This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NVIDIA Invests $2 Billion In Synopsys. But Why?

- NVIDIA & Synopsys announced a new strategic partnership on Dec 1, mostly covering topics they were already strategically partnering on, with one exception, Cloud-Ready Solutions

- The partnership sees NVIDIA purchase $2 billion worth of Synopsys stock in a private placement. Other, recent, similar strategic partnerships e.g. Siemens & GM, involved no such investment

- They plan to start enabling cloud access for GPU-accelerated engineering solutions. Could this be where that $2 billion finds a home? Is this a new Neocloud in disguise? Let’s see

2. Intel (INTC.US): Apple M-Series in 2027; Intel 18A Is the Key.

- Apple (AAPL US) may outsource iPad CPU production to Intel in 2027.

- U.S. semiconductor reshoring faces fundamental structural barriers, and Trump is trying to blame this by pushing TSMC to move advanced manufacturing technology to the U.S.

- The key variable remains Intel’s 18A execution. However, Intel’s current CEO, Lip-Bu Tan, has not demonstrated an aggressive stance so far.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Mao Geping IPO Lockup – US$4.7bn Lockup Release for Founders and Pre-IPO Investors

- Mao Geping Cosmetics (1318 HK) raised around US$345m in its Hong Kong IPO. The lockup on its founders and pre-IPO investors is set to expire soon.

- Mao Geping Cosmetics (MGC) operates in the premium beauty segment. Via its two brands, MAOGEPING and Love Keeps, the firm offers a wide range of Color cosmetics and Skincare products.

- In this note, we will talk about the lockup dynamics and possible placement.

2. [Japan IPO] The SBI Shinsei Bank (8303 JP) IPO; Cosmetically Pretty, Otherwise Meh

- The SBI Shinsei Bank (8303 JP) IPO is due to be priced on 8 December and start trading on 17 December 2025.

- I have been reluctant to write because of my general lack of excitement regarding the IPO and its after-market prospects. It is, as a friend says, “neither here nor there.”

- But as the bank was my High Conviction Long trade for 2021, 2022, and 2023 and I wrote about the events in the interim, I thought I should opine.

3. SBI Shinsei Bank IPO – Stronger Support, Decent Valuation

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2.1bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- We looked at the company’s past performance in our earlier note. In this note, we talk about valuations.

4. SBI Shinsei Bank (8303 JP) IPO: Price Range Is Attractive

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, has set an IPO price range of JPY1,440 to JPY1,450 per share compared to the reference price of JPY1,440.

- I discussed the relisting in SBI Shinsei Bank (8303 JP) IPO: The Investment Case and SBI Shinsei Bank (8303 JP) IPO: Valuation Insights.

- The relisting has attracted solid interest from several investors. The peers have modestly re-rated, and the IPO price range is attractive.

5. JD Industrials IPO – Valuation Cut Means Its Priced to Go

- JD Industrials (7618 HK) is now looking to raise up to US$421m, in its Hong Kong IPO.

- JDI is a leading industrial supply chain technology and service provider in China in terms of GMV in each year during the Track Record Period, according to CIC.

- We looked at the company’s past performance in our earlier notes. In this note, we talk about valuations.

6. UltraGreen.ai IPO Trading: Attractive Pricing, Strong Tailwinds

- UltraGreen.AI (2594794D SP) raised around US$400m in its Singapore IPO.

- UltraGreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- We have looked at the company’s background and pricing in our earlier note, in this note we talk about the trading dynamics.

7. Pre-IPO JD Industrials (PHIP Updates) – Business Model, Peer Comparison, Forecast and Valuation

- JD Industrials’ business model integrates the advantageous resources of JD Group and follows “self-operated heavy asset” route.The operation model is to rely on JD Logistics network to achieve efficient performance.

- The platform’s openness of JD Industrials is relatively limited. The entry and listing thresholds for merchants are higher than that of peers, which limits the rapid expansion of product richness.

- P/S is more appropriate because net profit fluctuates greatly and is more suitable for growth-oriented supply chain companies.JD Industrials’ valuation could be higher than ZKH but lower than Ww Grainger.

8. NS Group IPO – Deal Downsized; Pricing Looks Digestible Now

- NS Group (471A JP) (NSG) is one of Japan’s leading rent guarantee service providers, offering payment guarantee and rent collection solutions to property owners and management companies.

- NSG aims to raise around US$220m in its Japan IPO via an entirely secondary offering, marking Bain Capital’s full exit from the company.

- In our previous note, we looked at the firm’s past performance and peer comparison. In this note, we talk about the pricing updates and IPO valuations.

9. 3SBio Placement: Partnership with Pfizer Going Well; Digestible Deal

- 3SBio Inc (1530 HK) is looking to raise around US$400m from a primary placement.

- The deal is a small one, representing 2.9 days of the stock’s three month ADV, and 3.9% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

10. Meesho IPO: Garmenting a Mass Market Play for Long-Term Growth

- Meesho IPO will comprise a fresh issue of INR42.5B, and an OFS of 105.5M shares. The price band of the IPO has been fixed between INR105 and INR111 per share.

- Meesho’s IPO will open for subscription on Wednesday, December 3 and close on Friday, December 5. The IPO is scheduled to list on the stock exchanges on Wednesday, December 10.

- Meesho intends to utilize IPO proceeds for investment for cloud infrastructure, paying salaries of technology team, marketing and brand building initiative, and acquisition. The IPO is suitable for risk-seeking investors.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

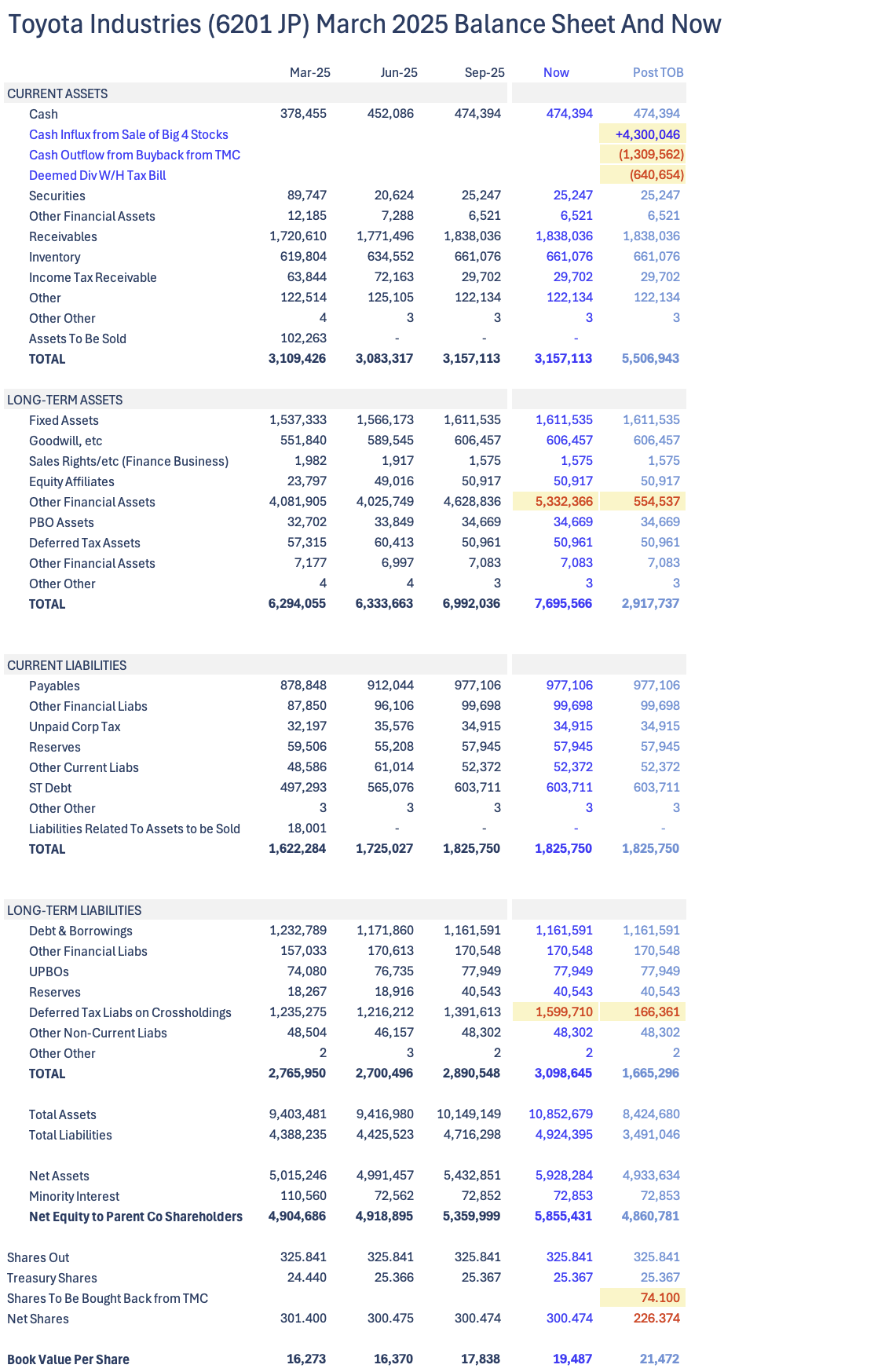

1. [Japan M&A] Toyota Inds (6201) – Process ALWAYS Bad, Price Bad To Worse; Easily Worth ¥20k+

- In April there was a story suggesting Toyota Group would buy out Toyota Industries (6201 JP). In June, they announced a deal. It was a BAD DEAL.

- The price was low, but it was BAD governance because it was the WRONG DEAL. TICO’s Board declared a valuation fair for a deal not announced, ignoring the ACTUAL DEAL.

- The valuation? Assumed no changes to the business. Actual deal? Sell 90+% of net assets driving 50% of net income, buy back 24+% of shares at discount.

2. [Japan Partial Tender] AEON (8267) Partial Offer for TSURUHA (3391) Announced at ¥2,900/Share

- Tsuruha Holdings (3391 JP) had been planning to release a Medium Term Management Plan this month BUT stock prices are higher, goodwill effects changed, so they announced a “Vision” instead.

- Today post-close, Aeon Co Ltd (8267 JP) announced its Partial Tender Offer on TSURUHA (Japanese) at ¥2,900/share. Slightly lower than hoped. Much better than before.

- AEON obviously really did not want to bump, but they did, considering synergies and the desire to consummate the deal. The Tender Offer shrinks so minimum pro-ration is lower.

3. [Japan M&A] Possible Partial TSURUHA (3391 JP) Tender Changes – More Accretion! Smaller Tender?

- Today, post-close of its first day of trading as MergeCo, Tsuruha Holdings (3391 JP) announced 12 different investors who had voted against the deal filed for dissenting shareholder share repurchase.

- This covers 27.154mm shares – a bit more than what Orbis owned when they last filed (25.5mm shs) and is just over half the AGM dissension.

- This creates some weirdness. A 5+% buyback is strong accretion, but “fair price” is a question, and it could mean smaller tender offer quantity and larger eventual index selldowns.

4. ANE Cayman (9956 HK): Q&A With The FA

- On the 28th October, ANE Cayman Inc (9956 HK), a road freight transportation play, announced a Scheme from Centurium Partners, a pre-IPO investor, Temasek, and Singapore-based asset manager True Light.

- The consortium offered HK$12.18/share, a 48.54% premium to undisturbed. A special dividend was bolted on. All pre-cons, including SAMR’s approval, have been satisfied. Scheme Doc dispatch expected on/before 31st December.

- I had a number of questions concerning the transaction, and yesterday pinned down a one-on-one with the FA to the Offeror.

5. Tsuruha (3391 JP): Aeon (8267 JP) Bumps Its Partial Tender Offer to JPY2,900

- Tsuruha Holdings (3391 JP) announced a partial tender offer from Aeon Co Ltd (8267 JP) at JPY2,900, a 27.2% premium over the previously stated offer price of JPY2,280.

- Aeon will acquire a maximum (upper limit) of 43.2 million shares (9.52% ownership ratio) such that it attains a 50.90% ownership ratio. There is no lower limit.

- The offer is above the midpoint of the IFA DCF valuation range and marginally below the JPY3,100 price Aeon paid in 2024 to acquire Oasis’ stake.

6. StubWorld: Don’t Sell Toyota Inds (6201 JP) – Buy More

- At ¥17,340/share, Toyota Industries (6201 JP) is cheap. Corporate governance supporting this deal is shocking. In Travis Lundy‘s words: “Stay long. Buy more. And make some noise.”

- Preceding my comments on Toyota are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

7. Dongfeng (489 HK): Revisiting VOYAH’s Spin-Off Valuation

- Back on the 22nd August 2025, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH. The two proposals are interconditional.

- In its October application proof, VOYAH turned a profit in 7M25. The market was implying a price-to-trailing-sales of 1.5x for VOYAH, versus the basket average of 2.1x. It’s now ~1.2x.

- Key PRC reg approvals (Mofcom/NDRC/SAFE) remain outstanding. Meanwhile, a basket of peers are down 21% since the dual proposals were announced. And their average price-to-trailing-sales are down to 1.7x.

8. A Review of Tender Offers in Korea in 2025

- In this insight, we review the major tender offers of Korean companies in 2025. Some of the major M&A tender offers in 2025 include HMM, Kolon Mobility Group, and VIOL.

- The tender offers have mostly been profitable for the investors in these targeted companies (especially those shareholders who owned these shares prior to the tender offer announcement).

- What is also impressive is that even after the 1st day of trading (post tender offer announcement), there have been extra alpha for the following week.

9. Korea’s 4th Policy Trade Is Right Around the Corner: Mandatory Tender Offers

- The next policy swing is mandatory tender offers (MTO), with the gov’t + ruling party pushing for passage this session, likely alongside the mandatory treasury-share cancellation.

- 2022 FSS/FSC 50%+1 trigger scrapped; 25% stays. Ruling party favors 50%+ MTO, base case 100%, but pushback may reduce to 70–80%.

- MTOs tighten discounts, benefit minority holders; focus on local holding firms, PE-backed exits, and parent-driven M&A prospects.

10. ANE (9956 HK): Precondition Satisfied

- The precondition for the consortium’s privatisation offer for ANE Cayman Inc (9956 HK) has been satisfied. The right to increase the share alternative cap was also satisfied.

- The consortium has until 12 December to decide whether to increase the share cap. The option helps the consortium gain support from shareholders who would not accept the cash offer.

- The scheme vote remains low risk, as the offer is attractive relative to historical ranges and peer multiples. The de-rating of peers is also helpful.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

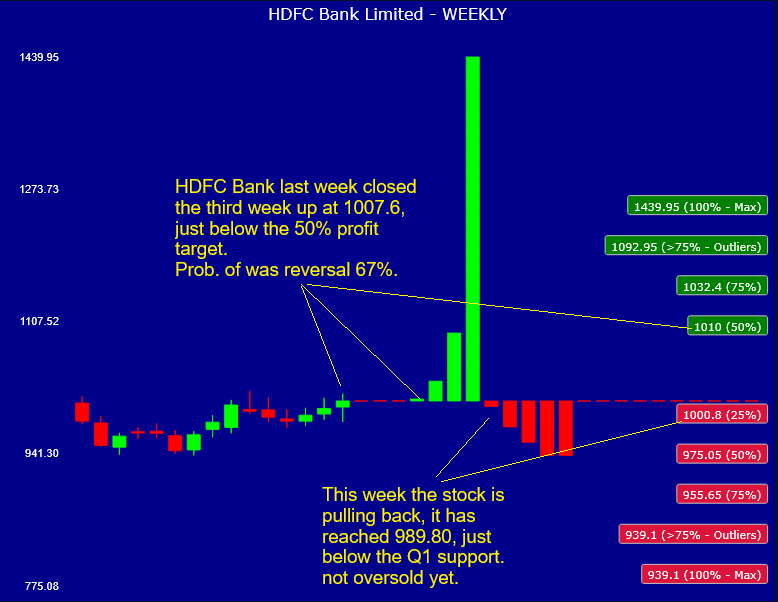

1. HDFC Bank (HDFCB IN): Tactical Outlook Post–NIFTY Bank Index Overhaul

- Brian Freitas has discussed in a recent insight the methodology changes for the NSE Nifty Bank Index that will be implemented starting from December 30.

- HDFC Bank (HDFCB IN) is one of the two stocks that passive trackers need to sell (the other is ICICI Bank Ltd).

- HDFC Bank (HDFCB IN) is falling this week, so we analyze our model’s WEEKLY support entry zones, to evaluate how much HDFC Bank can fall, for hedging or re-entry purpose.

2. [2026 High Conviction] Korean Mega Cap Investment: Samsung’s $310B Tech Spend, the AI-Momentum Trade

- Samsung is positioned as a global hub for the AI Supercycle, driven by a pivot to memory technology, and evidenced by a KRW 450T ($310 billion) local investment plan.

- The Device Solutions division’s Q3 2025 rebound (sales +19% sequentially) and an estimated 43.4% Fwd 2-Yr EPS CAGR support potential upside for the stock

- The company has demonstrated a commitment to enhancing shareholder value by completing its 10T share repurchase program ahead of schedule and maintaining a consistent annual dividend payout through 2026.

3. 2026 High Conviction – Japan’s Triple Play: How PBR Reform, AI, and Banks Unlock Alpha

- Sustained pressure from the JPX initiative targeting firms trading below P/B is forcing enhanced capital returns (buybacks and dividends), creating opportunity across both indices.

- BoJ’s shift to a positive rate environment is fundamentally restoring Net Interest Income and profitability to the Financials sector, positioning the TOPIX, in particular, for outperformance.

- AI/Tech Sector Dominance: The Nikkei 225 is driven by high-tech firms. This concentration, led by high-priced high weighted stocks like Advantest and Softbank Group, provides high-beta AI exposure

4. Hong Kong December 2025 Monthly Covered Call Report

- Top Hong Kong Stock Exchange listed covered call candidates for the month of December.

- The top 10 provide an average ~6.9% premium with a potential ~8.4% upside P&L if exercised.

- Investors with a neutral 1-month view on the underlying can seek to generate income.

5. NVDA Tactical Outlook: Time to BUY?

- NVIDIA Corp (NVDA US) started correcting at the end of October 2025. At the same time, in early November, SoftBank Group announced it was unloading all its NVDA stake.

- SoftBank founder Masayoshi Son, speaking at an investment forum in Tokyo Monday, revealed he was reluctant to sell SoftBank’s Nvidia stake, but needed to raise cash for new AI investments.

- Both companies are very oversold according to our models, NVDA has reached a point where is a good BUY, we present here a new analytics tool, to support this theory.

6. Bitcoin Tactical Outlook After The -35% Drop

- Bitcoin has been selling off since early October 2025 and reached a -35% loss around November 20, then bounced back, the rally is currently ongoing.

- Our focus is always short-term and in this insight we will try to analyze how far the current BTC-USD spot rally can go before a new sell-off begins.

- The alternate hypothesis is that the current downturn is merely a sharp, tactical correction within a larger secular bull market. Under this interpretation, the pullback could be a buying opportunity.

7. Hong Kong Single Stock Options Weekly (Dec 01 – 05): Narrow Range, Low Vols and Weaker Put Flow

- Quiet trade across Hong Kong Single Stock this week with HSI’s weekly range near the lows of the year.

- Implied vols were mixed and are still clinging to the lowest levels of the year.

- Options activity lower week over week, led by declines in Put trading.

8. Macro Monthly (December): Seasonal Strength, Vol Selling Edges and a Notable Nifty Setup

- December seasonals across major markets show a generally positive profile, but the path is uneven, with most gains clustering in the final days of the month.

- Several markets offer appealing vol selling setups, particularly those with consistently positive December vol premiums and elevated implied levels relative to past outcomes.

- Nifty vol appears attractively priced, but its tendency not to monetize in December requires traders to think differently about how they extract value.

9. Australia Single Stock Options (Dec 01 – 05): Narrow Range and Mixed Implieds

- Very quiet trading this week with a weekly closing range near the lows for the year.

- Breadth deteriorated from last week’s elevated readings as the market tries to push higher.

- Quiet earnings calendar with only six companies issuing earnings reports in the coming week.

Entity | Insights | Analytics | News | Discussion | Filings | Reports |

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NVIDIA. Burry’s Claims Miss The Forest For The Trees. The Real Issues Are Structural, Not Legal

- After taking short positions against Palantir & NVIDIA, Michael Burry has closed his hedge fund and taken to substack to continue his assault on the AI bubble

- While he makes some valid points, these are mainly things everybody already knows and in the end he’s missing the forest for the trees

- There are key structural issues surrounding the AI Infrastructure build out (grid, foundry, memory capacity to mention a few). These will drive course corrections, all by themselves.

2. TSMC (2330.TT; TSM.US): Retired Sr. VP Joins Intel; U.S. Fab Impact; Arizona Earnings Decline.

- TSMC (Taiwan Semiconductor Manufacturing) – ADR (TSM US)’s retired Senior Vice President Dr. Wei-Jen Lo has taken a position at Intel.

- Trump has been in power for less than a year, and the U.S.’s measures have fully revealed its purpose of confrontation between China and the United States.

- TSMC’s Arizona fab profit dropped from NT$4.32 billion in 2Q25 to NT$410 million in 3Q25.

3. Did The Elon & Jensen Clown Show Just Crater The AI Narrative?

- Maybe it’s 10, 20 years something like that. For me that’s long term. Um my prediction is that work will be optional.

- The evidence speaks for itself uh but but but AI and humanoid robots will actually eliminate poverty and Tesla won’t be the only one that makes them.

- There will still be constraints on power like electricity. The fundamental physics elements will still be constraints. Um but um I think at some point uh currency becomes irrelevant.

4. Taiwan Dual-Listings Monitor: TSMC Spread Back in Extreme Range, UMC Discount

- TSMC: +25.8% Premium; Rebounded to High End of Range, Good Level to Open a Short of the ADR Spread

- UMC: -2.2% Discount; Good Level to Open a Short of the ADR Spread

- ASE: +3.2% Premium; Wait for More Extreme Level Before Going Long or Short

5. PC Monitor: Dell/HP Results Support PC Up-Cycle Into 2026E

- AI PCs turning the PC refresh into a gradual, extended up-cycle

- Memory inflation is one of the major margin risks for PC makers in 2026

- Dell’s server business indicates AI factory build-outs becoming a multi-year investment cycle. Remain long Dell, Asustek, Acer.

6. Taiwan Tech Weekly: Rapidus Making Progress… TSMC Impact; Latest PC Results Support 2026E Up-Cycle

- Japan’s Rapidus Moves Ahead With 1.4nm Plans… TSMC Impact? — Latest and Past Analysis

- PC Monitor: Latest Dell/HP Results Support PC Up-Cycle Into 2026E

- TechChain Insights: Factory Visit with One of Taiwan’s Critical Battery Suppliers

7. TechChain Insights: Visit with Taiwan’s Critical Battery Supplier

- Factory visit to GUS Technology reveals Taiwan’s strategic position as a non-China battery supplier for defense and critical infrastructure applications.

- Proprietary pouch cell technology with patents in Taiwan and Japan addresses weight-sensitive applications including drones, underwater vehicles, and data center UPS systems.

- Dual product strategy (safety-focused Mettle Series and energy-dense Hyper Series) targets both commercial reliability and mission-critical performance markets.

8. Taiwan Dual-Listings Monitor: TSMC ADR Spread Deeper in Historically Rare Zone

- TSMC: +27.1% Premium; Increased to More Historically Extreme Level; Deeper in Short Range

- UMC: +2.3% Premium; Good Level to Open a Short of The Spread

- ASE: +2.3% Premium; Wait Better Long Opportunity Near Parity or Below

9. TSMC (2330.TT; TSM.US): Rapidus Plans to Build a Second Fab to Begin 1.4nm Volume Production in 2029

- Rapidus is currently moving in parallel with TSMC (Taiwan Semiconductor Manufacturing) – ADR (TSM US) in targeting the 2nm, and is regarded as Japan’s core force in the advanced-process arena.

- Rapidus plans to build a second fab in Hokkaido in FY2027. The facility is scheduled to begin 1.4nm volume production in 2029 to accelerate the catch-up with global leader TSMC.

- During its mid-October earnings briefing, TSMC stated that 2nm will enter volume production as scheduled in 4Q this year, and that it will begin 1.4nm mass production in 2028.

10. Silicon Motion (SIMO US): Multiple Growth Drivers Converging Into 2026E

- Four growth drivers ramping simultaneously: PCIe5 targeting 40% market share, NAND makers increased outsourcing of controller design, automotive segment approaching 10% of revenue, and datacenter products approaching 5-10% of revenue.

- Near-Term catalysts compelling as memory supply tightness drives controller outsourcing and gross margins approach 49-50%.

- 19x 2026E PER represents good value if company hits targets. While stock carries market pullback risk, we nevertheless maintain our Structural Long rating due to multi-year growth in view.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

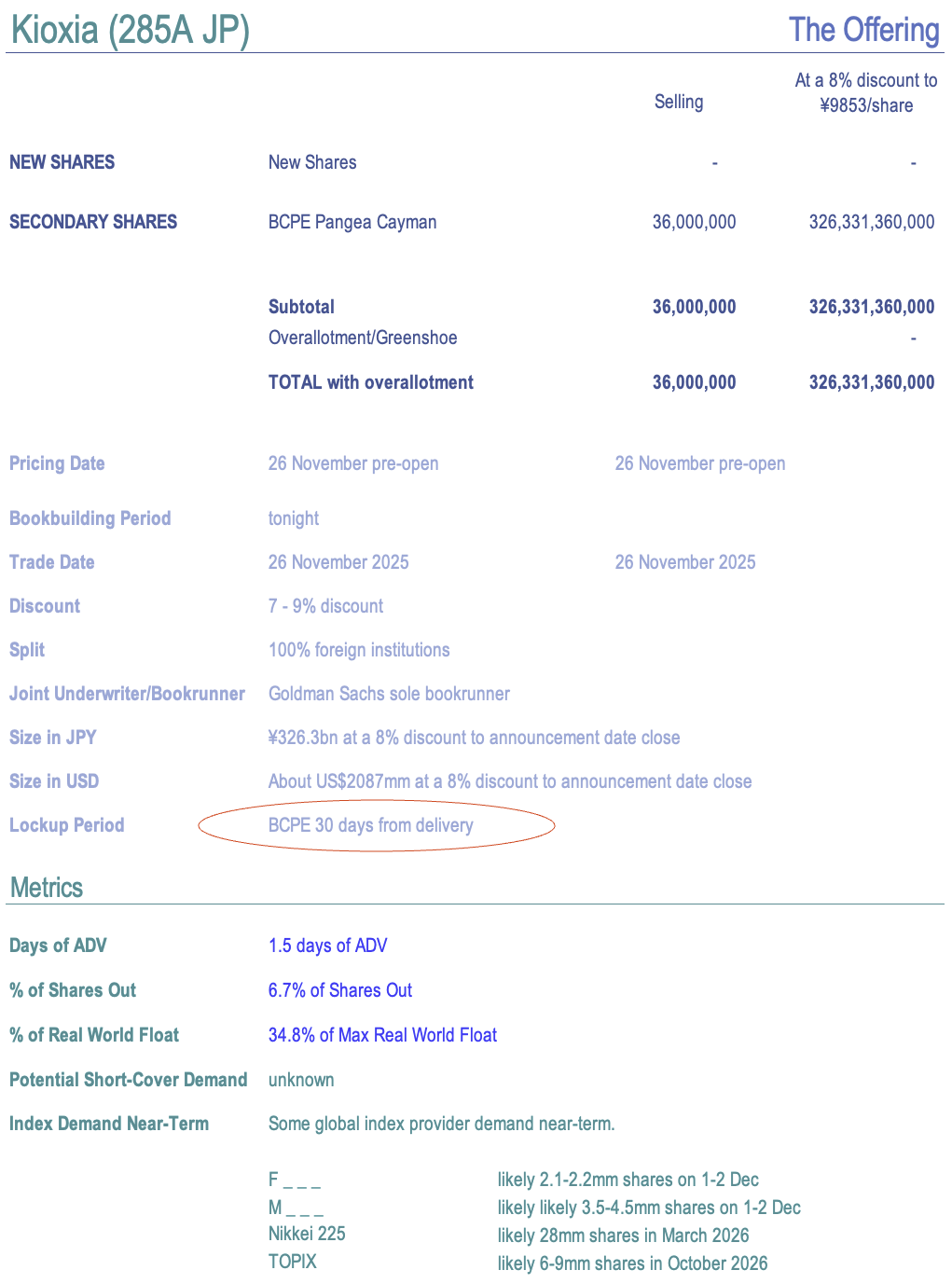

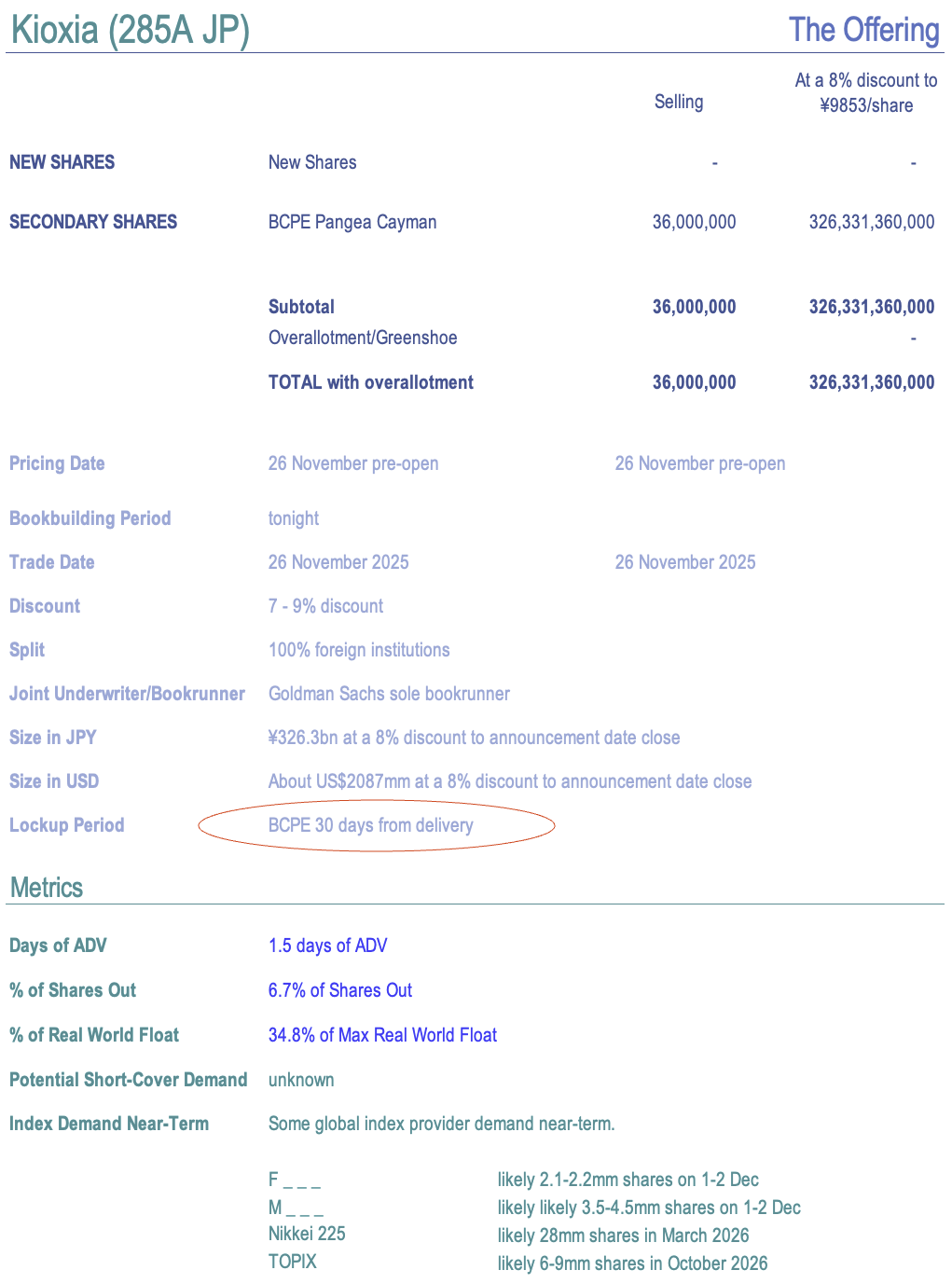

1. [Japan Offering] Bain Starting Kioxia (285A) Selldown; More to Come Soonish?

- After the close today, BCPE Pangea Cayman announced plans to sell a stake of 36mm shares of Kioxia Holdings (285A JP) in an overnight block. It trades tomorrow.

- This is 6.7% of shares out, 1.5x ADV. The discount is 7-9%. But it is 35% of Max Real World Float. And probably gets tradable shares to 34+%, not 35%.

- That means another offering is likely near-term. The lockup is only 30 days it appears. There is possibly a fair bit of long-dated index demand.

2. [Japan Offering] Toyota Selling Down Toyoda Gosei (7282) In BIG Offering; 85d ADV, 125% of Max RWF

- Last week, before the long weekend, Toyota Motor (7203 JP) and Sumitomo Mitsui Financial Group (8316 JP) announced a very big secondary selldown of shares in Toyoda Gosei (7282 JP).

- The selldown is 85x 3mo ADV, 27% of shares out. 125% of Max Real World Float. It’s a lot of stock at $750mm. One wonders where demand is.

- They also announced a big buyback, which is some of it, and there are index impacts, BUT this offering needs to find LOTS of new fundamental owners quickly.

3. Kioxia (285A JP): Bain’s US$2.1 Billion Selldown

- Bloomberg reports that Bain Capital is selling 36.0 million Kioxia Holdings (285A JP) shares through a block trade. IFR reports that the offering is worth up to JPY330 billion (US$2.1 billion).

- The offering is unsurprising given the shares are up around 7x since the IPO. The offering is easily digestible as it represents 2.7 days of the average ADV since listing.

- Kioxia is anticipated to return to growth in 3Q, and the underlying margin is recovering from recent lows. However, Kioxia’s EV/EBITDA multiple is full compared to peers and historical ranges.

4. [Japan Offering] Dear Life (3245 JP) – Unusual Offer Dynamics Are Bullish Despite Dilution

- Today after the close, Tokyo-based Dear Life (3245 JP) announced a primary offering to raise approximately ¥7bn through 15% dilution. Implying a 13+% price drop to protect PER.

- But the company plans on growing earnings. It has some projects in inventory, but it obviously plans a lot of turnover this year and needs to replenish.

- The MTMP “slogan” is “2028 – Ride the Wave!” This is a bit what investing in Tokyo real estate is like now. So one rides it until one doesn’t.

5. Kioxia Placement – US$2bn Deal, Relatively Small, Index Upweight but the Shares Have Runup

- Bain aims to raise around US$2bn via selling around 6% of its stake in Kioxia Holdings (285A JP). The IPO linked lockup on its shareholding had expired in Jun 2025.

- Kioxia is a manufacturer and a global leader in flash memory and solid state drives for smartphones, PCs, enterprise servers and data centers.

- In this note, we will talk about deal dynamics and run the deal through our ECM framework.

6. Suzhou Novosense A/H Listing – Growth Has Been Strong but Margins Weak

- Suzhou Novosense Microelectron (688052 CH), an analog chips producer, aims to raise around US$500m in its H-share listing.

- According to Frost & Sullivan, in terms of revenue from analog chips in 2024, SNM ranked fifth among Chinese analog chip companies in the Chinese analog chip market.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Jingdong Industrials (JDI) IPO: The Investment Case

- JD Industrial Technology (2231713D CH), a leading industrial supply chain technology and service provider in China, is seeking to raise US$500 million.

- JDI is the largest industrial supply chain technology and service provider in China in terms of GMV, customer coverage and SKU offerings in 2024, according to CIC.

- The investment case is bearish due to weak market share gains, declining product revenue growth, margin pressures, declining cash generation and factoring of receivables.

8. UltraGreen.ai IPO: High Growth and High Margins, Market Leader

- UltraGreen.AI (2594794D SP) is looking to raise US$400m in its upcoming Singapore IPO.

- UltraGreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

9. SBI Shinsei Bank Pre-IPO – Thoughts on Valuations

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- We have looked at past performance in our earlier notes. In this note, we talk about valuations.

10. Hong Kong: IPO SPOTLIGHT – OVERVIEW 2025

- Hong Kong is the top global destination for IPOs in 2025, with over HK $280 billion raised so far. Large scale A+H dual listings have surged this year.

- Technology and healthcare sectors have dominated IPOs with the materials sector also floating several large listings. With nearly 300 listings in the pipeline, 2026 should be another banner year.

- Zijin Gold (2259 HK) , Chery Automobile (9973 HK) and Mixue Group (2097 HK) were the largest IPOs of the year while PegBio (2565 HK) has had the best return.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Kioxia (285A JP) Placement: Limited Passive Buying & Big Runup Opens Up More Downside

- Bain Capital is looking to place 36m shares of Kioxia Holdings (285A JP) to overseas investors at a 7-9% discount to the last close of the stock.

- The stock has run up a lot since its IPO with the last leg driven by inclusion in a global index that took place at the close on Friday.

- Toshiba (6502 JP) had already been selling stock, and the Bain selling could take the stock lower, especially with limited passive buying in the short-term to support the big runup.

2. Curator’s Cut: Powering Down CATL, Iron Ore Plays & Japan Consumer Consolidation

- Welcome to Curator’s Cut — a fortnightly roundup of standout themes from the 1,500+ insights published on Smartkarma.

- In this cut, we review CATL’s H-share lock-up expiry, iron ore equity opportunities in the face of Simandou’s expected supply, and the accelerating consolidation in Japan’s consumer sector.

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next.

3. National Storage REIT (NSR AU) In Trading Halt Ahead Of Possible Brookfield/GIC Tilt

- Reportedly, Brookfield and Singapore’s GIC will make an Offer for National Storage REIT (NSR AU), Australia and New Zealand’s largest landlord of self-storage sites .

- The AFR is reporting that Brookfield/GIC are on the cusp of launching a bid around NTA. NSR entered into a trading halt this morning.

- Earlier this year, key peer Abacus Storage King (ASK AU) fielded an NBIO from Ki Corporation/Public Storage (PSA US) at a ~3% premium to NTA; however, Ki/PSA ultimately walked.

4. Qube (QUB AU): Macquarie’s Lobs NBIO

- Qube Holdings (QUB AU), a logistics and infrastructure play, has announced a A$5.20/share non-binding indicative Offer from Macquarie Asset Management, a unit of Macquarie Group (MQG AU).

- That is a 27.8% premium to last close. And ~14.4x FY25 EV/EBITDA. The proposal “follows an earlier unsolicited, non-=binding and indicative offer at lower value.” Dividends paid will be netted.

- Qube directors are supportive. The proposal is conditional on due diligence, board approvals, no MACs at Qube, plus regulatory clearance, including FIRB and ACCC signing off.

5. [Quiddity Index] Bengo4.com (6027 JP) To TSE Prime and TOPIX Inclusion

- Back in mid-August, Bengo4.Com Inc (6027 JP) (“Bengoshi.com”) announced that it had applied to transfer to TSE Prime. 3+mos later, today it announced it will move on 4 Dec 2025.

- That sets up a TOPIX inclusion for end-January 2026 and then a likely upweight at end-April 2026.

- There is no accompanying offering, and the float is likely small. But the inclusion displaces the current active base. And there’s at least one large holder selling recently.

6. Korea Dividend Tax Cut: Eligibility Criteria & Market Impact on Large Caps, Including Samsung Prefs

- Market eyed 25% top rate, but 30% is still punchy; <100 people hit it, lower than before, giving big shareholders incentive to rotate back into dividends.

- The new regime hits only companies with 25% payout last year and +10% YoY dividend: lower than the original draft, and the 10% bump is a solid positive.

- Companies >5tn KRW with ≥25% payout last year must boost dividends +10% YoY to get the tax cut; Samsung could add ~1tn KRW, potentially easing its pref discount.

7. A Tender Offer of 10% Stake in Gabia by Align Partners Asset Management

- After the market close on 24 November, it was announced that Align Partners is conducting a partial tender offer of a 10% stake in Gabia Inc (079940 KS).

- Tender offer price is 33,000 won (20% higher than current price). Tender offer amount is 44.7 billion won.

- If Align Partners successfully completes this tender offer, its stake would rise to 19.03%. Plus, the combined stakes of Align Partners and Miri Capital would be 42.99%.

8. HK Connect SOUTHBOUND Flows (Wk To 21 Nov 2025) – BIG Net Buy on Lower Gross Flows. BABA Bought

- HK$100bn a day of gross SOUTHBOUND activity with US$600mm+ of net buying on average. Net flows continue to be impressive. SOEs/Energy/Financials dominate.

- Watch for news on the Dual Counter (RMB) Trading eligibility for SOUTHBOUND near-term. That could up the pace of things.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The Southbound Flow Monitor and AH Pairs Monitor are both there – free – for all SK readers.

9. [Japan Activism] Mandom (4917) Holders Get an Early Win as MBO Bidder CVC Bumps 29%

- Today late in the afternoon session, the Nikkei reported that the MBO price would be bumped by “about 30%”. The stock popped 4.6%.

- Post-Close, the deal is bumped from ¥1,960 to ¥2,520 (+29%). Activist holders Murakami Group with 21.4% and Hibiki Path Advisors with 5.5% have agreed to tender.

- With the two main activists publicly engaged now agreed to tender, this looks like a done deal.

10. [Japan Activism/M&A] SilverCape Renews Its Effort on Digital HD (2389 JP) To Resolve Board Complaint

- Digital Holdings Inc (2389 JP) jumped today after spending a week or more at levels just above the revised Tender Price of Hakuhodo Dy Holdings (2433 JP).

- SilverCape had promised to bid ¥2,380 against Hakuhodo’s ¥1,970 and the Company responded by threatening a Poison Pill against SilverCape, for relatively spurious reasons (as discussed here).

- Hakuhodo bid slightly more, and lowered its minimum, thereby nearly ensuring their success. HOWEVER…. SilverCape’s CIO interviewed yesterday promised a higher price. The stock popped today. But…

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

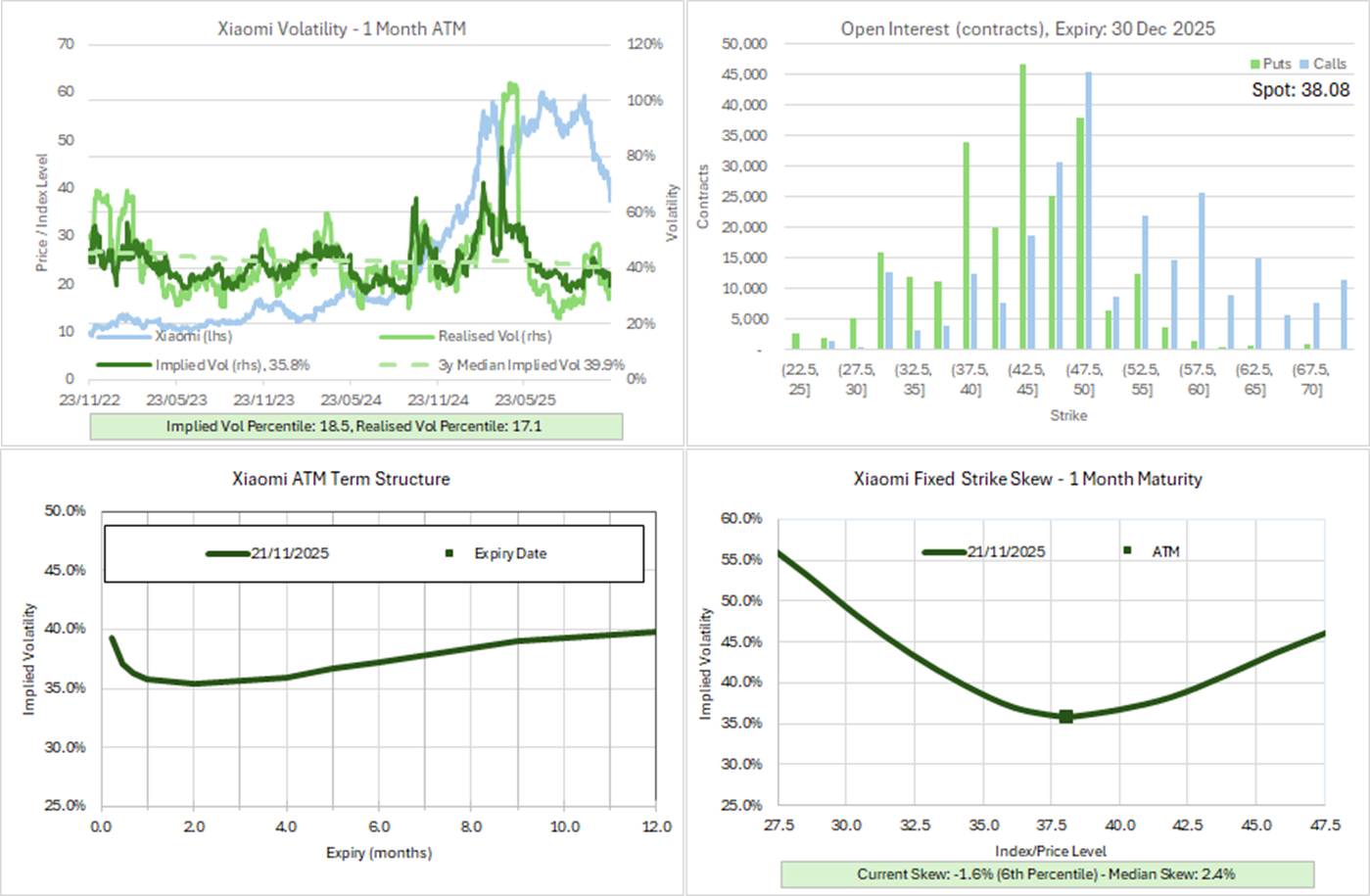

1. Xiaomi (1810 HK): Top Trades Bet on a Bullish Trend Reversal

- Context: Over the past five trading days, Xiaomi (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: 55% of strategies exhibit a bullish bias, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

2. SoftBank (9984 JP) Tactical Outlook: Extremely Oversold After -11% Plunge

- Softbank Group (9984 JP) crashed nearly -11% between Thursday and Friday close, reaching deeply oversold extremes.

- Softbank Group has declined for three consecutive weeks, posting a cumulative -37% correction over this period.

- Softbank Group‘s entry into the Outliers zone suggests an extreme oversold condition—potentially creating a tactical long setup for risk-tolerant traders.

3. ALIBABA (9988.HK) Earnings: Option Market Expectations and Post-Release Price Behavior

- Alibaba will announce Q2 earnings on after the market close (HK time) November 25.

- Earnings implied jump pricing is similar to the last release, but recent downside skew in past Q2 moves highlights why traders may focus more on potential weakness.

- Recent market patterns, including muted reactions to beats and sharp responses to misses, add weight to risks around Baba’s earnings day move.

4. Comparing the Singapore Next 50 to Its Regional Peers: An Asia Portfolio Context

- This insight compares the iEdge Singapore Next 50 Index with regional next-tier indices, focusing on methodology, sector composition, and historical performance.

- Combining flagship and next-tier indices can broaden sector exposure and balance within an Asia-focused equity portfolio.

- A volatility-driven allocation strategy is presented, showing that dynamic mid-cap exposure can help moderate drawdowns and enhance returns during market cycles.

5. GOLD Tactical Outlook: Profit Targets for December 2025

- Gold (GOLD COMDTY) this week has resumed its uptrend after a brief, shallow setback in mid-November.

- This insight will analyze our Gold Futures Dec 25 model to determine profit targets that could be reached in the next 3 weeks (in December 2025).

- Range: Gold could reach again previous highs, in December, while if it goes down it could reach the 3933 support zone.

6. Asian Stocks Tactical Outlook (Week Nov 24 – Nov 28)

- A tactical snapshot of the Asian indices and stocks we cover.

- Many Asian stocks we track are flashing very oversold signals—creating tactical long setups worth considering.

- We find no overbought stocks or indices in Asia at present. US equities are aligned with this view, this is a global market pullback, probably about to end.

7. TSMC (2330 TT) Tactical Outlook After November’s Pullback: Further Downside Risk Remains

- TSMC (Taiwan Semiconductor Manufacturing) (2330 TT) delivered stellar returns this year, but after peaking in early November and pulling back all month, we see downside risk persisting.

- We hypothesize the current rally may be a bear rally. If correct, our models indicate TSMC has nearly depleted this rebound and downside risk looms.

- If we are wrong, TSMC could continue this rally to 1483-1581, the details as always are discussed in the insight.

8. Tencent (700 HK): Top Option Trades Reveal a Split in Market Sentiment

- Context: Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Market sentiment is evenly balanced between bullish and bearish strategies, with diagonal spreads accounting for 25% of all trades.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

9. A Global Portfolio Inflation-Stagflation Hedge: Gold and NK Index Volatility

- Gold’s outlook is strongly supported by a dovish Federal Reserve, structural de-dollarization trends, and increasing central bank demand for a strategic stagflation hedge.

- The Nikkei 225’s high is vulnerable to concentrated risk in the technology sector and geopolitical volatility, necessitating a tactical approach to portfolio protection.

- Deep dive into a two-part portfolio-defensive structure, pairing a strategic long-term inflation asset with a short-term volatility hedge on a key equity index.

10. CSI 300 (SHSZ300) Tactical Outlook After Nov. 28 Rebalance Announcement

- On November 28th China Securities Index Co (CSI) announced the changes to the CSI 300 Index (SHSZ300 INDEX): 11 companies added and 11 deleted.

- The complete list of additions and deletions is available here (or see the attachment at the end of this insight for your convenience).

- We analyze our probabilistic models to forecast short-term market directions for the CSI 300 Index, as passive flows between here and December 12 may affect the index volatility and trend.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Backloads A Tax Trap

- The UK’s fiscal hole was even smaller than we thought (£6bn), allowing the government to backload a fiscal tightening that is unsurprisingly focused on tax increases.

- Delaying prudence to an election year is implausible. There will be a substantial deficit in 2029-30, not the current budget surplus in the OBR forecasts based on existing policy.

- Labour is setting up a tax trap for Reform and the Conservatives to say how they’d avoid tax increases, similar to the backloaded spending cuts they myopically ignored in 2024.

2. UK Labour Party: Damned If They Do…

- Whatever Rachel Reeves comes up with in her 26 November budget, she is bound to run into criticism from within her own parliamentary party.

- Bond markets seem set to react badly to this, especially if it seems likely that her overall objectives will be undermined by internal resistance to proposed measures.

- She and the PM will probably survive this, but a market-unsettling change and slide to the left look increasingly likely by mid-2026, followed by defeat at the next election.

3. US Market: WALK TO THE EXIT NOW BEFORE EVERYONE STARTS RUNNING!

- The US market is weakening again as an interday reversal after Nvidia results foreshadows continued selling in the AI theme. Market breadth is weakening and stocks at 52-week lows surging.

- Volatility has reached levels last seen during the tariff tantrum in April. Insider sales of Nvidia have surged since June. Private credit and private equity markets are showing stress.

- US consumption has narrowed and is highly dependent on stock market gains. Household debt levels are at new highs, and consumer sentiment is lower than during the GFC in 2008/09.

4. Overview #42 – What a Difference a Day Makes!

- A review of recent events and data impacting our investment themes and outlook

- US interest rate expectations continue to whip markets around, even as more cracks emerge in the AI trade.

- Japan goes for broke with its latest budget and debt issuance.

5. HEW: Slow Shovels

- UK fiscal policy had an even smaller hole to fill than we expected, with the work to fill it in delayed until the election. There is no dovish pressure on the BoE from this.

- European data releases were relatively resilient again, with household lending and business sentiment broadly increasing. National inflation surprises were offsetting.

- Next week’s Euro area flash HICP is still tracking 2.1% in our forecast. Final PMI releases and the BoE’s decision maker panel survey results are our other release highlights.

6. 241: Europe’s Economic Comeback: What It Will Take for a Broad Resurgence

- Europe is experiencing an air of optimism in 2025 due to more flexible fiscal policy and increased government spending on infrastructure and defense.

- European defense companies and banks have seen significant growth year to date, indicating potential for further investment opportunities.

- Challenges to Europe’s long-term competitiveness include an aging workforce and underdeveloped capital markets, but progress is being made in areas such as harmonizing tax rules and increasing efficiency in capital markets.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (November 27)

- Hong Kong market continues to consolidate during the early stage of its Secular Bull Market. Strength and momentum indicators show further weakness ahead.

- Materials and healthcare sectors have lost momentum with other sectors trendless. Analysts target 20% price gains in materials sector over the next year.

- China Taiping Insurance Hldgs (966 HK) shares fell on Thursday on concerns over the insurer’s estimated HK$2.6B exposure to a HK residential project at the center of a deadly fire.

8. How to Trade the AI Panic

- The recent market pullback may have been attributable to a combination of breadth deterioration and a highly bifurcated market.

- In the short term, technical price action and sentiment have become stretched to the downside that a bounce is more or less inevitable.

- We continue to believe stock prices will rally into year-end, but we are watching for signs of a bullish follow-through after the reflex rally for confirmation.

9. Japan Is at a Policy Crossroads, Yen Offers a Guide

- BOJ minutes from the October meeting show 8 of 13 members backing near-term hikes, raising odds of tightening in December–January as wage negotiations strengthen.

- Japan’s JPY 21.3T fiscal package and rising JGB yields highlight a growing policy clash, pushing the yen toward the prior 160 intervention zone.

- Historical patterns of rapid yen reversals indicate that a BOJ hike alongside emerging Fed cut expectations materially increases the probability of a near-term yen appreciation.

10. Japan: CAN TAKAICHI SURVIVE THE COMING TSUNAMI?

- Prime Minister Takaichi started a firestorm with her comments about attacking China over the Taiwan issue. Japan’s missile deployment near Taiwan further inflamed the situation.

- President Xi called President Trump on the matter, and Trump followed up with a call to Takaichi soon after. Takaichi’s miscalculation in provoking China may have led to U.S. concessions.

- PM Takaichi’s fiscally reckless budget is adding fuel to a fire as the yen, JGBs, and stock market are falling simultaneously. Inflation, currently at 3% is rising again.