Receive this weekly newsletter keeping 45k+ investors in the loop

1. TSMC (2330.TT; TSM.US): U.S. Stocks Plunged on October 10 Under Heavy Selling Pressure.

- U.S. President Donald Trump announced a 100% tariff on China.

- Facing the escalation of the U.S.–China tariff war, U.S. stocks plunged on October 10 under heavy selling pressure.

- Facing the escalation of the U.S.–China tariff war, U.S. stocks plunged on October 10 under heavy selling pressure.

2. Taiwan Dual-Listings Monitor: TSMC Set Up Opportunity During Taiwan Sesssion Ahead of Results Today

- TSMC: +27.3% Premium; Opportunity to Set Up ADR Spread Short During Taiwan Session

- UMC: +2.0% Premium; Wait for Slightly Higher Premium Before Opening Spread Short

- ASE: +2.6% Premium; Wait for More Extreme Swing Before Going Long or Short

3. Nvidia (NVDA.US): Problems Encountered in Land Acquisition to Establish Offshore Headquarters.

- NVIDIA Corp (NVDA US) is setting up an offshore headquarters in Taipei, and is currently in the process of acquiring land.

- Taiwan’s central government is currently ruled by the Democratic Progressive Party (DPP), while Taipei City is governed by a mayor from the Kuomintang (KMT), creating political complications.

- Politics often takes precedence over economics, yet in a democracy, politics is driven by competing parties—inevitably leading to conflicts of interest.

4. TSMC (2330.TT; TSM.US): 4Q25 Outlook Slightly Softer; US Fab to Dilute GM; AI Remains Key Driver.

- For 4Q25, revenue guidance is US$32.2–33.4 billion, equivalent to NT$985.3–1,022.0 billion (based on an assumed FX rate of 30.6).

- N2 will begin mass production later this quarter with good yields, and volume will ramp in 2026 driven by both smartphone and HPC/AI applications

- Smartphone inventory has returned to seasonally healthy levels, with no signs of early pull-ins.

5. Why TSMC 3Q25 Indicates Strong AI Accelerator Demand Through 2029E; Maintain Structural Long Rating

- TSMC 3Q25: Margins Surge as Pricing Power Strengthens Ahead of 2nm Ramp

- AI Megatrend Continues to Reshape Demand – 40% CAGR Expected for AI Accelerators Through 2029

- Maintain Structural Long Rating — TSMC Remains Inexpensive vs. Tech Companies Highly Dependent on It

6. First AMD, Now Broadcom. How OpenAI Is Ruining NVIDIA’s Party

- OpenAI just signed a deal with Broadcom to deploy ten gigawatts of OpenAI designed AI accelerators targeted to start in H2 2026, and to complete by end of 2029.

- OpenAI’s AMD & Broadcom deals undermine the credibility of the NVIDIA deal. Where exactly is all the money going to come from?

- In partnering with AMD and Broadcom, OpenAI has given huge credibility to AMD as a GPU competitor and Broadcom as a custom accelerator competitor. Two big headaches for NVIDIA. Ouch!

7. Memory Monitor: Nanya Tech Indicates DRAM Price Spike to Persist Longer; SK Hynix Relative Trade

- Nanya Tech 3Q25: Rebounds to Profit Thanks to DDR4 Price Surge Windfall… But Underlying Structural Drivers Remain Unsteady

- The World’s DDR4 Shortage to Extends Pricing Spike Through 4Q25

- Nanya Technology vs SK Hynix — We Expect Relative Strength Ahead for SK Hynix Over Nanya Tech

8. Taiwan Tech Weekly: TSMC’s Market Share Keeps Rising; Semi Revenues Show AI the Only Pillar; AI PCs

- TSMC’s Grip Tightens: 2Q25 Market Share Hits New Heights; September Revenue Implies Even More Taken

- TSMC (2330.TT; TSM.US): U.S. Stocks Plunged on October 10 Under Heavy Selling Pressure.

- PC Monitor: Dell Doubles Multi-Year Forecasts; AI PC Up-Cycle, Art Thou Finally Here?

9. MediaTek (2454.TT): 4Q25 Expected to Be Flat QoQ; D9600 Mass Production Scheduled for Late 2026.

- Mediatek Inc (2454 TT)’s 4Q25 performance is expected to remain roughly flat QoQ, compared with 3Q25.

- Based on the product launch cycles of major smartphone manufacturers, by the end of 2026, the 2nm process will be adopted in multiple flagship chips

- At the China Mobile Global Partner Conference on October 10, MediaTek showcased a range of its latest products

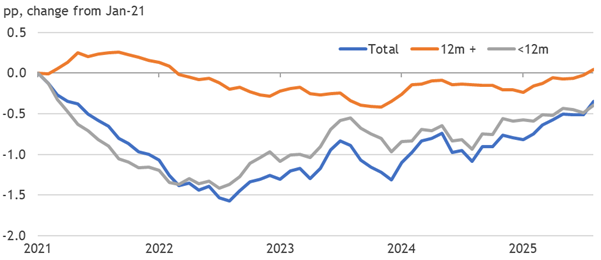

10. Semiconductor WFE. China Retains #1 Spending Slot In Q225, US Mulls Yet Further Sweeping Sanctions

- Q225 WFE billing amounted to $33 billion, up 24% YoY and up 3% QoQ. China was the biggest spender with billings of $11.36 billion, +11% QoQ, albeit down 7% YoY

- A US select committee on China WFE spending, published on October 7 last, highlights multiple gaps with existing US restrictions on China WFE and proposes nine separate remedies

- Remedies include sweeping China country-wide bans, bans on related components, consumables & deploying “incentives & leverage” with allies so they follow suit. Still wondering about China’s surprise rare earth move?

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tekscend Photomask IPO Trading – Priced at the Top, but Still Relatively Cheap

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, raised around US$900m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- In our previous note, we looked at its past performance and valuations. In this note, we will talk about the trading dynamics.

2. Tekscend Photomask (429A JP) IPO: Trading Debut

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. At the IPO price, Tekscend will raise JPY138 billion (US$910 million). The shares will be listed on 16 October.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case, Tekscend Photomask (429A JP) IPO: The Bear Case and Tekscend Photomask (429A JP) IPO: Valuation Insights.

- The peers have re-rated since the release of the prospectus. My analysis suggests that Tekscend is attractively valued at the IPO price.

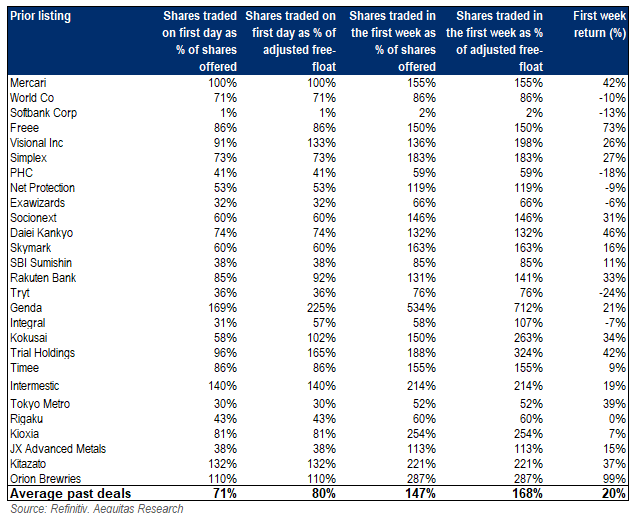

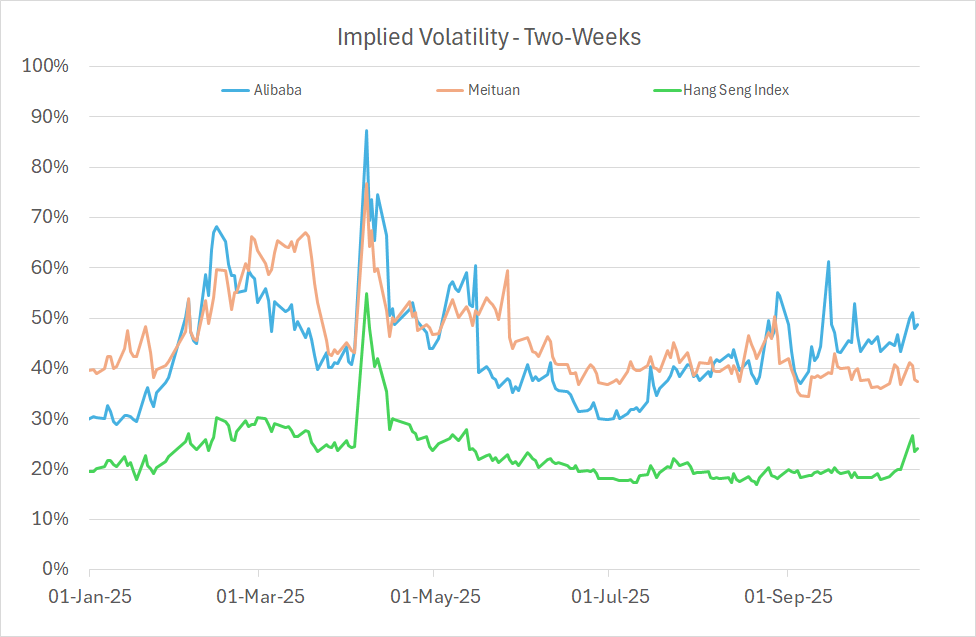

3. ECM Weekly (13 October 2025)- LG India, Tata Capital, Rubicon, Canara, FineToday, Maynilad, Kokusai

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the year end looks set to see a flurry of listings, with the pace already starting to pick up again.

- On the placements front, markets were back where they left of prior to the October holidays.

4. Top Toy IPO Preview

- Top Toy International is getting ready to complete its IPO in Hong Kong in the next several months.

- Top Toy was last valued at US$1.3 billion in July 2025 when it received a US$59.4 million Series A financing (of which Temasek contributed US$40 million for a 3.2% stake).

- Top Toy is trading at P/E of 32x (2024 net profit) (valuation of US$1.3 billion) versus Pop Mart (P/E of 103x based on its 2024 net profit).

5. FineToday Holdings (420A JP) IPO: Valuation Insights

- FineToday Holdings (420A JP), a Japanese personal care business, is seeking to raise US$280 million. It previously pulled an IPO to raise US$500 million in December 2024.

- I previously discussed the investment thesis in FineToday Holdings (420A JP) IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that FineToday is fully valued at the IPO price.

6. Fibocom A/H Listing: Strong Revenue Growth, Some Margin Pressures

- Fibocom Wireless (300638 CH) a wireless communication modules provider, aims to raise up to US$400m in its H-share listing.

- Fibocom was founded in Nov 1999, and is a leading wireless communication module provider. The firm’s module products include i) data transmission modules, ii) smart modules, and iii) AI modules.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Sany Heavy Industries A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Sany Heavy Industry (600031 CH), aims to raise around US$1.5bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the company’s past performance in our earlier note. In this note, we talk about the updates and likely A/H premium.

8. LG Electronics India IPO Trading – Very Strong Subscription, Won’t Be Chasing if It Pops Too High

- LG Electronics (066570 KS) raised around US$1.3bn via selling 15% of its stake in LG Electronics India IPO.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about the trading dynamics.

9. JST Group (6687 HK): Valuation Insights

- JST Group (6687 HK) is China’s largest e-commerce SaaS ERP provider. It is seeking to raise HK$2,086 million (US$268 million).

- I previously discussed the IPO in JST Group IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive in the context of the revenue growth.

10. Seres Group A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$2bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- In our previous note we had looked at its past performance. In this note, we talk about the recent updates and likely A/H premium.

Receive this weekly newsletter keeping 45k+ investors in the loop

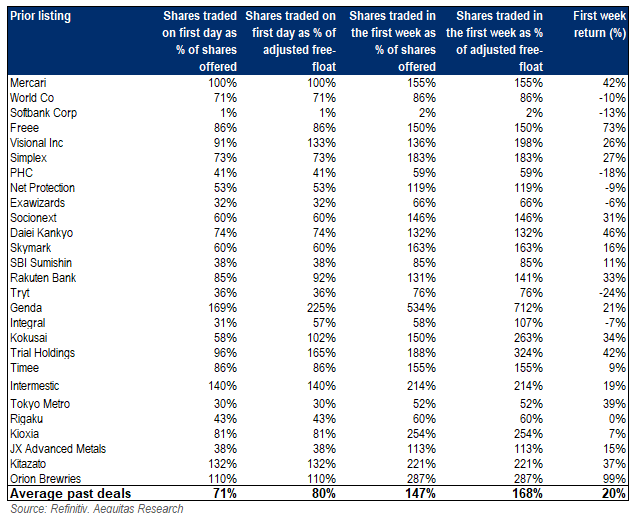

1. [Japan Activism/M&A] – Closing In On the Tsuruha Partial Tender – Likely Needs To Be Higher

- The merger between Tsuruha Holdings (3391 JP) and Welcia Holdings (3141 JP) will go through in about 6 weeks. In the interim, there are interesting events.

- After, there is a Partial Tender Offer. I expect Aeon Co Ltd (8267 JP) will have to pay up.

- Furthermore, the stock is not overly expensive vs Peers AND there are synergies to come from the merger, making it relatively cheaper. It’s not squeezy, but it’s skewed.

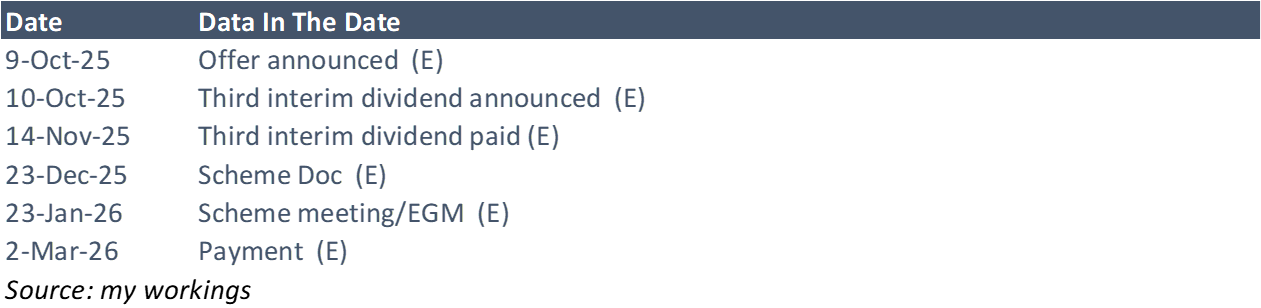

2. Hang Seng (11 HK)’s Offer: HSBC Investors Are Not Sold On The Strategic Benefits

- Since announcing HSBC (5 HK)‘s Offer, Hang Seng Bank (11 HK) has traded tight-ish to terms, at a ~3.9% gross spread (including dividends). Or ~10% annualised if a five month offramp.

- Annualised spreads for clean liquid deals in Asia-Pac, do tend to widen after day 1. Meaning, the gross spread remains roughly static as investors hit their full quota early on.

- HSBC shareholders are questioning the deal merits. For Hang Seng minorities, this is a great exit. Inside this report, I take a deeper dive into Hong Kong bank takeover precedents.

3. Merger Arb Mondays (13 Oct) – Dongfeng, Hang Seng, Soft99, Toyota Industries, Pacific Ind, Mandom

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Soft99 Corp (4464 JP), Dongfeng Motor (489 HK), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Mandom Corp (4917 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Seven West Media (SWM AU).

4. Genting Malaysia (GENM MK): Genting (GENT MK)’s Curious Offer

- Genting Malaysia (GENM MK), the owner of Resort World Genting, has announced a conditional offer from controlling parent Genting Bhd (GENT MK).

- GENT is offering RM2.35/share, an uninspiring 9.81% premium to last close, for the 50.64% of shares out not held. The Offer has a 50% acceptance threshold.

- GENT already consolidates GENM (AFAIK). At this price, compulsory acquisition won’t be afforded (you’d think). GENT should have launched the Offer back in April when the share price was floundering.

5. Korea’s Div Tax Story Suddenly Hits a Radical Inflection: Targeting Samsung Elec & Hyundai Motor

- Kim Yong-beom proposed cutting eligibility to 25%+ payout firms and hinted the Presidential Office may slash the dividend tax ceiling to 25%, potentially the boldest move yet.

- Short-Term spotlight: large-cap 25–40% payout stocks, led by Samsung Elec and Hyundai Motor. Kim Yong-beom hinted the Presidential Office wants them included to drive dividend growth.

- Big-Cap 25–40% payout stocks, especially Samsung Elec and Hyundai Motor, could see heavy flows, with their preferred shares poised to outperform in the near term.

6. [Quiddity Index] Index Consultation Anncmt Suggests The Big M Will Delete 1 LargeCap, 5 Small.

- Global Index Provider M _ _ _ announced an index consultation on Digital Asset Treausry Companies on 27 August. Friday, they extended til year-end, but gave a clear proposal update.

- They propose to exclude companies where digital asset holdings represent >50% of assets. They seek input. They also seek input on whether a company self-defines as a DAT…

- And also look at stated reasons for capital raising. A preliminary list suggests Strategy (MSTR US) and Metaplanet (3350 JP) are obvious targets. Others will be too.

7. Genting Malaysia (GENM MK): Genting’s Conditional Voluntary Offer at RM2.35

- Genting Malaysia (GENM MK) disclosed a conditional voluntary offer from Genting Bhd (GENT MK) at RM2.35, a 9.8% premium to the last close price of RM2.14.

- The 50% minimum acceptance condition is easily met as Genting is the largest shareholder, representing 49.36% of outstanding shares.

- Genting’s preferred endgame is to delist GENM, thereby fully benefiting if GENM successfully bids for a downstate New York casino licence. Therefore, there is a good chance of a bump.

8. Mayne Pharma (MYX AU): Court Rules Cosette Cannot Walk

- In a watershed decision, the Supreme Court of NSW ruled Cosette cannot terminate its Scheme for Mayne Pharma (MYX AU).

- The hearings were the first time a material adverse change clause had been considered by an Australian court under such circumstances.

- The transaction still requires FIRB signing off. Concerns linger over whether Cosette intends to close a South Australian plant. Mayne has previously dispelled these concerns.

9. StubWorld: Genting (GENT MK)’s U.S. Expansion Is A Gamble

- Genting (GENT MK)‘s Offer for Genting Malaysia (GENM MK) is further evidence of the gaming group’s move for even greater U.S. exposure.

- Preceding my comments on GENT are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

10. Value Partners: Supports Samyang Holdings’ Equity Spin-Off Plan But Must Cancel Treasury Shares

- On 13 October, Value Partners has come out in support of Samyang Holdings (000070 KS)’s equity spin-off plan but on the condition that the company must cancel its treasury shares.

- Value Partners believes Samyang Holdings is currently severely undervalued, trading at a P/B of 0.34x. A shareholders meeting for Samyang Holdings is scheduled for 14 October.

- We have a positive view of this equity spin-off. Our NAV valuation of Samyang Holdings suggests an implied price per share of 127,138 won (28.6% higher than current price).

Receive this weekly newsletter keeping 45k+ investors in the loop

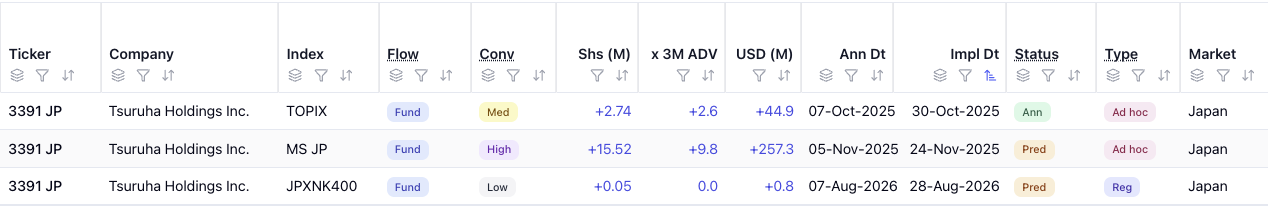

1. Tariff Shock Sends HK Volatility Higher: Meituan (3690 HK) Looks Cheap, Alibaba (9988 HK) Stays Rich

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for eight prominent Hong Kong stocks and the HSI Index.

- Highlights: Recent market turbulence moderately lifted implied volatility for many stocks, but not to extreme levels. The approaching earnings season impacts October and November implied volatility.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

2. Nikkei 225 (NKY) Tactical Setup: BUY The Bottom, Not the Dip!

- The Nikkei 225 (NKY INDEX) dived to 46544 on Tuesday, after peaking at 48.5k last week. It was ultra-overbought.

- This correction offers an opportunity to re-enter the rally (or enter the rally, if you missed it), but don’t be too eager to enter early.

- The Nikkei could correct easily for 2,3 or even 4 weeks when this pattern is encountered, according to our TIME MODEL. 43.5k may be the right area, details in insight.

3. Pop Mart (9992 HK): New Options Listing Poised for a Volatile Start

- Context:Pop Mart (9992 HK) begins trading monthly options on the Hong Kong Exchange (HKEX) on Monday, 13 October 2025, marking its debut in the derivatives market.

- This Insight examines expected implied volatility, referencing both realized volatility trends and peer valuations for context.

- Why Read: Gain early insight into Pop Mart’s option launch, including option specifications and how implied volatility could set the tone for first-day trading.

4. BYD (1211 HK) Tactical Outlook: Bottoming, But Wait to Buy The Dips…

- As discussed in our previous BYD insight on October 3, the stock is oversold and could start a rally soon.

- BYD (1211 HK) was heavily overbought at its peak in mid-2025, then declined >30% in a few months. It’s oversold.

- However at the moment our model has identified the current short-term trend pattern as bearish: a 1-2 weeks rally can happen, but then the stock will pullback again. Caution advised.

5. Advantest: Tests Are the Unsung Hero of the AI Chip Rally

- Advantest, a leader in semiconductor testing, is uniquely positioned to capitalize on the AI chip rally, driven by increasing complexity and the critical need for stringent testing in next-generation devices.

- Record-Breaking financial performance and strategic capacity expansions signal long-term growth, despite anticipated near-term revenue fluctuations, setting the stage for future market outperformance.

- Technological dominance in areas like chiplet architecture and advanced digital solutions further solidifies Advantest’s structural advantage, hinting at a compelling opportunity for discerning investors.

6. NIFTY 50 Tactical Outlook: Indecision May Lead to Pullback

- The NIFTY Index has been stuck in the 25k price zone since May 2025. The index is going nowhere.

- Our quantitative model indicates a 62.5% probability of reversal next week, if the index closes around 25300 (if the close is positive).

- If the index closes this week down, a pullback may be under way, entry zones details are discussed in detail in the insight.

7. CSI 300 (SHSZ300) Tactical Outlook: Severe Downside Tail Risk

- The CSI 300 Index (SHSZ300) has began a small correction. Our model has identified the current trend pattern as bearish. The pullback could reach the 4.3k/4.1k support zone.

- These corrections can last up to 4 weeks, but usually they resolve after 2-3 weeks (the index has already closed 1 week down, so there could be 1-2 more weeks).

- According to our model, the key support area is 4300: if the index breaks that support, it can fall quickly to 4100 or 4000. Read detailed tactical analysis in the insight.

8. The Volatility Playbook: Japan Vs. Developed Markets

- Amidst US-China tariff uncertainties and divergent central bank policies, a strategic approach to volatility across key global indices is being considered, aiming to capitalize on anticipated market shifts.

- The evolving political landscape in Japan, alongside a unique monetary policy trajectory, presents distinct volatility opportunities compared to volatility markets in the US and Europe.

- Part I explores a multi-leg volatility strategy, designed to leverage specific market conditions. Part II is a deep dive into VIX, VNKY, VSTOXX trading.

9. Hong Kong Single Stock Options Weekly (Oct 13 – 17): Option Stress Builds, Breadth Weakens

- Single stock options showed early signs of stress, with both volumes and implied vols moving higher as Put trading outpaced Calls.

- Breadth was weak across single names, with only 3 of 11 sectors trading higher.

- We provide a table of earnings events for the week ahead.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK: Mixed Messages On Labour Market

- Most narratives can find some support in the latest labour market report, preserving uncertainty that should keep the BoE on hold at least until some clarity emerges.

- Unemployment has increased (LFS) or stabilised (payrolls), while pay is shockingly resurgent (inc-bonuses), slowing as expected (ex-bonus) or stagnating (private pay).

- Weakness isn’t as clear as the consensus and press sometimes make out, but concerns aren’t invalidated. We still expect resilience to preserve excess inflation hawkishly.

2. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 17 October 2025

- China: Monetary & Trade Indicators Strengthen: September data show broad-based monetary growth

- Korea: Early Signs of Trade Softness: The first 10 days of October show exports down 15% YoY, imports down 22.8%.

- India: Inflation Trends Favor Rate Cuts: Wholesale prices up just 0.1% YoY in September — a stark contrast to >10% in 2022 and flat in 2023.

3. UK: Unseasonably Resilient In Q3

- Slight growth in August sustains an above trend level of activity and is tracking to a 0.2% q-o-q pace for Q3, matching our forecast and the consensus, but disappointing the BoE.

- The ongoing slowdown in service sector activity repeats residual seasonality that would leave a trough in two months, but there is slightly more resilience this year.

- Policymakers shouldn’t react to statistical noise, and are unlikely to amid ongoing excesses in underlying inflation that a stabilising labour market wouldn’t break.

4. The Art of the Trade War: PAIN THRESHOLD FOR THE TACO TRADE!!

- Tensions between China and the U.S. have increased. Last week’s tit-for-tat exchanges culminated with President Trump threatening China with higher tariff rates and a cancellation of his meeting with Xi.

- Trump’s Friday post on social media immediately caused U.S. markets to swoon with the S&P breaking support levels. In a TACO trade moment, Trump reversed his harsh rhetoric on Sunday.

- Anyone can speculate on what the next few weeks will look like for markets, but we believe the market may start pricing in more long-term risk.

5. HEW: Cockroaches Startle Pricing

- Losses on bad and fraudulent US loans raise the risk that more cockroaches will emerge, nourished by monetary policy stimulating asset prices outside of recessionary regimes.

- Market rates fell on this, while macro data didn’t offer direction as UK Q3 GDP kept tracking 0.2%, EA inflation was confirmed, and UK labour market data were mixed.

- Next week’s UK inflation data should reveal a rise, with the CPI reaching 4%. Delayed US CPI data will provide a rare signal more relevant to the Fed’s likely decision to cut.

6. EA: Inflation Rises Briefly In The Fall

- Inflation’s rise to a high 2.3% in September was confirmed in the final print, although some payback remains likely in October. We doubt it goes fully back to the target then.

- Underlying inflation metrics were broadly stable again at about 2.5%, with little progress in most statistical measures for over a year.

- There is little cause for alarm at this stage, so the ECB can keep waiting in a good place, but we still see a greater risk of hikes than cuts in 2026.

7. The Return of Tariff Man

- We’ve been warning forweeks that the U.S. equity market advance was extended and it could pull back at any time.

- President Trump’s threat to impose high tariffs on China seems to be the bearish trigger.

- Our base case calls for a 5-10% pullback, and we regard any correction as a welcome pause and opportunity to add to equity positions at lower prices.

8. The AI Bubble Debate

- Are we in an AI bubble? Probably, but much depends on what stage we are in the bubble.

- On one hand, headline M&A deals like the one concluded with AMD is supportive of further gains.

- On the other hand, the recent Oracle earnings report casts doubt about the profitability of AI cloud computing sustaining elevated valuations.

9. US Equities: Maintaining Elevated Leadership Valuations Will Require Upside Surprises

- Hype surrounding the benefits of artificial intelligence (AI) has increased in 2025, despite a slowing economy. While new economy sectors have contributed to growth, not all is AI-related.

- There are valid comparisons between the current environment and the late 1990s surrounding hype about the beneficial impact of technological innovation on corporate performance. S&P500 leadership is priced to perfection.

- Current US equity leadership valuations are exposed to threats over the next 9 months, including stress in credit markets due to high bond issuance by companies in AI-related activity.

10. Asia Cross Asset Podcast: Japan – The New LDP Leader: Implications for policy and markets

- Ayako Takashi advocates for responsible expansionary fiscal policy, focusing on income distribution rather than aggressive fiscal expansion.

- Takashi’s comments on the relationship between the government and the Bank of Japan do not necessarily indicate clear intervention, but may put pressure on the central bank.

- The BOJ may need to deliver rate hikes every six months to combat elevated inflation, with market expectations of a terminal rate around 1%. Timing of rate hikes may be tricky, especially with fluctuating exchange rates.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. OpenAI, AMD Enter Into Strategic Partnership. Guys, This Is Getting Ridiculous!

- OpenAI agrees to deploy 6 gigawatts of AMD GPUs based on a multi-year, multi-generation agreement. The deal could be worth upwards of $100 billion to AMD through 2030

- AMD issued OpenAI a warrant for up to 160 million shares of AMD common stock, structured to vest as specific milestones are achieved, including AMD share price appreciation to $600

- Could a strategic partnership with Intel now also be on the cards? After all, OpenAI needs CPUs as well as GPUs, especially as they ramp into enterprise. Just saying…

2. Hitachi Ltd. (6501 JP): Tie-Up with OpenAI Opens the Flood Gates

- An agreement to supply OpenAI with energy-saving electric power equipment should be accretive to Hitachi’s sales and profits as long as the AI boom continues.

- Hitachi is also building an “AI Factory” based on Nvidia technology. This should accelerate the growth of Hitachi’s Lumada digital services platform, also boosting sales and profits.

- Hitachi’s share price jumped 10.3% on the OpenAI news. Data center news flow and AI sentiment now drive the share price.

3. Intel (INTC.US): AMD to Submit Foundry Orders to Intel? We Think It’s Highly Unlikely.

- What is happening with Advanced Micro Devices (AMD US) and Intel Corp (INTC US)?

- Intel’s stock price has risen about 50% from its April 8 low. However, we have yet to see any tangible progress in its manufacturing technology.

- Intel’s stock price has risen about 50% from its April 8 low. However, we have yet to see any tangible progress in its manufacturing technology.

4. Astroscale (186A.T-JP/ASTRO): The Small-Cap Takaichi Defense Trade

- After months of going nowhere, Astroscale shot up more than 20% in the two trading days following the election of defense hawk Sanae Takaichi as president of the LDP.

- Astroscale made a small gross profit last quarter, but needs a rising flow of contracts and subsidies in order to turn profitable at the operating and net levels.

- At ¥825, the stock price is 38% below the ¥1,326 high reached just over a year ago. If Takaichi becomes prime minister, the chances of regaining that high would improve.

5. Taiwan Tech Weekly: Why Many Tech Companies Could Soon See Their Chip Costs Rise Substantially

- As Chips Move to 3nm and 2nm Designs, Tech Companies Could See a Sharp Increase in Their Chip Manufacturing Cost

- Intel (INTC.US): AMD to Submit Foundry Orders to Intel? We Think It’s Highly Unlikely.

- HBM Stocks Will Keep Running (Micron, SK Hynix), It’s Just the Beginning

6. PC Monitor: Dell Doubles Multi-Year Forecasts; AI PC Up-Cycle, Art Thou Finally Here?

- Dell doubles long-term growth outlook to 7–9% revenue and 15%+ EPS CAGR through FY30, led by AI infrastructure.

- AI PCs emerge as Dell’s next growth engine; global refresh cycle could finally kickstart long-awaited PC upturn.

- Taiwan makers Asus, Acer, Quanta, and Wistron positioned to benefit as AI PC and server demand scales together.

7. Taiwan Dual-Listings Monitor: Weak US Friday Session Opens Up Wide Opportunities Across the Board

- TSMC: +19% Premium; Good Level to Close Out for Those Short the ADR Spread

- UMC: -3.9% Discount; Rare Deep Discount Good Level to Long the ADR Spread

- ASE: -5.5% Discount; Any Spread Below Parity a Good Level to Long the ADR Spread

8. Sovereign AI. National Strategic Imperative, FOMO Or Both?

- If all of the publicly announced sovereign AI initiatives come to pass, they could account for upwards of $1 trillion in AI infrastructure spending through 2030

- For now, “sovereign” AI means mostly means made in the USA. However, there a growing demand for “sovereign” AI from China, particularly among countries disillusioned by the US trade wars

- In general AI infrastructure, the US is outspending China six to one in 2025. Could one be spending too much and the other spending too little? Let’s see…

Receive this weekly newsletter keeping 45k+ investors in the loop

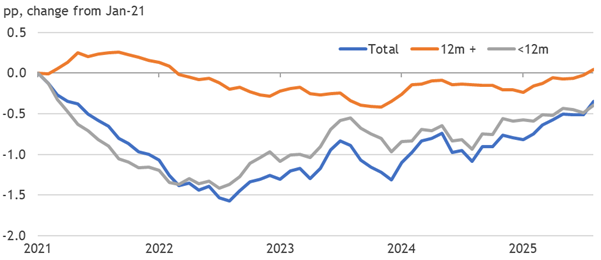

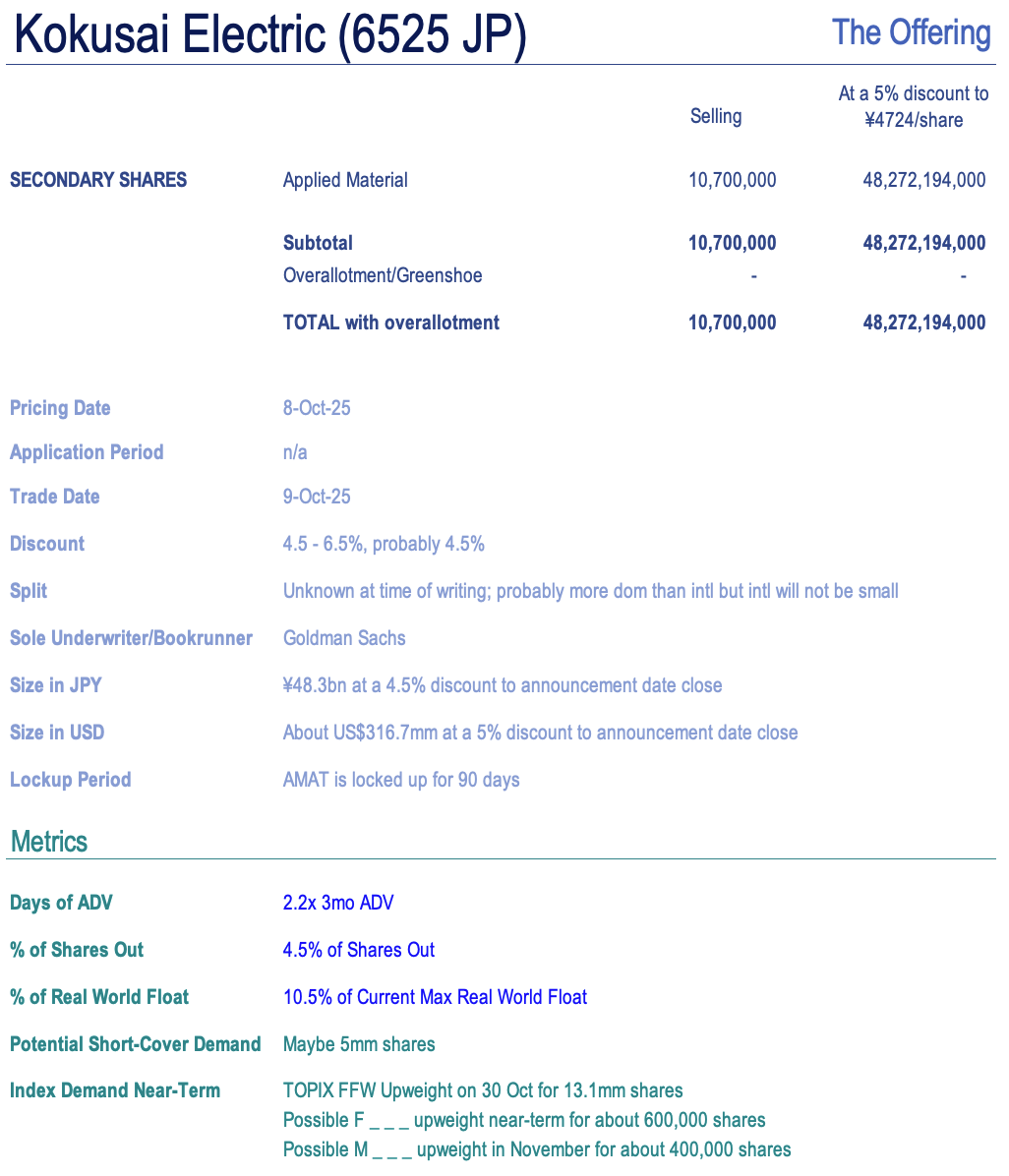

1. [Japan ECM] Kokusai Elec (6525) – Applied Materials $330mm Selldown

- Three weeks ago I wrote that KKR’s lockup would expire about now in [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Today post-close, Applied Materials (AMAT US) announced a 10.7mm share (4.5%) Accelerated Block Offering to be priced tomorrow morning, at an indicated 4.5-6.5% discount. This would put them at 10+%.

- This should be very well taken up. There is index demand on the follow. The question is more about the unwind of KKR’s last bit. Perhaps to come soon?

2. FineToday Holdings (420A JP) IPO: The Investment Case

- FineToday Holdings Co Ltd (289A JP), a Japanese personal care business, is seeking to raise US$286 million. It previously pulled an IPO to raise US$500 million in December 2024.

- FineToday has four product categories: Hair care, Skin care, Body care and others. Hair care is the largest category, accounting for 49.0% of 1H25 revenue.

- The investment case rests on top-tier revenue growth, top-quartile profitability, peer-leading FCF generation and manageable leverage.

3. Kokusai Electric Placement – Unexpected Seller but Relatively Small Deal

- Applied Materials (AMAT US) is looking to raise approximately US$330m through an accelerated secondary offering for around 4.5% of Kokusai Electric (6525 JP) (KE) stock.

- KE had seen two selldown earlier, from KKR, with mixed results. KKR just came out of its last lockup.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. LG Electronics India IPO – Thoughts on Valuation – Better Placed This Time Around

- LG Electronics (066570 KS) is looking to raise US$1.3bn via part-selling its stake in LG Electronics India.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about valuations.

5. Tekscend Photomask IPO: Market Leader with Strong Prospects Ahead

- Established in 2022, Tekscend Photomask (429A JP) (previously Toppan Photomask) is the world’s leading semiconductor photomask supplier, holding a global market share of 38.9%.

- Tekscend provides a diverse portfolio of high-precision photomasks for semiconductors, displays, MEMS, and R&D, including cutting-edge EUV masks, leveraging its expertise in microfabrication.

- The company is planning for a listing on TSE on 16th October and plans to raise proceeds of around US$800m through a combination of existing and new share issues.

6. LG Electronics India IPO: Attractive Upside

- After incorporating the company’s FY25 results, we have tweaked our income statement estimates and valuations of LG Electronics India IPO.

- Our base case valuation is target price of 1,514 INR which is 33% higher than the high end of the IPO price range.

- It appears that the company wants the IPO to be successful and after much review the company has decided to price the IPO at more attractive levels to new investors.

7. Innoscience Suzhou Tech Placement – Selling Ahead of Lockup Expiry, Relatively Small

- InnoScience Suzhou Technology (2577 HK) aims to raise around US$200m in its Hong Kong placement.

- Innoscience was only listed in Dec 2024 and it undertook another primary raising in July 2025, the lockup for which has yet to expire.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. LG Electronics India IPO: Leading Player Priced at a Steep Discount ?

- LG Electronics (066570 KS) will divest a 15% stake in its 100% subsidiary LG Electronics India (123D IN) through an IPO, raising Rs116 billion (USD 1.3 billion).

- The IPO pricing implies a valuation well below that of listed Indian peers and appears to overlook the sector’s underlying near term macro demand tailwinds.

- LGEIL’s 1QFY26 financial performance came in weak, primarily due to a seasonal slowdown in cooling product sales, particularly air conditioners. This follows a strong FY2025.

9. FineToday Pre-IPO – Refiling Updates

- FineToday Holdings (420A JP) (FT) is planning to raise around US$280m via selling a mix of primary and secondary shares.

- FineToday (FT) is a beauty and personal care company in Asia offering a range of products, including hair care, skin care and body care products.

- In our previous note, we had looked at its past performance. In this note, we will talk about the updates from its most recent filings.

10. LG Electronics India IPO- Strained in Legal Heat

- LG Electronics India (123D IN) much awaited INR 116.1 bn IPO is set to open for subscription this week. It’s a complete OFS by the Korean Parent.

- While LG is the market leader, there are huge litigation liabilities ~74% of net-worth which could pose a serious threat to the financials, with particular attention to AMP spends proceedings.

- We also find it disturbing to note that the parent has taken out 175% of the free cash flows in FY23 and FY24 as interim dividends.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HSBC (5 HK)’s Clean Offer for Hang Seng (11 HK)’s Minorities

- Hang Seng Bank (11 HK) has announced an Offer from controlling parent (63.3551%), HSBC Holdings (5 HK), by way of a Scheme, in a HK$106bn (US$13.6bn) deal.

- The Scheme Consideration is HK$155/share, a 30.3% premium to last close. The price is final. A “third interim dividend” will be added. Optically, the price is bang on.

- The long stop for conditions is the 30th September 2026. I think this transaction can be wrapped up in around five months.

2. Tata Motors (TTMT IN) Demerger: Interesting Index Implications

- Tata Motors (TTMT IN) is demerging the company into two separate listed entities that will focus on the Passenger Vehicle business and the Commercial Vehicle businesses.

- Based on the estimated valuation for the two entities, both stocks will continue to remain in the MGlobal Index and the FGlobal Index.

- NIFTY and SENSEX trackers will need to sell their Commercial Vehicle business holdings soon after listing. There could be selling in the Passenger Vehicle business holdings at a later rebalance.

3. [Japan Event] Sony Financial (8729 JP) Moves On From ToSTNeT-3 Buybacks, Now In the Market

- Sony Financial Group (8729 JP) started ToSTNeT-3 buybacks last week and did one this week to jumpstart the buyback, cushioning the Nikkei 225 deletion on 29 Sep and subsequent overhang.

- In three ToSTNeT-3 buybacks in 6 trading days spending ¥28.9bn, the company bought back 177.513mm shares or 2.5% of shares out, or about 6.2% of Max Real World Float (MRWF).

- With ¥71.1bn left, at last that’s 460mm shares, or 16.2% of MRWF. Over 10mos that is 1.62%/month. That will boost Mar26 DPS, Mar27 DPS projections, EPS, etc.

4. Dongfeng Motor (489 HK): VOYAH Listing Docs Underscore the Upside

- On 22 August, Dongfeng Motor (489 HK) disclosed a pre-conditional privatisation by merger by absorption by Dongfeng Motor Corporation, along with a proposed distribution and listing of VOYAH shares.

- The VOYAH application proof, filed on 2 October, points to strong fundamentals and suggests that the appraised value of VOYAH and the offer are conservative.

- Based on the data points from the application proof, I calculate that the implied offer is HK$12.11-12.25 per H Share, a 11.6%-12.9% premium to the appraised value of HK$10.85.

5. Korea’s Mandatory Treasury Share Cancellation Situation Creates New Passive Flow Dynamics

- KRX may preemptively adjust KOSPI 200 screening, switching from full market cap to market cap excluding treasury shares for index inclusion.

- With treasury-share cancellation likely this quarter, KRX may act before June ’26. For December KOSPI 200, we should run both full-cap and ex-treasury screens; flows could behave unusually.

- Focusing on Hanssem (009240 KS) and Taekwang (003240 KS); borderline, high treasury shares, potential KOSPI 200 exclusion, making them key flow-sensitive setups for December reshuffle.

6. Dongfeng (489 HK): On VOYAH’s Updated Financials

- On the 22nd August 2025, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- Dongfeng has now released the application proof for VOYAH, with finances through to July 2025. Of interest, VOYAH is in the black for 7M25.

- The market is implying a price-to-trailing-sales of 1.5x for VOYAH versus the basket average of 2.1x.

7. [Japan Activism] Sun Corp (6736) Gets ANOTHER Public Activist – ValueAct Reports 7.9%

- Today after the close, Value Act reported that it owned 7.87% of shares outstanding in Sun Corp (6736 JP) and it may make proposals to management.

- This has been trading cheaply (and I pointed it out on 13 Aug and 12 Sep). Cellebrite DI (CLBT US) is up 35% in those 8 weeks. Sun Corp +50%.

- ValueAct had owned 4.9+% for at least a few months before, but now it has gone public. They were likely in already under a different name in March, now public.

8. Merger Arb Mondays (06 Oct) – Kangji, Soft99, I-Net, Daiseki, Mandom, Changhong, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Soft99 Corp (4464 JP), I Net Corp (9600 JP), Daiseki Eco. Solution (1712 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Mandom Corp (4917 JP), Seven West Media (SWM AU), Ainsworth Game Technology (AGI AU).

9. [Japan M&A/Activism] Soft99 Board Rebuts Effissimo’s Rebuttal. Still An Awful “Fiduciary” Response

- Today after the close, Soft99 Corp (4464 JP)‘s Board issued a statement on “Our View” of Effissimo’s “Our View” Press Release. It’s bad.

- But it points out the “weaknesses” that Effissimo’s Tender Offer Press Release had as it concerns a counterbid. And that tells you how Effissimo should amend their Tender Offer docs.

- Soft99 Board’s response is interesting. It asks Effissimo to not be coercive (i.e. bid for 50%+) in response to the MBO Bid’s coerciveness. Not a winning argument but not impossible.

10. [Japan Activism] Mandom (4917 JP) MBO Sees Murakami Pushing Harder, Now at 16.59%

- Four weeks ago, CVC announced a family-led MBO of hair care and cosmetics company Mandom Corp (4917 JP) at a price which was decidedly too light, well below company plans.

- One activist wrote a letter clearly calling them out for accepting a low-ball price well below the Medium Term Management Plan target. Another bought a lot of shares.

- On 25 September, Murakami-san and affiliates reported an 8.39% position. Seven trading days later it is 16.59% and the shares are up small from my last piece + 1.

Receive this weekly newsletter keeping 45k+ investors in the loop

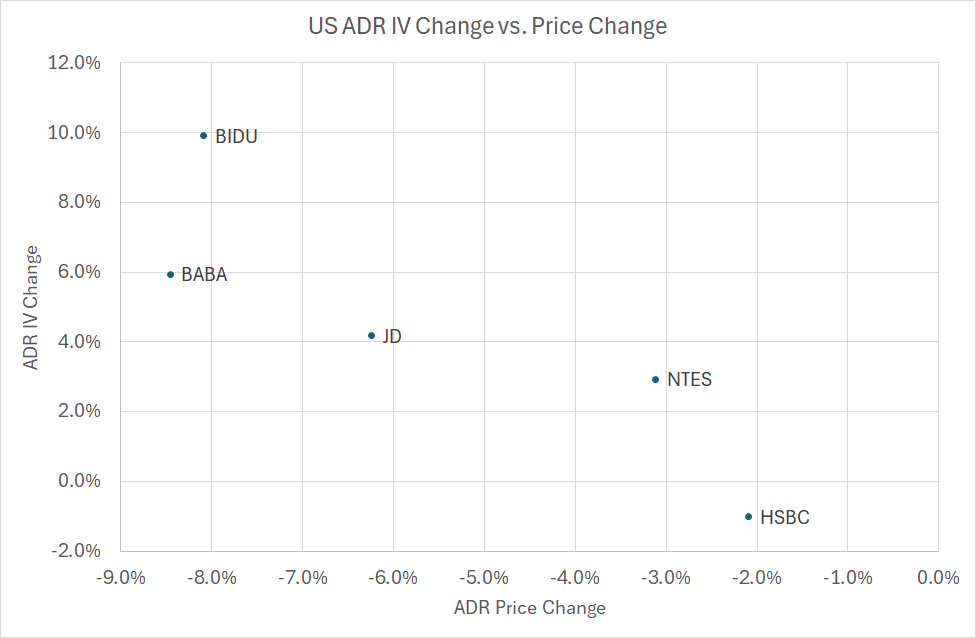

1. Alibaba Drops 8%: What Friday’s U.S. Sell-Off Means for Hong Kong Stocks

- Context: Friday’s sell-off occurred after the Hong Kong market closed, but several Hong Kong–listed companies were caught up in the rout through their U.S.-listed ADRs.

- This Insight details the impact on 15 prominent Hang Seng Index constituents — including Alibaba, Tencent, and HSBC. Implied volatility in U.S.-traded options on these ADRs moved sharply in response.

- Why Read: Understand what to expect when the Hong Kong market reopens after the weekend — both in terms of price performance and implied volatility.

2. Market Sell-Off (Oct 10): How Asian Index ETFs Responded to Market Slide

- A renewed tariff threat from Trump sparked a sharp, sell-off across North American Equity markets.

- The sell off was broad based and accordingly we look at the performance of Asian Index ETF’s that trade in North America to help prepare for Monday’s price action.

- Implied volatility, price and option volume are displayed for each symbol.

3. Nikkei 225 (NKY) Tactical Outlook: Flying Too High…

- The Nikkei 225 (NKY INDEX) has reached eye-popping valuations, a 20% rally from the end of June into early October (40k to 48k).

- Our forecast is always short-term, 3-5 weeks horizon, so we cannot say if the index will continue to rally in 2026, but right now it’s OVERBOUGHT.

- We expect a pullback soon, you can buy the pullback, we discuss the support areas in the insight.

4. HSI Tactical Outlook: Maybe It Is a Large Pullback…

- In our previous insight dedicated to the Hang Seng Index we formulated a key question: is this going to be a small pullback or a large pullback?

- The HSI pulled back just for 1 week, small pullback, our models were reset. But this week the index pulled back again, almost reaching Q2 support (mildly oversold).

- Then, on Friday, Trump tweeted something against China, after the Asian markets closed and all hell broke loose. The HSI Oct. futures tanked to 25300. Let’s discuss support zones…

5. Amazon: Still Riding the Tech Volatility Wave

- Amazon is navigating a dynamic tech landscape, leveraging its strong position in AI infrastructure and cloud services to drive long-term value creation and maintain a premium valuation in the market.

- The company is making strategic investments in AI chips and foundational AI companies like Anthropic, aiming to optimize efficiency and scalability in its AWS segment.

- Despite a current range-bound stock price, Amazon’s financial metrics and company culture approach underscore its commitment to growth and competitive advantage in the evolving tech ecosystem.

6. Cheap Vs. Rich Volatility: Diverging Signals Across Alibaba (9988 HK), Tencent (700 HK) & The HSI

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for 8 prominent Hong Kong stocks and the benchmark index.

- Highlights: In contrast, Alibaba’s IV remains rich, while Hang Seng Index IV is cheap across the curve, offering attractive hedge entry points.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

7. Monthly Macro Markets (October): Diverging Volatility Trends Highlight Risk Sensitivity

- October seasonals, despite their reputation, show most markets with better than 60% odds of finishing higher albeit with meager returns.

- Volatility trends have diverged, with implied vols climbing even as realized vols fell, raising questions about early signs of risk sensitivity.

- Implied vols on most markets have been trending higher vs the SP500 despite the US being ground zero for policy uncertainty.

8. Hong Kong Single Stock Options Weekly (Oct 06 – 10): Options Calm But Stormy Seas Ahead

- Hong Kong equities erased last week’s gains, with further losses on Monday likely after Trump’s social media post Friday morning.

- Weakness was not widespread, though there was a sharp reversal in breadth week over week.

- Option volumes and ratios suggest there’s little concern in the market at this point.

9. Tactical Alert: Undervalued Stocks Poised to Rally This Week

- China Mobile (941 HK) and Meta (META US) are both oversold according to our quantitative tactical models.

- We have been discussing China Mobile (941 HK) before, in early September, we said the pattern was bearish (“brief rally then down again”) , but now this has changed.

- Meta (META US) is a different story, looks like a bearish pattern but it is very oversold, it could rally 2 weeks before going lower.

10. From Banks to Miners: Cheap Vs. Rich Volatility Across Australia

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for ten prominent Australian stocks and the benchmark.

- Highlights: December implied volatility tends to be rich for the banks and cheap for the miners. S&P/ASX 200 (AS51 INDEX) implied volatility is cheap across the curve.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. From Buyers to Builders: Assessing the U.S. Housing Market

- Market sentiment on rate cutting and its impact on the housing market in 2026 is largely optimistic

- Home prices are up two and a half percent through June but have been declining month-over-month

- Housing supply at a national level is back to pre-Covid levels, transitioning to a buyer’s market from a seller’s market with strong mortgage credit but affordability challenges due to higher rates

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. HEM: Oct-25 Views & Challenges

- Hawkish inflation and policy rate pricing shifts toward our UK/EA view did not stop US rates frontloading more cuts.

- We still see markets overpricing easing, with UK inflation expectations stuck above target, and neutral rates high.

- A break in activity data, especially unemployment, and underlying price/wage inflation, would threaten our view.

3. US Shutdown: A Means To An End

- The Democrats opted for a US government shutdown despite the Administration being well prepared for what it sees as an opportunity to promote its longer-term agenda.

- While they hold out, the president’s ‘grim reaper’, OMB Director Russell Vought, will have a free hand to cut the size of government and pursue his unitary executive vision.

- Some of his actions will undoubtedly be challenged in the courts, but the signs are that the Supreme Court will continue to side firmly with the Administration.

4. UK: Poor Productivity Paradigms

- The OBR looks likely to trim its productivity trend assumption to 1%, which would still be a bullish break from the current stagnation. Trends rarely break outside recessions.

- High taxes are squeezing the most productive and being transferred to the inactive. It should not be surprising that the UK’s political choices have stalled productivity.

- We see no reason to think the UK will pull off an internationally exceptional jobs-light boom from here. Ongoing stagnation would extend the UK’s rule for fiscal slippage.

5. EM Fixed Income: Is better growth worse for EM?

- Recent data has shown better-than-expected growth globally, leading to a shift in the macro landscape.

- The US economy has shown signs of weakness, particularly in the labor market, but overall growth forecasts have been revised upwards.

- Emerging markets have maintained a positive bias, with inflows steadily coming in, but there are concerns about potential vulnerability in EM currencies and local rates markets if the US growth environment remains strong.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. US: Steady As She Shuts

- The US government shutdown causes vital economic data to go dark, leaving the Fed facing market pressure to blindly cut rates as priced, creating risks of policy error.

- Both parties see strategic value in prolonging the shutdown, risking disruption that lasts well beyond historical norms. But levels will rebound when it inevitably ends.

- In the interim, private surveys signal weakness, and this picture is unlikely to improve significantly enough to block cuts in 2025, but that won’t drive more Fed cuts in 2026.

7. Beyond The Blue Chips: A Look At SGX’s iEdge Singapore Next 50

- SGX iEdge has launched the SGX iEdge Singapore Next 50 indices to track the 50 largest and most liquid SGX Mainboard companies beyond the 30 companies featured in the Straits Times Index (STI).

The Next 50 index has the highest weighting in the Real Estate sector, comprising ~47% of the index by weight. Other meaningful sectors are Financials, Industrials, and Consumer.

- By utilizing the new index in conjunction with the Straits Times Index (STI), investors and asset managers can more effectively construct tactical asset allocation strategies that aim to enhance portfolio performance.

8. Turning tides: a new dawn for capital flows

- Shift in capital flows and rise of domestic emerging market investors

- Discussion with experts in UAE and Singapore on their experiences and perspectives

- Impact of global events like financial crisis and COVID on emerging markets and expat communities

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Q4 Outlook for Our Investment Themes Part 2 – Asian Equities

- How have our major investment themes performed so far in 2025?

- Review of the performance of the major markets and asset classes we focus on

- We revisit our outlook for each of those asset classes for Q4 25

10. RARE EARTH ELEMENTS: China Plays Its AI Trump Card!

- China has implemented extensive restrictions on its export of Rare Earth Elements, which will affect critical parts of the AI supply chain including semiconductor equipment and chips, and data centers.

- The restrictions were in response to recent actions by the U.S. to broaden restrictions on semiconductor equipment exports to China and Secretary Bessent’s comments regarding Argentina’s future relationship with China.

- President Trump responded with a social media post threatening a 100% increase in tariffs on Chinese imports and export controls on critical software.