In today’s briefing:

- EQD | SX7E(SX7E Index): Value or Value Trap? Use High Vols to Sell Premium and Play the Range

- Central China – Tear Sheet – Lucror Analytics

- Mill City Ventures III

- Morning Views Asia: CIFI Holdings

- Grupo Gilinski – Grupo Sura; Focus on BanColombia (CIB US)

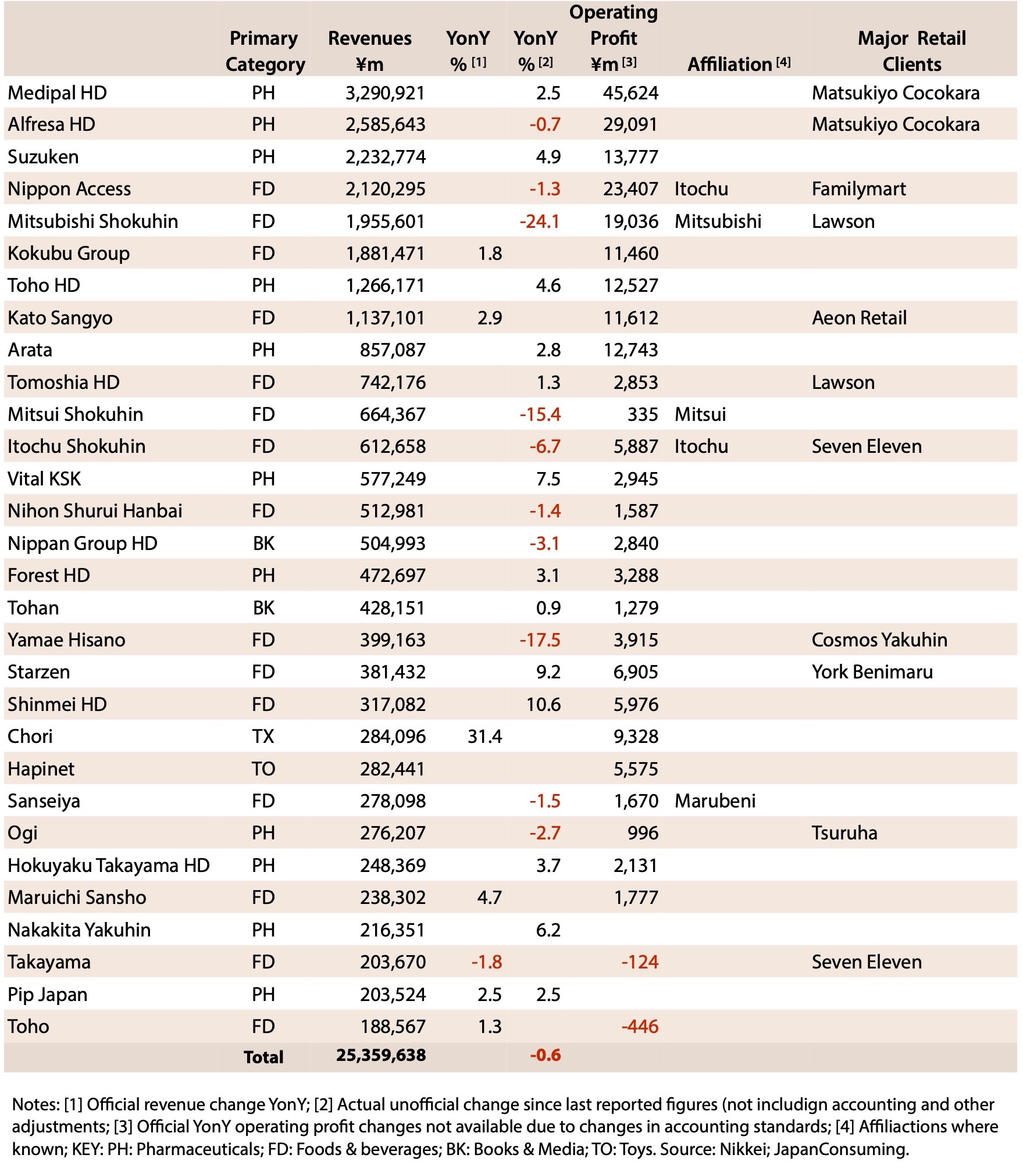

EQD | SX7E(SX7E Index): Value or Value Trap? Use High Vols to Sell Premium and Play the Range

- European banks are screening cheap and the sell side are once again banging the drum on the upside

- Recession risks in broader economy are likley to counteract the positive effects of rate rises

- Implied vols have moved higher, representing an oportunity to sell premium

Central China – Tear Sheet – Lucror Analytics

We view Central China Real Estate (CCRE) as “High Risk” on the LARA scale. The company’s operations are geographically concentrated in Henan, China’s third-most populous province. While this exposes CCRE to policy and political changes within the province, we believe the risks are partly mitigated by the company’s deep market knowledge, brand recognition, as well as longstanding relationships with the local government and construction companies. Our view also considers the deteriorated operating and financing environment across the Chinese property industry, which has adversely impacted CCRE and other private developers.

Our fundamental Credit Bias on CCRE is “Negative”, given the company’s weak sales, very low margins, poor liquidity and lack of access to capital market financing amid the industry turmoil. Moreover, CCRE has material non-debt liabilities. Going forward, the company’s debt repayment prospects may hinge on the development of synergies with its SOE minority investor (Henan Railway) to achieve new business and financing opportunities.

Controversies for CCRE are “Immaterial”, despite reputational risk on account of worker fatalities. This was mainly reported in the media in 2019 and 2020, with such statistics not provided in the company’s ESG reports. The ESG Impact on Credit is “Neutral”. We note positively that CCRE’s corporate governance has improved, supported by increased transparency and its willingness to honour debt obligations.

Mill City Ventures III

- This is our first report on Mill City Ventures III and we look to provide a detailed account of the various industries that the company operates in and the key macro-economic factors.

- Given its current size, Mill City Ventures III is exempt from many of the regulatory restrictions that apply to other traditional lenders or institutional rivals.

- Overall, we believe that Mill City Ventures III has phenomenal growth prospects and is an excellent investment prospect.

Morning Views Asia: CIFI Holdings

Lucror Analytics Morning Views comprise our fundamental credit analysis, opinions and trade recommendations on high yield issuers in the region, based on key company-specific developments in the past 24 hours. Our Morning Views include a section with a brief market commentary, key market indicators and a macroeconomic and corporate event calendar.

Grupo Gilinski – Grupo Sura; Focus on BanColombia (CIB US)

- For Grupo Gilinski to achieve shareholder control of BanColombia seems increasingly unlikely, and there increased opposition from Grupo Sura and the Grupo Empresarial Antioqueño (GEA)

- Nonetheless, Gilinski is effectively creating shareholder value by behaving like an activist investor putting pressure on management teams, particularly in BanColombia and in the other core components of the GEA

- BanColombia is delivering improved fundamental performance, as seen in 1Q22 and 2Q22 results, with 2022E ROE guidance of c20% yet to be reflected in its modest PBV ratio of 0.9x

💡 Before it’s here, it’s on Smartkarma

Sign Up for Free

The Smartkarma Preview Pass is your entry to the Independent Investment Research Network

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars