Receive this weekly newsletter keeping 45k+ investors in the loop

1. Kitazato Pre-IPO – Past Sales Have Been Steady but Slowing

- Kitazato (368A JP) manufactures and sells medical devices and products for fertility treatment. It aims to raise around US$120m in its Japan IPO.

- Kitazato specializes in artificial insemination, in vitro fertilization, cell cryopreservation and reproductive engineering technologies in regenerative medicine.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

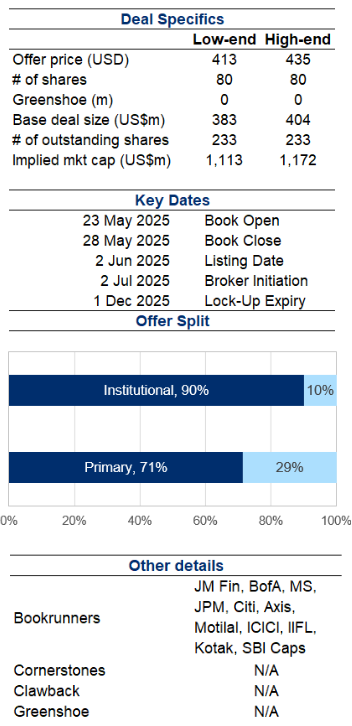

2. Virgin Australia IPO – Not Terribly Exciting, After Significant Items Adjustment

- Bain Capital is looking to raise around US$440m via selling some of its stake in Virgin Australia Holdings (VAH AU).

- Virgin Australia is the second largest airline group operating in the Australian aviation market, with an average 32% domestic RPT capacity market share in CY24.

- In this note, we look at the company’s past performance and provide our thoughts on valuations.

3. Kelun-Biotech Placement – Recent Run-Up Makes Its Tricky

- Sichuan Kelun-Biotech Biopharm (6990 HK) is looking to raise up to US$200m from a primary placement. The offering is priced at HK$ 330.2-341, a 5-8% discount to last close.

- The company plans to use the proceeds for research and development, clinical trials of its core products and as working capital.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. Wistron GDR Offering – Well Flagged US$922m Offering, Discount Slightly Wider than Recent Deals

- Wistron Corp (3231 TT) is looking to raise up to US$922m in its global depository receipts (GDRs) offering.

- Similar to previous GDR listings, the firm has undergone a long drawn out process prior to launching the deal, having to jump through a number of board/shareholder/regulatory approval loops.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

5. Primo Global Pre-IPO: Driven by Domestic Demand as International Ops Falter

- Primo Global (367A JP) is looking to raise at least US$104m in its upcoming Japan IPO.

- Primo Global specializes in merchandising bridal jewellery, namely engagement rings and wedding rings.

- In this note, we look at the firm’s past performance.

6. Circle IPO Analysis (Second Largest Issuer of Stablecoins Globally)

- Circle raised both the IPO shares to be issued and IPO price range. New IPO price range is $27 to $28 per share (from $24 to $26 per share previously).

- We have a Positive View of the Circle due to its status as the second largest issuer of stablecoins globally, rapidly increasing user base and sales, and improving profit margins.

- Major risk factors of this IPO include CBDCs, centralization, cyberattacks, and potential government crackdown.

7. ECM Weekly (2 June 2025) -Indigo, ITC, EBOS, Isuzu, Foshan Haitian, Lens Tech, Seres, Schloss, Aegis

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) might launch its A/H listing this week.

- On the placements front, there were a number of large deals across the region, with notable ones in ITC Ltd (ITC IN) and InterGlobe Aviation Ltd (INDIGO IN).

8. Aegis Vopak IPO: Anemic Demand

- Aegis Vopak Terminals Ltd (1902844D IN) raised about US$328m in its upcoming India IPO.

- It is the largest Indian third-party owner and operator (in terms of storage capacity) of tank storage terminals for liquified petroleum gas (LPG) and liquid products.

- In our previous notes, we talked about the company’s historical performance, undertook a peer comparison and shared our thoughts on valuation. In this note, we talk about the trading dynamics.

9. Pre IPO Eastroc Beverage Group (H Share) – The Strength, the Concerns and the Outlook

- 2024 is a milestone year. The weighted average ROE set a new high. Due to cost dilution brought by economies of scale, net profit growth was higher than revenue growth.

- The risk of relying on a single category hasn’t been eliminated. Traditional advantages of offline channels are becoming saturated. There is a gap between channel structure and new consumer forces

- Eastroc’s valuation is expected to be higher than the industry average and peers due to its higher growth rate, but investors needs to consider the H/A premium

10. Slide Holdings Insurance, Inc.(SLDE): Peeking at the IPO Prospectus of Another Florida Based Insurer

- They write several homeowners’, condominium owners’, and commercial residential products in coastal specialty markets in Florida and South Carolina.

- For the three months ended March 31, 2024 and March 31, 2025, they had gross premiums written of $245 million and $278 million.

- The strong performance of peers could provide a potential tailwind for this IPO.