Receive this weekly newsletter keeping 45k+ investors in the loop

1. OpenAI. Is The Narrative Slowly Disintegrating ?

- Fresh on the heels of his podcast meltdown, Mr. Altman has had to scramble to walk back his CFO’s assertion that a potential federal bailout was on her agenda.

- One of Mr. Altman’s revenue generating ideas is to lease AI compute directly to others. Of course, that’s compute capacity he can’t afford to purchase in the first place.

- Mr. Altman wants OpenAI to be all things to all people all at once. That’s a strategy that rarely ends well. Let’s see..

2. Microsoft. Acting Like There’s An AI Bubble Without Saying There’s An AI Bubble

- Microsoft has significantly course corrected on their compute capacity build out, demurred on their right of first refusal for OpenAI compute demand and adopted a risk off “fungible” compute strategy

- Mr. Nadella thinks AGI as more hype than substance, “jagged” intelligence will remain problematic for a longer, and the true measure of AI success will be measured by GDP growth

- Microsoft stopped reporting AI-driven ARR when the number hit $13 billion six months ago, but why? Broadly deploying AI into productivity tools is a marathon not a sprint.

3. NVIDIA Results: Taiwan Take-Aways — Demand Visibility Implies Strength for Key Suppliers

- NVIDIA’s AI Factory Buildout Signals Multi-Year Demand for Taiwan’s Supply Chain

- TSMC’s Growth Outlook De-Risked by NVIDIA’s Smooth Transition to GB300

- NVIDIA’s Networking Segment Surge Expands System-Level Product Integration Opportunity for Taiwan Ecosystem

4. Taiwan Tech Weekly: NVDA Results- Taiwan Supplier Winners; Silicon Valley’s Substrate- TSMC Slayer?

- NVIDIA Results: Taiwan Take-Aways — Demand Visibility Implies Strength for Key Suppliers

- NVDA Strong Quarter, Strong Guidance, Consensus ~20% Too Low, Stock Is Not Expensive

- Silicon Valley’s Substrate — ASML, TSMC Slayer Or Ideological Pipe Dream?

5. Taiwan Dual-Listings Monitor: TSMC and ASE Premiums Near Spead Short Levels

- TSMC: 24.5% Premium; Near Level to Open Fresh Short of ADR Spread

- ASE: +5.7% Premium; Good Level to Short the ADR Spread

- ChipMOS: -1.7% Discount; Near Discount Level to Go Long the ADR Spread

6. IHI (7013 JP): Orders and Profits Headed Up, Share Price Down

- Sales and operating profit declined YoY in 1H, but new orders were up 17.5% and the book-to-bill ratio rose from 1.00 to 1.25. anagement has raised full-year guidance.

- Aerospace & Defense continue to lead growth, with nuclear energy and Asian EPC making significant contributions to new orders and the restructuring of Industrial Systems & Machinery boosting operating profit.

- Share price down 15% in two weeks to 23x FY Mar-26 EPS guidance. Once again a reasonably valued investment in Japan’s rising defense budget and corporate restructuring.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. SBI Shinsei Bank (8303 JP) IPO: The Investment Case

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, is looking to relist by raising about US$2 billion. The primary/secondary split is 40%/60%.

- In December 2021, Shinsei Bank was privatised by SBI Holdings (8473 JP) through a contentious tender offer at JPY2,800 per share.

- The investment case rests on growth in accounts/deposits, robust loan book growth, accelerating revenue growth, rising margins and improving asset quality.

2. [Japan Offering] DAIHEN Corp (6622 JP) Sees Crossholders Selling 25% of Max Real World Float

- Yesterday saw the announcement of a secondary offering structured like a delayed pricing ABO.

- 1.5mm shares which is 7.5% of shares out, 25% of Max Real World Float, and 9 days of ADV. There’s more cross-holdings to come out later at some point.

- Though it is not particularly expensive, Momentum is not this stock’s friend right now.

3. Toyoda Gosei (7282 JP): A US$0.8 Billion Secondary Offering

- Toyoda Gosei (7282 JP) has announced a secondary offering of up to 29.7 million shares (34.2 million including overallotment), worth around US$0.7 billion (US$0.8 billion including overallotment).

- Toyoda Gosei’s primary goal with the secondary offering is to reduce Toyota Motor (7203 JP)‘s shareholding to around 20% of outstanding shares.

- The offering as a percentage of outstanding shares and ADV is large compared to recent large placements. The likely pricing date is 1 December.

4. SBI Shinsei Bank Pre-IPO – The Positives – Has Been Growing Well Since SBI Group Took Control

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- In this note, we talk about the positive aspects of the deal.

5. China Hongqiao Placement: Good Valuation but Likely Opportunistic, on the Back of Chuangxin Listing

- China Hongqiao (1378 HK) is looking to raise around US$1.2bn from a primary placement.

- This represents 9.1 days of the stock’s three month ADV, and 2.9% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. SBI Shinsei Bank (8303 JP) IPO: Valuation Insights

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, is looking to relist by raising about US$2 billion. The primary/secondary split is 40%/60%.

- I discussed the investment thesis in SBI Shinsei Bank (8303 JP) IPO: The Investment Case.

- In this note, I discuss valuation. My analysis suggests that SBI Shinsei is fairly valued at the IPO price of JPY1,440 per share.

7. Toyoda Gosei Placement – Somewhat Expected but Relatively Large with Delayed Buyback

- Toyota Motor (7203 JP) and Sumitomo Mitsui Financial Group (8316 JP) plan to raise around US$700m via selling down some of their stake in Toyoda Gosei (7282 JP).

- The deal is a large one to digest at over 20% of the company and 90 days of ADV.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. UltraGreen.ai Pre-IPO: Strong Financials Despite Misleading Branding

- UltraGreen.AI (2594794D SP) is looking to raise US$400m in its upcoming Singapore IPO.

- Ultragreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- In this note, we look at the company’s past performance.

9. Chuangxin Pre-IPO: Increasing Exposure to Volatile Alumina; Offered at Premium to Peers

- Chuangxin Industries (CXI HK) is looking to raise up to US$700m in its upcoming Hong Kong IPO.

- It is focused on alumina refining and aluminum smelting within the upstream of the aluminum industry chain.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

10. SBI Shinsei Bank Pre-IPO – The Negatives – PAT Growth Aided by One-Offs, Margins Under Pressure

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing.

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- In this note we talk about the not-so-positive aspects of the deal.

Receive this weekly newsletter keeping 45k+ investors in the loop

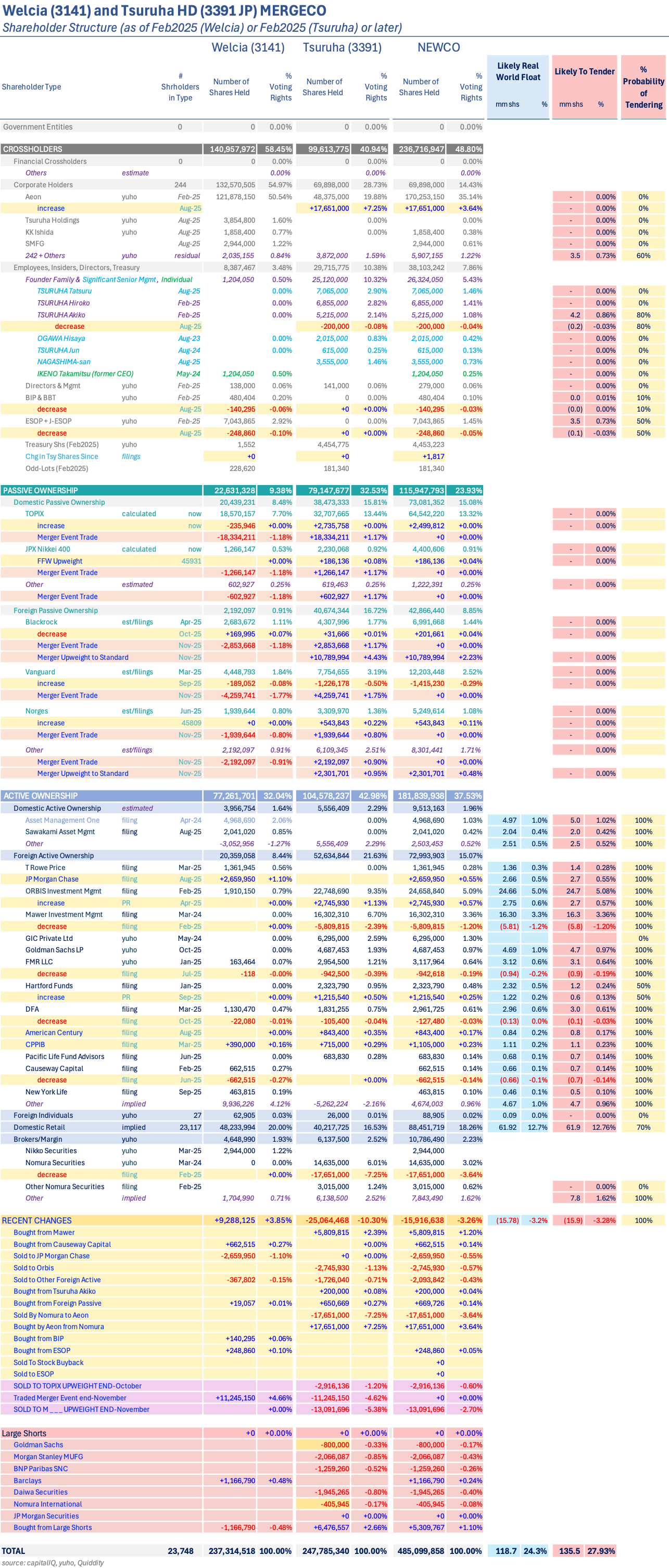

1. [Japan Activism/M&A] Thinking About the Partial Tender Trade Coming in Dec25

- A month ago I wrote [Japan Activism/M&A] – Closing In On the Tsuruha Partial Tender – Likely Needs To Be Higher. Now we are <2wks to the deal.

- At the time, I said the Partial Tender Offer Price needed to be higher than the mooted ¥2,280. Tsuruha Holdings (3391 JP) shares are up 10.0% in that month.

- The three largest peers are -2.0% on average in that period. The average of 8 peers is +0.5%. I still expect the partial offer price needs to be near ¥3,100

2. China Hongqiao (1378 HK): Index Impact of US$1.2bn Placement

- China Hongqiao (1378 HK) is looking to raise US$1.2bn via a top-up placement at an indicative price of HK$29.2/share, a 9.6% discount from the last close.

- There will be limited passive buying from global index trackers at the time of settlement of the placement shares. However, there are a couple of potential index inclusions in December.

- Then there will be more passive buying from trackers of a global index, Hang Seng Index (HSI INDEX) and Hang Seng China Enterprises Index (HSCEI INDEX) next year.

3. CATL IPO Lockup – US$5.3bn Lockup Release, with H-Shares at Significant Premium to A-Shares

- CATL (3750 HK) raised around US$5.2bn in its H-share listing in May 2025. The lockup on its cornerstone investors is set to expire soon.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research.

- In this note, we will talk about the lockup dynamics and possible placement.

4. SBI Shinsei Bank (8303 JP) IPO: TPX Add in Jan; Global Index: One in May; One in June

- SBI Shinsei Bank (8303 JP)‘s listing has been approved by the JPX and the stock is expected to start trading on the Prime Market from 17 December.

- At the indicated IPO price of ¥1,440/share, the IPO will raise up to ¥367.6bn (US$2.38bn) and value SBI Shinsei Bank (8303 JP) up to ¥1,290bn (US$8.34bn).

- The stock should be added to the TOPIX INDEX at the close on 29 January while inclusion in global indices should take place in May and June.

5. [Japan Activism/M&A] Hakuhodo DY Lowers Digital Holdings (2389 JP) TOB Threshold, Bumps a Tiny 2.2%

- Today after the close, Hakuhodo Dy Holdings (2433 JP) announced changes to the terms of its Tender Offer for Digital Holdings Inc (2389 JP), which faces an overbidder in SilverCape.

- Hakuhodo had bid ¥1,970. Silvercape came over the top with a proposed ¥2,380 but a delay for approvals. DH is fighting against SilverCape because of “remaining minority shareholder risk.”

- That’s garbage. Utter blatherskite. Trumpworthy trumpery. Now Hakuhodo DY has lowered the minimum threshold making it hard to miss, and raised the price 2.3% to ¥2,015.

6. Alibaba (9988 HK / BABA US): Brace for a Big Earnings Move

- Alibaba (9988 HK) / Alibaba (BABA US) will announce quarterly results on Tuesday, November 25, 8:30 p.m. HKT (7:30 a.m. U.S. Eastern Time)

- Options markets anticipate an above average move with a bearish bias in traders’ expectations. Implied volatility is expected to drop significantly after the event.

- Get ready for Alibaba‘s earnings announcement. Potential above-average volatility in Alibaba has the potential to impact the wider market and Chinese benchmark indices.

7. Merger Arb Mondays (17 Nov) – Mandom, Paramount Bed, Maruwn, Paris Miki, Mayne, AUB, Genting

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), AUB Group Limited (AUB AU), Dongfeng Motor (489 HK), ENN Energy (2688 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Seven West Media (SWM AU), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Jinke Smart Services (9666 HK).

8. Grindr (GRND US)’s Wide Spread As Majority Owners Court Delisting

- Back on the 24th October, Ray Zage (director) and James Lu (chairman), collectively holding ~60% in Grindr (GRND US), proposed to take the company private in a US$3.5bn deal.

- The non-binding cash Offer of $18/share, is a 51% premium to undisturbed. A condition to a firm Offer may incorporate a majority of minority vote.

- While the Special Committee considers the proposal, James Lu has unusually opted to step down. Currently trading at a ~30% gross spread to indicative terms.

9. Tsuruha-Welcia Merger to Form Biggest Drugstore Alliance, +Aeon TOB

- The Tsuruha-Welcia merger creates Japan’s largest drugstore alliance, poised for long-term growth and market dominance, driven by an expected JPY 50B in synergies over three years.

- A two-step corporate action—share exchange (Dec 1, 2025) followed by an Aeon TOB—provides structural certainty and strategic backing, securing the combined entity’s market leadership.

- These catalysts establish a large market leader in the consumer staples space, suggesting a timely opportunity to gain exposure to the new entity.

10. Webjet (WJL AU): Helloworld Steps Up As Weiss/BGH Seek Board Spill

- In Webjet (WJL AU): Undisclosed Buyer Buying, rumours surfaced earlier this year of an undisclosed buyer with ~5%. On the 12th May, Helloworld (HLO AU) emerged with a 5.015% stake.

- On the same day, Gary Weiss/BGH, collectively holding 10.76%, launched a A$0.80/share NBIO, which was subsequently rejected. Undeterred, Weiss/BGH has called for an EGM (21st November) to spill the board.

- Helloworld has now tabled a A$0.90/share non-binding Offer, by way of Scheme. The 1H26 dividend of A$0.002/share will be added. Helloworld currently holds 17.27%. Weiss/BGH hold 17.75%.

Receive this weekly newsletter keeping 45k+ investors in the loop

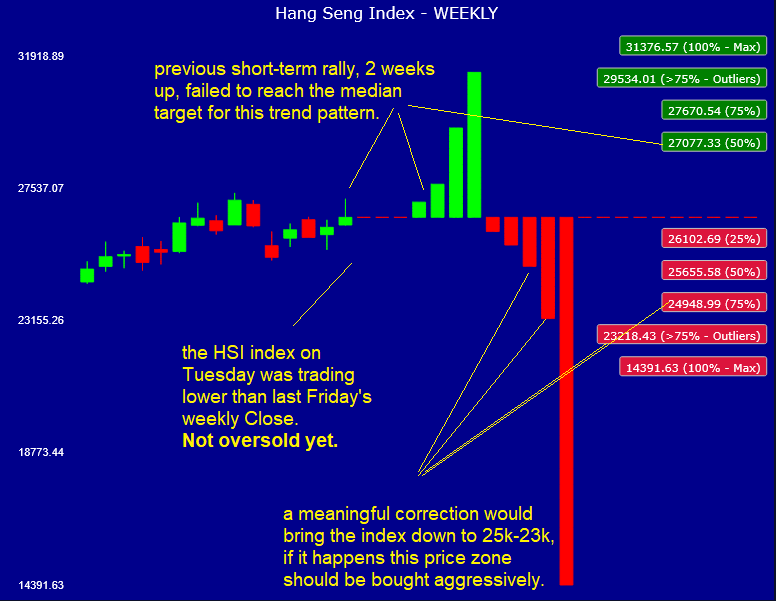

1. HSI INDEX Tactical Outlook Ahead of December 6 Rebalance

- As Brian Freitas recently outlined, the Hang Seng Index (HSI INDEX) changes will be announced November 21st (this Friday) and take effect on December 6th.

- Brian predicted index additions and no deletions. As with all rebalances, inflows, outflows, and adjustments could trigger volatility. Our models, trained on decades of market data, help forecast these moves.

- Currently the HSI INDEX is in a mild WEEKLY correction, after a previous modest 2-week rally. We are still waiting for a meaningful correction, after the recent monster rally.

2. S&P/ASX 200 Outlook Ahead of Dec25 Index Rebalance

- November 21st marks the close of the review period for the S&P/ASX 200 (AS51 INDEX) December rebalance. Changes will be announced on December 5th.

- Implementation of changes begins December 19th, read Brian Freitas‘ recent insight to learn about the 7 possible modifications to the ASX 200.

- Passive tracker flows can significantly move markets around index rebalance dates. In this insight, we leverage our models to identify critical support and resistance zone (the index is very OVERSOLD).

3. NVIDIA’s $500B Order Book: Implications for Valuation, Option Strategies

- NVIDIA has secured unprecedented demand visibility with a reported USD 500 Billion order book for its next-gen AI chips, solidifying its position as the keystone of the AI industrial revolution.

- The company’s financial health highlighted by a USD 48.3 Billion net cash balance and strategic capital return, affirming confidence that structural growth will outweigh geopolitical risks.

- Following a period of short-term volatility and profit-taking, the confluence of long-term structural catalysts suggests the stock is poised to resume a higher trajectory and trading range.

4. The Nikkei Semiconductor Index Rebalance, Kioxia, Nikkei Volatility Hedge

- Kioxia set for inclusion in the Nikkei Semiconductor Index next week, alongside JX Advanced Metals, less than one day’s average daily volume in passive inflow at the close.

- Kioxia’s Q2 2025 results show an accelerating QoQ recovery and solid Q3 2025 forecasts, driven by high demand from data center and smart device products, confirming effective business structure reform.

- Stock is fairly valued after 2025 rally, potential weaknesses being value metrics such as P/E alongside execution of margin and product pipeline targets.

5. Asian Stocks Tactical Outlook (Week Nov 17 – Nov 21)

- A tactical snapshot of the Asian indices and stocks we cover.

- Multiple Asian stocks we track are flashing oversold signals—creating tactical long setups worth considerin.

- We find no overbought stocks or indices in Asia at present. US equities show the same pattern, indicating a synchronized global market pullback

6. Nikkei 225 (NKY) Tactical Outlook After Japan’s Economy Contracts on Tariff Hit

- Japan’s Q3 GDP shrank 1.8% vs forecast 2.5% (annualised), while consumption slowed to 0.1%. This is the first contraction in six quarter.

- The cause is the drop in exports in the face of U.S. tariffs, automakers in particular plummeted, following a period of hiking exports before tariffs came into effect.

- We’ve consistently flagged the Nikkei 225 (NKY INDEX) as overbought. This tactical short-term analysis pinpoints critical support (and resistance, but we think the index may fall).

7. BYD (1211 HK): Leverage Softening Fundamentals with Short Calls

- Bearish fundamental views are strengthening: Recent Smartkarma Insights argue BYD (1211 HK) is overvalued, with slowing sales growth and valuation multiples pointing to limited upside.

- Call overwriting offers efficient yield: Implied volatility in the mid-30s enables attractive income generation.

- Strike and expiry selection matter: Short-dated December options provide the best liquidity, while higher strikes balance premium income with room for near-term upside.

8. 4-Hour Contagion: NVIDIA Q3, Advantest, the AI Flow Footprint on the Global Synchronized Selloff

- Performance was in line with estimates, with total revenue of $57.01B and an expanding Non-GAAP Gross Margin of 73.6%. Management issued robust Q4 revenue guidance of $65B.

- Despite strong fundamentals, the stock’s muted reaction and subsequent slide highlight the risk of unusual, synchronized cross-asset market drops, signaling a need to examine, and hedge against potential systemic vulnerability.

- The synchronized cross-asset market drop on November 20, lacking a clear catalyst, suggests hidden systemic risk driven in part by algorithmic positioning.

9. JD.com (9618 HK / JD US): Top Option Trades Reveal Strong Bearish Sentiment

- Context: Over the past few trading days, JD.com (9618 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Strategies tend to have a short-term horizon, with approximately 40% of all strategies employing weekly options. Bearish views dominate with almost 70% of strategies being put spreads.

- Why read: This Insight breaks down complex option strategies and sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

10. Hong Kong Single Stock Options Weekly (Nov 17 – 21): Breadth Collapses, Put Volumes Rise

- Broad declines set a cautious tone as only a handful of single stocks avoided losses last week amid rising option volumes.

- Market breadth deteriorated sharply, marking the weakest showing of the past year and highlighting the pressure across Hong Kong equities.

- We highlight companies reporting next week in what shapes up as a busy week ahead with Baba and Meituan both reporting.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Disinflationary Kool-Aid

- UK disinflation relied on smaller utility price hikes and only went as far as the 3.6% forecast before September’s dovish surprise. It does not mean a path to 2% lies ahead.

- A broad rebound in price increases took the annualised median impulse above 4% to average 2.5% over two months, or 3% on the year, as the underlying problem persists.

- The BoE’s December decision pivots around the Governor, who seemingly needs upside news to avoid delivering a cut, so this outcome preserves that riskily dovish course.

2. Japan Picks a Fight with China!! What Happens Now?

- Japan has intentionally stepped into the middle of the geopolitical battle between the U.S. and China with Prime Minister Takaichi’s policy-changing Taiwan comments to Japan’s parliament.

- China’s retaliation has been swift and tactical, issuing travel warnings, high-level diplomatic reprimands, and conducting military exercises near the Senkaku Islands. China has promised a continuing substantial and broad-based response.

- We expect China’s response to include rare earth export and Japanese trade restrictions and targeted boycotts of Japanese goods on the mainland.

3. HEW: Micro Risk Off

- Risk assets have suffered, despite decent Nvidia results suggesting AI demand hasn’t turned yet, and the macro data remaining resilient. Fears are more theme-specific.

- US labour market activity entered the shutdown solidly, and low jobless claims suggest it survived fine. Meanwhile, UK inflation only lost a little excess, and our forecast rose.

- Next week’s UK Budget is the lowlight of our week, but it may struggle to live up to all the noisy hype. Sneaky backloaded tax hikes will close the latest forecast hole again.

4. EA: Unsatisfying disinflationary snack

- Slower food price inflation nibbled the EA rate down to 2.1% in October, while services increased to their fastest pace since April. Labour costs are still rising too fast.

- Underlying inflation metrics are broadly a bit beyond target, risking a slight overshoot in the medium term, but the median impulse is reassuring, weighed down by France.

- Energy prices are set to bump inflation around the target in 2026, averaging above the consensus in our view. The ECB would need tightness elsewhere to shift rates, though.

5. The Dollar Is Smiling But It’s Not Happy 🙁

- The dollar has strengthened in the face of weakening equity markets, however it is not the Dollar Smile theory supporting its move this time.

- A more hawkish Fed signals a break with past conditioning for a Fed Put to bail out the stock market. Post-COVID inflation caused by Fed policies will constrain aggressive easing.

- Safe-Haven support for the dollar and Treasuries broke down during the April selloff, indicating a change in foreigners’ perception of holding USD assets and leading to significantly increased dollar hedging.

6. Japan: The New Takaichi Trade, SELL THE RIP!

- Sentiment in Japan has reversed sharply showing strains in the JPY and JGB markets. The Nikkei 225 has retraced all its gains since the election of Prime Minister Takaichi.

- The market is nervous about the size of Takaichi’s economic package, which will be ¥21.3 trillion; 27%. more than her predecessor pledged. It will increase bond issuance substantially.

- Tensions from Takaichi’s provocation of China show no sign of easing. China has started economic and other measures to respond. The US has removed a missile launcher from Japan.

7. US: Resilient Into Shutdown

- US payroll data revealed resilience going into the US government shutdown, with jobs growth the strongest since April and annualising to a pace capable of plateauing growth.

- Surging labour force participation drove unemployment up in the least disappointing way, with the employment to population ratio making a contradictory improvement.

- Jobless claims suggest stability into the shutdown’s end, besides noisy federal claims. The FOMC may not get the evidence it needs to cut again in December. It may not exist.

8. Asian Equities: A Correction, Not a Bear Market; Rates Still Falling and Earnings Are Catching Up

- Combination of concerns about Fed rate trajectory, AI capex monetization, Chinese growth slowdown and Japanese Yen carry trade unwinding brought the US and Asian markets 4-5% down since late October.

- Expensive valuations are now justifiably correcting. Notwithstanding worries about a December cut, the interest rate trajectory remains resolutely downwards. Asian disinflation offers several central banks further room for monetary easing.

- AI capex monetization worries will wax and wane. But Asian AI enablers’ cash flows seem safe and valuations inexpensive. Corporate earnings environment is solid in US and recovering in Asia.

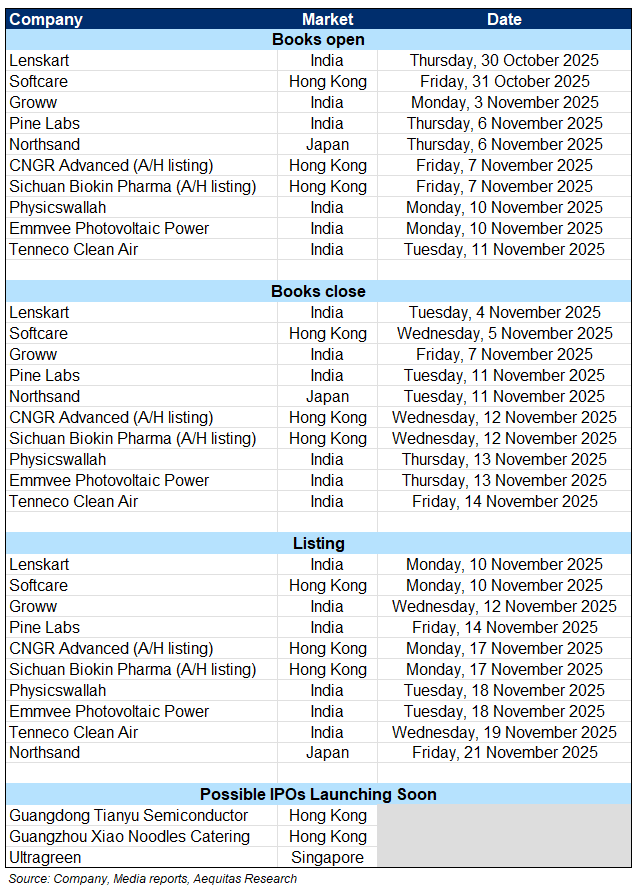

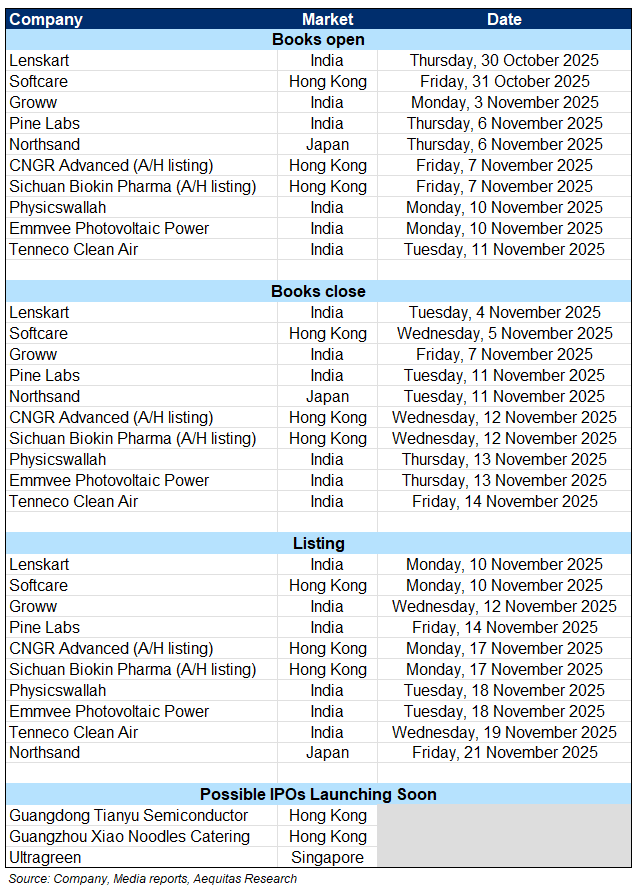

9. Asian Equities: Policy Focus Reflected in Sector-Wise IPO Revival in Leading Markets

- Asian IPOs’ spike in 2025 (21% higher till October) has been driven primarily by HK/China. Indian IPOs are almost at the same level as in a very strong 2024.

- Policy thrust for “New Productive Forces” are driving capital raising from industrials, materials, technology and utilities and shall continue to do so. Healthcare should also be a buoyant capital raiser.

- India’s policy focus on manufacturing and listing of PE-funded companies should drive IPOs from industrials, materials and consumer discretionary. Financials shall also remain a large issuer sector.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 21 Nov 2025

U.S. data releases are expected to clarify economic conditions while political pressure complicates monetary policy sentiment.

Japan’s new leadership has escalated geopolitical tensions with China through unnecessary provocative statements.

Asian growth remains mixed but resilient, led by strong performances in Vietnam, India, Taiwan, and Malaysia.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Tech Weekly: Nvidia Asking TSMC for More Capacity; Apple to Disintermediate Telcos?

- Nvidia Pushes TSMC for More Capacity as AI Chip Demand Surges

- Apple Expands Its Satellite Ambitions for iPhones Beyond Just Emergencies — A Step Towards Disintermediating Telcos?

- Nvidia’s International HQ in Taipei Deal Clears Final Hurdle — Boost for Taiwan 2026E-2027E

2. Substrate. ASML, TSMC Slayer Or Ideological Pipe Dream?

- Silicon valley startup Substrate made waves two weeks ago when they emerged from stealth mode to announce a revolutionary new tool they claim will rival ASML’s EUV lithography capability

- Substrate simultaneously plans to build next-generation semiconductor fabs to return America to dominance in semiconductor production and will use their technology—a new form of advanced X-ray lithography—to power them.

- For a three year old startup, whos CEO has zero documented experience of semiconductors or lithography, these are bold claims indeed. This should be interesting!

3. Humanoid Robots Won’t Take Your Job, We’ve Just Decided Not To Give You The Job In The First Place.

- Jensen Huang claims that the world is running out of workers & there will be a shortage of 50 million workers by the end of the decade. Enter humanoid robots.

- Elon Musk claims that AI and robots will take all our jobs, working will be optional and we can grow vegetables while he’s on his way to becoming a trillionaire

- Technology and society are rapidly approaching a critical decision point. Jobs for robots or for humans?

4. SMIC (981.HK): Although GM May Decline Slightly, Revenue Is Expected to Continue Growing in 4Q25.

- Revenue in 3Q25 was 7.8% higher than in 2Q25, in line with stronger seasonal demand. GM: 22.0% in 3Q25, compared with 20.4% in 2Q25 and 20.5% in 3Q24.

- The Company expects: Revenue Flat to up 2% quarter-over-quarter (QoQ). Gross Margin: Between 18% and 20%.

- SMIC’s stock price has risen 160.7% year-to-date in 2025, outperforming Taiwan Semiconductor (TSMC) – ADR (TSM US) at 44.2% and United Microelectron Sp Adr (UMC US) at 10.8%.

5. Hamamatsu Photonics (6965 JP): Capex Peaking, Profits to Rebound

- Announced last Friday, FY Sep-25 sales and net profit were in line with guidance, but operating profit fell short. On Monday, the shares dropped 4.5%, wiping out a month’s gains.

- Looking ahead, management expects three years of sales and profit growth as capex declines, depreciation and R&D level off, and the NKT Photonics acquisition approaches breakeven.

- In this scenario, semiconductor, bio-medical, defense and quantum computing applications should drive 3-year sales growth of 24% and a 71% increase in net profit, bringing the P/E down to 20X.

6. Silergy (6415.TT): 4Q25 Flat or Slightly Upside; Early Gen4 Yields Remain Non-Comparable.

- 4Q25 seasonal outlook? Silergy expects flat to slightly up QoQ, similar to past years.

- Silergy does see consolidation, and given its stronger financials, product breadth, and R&D capabilities, the company remains a top supplier and will continue to gain share.

- Will 1H next year be better than 2H this year?Hard to say because of Chinese New Year seasonality.We expect YoY growth, but not strong yet.

7. TechChain Insights: ChipMOS Indicates Memory Industry Surge into 2026E; Smartphones Currently Soft

- This assembly and testing leader provides fresh insight into the state of display, memory, consumer, enterprise, and industrial end markets.

- ChipMOS: Memory Industry Strength Offsets Display Industry Weakness. Memory strength seen into 2026E. Company noted soft smartphone industry panel demand currently.

- Management signals sustained memory upcycle; disciplined capex to serve multi-year AI and datacenter growth. We rate ChipMOS shares as a Structural Long.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. ECM Weekly (10 November 2025) – Seres, Pony, WeRide, Joyson, DIY, Maynilad, Northsand, Softcare

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the deal flow continues unabated, although a lot of listing in Hong Kong didn’t do to well last week.

- On the placements front, there were a number of deals, with a few right at lockup expiry.

2. Groww IPO Trading – Decent Overall Demand

- Groww (1573648D IN) raised around US$747m in its India IPO. Groww, officially called Billionbrains Garage Ventures, is a direct-to-customer digital investment platform providing multiple financial products and services.

- With Groww, customers can invest and trade in stocks (including via IPOs), derivatives, bonds, mutual funds and other products. Customers can also avail margin trading facility and personal loans.

- We have looked at the company’s past performance and valuations in our previous notes. In this note, we will talk about the trading dynamics.

3. CNGR Advanced Material H Share Listing (2579 HK): Valuation Insights

- CNGR Advanced Material (2579 HK), a new energy materials company, has launched an H Share listing to raise US$507 million.

- I discussed the H Share listing in CNGR Advanced Material H Share Listing: The Investment Case.

- The proposed AH discount range of 36.9% to 29.9% (based on the 7 November A Share price) is attractive, and I would participate in the H Share listing.

4. Human Made Pre-IPO: A Bathing Ape, Reborn

- Human Made (456A JP) aims to raise around US$116m in its Japan IPO.

- Human Made Inc. is a Japan-based apparel and lifestyle company. Its business model centers on producing high-value, limited-supply apparel and goods.

- In this note, we look at the company’s past performance.

5. CNGR A/H Listing: Healthy A/H Premium and Cheap Valuation

- CNGR Advanced Material (300919 CH) is looking to raise up to US$500m in its upcoming Hong Kong IPO.

- CNGR is a Chinese battery-component producer and a new energy materials company. It is the global leader of nickel-based and cobalt-based pCAM (cathode) for lithium-ion batteries.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

6. Sichuan Biokin Pharmaceutical IPO: Well-Positioned to Ride Oncology Focused Global ADC Wave

- Sichuan Biokin Pharmaceutical has launched HK IPO to raise ~$430M by offering 8.6M shares at HK$389 per share. Subscriptions will close on November 12, with expected listing on November 17.

- Lead candidate, iza-bren is the world’s first and only EGFR × HER3 bispecific ADC to have entered Phase 3 trial. Biokin has co-development and co-commercialization agreement with BMS for iza-bren.

- The company is already listed on China’s A-share market in Shanghai. Biokin shares have been a strong performer since it went public and rose 77% over the last one year.

7. Lenskart Solutions IPO Trading – Very Strong Anchor Facing Weak Markets

- Lenskart Solutions raised around US$825m in its India IPO, with a very strong anchor book.

- Lenskart Solutions Limited (LSL) is a technology-driven eyewear company with integrated operations spanning designing, manufacturing, branding and retailing of eyewear products.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

8. Physicswallah IPO – RHP Updates and Thoughts on Valuation

- Physicswallah Is looking to raise about US$434m in its upcoming India IPO.

- Physicswallah Ltd (PWL) offers test preparation courses for competitive examinations, and other courses such as for upskilling, across 13 education categories, including JEE, NEET, and UPSC, among others.

- We have looked at the company’s past performance in our earlier notes. In this note we talk about the RHP updates and provide our thoughts on valuations.

9. Pine Labs IPO Trading – Low/No Demand

- Pine Labs raised around US$450m in its India IPO. Overall demand was weak.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

10. Klook Pre-IPO – The Positives – Growth Has Been Very Strong

- Klook (KLK US), a pan-regional experiences platform in Asia-Pacific, aims to raise around US$500m in its US listing.

- Klook connects travelers with merchants providing a vast array of activities, tours, attractions and other travel services across the globe.

- In this note, we talk about the positive aspects of the deal.

Receive this weekly newsletter keeping 45k+ investors in the loop

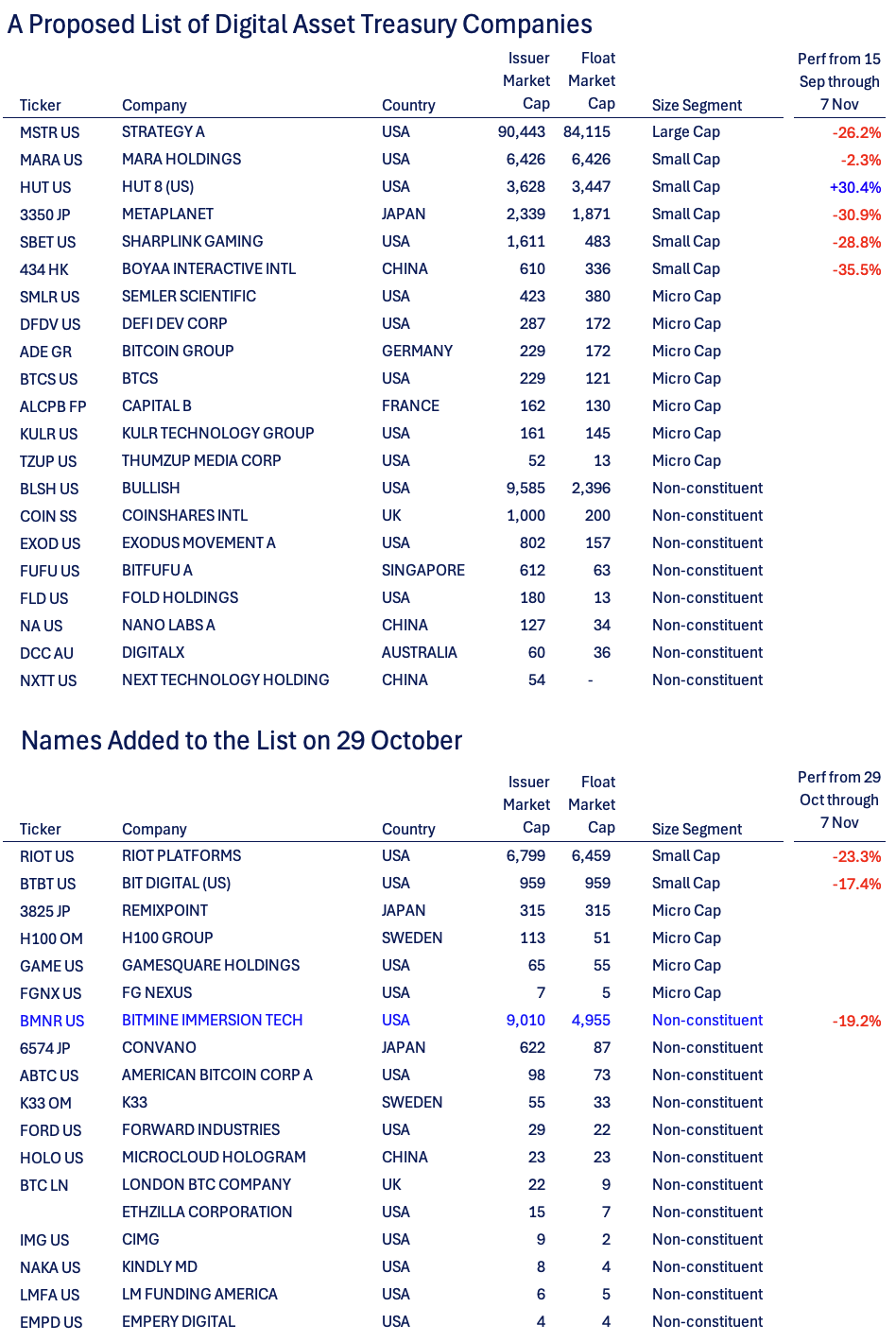

1. Index Consultation on DATCos Means MORE Selling Likely, and Another Index Questionable

- In mid-September, global index provider M _ _ _ announced that they were conducting an index consultation on Digital Asset Treasury Cos. I wrote about it here.

- My recommended short at the time is down 30%, despite announcing a large buyback program. Others have lost significant premium vs underlying digital assets.

- The same index provider expanded their list of affected names on 29 Oct. And a DIFFERENT Index provider this week added DATCOs to a US Advisory Panel Meeting Agenda Wednesday.

2. [Japan M&A] Senko Group (9069 JP) Bids for Maruwn (9067 JP) In Deal Which May Trigger Fireworks

- Today, logistics company SENKO Group Holdings Co., Ltd. (9069 JP) announced a bid for logistics company Maruwn Corp (9067 JP) with help from 35% holder JX Advanced Metals (5016 JP).

- The TOB only needs 11+% to get to 50.1%. There are three holders who Senko clearly regard as not necessarily agreeable to the deal. They hold 28.0% between them.

- If someone wanted to thwart this deal, there are a number of ways to do it. This could get interesting.

3. [Quiddity Index] Light & Wonder (LNW US/AU) US Delisting Event – Updating The Assumptions/Estimates

- Light & Wonder (LNW US) will be delisted at the close of tomorrow US time (two trading days left) and shares converted to Australian CDIs.

- After studying the matter we have amended our assumptions on how flows work. More net selling than expected in November, irksome uncertainy in December, more buyback flows in the meantime.

- The stock was higher on earnings in Australia, skipped a day, then skipped another day, then jumped in the US yesterday.

4. ChiNext/ChiNext50 Index Rebalance Preview: Maxing Out the Changes

- With the review period complete, we forecast 10 changes for the ChiNext Index (SZ399006 INDEX) and 5 changes for the ChiNext 50 Index in December.

- The largest flows will be in 2 stocks that are forecast adds for both indices. There are 14 stocks with over 0.5x ADV to trade from passive trackers.

- The forecast adds outperformed the forecast deletes from June to August, but there has been significant underperformance since then. Outperformance could resume as positioning kicks in prior to announcement.

5. [Japan M&A] Taiyo Pacific Offers ¥2,210 for Star Micronics (7718) Completing the Shareholder Ripoff

- Today after the close, well-known Japan engagement fund Taiyo Pacific Partners announced a deal to buy Star Micronics (7718 JP) for ¥2,210/share. They’ve been involved small-big-small for 20yrs.

- The company launched a new capital plan and MTMP in February. Cash-rich, it needed no money to grow aggressively. So TPP proposed buying a third of the company. Board agreed.

- Despite ActionsToImplementManagementConsciousOfSharePriceAndCostOfCapital announced February, in April-November the Board decided to sell the entire company to TPP at <1x book. This is borderline outrageous. It deserves notice and complaint.

6. Hynix L2 Flag Risk: Why Stuck Below ₩620k? Eyes on Nov 17 Pivot

- Hynix tagged L2: cash‑only, no margin. >40% two‑day rip triggers KRX halt. L2 caps distort tape; Square’s Oct 27–Nov 10 run showed the messy playbook.

- Hynix L2 review: five >200% YoY prints since Nov 4, but no fresh 15‑day high—₩620k from Nov 3 still the cap, yesterday stalled just below.

- Break above ₩620k likely triggers L2, leverage caps, volatile tape, Square outperformance; hold below into Monday kills L2 risk, keeps Hynix’s relative bid with retail still piling in.

7. [Japan M&A] Paris Miki Is Indeed an MBO Target; Luxottica May Complain But Tough To Block

- Today after the close, Paris Miki Holdings (7455 JP) announced the Tane family Holdco would buy out the company in an “MBO” at ¥581, or 4.8x current year EBITDA.

- World famous eyeglass/sunglass manufacturer Luxottica bought 13.8% of the company in the low ¥300s almost stopping about a year ago. They might complain, but Paris Miki is a big outlet.

- This looks like it gets done. The family+crossholders+ESOP+warrants have 65% of the expanded share count. Those who would complain would need to do so soon, and loudly.

8. Square’s Level 2 Leverage Caps End Tomorrow — Fresh Near‑term Factor in the Square Vs Hynix Setup

- Square closed ₩290,000, missing all criteria; Level 2 removal effectively confirmed, with KRX disclosure expected ~8 p.m. Seoul, effective from tomorrow’s open.

- Square vs Hynix hinges on retail chase structurally, but near‑term Square’s underperformance worsened by asymmetric leverage shackles.

- Square’s Level 2 setup ends tomorrow; flows normalize, likely giving Square more juice vs Hynix. Key spot to watch from tomorrow’s open.

9. [Japan M&A] KKR and Founder to Take Engineer Staffing Agency Forum Engineering (7088) Private

- Today after the close, KKR announced a deal whereby they and founder OKUBO Izumi-san would take Forum Engineering Inc (7088 JP) private in an LBO.

- The process of this deal ticks most all of the “bad process” boxes but the price is pretty good.

- 52% is locked in. Insiders and cross-holders appear to own another 15-18%. This looks like a done deal to me. Money comes 30 December.

10. Merger Arb Mondays (10 Nov) – Soft99, Digital Holding, Saint-Care, ANE, ENN Energy, Mayne, AUB

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Saint-Care Holding (2374 JP), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Seven West Media (SWM AU), Jinke Smart Services (9666 HK).

Receive this weekly newsletter keeping 45k+ investors in the loop

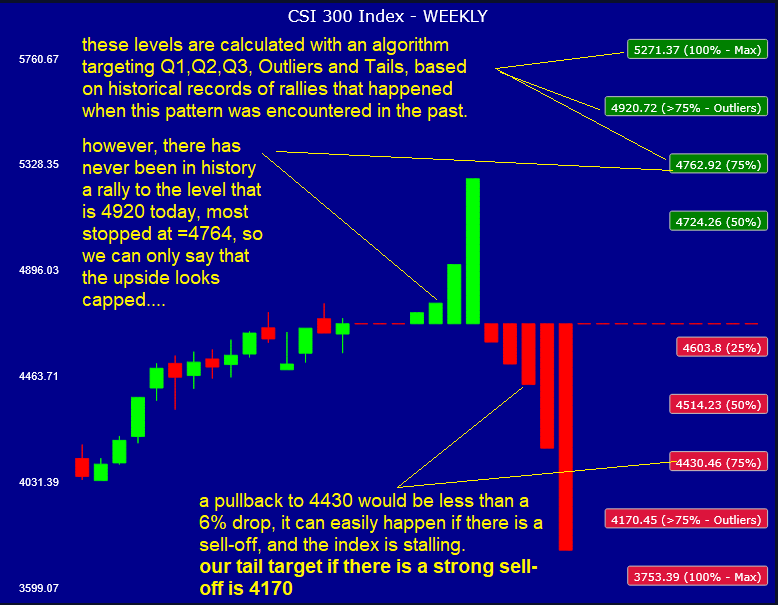

1. CSI 300 (SHSZ300) Tactical Outlook Ahead of December Rebalance

- As Brian Freitas recently outlined: the CSI 300 Index (SHSZ300) will undergo its semi-annual review by the end of November 2025, there could be profit-taking as we near that date.

- In our previous insight we flagged potential downside tail risk. While the index hasn’t fallen since our warning, this doesn’t mean the risk has dissipated.

- Our profit target model (the “go SHORT” model) is showing a rare pattern with very few rallies, severely limited upside (less than 1.5%) and an 80% reversal probability.Bearish.

2. Happy Singles’ Day! How Alibaba (9988 HK) And JD.com (9618 HK) Move After 11/11

- Alibaba (9988 HK) and JD.com (9618 HK) often see heightened volatility following Singles’ Day (11 November), though performance varies by year.

- Alibaba’s post-event returns are mixed, averaging nearly twice its normal four-day move, while JD.com has shown stronger and more consistent gains.

- Option markets imply elevated short-term volatility—especially for JD.com—with potential trading opportunities around the 14 November expiry.

3. SoftBank (9984 JP) Tactical Outlook: What’s Next After NVDA Exit, Wild Swings, and Strong Earnings?

- Softbank Group (9984 JP) is swinging wildly. On Nov 11, the stock sank -13% after it said it had sold its entire stake in NVIDIA (NVDA US) for $5.83 billion.

- The stock also posted record Q2 earnings on Nov 12, but closed the day down -3.46% (after a strong rally from the 21k bottom). Most gains come from OpenAI investment.

- For sure it’s not easy to hold this stock at the moment, this insight will analyze the next 2-3 weeks’ outlook, support and resistance, according to our quantitative model.

4. Mitsubishi Electric: Digital Pivot Sparks 60% Profit Surge, What’s Next?

- Mitsubishi Electric is successfully executing a multi-year pivot toward becoming a high-margin digital solutions provider, anchored by its DX strategy and acquisition of OT security leader Nozomi Networks.

- H1 FY26 financial results confirm clear operating strength, showing a strong 60% year-over-year surge in net profit and strong revenue growth, especially within the Infrastructure and Life segments.

- Management’s shift to higher-margin software and services, along with disciplined capital management, is materializing value and helps justify a positive long-term view.

5. Earnings Volatility Preview: Options Price Sharp Swings in China Tech Earnings Week

- Context: Some of Hong Kong’s largest and most prominent companies will report in the coming days, representing 20% of the Hang Seng Index (HSI INDEX)

- Highlight: This Insight quantifies option-implied swings which serve as a gauge for post-earnings reactions.

- Why Read: Prepare for a busy earnings week by understanding where single-stock and broader market volatility may be elevated.

6. Advantest Q2 FY2025, Navigating Post-Earnings Volatility

- Advantest’s updated guidance and MTP3 targets confirm its dominant, long-term growth trajectory as a key supplier for the high-performance computing and AI semiconductor supply chain.

- Despite a strong structural growth story, the stock faces near-term headwinds from a sequential decline in Q2 operating income and an elevated valuation that reflects peak market optimism.

- We suggest a tactical adjustment to vega exposure due to market dynamics, recommending a strategy to monetize the heightened implied and realized volatility following the strong earnings report.

7. Macro Markets and the U.S. Thanksgiving Effect: Shedding Light on Historical Patterns

- November’s seasonal strength extends into the U.S. Thanksgiving period, where macro markets have tended to post positive returns.

- Despite the positive averages, dispersion in returns remains wide, reminding traders that seasonality is no guarantee.

- Positive seasonals can align with favorable trading setups, but timing and risk management remain key.

8. Fast Retailing (9983 JP) Tactical Outlook: Exit or Hedge Your Position

- In our previous, September 29th insight about Fast Retailing (9983 JP) , we flagged the stock for a rally. But boy, we didn’t anticipate how far it would run!

- 6 weeks have passed and the stock has rallied up nearly 30% as of Tuesday’s Close. We think it’s time to sell (or at least hedge your position).

- Rationale: the stock is incredibly overbought according to our model, plus it is one of the few stocks we track in Asia that has not started a pull back (yet).

9. Nintendo Post-Earnings, Pre-Holidays: Are Profit Margins Going to Jump Back?

- Switch 2’s successful launch drives a hyper-growth cycle, which may have been confirmed by the full-year hardware forecast hike to 19 million units for FY26.

- Despite a temporary Gross Profit Margin drop due to the initial low-margin hardware sales mix, a continued rebound could occur fueled by higher-margin software sales, especially during the holiday season.

- The analysis concludes with a leverage-optimized directional trading strategy, utilizing a typical recommended hedge to protect against potential short-term broader market volatility risks.

10. Samsung, SK Hynix, Samsung F&M, Meritz: The Balanced AI-Momentum Korea Portfolio, and KOSPI Options

- AI-Driven KOSPI concentration necessitates a balanced, diversified portfolio (AI/Tech + Defensives) with a tactical hedge.

- KOSPI’s 84% YTD gain is narrowly led by Samsung and SK Hynix (45% of gains), raising concentration risk tied to the volatile global AI capex cycle.

- The strategy is built by blending high-beta AI-linked technology exposure with lower-beta insurance and industrial stocks for ballast and stability.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK: Jobless Embolden Bailey’s Cut

- Another disappointing rise in the unemployment rate should embolden Bailey’s bias to cut rates in December. Falling net underemployment contradicts, but is easily ignored.

- Another step down in payrolls, matched by employment this time, could be blamed on fears for the Budget. Redundancies also spiked, although vacancies are stable.

- Headline pay growth is slowing as expected, while the monthly impulse remains excessively strong, so the hawks are unlikely to see inflation persistence as broken.

2. UK: Return To Residual H2 Gloom

- UK GDP disappointed in Q3 at 0.1% q-o-q after the ONS revised away August’s surprise resilience and led it into a slight September fall, setting up for a soft Q4 too.

- Residual seasonality in service sector growth has reasserted itself on the average post-pandemic path. So statistical stories seem more plausible than fundamental ones.

- Weakness in labour market activity is more relevant. The hawkish half of the MPC probably needs disinflationary news to support a cut, but the Governor seems swayed.

3. CHINA’S AI COMMODITIZATION: Can Global AI Valuations Survive?

- Chinese AI model downloads have surpassed those of the U.S. putting at risk the valuations of the large hyperscalers in the U.S.

- Chinese open-source AI models offer a more secure, efficient, and lower cost alternative to Chat GPT -5 , Claude 4.5 Sonnet, and other U.S. LLMs.

- We believe that there will be a turning point when investors will realize that the Chinese open-source AI models have undercut the premise of U.S. global dominance of AI.

4. 239: How Private Markets Could Reshape Portfolios and Investment Opportunities by 2030

- Private markets are investments into non-listed companies or assets, providing diversification and potentially higher returns for portfolios

- There is a significant trend of companies staying private for longer, leading to increased opportunities for private market investors

- Individual investors are increasingly looking to allocate to private markets, with the total alternative assets under management expected to reach $32 trillion by 2030.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. NPS Could Raise Allocation of Korean Stocks = KOSPI to 5,000 Soon

- One of the biggest stories in the Korean stock market in the past several weeks has been the discussions about NPS potentially increasing the allocation of Korean stocks.

- If NPS announces a meaningful increase in the allocation of Korean stocks for its AUM, then there could certainly be an acceleration to KOSPI reaching 5,000.

- Based on what we have gathered so far, there is a higher probability (70-80%) that NPS meaningfully increases the allocation of Korean stocks in the next several months.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (November 10)

- The Hong Kong market is consolidating with rotational buying into value and high dividend factor investments. Mainland buying has slowed and diversified away from tech into low volatility names.

- After leading the market for nine months, growth and momentum factors turned down sharply in October. The energy sector is showing increased strength and momentum, while tech and healthcare lag.

- Xinyi Solar Holdings (968 HK) had a technical breakout after forming a Golden Cross with a rebound off its 50 day-moving-average. The share price is benefiting from anti-involution policies.

7. Oil: Wisdom of (Mohammed bin) Salman

- Most analysis of Opec+’s 2 November decision is as overly simplistic as the cartel’s public justifications. Calling an unwinding ‘time out’ in 2026Q1 is by no means unwise.

- Most notably — and despite continuing economic and political uncertainty — it is very likely that the market will be awash with oil in any case for some months to come.

- In other words, the cartel may already have done enough to achieve its primary objective, i.e. clawing back market share at the expense of US shale producers.

8. Asian Equities: Earnings Estimate Upgrades Climbing, but Slowly and Selectively

- Midway through the 3Q25 result season, eighteen Asian market-sectors have reported consensus EPS estimate upgrades over past one, three and six months. A quarter ago, we identified 11 such sectors.

- Eleven of these sectors are from HK/China, Korea and Taiwan. Seven are from ASEAN markets, dominated by Thailand. India and Singapore are conspicuous by their absence.

- Among the notable sectors with EPS upgrades, Chinese base metals, HK/Chinese and Korean financials, Chinese pharmaceuticals, Korean and Taiwanese technology, Thai utilities and communication and Philippines transportation stand out.

9. HEW: Back To Business

- The US government reopened after some of those seeking to expand the state inevitably broke ranks to reverse some shrinkage, although the fight could resume in January.

- UK activity data were broadly disappointing as unemployment rose and GDP fell at the end of Q3, after downwards revisions helped realign with the residual seasonality.

- Next week’s UK inflation data will be more insightful for the BoE’s hawks and us. The belated release of US macro data will probably be more substantive market news.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 14 Nov 2025

India delivers exceptionally low headline inflation while Japan and the United Kingdom face persistent price pressures and weak growth signals.

Vietnam undergoes political restructuring, yet I see improving economic prospects driven by potential domestic-demand reforms.

China’s seemingly weak October data reflect calendar effects, with monetary indicators instead pointing to strengthening momentum.