This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

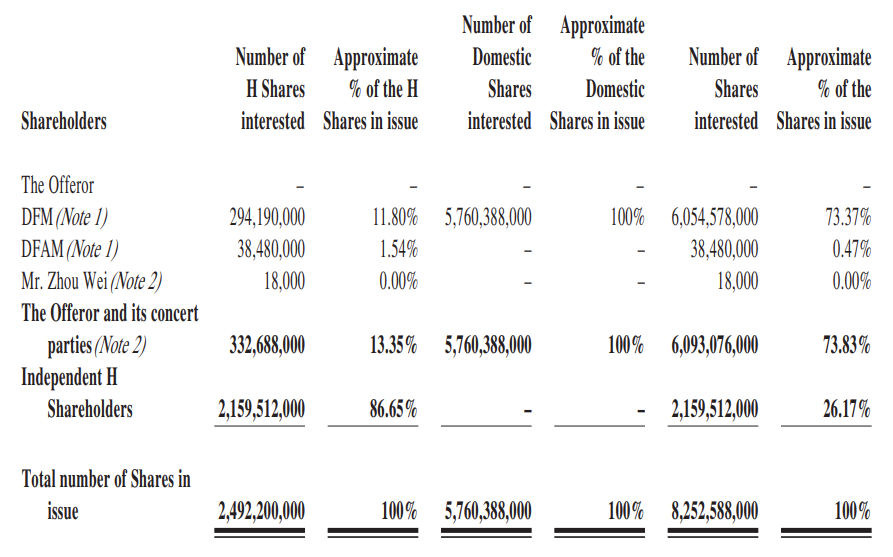

1. Dongfeng (489 HK)’s Privatisation And EV Backdoor Listing

- Dongfeng Motor (489 HK) has announced a privatisation; together with a concurrent listing of its EV arm.

- The same day as the dual proposals, Dongfeng announced an interim loss (1H25). Evidently, the way forward – from an investor standpoint – is electric, not internal combustion engines.

- The cash terms + scrip (into the EV listing) under the proposals are attractive. Even after this morning’s move (+53.6%) in Dongfeng’s share price.

2. Merger Arb Mondays (25 Aug) – Dongfeng, ENN Energy, Shibaura, Santos, Lynch, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Dongfeng Motor (489 HK), Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Santos Ltd (STO AU), Shibaura Electronics (6957 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), PointsBet Holdings (PBH AU).

3. [Japan M&A] YAGEO Says It Expects FDI Clearance on Shibaura – Minebea Likely To Fold

- Last weekend then post-close Monday, Yageo Corporation (2327 TT) raised its TOB Price for Shibaura Electronics (6957 JP) to ¥7,130 – a full 15% through Minebea’s proposed ¥6,200/share terms.

- Minebea was playing chicken with the result, closing its tender on 28 August, before Japan’s Foreign Direct Investment approval (FEFTA approval) was cleared, expected 1 Sep or later.

- Today post-close, YAGEO announced it had concluded discussions with METI, would make all required regulatory submissions today, and expects to obtain approval “no later than 10 September”

4. PointsBet (PBH AU): Betr’s Dyslexic Bump. Mixi’s Now Holding 42.38%

- Betr Entertainment (BBT AU) has bumped scrip terms to 4.375 betr shares per PointsBet Holdings (PBH AU) share, equivalent to A$1.31/share, based on betr’s last traded price.

- True to form with betr, there’s a typo in its latest announcement stating a 4.735 ratio. betr just issued a Bidder’s Statement with the correct info.

- Apologies: in my last note I mentioned Mixi Inc (2121 JP) had bumped to A$1.30/share. However, that was predicated on Mixi securing 90%, which won’t happen if betr doesn’t tender.

5. A Merger Between HD Hyundai Heavy Industries and HD Hyundai Mipo

- It was announced today that HD Hyundai Heavy Industries will merge with HD Hyundai Mipo. The merger ratio between HD Hyundai Heavy Industries and HD Hyundai Mipo is 1:0.4059146.

- HD Korea Shipbuilding & Offshore Engineering (009540 KS) will own a 66.29% stake in the merged entity.

- HD KSOE is proceeding with this merger of its two major subsidiaries ahead of the full-scale launch of the MASGA (“Make America Shipbuilding Great Again”) project.

6. Near-Term Flows to Watch on Mandatory Treasury Share Cancellation in Korea

- Dems likely to push 3rd package in Q4; near-term flows chasing treasury stock cancellation theme, with locals screening >₩1tn mkt cap, >10% treasury shares of float.

- Little pushback on mandatory treasury cancellations; debate focused on timeline — grace period vs. immediate rollout — highlighting how much leeway government may grant differing governance structures.

- Too early for governance plays; near-term momentum flows likely in names with highest treasury stock relative to float, where cancellation is expected to hit flows hardest.

7. [Japan M&A] CareNet (2150 JP) – Opaque LBO/MBO Garners New Attention from Existing Shareholder

- When EQT launched its deal for Carenet Inc (2150 JP) two weeks ago, I thought it opaque, and light, and strangely lacking in information which should be there.

- It has not gotten clearer, though three days ago, the largest foreign shareholder as of the announcement reported they had lowered their position by 3.77% (4.22% of votes).

- Then yesterday, someone else reported they had gone above 5%. The data implied in that filing suggests this may have legs. I’d buy through terms.

8. ENN Energy (2688 HK): Chipping Away at the Precondition

- ENN Natural Gas (600803 CH) has made steady progress in satisfying the precondition for its ENN Energy (2688 HK) offer. On 22 August, NDRC approval was obtained.

- The appraised offer HK$80.00 value is the key debating point. Based on several methodologies, I estimate a realistic offer value of HK$74.44 (range of HK$67.84 to HK$83.64).

- The protest votes for director re-elections at the 23 May AGM are a risk. On balance, the scheme vote should pass as the offer is reasonable and strategically sensible.

9. HHI–Mipo Merger Swap: Deal Mechanics & Spread Play Opportunities

- HHI–Mipo merger spread looks minimal, but today’s MASGA-driven pop signals momentum flows—likely to mean-revert toward appraisal rights once the theme dissipates.

- Froth lifted prices past fundamentals—once it unwinds, HHI–Mipo could diverge from swap ratio, creating the spread window where traders can get paid.

- This isn’t classic merger arb—it’s about fading a policy-fueled pop, riding the snapback toward appraisal baseline, with flow-driven swings creating short-term tactical arb setups.

10. Shibaura Electronics (6957 JP): Method in the Madness as Yageo Bumps Twice in Two Days

- On 21 August, Yageo Corporation (2327 TT) increased its Shibaura Electronics (6957 JP) offer by 7.0% to JPY6,635. On 23 August, Yageo further increased its offer by 7.5% to JPY7,130.

- The offer is partially in reaction to Minebea’s recent comments around Yageo securing FEFTA approval. Crucially, Yageo finally provided an update suggesting that only a few issues remained.

- Yageo’s JPY7,130 offer is not over-the-top, as Minebea’s 10x EV/EBIT pricing guideline outlined on 18 August potentially justified a JPY7,300 offer. The likelihood of Minebea walking has increased.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

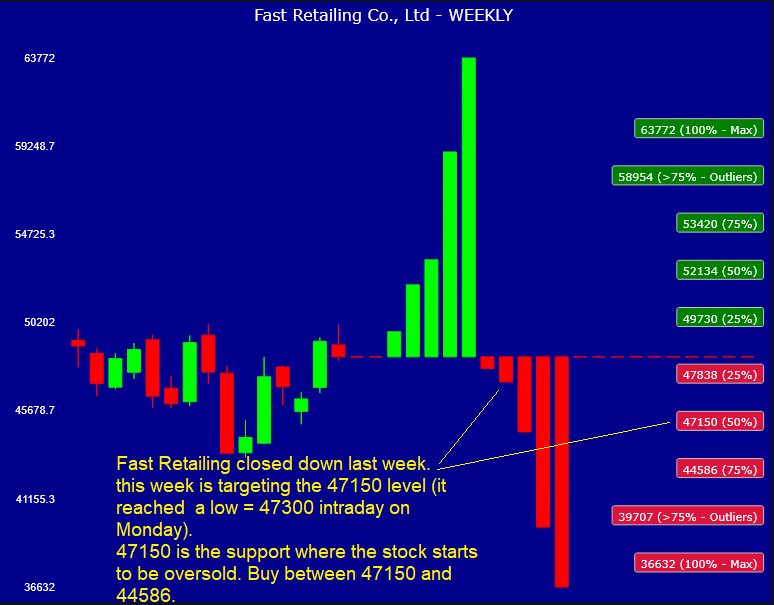

1. Fast Retailing (9983 JP) Tactical Outlook: Turning OVERSOLD, Potential BUY Ahead of Sep-25 Rebalance

- In his recent insight, Brian Freitas stated that Fast Retailing (9983 JP)‘s CPAF will stay the same at the September 25 Nikkei 225 Index rebalance.

- The stock is turning oversold—not yet extreme, but notable. Historically, this short-term downtrend pattern often reversed after two weeks of declines; we are now in the second consecutive week lower.

- Monitor the 47150 support level: the stock is trading at 47810 at the moment of writing, if it goes at or below 47150 it will start to be clearly oversold.

2. Alibaba (9988 HK): Top Trades Ahead of Earnings

- Alibaba (9988 HK) will announce quarterly results on Friday, August 29, 7:30 p.m. Hong Kong Time. In the lead-up, options strategies on the Hong Kong Exchange showcase a variety of approaches.

- Highlights: Recent option trades show a bias towards bullish sentiment. Two strategies using weekly options expiring soon after the earnings announcement are explored.

- Why Read: This review offers real-market insight into how sophisticated participants are positioning ahead of Tencent’s earnings.

3. Toyota (7203 JP // TM US) Hits Overbought: Rich Options for Tactical Shorts

- Context: After three consecutive up weeks, Toyota (7203 JP) / Toyota ADR (TM US) now screens as overbought, with quantitative models signaling a high probability of a trend reversal.

- Trade Idea: Elevated implied volatility (82–83rd percentile) makes short call strategies attractive. Selling near-term calls captures rich premium while aligning with downside risk.

- Why Read: This Insight highlights a timely opportunity where technical overbought signals and historically rich IV converge — ideal for investors seeking a tactical setup.

4. Xiaomi (1810 HK): Earnings Recap & Volatility Dynamics

- Xiaomi (1810 HK) reported 2Q25 results on 19 Aug, beating expectations. This Insight analyzes price reactions in Hong Kong and two overseas markets.

- Highlights: Implied volatility dropped sharply post-earnings, both across the term structure and skew.

- Why it matters: With Xiaomi’s implied volatility now at historically cheap levels, investors may find opportunities in long-volatility strategies ahead of the next earnings in November.

5. Global Markets Tactical Outlook WEEKLY: August 25 – August 29

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 25 – August 29. .XLSX MODEL DATA FILE ATTACHED.

- OVERBOUGHT at the WEEKLY Close: Alphabet, S&P 500 INDEX , Tesla , China Mobile (941 HK) , Toyota Motor (7203 JP) , ASX 200 INDEX , CSI 300 Index , HSI INDEX.

- OVERSOLD at the WEEKLY Close: Meta (META US) , Softbank Group (9984 JP).

6. NIFTY 50 Tactical View: Risk-Off Scenario Before Sep-30 Rebalance + Tariffs Impact

- As forecasted in our previous insight, the NIFTY Index rallied past 25k, but we said this was a BEARISH pattern – rally was short-lived (2 weeks), then this week down.

- Effective September 30 InterGlobe Aviation (IndiGo) and Max Healthcare Institute will be added to the NIFTY, replacing Hero MotoCorp and IndusInd Bank, in the meanwhile 50% US tariffs kicked in.

- We see a potential continuation of the recent bearishness with a RISK-OFF scenario where the index could drop to much lower prices in September, support target 23819 or below.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel Snags $2 Billion From SoftBank. What Now?

- Intel just announced that SoftBank has agreed to buy $2 billion worth of Intel stock, details here.

- The shares are likely newly issued, meaning dilution of existing shareholders. Markets didn’t care and shares rose >5% in after hours trading.

- $2 billion is a far cry from the $40 billion former CEO Craig Barrett thinks Intel needs. Could this be the first of similar deals with US semiconductor/technology companies?

2. CHIPS Act Money For Equity Stake, Pay For China Play? For Goodness Sake!

- US commerce secretary Howard Lutnick confirmed that the US Administration is pursuing a strategy of converting CHIPS Act funding into equity stakes with Intel acting as its guinea pig

- It seems clear that Mr. Lutnick is bent on applying the same formula with other beneficiaries of US CHIPs Act funding

- CHIPs Act Dollars for Equity, Pay For China Play may seem like innovative ideas but in reality they are a slippery slope to confusion & chaos. Who or what’s next?

3. Intel (INTC.US): SoftBank Buys $2bn of Intel Stock at $23; U.S. Government Considers Investment.

- Monetary support may temporarily ease Intel’s current financial difficulties, but the ultimate solution lies in securing technical support from manufacturing.

- We remain curious how the U.S. government will devise a solution for Intel if the company ultimately cannot provide the necessary support for U.S. Fabless players.

- We are bearish on Intel Corp (INTC US)’s current position and do not believe financial support alone can help the company overcome its challenges.

4. SUMCO Q225. Operating Profit Tanks As Depreciation Soars

- SUMCO reported Q225 revenues of ¥102.9 billion, flat sequentially and roughly 3% higher than guidance.

- Operating profit of ¥1.5 billion was also slightly better than the forecasted breakeven, but dramatically down from its peak of ¥30.2 billion in Q322.

- A projected further increase in depreciation charges for the current quarter is forecasted to drive operating profit to negative ¥3.5 billion. Yikes!

5. TSMC (2330.TT; TSM.US): 2nm Production Schedule in US Could Be One Year Ahead of Previous Schedule.

- TSMC Chairman C.C. Wei previously emphasized that customer demand for 2nm technology surpasses that for 3nm, and the company is actively working to expand production capacity.

- For 2nm technology, we expect production to take place at the Tainan fab, ahead of the U.S. Arizona fab and earlier than the previously anticipated 2028 timeline.

- Taiwan Semiconductor (TSMC) – ADR (TSM US)’s next generation 2nm development is actively progressing.

6. Intel’s Historic Agreement Or Moment Of Surrender?

- Intel has agreed to convert US CHIPs Act funding (past & future) & Secure Enclave contracts into a 10% equity stake for the US Administration.

- The equity stake will comprise 433.3 million primary shares of Intel common stock at a price of $20.47 per share, a roughly 16% discount to their market value yesterday

- In his commentary on the deal, President Trump referred to Intel CEO Lip-Bu Tan as a victim, stating he came to the White House to save his job. Wow!

7. A Defining Bet: Intel’s New Capital and the Case for Buying a Stake in Taiwan’s UMC

- A major Intel balance sheet boost, backed by SoftBank, the U.S. government, and leading institutions, would enhance the company’s capacity to make bold bets on regaining global chip manufacturing leadership.

- UMC’s market valuation is less than the capex for just one advanced fab. Intel would likely make a gain on its investment since it would cause UMC shares to rally.

- For less than the cost of a single advanced fab, a large company could acquire UMC and gain chipmaking expertise approaching TSMC’s level; boosting returns across an entire fab network.

8. Taiwan Tech Weekly: TSMC’s US Fabs On a Roll; Why Intel Should Invest in UMC; The Big SPE Reset

- TSMC’s Tale of Two Fabs: Arizona’s Surprise Upside vs. Kumamoto’s Challenges

- A Defining Bet: Intel’s New Capital and the Case for Buying a Stake in Taiwan’s UMC

- SPE – Semi Production Equipment: The Big Reset Is Happening. SPE Firms Expectations Is the Problem

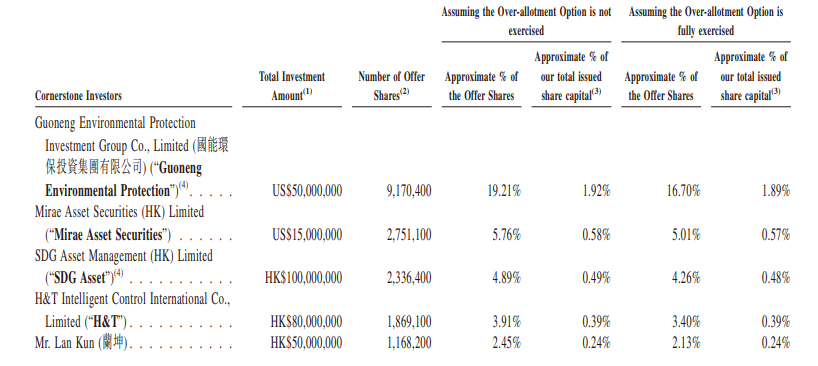

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

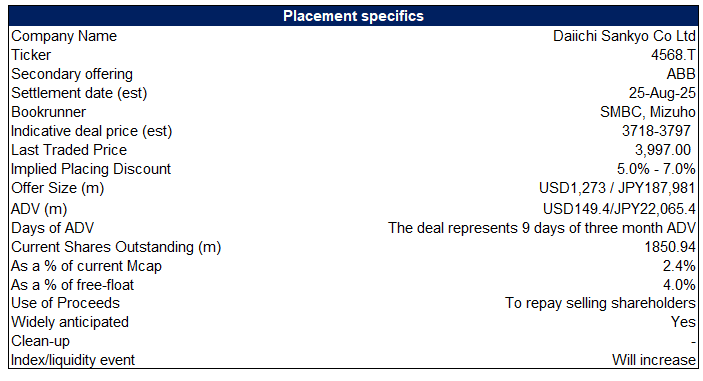

1. Daiichi Sankyo Placement – US$1.2bn Deal but Momentum Isn’t the Best, Last Deal Didn’t Do Well

- A group of shareholders are looking to raise up to US$1.2bn via selling most of their stake in Daiichi Sankyo (4568 JP) .

- While the deal shouldn’t come as a surprise, given the ongoing cross-shareholding unwind, the last deal in the stock didn’t do well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Hansoh Pharma Placement – Somewhat Expected but Still Opportunistic

- Hansoh Pharmaceutical Group (3692 HK) aims to raise around US$500m via a primary placement.

- The stock has done exceptionally well this year but is now trading at near its all-time highs and it doesn’t really need the cash.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

3. [Japan ECM/Index] Japan Business Systems (5036) Offering Triggers Move to TOPIX

- Japan Business Systems (5036 JP) today announced a couple of interesting things. First, admission to TOPIX (contingent on a successful secondary offering of shares, also announced today).

- Then a ¥5/share special commemorative dividend (0.4%) and a “gift” of 4% of the company to a J-ESOP Trust for employees, where the company gifts the shares.

- The latter looks aggressive/generous, but the modalities here are interesting.

4. IFAST Placement – Great Track Record but the Stock Is Toppish

- Temasek aims to raise around US$104m via selling nearly half of its stake in iFAST (IFAST SP).

- The stock has done exceptionally well over the past few years, however, it is now trading at its all time highs.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

5. ECM Weekly (18 August 2025)- Eve Energy, CNGR, Will Semi, 52 Toys, JSW, Bluestone, Tuas, Hexaware

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of companies are lining up to start 2H listing season, which is likely to be one of the busiest over the past few years.

- On the placements front as well, given ongoing earnings annoucement there were only one large placement last week.

6. Hansoh Pharmaceutical (3692 HK): Placing Shares to Fund R&D Amid Stellar 1H Performance

- Hansoh Pharmaceutical Group (3692 HK) is placing 108M shares at the price of HK$36.30 per share. 65% of the proceeds will be used for the R&D of new innovative drugs.

- Hansoh’s late-stage pipeline seems to be interesting, as its key focus areas being oncology and metabolic diseases, which are among the fast-growing therapeutic areas, with huge addressable patient population.

- Hansoh has announced better-than-expected 1H25 result, with both revenue and net profit beating consensus. Innovative drugs revenue increased 22% YoY to RMB6B, contributing 82.7% of total revenue.

7. Shuangdeng Group IPO: Weak Earnings This Year but Potentially Hot Data Centre Trade

- Shuangdeng Group Co Ltd (JISHUZ CH) is looking to raise around US$109m in its upcoming Hong Kong IPO.

- It’s a global leader in energy storage business for big-data and telecommunication industries with a diverse customer base comprising telecom base station operations, data centers, power stations and power grids.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

8. Aux Electric Pre-IPO: Competitive Niche

- Aux Electric Co Ltd (0917839D HK) is looking to raise up to US$600m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we look at the firm’s past performance.

9. Guzman IPO Lockup – Last of the Lockups for a US$750m+ Release

- Guzman Y Gomez (GYG AU) raised around US$221m in its Australian IPO. Its final IPO linked lockup expiry is due soon.

- GYG is a quick service restaurant business with more than 200 restaurants globally. It mainly focuses on fresh, made-to-order, Mexican-inspired food.

- In this note, we will talk about the lockup dynamics and possible placement.

10. SICC A/H Trading – Strong Retail, Lukewarm Insti Demand

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, raised around US$260m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. FEFTA Classification Changes Summer 2025

- The Ministry of Finance has published an updated “FEFTA List” of classifications of listed companies as of July 15, 2025.

- 50 names lowered their ranks from the most “core” Type 3 to Type 2(20), or Type 1(30). 104 names raised from Type 1(51) or Type 2(53) to Type 3.

- Smartkarma readers may want to peruse the lists and details to see if they think companies are trying to protect themselves (from threats as yet not known by the public).

2. Merger Arb Mondays (18 Aug) – Santos, Shibaura, ENN Energy, Kangji, OneConnect, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Smart Share Global (EM US), Mayne Pharma (MYX AU), ENN Energy (2688 HK), Santos Ltd (STO AU), Joy City Property (207 HK), Oneconnect Financial Technology (6638 HK).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Shibaura Electronics (6957 JP), Ci Medical (3540 JP), Soft99 Corp (4464 JP), Ainsworth Game Technology (AGI AU).

3. Smart Share Global (EM US): Hillhouse Crashes The Party. And Rightfully So

- Nearly seven months after receiving a preliminary non-binding proposal, Smart Share Global (EM US) announced on the 1st August a firm Offer had been entered into.

- The Offeror consortium, led by Mars Guangyuan Cai, Chairman and CEO, made an Offer of US$1.25/ADS, a 74.8% premium to last close; but ~20% below net cash + short-term investments.

- Now Hillhouse has thrown its hat into the ring with a US$1.77/ADS NBIO. Smart Share’s special committee of independent directors should engage.

4. Today’s HMM Tender Follow-Up Disclosure and Hedge Ratio Setup

- KOBC’s core mission hinges on HMM; without it, no real mandate. Structural incentive to hold remains, so its active tender participation is still questionable.

- Still, max proration risk seems base case, with weak Q2, soft Q3 freight outlook, and post-tender skew pointing bearish for HMM.

- Spread >10% makes this too good to pass, but should also watch policy risk — better to lock futures hedge early as flows show players scrambling for cover.

5. HMM Tender Side Play: Targeting a Basis Squeeze Ahead of Sep Expiry

- Most traders are starting in September, rolling into October. Sep/Oct spread volume has picked up unusually fast, clearly reflecting hedge demand linked to the tender

- As September expiry approaches, basis-squeeze risk rises, likely pushing September cheap and October expensive, widening the spread — creating a clear side trade opportunity.

- With a basis squeeze expected near September expiry, we could enter a Sep/Oct spread (short Sep, long Oct) and also watch for spot-futures decoupling to play the cash-futures spread.

6. Hanon Systems Announces a Major Potential Rights Offering

- On 14 August, Hanon Systems (018880 KS) announced a potential rights offering capital raise. The exact amount will be finalized at the EGM next month.

- The significant size of the rights offering is expected to burden its largest shareholder Hankook Tire & Technology (161390 KS) which owns a 54.8% stake in Hanon Systems.

- We believe the potential rights offering is likely to continue to negatively impact Hanon Systems by diluting its existing shareholders.

7. Krungthai Card (KTC TB): Still A Buy As Pledged Shares Further Decline

- Back in May this year, shares in Krungthai Card (KTC TB), XSpring (XPG TB), BEC World Public (BEC TB), and The Practical Solution (TPS TB) all went limit down. Twice.

- This situation was discussed in Krungthai Card (KTC TB): Buying Opportunity After Margin Call. Reportedly Mongkol Prakitchaiwattana had pledged his shares in all four companies, leading to margin calls.

- On the 16th August, the SET released an updated list of securities pledged, with pledged shares in KTC now at 2.3% of shares outstanding, down from 16.3% in May.

8. Curator’s Cut: Singapore Unlocks Value, India’s Jewellery Caution & Taiwan’s Top ETF’s Rebalance

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ Insights published over the past two weeks on Smartkarma

- In this cut, we review value-unlocking moves by Singapore-listed companies, take stock of India’s jewellery retail market, and track how Taiwan’s largest ETF drives flows for its adds and deletes

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

9. [Japan M&A] Minebea Forces a Game of Regulatory Chicken on Shibaura (6957 JP)

- Minebea Mitsumi (6479 JP) has bid ¥6,200/share for Shibaura Electronics (6957 JP). The tender ends 28 August. YAGEO has over bid now to ¥6,635/share.

- YAGEO’s regulatory clearance decision may not arrive before 1 September, after the Minebea tender closes. Minebea now says they will neither bump nor extend.

- Minebea is hoping people will throw in the towel and tender because if their tender ends and Yageo’s fails, it might a long way down. There are possibilities but… scary.

10. US Government May Acquire Equity Stakes in Samsung Electronics and TSMC

- According to Reuters, the US government may be interested in acquiring equity stakes in Samsung Electronics and TSMC in exchange for CHIPS and Science Act grants.

- The US government is exploring ways to take equity stakes in these two Asian tech giants that have been expanding their semiconductor facilities in the United States.

- If the US government decides to invest $10 billion each in Samsung Electronics and TSMC, they would represent about 3% and 1% of Samsung Electronics and TSMC’s market caps, respectively.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

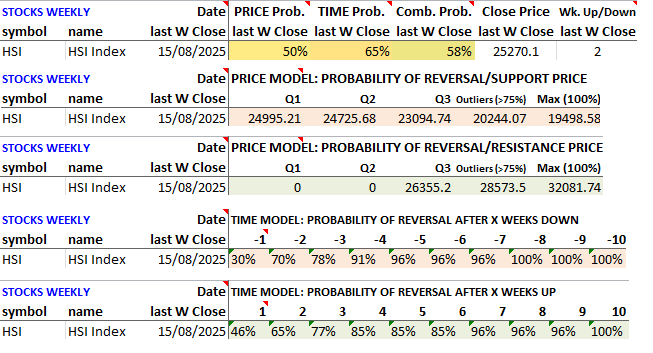

1. Hang Seng Index (HSI) Outlook Ahead of Sep25 Rebalance

- Brian Freitas has highlighted in his August 18th’s insight the details of what to expect in the upcoming, September 5, index rebalance for the Hang Seng Index (HSI INDEX) .

- The HSI started a modest pullback this week, outlook for the index remains bullish, this insight will try to determine both buy-the-dip and profit targets areas for the coming weeks.

- We have attached at the end of the insight an Excel file with all our price and time model’s data for the HSI INDEX. Check it out.

2. Tencent (700 HK): Positioning After 41% YTD Rally with Collar Strategies

- Context:Tencent (700 HK) has performed strongly this year, gaining 41% YTD, including 5.5% last week around its earnings release.

- Volatility Skew: A rare setup shows calls trading rich versus puts, creating favorable conditions for protective collar strategies.

- Actionable Trade Ideas: Three variations of a protective collar — with charts, pricing, and Greeks — illustrate how to position in the current market.

3. S&P/ASX 200: Profit Targets After Sep-25 Rebalance Methodology Finalized

- As reported by Brian Freitas , 2 days ago S&P DJI confirmed that the proposals in the market consultation will be implemented at the September 25 rebalance. Details here.

- The S&P/ASX 200 (AS51 INDEX) is currently OVERBOUGHT according to our models: the index reached an 83% probability of reversal at the intraweek high (9025). Incoming pullback.

- The index could rally one more week (next week), that should be the end of this rally (short-term forecast), but could also pull back this week, checkour modelkey-supports.

4. Tencent (700 HK): Rally Before Results, Options Market Repricing After

- Context:Tencent (700 HK) reported 2Q25 results last week, beating expectations and fueling a 5.5% move in the stock.

- Market Reaction: Shares rallied while front-end options saw a pronounced volatility crush, rotating the term structure back into contango.

- Why Read: This note unpacks Tencent’s price action and the evolving volatility setup.

5. Nikkei 225 Index Outlook: Key Buy Targets To Watch

- As predicted in our July 15th insight, the Nikkei 225 (NKY INDEX) rallied past 41k (reached near 44k) and now, as predicted by our latest WEEKLY HEAT MAP, went down.

- The index reached a low of 42724 this week, it is only mildly oversold so far, probability of reversal is around 52% at the moment.

- Key support levels to watch are 42577 (Q2) and 41606 (Q3). A file with all our PRICE/TIME model dataset for the Nikkei 225 is attached at the end, for your reference.

6. Global Markets Tactical Outlook WEEKLY: August 18 – August 22

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, for the week August 18 – August 22. .XLSX MODEL DATA FILE ATTACHED.

- OVERBOUGHT at the WEEKLY Close: AAPL US , GOOG US , META US , China Mobile (941 HK) , Toyota Motor (7203 JP) , Softbank Group (9984 JP) , Nikkei 225

- OVERSOLD at the WEEKLY Close: Commonwealth Bank of Australia (CBA AU) , Crude Oil (CL1 COM COMDTY)

7. Volatility Cones: Opportunities Across 8 Hong Kong Stocks

- Context: Volatility cones chart implied volatility against historical percentiles across the term structure, providing a clear framework to evaluate whether options are trading cheap or rich.

- Highlight: Several high-profile HK stocks currently show historically cheap implied volatility. With some of them trading near 52-week highs, now may be an opportune time to hedge.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

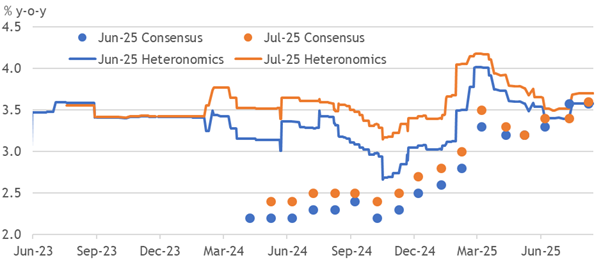

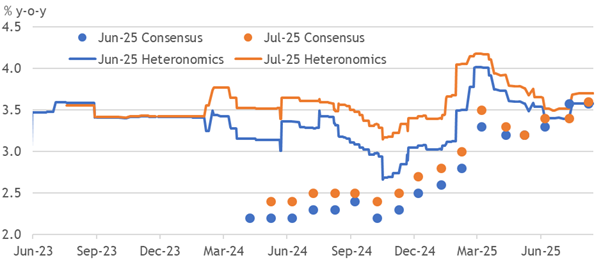

1. UK Excess Inflation Expectations

- The upwards trend in consensus inflation forecasts reflects persistent excess effective expectations supporting wages amid policymakers’ failure to re-anchor at the target.

- Easing on the assumption of success predictably negated the required conditions, so we forecasted the problem. Nonetheless, expectations were also stickier than we assumed.

- Without renewed progress, wage growth should keep trending above the BoE’s forecast, discouraging further rate cuts. Hikes may even be needed in 2026 to break excesses.

2. UK CPI Trend Extends Excess In July

- Another upside surprise in UK CPI inflation extended the accumulated drift to 1.3pp over the past year, yet was only 0.2pp above our old call.

- This outcome matched the BoE’s latest call, with airfares driving the rise, and median pressures holding slightly above a target-consistent pace, so there is less policy impact.

- The MPC was finely balanced in its support for August’s cut, and this rise will not lead dissenters to support past action, let alone another cut, which we still doubt occurs.

3. EA: Sticky Inflation Survives Euro’s Surge

- Inflation’s surprise stickiness at 2% was confirmed in the Euro area’s final print, with pressures broad based and slightly above a target-consistent pace in most countries.

- There has been little progress in inflation’s latent trend or our persistence-weighted measure, despite the Euro’s substantial and sustained appreciation.

- Without dovish second-round effects, the ECB can look through a potential slowing in headline inflation to a tight labour market and persistent pressures, then not cut rates.

4. India-China Economic Relations: Navigating Massive Imbalances and Strategic Dependencies

- India’s $101B trade deficit with China highlights strategic economic vulnerabilities across key sectors.

- Regulatory barriers since April 2020 sharply limited Chinese FDI, leading to negligible investments and shelved deals.

- India’s import dependency is profound, spanning pharmaceuticals, electronics, chemicals, and railway components, exposing multiple strategic sectors to supply risks.

5. India Economics: Choppier Waters Ahead?

- After a strong showing in the first quarter of 2025, the Indian economy is likely to see growth normalise. Key drivers of demand are showing mixed performance.

- Across consumption and investment, performance remains uneven across key sectors, leading to signs of softening momentum based on non-GDP demand indicators.

- Trump’s latest tariff threat against India poses tough questions on the long-term outlook. With its “China+1” strategy in doubt, the economy needs a new playbook to fortify growth.

6. EA: Re-Balance Of Payments

- An end to the Euro’s bullish trend is now revealed to have coincided with a reversal of two critical supports. Frontloaded export levels have normalised without payback.

- International portfolio investment into the EA during April fully unwound between May and June, revealing no investor appetite to hold higher allocations to EA assets.

- The Euro is not benefiting from a structural shift towards it, so we doubt the bullish trend will resume. Belated payback in goods inventories could also eventually weigh.

7. HEW: Dovish Bias Dominates

- The evidential hurdle formally shifted in support of a Fed rate cut in September. Still, the data may yet discourage it, or embolden the market to price it as mistaken.

- Flash PMIs broadly reinforced the resilience narrative, while another upside UK inflation surprise sets the BoE up to resist cutting amid persistently excessive expectations.

- A quieter, bank holiday-shortened week leaves the BOK and BSP decisions as monetary policy highlights. Euro area M3 and some national flash HICP prints are our data focus.

8. Asian Equities: FIIs Selling Asia in August; Only Taiwan Still Being Bought

- After buying Asian equities for three months, FIIs sold Asia in the three weeks of August: notably India (-$2.53bn) and Korea (-$298m). Taiwan (+1.6bn) was the only large market bought.

- It’s too early to call a trend change. Our FII gauge of 6-month cumulative buying as percentage of the market’s capitalization indicates that most markets are neither overbought nor oversold.

- Even though FIIs have bought the large Asian markets lately, none of them are overbought. Taiwan’s FII gauge is relatively closer to the upper limit. Indonesia is unequivocally oversold.

9. Separate Dividend Tax Plan in Korea: A Push for a 25% Rate for Top Bracket

- Democratic Party lawmaker Kim Hyun-jung has introduced a revised Income Tax Act that would lower the top tax rate on dividend income from 35% to 25%.

- Given that this proposal is coming from the ruling Democratic Party, there is a fairly high probability that this could be passed into law in 3Q 2025.

- We provide a list of 28 mid-cap/large cap stocks in Korea with more than 35% dividend payout and 3% or more dividend yield that could benefit from this new proposal.

10. Asian Equity: As the Result Season Nears Its End, Asian EPS Estimates Suffer a Surprising Downgrade

- As the earnings reporting season nears completion, our EPS estimate tracker reveals a downgrade to Asian EPS. AxJ EPS declined only 0.5%-0.8%. But several constituent markets’ EPS declined much more.

- Asian EPS estimates were supported by China and somewhat surprisingly, Thailand. Indian estimates continued to decline. Even Korea and Taiwan, the recent earnings outperformers, were downgraded during this season.

- Unlike Asia, US EPS estimates rose during this season. Japan’s and Europe’s declined. In a subsequent note we shall track the estimates of all the sectors in each Asian Market.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Intel CEO Heads To DC To Save His Job As Former CEO Calls His Leading Edge Strategy A Joke

- Intel CEO Lip Bu Tan is reportedly headed to Washington today to meet with the US Administration and clear up any misunderstandings about his past investments in China etc.

- Meanwhile, former CEO Craig Barrett published his third opinion piece about Intel’s future and calls LBT’s strategy of not investing further in 14A without customer support a joke

- It’s challenging to deal with the US Administration from a position of strength. It’s a whole different ball game when both the CEO & the company are in crisis mode…

2. Taiwan Dual-Listings Monitor: TSMC Spread Remains Extreme; UMC ADR Short Interest Falling

- TSMC: +22.8% Premium; ADR Spread Remains at Historically Extreme Levels

- UMC: -0.8% Discount; Wait for More Extreme Levels; Short Interest in ADRs Falling

- ASE: -0.1% Discount; Continued Opportunity to Go Long the ADR Spread

3. Taiwan Tech Weekly: Foxconn US$1bn USA Robotics Push; Samsung Doubles Down on US Fabs; Intel Crisis

- Foxconn Tech invests US$1bn in U.S. robotics, AI, and smart manufacturing over 10 years, expanding into service robotics via RoboTemi stake.

- Samsung to surpass US$50bn in U.S. chip investments, adding US$7bn for advanced packaging to compete with TSMC and capture AI/HPC integration opportunities.

- Intel faces leadership crisis as CEO Lip Bu Tan’s strategy is criticized; U.S. policy and competitive pressures may accelerate market gains for TSMC and Samsung.

4. TSMC (2330.TT; TSM.US): Board Meeting Resolutions; 2nm Technology Information Leakage Issue.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) disclosed Board of Directors meeting resolutions today.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) 2nm technology manufacturing information leakage issue.

- Currently, only TSMC, Samsung, and Intel have achieved trial production at the 2nm node.

5. Apple. A Master Class On How To Win Friends & Influence People

- Apple CEO Tim Cook visited the White House announcing an additional $100 billion investment in the US over the next four years, on top of the $500 billion already committed.

- He launched the American Manufacturing Program with nine initial members seven of which are already long terms partners and two of which have no direct relationship with Apple at all

- Samsung with its image sensor deal (presumably) and MP Materials with its rare earth magnets deal are two clear winners from the Apple announcement. Overall, successful mission by Mr. Cook.

6. Nanya July Revenue Soars 31% MoM As Micron Revises Current Quarter Guide Up >5%

- Nanya last week announced that revenues for the month of July amounted to NT$5.3 billion, an increase of 31.4% MoM, and an increase of 95% YoY,

- Micron this week revised upwards its guidance for the current quarter with a roughly $500 million increase in revenue, attributable primarily price increases for DDR5

- Customisation of Micron’s HBM4E base logic die is transforming their key customer relationships from commodity vendor to strategic ASIC design-like partner. That’s good for Micron…

7. AMAT Q325. Tanking On Tepid Leading Edge Outlook & China Woes

- AMAT reported FY Q325 revenues of $7.3 billion, up 3% QoQ, up 8% YoY and ~$100 million above the midpoint of the guided range

- Looking ahead, AMAT forecasted current quarter revenues of $6.7 billion at the midpoint, down 8.3% QoQ and down 4.9% YoY

- The China slump was not unexpected, but the leading edge logic drop was definitely a surprise

8. PC Monitor: ASUS’s Gaming & Commercial Strength Signal AI PC Cycle; Positive Read for Dell, HP

- ASUS experienced record 2Q25 revenue driven by 30–40% YoY growth in gaming and commercial PCs, supported by a new GPU sales strength and enterprise market expansion.

- AI servers held mid-teens revenue share for ASUS; margin pressure from tariffs and FX expected to ease after 3Q.

- Strong gaming and commercial PC momentum could signal PC upgrade activity in response to AI PCs, offering positive read-through for Dell and HPQ’s upcoming results end-August.

9. Taiwan Dual-Listings Monitor: TSMC ADR Premium Sees Small Breakdown; ASE Discount Long Opportunity

- TSMC: +21.5% Premium; Historically High Short Interest in the Local Begins to Drop?

- ASE: -0.4% Discount; Opportunity to Go Long the ADR Premium

- UMC: +0.2% Premium; Wait for More Extreme Levels Before Going Long or Short the Spread

10. Himax (HIMX US) – Share Drop: Near-Term Weakness Offset by Structural Automotive & AI Growth Drivers

- 2Q25 beat on margins, in-line on profit; automotive and non-driver ICs resilient despite macro headwinds; guidance points to weaker 3Q25 from seasonal bonus costs and softer demand.

- Automotive, OLED, WiseEye AI, and WLO/CPO remain multi-year growth drivers; CPO mass production targeted for 2026 with early-stage annualized revenue potential above US$100m.

- Shares likely fell on weak near-term outlook, but structural leadership in automotive display ICs, AI sensing, and optical technologies underpins long-term growth runway through 2028.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. SICC A/H Listing – Needs a Very Deep Discount

- SICC (688234 CH) , a manufacturer of high-quality SiC substrates, aims to raise up to US$260m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

2. ECM Weekly (11 August 2025)-Bharti, Eternal, Paytm, LG CNS, Guming, JSW, Bluestone, SICC, Roborock

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Inida ECM flows continued unabated with more deals being launched.

- On the placements front as well, India saw over US$2bn worth of deals during the week.

3. Bullish US LLC (BLSH): Digital Asset Platform Delivers One of the Year’s Biggest First-Day Pops

- Bullish US (BLSH US) priced its upsized IPO of 30.0 million shares at $37.00, which was $4 above the already upwardly revised $32–$33 range.

- The stock opened at $90.00, marking a +143.2% gain at first trade, and cementing one of the largest opening day premiums for a U.S. IPO this year.

- The debut pop places Bullish among the standout IPOs of 2025, but the question will be whether the stock can maintain momentum in the aftermarket.

4. Eve Energy A/H Listing – One of the Leaders but Growth Has Been Slowing

- EVE Energy (300014 CH) (EVE), a lithium battery provider, aims to raise around US$1bn in its H-share listing.

- EVE produces lithium batteries which cater to consumer battery, power battery and ESS battery sectors.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

5. Bullish US LLC (BLSH): IPO Range and Size Increased, Next Digital Asset Moonshot on Deck

- The global digital asset platform that provides market infrastructure and information services increased its price range and shares being offered on Monday morning.

- Looking at the prospectus, there is a $200 million anchor order from Ark Investment and BlackRock.

- The Bullish IPO is looking to ride the tailwinds from the regulatory wins in the digital asset space as well as the success of recent IPOs.

6. Tuas Ltd Placement: Cheap Acquisition Funded by Expensive Currency

- Tuas Ltd (TUA AU) is looking to raise around US$239m in its fully underwritten Australian placement.

- The company will use the proceeds to partially fund the acquisition of Singaporean digital network operator M1.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

7. Bluestone Jewellery IPO – Moving from Online to Offline. Thoughts on Valuation

- Bluestone Jewellery and Lifestyle (BJL) is planning to raise about US$176m in its upcoming India IPO.

- BJL offers contemporary lifestyle diamond, gold, platinum, and studded jewellery under its flagship brand. It is a digital-first direct-to-consumer (DTC) brand.

- We have looked at the past performance in our previous note. In this note, we talk about the IPO pricing.

8. Kasumigaseki Hotel REIT IPO: Books Well Covered; Modest Upside from Here

- Kasumigaseki Hotel REIT (401A JP) raised US$193m in its upcoming Japan IPO.

- Kasumigaseki Hotel REIT Investment is a REIT with hotel assets. It is an investment corporation sponsored by affiliated developer, Kasumigaseki Capital.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation

9. Innogen IPO: Competition Mars Outlook, Long Way To Go, Listing Gain Only Incentive For Now

- Guangzhou Innogen Pharmaceutical Group launched its Hongkong IPO aiming to raise up to HK$683M. The company plans to sell 36.6M shares at HK$18.68 per share.

- Innogen discovers, develops, and commercializes innovative therapies for diabetes and other metabolic diseases. Their portfolio currently comprises of one core product, Efsubaglutide Alfa, for treatment of type 2 diabetes.

- The GLP-1 drug market is slowly tending towards an overheated zone with upcoming Ozempic’s patent expiry in 2026.

10. Innogen (银诺医药) IPO Trading Update

- Innogen raised HKD 683m (USD 88m) from its global offering and will list on the Hong Kong Stock Exchange on Friday, August 14th.

- In our previous note, we looked at the company’s operation, management track records and discussed the IPO valuation.

- In this note, we provide an update for the IPO before trading debut.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

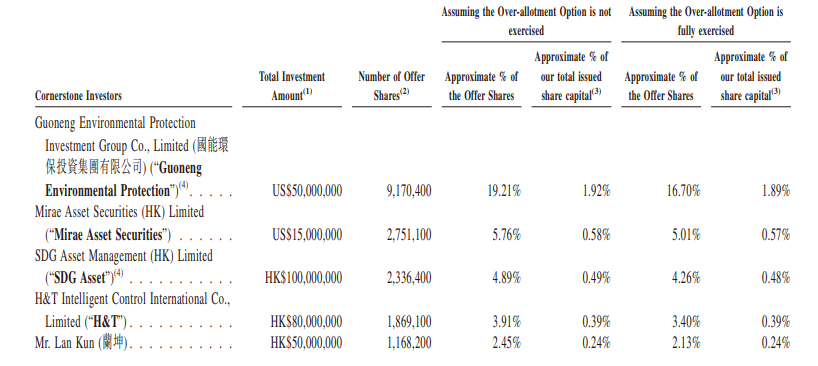

1. Sun Corp (6736) – CLBT Has Round-Tripped, But Now Better ParentCo and a Buyback so Set-Up Is Better

- 12 months on from the Tender Offer which changed the shape of the shareholder register, Sun Corp (6736 JP) is up small and its main asset Cellebrite is -10%.

- The value of the rest of Sun Corp has probably increased to cover that 10% through new business earnings, but the main value is still Cellebrite. An exit still awaited.

- Now Cellebrite is lower, and SunCorp is lower (but recently rising) and SunCorp has announced a buyback which accounts for a big chunk of Real World Float. Hmmm…

2. [Japan M&A] Taisei Corp To Take Toyo Construction (1890 JP) Private – Governance Torture Ends

- In March 2022, Infroneer bid ¥770. The Board said “too low” but then accepted. A month later, YFO offered ¥1,000. Too high, bad owner, not accepted.

- Summer 2023 after a year of palm to the face for YFO, the Board was partly spilled. YFO bid ¥1,255/share and the Board said the premium was too low.

- Now, the Board has accepted a bid from Taisei at a roughly similar premium. But the price is ¥1,750/share. Infroneer and YFO have agreed to sell. Minorities win… -ish

3. Kangji Medical (9997 HK): Consortium’s Light Preconditional Scheme Offer

- Hangzhou Kangji Medical Instrument Co., Ltd. (9997 HK) disclosed a preconditional privatisation from a consortium at HK$9.25, a 9.9% premium to last close and a 21.7% premium to the undisturbed price.

- The precondition relates to SAMR approval. The key condition will be approval by at least 75% disinterested shareholders (<10% of all disinterested shareholders’ rejection). The offer is final.

- The scheme vote risk is medium-to-high due to an unattractive offer, a blocking stake below the substantial disclosure threshold, unfavourable AGM voting patterns, and emerging retail opposition.

4. Identifying the SK Square Vs. Hynix Price Ratio Reversion Alpha Setup

- Hunting the reversion point for Square-Hynix price ratio amid local buzz: need clear pro-business tax signals and Hynix’s downtrend to continue despite today’s bounce.

- Tax tweak likely turns neutral despite gov’s cautious tone today. Hynix’s bounce faces headwinds from supply ramp and yield issues, so fresh rally odds remain slim.

- Focus on hunting SK Square vs. Hynix price ratio reversion, pairing it with Samsung Long/Hynix Short for a strong short-term trade setup to ride the trend.

5. [Japan M&A] Minebea Matches YAGEO for Shibaura Elec (6957) At ¥6,200. Presses on Early Cashout

- After three months of NOT matching YAGEO’s bid for Shibaura Electronics (6957 JP) at ¥6,w00 as YAGEO’s proposal continues its long plod through FEFTA review, Minebea-Mitsumi has now matched ¥6,200.

- Key is that their bid closes before the indicative deadline for YAGEO to receive word on FEFTA approval. They are hoping this bid mollifies the irrevocables and everyone else.

- But if YAGEO cares, it could bump to ¥6,300 tomorrow and extend its tender offer which closes on Monday. But the put option is now struck higher, which de-risks this.

6. Why We’re Eyeing KRX’s Sep 29 KCMC Event for Dividend Momentum Trades

- KCMC 2025 will likely reveal fresh, unpriced stimulus details, potentially sparking a price rally like last year’s 2% KOSPI 200 jump on the value-up ETF rollout.

- The key wildcard at KCMC 2025 is dividends—shifting from Yoon’s Japan-style ROE grind to a Taiwan-style push for bigger shareholder payouts.

- With Sept 29 approaching, dividend policy buzz may drive price moves—smart to prep dividend momentum trades to front-run this catalyst.

7. Current Samsung Biologics Split Dynamics with Alpha Potential Both Ways

- One of the hottest local plays is gauging KRX and FSS leanings on Biologics split, which could drive short-term alpha across the three Samsung names alongside battery and HBM flows.

- Short-Term focus is KRX pre-listing review and FSS registration window. Once approval and lock-up kick in, Biologics and Samsung Electronics could outperform Samsung C&T.

- From a risk-hedge angle, this is a long-short alpha setup: if the split fails, Samsung C&T likely takes the hit, offering alpha potential both ways.

8. Merger Arb Mondays (11 Aug) – Mayne, PointsBet, Infomedia, Ashimori, Toyo Const, HKBN, Joy City

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Ashimori Industry (3526 JP), ENN Energy (2688 HK), Ci Medical (3540 JP), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Ainsworth Game Technology (AGI AU), Welcia Holdings (3141 JP), ZEEKR (ZK US), Soft99 Corp (4464 JP).

9. [Japan M&A] Founder, KEPCO, Try ¥2,750 Bain-Led MBO on Rezil (176A). Light Given Growth – Bumpity?

- To my knowledge, this may be the first Tender Offer takeout proposal on a “new ticker.” Rezil (176A JP) was listed just 16mos ago.

- This takeout is done on a highish-growth stock at 11.7x 1yr forward EV/EBITDA. It’s not expensive, but they have ~60%. BUT… there’s another Potential Player who may have Big Thoughts.

- Slightly long-dated, small-cap, likely to be illiquid. Watch how it trades early for hints.

10. Value Unlock SG: Value Creation Via Corporate Action. May the Wind Carry Many More Sails

- A wave of corporate actions by SGX-listed companies has unlocked substantial shareholder value and re-rated select stocks in recent months. In this note, we spotlight five standout cases.

- Our top picks with the strongest catalysts for further upside after delivering significant shareholder returns over the past year are – Keppel Corp (KEP SP) and Yangzijiang Financial (YZJFH SP).

- The outsized value creation delivered by these companies should serve as a wake-up call for other managements to follow suit and initiate actions to boost returns and unlock shareholder value.