This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

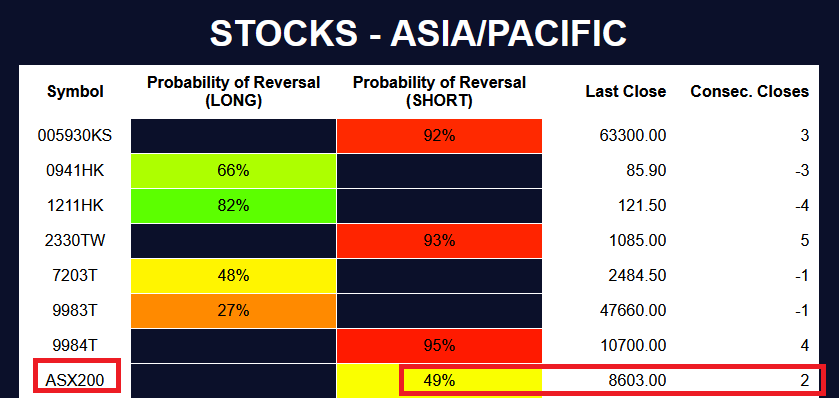

1. S&P/ASX 200 Outlook Following Proposed Index Rule Review

- As reported by Gaudenz Schneider , the 90-Day pause on country-specific reciprocal tariffs was set to expire on July 9, 2025 and Australia and its Minerals sector might suffer indirectly.

- Australia has business with a number of Asian countries, especially China and Japan. Any shock to the growth of other economies in the region could affect the S&P/ASX 200 INDEX.

- This insight will focus on the short-term tactical outlook and possible trend direction for the Australian index for the coming weeks.

2. KOSPI 200: Event-Driven Strategies into the July 10 BoK Decision

- Context: The Bank of Korea will announce its rate decision on July 10, 2025. This Insight compares market and option-implied expectations with historical KOSPI 200 reactions.

- Highlights: While average market reactions to BoK moves are historically muted, options are pricing in elevated volatility. Two event-driven strategies are discussed.

- Why Read: This Insight offers actionable, volatility-focused options strategies grounded in empirical data and current pricing—timely for traders seeking to monetize elevated volatility ahead of central bank and geopolitical events.

3. Samsung Electronics (005930 KS) Outlook After 3.9 Trillion Won Buyback Plan Announcement

- Douglas Kim and Sanghyun Park have discussed Samsung Electronics (005930 KS)‘s 3.9 Trillion Won Share Buyback Plan announced on July 8th. Read the details in their insights.

- Our latest insight maintained our BUY recommendation: the stock rallied during the following 2 weeks, reaching 64,700, then was marked as “very overbought” in our latest Global Tactical Weekly view.

- The stock started to pull back last Friday, after reaching extremely overbought levels (64700). This insight presents a tactical view for Samsung Electronics direction, for the next 2-3 weeks.

4. Global Markets WEEKLY Tactical Outlook: July 7 to July 11

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week July 7 – July 11.

- Since our Global Markets WEEKLY Tactical Outlook published last week, US markets became even more overbought by the end of the week, while some Asian stocks started to pull back.

- Stocks are falling on Monday, the Trump administration is threatening imposing 25% tariffs on a number of nations (including Japan and South Korea), global markets may close the week down.

5. Tariff Risk Returns: Market Signals and Asia’s Volatility Momentum

- Context: The 90-day pause on US reciprocal tariffs expires on July 9, 2025. Japan, South Korea, Taiwan, and India, now face a return to steep US tariffs.

- Highlights: Markets reacted sharply to the original tariff announcement in April, with volatility peaking. While implied volatility eased in May, it has since climbed again, suggesting rising investor concern.

- Why Read: As markets face renewed risk of stress, this Insight helps investors understand which markets and sectors are most exposed, how volatility is evolving, and how best to position.

6. Hong Kong Single Stock Options Weekly (July 07–11): Financials in Focus as Call Volumes Rise

- Sentiment improved modestly, though breadth remains well below recent highs in a subdued price action.

- Option activity climbed steadily, with strong Friday Call demand pushing the Put/Call ratio to lower bound.

- Financials stood out across price action, volatility, and options activity.

7. KOSPI 200 Tactical Outlook Amid Renewed Uncertainty from US Tariff Risks

- As reported by Gaudenz Schneider , South Korea left interest rates unchanged on July 11th, but significant uncertainty from US Tariffs policies pose a challenge for its economy.

- In our previous KOSPI 200‘s insight we flagged an ‘overbought warning’, yet the index extended its rally for four more weeks, closing at 428 — near its all-time highs (449).

- The index is now off the chart on our time model and approaching the upper limit of our SHORT price model. A WEEKLY pullback is imminent, but may be short-lived.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Global Markets Tactical Outlook: Week of June 30 – July 4

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week June 30 – July 4.

- US Markets will be closed for Independence Day celebrations on July 4th.

- Most stocks and global indices appear to be overbought or nearly overbought. 10-year US Treasuries Futures are also overbought. Commodities like Gold and Crude Oil are down.

2. BYD (1211 HK) Top Trades Highlight Bearish Bias Among HK Option Traders

- Context: Over the past five trading days, BYD (1211 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy huge popularity. Strategies tend to have a short-term horizon of one month, and over 60% of strategies exhibit a bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

3. HSI INDEX Tactical Outlook

- The Hang Seng Index has been rallying since our last BUY recommendation. However the rally may be temporarily stalling.

- The index is not overbought according to our model, around 50% probability of WEEKLY reversal – it could go higher.

- If the index closes this week down, it could be a buy opportunity, depending on the price reached (if the pullback is mild is probably better to hold/wait).

4. Nikkei: Failed Breakout and Summer Seasonals Signal Opportunity

- Seasonal weakness and failure at highs support a tactical short.

- July has historically been weak for the Nikkei in both price and realized vol; Trump-era data showed summer vol was suppressed.

- We propose a tactical trade that aligns with the current setup and supportive price and volatility seasonals.

5. Hong Kong Single Stock Options Weekly (June 30 – July 04): Narrowing Breadth and Rising Put Activity

- Hong Kong single stocks traded lower in a holiday-shortened week.

- Breadth pulled back sharply from the previous week’s extremes and Put activity picked up noticeably across single stock options.

- Intervention in HKD continues to ramp steadily higher with HKD bumping along top of the range.

6. Nifty’s Summer Setup: Quiet Vol and Strong Price Seasonals

- Nifty enters July with supportive seasonal trends in both price and volatility.

- Trump-Era seasonal trends point to subdued summer volatility compared to historically low July volatility.

- Nifty’s proximity to all-time highs sets up attractive strike locations for vol sellers.

7. Global Macro Outlook (July): Trump Volatility Playbook Offers Clues for July Positioning

- Across markets realized volatility generally came in below implied, making June favorable for volatility sellers.

- July has historically rewarded vol sellers; we reference a prior Insight on volatility during Trump’s first term highlighting a large deviation from average in July.

- Average July returns are mixed, but there are clear standouts among the macro markets.

8. NIFTY Index at a Crossroads: Two-Week Tactical Outlook

- The NIFTY Index rally may stop briefly, for 1 or 2 weeks. At the moment the index hast started a very mild pullback, after closing higher for 2 consecutive weeks.

- Usually the rally does not last more than 3 weeks when this pattern is encountered although there has been occasions where it lasted 7 weeks.

- Two scenarios lie ahead: (1) if this week closes higher, expect a near-term pullback; or (2) if it closes lower—possibly continuing into next week—the rally may resume afterward.

9. Commonwealth Bank of Australia (CBA AU) Outlook Amid Overblown Passive Inflows And NIM Pressures

- Commonwealth Bank of Australia (CBA AU)’s shares have surged >80% since November2023, outpacing its underlying profit growth and dividend yields. Passive‐index ETF reallocations are the primary driver of this rally.

- A Reuters poll forecasts the RBA will cut rates by 25 bps to 3.60% on July 8—with further cuts likely into year‐end. This will compress NIMs, a key earnings driver for CBA.

- This insight marks the start of our coverage for CBA: the stock closed this week down (CC -1) reaching oversold levels, it can bounce but the rally potential appears limited.

10. JD.com (9618 HK) Top Option Trades: Bullish Butterfly Stands Out Amond Bearish Sentiment

- Context: Over the past five trading days, JD.com (9618 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy popularity. Plus, an out of the money butterfly at near zero premium demonstrates a creative application of this popular option combination.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

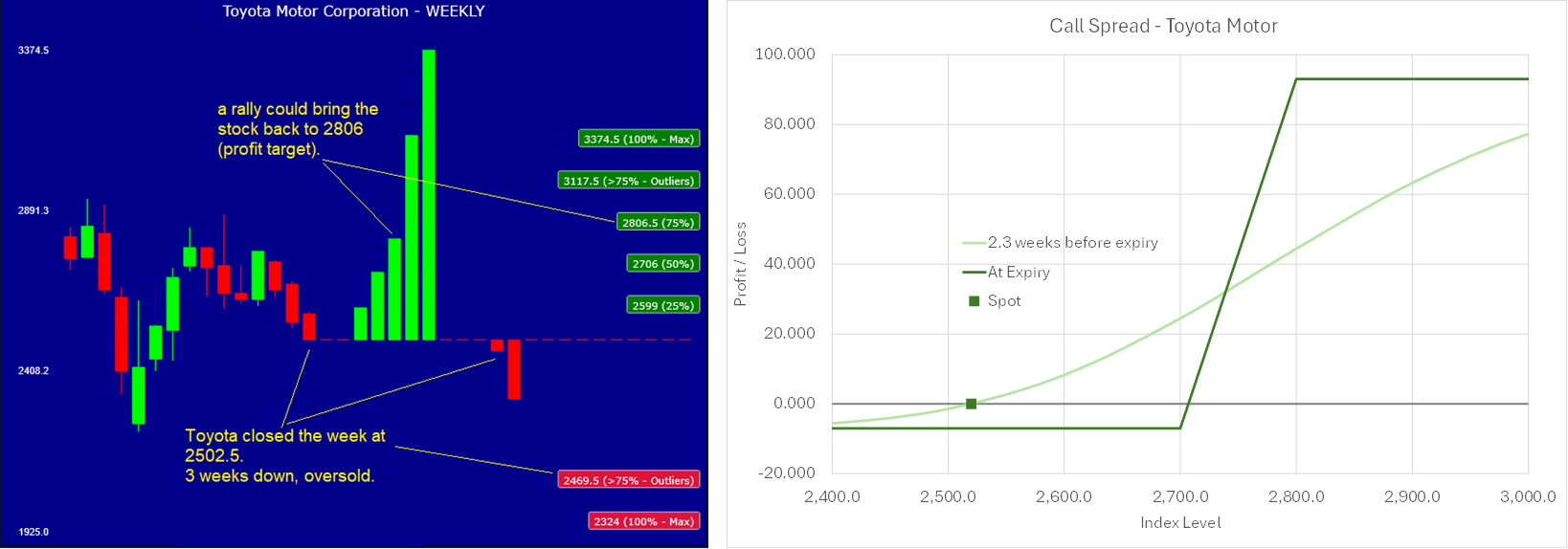

1. Toyota (7203 JP // TM US) Hits Oversold: Your High-Potential Options Strategy

- Context: After three consecutive down weeks, Toyota Motor (7203 JP) has entered oversold territory, triggering a potential upside signal in quantitative models.

- Trade Idea: With signs pointing to a short-term reversal, a Bull Call Spread strategy offers high return potential (~12x premium) with limited upfront cost.

- Why Read: This Insight presents a timely, actionable trade idea with a well-defined risk/reward profile—ideal for investors seeking tactical exposure. Details Provided.

2. S&P/ASX 200 Outlook Following Proposed Index Rule Review

- As reported by Brian Freitas and Janaghan Jeyakumar, there are potential methodology changes for the S&P/ASX family of indices in sight, read their insights for more details.

- If approved, the changes could take effect with the September index review and could bring in signficant reshaping for the S&P/ASX 200 (AS51 INDEX).

- In our previous insight on June 9th we signaled how the ASX 200 was overbought. The index close last week down. This insight discusses our new forecast and outlook.

3. Toyota Motor (7203 JP) Tactical Outlook: Uncertainty Persists, But Rebound Likely

- We continue our coverage of Toyota Motor. In our last insight we flagged overbought conditions and a likely pullback—Toyota declined as expected. Our model now flashes an “upcoming rebound” signal.

- Toyota Motor (7203 JP) has been falling for 3 weeks. At the end of last week our WEEKLY model flagged the stock as “very oversold“: 83% probability of WEEKLY reversal.

- We cannot say if this rebound will become a rally, at the moment: uncertainty around the stock persists, and this particular pattern usually sees more selling, after the bounce.

4. Tencent (700 HK): Top Trades and Strategy Insights from Options Trading

- Context: Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: With 20% of all strategies traded being Diagonal or Calendar Spreads, this remains a popular strategy. Directional positioning does not exhibit a bullish or bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

5. SoftBank (9984 JP) Is Flying High, But It May Be Time to Take Some Off the Table

- Softbank Group (9984 JP) is seeing solid short-term momentum, bolstered by asset sales and AI-led strategic narratives. Key triggers to monitor: deleveraging moves, AI investment updates, and broader macro sentiment.

- The stock is very overbought according to our WEEKLY model, there could be a pullback soon.

- Another perspective: what if this is just a bold rebound rally—and the next move takes SoftBank back down toward the 5,000 level? Just an hypothesis worth considering.

6. Kospi200: Where Implied Vol Stands After 33% Surge

- Kospi200 posted a strong weekly gain, advancing every day and extending a powerful rally off the April lows.

- The percentage of positive trading days since early April reflects strong momentum.

- A divergence is emerging, with implied volatility no longer reacting to spot moves as before.

7. NVIDIA (NVDA US) At All-Time High Acquires CentML: Weekly Tactical Outlook (June 30 – July 4)

- NVIDIA Corp (NVDA US) stock keeps climbing towards an hypothetical 5 trillion $ market cap, as the artificial intelligence (AI) trade accelerates.

- Unconfirmed rumors say NVIDIA has acquired CentML, a machine learning startup that provides an optimization platform to enhance the efficiency and cost-effectiveness of AI model training and deployment.

- After 5 weeks up in a row and a furious, vertical rally, the stock begins to appear OVERBOUGHT, according to our model.

8. Kospi200: Elevated Returns, Historical Extremes and Optionality Opportunity

- We assess whether recent returns have been extreme and put yesterday’s sharp rally in context.

- The evolution of volatility following past extreme states is examined.

- Rationale for using optionality in this stretched price environment is outlined.

9. Hong Kong Single Stock Options Weekly (June 23 – 27): Breadth Snaps Back and Option Volumes Surge

- Breadth rebounded sharply after last week’s weakness, with most single stocks posting gains.

- Single stock option volumes surged, reaching the highest levels seen since early April.

- Xiaomi stood out this week across multiple contract and volume statistics.

10. Hang Seng Index (HSI INDEX) Top Trades: Recent Option Flow Reveals Strategic Positioning

- Context: Over the past five trading days, Hang Seng Index (HSI INDEX) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Yield-extracting strategies prove more popular in the index than in single stocks. Two such examples, a Ratio Put Spread and an Iron Condor, are presented.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BYD (1211 HK) Outlook Following Regulatory Pushback on Market Dominance

- As reported by Ming Lu, Chinese regulators are pushing back against BYD (1211 HK)’s dominance, which has strained smaller domestic EV competitors. Read his latest BYD insight for more details.

- In a recent insightwe signaled BYD was tactically overbought. The stock fell rapidly right after.

- The stock is currently mildly oversold according to our WEEKLY model: it could fall a bit more, but if this week closes in negative territory there could be a rebound.

2. Nikkei 225 Outlook And Profit Targets Amid Uncertainty Over Japan-US Tariff Negotiations

- Japan PM Ishiba says disagreements remain with US on tariff talk. This is probably the main catalyst that could slow down the current Nikkei 225 (NKY INDEX) rally.

- Our WEEKLY Nikkei 225 model signals a mildly overbought status, the index could go higher, but will face harder resistance in 1-2 weeks from now.

- We don’t see the Nikkei pulling back this week, we think it will close this week up.

3. Xiaomi (1810 HK): Strategic Insights and Top Option Trades

- Over the past five trading days, Xiaomi Corp (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Popular Strategies: Diagonal Spreads account for 27%of all strategies. This versatile strategy allows for many different profiles in terms of upfront premium (positive or negative), and time horizon.

- This Insight of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies.

4. Alibaba (9988 HK) Options Insights: Navigating Contango and Skew for Profitable Trades

- Context: Analysis of Alibaba’s (9988 HK) implied volatility surface as of June 20, 2025, examining implied volatility patterns, skew structures, and open interest distribution across various expiry dates.

- Highlights: One-month implied volatility at 31.6% is trading at historically cheap levels (13th percentile), while the skew shows a pronounced volatility smile favoring spreads.

- Why Read: Essential for options traders and volatility strategists looking to capitalize on the historical cheapness of current implied volatility levels, particularly given the favorable skew structure for spread strategies.

5. Alibaba (9988 HK): Top Trades and Strategic Insights from Options Trading

- Context: Over the past five trading days, Alibaba Group Holding (9988 HK) live multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy popularity. Strategies tend to have a short-term horizon and exhibit a slightly bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

6. Samsung Electronics (005930 KS) Outlook as Foundry Spin-Off Gains Momentum

- Sanghyun Park has reported in detail about what seems to be going on behind closed doors at Samsung in regard to the foundry spin-off: read his insight – highly recommended.

- We maintain our BUY recommendation for Samsung Electronics (005930 KS) and although we have not yet seen a strong rally, we see the stock slowly drifting upward from its bottom.

- Our short-term tactical perspective covering the next 2–3 weeks is presented in this insight.

7. HKEX (388 HK) Options: Unpacking the Top Trades of the Week

- Be inspired by sophisticated, live, multi-leg options strategies on HKEX (388 HK), executed over the period from 9 to 13 June.

- Highlights: Discover a range of noteworthy strategies, for example a self-financing Diagonal Put Spread using weekly options, or a Diagonal Call Spread generating 3.9% upfront yield.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

8. Hong Kong Oil Stocks: Surge in Oil Volatility Creates Opportunity

- Oil has surged on geopolitical headlines, with a sharp increase in both price and implied volatility.

- Implied vols in Hong Kong-listed oil names have lagged sharply behind the move in Oil.

- The relative dislocation in volatility opens the door to tactical pair trade and hedging ideas.

9. KOSPI 200 Tactical Warning: OVERBOUGHT

- The KOSPI 200 INDEX has been rising > 30% since its 303-low in early April 2025: a vertical rally after Lee Jae-myung’s won the Presidential Elections in South Korea.

- Our most extreme profit target set in our latest insight was 392. The KOSPI 200 reached 394 on June 16th. It is now ultra-overbought.

- Our short-term WEEKLY tactical view is the following: the index could go maybe a bit higher or it could pullback soon (more likely). Not bearish, will be a buy opportunity.

10. Hong Kong Single Stock Options Weekly (June 16 – 20): Breadth Erodes, Vol Slips, Hedges Worth a Look

- Single stocks were softer on the week, with breadth continuing to weaken.

- Put volumes surged to their highest levels since April; Put open interest continues to rise.

- Implied volatility declined on the week despite elevated demand for downside protection.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. S&P/ASX 200 Tactical Outlook Post-Index Rebalance Announcement

- As reported by Brian Freitas on 6 June the list of changes to the S&P/ASX family of indices was announced, including some change for the S&P/ASX 200 (AS51 INDEX).

- The S&P/ASX 200 index has become quite overbought as of last Friday’s Close, a pullback is probably imminent.

- This insight evaluates possible scenarios for the possible 2-4 weeks, beyond the June 20 date when the index review will become effective.

2. BYD (1211 HK) Options: Unpacking the Top Trades of the Week

- This Insight analyzes sophisticated, live, multi-leg options strategies on BYD (1211 HK), executed over the period from 2 June to 9 June on the HKEX

- Highlights: Discover a range of noteworthy strategies, from an in-the-money bear put spread, to a bold short-term bullish iron condor, and a butterfly aiming at a narrow price target.

- Why read: In-depth breakdown of complex option strategies, shedding light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

3. Key Markets Tactical Outlooks After Israel Strike on Iran

- A quick look at the tactical forecast models for some key markets impacted by the Israeli attack to Iran on June 13th.

- We analyze: Crude Oil Futures (CL1 COM COMDTY) , Gold Futures (GOLD COMDTY) , Nasdaq-100 Index (NDX) , Nikkei 225 Index, Hang Seng Index and NIFTY Index

- Keep in mind that high volatility can push easily a market into the model’s tails, and forecasts in tails area rely on less data (i.e. less accurate).

4. Nikkei 225 Tactical Outlook Amidst Sony Corp’s Financial Group Spin-Off Talks

- The Nikkei 225 (NKY INDEX) is currently rallying after a modest pullback last week.

- The index went above our model resistance level at 38347 (50% prob. of reversal). It’s modestly overbought and could go higher.

- News can perturbate the trajectory of the index but at the moment the Nikkei seems directed towards higher prices: 39216 is our profit target for this rally, before Jun 27th.

5. Is Samsung Electronics (005930 KS) Quietly Starting to Take Off?

- Samsung Electronics (005930 KS) has been range-bound since October 2024, its chart pattern echoing a flat EKG with brief spikes… we suggested to BUY on May 20th, now up +7%….

- Still, maybe something is changing, the stock is about to reach a reversal point, it will pullback soon, but it may be a brief, buy-the-dip opportunity, possibly before a rally.

- Our price and time models currently indicate there is considerable resistance to rally higher: this week may be the last one up before the pullback.

6. US Asset Correlations Spike: Early Days, But A New Regime May Be Unfolding

- We revisit the evolving correlation between US equities, bonds, and the dollar post-Liberation Day.

- Recent asset price behavior may be signaling a deeper structural shift in US market dynamics.

- Market moves suggest that traditional hedging assumptions may need to be re-evaluated.

7. JD.com (9618 HK): Top Trades and Strategic Insights from HKEX Options Trading

- Discover sophisticated, live, multi-leg options strategies on JD.com (9618 HK), executed over the period from 4 June to 10 June on the HKEX

- Highlights: A range of noteworthy strategies, including a deep in-the-money, three-months Diagonal Call Spread and an ultra-low-cost, one-week Calendar Put Spread, highlighting diverse approaches to capitalize on market movements.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

8. S&P/ASX 200: All-Time Highs, Complacent Vols and a Tactical Hedge with a Relative Value Edge

- S&P/ASX 200 posts a rare rally, joining an elite list of historical moves.

- Implied volatility has collapsed to multi-year lows despite the surge in price.

- We discuss a defined, cost-efficient structure that allows positioning with asymmetry and edge.

9. Ping An (2318 HK): Strategic Insights and Top Option Trades

- Be inspired by sophisticated, live, multi-leg options strategies on Ping An Insurance (2318 HK), executed over the period from 6 to 12 June on the Hong Kong exchange.

- Highlights: Many strategies creatively utilize weekly expiries, sometimes employing options with as little as one or two days to maturity to generate upfront yield or financing.

- Why read: Detailed examples and break-down of complex option strategies provide actionable insights that could inspire similar strategies,

10. Meituan (3690 HK) Options: Unpacking the Top Trades of the Week

- Discover sophisticated, live, multi-leg options strategies on Meituan (3690 HK), executed over the period from 5 June to 11 June on the Hong Kong exchange.

- Highlights: A range of strategies, spanning time-horizons from just a few days to several months. Including a low-cost call spread with the potential to return approximately 8x the invested premium.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Toyota Motor (7203 JP) Outlook Amid Uncertainty Over Toyota Industries Privatization Bid

- Travis Lundy and Arun George have recently written extensively about Toyota Industries (6201 JP) proposed takeover. Read the details in their insights.

- Toyota Motor (7203 JP) is involved: 2 weeks ago we predicted a rally, and the rally did happen and went past our suggested profit target – time for an update.

- Toyota Motor (7203 JP) at the end of last week was overbought, according to our model. Any catalyst could trigger a sell off from here but let’s analyze the models….

2. HSI Tactical Outlook: Buy This Dip

- After a 7-week rally the Hang Seng Index (HSI INDEX) last week gave up and close the week down (CC=-1 on our WEEKLY LONG model).

- The pullback continued on Monday, reaching 22668 and in our WEEKLY LONG model this price support zone is oversold.

- The pullback may continue, so in this insight we are going to offer some perspective on possible support zones where to buy. We think this setback is a buy opportunity.

3. KOSPI 200 Update: Market Moves After Lee Jae-Myung’s Victory

- Lee Jae-myung’s is projected to win the Presidential Elections in South Korea. The Democratic Party of Korea candidate said he wants to revive the economy and stabilize the stock market.

- At the moment of writing (around midnight Singapore time) the KOSPI 200 INDEX‘s reaction is positive, the futures are rising towards the most recent, last week highs (363).

- This is a quick review of our most recent KOSPI 200’s tactical setups, in light of the political news coming out of the polls.

4. TSMC (2330.TT) Outlook: Bullish After Shareholders Meetings

- As reported by Patrick Liao ,Taiwan Semiconductor (TSMC) (2330 TT) held its shareholders meetings on June 3rd, read the insight for the details.

- The bottom lines emerging from the meeting are: no fear of tariffs, no fear of appreciation of the NT dollar, no fear of having their tech stolen in foreogn-based factories.

- The stock rallied from June 3rd, closing at 998 on Thursday. Our model say the stock is not yet overbought, could rally higher.

5. Global Macro Outlook (June): From Rally to Reversal? Macro Trends Shift as June Unfolds

- Most major indices extended their April rally through May, but seasonal patterns suggest caution from here.

- Implied volatility declined across most markets, but remains above historical medians in several key regions.

- Vol premium analysis highlights a few standouts where short vol has historically outperformed.

6. Hong Kong Single Stock Options Weekly (June 02 – 06): Broad Gains as Option Activity Fades

- A weekly roundup of key option and price metrics for Hong Kong single stocks.

- Option volumes on par with the lowest levels seen over the past 6 months.

- Implied volatility appears to have broadly settled around current levels.

7. Nifty 50 Tactical Outlook After RBI’s Steep Rate Cut

- The NIFTY Index rallied after RBI cuts key policy rate by 50 bps to 5.50%(but RBI governor said there is limited policy space from here).

- Inflation forecast was cut to 3.7%; GDP growth forecast retained at 6.5, but Trump’s trade tariffs and the prospect of a global economic slowdown are generating uncertainty.

- The NIFTY was already moving up in the last 2 days and accelerated sharply on Friday. But our model signals that the index is not overbought, it can go higher.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Alibaba (9988 HK): Unpacking the Week’s Savvy Top Options Trades

- Over the past five trading days, Alibaba Group Holding (9988 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Popular Strategies: Over 35% of all strategies are Calendar or Diagonal Spreads. Bullish and bearish views prevail at equal rates, with very few market-neutral views expressed.

- Top Trades: Some market participants were betting on a short term re-bound after the post-earnings drop. Others take a bearish view with finely calibrated medium-term hedges. Trade-examples are presented.

2. Alibaba (9988 HK): Navigating Post-Earnings Volatility

- Implied Volatility Trends:Alibaba Group Holding’s (9988 HK) one-month implied volatility has significantly receded to the 37th percentile after its 15 May earnings, reflecting a substantial implied vola crush.

- Skew and Term Structure Dynamics: The implied volatility term structure is now slightly upward-sloping with longer-dated options commanding a small premium. Skew dynamics indicate cheaper puts.

- Open Interest Distribution: Liquidity is greatest in the June and September expiries. Short term strikes are concentrated near or at the money.

3. HDFC Bank Tactical View: Inflection Point or Just a Pause?

- HDFC Bank (HDFCB IN) is navigating a mix of positive growth indicators and emerging regulatory challenges but average 12-month target is ₹2,194, with estimates ranging from ₹1,627 to ₹2,793.

- Consensus rating: predominantly “Buy” from major brokerages, including ICICI Securities and Motilal Oswal, citing strong loan growth and stable asset quality.

- The stock’s strong fundamentals and growth outlook remain intact, but momentum has stalled in recent weeks following the sharp rally we correctly anticipated from January 14, 2025.

4. CATL (3750.HK): Rich Vols, Strong Start, and a Tactical Hedge

- CATL’s options debut in Hong Kong has been active, with strong Call interest and rising open interest suggesting early investor enthusiasm.

- Implied vols are holding firm post-listing and appear rich —potentially justifiable given the trading dynamics and catalysts.

- We recommend a tactical hedge structure that skews return favourably, targeting recent highs and protecting against downside drift.

5. China Mobile (941 HK) Poised for Pullback: A Tactical Low-Cost Options Play With High Upside

- With a 5-week rally China Mobile (941 HK) is in overbought territory and quantitative models flag potential for a pullback.

- Options may be underpricing the downside risk, creating an attractive opportunity to buy cheap options with high payoff potential.

- This Insight outlines an option strategy combining quantitative signals with volatility analysis.

6. KOSPI 200 Tactical Outlook After Index Rebalancing

- Korea Exchange announced its KOSPI 200 rebalance changes on 27 May, Sanghyun Park and Douglas Kim wrote extensively about this, here we want to focus purely on the tactical strategy.

- The KOSPI 200 INDEX pulled back last week, then surged on Monday and stagnated on Tuesday, the index has plenty of room to go higher according to our model.

- According to our model, the number of rallies vastly offset the number of pullbacks when this pattern is encountered (=pullbacks are rare), this could be read as a bullish indication.

7. HSI Index Options Weekly (May 26-30): Choppy Tape, One Strike Rules Them All

- HSI traded sideways for a third straight week as macro headlines swirled and tariffs turned internally litigious.

- Volatility drifted lower, with 1M implied vol dropping below its 1-year median for the first time in months.

- Call volumes were significantly higher led by one strike in particular.

8. All Eyes On Nvidia (NVDA US): Post-Earnings Outlook and Profit Targets

- By the time this insight is published, NVIDIA Corp (NVDA US) will have reported earnings. Our model does not rely on fundamentals or news, so the forecast is made in advance.

- The stock pulled back last week, mild pullback, not oversold, ideally a buy-the-dip opportunity. Support targets: 123-112

- If the stock rallies, the rally could last 3 weeks and reach 156. Read the detailed analysis in the insight.

9. Nifty Index Options Weekly (May 26 – 30): Rally Pauses, Vol Holds at Elevated Levels

- Nifty had limited movement this week with the rally off the April low stalling out.

- Elevated volatility metrics contrast with an otherwise quiet tape over the past week. We recommend taking some chips off the table, taking advantage of vol levels.

- Nifty has given up about 1/2 its outperformance vs the SP500 over the past couple of weeks.

10. TLT – From Hedge to Risk Asset: Behavior Continues to Shift

- TLT is showing signs of shifting behavior, no longer acting like a classic flight-to-quality asset.

- One-Month implied vol sits above average, though not at extreme levels.

- The evolving vol structure suggests caution for those expecting traditional bond market flight to quality behavior.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Toyota Motor (7203 JP) Tactical View: Privatization Momentum Builds — Ready to Rally?

- Since April 28th we traced a path for Toyota Motor (7203 JP)‘s stock price, first here (forecast: going down) and then here (forecast: potential 2-week pullback to 2578).

- Last week Toyota Motor (7203 JP)pulled back to 2598 (pretty close to our 2578 target). The stocks closed down for 2 weeks, as predicted. A rally may be starting.

- Rumors of an acceleratingof privatization bid for Toyota Industries (6201 JP)could act as a fresh catalyst for the stock—aligning with our model’s forecast from May 8th.

2. Fast Retailing (9983 JP)Tactical Setup: Buy-This-Dip

- Fast Retailing (9983 JP) presents a mixed outlook characterized by strong earnings momentum tempered by some geopolitical and macroeconomic challenges. Analyst opinions are mixed but consensus is mostly = “Hold”.

- The stock started a pullback this week and is reaching a support zone that offers the possibility of entering LONG positions at a discounted price.

- This is a short-term tactical setup but the stock can be hold for the long run if the rally continues in the coming weeks.

3. Samsung Electronics (005930 KS) Tactical Outlook Amid Rumored Phase 2 Buyback Confirmation

- As reported by Sanghyun Park, Samsung Electronics (005930 KS) ‘s phase 2 buyback disposal plan appears to be virtually finalized (or will be finalized soon – not official yet).

- As always, we’ll assess what our tactical models suggest about the trend from here—interpreted alongside the latest catalysts.

- We have been monitoring Samsung Electronics (005930 KS) for a while: the stock has been bottoming, then flat for a while, rallied modestly, now a minor pullback… time to BUY?

4. BYD (1211 HK) Outlook: Near-Term Upside Still Possible, but Rally Looks Stretched…

- BYD (1211 HK) has been rallying hard since its 309.80 bottom in early april, the stock closed at 465.20 last Friday, a +50% rally! Probably well deserved.

- This insight analyzes the short-term tactical outlook on a WEEKLY time period basis. Our model finds that the stock is currently very overbought, however some upside is still possible.

- You may want to consider hedging your bets with some puts (probably cheap at this point), 1-2 weeks expiry, to protect against a (probably mild), upcoming pullback.

5. Tencent (700 HK): Strategic Insights and Top Trades from HKEX Options Trading

- Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Calendar and Diagonal Spreads make up a quarter of all strategies. Several examples are presented incorporating upfront cost, upfront credit, or zero-cost combinations.

- While there is a bias towards bullish strategies, 26% of all strategies express a market-neutral view in the form of Straddles, Strangles, Butterflies or Condors.

6. Tencent (700 HK): Strategies to Navigate Low Volatility and A Flat Term Structure

- Implied Volatility Trends: One-month implied volatility is currently cheap, trading in its 14th percentile, while Tencent (700 HK) approaches its twelve-months high.

- Skew and Term Structure Dynamics: A pronounced skew smile and a relatively flat term structure make spreads and calendar / diagonal spreads attractive strategies.

- Open Interest Distribution: Liquidity can be found in the monthly May expiry and the Quarterly expiries. The historically low implied volatility facilitates longer term positions.

7. 10Y US Treasury Futures Rally: Tactical Outlook & Key Profit Zones

- 10Y US Treasury Futures started to rally on Thursday, after the House of Reps approved Trump’s Big, Beautiful Bill

- The Trump administration has dismissed concerns that the latest bill will harm the nation’s financial standing, even after the U.S. lost its top-tier credit rating last week.

- This is a brief insight to try to identify potential profit targets and duration of this rally.

8. NSE NIFTY50/ Vol Update / Indo-Pak Ceasefire! Large Markdowns in IV-Skew-Smile Triggered

- Indo-Pak ceasefire triggers risk-premia markdowns – Monthly IVs -4.0 vols lower, Skew & Smile get compressed

- Vol-Regime stays in “High & Up” state with high likelihood of switching to “High & Down” in the upcoming week.

- IV term-structure flattened as the week progressed. Leaving front-end vol-differentials in Contango & Back-end Backwardation now eased to +0.60 vols.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nvidia (NVDA US) Outlook Following $7B AI Chip Deal with Saudi Arabia

- NVIDIA stock rose over 3% Wednesday morning, after news of a reported multi-billion-dollar AI chip deal with Saudi Arabia, announced during an investment forum attended by President Trump.

- Nvidia will supply hundreds of thousands of AI chips over five years to Humain, a new Saudi AI venture backed by the $925B Public Investment Fund.

- Bank of America raised NVDA price target to $160 from $150. A Bloomberg report suggested the UAE may buy over 1 million Nvidia AI chips under a potential U.S. deal.

2. China Mobile (941 HK) Tactical Outlook

- Our previous insight indicated a potential buy opportunity immediately followed by higher prices, but China Mobile (941 HK) hasn’t really rallied much since our signal was released, 2 weeks ago.

- Monday, news about a US-China tariffs deal sent global stocks sharply higher. However, the stock closed the day at 84.25, our model’s Q2 profit target (i.e. not a strong rally…).

- Our time model also indicates an overbought state (74% probability of reversal): we’re not bearish on the stock, but in this insight we will discuss a few tactical scenarios.

3. BABA (9988.HK) Earnings: Volatility Setup, Post-Release Price Behavior and Hedge Recommendation

- Baba has rallied 26.6% off the April low but remains 6.82% below its March high. Against this backdrop, we examine implied vol, the earnings-implied jump, and post-earnings price patterns.

- Implied volatility and the implied jump are both elevated relative to historical norms.

- Given the setup, we suggest a short-vega hedge that offers downside protection while preserving limited upside participation.

4. Tencent (700.HK) Q1 Earnings: Volatility Setup and Post-Release Price Behavior

- Tencent has rallied 17.29% off the April low—against this backdrop, we analyze implied vol, the earnings-implied jump, and post-earnings price patterns.

- Relative to past earnings cycles, current implied vol screens lower across multiple timeframes and spread metrics.

- Post-Earnings price behavior reveals some non-intuitive dynamics worthy of consideration.

5. TSMC (2330.TT) Outlook After Intel 18A Setback

- TSMC (2330 TT) recent revenues reports were good (April: up 22.2% MoM, and up 48.1% YoY) and its direct competitor Intel (INTC US) is starting to look less competitive.

- According to a report from Reuters, Intel CFO David Zinsner revealed that some of the 18A prospects withdrew after trial production, leading to a lower-than-expected volume of committed demand.

- While Intel struggles, TSMC’s N2 technology is experiencing strong success, being adopted quickly by a wider range of mobile, HPC, AI customers. Our model suggests the stock can rally higher.

6. KOSPI 200 Tactical Outlook: Waiting for the June Elections

- In just three weeks, on June 3rd, South Korea will hold an early presidential election.

- The KOSPI 200 INDEX on Tuesday closed at 347.17, entering deeply overbought territory based on our time and price quantitative models.

- Whether the index rallies into the election and then declines, or starts selling off ahead of the vote, our tactical stance is unchanged: we recommend short exposure or appropriate hedging.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CSI 300 Index: Tactical Outlook Following the Labor Day Holiday

- Following an extended holiday beginning May 1st, the CSI 300 Index (SHSZ300 INDEX) resumes trading on May 6th.

- The WEEKLY close before the holiday—during a shortened trading week—was modestly negative. However, the index would need to decline to 3697 or lower to trigger a buy-the-dip opportunity.

- Since the index has already closed 1 week down, our time model suggests there is a good chance (62%) it could go up this week.

2. Toyota (7203 JP) Post-Earnings Outlook Amid ¥180B Estimated U.S. Tariff Cost

- Toyota Motor (7203 JP) expects U.S. tariffs, material costs and a weak(er) dollar to dent profits. The automaker estimated the levies directly costing it 180 billion yen in April/May.

- The stock fell after the company reported its fiscal-fourth-quarter results on Thursday. Guidance for the coming year came in lower than expected, with tariffs taking a bite out of profits.

- In a previous insight we flagged the stock as overbought; those model targets remain valid. Here, we analyze updated support to gauge the pullback’s potential depth.

3. NIFTY INDEX Outlook: Back in an Uptrend – Where To Buy This Dip

- In our previousNIFTY Index insight we highlighted rally targets in the 24039-24496 zone. The index reached 24589 last week, double-topped this week, then closed the week down at 24008.

- The index was ultra-overbought according to our WEEKLY model, the pullback was overdue. This pullback is a buy opportunity.

- This insight discusses key support zones to buy and profit taking targets for the rally.

4. TESLA (TSLA US) Tactical Outlook Amid Rumors of Elon Musk’s Replacement

- 2025 has been a tumultuous year for Tesla (TSLA US), the stock struggled due to weakening sales, and CEO Elon Musk’s role in the US government has damaged the brand.

- Rumors of Tesla’s board seeking to replace Elon Musk are likely unfounded. A leadership change could backfire. The stock is up 26% since Musk signaled reduced involvement in government affairs.

- Despite rising competition from BYD (1211 HK) and others, Tesla (TSLA US) remains a top pure-play EV maker. The current pullback could present a potential buying opportunity.

5. APPLE (AAPL US) Post-Earnings Outlook: A Potential Tactical Buy

- Apple (AAPL US) started a mild pullback after releasing its earnings on May 1st. We think this pullback may be a BUY opportunity.

- Some analysts believe the Trump administration’s tariffs will ultimately prove transitory. While near-term impacts are surely expected for Apple (AAPL US) , they’re probably short-term in nature.

- Our model suggests a potential buying opportunity in Apple (AAPL US) may be approaching. This insight outlines the tactical considerations behind that view.

6. NSE NIFTY50/ Vol Update / INDO-PAK CONFLICT SPURS LOCAL RISK-PREMIA HIGHER. IV @ +18.0%

- Onset of IND-PAK military conflict spurs IVs higher to +18% levels. Vol Regime model holds in “High & Up” state.

- Skew extends to extreme levels, RRs trades from -5.0 to -7.0 vols. Vol Term-structure is now flat in the front-end & in Backwardation at the back-end of the curve.

- Tactical Implications: Avoid Risk-premia harvesting as “High & Up” vol-state prevails.