Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel CFO @ Citi’s 2025 Global TMT Conference: “We Will Use TSMC Forever”

- We will be putting products on TSMC you know, forever, really. TSMC is a great partner for us. Obviously everyone understands that their support and technology are great.

- 18A is actually a good node for us. We want to milk that node We won’t get peak volume on 18A until the 2030 timeframe.

- Kevork Kechichian joined Intel as head of the Data Center Group. He will lead Intel’s data center business across cloud and enterprise, including the Intel Xeon processor family

2. Synopsys Crashes On “Major Foundry Challenges”. Intel, What Have You Done?

- Last week, Synopsys reported Q325 results and guidance both well below expectations causing the share price to collapse over 34% in the immediate aftermath.

- The company revised down full year revenue targets, noting that “challenges at a major foundry customer are also having a sizeable impact on the year”

- That “major foundry customer” is likely Intel. Who’s next in line to face similar revenue impact from Intel’s challenges?

3. MediaTek: Satellite Connectivity the Next Strategic Battleground for Mobile SoCs (Structural Long)

- Starlink’s Direct-to-Phone Semiconductor Integration Push Signals a Major Shift Coming for Telecom

- Direct-To-Satellite Connectivity Could Become Critical for a Market-Competitive Smartphone SoC Design

- Leadership in Satellite Connectivity Will Soon Mean Leadership in Smartphone SoCs

4. NVIDIA Becomes The Latest To Back Intel’s GoFundMe Appeal

- NVIDIA will invest $5 billion in Intel’s common stock at a purchase price of $23.28 per share

- Intel will supply custom x86 server CPUs to NVIDIA, who in turn will sell RTX graphics cores to Intel to combine into an new type SOC for the PC market

- Under sustained questioning during the Q&A, Jensen did a remarkable marketing pitch for TSMC, drowning any hopes of a looming Intel Foundry deal for the foreseeable future

5. TSMC’s COUPE Signals Silicon Photonics Go-Time — Early Winners in Taiwan’s Listed Supply Chain

- Last week at SEMICON, TSMC unveiled COUPE, moving silicon photonics from lab demos into industrial-scale advanced packaging.

- Himax, ASE, Zhen Ding, GlobalWafers, ACON, and Accton form Taiwan’s listed ecosystem for silicon photonics adoption.

- As NVIDIA Corp (NVDA US)-driven AI clusters proliferate, the power and cost of moving data between chips have become as constraining as compute itself.

6. Taiwan Tech Weekly: Starlink Engaging Chipmakers in Direct-To-Phone Push; Intel’s TSMC Dependency

- Starlink Engaged with Chipmakers to Bring Satellite Connectivity Direct to Smartphones — Mediatek Well Placed to Benefit

- Intel CFO @ Citi’s 2025 Global TMT Conference: “We Will Use TSMC Forever”

- TSMC’s COUPE Signals Silicon Photonics Go-Time — Early Winners in Taiwan’s Listed Supply Chain

7. Intel (INTC.US): NVIDIA’s $5B Intel Stake — A Shift in Tech’s Competitive Landscape?

- NVIDIA Corp (NVDA US) surprised the market with its announcement of a $5 billion investment in Intel Corp (INTC US).

- The market seems to read this as the beginning of a deeper Intel–NVIDIA partnership in AI chips.

- We also note that Japan’s push to establish its own foundry industry through Rapidus deserves continued attention, as it could reshape the competitive map in the years ahead.

8. Memory Monitor: The Sticky Era — Memory’s Transition from Spot Pricing to Long-Cycle Commitments

- The Industry Is Moving From Cyclical Volatility Into a Sticky Pricing Era.

- Why Memory Pricing is Becoming Sticky. — HBM Memory is Hard to Swap Out Once Designed Into a GPU Product.

- Investment View: Entering Memory’s Sticky Pricing Era — Structurally Long Micron & SK Hynix; Underperform for Nanya Tech.

9. UK Sovereign AI Proudly Paid For & Made In The USA

- Microsoft CEO Satya Nadella announced his intention to spend $30 billion on AI infrastructure in the UK. NVIDIA, Coreweave, Alphabet and OpenAI are also ponying up further billions

- Jensen Huang declared the UK and AI powerhouse, third in line globally behind the US and China

- Is it really UK sovereign AI when it’s mostly paid for and made in the USA?

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Kokusai Electric (6525 JP) was IPOed too cheap in 2023 after a couple of years in the wilderness and an aborted private sale effort, blocked on antitrust grounds.

- It nearly tripled, there was an offering announced at ¥5,000+ priced ¥4,500+. Shares fell back to IPO price, then bounced, and we got a July follow-on offering at ¥3,000+.

- I suggested here the back end could be squeezy. It was for a hot minute, then it wasn’t. Now the stock is up 50% in 2 weeks. Watch out!

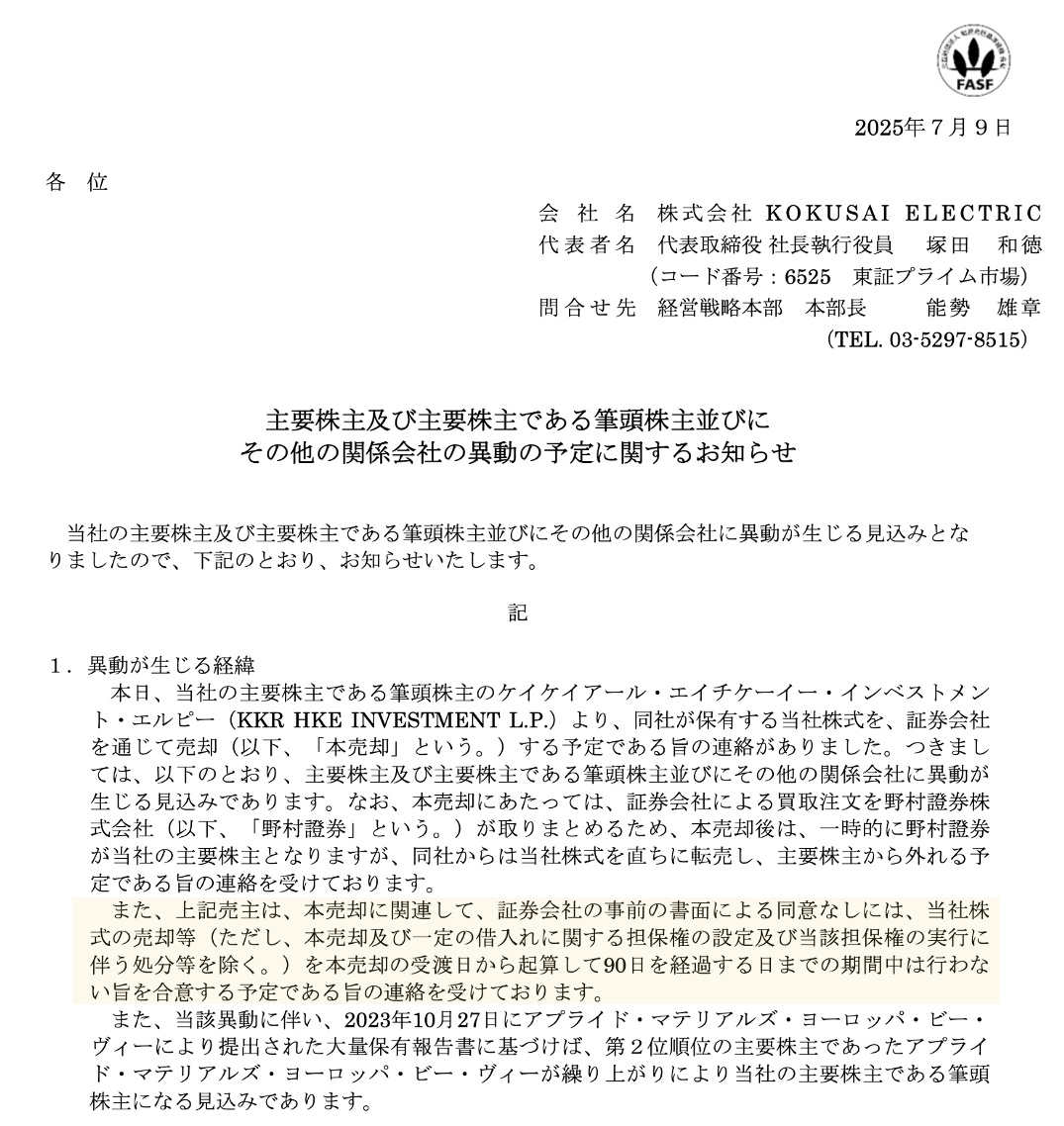

2. Zijin Gold IPO: Strong Cornerstone Book; Should Trade at Premium to Group

- Zijin Gold (2259 HK) is looking to raise US$3.2bn in its upcoming HK IPO.

- It s a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance in our previous notes. In this note, we talk about valuations.

3. Zijin Gold Pre-IPO: Superior to Peers; Should Trade at High End of Group

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance and done a peer comparison in our previous note. In this note, we will look at the firm’s valuation.

4. ECM Weekly (15 September 2025)- Chery, Zijin Gold, Hesai, Orion, Myungin, Urban, Nio, Kotak, Toei

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, things are picking up going into the year end, as is usual, with multiple US$1bn+ deals said to go live over the next few weeks.

- On the placements front, as well, market remains receptive for both primary and secondary offerings.

5. Zijin Gold Pre-IPO: PHIP Update: Acquisition of Raygorodok Mine for a Song

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance, and done a peer comparison in our previous note. In this note, we will provide a PHIP update.

6. Zijin Gold IPO: PHIP Updates Support the Investment Thesis

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is pre-marketing an HKEx IPO to raise US$3bn.

- I previously discussed the IPO and outlined my investment thesis in Zijin Gold IPO: The Investment Case.

- In this note, I take a look at the new information from the PHIP. The 1H25 results and latest developments underscore my previous bullish thesis.

7. Centurion Accomodation REIT IPO – New Asset Class

- Centurion Accomodation REIT (CAREIT SP) (CAREIT) plans to raise around US$600m in its Singapore listing.

- CAREIT plans to invest directly or indirectly, in a portfolio of purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA) or other accommodation, located globally (excluding Malaysia).

- In this note, we look at the REIT’s portfolio and performance.

8. Pre-IPO Zijin Gold (PHIP Updates) – Thoughts on the Business, the Forecast and Valuation Outlook

- The spin-off of Zijin for an independent listing is equivalent to presenting a “pure gold business” to the market. Such “asset revaluation” can unlock the hidden value of gold business.

- For enterprises like Zijin in the upstream of gold industry chain, a sustained high and rising gold price is usually a significant positive factor. However, there are also potential risks.

- Zijin Gold has better growth potential than peers, so we think its valuation range could be P/E of 18-22x. If based on 2025 net profit forecast, valuation is US$36.9-45.1 billion.

9. Chery Automobile IPO (9973 HK): Valuation Insights

- Chery Automobile (9973 HK) is a Chinese automobile manufacturer. It has launched an HKEx IPO to raise up to US$1.2 billion.

- I previously discussed the IPO in Chery Automobile IPO: The Bull Case and Chery Automobile IPO: The Bear Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is reasonable.

10. Hesai Secondary Trading – Decent Demand, Despite Lack of Correction

- Hesai Group (HSAI US) raised around US$530m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the ADS movement and trading dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Mining (2899 HK): This Is A Short

- In my June note, Zijin Mining Group (2899 HK) appeared fully valued; but I (thankfully) stopped short of being outright bearish. Its share price is up 48% since!

- A basket of peers is also up 37% since that note. Gold is up~8%, and 41% YTD. On the 14th September, Zijin released Zijin Gold’s PHIP. 1H25 numbers were solid.

- However, Zijin Gold’s earnings are by no stretch an outlier. Zijin’s Mining’s current share price is now baking in exceptional (unrealistic?) metrics for the gold play spin-off.

2. Zijin Gold (2259 HK) IPO: HSCI Fast Entry; Quick Stock Connect Add; Global Indices Entry in 2026

- Zijin Gold (2259 HK) is looking to raise up to HK$28.7bn (US$3.7bn) in its IPO, valuing the company at HK$191.6bn (US$24.6bn).

- Zijin Mining (2899 HK) will hold between 85-86.7% of Zijin Gold and that will limit the free float of the stock. Half the IPO has been allotted to cornerstones.

- Zijin Gold could be added to the HSCI via Fast Entry and to Stock Connect in October. Global index inclusion should take place in the first half of 2026.

3. [Japan M&A/Activism] SOFT99 MBO Sees Activist EffissimoOverbid by 66%! Will This Set New Precedent?

- In early August, the founder-family announced they would MBO the car care company Soft99 Corp (4464 JP). It was a very cheap MBO. Even 20% higher it would be cheap.

- On Saturday, Kyodo, followed by various other media outlets, announced activist Effissimo Capital Management had announced a TOB to buy the company saying the MBO was “an extremely low level.”

- The Nikkei-reported goal would be “to protect the interests of minority shareholders while ensuring medium- to long-term increases in corporate value.” This is REALLY BIG NEWS.

4. Chery Auto (9973 HK) IPO: No Inclusion in Global Indices; HSTECH Is Interesting

- Chery Automobile Co. Ltd. (9973 HK)‘s IPO range is HK$27.75-HK$30.75/share and will raise up to HK$10bn (US$1.3m) if the oversubscription option is exercised, valuing the company at HK$169bn (US$21.7bn).

- The stock should be added to the HSCI Index in December and that will make the stock eligible for inclusion in Southbound Stock Connect.

- There will be no inclusion in global indexes for the next year, but there is a possibility of inclusion in the Hang Seng TECH Index (HSTECH INDEX) in December.

5. Mori Hills REIT (3234) – Large Sponsor Buy in Market as % of Max Real World Float

- In the past 24 months, J-REIT sponsors have bought units in their REITs at sharp discounts to PNAV to raise PNAV and reduce overhang pressure.

- The goal is, basically transparently, to get PNAV to a level at which the REIT can buy more properties from the sponsor, who carries them at a much higher WACC.

- Mori Building has announced a 4.99% buy on Mori Hills REIT Investment Corporation (3234 JP) which is a Very Big portion of Max Real World Float. This should influence price.

6. HK Connect SOUTHBOUND Flows (To 12 Sep 2025); HUGE Single Stock Trading, ETFs Meh. Tech Bought Bigly

- Gross SOUTHBOUND volumes just under US$20+bn a day this past 5-day week. BIG Net buying. Big BABA trading.

- SOUTHBOUND investors traded US$9bn of Alibaba (9988 HK) in the week. Not shy. It was a big net buy as well (4 of 5 days was +US$500mm or more).

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

7. Soft99 Corp (4464 JP): Effissimo Sheds More Light on Its Hostile Offer

- Effissimo has formally launched its hostile tender offer for Soft99 Corp (4464 JP) at JPY4,100, which is 66.3% higher than the MBO price of JPY2,465.

- The Board stonewalled Effissimo’s attempts to negotiate a friendly offer. The huge premium of Effissimo’s offer relies on lower WACC assumptions compared to the target/special committee IFA.

- Management’s initial approach will be to rely on the Board to oppose the Effissimo offer. There is a good chance that Soft99 will remain listed with two large shareholders.

8. [Japan M&A/Activism] The Nagging Little Detail In the Soft99 MBO Extension Target Doc

- Yesterday, Soft99 Corp (4464 JP) announced a slight change in its “Target Opinion Document” after the MBO Bidco extended its TOB by 8 days the day before.

- The detail was not in the MBO Bidco extension. It was just revealed in an added note on p3 of the Target Opinion.

- That details matters A LOT to people looking at the Effissimo Overbid. The company’s Board has some serious work ahead.

9. Flagging a New Passive Flow Trading Opportunity Triggered by Korea’s Divvy Policy Momentum

- PLUS High Dividend ETF (161510 KS) reshuffle is now a key flow catalyst: June saw GS E&C and HD Hyundai out, Hyundai Motor in, with sharp one-day moves.

- December review shaping up as 2-in/2-out: Seoul Guarantee (031210) and LG Corp (003550) in, Shinhan (055550) and KB (105560) out.

- Passive flows: Shinhan/KB ~0.3–0.4x DTV, LG ~3x, Seoul Guarantee 5–6x. With AUM up 30% since June, upcoming adds face outsized passive impact.

10. Zijin Mining (2899 HK): Zijin Gold Priced At US$24bn

- The global offering doc for Zijin Gold (2259 HK) is out.

- At the IPO Price of HK$71.59/share, Zijin Gold’s implied market cap is HK$187.9bn or US$24bn. Commencement of trading is the 29th September.

- Zijin Mining (2899 HK) will hold 86.7% in Zijin Gold post-IPO (before over-allotment). Even if Zijin Gold trades north of HK$100/share, Zijin Mining is fully valued.

Receive this weekly newsletter keeping 45k+ investors in the loop

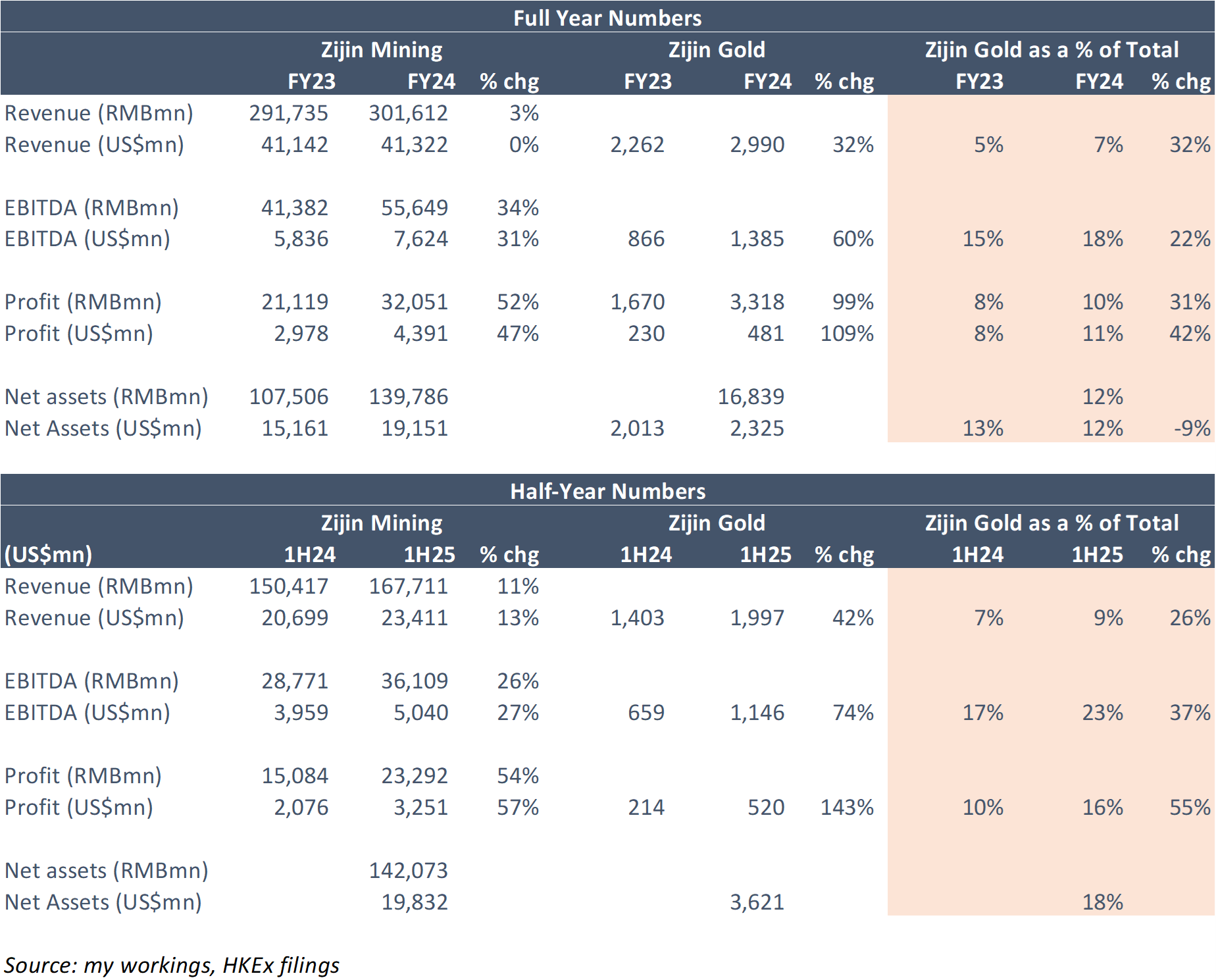

1. KOSPI 200 Tactical Call: Positioning for September Pullback

- The KOSPI 200 INDEX reached a new all time high last Friday, closing at 462.74. Let’s be clear: it’s very overbought according to our model.

- Our forecast is that the index will NOT rally for more than another 1 or 2 weeks (i.e. this week and maybe one more week).

- 449-442 is the price support zone with 50%-75% probability of reversal, if it was hit this week (this data will be updated if the index closes up this week).

2. HDFC Bank (HDFCB IN) Tactical Outlook: Will The Rally Continue?

- HDFC Bank (HDFCB IN) has been in a mild pullback since the end of July. The stock closed up for 2 weeks but has not reached any significative overbought level.

- This week HDFC Bank went down a bit, stayed above the Q1 support level but this pattern is very bullish, in the past it gave way to long, profitable rallies.

- We cannot say for sure if the stock will rally up from here, but if it does, consider profit targets north of 1034 (Q3), and it could rally higher.

3. ‘Toppish’ Nikkei 225’s Outlook: Where to Cover, Where to Buy

- The Nikkei 225 (NKY INDEX) reached 44790 on Wednesday, this is the 3rd week up in a row for the index, this market is OVERBOUGHT.

- The outlook remains bullish, the forecast is for a pullback, followed by another leg up.

- This insight’s goal is to help you figure out where to cover your LONG Nikkei 225 positions, and where to add more LONG positions during the pullback.

4. HDFC Bank (HDFCB IN): Ready for the Rally with Tactical Low-Cost Options

- Context:HDFC Bank (HDFCB IN) remains in a bullish setup. Quantitative models highlight further upside potential in the near term and identify key support levels.

- Trade Idea: With implied volatility near multi-year lows (12th percentile), long call strategies are favored. Suitable expiries and strikes are outlined, with an alternative structure discussed for reducing premium outlay.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where low implied volatility and bullish probabilities align, offering investors defined risk/reward.

5. Asia/Pacific Stocks Outlook For the Week Sep 15-19

- 1-Week directional forecast for the Asian indices and stocks we track, based on our proprietary probability model.

- OVERBOUGHT: Samsung Electronics (005930 KS) , Taiwan Semiconductor (TSMC) (2330 TT) , Softbank Group (9984 JP) , HSI Index , KOSPI 200 INDEX , Nikkei 225 .

- OVERSOLD: BYD Company (1211 HK) , S&P/ASX 200 INDEX .

6. HK Volatility Cones: Volatility on the Rise, Meituan and Ping An Historically Cheap

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has increased across the board, but while some stocks recorded a 5-10% increase, other just added 1-2%. Upcoming November earnings start to shape the term structure.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

7. BYD (1211 HK) Tactical Outlook: Rally or Bear Rally?

- In our previous insight from September 2 we suggested if BYD (1211 HK) reached 102 could have been a good BUY signal.

- It took a bit more than a couple of week for the stock to bottom at 102.80 (this week), then rally 10% to 113.50. Impressive, but….

- … it could be a Bear rally, so in this insight we will try to assess BYD upside potential, and suggest some tactical positioning for the next few weeks.

8. Hong Kong Single Stock Options Weekly (Sept 15 – 19): Caution Signs Emerge as HSI Stretches Higher

- HSI tested new highs before fading, as weak breadth and strong option volumes highlighted diverging signals in Hong Kong equities.

- Technically, HSI may have reached a level from which minor corrections have started.

- Option trading activity surged, reaching its busiest day since November, even as overall market momentum faltered.

9. Global Monetary Tides Turn: Fed Cuts, Europe Holds, Japan’s Stance and Market Impacts Explored

- Global central banks are navigating divergent monetary policies, with the Fed initiating rate cuts while European and Japanese counterparts maintain cautious stances amid varying inflation and growth outlooks.

- Significant economic headwinds, including the impact of tariffs and political instability in key regions, are influencing central bank decisions and contributing to a nuanced global economic landscape.

- This environment of diverging policies and persistent economic pressures sets the stage for a strategic market opportunity, focusing on volatility dynamics in developed markets.

Receive this weekly newsletter keeping 45k+ investors in the loop

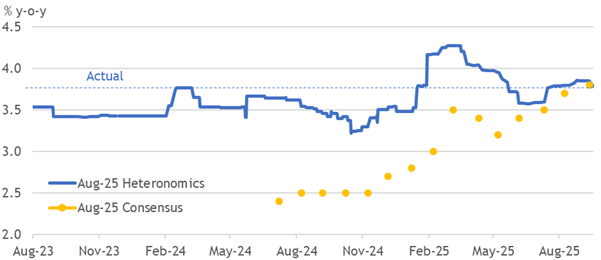

1. UK CPI Stickier For Longer

- UK inflation data confirmed the substantial upwards drift in the consensus, worth 0.6pp since May and 1.1pp over the past year, while matching final forecasts for August.

- The consensus has shifted further than usual over the past month. It now aligns with our hawkish forecast until April, when hope again dominates in dragging inflation down.

- Although the MPC won’t be shocked by this outcome, the persistent excess in underlying inflation still seems set to keep it holding rates. We do not expect cuts to resume.

2. UK Jobs Find Their Floor

- Stability in unemployment at 4.66%, while payrolls only marginally decline, suggests the labour market has found its floor before disinflationary pressures accumulate.

- A narrative-breaking improvement could occur next month. Tax rises structurally explain the scale of the previous shock, with weakness seemingly not going beyond that.

- Excess supply is needed to break wage growth to a target-consistent trend. Without that, the MPC should hold rates before potentially reversing by raising them in 2026.

3. Emerging Markets Outlook and Strategy for September 2025

- Global growth has been better than expected, particularly in emerging markets, due to strong export performance and tech cycle strength

- China’s growth is expected to slip below 3% in the second half, with domestic demand slowing sharply

- Despite the growth resilience in EM, central banks are expected to continue their gradual cutting cycle due to weak domestic demand and disinflation trends

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Generative AI in Investment Mgmt: Value Investor’s Perspective w/ Ehsan Ehsani | New Barbarians #035

- Ehsan Ehsani, executive director at Crescendo Partners and adjunct professor at Columbia Business School, joins the discussion with Harmonic Insights and will be organizing the Generative AI and Investment Management Conference at Columbia.

- Futures markets are predicting a 25 basis point cut with more cuts in the future, while volatility and factor returns continue to be influenced by macro factors.

- Quantitative investors typically do not make significant changes to their portfolios based on short-term data, instead focusing on longer-term trends and statistically significant moves.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

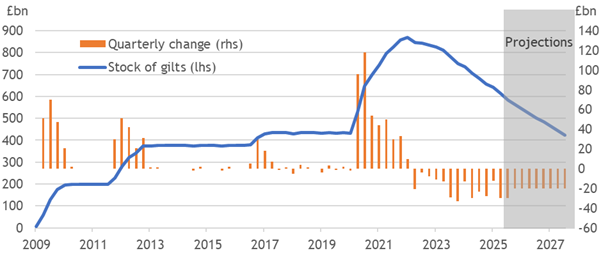

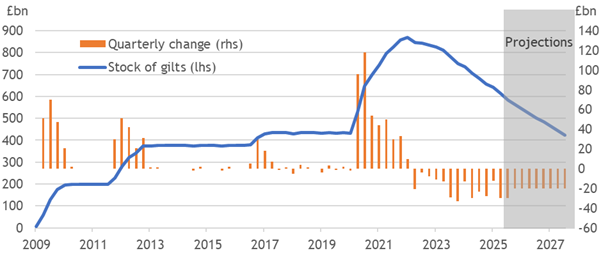

5. BoE Trims QT To Hold Policy Steady

- The MPC unsurprisingly held rates while seeking an answer to its key question around inflation risks amid elevated expectations and a possible structural shift.

- It also trimmed QT by £30bn to £70bn, keeping active sales of long gilts steady in the next three quarterly auctions while skewing QT towards short and medium gilts.

- We still expect the MPC’s presumption of rate cuts resuming to fade out in early 2026 as hawkish pressures persist. Some offsetting fiscal space arises from QT being trimmed.

6. Japan Macro: Restarting Coverage

- Bank of Japan likely to remain on hold till January 2026 with risk of further delay

- Once BoJ resumes hiking cycle, it will likely follow twice a year pace till 1.5%

- With the Fed cutting rates, the long end of the JGB curve is firmly anchored

7. HEW: Cautious Cuts Through The West

- Economic data releases revealed more resilience in labour markets than feared, while inflation remained high. Yet Western central banks broadly cut rates, albeit cautiously.

- The BoE’s caution left only two dovish dissents to its on-hold decision, while it cut QT by £30bn to £70bn to reduce the likelihood of gilt market indigestion.

- Next week’s SNB and Riksbank decisions should join the BoE in holding steady, although they have already cut much further. Flash PMIs are the data focus in a thin calendar.

8. US: You Ain’t Seen Nothin’ yet on the Impact of the Trump Tariffs

- China’s share of US imports will halve in 2025 from Mar’18 peak of 21.8%, and ASEAN’s share (led by Vietnam) will rise to 14%. India, Korea, Taiwan’s shares gain too.

- There was a big surge in Asian exports to the US in Jun-Jul’25 to beat tariffs, but tariffs will alter patterns in 4Q2025, cutting export growth and reducing US disinflation.

- The rebound in US steel production (+4.6%YoY in Jun-Jul’25) and ISM manufacturing new orders suggests select American industries (metals, automobiles, electronics) will gain but downstream users will suffer steadily more.

9. Twilight of the AI Bull?

- The leadership of AI-driven stocks is starting to stumble from bubbly valuation levels, which brings up the warning from Bob Farrell’s Rule #4.

- The debate is ongoing as to whether the AI bull is evolving from hyperscaler leadership to the next phase of companies that can better exploit the technology.

- The lack of cyclical market leadership is concerning from a technical perspective. We are therefore tactically cautious about the short-term outlook for U.S. equities.

10. Dialling down the Noise

- Traders, Quants and Passive Investors have steadily crowded out most earnings signals for long term investors.

- Quarterly reports won’t be missed, and ironically their ending may help restore the role of fundamental analysis.

- However, narrative trading will simply go elsewhere and developments in AI, options and meme stocks are already creating a new asset class we might call ‘Equity as Crypto’.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. @Sama Says There’s An AI Bubble. What’s Going On?

- OpenAI CEO Sam Altman caused quite a stir with his recent comments about an AI bubble, people getting burned and someone on track to lose a phenomenal amount of money

- However, his message would appear to be directed at other AI startups, not OpenAI, which he says plans to spend trillions on data centers in the not very distant future

- Meta’s no-cost-spared talent grab & Palantir’s valuation are bubbly red flags but the AI infrastructure build out currently underway is real & rational, assuming the ROI can follow expeditiously

2. MIT Report Claims 95% of GenAI Projects Fail. How Is This Possible?

- Despite $30–40 billion in enterprise investment into GenAI, this report uncovers a surprising result in that 95% of organizations are getting zero return

- While employees are likely using LLMs in a personal capacity, this mostly isn’t feeding into the KPI’s that are being used to monitor the success of GenAI projects

- The harsh reality is that integrating GenAI tools into existing workflows is time consuming, needs careful planning and likely best done with help from the professionals.

3. Texas Instruments & KLA Signal Continued AI Strength, Foreshadow TSMC’s 2nm Breakout

- TI is experiencing 50%+ YoY growth in data center, showing no signs of AI server demand slowdown.

- KLA calls 2nm a “compelling” node, projecting it could be the industry’s largest over first three years.

- Taiwan Tech positioned to benefit via TSMC N2 ramp, CoWoS packaging, and ABF substrate expansion.

4. UMC (2303.TT; UMC.US): 4Q25 Revenue Is Projected to Decline 5–10% QoQ.

- United Microelectron Sp Adr (UMC US) – 2025 Full-Year and 4Q Outlook.

- The impact of U.S. recent restrictions on United Microelectron Sp Adr (UMC US) appears negligible.

- Customer demand trends are diverging in 2H25, and overall demand is expected to soften in 4Q25.

5. TSMC (2330.TT; TSM.US): TSMC Has Raised Wafer Prices; Rapidus Provides 2nm Milestone.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) has raised wafer prices, with 2nm wafers expected to cost at least 50% more—exceeding USD 30,000 per wafer.

- Rapidus plans to begin 2nm engineering production in 1Q26 and target mass production by 2027, likely one node behind TSMC.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) is expected to be ready for iPhone 17 production.

6. Taiwan Tech Weekly: SEMICON Taiwan Just Started; TSMC August Sales Soar; 2026 to Be Year of Edge AI?

- TSMC August Revenue +34% YoY: AI Demand Remains the Key Driver

- ARM Pushes Edge AI Forward with New “Lumex” Chip Designs — 2026 Could Be a Major Growth Year for Edge AI

- From AI Packaging to AI Edge: Listed Names to Watch at SEMICON Taiwan 2025 Starting Today

7. From AI Packaging to AI Edge: Listed Names to Watch at SEMICON Taiwan 2025 Starting Today

- Defining themes: Packaging, edge AI, and silicon photonics dominate SEMICON Taiwan 2025

- Global heavyweights Applied Materials, Lam, and TEL anchor this year’s industry sponsorship

- Taiwan’s next tier — Zhen Ding, ASE, Advantech, ASPEED, Egis — showcase critical AI enablers beyond TSMC

8. Hitachi Ltd. (6501 JP): Short and Long Term Benefit from New U.S. Investments

- More than $1 billion to be invested in electric power equipment and railway car production, plus a new automation center, to counter tariffs and support long-term expansion in the U.S.

- The rising share of sales accounted for by smart factory and other digital technologies should lead to higher profit margins and ROIC over the next several years.

- The share price has dropped 13% from its recent high to 26x EPS guidance for FY Mar-26. Buy on weakness for long-term growth. The main risk is a slowing economy.

9. Intel (INTC.US): Who Will Adopt Intel’s 14A Technology?

- Why does Intel Corp (INTC US)’s current CFO state “Intel will use TSMC basically forever”?

- From Taiwan Semiconductor (TSMC) – ADR (TSM US)’s perspective, they have always maintained a “no competition with customers” principle.

- Another question remains: who will adopt Intel’s 14A technology in 2027-28?

10. Taiwan Dual-Listings Monitor: TSMC Extreme Level; ASE Spread Hits Parity; ChipMOS Near Long Level

- TSMC: +24.4% Premium: Remains at Level to Short the ADR Spread

- ASE: 0.0% (Parity); Open Fresh Longs Here or at a Discount

- ChipMOS: -1.9% Discount; Near Level to Go Long the Spread

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO: The Investment Case

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is seeking to raise US$3 billion.

- Zijin Gold hold interests in eight gold mines located in gold-rich regions across South America, Oceania, Central Asia and Africa.

- The investment case is bullish due to a diversified mine portfolio, strong growth, an attractive margin profile, robust cash generation, and modest leverage.

2. [Japan ECM] Toei Animation (4816) Not as Interesting An Offering As It Could Have Been

- In Feb 2024, I wrote Toei Animation (4816 JP) – This Offering Could Be Heavy; the NEXT Offering Is More Interesting.

- Today, the company announced another offering where Fuji Media Holdings (4676 JP) is selling 10.575mm shares in an overseas offering priced likely tomorrow.

- It is not as interesting as I had expected. But it means the NEXT offering could be more interesting. But there is index buying long-term anyway.

3. Hesai Secondary Offering – Stock Hasn’t Corrected Yet

- Hesai Group (HSAI US) plans to raise around US$450m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

4. ECM Weekly (8 September 2025)- Metaplanet, Lifedrink, Koei, Hesai, Orion, Myungin, Hesai, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a few US$1bn+ IPOs are said to be looking to launch later this month, across regions.

- On the placements front, deals continue to flow through as the market remains receptive.

5. NIO (NIO US/9866 HK): An Opportunistically Timed US$1 Billion Raise

- NIO (NIO US), a Chinese premium electric vehicle manufacturer, has launched an equity offering to raise around US$1 billion.

- The raise is opportunistically timed to take advantage of the 83% QTD share price rally and comes hot on the heels of a US$513 million raise in April.

- While NIO continues to target a break-even in 4Q25 and reduce its cash burn, the valuation is stretched. A history of false dawns and intensifying competition warrants caution.

6. Toei Animation Placement: Expensive, but Owns Valuable IP

- Toei Animation (4816 JP) ’s shareholder, Fuji Media, is looking to raise around US$210m from a secondary placement.

- The deal is a large one to digest, representing 41.7 days of the stock’s three month ADV and 4.9% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

7. NIO HK/ADS Placement – Slightly Better Placed, but Slightly Bigger Deal at US$1bn

- NIO (NIO US) is looking to raise around US$1bn via a primary placement in Hong Kong and US.

- The company had last raised around US$450m in March 2025. The deal didn’t end up doing well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Zijin Gold IPO Valuation Analysis

- Our base case valuation of Zijin Gold suggests implied EV of US$40.4 billion and market cap of US$42.9 billion.

- Our EV/EBITDA valuation multiple of 14.3x is based on a 50% premium to the comps’ valuation multiple in 2026.

- We believe a 50% premium valuation to the comps’ average EV/EBITDA multiple is appropriate for Zijin Gold mainly due its higher sales growth, EBITDA margins, and ROE than the comps.

9. Chery Automobile IPO: The Bear Case

- Chery Automobile (CH3456 CH), a Chinese automobile manufacturer, has secured HKEx listing approval for a US$1.5-2.0 billion IPO.

- In Chery Automobile IPO: The Bull Case, I highlighted the key elements of the bull case. In this note, I outline the bear case.

- The bear case rests on weakening trends of the primary business, gross margin pressure, declining contract liabilities and factoring of receivables.

10. Zijin Gold IPO Preview

- Zijin Gold is getting ready to complete its IPO in Hong Kong this year. A successful IPO of Zijin Gold could fetch as high as US$3 billion in IPO proceeds.

- Zijin Gold had sales of US$3.0 billion (up 32.2% YoY) in 2024. Net margin increased from 14.2% in 2023 to 20.8% in 2024.

- There has been a sharp increase in the gap between gold AISC (all-in-sustaining cost) and gold price in the past year, leading to higher profit margins of gold producers globally.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event/Buyback] The Sony Financial Spinoff – ‘Maybe’ BUYBACK Complicates Planning

- The Sony Financial Holdings (8729 JP) (now called Sony Financial Group Inc (“SFGI”)) spinoff approaches. It will start trading 20 days from now.

- Yesterday, the TSE confirmed approval (outline, Securities Report (J), Corporate Governance Report (J). The company provided details of a possible ToSTNeT-3 buyback on Day 2 pre-open. That complicates things.

- The introduction of that type of buyback flexibility indicates that supply overhang may be managed better than buyers would hope. Means other strategies may be necessary.

2. [Japan M&A] Mandom (4917 JP) MBO – Light Price, Open-Ish Register, Tough to Take Over, Could Do Fun

- On 10 September, the founding Nishimura family, the PE Firm CVC, and Mandom Corp (4917 JP) agreed that the first two could take over the latter at 4.9x Mar28 EBITDA.

- A cocktail napkin calculation of expected leverage suggests the equity check is buying this at 5x average Mar27-28 free cash flow. That’s cheap for a growing company.

- The register is open enough to cause problems but not open enough to allow a clean hostile bid by a strategic. But still open enough for someone to have fun.

3. Dongfeng (489 HK): Questioning The EV Listing Valuation

- Back on the 22nd August, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- The share price closed up 54% on the first day, ~15% adrift of the independently valued cash + scrip (into VOYAH) under the privatisation.

- Shares have pared back 5% since. VOYAH’s peer basket has fallen ~15% on average. The market is implying a price-to-trailing-sales of 1x for VOYAH versus the basket average of 1.9x.

4. Merger Arb Mondays (08 Sep) – Kangji, OneConnect, Ashimori, Pacific Ind, RPM, Santos, Zeekr

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), Toyota Industries (6201 JP).

5. Mandom (4917 JP): A Light CVC-Sponsored Preconditional MBO

- Mandom Corp (4917 JP) has recommended a CVC-sponsored preconditional MBO at JPY1,960, a 32.1% premium to the last close price.

- The offer is below the midpoint of the IFA DCF valuation range and the special committee’s requested price. It is unattractive compared to precedent transactions and peer multiples.

- The offer is unequivocally light. The setup has the potential for a bump, particularly if an activist emerges as a substantial shareholder.

6. Regarding the Six KRX Sector Names that Ran Ahead of Friday’s Official Review Drop

- Six names stood out with simultaneous volume spikes and sharp pops last Friday; all Semis and Autos additions with big passive impact, while all others showed no tape action.

- Results likely leaked early, prompting front-running on Semis and Autos adds—high passive impact names—causing Friday’s sharp volume and price spikes.

- Early movers are mostly priced in; Thursday momentum plays still work, but Monday–Thursday morning requires caution. Focus on volume-driven flows before loading positions, long-short basket viable for other passive-impact names.

7. [Japan M&A] Pacific Industrial (7250) The MBO Is Extended After Effissimo Buys Above Terms

- Activist-Ish-Y investor Effissimo reported Friday they had a 6.68% stake as of the end of August.

- Their average price is ¥2,253 which is 10% through the price the family Bidco was bidding (¥2,050).

- As this hasn’t traded below terms at any point since announcement, an extension was likely. This morning, we got one. We’ll get another one before it’s done, BUT…

8. Timing the HHI–Mipo Spread Play Around the Passive Inflow Kick

- HHI–Mipo spread holds 3–4%; cancellation risk minimal. Market views HHI as the cleaner MASGA play vs. Mipo, keeping the spread sticky and unlikely to tighten soon.

- Potential kicker for widening comes from passive inflows when Mipo halts, as HHI gains weight in Global Standard vs. Mipo’s Small Cap.

- HHI may see ~4x DTV passive inflow as it absorbs Mipo; pre-announcement flows could start late October, potentially widening the swap spread ahead of the Nov 27 halt.

9. PointsBet (PBH AU) And Mixi Double Down Ahead Of Offer Closing

- On the 29th August, Mixi (2121 JP) cleared 50% of the voting power in PointsBet (PBH AU). It’s Offer was automatically extended, and will now close on the 12th September.

- Mixi has 51.59%. betr Entertainment (BBT AU) said it holds 20.45%, plus 6.5% in the IAF, the instructions for which can be withdrawn. betr said it won’t accept Mixi’s Offer.

- Mixi adds betr will have no PBH board representation “either now or in the future”; and betr will continue to be a clear competitor. Additionally, PBH questions betr’s buyback funding,

10. StubWorld: The Murdoch Succession Into News Corp, Fox & REA

- After a protracted succession stoush, Rupert Murdoch’s son Lachlan is set to take control of News Corp (NWS US) and Fox (FOXA US).

- Preceding my comments on News Corp and 62%-held REA Group Ltd (REA AU) are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

Receive this weekly newsletter keeping 45k+ investors in the loop

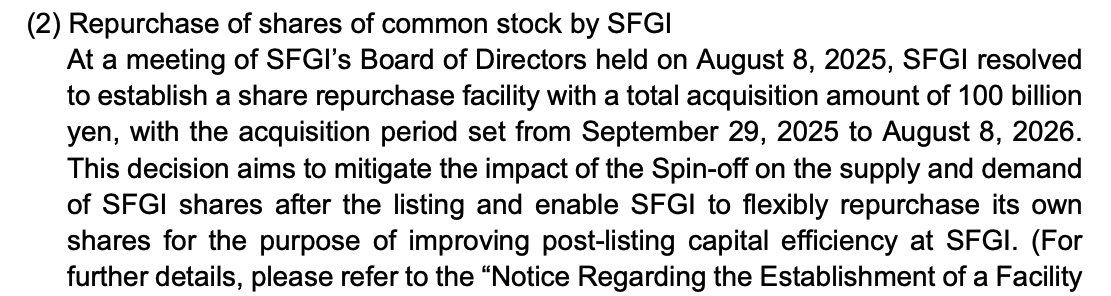

1. Volatility Cones: Spotting Opportunities in Tencent, JD.com, Ping An & More

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Major stocks, including Tencent (700 HK), Xiaomi (1810 HK), and Meituan (3690 HK), trade at historically cheap implied volatility. Upcoming earnings are starting to be reflected in November IV.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

2. China Mobile (941 HK): Tactical Outlook as HKBN Deal Unfolds

- As you all know China Mobile (941 HK) has strategically ramped up its ownership in HKBN Ltd (1310 HK) aiming at full control/takeover, while navigating regulatory approvals and competitive bids.

- The stock suffered a pretty big drop in the last 2 weeks, especially last week, when it reached 85.1. This week the stock started a small recovery rally.

- Our model finds China Mobile oversold (short-term) but we cannot rule out a further drop to/below 83.2 (Q3 support), the current pattern is bearish: brief rally then down again.

3. Samsung Electronics (005930 KS): Tactical Outlook and Profit Targets

- Samsung Electronics (005930 KS) has been in a downtrend for 4 weeks, but it was only mildly oversold (60% prob. of reversal last Friday, at the Close).

- After 4 weeks down, this week the stock re-started its rally, touching 71200 on Tuesday at the Close.

- This insight will try to define the short-term profit targets for this rally (spoiler: they are not far, at least from the TIME MODEL perspective…).

4. Mitsubishi Electric’s Nozomi Networks Acquisition, a Potential Catalyst

- Mitsubishi Electric’s $1 billion acquisition of Nozomi Networks is a strategic move to continue its transition from hardware manufacturing to a leading solutions provider in the expanding industrial cybersecurity market.

- This significant deal is expected to create growth and synergy by combining complementary strengths in operational technology (OT) security.

- The acquisition represents a major commitment to digital transformation, which is anticipated to have a positive impact on Mitsubishi Electric’s stock performance in the 5-10 year horizon.

5. Hang Seng Index (HSI) Profit Targets: Has The Rally Topped?

- The Hang Seng Index (HSI INDEX) has been rallying +37% since its plunge to 19260 on April 7th. It is +6% higher than its previous high in mid-March.

- The sentiment towards the index remains positive lately, and our model indicates the HSI is a bit overbought but could go higher.

- The HSI INDEX starts to be toppish around 26874 (75% prob. of reversal). Covering past that point is not a bad idea, especially if the index is up 3-4 weeks.

6. Hong Kong Single Stock Options Weekly (Sept 08 – 12): Alibaba Surge Helps Push HSI to Four-Year High

- HSI broke out to fresh four-year highs, driven by Alibaba’s surge, with broad-based gains and rising single stock option activity.

- Market breadth strengthened across both price action and single stock options flows.

- Spot-Up/Vol-Up dynamics defined the week, as sectors with strong gains also posted the largest implied vol increases.

7. Global Markets Tactical Outlook: WEEKLY Recap (Sep 8 – Sep 12)

- A synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, week September 1 – September 5. The MODEL’s SUPPORT/RESISTANCE data file is attached.

- OVERBOUGHT at the WEEKLY Close: Alphabet (GOOG US) , Taiwan Semiconductor (TSMC) (2330 TT) , Gold (GOLD COMDTY) , 10-Year US Treasuries (ZN Futures)

- OVERSOLD at the WEEKLY Close: NVIDIA Corp (NVDA US) , Samsung Electronics (005930 KS) , China Mobile (941 HK) , Softbank Group (9984 JP)

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BoE QT: Pruning A Bad Policy

- The BoE’s annual Quantitative Tightening announcement in September should see it prune the targeted size, we expect by £20bn to £80bn, concentrated in the long-end.

- Fewer maturities in the year ahead would otherwise put too much pressure on active sales into a market that lacks appetite, especially with LDI demand disappearing.

- Pruning the size and duration delays costs crystallising by several billion a year, which the Chancellor will welcome, yet QT’s poor design remains an expensive fiscal disaster.

2. Fed: Politics Vs Fundamentals

- President Trump’s current preference for rate cuts is not unconditional. Higher-order logic suggests this would not override fundamental resilience or fairly prove “TACO”.

- Political pressure is state-dependent, with the messenger mattering more than the objective truth beneath any message. Trump’s Chair will have a stronger hand.

- Brazil suffered President Lula’s pressure, but he still supported his “Golden Boy’s” turn from dovish dissent to forceful rate hikes. Fed pricing ignores the potential for change.

3. France: Déjà Vu?

- Despite the near certainty that the Bayrou government will fall on 8 September, investors are wary, rather than spooked, reckoning that they have seen all this before.

- They are likely correct to judge that compromises will then be found, allowing the 2026 budget to be passed by a new centrist government.

- However, this would again only be putting off the day when a real crisis point is reached.

4. HEW: Crystalising Policy Divergence

- Spreads between ECB and Fed expectations widened again this week as the ECB held rates with a neutral bias while disappointing US labour market data drive dovish hopes.

- Underlying US services inflation was soft, and initial jobless claims spiked, albeit over Labor Day. We think US pricing has gone too far, and political pressure won’t dominate.

- Guidance with the Fed’s upcoming cut could start to correct that. The BoE will hold rates, after more hawkish macro news next week, and should trim its QT plan this year.

5. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (September 11)

- HSTECH index is showing increasing strength as Hong Kong continues it Secular Bull Market. Continued strong market breadth indicates both rotational buying and new investors entering the market.

- Southbound buying from mainland investors remains strong after the “Liberation Day announcement. Mainland investor volume is now 20% of total volume in the Hong Kong market.

- China Biotech and Drug sectors were hit as the U.S. administration indicated it may begin restricting import of Chinese-made drugs and to cut off the pipeline of Chinese-invented experimental drugs.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (September 10)

- The Hong Kong secular bull market continues to broaden and has broken all long term resistance levels. The HSCEI has beaten Asian and global peers over the last 18 months.

- Growth and Momentum factors have been the best performers in the HSCI year to date. The Materials and Healthcare sectors continue to show increasing strength in their relative returns.

- Cloud Village (9899 HK) had a breakout pattern from a continuation triangle after reporting a deal to stream Korean drama series to Chinese market. The company’s profits grew in 1H25.

7. ECB: Balanced In The Good Place

- Staying in the ECB’s “good place” encouraged a neutral bias around its unanimous decision for no change, while being appropriately open to tackling future shocks.

- Staff inflation forecasts still undershoot the target, with recent upside news seemingly postponing passthrough rather than trimming the extent into something like our view.

- President Lagarde sounded relaxed about France’s spread widening, and the ECB did not discuss the TPI. We still expect no ECB easing against this, or further rate cuts.

8. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 12 September 2025

US producer prices softened in August, but structural factors keep inflation pressures elevated despite Fed rate cuts.

Labour market revisions show weaker US job growth, raising doubts on monthly payroll data reliability.

Japan’s GDP growth headline looks strong, but weak domestic demand and lower business spending reveal fragile fundamentals.

9. Seasonal Weakness Ahead?

- We are seeing fundamental headwinds in the form of elevated valuations and earnings uncertainty from tariffs, which won’t be visible until Q3 earnings season.

- On the other hand, the technical outlook appears relatively benign.

- Our base case calls for some choppiness ahead. We are near-term cautious, but not bearish.

10. Waller’s Gambit

- Fed Governor Chris Waller is a leading candidate to be the next Fed Chair, and the issue of Fed independence is paramount.

- Our evaluation of his economic case for rate cuts should be whether the decisions are based on sound data, theory and solid judgment.

- He has shown solid thinking on employment, but his justification for rate cuts based on the Fed’s inflation mandate is weaker and shows signs of wishful thinking.