. The stock jumped ~49% on first day as a public company and peaked at HK$11.00 per share.

6. Lens Technology A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Lens Technology (300433 CH), a precision manufacturing solution provider, aims to raise around US$1bn in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Geek+ IPO (2590.HK): Long-Term, Warehouse Automation Story, But IPO Valuation Is Not Cheap

- Geek+, global technology company and provider of scalable and flexible highly efficient solutions for warehouses, aims to raise ~$300M in Hong Kong IPO.

- The company is expected to IPO next week and offer price of HK$16.80 implies a market cap of HK$22B (~$2.8B). Geek+ is set to start trading on July 9, 2025.

- I believe that Geek+ has a large runway for growth in the global AMR solution market, but valuation keeps me from being positive on the name.

8. Lens Technology A/H Listing – Pricing Looks Decent

- Lens Technology (300433 CH), a precision manufacturing solution provider, aims to raise around US$600m in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. Geekplus Technology IPO (2590 HK): The Investment Case

- Geekplus Technology (2590 HK) is a leader in the global autonomous mobile robot (AMR) market. It is seeking to raise US$300 million.

- Geekplus has been the world’s largest warehouse fulfilment AMR solution provider in terms of revenue for the last six consecutive years.

- The investment case is bearish due to declining growth, lower contract liabilities, hints of window dressing relating to reducing losses and ongoing cash burn.

10. Lens Technology H-Share Listing: Thoughts on Valuation

- Chinese iPhone glass supplier Lens Technology (6613 HK) has announced the terms for its H-share listing, and plans to raise around US$600m through issuing 262.3m shares.

- The company’s listing is priced at HK$17.38-18.18 per share, at a 25-28% discount to the last close price of the A-shares as of 27th June.

- Our valuation analysis suggests that the company’s H-share offering is priced reasonably compared to domestic and international peers.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HDB Financial IPO: The Investment Case

- HDB Financial Services Ltd (0117739D IN) is India’s seventh-largest non-banking financial company (NBFC). It is seeking to raise Rs125 billion (US$1.4 billion).

- The proposed IPO comprises a primary raise of Rs25 billion (US$388 million) and a secondary raise of Rs100 billion (US$1.2 billion) by the parent.

- The fundamentals are average at best, as HDB does not outperform its NBFC peers on key performance indicators.

2. Anjoy Foods Group A/H Listing – Isn’t Great but Can’t Ask for It to Cheaper

- Anjoy Foods Group (603345 CH), a quick-frozen food company in China, aims to raise around US$336m in its H-share listing.

- AFG was the largest quick-frozen food company in China in terms of revenue in 2023, with a market share of 6.2%, according to the Frost & Sullivan report.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

3. Innovent Biologics Placement – Second for the Month, Stock Has Doubled but Momentum Is Strong

- Innovent Biologics Inc (1801 HK) aims to raise around US$500m for R&D and marketing.

- The company has undertaken a number of deals in the past, with the overall results being mixed but recent deals have done well.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

4. IFBH Ltd IPO: Heavy on Coconut and Light on Asset Makes the IPO Juicy

- IFBH Ltd launched its Hongkong IPO aiming to raise up to HK$1,160 million. The company plans to sell 41.7 million shares at HK$25.3–27.8 per share.

- IFBH is a ready-to-consume beverage and food company based in Thailand. It enjoys market leader position in the ready to drink coconut water segment in Mainland China.

- The growth momentum is expected to continue in the near term. IFBH’s leadership position would help garner volume strength. We would recommend the investors to subscribe to the issue.

5. HDB Financial IPO: Valuation Insights

- HDB Financial Services Ltd (0117739D IN) is India’s seventh-largest non-banking financial company (NBFC). It is seeking to raise Rs125 billion (US$1.4 billion).

- I discussed the fundamentals in HDB Financial IPO: The Investment Case. The shares will be listed on 2 July.

- My valuation analysis suggests the HDB is fully priced at the IPO price range of Rs 700- 740 per share. I would avoid the IPO.

6. IFBH IPO – Leading Position in a High Growth F&B Segment Driving Valuations

- IFBH (IFBH HK) is looking to raise about US$148m in its HK IPO.

- IFBH specializes in ready-to-consume beverages and food, with a focus on coconut water and plant-based products.

- In our previous note, we looked at the firm’s past performance. In this note, we talk about the IPO valuations.

7. EB Event Trade Setup: HD KSOE Lining up a New Deal with HD Hyundai Heavy as the Underlying

- HD KSOE plans a second EB similar to earlier this year: a zero-coupon, 2% HD Hyundai Heavy stake with 13–15% premium, aiming to raise around ₩850 billion.

- With Korea’s Commercial Act revision expected by July 4, EB deals risk director liability; HD KSOE aims to raise cash now before stricter rules limit easy board-approved EB issuance.

- Targeting a short in HD Hyundai Heavy triggered by HD KSOE’s board approval before July 4; consider hedging with a long position in HD KSOE due to ongoing sector catalysts.

8. FWD Pre-IPO – PHIP Updates – Growth Slowing, Metrics Evolution Continues

- FWD Group Holdings (FWD HK), a pan-Asian life insurer founded by Richard Li, now aims to raise around US$500m in its HK IPO.

- FWD is a pan-Asia life insurer operating in ten markets including Hong Kong (and Macau), Thailand (and Cambodia), Japan, the Philippines, Indonesia, Singapore, Vietnam and Malaysia.

- We looked at the company’s 2018-21 performance in our past notes. In this note, we will talk about the updates since then.

9. Zhejiang Sanhua Intelligent Controls A/H Trading – Strong Demand, Weakening Sentiment

- Zhejiang Sanhua Intellignt Controls (002050 CH) (ZSIC), a manufacturer of refrigeration and air-conditioning control components, raised around US$1.4bn in its H-share listing.

- ZSIC is a market leader in a number of products, with commanding market share both domestically and globally.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

10. Xero US1.2bn Placement – Trying to Jump Start US, Again. Might Not Be a Game Changer.

- Xero Ltd (XRO AU) plans to raise around US$1.2bn via an institutional placement to partly fund the US$2.5bn acquisition for Melio.

- The US market has been a growth dampener for Xero for a while. The acquisition is large but might not be a game changer.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. ECM Weekly (16 June 2025) – Haitian, Sanhua, Kitazato, Primo, Kioxia, Xtalpi, Horizon, Keymed, Wuxi

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) launched its IPO, while Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) has been pre-marketing.

- On the placements front, there were a number of large deals acros the region, along with some large lockup expiries.

2. Foshan Haitian Flavouring A/H Trading – Very Strong Demand, Weak Price Momentum

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, raised around US$1.5bn (including over-allocation) in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

3. Cao Cao Pre-IPO: Grossly Overvalued

- CaoCao (2643 HK) is looking to raise up to $236m in its upcoming Hong Kong IPO.

- It is a ride hailing platform in China originally incubated by Geely Group connecting passengers and drivers to deliver consistent and high-quality ride experiences.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

4. CaoCao IPO (2643 HK): Valuation Insights

- CaoCao (2643 HK) has launched its IPO to raise US$236 million at HK$41.94 per share. The shares will be listed on 25 June.

- I previously discussed the IPO in CaoCao IPO: The Bull Case and CaoCao IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that CaoCao is at best fairly valued at the offer price. Therefore, avoid the IPO.

5. Eternal Beauty IPO – Not Expensive but Its Not Enticing Either

- Eternal Beauty Holdings Limited is looking to raise around US$144m in its Hong Kong IPO.

- Eternal Beauty is the largest brand management company of perfumes in the combined markets of Mainland China, Hong Kong and Macau, in terms of retail sales in 2023.

- We have looked at the company’s past performance in our previous note. In this note we talk about valuations.

6. MakeMyTrip Placement – Basically a Selldown by Trip.com

- Makemytrip Ltd (MMYT US) is looking to raise upto US$2.66bn via an equity combo of a 14m share selldown, which could raise around US$1.41bn and US$1.25bn five-year put-three convertible bonds.

- The company plans to use the proceeds to buy back Class B shares from Trip.com to lower Trip.com’s voting power in MakeMyTrip to 19.99%.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

7. CaoCao IPO: The Bear Case

- CaoCao Inc (1646553D CH) is the second-largest ride-hailing player in China. It has filed its PHIP to raise US$200-300 million.

- In CaoCao IPO: The Bull Case, I highlighted the key elements of the bull case. In this note, I outline the bear case.

- The bear case rests on low net take rates, unfavourable trends of key cost items, expected losses in the current year and a stretched balance sheet.

8. Foshan Haitian Flavouring H Share Listing (3288 HK): Trading Debut

- Foshan Haitian Flavouring & Food Company (3288 HK) priced its H Share at HK$36.30 to raise HK$10,128.9 million (US$1.3 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in Foshan Haitian Flavouring H Share Listing: The Investment Case.

- Haitian had the highest oversubscription rates among recent large AH listings. The AH discount implied by the offer is attractive.

9. Foshan Haitian Flavouring & Food Company Hong Kong IPO Preview

- Foshan Haitian Flavouring & Food Company is the largest listed condiments producer in mainland China which is seeking to raise up to HK$9.56 billion (US$1.22 billion) in Hong Kong listing.

- It is offering 263.2 million shares at HK$35 to HK$36.30 each. The final offer price is expected to be announced on 17 June.

- Foshan Haitian Flavouring & Food is the largest condiments company in China with strong brand power with loyal customers.

10. Biocon Ltd QIP – Well Flagged US$522m QIP; Largely Towards Clearing Debt

- Biocon Ltd (BIOS IN) Biocon Ltd is looking to raise up to US$522m in its qualified institutional placement (QIP).

- The deal is well flagged, having gone through rounds of board/shareholder approvals. The QIP has also been covered by domestic media reports.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Horizon Robotics Placement – Momentum Is Strong but Raising Seems Opportunistic

- Horizon Robotics (9660 HK) raised around US$800m in its Hong Kong IPO in October 2024. It’s back again to raise another US$600m via a placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. [Japan ECM/Index] Azoom (3496) Offering to Enable Move to TOPIX

- On Friday 6 June, Azoom (3496 JP) announced it would conduct an offering (small issuance of new shares, some Treasury shares, larger selldown by the main shareholder).

- That comes in conjunction with a transfer to TSE Prime from TSE Growth, which itself leads to a TOPIX Inclusion trade next month.

- The company has decided to tack on a special dividend for this year, on top of growth and more liquidity. None of this is especially bad.

3. Zhejiang Sanhua Intelligent Controls A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) (ZSIC), a manufacturer of refrigeration and air-conditioning control components, aims to raise around US$1bn in its H-share listing.

- ZSIC is a market leader in a number of products, with commanding market share both domestically and globally.

- We have looked at the company’s past performance in our previous note. In this note, we look at the PHIP updates and talk about the likely A/H premium.

4. Xtalpi US$860m IPO Lockup Expiry – Last of the Lockup Release with Nearly All Shares in CCASS Now

- XtalPi Holdings (2228 HK) was listed in Hong Kong on 13th Jun 2024 after raising US$126m. Its one-year lockup will expire soon.

- QuantumPharm is a R&D platform, utilizing quantum physics-based first-principles calculation, advanced AI, high-performance cloud computing, and scalable and standardized robotic automation to provide drug and material science R&D solutions.

- In this note, we will talk about the lock-up dynamics and updates since our last note.

5. Sanhua Intelligent Controls H Share Listing: The Investment Case

- Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH), the world’s largest refrigeration and air-conditioning control component manufacturer, has filed its PHIP for a H Share listing to raise US$1.0-1.5 billion.

- Sanhua’s market share in the global refrigeration and air-conditioning control component market was 45.5% in terms of revenue in 2024, according to Frost & Sullivan.

- The fundamentals are good, with the positives (refrigeration and aircon rising growth, stable margin, and cash generation) outweighing the negatives (automotive declining growth, US tariffs overhang).

6. Keymed Bioscience Placement – Track Record Isn’t Great but Recent Performance Has Been Better

- Keymed Biosciences (2162 HK), along with its controlling shareholder, is looking to raise around US$112m to fund its R&D requirements.

- Keymed Biosciences, a China-based biotech company which focuses on therapeutic areas of autoimmune and oncology

- In this note, we will talk about the placement and run the deal through our ECM framework.

7. ECM Weekly (9 June 2025) – Haitian, Sanhua, Virgin Aus, Primo, Kitazato, Wistron, Kelun Bio, Mao Gep

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) and Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) might launch their IPOs soon.

- On the placements front, Wistron Corp (3231 TT) launched its well flagged GDR, along with a few more deals this week.

8. Foshan Haitian Flavouring A/H Listing – Strong Cornerstone, Weak Momentum

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, aims to raise around US$1.2bn in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. Everest Medicine Placement: Another Sell-Down by CBC, Some Caution Warranted

- Everest Medicines (1952 HK) aims to raise around US$150m in a secondary sell-down of shares conducted by CBC Group.

- This comes on the heels of a similar secondary sell down in Jan 2025, whereby CBC sold ~US$100m worth of stock, priced at a 10% discount.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.

10. Foshan Haitian Flavouring (3288 HK) IPO: The Valuation Perspective

- Fundamentals first, Foshan Haitian Flavouring & Food Company (3288 HK)‘s IPO is interesting given a positive growth outlook – 1Q25 growth accelerated to 14.8% with margin expansion.

- We value the H-share at HK$39.35, 8.4% higher than the high-end of the IPO price based on 28.2x FY25F PER to reflect its significantly stronger 3-year earnings growth.

- It equals 5.9x pre-money FY25F P/B, justified by ROE of 21.8-22%, sharply ahead of peers. Net cash equals 12.4% of its A-share market cap.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Kitazato Pre-IPO – Past Sales Have Been Steady but Slowing

- Kitazato (368A JP) manufactures and sells medical devices and products for fertility treatment. It aims to raise around US$120m in its Japan IPO.

- Kitazato specializes in artificial insemination, in vitro fertilization, cell cryopreservation and reproductive engineering technologies in regenerative medicine.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

2. Virgin Australia IPO – Not Terribly Exciting, After Significant Items Adjustment

- Bain Capital is looking to raise around US$440m via selling some of its stake in Virgin Australia Holdings (VAH AU).

- Virgin Australia is the second largest airline group operating in the Australian aviation market, with an average 32% domestic RPT capacity market share in CY24.

- In this note, we look at the company’s past performance and provide our thoughts on valuations.

3. Kelun-Biotech Placement – Recent Run-Up Makes Its Tricky

- Sichuan Kelun-Biotech Biopharm (6990 HK) is looking to raise up to US$200m from a primary placement. The offering is priced at HK$ 330.2-341, a 5-8% discount to last close.

- The company plans to use the proceeds for research and development, clinical trials of its core products and as working capital.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. Wistron GDR Offering – Well Flagged US$922m Offering, Discount Slightly Wider than Recent Deals

- Wistron Corp (3231 TT) is looking to raise up to US$922m in its global depository receipts (GDRs) offering.

- Similar to previous GDR listings, the firm has undergone a long drawn out process prior to launching the deal, having to jump through a number of board/shareholder/regulatory approval loops.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

5. Primo Global Pre-IPO: Driven by Domestic Demand as International Ops Falter

- Primo Global (367A JP) is looking to raise at least US$104m in its upcoming Japan IPO.

- Primo Global specializes in merchandising bridal jewellery, namely engagement rings and wedding rings.

- In this note, we look at the firm’s past performance.

6. Circle IPO Analysis (Second Largest Issuer of Stablecoins Globally)

- Circle raised both the IPO shares to be issued and IPO price range. New IPO price range is $27 to $28 per share (from $24 to $26 per share previously).

- We have a Positive View of the Circle due to its status as the second largest issuer of stablecoins globally, rapidly increasing user base and sales, and improving profit margins.

- Major risk factors of this IPO include CBDCs, centralization, cyberattacks, and potential government crackdown.

7. ECM Weekly (2 June 2025) -Indigo, ITC, EBOS, Isuzu, Foshan Haitian, Lens Tech, Seres, Schloss, Aegis

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) might launch its A/H listing this week.

- On the placements front, there were a number of large deals across the region, with notable ones in ITC Ltd (ITC IN) and InterGlobe Aviation Ltd (INDIGO IN).

8. Aegis Vopak IPO: Anemic Demand

- Aegis Vopak Terminals Ltd (1902844D IN) raised about US$328m in its upcoming India IPO.

- It is the largest Indian third-party owner and operator (in terms of storage capacity) of tank storage terminals for liquified petroleum gas (LPG) and liquid products.

- In our previous notes, we talked about the company’s historical performance, undertook a peer comparison and shared our thoughts on valuation. In this note, we talk about the trading dynamics.

9. Pre IPO Eastroc Beverage Group (H Share) – The Strength, the Concerns and the Outlook

- 2024 is a milestone year. The weighted average ROE set a new high. Due to cost dilution brought by economies of scale, net profit growth was higher than revenue growth.

- The risk of relying on a single category hasn’t been eliminated. Traditional advantages of offline channels are becoming saturated. There is a gap between channel structure and new consumer forces

- Eastroc’s valuation is expected to be higher than the industry average and peers due to its higher growth rate, but investors needs to consider the H/A premium

10. Slide Holdings Insurance, Inc.(SLDE): Peeking at the IPO Prospectus of Another Florida Based Insurer

- They write several homeowners’, condominium owners’, and commercial residential products in coastal specialty markets in Florida and South Carolina.

- For the three months ended March 31, 2024 and March 31, 2025, they had gross premiums written of $245 million and $278 million.

- The strong performance of peers could provide a potential tailwind for this IPO.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Schloss Bangalore IPO – Thoughts on Peer Comp and Valuation

- Schloss Bangalore Ltd (SCHBL IN) is looking to raise about US$409m in its India IPO. The deal has been downsized from an earlier size of around US$600m.

- It is a luxury hospitality company which owns, operates, manages and develops luxury hotels and resorts under ‘The Leela’ brand, through direct ownership and hotel management agreements with third-party owners.

- In this note, we will talk about the IPO valuations.

2. Curator’s Cut: Korea’s Value, CATL’s Charge and Copper’s Surge

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published over the past two weeks on Smartkarma

- In this cut, we look at Korea’s compelling valuation versus AxJ equities, CATL’s blockbuster Hong Kong listing and its market implications, and explore copper’s price surge amidst Chinese demand

- Want to dig deeper? Comment or message with the themes you think should be highlighted next

3. [Japan ECM] Financial Crossholders Offering Isuzu (7202) – Big Buyback Covers Most Of The Back End

- In line with the trend of financial institutions led by non-life insurers selling out of their cross-holdings, today we get an offering of shares held in Isuzu Motors (7202 JP).

- Today we got an announcement of 29.28mm shares being offered by a dozen financial institutions and a greenshoe for 15% more. At a 10% discount from here it’s ¥57bn/US$400mm.

- It is 16 days of ADV, which is big, but the company also announced a ¥50bn buyback from Pricing+6 to end of March 2026. That should stabilise things.

4. HK Strategy: Some Consumer IPO Pipelines and Their Proxies

- Hong Kong’s IPO market has gathered momentum lately, especially with the overwhelming response to CATL (3750 HK). Consumer IPOs are the next ones to gather interest.

- Foshan Haitian Flavouring & Food Co (FHF HK) is the most imminent one, potentially seeking up to US$1bn. Without significant peers in Hong Kong, it should attract good attention.

- The other interesting ones include Zhou Liu Fu Jewellery Co., Ltd. (1716396D CH), Three Squirrels (TRS HK), and Eastroc Beverage Group (EBG HK).

5. Interglobe Aviation (Indigo) Placement – Another US$800m+ Deal by Co-Founder

- InterGlobe Aviation Ltd (INDIGO IN)‘s co-founder, Rakesh Gangwal, aims to raise around US$803m via selling around a 3.3% stake in Indigo.

- He had earlier stated his intention to pare down his stake after a long drawn, and very public battle, with his co-founder Rahul Bhatia. He has sold many times before.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

6. Foshan Haitian Flavouring H Share Listing: The Investment Case

- Foshan Haitian Flavouring & Food (603288 CH), a leading Chinese pharmaceutical company, has filed its PHIP for an H Share listing to raise US$1 billion.

- Foshan Haitian Flavouring & Food Company (FHF HK) has been China’s leading condiments company in terms of sales volume for 28 consecutive years.

- The investment case rests on its market positioning, return to growth, industry-leading profitability, cash generation and strong balance sheet. However, the valuation of the A Shares is full.

7. Isuzu Motors Placement – Relatively Small Deal Along with Buyback

- A group of shareholders aims to raise around US$380m via selling around 4% of Isuzu Motors (7202 JP).

- Being another cross-shareholding unwind in Japan, it shouldn’t carry much negative connotations, in our view.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Foshan Haitian Flavouring A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, now aims to raise around US$1bn in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance in our earlier note. In this note we talk about the PHIP updates and likely A/H premium.

9. ECM Weekly (26 May 2025) – CATL, Hengrui, Eastroc, Haitian, Schloss, Aegis, Hyundai Marine, Pony

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Contemporary Amperex Technology (CATL) (300750 CH) and Jiangsu Hengrui Pharmaceuticals (1276 HK) performance has paved the way for a slew of A/H listings to follow.

- On the placements front, there was a large selldown in HD Hyundai Marine Solution (443060 KS) and a lockup release for Pony AI (PONY US) is coming up.

10. Capitaland Ascendas REIT Placement: DPU and NAV Accretive

- CapitaLand Ascendas REIT (CLAR SP) is looking to raise at least S$500M in a private placement, to fund the acquisition of some valuable properties.

- These acquisitions will expand the firm’s portfolio exposure to Singapore and data centers.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. GMO Internet (4784) – Squeeze-Able So Squeezing, Offering Likely Gets Pulled – AVOID LIKE THE PLAGUE

- GMO Internet (4784 JP) was created by the reverse takeover of a listed cad/media company by its parent company’s “internet infrastructure” business. GMO Internet Group ended up with ~98%.

- In the process, the stock rose 500%. Now, as part of its promise to the TSE allowing TSE Prime membership for the extraordinarily low-float target, the parent is offering shares.

- The squeeze has it at 180x Dec25e EPS, 111x EBIT, 70x book. The offering likely gets pulled and the stock isn’t shortable… so what next? Pain, and an ECLWO.

2. CATL A/H Trading – Strong Demand, Upsized, Included in Short-Sell List

- Contemporary Amperex Technology (CATL) (300750 CH), one of the world’s largest battery solutions providers, raised around US$5.2bn in its H-share listing.

- Contemporary Amperex Technology (3750 HK) is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance and valuations in our earlier notes. In this note, we talk about the trading dynamics.

3. GMO Internet Placement: Extremely Overvalued at the Moment

- GMO Internet Group (9449 JP) is looking to sell its 33.4% stake in its subsidiary GMO Internet (4784 JP) to meet free-float requirements.

- Shares are very overvalued at the moment and should be worth a mere fraction of its current trading value.

- We have looked at the company’s deal dynamics in our earlier notes. In this note, we discuss the firm’s outlook as well as valuation.

4. Jiangsu Hengrui Pharma H Share Listing (1276 HK): Trading Debut

- Jiangsu Hengrui Pharmaceuticals (1276 HK) priced its H Share at HK$44.05 to raise HK$9,890.1 million (US$1.3 billion) in gross proceeds. The H Share will be listed tomorrow.

- The timing of the H Share listing is fortuitous, as the peers have materially re-rated since the prospectus was released on 15 May.

- Hengrui had the highest oversubscription rates among recent large AH listings. The AH discount implied by the offer is attractive.

5. CATL H Share Listing (3750 HK) IPO: Trading Debut

- Contemporary Amperex Technology (3750 HK) priced its H Share at HK$263 to raise HK$35,657.2 million (US$4.6 billion) in gross proceeds. The H Share will be listed tomorrow.

- The H Share listing price implies an AH discount of 6.6% at the A Share price of RMB63.51. This compares to Midea Group (300 HK)‘s AH discount of 4.7%.

- CATL had the highest oversubscription rates among recent large AH listings. Our valuation analysis suggests that the H Share listing price is attractive.

6. Eastroc Beverage A/H Listing – Energized – Fast Growth, Better Margins

- Eastroc Beverage Group (605499 CH) (EB), a China-based functional beverage company, aims to raise around US$1bn in its H-share listing.

- According to Frost & Sullivan (F&S), EB has been the largest functional beverage company in China in terms of sales volume for four consecutive years since 2021.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. ECM Weekly (19 May 2025) – CATL, Hengrui, Green Tea, SMPP, Unisound, Renesas, Genda, GMO, PayTM

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Contemporary Amperex Technology (CATL) (300750 CH) and Jiangsu Hengrui Medicine (600276 CH) will remain in the spotlight in the coming week as well.

- On the placements front, Japan deals appear to be picking up again.

8. HD Hyundai Marine Placement – Very Well Flagged, Overhang Easing but Last Deal Didn’t Do Well

- KKR is looking to raise around US$410m via selling some of its stake in HD Hyundai Marine Solution (443060 KS).

- KKR had come out of its IPO linked lockup in Nov 2024 and had tried to launch a deal in Dec 2024 and finally undertook a deal in Feb 2025.

- In this note, we will talk about the placement and run the deal through our ECM framework

9. Hanwha Aerospace: Higher Rights Offering Price and Amount

- On 21 May, Hanwha Aerospace (012450 KS) announced that the rights offering price increased to 684,000 won (up 26.9% from 539,000 won previously) due to recent increase in price.

- Due to the higher rights offering price, the scale of the capital raise has increased from 2.3 trillion won previously to 2.9 trillion won (US$2.1 billion).

- Issue price is determined by applying a 15% discount rate to the one-month weighted arithmetic average price, one-week weighted arithmetic average price, and the closing price on the base date.

10. PegBio 派格生物 IPO: A Hardsell but Mostly Done Deal

- PegBio, a China-based near commercial stage biotech company, launched its IPO to raise up to US$39m via a Hong Kong listing.

- We have previously covered the company’s fundamentals and valuation. We highlight issues of the company.

- In this note, we look at the deal term. We think the valuation is demanding, but the company managed to get support from local government facilitate its listing.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. POSCO Future M: A Rights Offering Capital Raise of 1.1 Trillion Won

- Posco Future M (003670 KS) announced today that it plans to complete a rights offering capital raise of 1.1 trillion won.

- The capital raise will involve 11.483 million new shares, representing 14.8% of current outstanding shares. The expected rights offering price is 95,800 won, which is 15.8% lower than current price.

- We have a Negative view on POSCO Future M and this capital raise, which is likely to have a negative impact on its shares due to the dilution risk.

2. GMO Internet (4784) Offering – This Is a GINORMOUS Re-IPO – AVOID LIKE THE PLAGUE

- Last year, GMO injected its internet business into GMO Internet (4784 JP) and took shares as consideration. Somehow, GMO Internet got a TOPIX inclusion earlier this year.

- The company has 1.24% float of 3.4mm shares. GMO Internet Group – the parent – will now offload 91.7mm shares in an equity offering to meet TSE Continued Listing Requirements.

- That is about ¥279bn at current price against float of ¥10bn. Full market cap is ¥850bn. That’s 170x Dec25e Net Income. I expect the price will fall. You were warned.

3. CATL H Share Listing (3750 HK): Valuation Insights

- Contemporary Amperex Technology (CATL) (300750 CH) has launched its H Share listing at a maximum price of HK$263. Pricing will be on 19 May, and the listing on 20 May.

- I discussed the H Share listing in CATL H Share Listing: The Investment Case, CATL H Share Listing: AH Discount Views, CATL H Share Listing: PHIP Reinforces the Investment Case.

- Our valuation analysis suggests that the low AH discount can be justified. We would participate in the listing.

4. CATL A/H Listing – High Quality, Large Size Make It Unavoidable but Needs a Discount

- Contemporary Amperex Technology (CATL) (300750 CH) , one of the world’s largest battery solutions providers, aims to raise around US$4bn in its H-share listing.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance in our earlier notes. In this note, we talk about the IPO pricing.

5. GENDA Placement – Good Track Record & Sort off Well Flagged but Relatively Large

- GENDA (9166 JP), along with a selling shareholder, is looking to raise around US$190m to partly fund its M&A.

- Genda develops and operates amusement facilities in Japan, primarily operating under its Genda GiGO Entertainment subsidiary.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. CATL A/H Listing – More like ADR Secondary Listing than an A/H Listing – Performance & Subscription

- Contemporary Amperex Technology (CATL) (300750 CH) , one of the world’s largest battery solutions providers, aims to raise around US$4bn in its H-share listing.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- In this note, we talk about the IPO pricing and how it compares to some of the past listings.

7. Curator’s Cut: “Bubble” Tea, Japan M&A 🍿and TSMC from Different Lenses

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published over the past two weeks on Smartkarma

- In this cut, we look through the bubble in Chinese tea company listings, the recent entertainment provided by Japanese M&A situations and the varied ways analysts look at TSMC on Smartkarma

- Want to dig deeper? Comment or message with the themes you think should be highlighted next time

8. GMO Internet Placement: Secondary Sell-Down (Quasi IPO) To Meet Prime Listing Requirements

- GMO Internet Group (9449 JP) is looking to sell its 33.4% stake in its subsidiary GMO Internet (4784 JP) to meet free-float requirements.

- As the current free-float is tiny, the deal is more like a quasi-IPO rather than a placement, in our view.

- In this note, we will talk about the deal dynamics as well as updates on the company’s financial performance.

9. GMO Internet (4784 JP): A Huge US$1.9 Billion Secondary Offering

- GMO Internet (4784 JP) has announced a secondary offering of 91.7 million shares, worth around US$1.9 billion.

- The selling shareholder is GMO Internet Group (9449 JP). The secondary offering aims to increase the tradable share ratio to satisfy the TSE Prime Market’s continued listing criteria.

- The offering represents 239.4 days of the 1-year ADV, the highest compared to the recent large Japanese placements. Pricing is likely to be on 5 June.

10. Jiangsu Hengrui Pharma A/H Listing – Low-End Is Probably Close to Fair Value

- Jiangsu Hengrui Medicine (600276 CH), a China-based pharmaceutical company, aims to raise around US$1.3bn in its H-share listing.

- JHP Has been ranked as one of the global Top 50 pharmaceutical companies by Pharm Exec for six consecutive years since 2019.

- We have looked at the company’s past performance and other deal dynamics in our previous note. In this note, we talk about the IPO pricing.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CATL: Launch of Book Building for Hong Kong Listing

- According to Reuters, CATL plans to launch its Hong Kong listing process including book building during the week of 12 May.

- We estimate CATL to generate revenue of 423.6 billion RMB (up 17% YoY) and net profit of 55.6 billion RMB (up 13.1% YoY) in 2025.

- Our base case valuation of CATL is implied market cap of 1.3 trillion CNY which is 32% higher than current market cap. We believe CATL’s shares are undervalued.

2. CATL H Share Listing: PHIP Reinforces the Investment Case

- Contemporary Amperex Technology (CATL) (300750 CH), the world’s largest supplier of EV and ESS batteries, has filed its PHIP for an H-Share listing to raise US$5 billion.

- I previously discussed the H Share listing in CATL H Share Listing: The Investment Case and CATL H Share Listing: AH Discount Views.

- In this note, I examine the latest results and developments outlined in the PHIP. Overall, the PHIP reinforces my positive view.

3. Laopu Gold (6181 HK): Heritage Luxury, Guochao Appeal. Key Facts, Financials & Valuation

- Laopu Gold (6181 HK) targets to raise approximately USD350 mn from a primary placement of 4.31 million new shares at HKD630 per share.

- Laopu Gold has delivered both superior margins and rapid growth by marrying cultural resonance, premium pricing, artisanal excellence, and outstanding store economics.

- Laopu’s growth track record coincides with period of rising gold prices. Investors should weigh its impressive margins and brand strength against the risk of a less supportive gold price environment.

4. EToro Group Ltd (ETOR): Retail Trading Platform Eyeing $4b Valuation; BlackRock in on the IPO

- The company set terms with a F-1/A putting 10 million shares for sale at a range of $46-$50 which would value the company as high as $4.05b.

- BlackRock and funds managed by BlackRock placed a 20-percent cornerstone investment order and is on the cover of the prospectus.

- The blueprint to getting an IPO out the door during this time is to shrink the size of the transaction, bring in a cornerstone investor and provide an attractive valuation.

5. CATL A/H Listing – PHIP Updates and Updated Thoughts on A/H Premium

- Contemporary Amperex Technology (CATL) (300750 CH), one of the world’s largest battery solutions providers, aims to raise around US$5bn in its H-share listing.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance and valuations in our earlier notes. In this note, we talk about its recent updates and provide updated thoughts on valuations.

6. ECM Weekly (5 May 2025) – CATL, Chery, Ather, Drinda, Eco-Shop, Green Tea, DN Sol, Lotte Glo, Hanwha

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Contemporary Amperex Technology (CATL) (300750 CH) is said to be gearing up for an IPO launch this month, as per media reports.

- On the placements front, Hanwha Ocean (042660 KS) was the only sizable placement over the past week that we covered.

7. EToro IPO Valuation: First-Day IPO Pop Is Possible, But The Stock May Struggle To Hold Gains

- EToro Group Ltd., a social trading platform, sets terms for upcoming IPO in the United States. The online broker offers 10M Class A shares at range of $46.00-$50.00 per share.

- At the midpoint of price range, eToro would command a market value of ~$4B on a fully-diluted basis. The selling shareholders offer 5M Class A shares.

- BlackRock has indicated a non-binding interest in purchasing up to $100M worth of eToro shares. However, these shares will not be subject to a lock-up agreement.

8. Ant Group Considering on Listing Overseas Unit Ant International in Hong Kong

- Ant Group is considering on listing its overseas unit Ant International in Hong Kong. Ant International contributes approximately 20% to Ant Group’s total revenue.

- Ant International operates four core business lines: Alipay+ (cross-border payment platform), Antom (global merchant acquiring network), WorldFirst (remittance service), and Bettr (digital payment solution).

- Given the growing political to delist Chinese stocks from the US exchanges, there could be a greater political pressure on the Chinese government to approve Chinese IPOs in Hong Kong.

9. Green Tea Group IPO – Peer Comp & Thoughts on Valuation

- Green Tea Group (GTG) is looking to raise US$157m (HKD 1.2bn) in its upcoming Hong Kong IPO.

- GTG is the fourth largest Casual Chinese Cuisine player in Mainland China, it has been gaining market share historically and is likely to continue.

- GTG plans to accelerate its expansion of the restaurant network, focusing on expansion into tier two cities and below, with small restaurants rather than large ones.

10. Jiangsu Hengrui Pharma H Share Listing: The Investment Case

- Jiangsu Hengrui Medicine (600276 CH), a leading Chinese pharmaceutical company, has filed its PHIP for an H Share listing to raise US$2 billion.

- Jiangsu Hengrui Pharmaceuticals (JHR HK) ranked first among Chinese pharma companies in revenue from NME drugs in 2023 and the number of commercialised NME drugs in 2024.

- The investment case rests on its product portfolio, strong revenue growth, rising profitability, cash generation, strong balance sheet and undemanding valuation.