Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC & UMC Spreads Higher After Taiwan Market Holiday

- TSMC: +28.3 Premium; Historically Extreme Level, Can Short the ADR Premium

- UMC: +3.3% Premium; Historically Extreme Level, Short the ADR Premium

- CHT: -0.7% Discount; Near Lower Bound, Consider Going Long the Spread

2. TSMC: New Signals Underscore N2’s Rise as a Blockbuster Node

- Latest Signals Continue to Indicate N2 Is Emerging as TSMC’s Blockbuster Node

- N2 Commercialization Timing Aligns With Major AI HPC Platform Roadmaps

- TSMC Market Share Over 70%… Could N2 Drive This Number Even Higher? Maintain Our Structural Long Rating for TSMC

3. PC Monitor: Nvidia GB10 PCs Poised to Redefine the AI PC Category

- GB10 Brings Nvidia AI Performance From Data Center to the Desktop

- GB10 PCs Will Be “True” AI PCs, Their Capabilities Will Be More Evident

- From Niche to Market Driver; Maintain Structural Long for Mediatek, Asustek, Acer

4. TSMC (2330.TT; TSM.US): Is It Possible TSMC’ Output Reach a 50:50 Ratio Between the U.S. And Taiwan?

- The U.S. Secretary of Commerce, Howard Lutnick, has requested that Taiwan Semiconductor (TSMC) – ADR (TSM US)’s production output reach a 50:50 ratio between the U.S. and Taiwan.

- By contrast, TSMC’s fab construction also requires strong supplier coordination, and in the case of its U.S. fabs, there are numerous regulatory hurdles to overcome.

- Meanwhile, Semiconductor Manufacturing International Corp (SMIC) (981 HK)’s share price in Hong Kong has surged this year (+209.14%), significantly outperforming TSMC’s share price increase (+28.15%).

5. It’s Official, OpenAI Is Becoming A Multi-Trillion Dollar Hyperscaler

- Inference compute is going increase by a factor of one billion. It’s already gone up at least 2x in the past twelve months

- OpenAI will become the next multi-trillion dollar hyperscaler. NVIDIA is going to make sure this happens

- AI-Related revenues have already reached $1 trillion since all hypercaler revenues are now AI related according to Jensen. Problem solved!

6. Taiwan Tech Weekly: OpenAI to Consume Nearly Half of Global DRAM; Why TSMC 2nm Will Be A Blockbuster

- OpenAI, Samsung & SK Hynix Lock In Memory Pact — Taiwan Next Stop

- MediaTek’s Major ASIC Ambitions Face Delays from Some Key Clients

- TSMC: New Signals Underscore N2’s Rise as a Blockbuster Node

7. Intel (INTC.US): Seeking Investment from TSMC?

- NVIDIA Corp (NVDA US)’s investment is focused on joint AI development.

- Intel Corp (INTC US) may seek to invite Taiwan Semiconductor (TSMC) – ADR (TSM US) to join its investment initiative.

- Meanwhile, Intel Corp (INTC US)’s stock price has risen about 50.2% from its recent low.

8. Taiwan Dual-Listings Monitor: TSMC Premium Remains High Ahead of 3Q Results; CHT Rare ADR Discount

- TSMC: +26.8% Premium; Remains at Historical Extreme; Earnings Release Ahead

- ChipMOS: +1.3% Premium; Wait for Higher Level Before Shorting the Spread

- CHT: -1.0% Discount; Good Level to Go Long the ADR Spread

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO (2259 HK): Trading Debut

- Zijin Gold (2259 HK) priced its IPO at HK$71.59 per share to raise gross proceeds of approximately US$3.2 billion. The shares will begin trading on September 30.

- The IPO was discussed in Zijin Gold IPO: The Investment Case and Zijin Gold IPO (2259 HK): Valuation Insights.

- The market sentiment of the peers has increased since the IPO launch. My analysis suggests that the IPO price range is attractive.

2. Tekscend Photomask (429A JP) IPO: Valuation Insights

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$828 million). Pricing is on 30 September.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case and Tekscend Photomask (429A JP) IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that Tekscend is attractively valued at the IPO price range compared to peer multiples.

3. Tekscend Photomask IPO – Thoughts on Valuation

- Tekscend Photomask (429A JP) (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

4. LG Electronics’ BOD Gives the Green Light for LG Electronics India IPO in 2025 – Updated Valuation

- LG Electronics’ BOD finally approved a plan to sell a 15% stake in LG Electronics India in an IPO to be completed in 2025.

- According to local media, LG Electronics India is now valued at about US$13 billion which is higher than LG Electronics’ market cap of US$8.8 billion.

- Our base case valuation of LG Electronics India is implied market cap of 1,280 billion INR or US$14.4 billion.

5. [Japan ECM] MIGALO Holdings (5535 JP) Offering to Raise Capital, Generate Interest

- Migalo Holdings (5535 JP) is one of the rare TSE Prime-listed companies which got the boot from TOPIX, stayed in Prime, and is clawing its way back.

- As of end-March-25, it met all the criteria to stay in Prime and rejoin TOPIX. Now they are launching a primary offering, and this may presage an effort to rejoin.

- They are adding float and 10% of shares to the pile, in this ¥4.4-5.0bn offering. But instos are net short this stock.

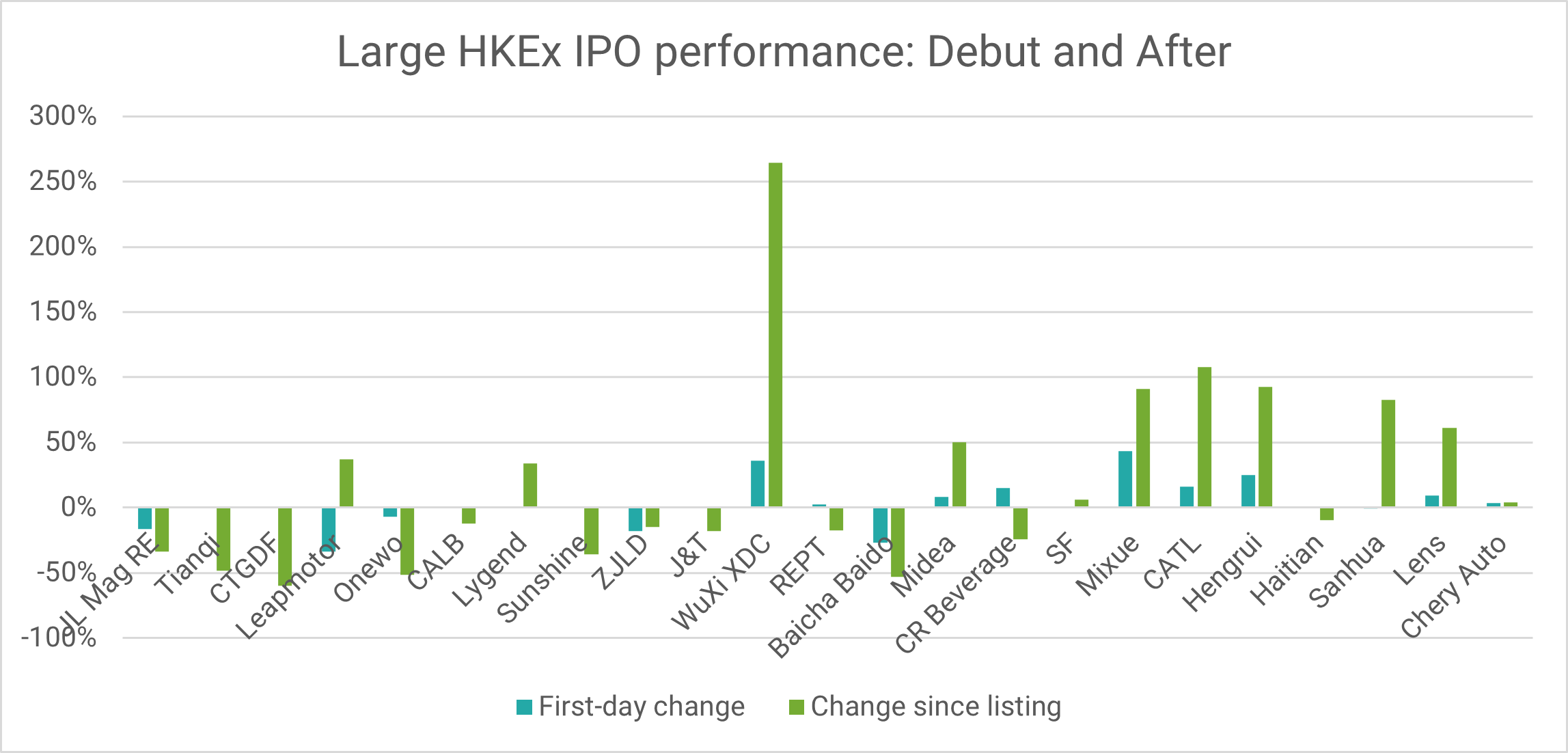

6. ECM Weekly (29 September 2025)- Zijin, Chery, CAREIT, Orion, Butong, Victory Giant, Northern Star

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, this week saw a few good listings across the region while the spotlight will be on Zijin Gold (2259 HK) in the coming week.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

7. Zijin Gold : Listing Pop Likely. Know Your Thresholds. Avoid Valuation Pitfalls.

- Riding on strong investor demand, Zijin Gold (2259 HK) has exercised its over-allotment option, boosting the total IPO size to USD 3.7 billion from USD 3.2 billion previously.

- As Hong Kong’s only pure-play gold miner with global exposure, Zijin Gold may command a premium, though any sharp price gains still depend on sustained gold price strength.

- Investors should define their medium- to-long-term gold price thresholds to shape a clear post-IPO strategy for Zijin Gold.

8. Tekscend Photomask IPO – Peer Comparison

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we will undertake a peer comparison.

9. Zijin Gold (2259 HK) IPO Debut – Some Points Worth the Attention

- Based on DCF model, valuation is about US$28.4 billion. We think this is the valuation bottom line. Conservative investors can take profits at this valuation level.

- Valuation has the potential to reach US$34-42bn (or 18-22x P/E ) if based on 2025 forecast.Optimistic investors can choose to wait for stock price to fall within this valuation range.

- Considering better profitability/shareholder resources, Zijin Gold has more advantage than Shandong Gold Mining. Therefore, market value of Zijin Gold will widen the gap with Shandong Gold Mining in the future.

10. Zijin Gold IPO Trading: Decent Retail but Strong Insti Demand

- Zijin Gold (2259 HK) raised around US$3.2bn in its Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.

Receive this weekly newsletter keeping 45k+ investors in the loop

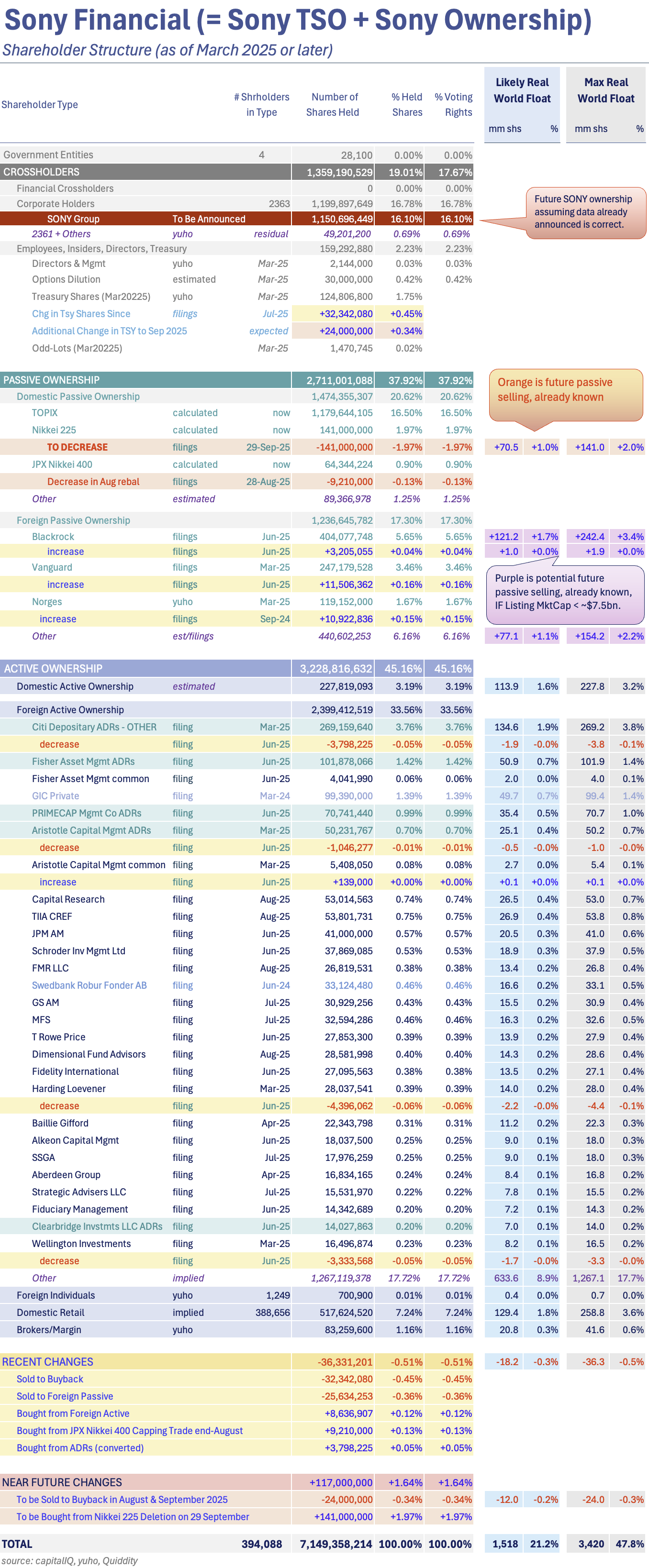

1. [Japan Event] Sony Financial (8729 JP) Overhang Hangs Over, Company Buys Back, ADR Selldown Awaits?

- Sony Financial Group (8729 JP) listed on Monday with a “Reference Price of ¥150. It opened at ¥205, quickly running to ¥210, then fell to ¥198 by lunch. Close? ¥173.8.

- That got a big ToSTNeT-3 buyback at ¥173.8. It traded lower on Day 2, closing at ¥164. Then lower still on Weds with another TN-3 buyback now ¥159.4.

- Neither buyback was full. SFGI has bought back 124mm shares. But the stock has fallen hard. ADRs/ADSs start trading Tuesday. That could see more selling.

2. Tekscend Photomask (429A JP) IPO: TPX Add in Nov; Global Index: One in Feb; One in June

- Tekscend Photomask (429A JP)‘s listing has been approved by the JPX and the stock is expected to start trading on the Prime Market from 16 October.

- At the top end of the IPO range at JPY 3000/share, Tekscend Photomask (429A JP) will be valued at JPY 298bn (US$2bn).

- The stock should be added to the TOPIX INDEX at the close on 27 November while inclusion in global indices should take place in February and June.

3. [Japan M&A] Mitsubishi Logisnext (7105) – This Deal Looks Mighty Bad

- JIP and MitHeavy have announced a takeunder to buy out MitHeavy sub Mitsubishi Logisnext Co., Ltd. (7105 JP) at a weighted average price 42% lower than Target Advisor DCF range midpoint.

- No/Minimal transparency. A sales process interrupted by Trump tariffs, leaving one low-ball bidder. And the sellers goes ahead with it BUT gets to reinvest on the back end. You don’t.

- The Board “supports” the Tender Offer, but leaves it to the opinion of the shareholders as to whether they tender. MitHeavy has 64.4% already so that basically gets done. But…

4. Mitsubishi Logisnext (7105 JP): JIP’s Takeunder Offer

- Mitsubishi Logisnext Co., Ltd. (7105 JP) announced a pre-conditional tender offer from Japan Industrial Partners (JIP) at JPY1,537 per share, representing a 15.3% discount to the last close price.

- The offer resulted from an auction process. The offer is light in comparison to peer multiples and is below the midpoint of the target IFA DCF valuation.

- While Mitsubishi Heavy Industries (7011 JP) irrevocable has a competing proposal clause, it is unlikely that a bidding war will transpire. The low required tendering rate suggests a done deal.

5. Merger Arb Mondays (29 Sep) – Soft99, Ashimori, Mandom, Paramount, OneConnect, Dongfeng, Spindex

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Soft99 Corp (4464 JP), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Mandom Corp (4917 JP), Paramount Bed Holdings Co Lt (7817 JP).

6. Curator’s Cut: BABA Hedges, Substantive Spin-Offs & Japanese Activist Situations

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,000+ Insights published over the past two weeks on Smartkarma

- In this cut, we review strategies to hedge Alibaba (9988 HK) exposure, examine signficant Asian spin-offs, and explore engaging activist situations in Japan

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

7. LG Electronics India IPO: Big Market Cap, Small Float -> Small Passive Flows

- LG Electronics India (123D IN) is looking to list on the exchanges by selling 101.8m shares at a valuation of US$8.7bn and raising around US$1.3bn in its IPO.

- The new valuation is around 24% lower than the rumoured valuation at the time of the DRHP filing last December.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

8. Jardine Matheson (JML SP): Additional Office Recycling Speculated

- The prior MO for the Jardines group was never sell your commercial buildings. This year marks a paradigm shift in that line of thinking.

- First Hongkong Land (HKL SP) sold nine floors of One Exchange Square to HKEX (388 HK). The first such sale since 1988.

- Now Mandarin Oriental (MAND SP) is negotiating the sale of “certain office space” at One Causeway Bay. Jardine Matheson (JM SP)‘s NAV discount and implied stub are at 12-month lows/highs.

9. Tata Capital IPO: Big Listing, Big Valuation, Small Float

- Tata Capital Limited (TATACAP IN) is looking to list on the exchanges by selling up to INR155bn (US$1.75bn) of stock at a valuation of around INR 1,384bn (US$15.6bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in June 2026.

- The stock should be added to the Large Cap segment in the AMFI Classification in January and to the Nifty Next 50 Index in March.

10. LG Chem: Announces a PRS Worth 2 Trillion Won Using Its Shares in LG Energy Solution as Base Asset

- LG Chem announced that it plans to complete a price return swap worth about 2 trillion won (US$1.4 billion) using its stake in LG Energy Solution as the base asset.

- This 2 trillion won PRS is likely to have a slightly positive impact on LG Chem and slightly negative impact on LG Energy Solution.

- Our NAV valuation of LG Chem suggests implied NAV per share of 369,187 won, which is 31% higher than current levels.

Receive this weekly newsletter keeping 45k+ investors in the loop

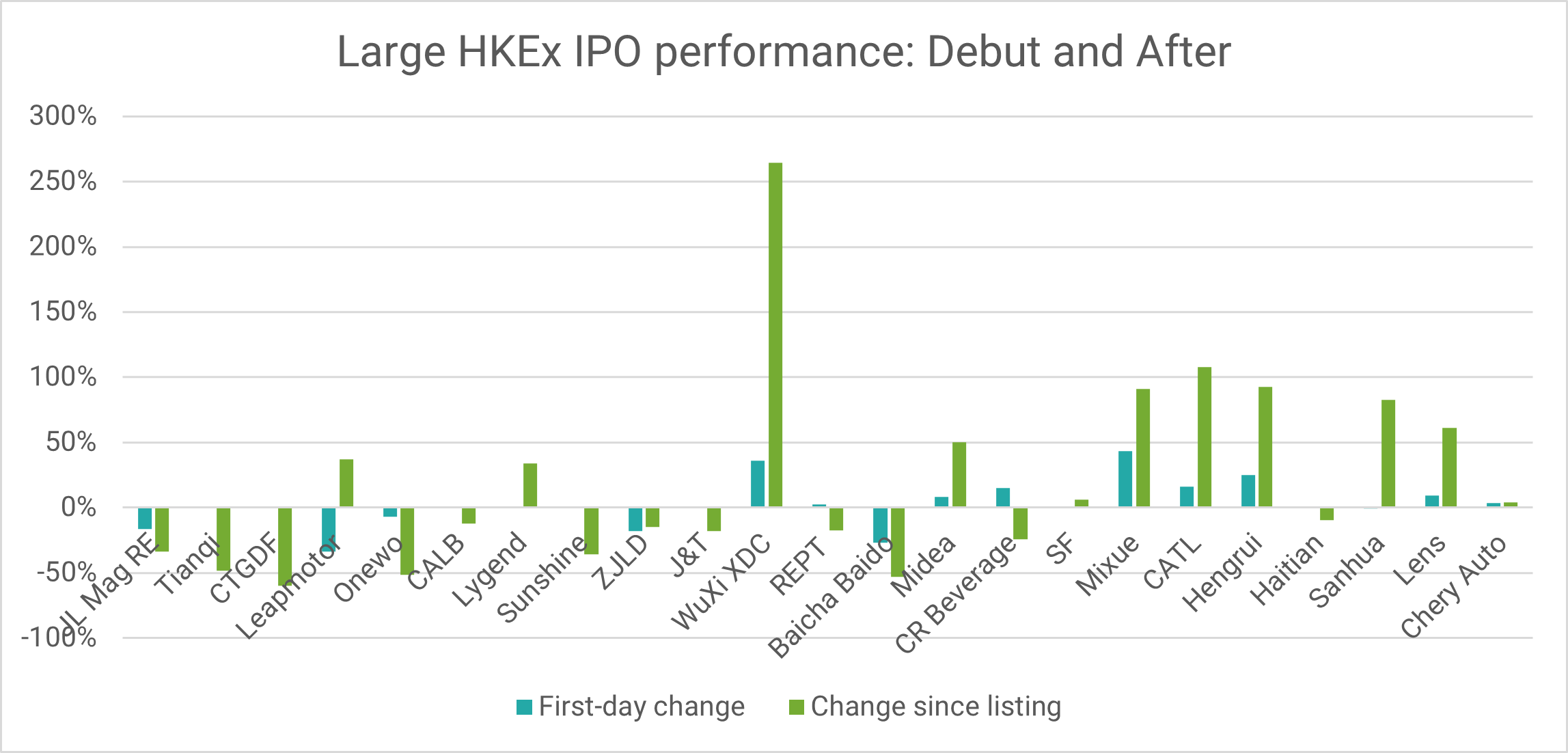

1. Fast Retailing (9983 JP) Tactical Outlook: Waiting for A Rally

- In our previous Fast Retailing (9983 JP) insight we identified a potential BUY opportunity ahead of the September 25 rebalance, but the rally failed to materialize.

- The stock at the moment is oversold, according to our quantitative model, so we would like to review its tactical outlook in this insight.

- Right now, the stock is the most oversold of all the Asian stocks we track, probability of WEEKLY reversal stands at 72%, after last week’s Close.

2. Asia/Pacific Stocks Outlook For the Week Sep 29-Oct 3

- Multi-Week forecasts for the Asian indices and stocks we track, based on our proprietary probability model.

- OVERBOUGHT: Samsung Electronics (005930 KS) , Softbank Group (9984 JP) , Toyota Motor (7203 JP) , Nikkei 225 (NKY INDEX)

- OVERSOLD: China Mobile (941 HK) , Fast Retailing (9983 JP)

3. BYD (1211 HK) Tactical Outlook: A Rally May Be Underway

- BYD (1211 HK) is currently in a position from where it could rally. Our previous insight suggested a possible bottoming area around 100.9 but the stock never reached that low.

- This week the stock rallied to 114.7, then pulled back. If the stock is temporarily bottoming, it could rally past 115 and up to 130 from here.

- According to our TIME MODEL the duration of the rally could be up to 3-4 weeks (2-3 more weeks up from here).

4. Hong Kong Single Stock Options (Sept 29 – Oct 03): Materials and IT Lead Amid Rising Option Activity

- HSI extended gains to fresh highs, supported by strong breadth, surging Materials and IT names, and rising single stock option activity

- Broad gains across all sectors highlighted strong momentum, with leadership from Materials and Information Technology.

- We examine the distribution of returns since the April lows finding that the tails are distinctly unbalanced.

5. A Rundown of the Last Month’s Futures and Options, Stock Options Views

- 3 global futures and options topics we covered included global equities, Brent, and Gold. We review the topics discussed and look forward to another interesting month of volatility trades.

- NK remains moderately interesting for NK vs MSCI World vol with the leadership change coming up, though deep downside swings would not be expected.

- Were bullish on AI stocks, and highlighted a few favorites with some tactical options trades to monetize existing equity longs or put on new hedged volatility positions.

6. Microsoft Corp: Balancing Cloud and AI Strength Against Cost and Execution Risk

- Microsoft’s cloud strength and AI leadership, particularly with Copilot, position it for growth, though its current valuation likely reflects these expectations, necessitating new market drivers.

- The company faces increasing pressure on efficiency metrics like gross margin and free cash flow due to significant, long-term AI infrastructure investments.

- We suggest a tactical approach to capitalize on anticipated stable price movements, leveraging current market conditions and implied volatility.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HONG KONG ALPHA PORTFOLIO: (September 2025)

- Hong Kong Alpha portfolio gained 8.45% in September and 60.89% and 62.80% YTD and since launch one year ago. The portfolio has outperformed Hong Kong indexes by more than 40%.

- The portfolio has a Sharpe ratio of 3.23 YTD and has generated more than 40% of its returns from stock-picking (alpha). Its beta is low at only 1.17.

- At the end of September, we increased exposure to AI and robotics and sold positions in the consumer and finance sectors.

2. UK: Lending Looks Stimulated

- Lending activity is sustaining beyond the levels prevailing before the stamp duty tax hike distortion. Only housing transaction volumes are down, but by less than before.

- New loan rates have fallen by 23bp since then, for a 110bp cumulative fall. New rates are close to the outstanding stock. Many borrowers are refinancing for similar deals.

- Past tightening has broadly passed through, but the strength in broad money growth signals that monetary conditions are settling at a slightly stimulative setting.

3. EA: Core Excess Revealed In Sep-25

- Inflation’s break above target to 2.23%, within 1bp of our forecast, came as past energy price falls dropped out to reveal the more resilient underlying pressures.

- Small upside surprises in large countries, like Germany and Italy, were balanced in number and contribution by larger surprises in small ones, like Greece and Estonia.

- We expect less negative payback in October and January, preventing our profile from languishing below the target through 2026, like the consensus view does.

4. UK: Government Leads Imbalances

- Household saving and inflation have eroded their debt burden while corporates remain prudent. A lack of imbalances to correct starves the UK of fuel for a recession fire.

- Persistent fiscal and current account deficits highlight where the UK’s primary risk lies. If the market regime focuses on fiscal issues, the corrective pressures could be fierce.

- We don’t expect that correction to occur, but the Chancellor should tread carefully, while doves need not worry about a recession arising from healthier other UK sectors.

5. Australian Equities: Where are we now, and what’s next?

- Australian economy remains sluggish, but some positives include recovery in small caps and resilience of Australian consumers

- Market volatility and narrow leadership driving unhappiness among active investors

- Resilience of Aussie consumer and strong retail results stood out in recent reporting season, with small caps and US housing exposure also notable themes

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. HEW: Watching What Didn’t Happen

- The US government shutdown removes the potential for official statistics to damp dovish concern, raising the likelihood of October’s cut, especially with other weak data.

- EA unemployment’s rise reflected rounding rather than substance. UK national accounts revealed healthy balance sheets, aside from the government, and bullish lending stats.

- Next week’s calendar stays thin with US releases suspended and Europe’s cycle focusing on the following week. The RBNZ, BoT, BSP and Peru announce rates next week.

7. Gold Mania, Niobium Dreams, and Antimony Nightmares (Datt)

- US monetary policy is accommodative and markets are buoyant, especially in commodities

- Investors need to be cautious about being overly bullish in current environment

- Similarities seen with 2006-2007 period, particularly in disruptions in copper supply and new technologies in metal recovery; investors should be wary of hype and potential risks involved

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

8. Get Ready to Buy the Dip, But Not Yet

- We remain intermediate-term bullish on stocks, but the market is at risk of a correction.

- If last week’s weakness is the start of a pullback, short-term trading indicators point to further downside potential.

- Investors should be prepared to buy the dip, but not yet.

9. Indian Market: WANT TO BUY THE DIP, THINK AGAIN !!

- India’s markets continue to underperform Asia since our insight last November recommending investors to “Fade the Market”.

- Foreign investors continue to exit the market this year with the largest net outflow since COVID.

- The Trump administration is pressuring India in trade negotiations with reciprocal tariffs (25%), additional tariffs for importing Russian oil (25%), pharma tariffs (100%), and new restrictions on H-1B visas.

10. EA: Rounding Jobs For Migrants

- A surprise rise in EA unemployment reflects rounding rather than alarming weakness, with labour supply and demand still surging. Finland’s woes are more idiosyncratic.

- Supply has trended much faster post-pandemic, sustaining demand at its old trend without extreme capacity constraints. Migration has more than accounted for the rise.

- Ukrainians are dominating the flow and complicating the read through to disinflationary spare capacity. Wage growth is an even more critical signal when supply is uncertain.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NVIDIA’S Genius Partnership With OpenAI May Be About More Than You Think

- OpenAI and NVIDIA announced an audacious alliance under which the latter will invest $100 billion in the former

- That investment will be staged to coincide with each completed gigawatt of compute capacity, up to ten gigawatts in total, which the two companies are planning to jointly install

- Is this NVIDIA cutting out the middleman and setting up their very own private hyperscale enterprise to lease their GPUs directly to OpenAI? Uh oh!

2. Taiwan Tech Weekly: Mediatek Eyes US Manufacturing, 40% Global Mkt Share; Micron Earnings Take-Aways

- Micron Earnings Call Analysis: AI Memory Tailwinds Getting Stronger as Servers, Smartphone, PC Demand Converge

- MediaTek Sharpens Flagship Push, Aiming for 40% Global Market Share… Also, Exploring U.S. Production Set Up

- KYEC (2449.TT): The Recent Upward Momentum in the Share Price Has Been Driven by Strong Fundamentals

3. TSMC (2330.TT; TSM.US): 4Q25/2025 Outlook Could Outperform; 2nm Is Likely to Largest Adopted in 2026

- Taiwan Semiconductor (TSMC) – ADR (TSM US) 2Q25 growth likely reaches ~39% YoY with upside risk if 4Q25 outperforms.

- Apple (AAPL US) remains the anchor customer driving N2 ramp in 2026.

- Since 2nm technology will be widely adopted starting in 2026, revenue growth is projected to be around 25% YoY.

4. KYEC (2449.TT): The Recent Upward Momentum in the Share Price Has Been Driven by Strong Fundamentals

- NVIDIA Corp (NVDA US)’s GPUs and AI chips have been tested at King Yuan Electronics Co, Ltd. (2449 TT) facilities for the past three years.

- The recent upward momentum in the share price has been driven by strong fundamentals.

- ASE Technology Holding (ASX US)/SPIL is trying to enter the burn-in testing space, but its equipment still lacks full certification from NVIDIA Corp (NVDA US).

5. MHI (7011 JP): Laser Power Transmission Positive, Political Support Unclear

- Laser wireless power transmission technology opens new defense, dual-use and civilian market opportunities.

- Japanese politicians inclined to spend more on defense, but worried about the national budget. Likely to split the difference between 2% of GDP and Trump’s demands.

- Aircraft, Defense & Space to drive sales and profit growth through 2030. Buy on dips for the long term.

Receive this weekly newsletter keeping 45k+ investors in the loop

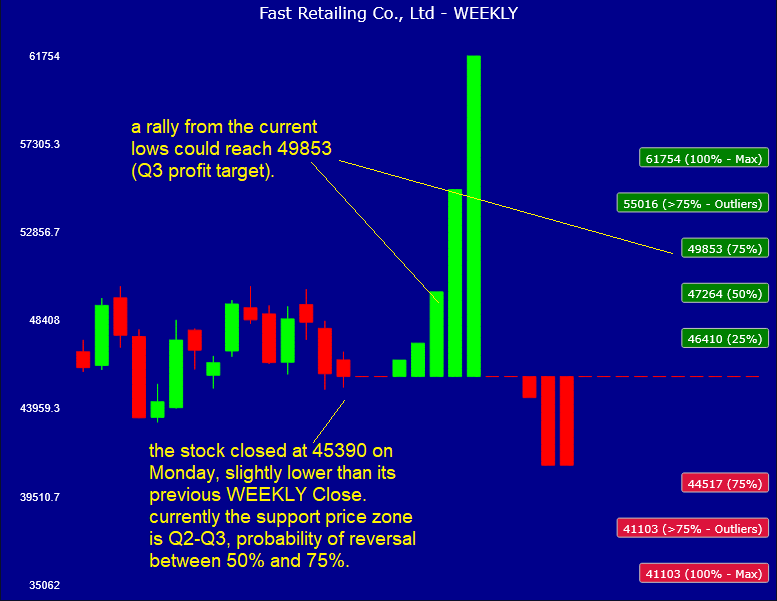

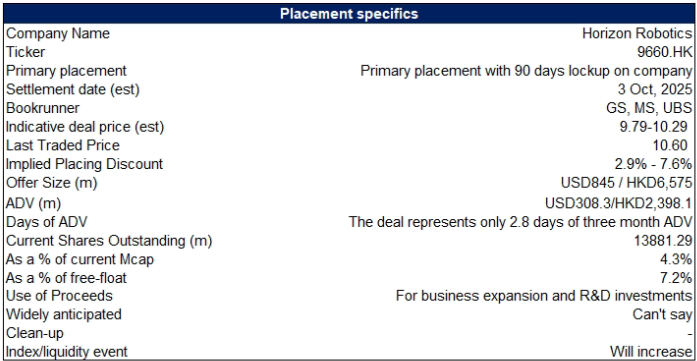

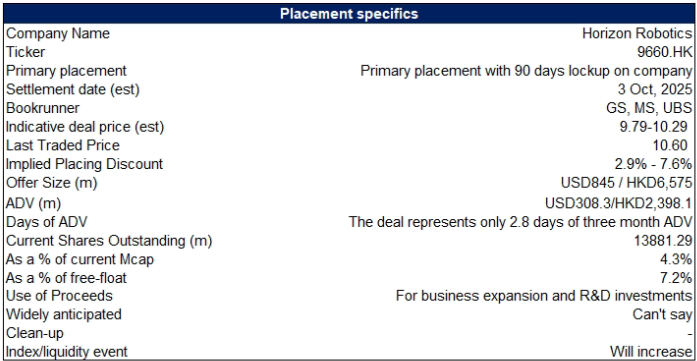

1. Horizon Robotics Placement – Another Opportunistic Raising

- Horizon Robotics (9660 HK) raised around US$800m in its Oct’24 IPO and another US$600m via a placement in June’25. It’s back again to raise another US$834m via a top-up placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. Trading Strategy of Zijin Gold on the First Day of IPO

- Zijin Gold IPO will start trading on 30 September. Zijin Gold is aiming to raise US$3.2 billion (HK$24.98 billion) from its IPO, offering 349 million shares at HK$71.59 each.

- Our base case valuation of Zijin Gold is HK$124.7 per share (74.2% higher than the IPO price). We expect a sharply higher pop on the first day of trading.

- If its share price appreciates more than 30-50% or more, we think it is prudent to take some profits off the table (at least 25%-30% of total investment).

3. Berkshire Hathaway Dumps All Its Stake in BYD – Impact on the Chery Auto IPO

- Warren Buffett’s Berkshire Hathaway completely exited its stake in BYD (1211 HK).

- We highlight four major reasons why Berkshire may have exited its entire position including valuations, tariffs, competition and lower profit margins, and greater risk prospects on economic stagnation in China.

- Berkshire selling all its stake in BYD is likely to have a slightly negative impact on the Chery Auto IPO. However, we maintain a Positive view of Chery Auto IPO.

4. Tekscend Photomask (429A JP) IPO: The Bull Case

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$832 million). Pricing is on 30 September.

- Tekscend, which was carved out of Toppan Printing (7911 JP) in 2022, is owned by Toppan (with a 50.1% stake) and Integral (5842 JP) (with a 49.9% stake).

- The bull case rests on its leading market position, attractive market opportunity, stable underlying margins, net cash position, and attractive dividend policy.

5. Zijin Gold IPO: The Good, The Bad and Valuations. For the Gold Bulls.

- Zijin Gold (2259 HK) IPO offers investors with a bullish outlook on gold prices a timely entry into a pure play gold miner with a globally diversified asset base.

- At HKD71.59/share, Zijin Gold IPO is set to raise US$3.2 billion with cornerstone investors already committing about half the deal (US$1.6 billion).

- At current gold prices, IPO valuations leave a reasonable buffer; however, a pullback toward year-ago levels would pose significant downside.

6. Fermi Inc. (FRMI): Pre-Revenue Data Center REIT Sets Terms Seeking $13.2b Valuation

- Fermi set terms for its IPO on Wednesday afternoon and will offer 25 million shares at $18-$22 and to debut on Wednesday, 10/1.

- One of Fermi’s founders is former energy sector director, Rick Perry.

- The underwriters have reserved for sale at the initial public offering price up to 5% of the shares of common stock for sale through a directed share program.

7. KCC Corp – To Issue 430 Billion Won in EB Using Its Treasury Shares?

- On 23 September, Hankyung Business Daily reported that Kcc Corp (002380 KS) plans to issue about 430 billion won worth of exchangeable bonds (EB) based on its own treasury shares.

- We believe the overall impact on this EB issue on KCC is likely to be more negative as compared to the EB issue it conducted in July 2025.

- Our NAV valuation of KCC Corp suggests NAV per share of 508,467 won, which is 22% higher than current price.

8. ECM Weekly (22 September 2025)- Chery, Zijin Gold, Orion, Myungin, Urban, Avepoint, Dongfang

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Zijin Gold appears to be shining bright.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

9. Zijin Gold IPO: Gold Price Sensitivity Analysis. A High Beta Proxy for Gold

- Zijin Gold (2259 HK) ’s US$3.2 billion IPO closes tomorrow, Wednesday, September 29.

- The pure-play gold miner, backed by Zijin Mining, is priced at an EV/Reserves multiple in the top quartile of global peers.

- With high sensitivity to gold price movements, Zijin Gold offers amplified upside potential — and downside risk — versus bullion itself.

10. Chery Auto IPO (9973.HK): Modest Potential Upside, Geely Auto Screens As a Good Comparison

- Chery Auto, the second largest Chinese domestic brand passenger vehicle company, priced its IPO at the high end of the range at HK$30.75/share.

- High demand for the stock was predictable. Cornerstone investors collectively agreed to acquire ~$588M worth of Chery Auto shares in this offering.

- The Chery Auto stock is set to start trading on Thursday. I see modest potential upside vs. IPO offer price as growth is slowing down and margins compressed.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event] Sony Financial Spin-Off Trades Monday – Fina(Ncia)L Thoughts

- Today is the last day of trading for Sony Corp (6758 JP) with Sony Financial Group (8729 JP) spin-off rights. SFGI starts trading separately on Monday 29 Sep.

- The reference price is ¥150/share. It will likely stay in all major indices except Nikkei 225, and it likely needs low ¥160s to stay in M _ _ _.

- The estimated Div Yield is higher on SFGI than peers by a fair ways, and looks to grow, and there is a big buyback to come. I like it.

2. Shift (3697 JP) – Short-Selling into Nikkei 225 Inclusion = Crowded Register Dynamic = Squeezy

- Shift Inc (3697 JP) runs a software quality assurance testing business. 400% revenue growth in 5 years, but this year to Aug25 is “only” 17.5% according to Q3 results guidance.

- It was a “growth stock” for a long while, and large long-only growth investors flocked to the name. In the past several months many have exited.

- The stock will be included in the Nikkei 225 Average next Tuesday. The supply/demand dynamics here to there are interesting. Afterwards they may be more interesting.

3. [Japan M&A] Paramount Bed (7817 JP) Founding Family Takeout – Too Cheap, Deserves Activist Response

- In a fairly common pattern, the founding family (38% ownership) of Paramount Bed Holdings Co Lt (7817 JP) have launched an MBO.

- It is too cheap at 4.2x adjusted EV/EBITDA (one could argue it is 5.0x but they also have net receivables) for such a ubiquitous brand and growth.

- Soft99 Corp (4464 JP) may have been a one-off. Maybe not. People may look at this situation through that lens. It deserves that look.

4. [Japan M&A/Activism] Soft99 Board Comes Out Against Effissimo Bid 66% Above MBO Price

- Today after the close, the Soft99 Corp (4464 JP) Board of Directors came out AGAINST the Effissimo ¥4,100/share counterbid to the original ¥2,465/share MBO.

- “The Special Committee advised that the Tender Offer would not contribute to the enhancement of the Company Group’s corporate value, nor would it be fair to the Company’s general shareholders.”

- ¥2,465 is fair. ¥4,100 is not fair. Absolute hogwash. Unmitigated blatherskite. Pure trumpery. Codswallop, buncombe, taradiddle, balderdash, and nincompoopery too. I expound below.

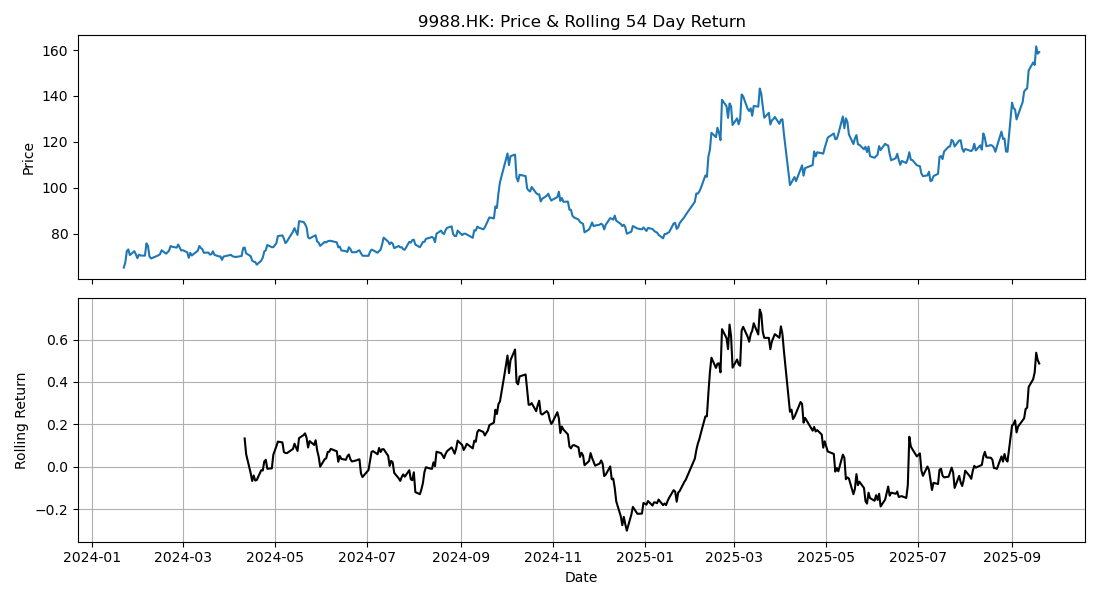

5. HK Connect SOUTHBOUND Flows (To 19 Sep 2025); BIG Single Stock Trading Again, Feels Slightly Toppish

- Gross SOUTHBOUND volumes just over US$22+bn a day this past 5-day week. Biggest week in a while. Net Flows not following gross flows. Feels toppish into GW.

- The recommended name last week was Alibaba (9988 HK) was up 2.2% on the week but only +0.7% from Monday close to Friday.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Pairs Monitor are both there for all SK readers.

6. The BOJ Announces the Start of ETF/JREIT Selldowns – Basically a Nothing-Burger

- In Friday’s Monetary Policy Statement, the BOJ announced it would start selling down its holdings in ETFs and J-REITs at the pace of ¥620bn and ¥5.5bn/year, respectively. BIG NEWS!

- That is US$17mm of ETFs and US$150k of J-REITs per day. The BOJ suggests it is 0.05% of volume per day. That’s close. SMALL EFFECT.

- Given ¥15trln of buybacks and ¥5trln+ of dividend reinvestment + NISA account buys, plus ¥trlns of cross-holding selldowns/year, this is a total nothingburger, even if they up the pace.

7. Korea Semicon ETF Rebal October Play: 2 In, 2 Out Long-Short Setup

- MTD screening results with 5 trading days left point to 2 names going out and 2 names coming in: Gemvax and Wonik IPS replace Dongjin Semichem and Jusung Engineering.

- Unlike last April’s tariff-distorted +1.3% rebalance, this time we expect cleaner, more meaningful price action.

- No pre-positioning seen, so I’ll target ETF rebalance day (Oct 10) and maybe take an anticipatory position a day earlier.

8. Sony Spin-off (Sony Financial Group) Spin-off Deep Dive

- Sony Group Corporation (6758) is planning to spin off 80% of its stake in Sony Financial Group Inc. (8729) on September 29, 2025.

- Sony Financial Group Inc. is the financial services arm of Sony, comprised of three main businesses

- The spin-off will generate ~ ¥100BN in the current fiscal year and pay a ¥50BN annual dividend.

9. Merger Arb Mondays (22 Sep) – Technopro, Soft99, Mandom, Pacific Ind, Dongfeng, Shengjing, Smartpay

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Oneconnect Financial Technology (6638 HK), Joy City Property (207 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), PointsBet Holdings (PBH AU), Mandom Corp (4917 JP), Humm Group (HUM AU), Fuji Oil Co Ltd (5017 JP).

10. Soft99 Corp (4464 JP): The Board Opposes Effissimo’s Hostile Offer and Hints the MBO Will Succeed

- The Soft99 Corp (4464 JP) Board has, unsurprisingly, opposed the Effissimo offer for several reasons. Notably, they do address the huge price disparity between the two offers.

- While most of the reasons to justify the opposition are weak, the Board unexpectedly notes that as of 24 September, the MBO retained acceptances to satisfy its minimum tendering condition.

- Despite the significant premium of the Effissimo offer, this development suggests that the current acceptances for the MBO are sticky, thereby increasing the likelihood that Effissimo’s offer will fail.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Alibaba (9988.HK): Overheated Momentum and Shifting Sentiment – Constructing a Smarter Hedge

- Baba’s recent surge mirrors past rallies, with recent sideways price action raising a caution flag.

- Metrics from the options market suggest that sentiment that was overheated has begun to turn.

- We explore an alternative hedge that will not cap a continued rally but is less expensive than directly buying Puts in Baba.

2. Hang Seng Index (HSI) Tactical Outlook: Small Pulback or Large Pullback?

- As suggested in our previous insight, the Hang Seng Index (HSI INDEX) rally was at risk of pulling back: a small correction began last week.

- The big question now: is this just a minor 1-week pullback (a buy-the-dip opportunity)? or a larger pullback, possibly directed towards 23k?

- This insight discusses the various tactical scenarios, including profit targets for a continuation of the rally from here.

3. Alibaba (9988 HK) Vs. Hang Seng Index (HSI INDEX): Relative Value Options Play with Leverage

- Context: Stat-arb models flag Alibaba (9988 HK) as overvalued versus the Hang Seng Index (HSI INDEX), with the difference between implied volatility and option premium at historically high levels.

- Highlight: An actionable trade setup — long HSI calls vs. short Alibaba calls — that captures relative value and introduces leverage through a ratio structure.

- Why Read: This is a timely opportunity to combine a directional view with favorable volatility dynamics, offering asymmetric payoff potential.

4. Baidu (9888.HK): Overheated Trading and Skew Dynamics Highlight a Distinct Hedge Opportunity

- There are multiple signs of overheating in Baidu trading including accelerating stock and option volumes.

- Skew has been driven higher by strong demand for up-strike Calls.

- We recommend a hedge that tilts the odds in the holder’s favor while establishing the position at a credit.

5. Volatility Cones Spotlight Hedging in Tencent (700 HK) And More

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has broadly risen across most, but not all, HK stocks. Front-month expiries remain historically cheap amid a steepening curve. Opportunities endure, though fewer than in recent weeks.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

6. NVIDIA: An Options Strategy for Riding the AI Data Center Waves

- NVIDIA’s has a strong position in the AI industry, but global trade policies introduce short-term uncertainties. Strong revenues and cash position buffer against policy-driven obstacles, particularly concerning its China revenues.

- We highlight NVIDIA’s technological leadership, including its full-stack computing infrastructure and rapid platform transitions. External pressures weigh on projected revenues, including export restrictions and increasing competition from major tech companies.

- We see potentially overpriced implied volatility. This strategy aims to generate premium while managing risks associated with price movements, especially in the context of evolving geopolitical and competitive landscapes.

7. Softbank Group (9984 JP) Tactical Outlook: Momentum Strong but Stretched, Higher Targets Speculative

- Softbank Group (9984 JP) performed a strong 1-week rally 2 weeks ago, then went marginally higher. The stock is OVERBOUGHT according to our models, but the pattern is bullish.

- We see two possible scenarios: a) the stock stalls and pulls back this week or b) it keeps rallying towards 20850.

- The current pattern had rallies lasting up to 5 weeks in the past, so Softbank Group (9984 JP) could rally 2 more weeks, and get closer to 20850.

8. Kospi 200: Rally Echoes Pandemic Rebound

- Current gains echo past moves that required lengthy consolidation, suggesting risk management is prudent.

- Volatility trends remain middling, but skew steepness points to cost-effective downside structures.

- Rally momentum slows as Kospi reaches levels where past reversals have occurred versus SPX.

9. HSI: Extended Run Faces Hurdles, Hedge Strategies Recommended

- After a 33.9% rally off the April lows HSI is starting to flash caution across a variety of metrics.

- Weak breadth and option exuberance at the single stock level are additional areas of concern.

- We outline the technical backdrop and recommend hedge strategies given the current level of implied vols.

10. NIFTY 50 Tactical Outlook: Quantifying Downside Risk and Strategic Re-Entry Zones

- In our previousNIFTY Index insight published at the end of August we highlighted two possible scenarios before the Sep-30 rebalance: 1) risk-off pullback or 2) small rally.

- Scenario 2), the small rally is what came true, it lasted 3 weeks (we said 2 weeks), but it was a weak rally. The NIFTY however is not very overbought.

- 3-Week rallies not reaching higher highs usually indicate a weakness in the trend, but this could be a buy opportunity, so let’s have a look at our model’s BUY zones…

Receive this weekly newsletter keeping 45k+ investors in the loop

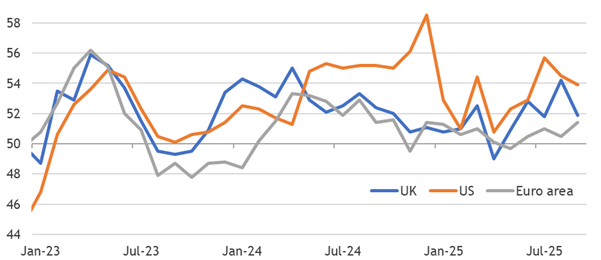

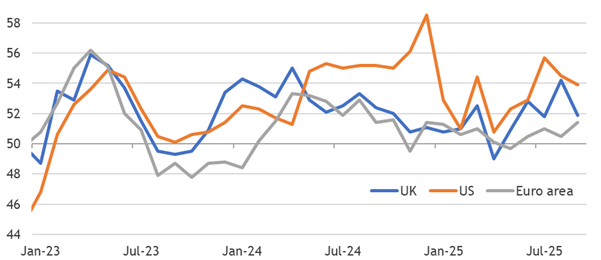

1. Broadly Slower Services PMIs

- PMIs broadly disappointed and declined relative to August, but absolute levels mostly remain robust or at least expansionary. We are not concerned by these noisy moves.

- Such broad slowing seems shocking relative to the past few months, but it is historically a regular occurrence. Five of the previous twelve were at least as broadly bad.

- The labour market remains tight in the euro area, softened in the UK, and steady in the US. Slower activity does not mean disinflationary slack. We stay relatively hawkish.

2. EM Fixed Income: (EM) Credit where credit’s due

- Despite a mixed Fed meeting, EM markets continue to rally in FX and rates

- EM local markets still in a good place with upside potential in growth and improving flow picture

- Sovereign credit markets have had a strong performance year to date, with investors feeling optimistic but also acknowledging the need to be humble in assessing macro risks and valuations.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. HEW: Resilience Reminders Roil Doves

- Bullish GDP revisions and jobless claims provided further reminders that the economy is much more resilient than market pricing has dovishly assumed, causing a hawkish shift.

- Nonetheless, the Riksbank surprised with a 25bp rate cut, but projected that as the terminal rate before hikes start reversing the stimulative setting in 2026.

- Next week’s US payrolls data dominates the calendar, given the potential to break market conviction in an October Fed cut. EA inflation should rise back above the target.

4. Asian Equity: Relative Valuations Have Mostly Converged; Korea the Only Large Rerating Candidate

- Most large Asian markets’ forward PE multiples are significantly higher than their long-term averages. But their valuations relative to Asia-ex-Japan are mostly at the averages, only Korea’s is significantly lower.

- HK/China’s relative PE is slightly lower than average, Taiwan’s is slightly higher. ASEAN markets’ relative PE are sharply lower than their averages, but we think most lack rerating catalysts.

- We think Korea and Philippines deserve to get rerated. India’s relative PE, though at its long-term average, could decline slightly further, to reach its recent bottoms.

5. Will AI save the US Economy?

- European policymakers and investors see Donald Trump’s economic policies harming Republican prospects in the 2026 midterms and the 2028 general election.

- The Trump Administration is placing a good deal of faith in AI as a panacea. But the US may not have the skilled labour or the power-generating capacity to fuel an AI boom.

- Nor is it clear whether the current Administration is preparing for the related socio-economic disruption from which the MAGA faithful would be far from immune.

6. Resilience Is Reinstating

- Falling US jobless claims and bullish GDP revisions are reinstating evidence of ongoing resilience. Underlying GDP only slowed by about 0.1pp in H1, or 15% of 2024’s average.

- Risk management rate cuts to balance the higher costs of being wrong on the downside raise the probability that easing proves premature and swiftly ends.

- The ECB already sees the transmission of its past cuts trending loan growth higher. It may reach pressures consistent with hikes next year, and it already clashes with easing.

7. Asian Equities: Foreign Flows Come Roaring Back in September; India, ASEAN Still Getting Sold

- Fed’s “risk management cut” and a dovish outlook of 2 more cuts in 2025 are driving foreign flows back to Asia. US$11.5bn inflows in September till date underscores the sentiment.

- Korea (US$4.94bn) and Taiwan (US$7.5bn) grabbed the Asian flows entirely, driven by the rejuvenated AI capex theme. India (-US$904m) continues to be sold, though the selling pace has diminished.

- FIIs bought Indonesia (US$672m) in August and sold almost identical amount in Thailand. Philippines, despite being cheap and having a few sectors with upward earnings inflection, continues to be sold.

8. US Tariff Policy: A.K.A. WHACK A MOLE!

- The U.S. continues to play “Whack-A-Mole” using tariffs to threaten and/or negotiate on many economic and geopolitical issues.

- The Trump tariff policy, which may be declared illegal by the Supreme Court next month, has caused manufacturers to hold off on hiring and expansion plans.

- Although tariff revenue for the U.S. government is at an all-time high, the U.S. will still record its highest trade deficit in history this year.

9. SLBs in 2025: Where Step-Ups Create Event-Driven Alpha

- Set-Up and scale: 245 SLBs face 2025 KPI tests; applying a 19% 2024 miss rate implies ~50 step-ups of ~25 bps, worth ~20–60 bps PV. >$80bn notional, heaviest in Q4.

- Trade design, credit and equity: Pre-position where slippage exists and no pre-test calls; run structure pairs; trade post-print drift; for equities, SLB misses flag delivery shortfalls and funding-cost creep.

- Why the market is inefficient: ESG KPIs hide in footnotes and annexes, overlooked by analysts. Verification lags and slow vendor updates delay repricing, so step-up structures stay mis-weighted and mispriced.

10. Indonesia : Sri Mulyani’s Exit Compounds Fiscal Risks

- The exit of Indonesia’s veteran Finance Minister, Sri Mulyani Indrawati, marks a turning point in the country’s fiscal regime.

- With her out of the picture, it is only a matter of time before the government revises the 3% deficit ceiling higher to accommodate Prabowo’s large spending plans.

- This is a slippery slope and an indiscriminate push for spending, without concomitant tax reforms, could put debt on an unsustainable path.