Receive this weekly newsletter keeping 45k+ investors in the loop

1. Delta Taiwan Vs. Thailand Monitor: Delta Thailand Crash Closes Gap, But Still Relatively Expensive

- Delta Thailand Has Dramatically Underperformed Delta Taiwan — Delta Thailand Now Finally Trading at a Less Extreme Level vs. Delta Taiwan

- Latest Relative Growth Profiles — Delta Taiwan Has Higher Growth Profile in 2025E

- Even After the Major Pricing Reversion Since Mid-February, Delta Thailand Remains Overvalued Relative to Delta Taiwan

2. Taiwan Dual-Listings Monitor: TSMC Spread Close to Long Level; UMC & ASE Deep Discounts

- TSMC: +14.9% Premium; Spread Has Fallen Close to Long Levels

- UMC: -2.6% Discount; Good Level to Go Long the Spread

- ASE: -3.2% Discount; Spread at Extreme Low, Good Level to Go Long

3. Intel Vision: Lip Bu Tan’s First Keynote As Intel CEO

- Rather than love, than money, than fame, give me the truth

- I intend to under promise and over deliver. I will not be satisfied until we delight you

- How long will I stay at Intel? I’m here for as long as it takes

4. Intel’s Annual Shareholder Meeting Proxy Statement Has A Few Interesting Gems

- We remain steadfast in our belief in our company’s future. That said, there are no quick fixes. We need to demonstrate consistent execution and results over a sustained period. Frank Yeary

- Intel’s ELT scored themselves a remarkable 29.7 out of 35 for their 2024 “Product Leadership” goal, despite mounting data center market share loss and Gaudi being an abject failure

- While Pat Gelsinger’s departure from Intel was labelled a “retirement” last December, the Proxy Statement refers to it as a “resignation”. Which was it?

5. Taiwan Tech Weekly: TSMC Goes ‘Taiwan Speed’ in Arizona; Phison Predicts Edge AI Flash Memory Boom

- TSMC Accelerates U.S. Expansion — New Arizona Fab to Be Built at ‘Taiwan Speed’

- Phison CEO Sees Decade-Long Boom for NAND Flash as AI Shifts to the Edge

- Delta Taiwan Vs. Thailand Monitor: Delta Thailand Crash Closes Gap, But Still Relatively Expensive

6. UMC (2303.TT; UMC.US): Merges with GFS? It Should Be a Terrific, but It Won’t Be Easy to Happen.

- Both United Microelectron Sp Adr (UMC US) and GLOBALFOUNDRIES (GFS US) saw positive reactions in their stocks following a possible merger news, despite the current instability in the stock markets.

- Although GLOBALFOUNDRIES (GFS US)‘s technology is held above 7nm, it is ahead of United Microelectron Sp Adr (UMC US), which is still certain generations above China’s current technology in general.

- If these two companies wish to merge, there are still some subjective factors that need to be considered, and it will not be easy to get approval.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CATL A/H Listing – Thoughts on A/H Premium

- Contemporary Amperex Technology (CATL) (300750 CH), one of the world’s largest battery solutions providers, aims to raise at least US$5bn in its H-share listing.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance in our earlier notes. In this note, we talk about its recent updates and provide our thoughts on valuations.

2. ECM Weekly (31st Mar 2025) – Xiaomi, NIO, FCT, Gigabyte, DN Sol, Nanshan Al, Zenergy, LXJ, Veeda

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, DN Solutions (298440 KS)‘s range looks a little pricey, while Eco-Shop Marketing (ECO MY) could trade ahead of its listed peers, in our view.

- On the placements front, Xiaomi Corp (1810 HK) matched BYD (1211 HK) in size, but couldn’t do so in returns.

3. Chagee Holdings (CHA US) IPO: The Bull Case

- Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$400-500 million through a Nasdaq IPO.

- According to iResearch, as of December 31, 2024, Chagee was the largest premium freshly made tea drink brand in China by the number of stores.

- The bull case rests on a strong brand, leading market share, peer-leading revenue growth, top-tier profitability and cash generation.

4. Wuxi XDC Placement – Following Biologics Playbook, past Deals Have Been Mixed

- WuXi AppTec (2359 HK) aims to raise around US$250m via selling around 3.5% stake in WuXi XDC Cayman (2268 HK).

- WuXi XDC Cayman (WXDC) is a contract research, development, and manufacturing organization (CRDMO) focused on the global antibody drug conjugates (ADC) and broader bioconjugate market providing integrated and end-to-end services.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. Chagee Holdings Limited (CHA): Peeking at the IPO Prospectus of China’s Premium Tea Brand

- As of December 31, 2024, their network comprised 6,440 teahouses, including 6,284 located in China.

- Their net revenues increased by 844% to RMB4,640.2 million in 2023 from RMB491.7 million in 2022.

- We anticipate this company to set terms (share size, price range) and debut in the second half of April.

6. Duality Biotherapeutics (映恩生物) Pre-IPO: Valuation and the Trap

- Duality Biotherapeutics, a China-based clinical-stage biotechnology company, plans to raise up to US$250m via a Hong Kong listing.

- We look at the company’s valuation based on its core products, namely DB-1303, DB-1311, and DB-1305.

- We highlight key differences between our valuation and the broker valuation guidance.

7. Clearing up FSS Review of Samsung SDI & Hanwha Aerospace: Watch for Ramped-Up Recall Pressure

- Samsung SDI’s rights offering is locked in and even accelerated. Hanwha Aerospace awaits FSS approval, but a pullback is unlikely, with no major red flags seen by regulators.

- With a four-week gap, supply pressure eases, reducing overhang concerns. This shift in dynamics impacts stock rights pricing and is key for any arb setup.

- The wider schedule gap between deals boosts lenders’ flexibility, increasing the likelihood of a stronger share recall. This makes for a solid trade setup, targeting recall-driven price action.

8. Chagee Pre-IPO – Market Leading Growth but Showing Signs of Fatigue

- Chagee Holdings (CHA US) is planning to raise up to US$500m through its upcoming US IPO.

- Chagee is a leading premium tea drinks brand, serving healthy and delicious freshly-made tea drinks.

- In this note, we look at the firm’s past performance.

9. SmartStop Self Storage (SMA): IPO for Yield Chasers, Traditional Players on the Sidelines

- According to our sources, the deal is multiple-times oversubscribed — our sources stated around 5x.

- Self-Storage was Monday’s second best performing sub-sector (+1.8%) as the overall REIT sector (+0.7%) slightly outperformed the broader market.

- While the “typical” IPO investor may not be “enthused”, the timing for this type of deal “may” be ideal for yield-chasers.

10. Maynilad Water Services Pre-IPO – The Positives – Key Infrastructure Provider

- Maynilad Water Services (MYNLD PH) (MWS) is looking to raise at least US$633m in its upcoming Philippines IPO.

- MWS is a leading global water utility player operating the largest concession by population served within a single concession area in the Philippines and Southeast Asia (SEA), as per GlobalData.

- In this note, we talk about the positive aspects of the deal.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Trump Team’s Weird Tariff Math – Not Meant to Be Negotiated

- For weeks, if not months, the world has been wondering what the “reciprocal tariffs” would be, and what the logic would be behind them.

- There is talk of VAT, and NTBs, and huge tariff step-ups after quotas are exceeded (US exports of milk and cheese to Canada – high tariffs, but quotas not exceeded).

- But a quick check of the math on the Trump Executive Order and Annex I tells you the logic is different than what everyone expected.

2. BYD (1211 HK): God’s Eye & Potential HSTECH Index Inclusion

- BYD (1211 HK) raised US$5.6bn in a secondary offering a few weeks ago and the stock is trading a lot higher than the placement price.

- Buying from global index trackers is done, but there will be more passive buying from Hang Seng Index (HSI) and Hang Seng China Enterprises Index (HSCEI) trackers later this month.

- With the release of the God’s Eye advanced driver-assistance system (ADAS), the stock could be added to the Hang Seng TECH Index (HSTECH INDEX) in June, bringing more passive inflows.

3. Korea Short Selling: Off to the Races

- Short selling in Korea resumes in a couple of hours. Expect heightened volatility for a few days before things settle down.

- Foreign investors have increased their holdings over the last five weeks and there could be further buying in select stocks on stock price drops.

- The KOSPI 200 INDEX has outperformed the KOSDAQ 150 Index, and the forecast index deletes have underperformed the indices indicating that there will be positioning for the short-sell resumption.

4. Korea Short Selling: What Happened on Day 1?

- Short notional ticked higher on the KOSPI and KOSDAQ markets and is expected to continue increasing over the next few months.

- Since the resumption of short selling, foreign holdings of Korean equities have increased from 29.26% to 29.3%.

- The Korea Stock Exchange KOSPI 200 (KOSPI2 INDEX) to KOSDAQ 150 Index (KOSDQ150 INDEX) ratio has stayed stable over the last 3 trading days.

5. T&D Holdings (8795) – A Really Good Look (Divs Up, Big Buyback, Good Historical Stats)

- Yesterday, post-close, T&D Holdings (8795 JP) announced ¥40 for 31-Mar-25 FY-end dividend (¥80/yr) and ¥120/share/year in the year to March 2026 on a higher planned payout ratio.

- The company also announced guidance for Adjusted Profit for 2025 at ¥130bn (up), and guidance for March 2026 at ¥140bn (lower growth than this past year).

- They announced the current ¥50bn buyback was 87.5% complete (they have until 13 May to complete) and a new buyback starting 19 May to spend up to ¥100bn over 10.5mos.

6. [Japan Activism] – KKR and JIC Buy Out Topcon (7732 JP) At ¥3,300/Share

- The difference between an LBO (Leveraged Buy Out) and an MBO (Management Buy Out) is that an MBO is usually just an LBO where the buyers don’t replace the CEO.

- After 4+mos of speculation/noise since a Bloomberg article said Topcon was weighing takeover bids, we have a deal. KKR and JIC will buy out Topcon in an “MBO” at ¥3,300/share.

- Unusually, the lower limit is 50.1%. This is an OK exit for the “Bad Cops” but not a great one. It should be higher. Start delayed for 4 months.

7. Nikkei 225 Sep25 Rebal: One ADD, One DELETE Still Probable Unless Kokusai Elec (6525) Offering/Split

- The March 2025 Nikkei 225 review came out with a sparse set of changes. That gives us hints for the September 2025 review.

- Kokusai did NOT get added, waiting for a split, an offering, or time to pass. Only one sector change was made. So we see One ADD and One DELETE.

- The lack of effort to address sector imbalances within the rules suggests the rules are not as hard as people thought. Intra-review changes could be more interesting in years ahead.

8. ENN Energy (2688 HK): This Is An Avoid

- Back on the 26th March, ENN Energy (2688 HK) announced a cash/scrip Offer from ENN Natural Gas (600803 CH), its largest shareholder.

- Investors hoping for a clean (er) exit, or one where the back-end terms were clearly defined, will be disappointed. And minorities are active in this name.

- The Offer pivots on where the newly-listed H-shares trade. The IFA’s assessment on the theoretical value of these H-shares is unrealistic.

9. Shin Kong (2888 TT)/Taishin (2887 TT) Deal Gets FSC Approval – Still A Good Swap

- Late Monday, The Financial Supervisory Commission approved the merger where Shin Kong Financial Holding (2888 TT) is to be absorbed by Taishin Financial Holding (2887 TT). Announcement here.

- Yesterday, the chairmen of both Shin Kong and Taishin decided the merger base date, which has been set a bit further out than even I expected, at 24 July 2025.

- The terms tightened yesterday. There is still a worthwhile switch to be done (or arb if you have cheap borrow), and NEWCO is cheap to peers, STILL.

10. Merger Arb Mondays (31 Mar) – ENN Energy, ESR, Vesync, Seven & I, Topcon, Sinarmas Land, Gold Road

- We summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: ENN Energy (2688 HK), Seven & I Holdings (3382 JP), OneConnect Financial Technology (OCFT US), Insignia Financial (IFL AU), Smart Share Global (EM US), Soundwill Holdings (878 HK).

- Lowest spreads: Makino Milling Machine Co (6135 JP), Shibaura Electronics (6957 JP), PointsBet Holdings (PBH AU), Millennium & Copthorne Hotels Nz (MCK NZ), Tonami Holdings (9070 JP).

Receive this weekly newsletter keeping 45k+ investors in the loop

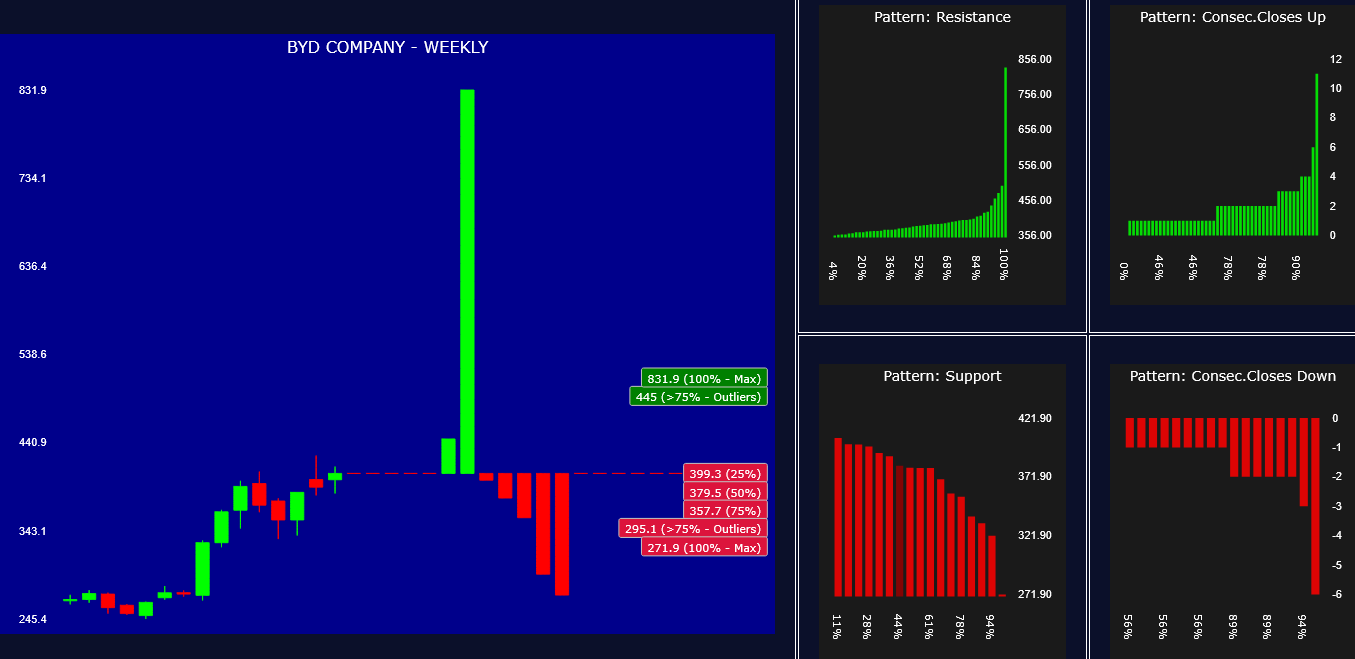

1. BYD (1211 HK) Tactical Outlook: Buy-The-Dip Scenarios With Passive Buying from HSI/HSCEI Trackers

- A recent insight by Brian Freitas signals that BYD (1211 HK)buying from global index trackers is done (more passive buying from HSI/HSCEI trackers may come later this month).

- As of Tuesday, the stock is currently in the middle of a modest pullback, 1 week down, reached a support area where the probability of a bounce is around 50%.

- We are at the start of the month, it may be early to benefit from the passive buying discussed by Brian Freitas, however this pullback could support a buy-the-dips strategy.

2. Global Stocks Outlook: Where Is the Bottom for This Crash?

- Analysis of the NIFTY, Nikkei 225, Hang Seng, KOSPI 200, S&P/ASX 200, S&P 500 and Nasdaq-100 stock indices: where is the bottom for the global stock market rout?

- As explained in this insight, our models have been battle-tested since 2008. While they can’t predict the future, they provide valuable insights for identifying market bottoms during crashes.

- What follows is a focused analysis of each market index we track, aimed at identifying potential bottoms amid extreme sell-offs, helping position ahead of the next Bear Market rally/reversal.

3. Tencent (700 HK): Volatility Plays and Skew Top Trades

- Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights and volatility context are provided.

- With short-term implied volatility below its median, long volatility strategies dominate, with a balanced mix of bullish and bearish positions.

- Open interest spread across monthly and quarterly expiries, with some notable strategies taking advantage of longer expiration dates, and a steep negatively sloped skew $475.

4. SP500: Friday Sell-Offs, the VIX, and a Bit of 1987

- Drops greater than 5% on a Friday are rare, we examine historical returns after such events.

- We revisit 1987 price action and reconstructed VIX levels to add historical context.

- With circuit breakers now in place and political volatility elevated, we assess what today’s sell-off might mean for the next trading day.

5. Global Markets: Why This Sell-Off Is Different and What It Signals

- The SP500 and DXY both dropped yesterday—historically an unusual development.

- We examine the SP500-DXY relationship alongside long-term shifts in capital flow and what this could mean for global markets vs SP500.

- A distinct performance trend that began in 2009 may now be in the process of reversing.

6. NSE NIFTY50/ Vol Update / SEBI Intervenes Stalling Expiry Day Shift. IVs Pushed to 1Yr Lows.

- SEBI intervenes on constantly changing Option contract specifications. NSE halts expiry day shift indefinitely & awaits clarity from regulator.

- IVs slid lower to 11% levels – extended weekend being a primary factor. Risk premia is nearing historically low extremes. “Low & Down” state persists for the Vol-Regime model.

- Tactical Implications: (1) Scale back Vol harvesting structures as “Low & Down” Vol-state persists. (2) Reverse Calendars for long gamma exposure to upcoming events. Utilize Low IVs & curve Contango.

7. TESLA’S Outlook After Rumors Elon Musk Will Step Back from DOGE

- Politico just published a report saying that Elon Musk is about to Step Back from DOGE, if true, this could impact somehow Tesla (TSLA US) stock price.

- Death threats and the spate vandalism directed at Tesla (TSLA US)‘s cars, plus Musk being viewed as a potential political liability by members of the Trump Administration are the drivers.

- Tesla (TSLA US) brand has been heavily damaged by Musk involvement in politics, sales are falling gobally and competitors like BYD (1211 HK) are rising. The stock is short-term OVERBOUGHT.

8. Nikkei 225 (NKY INDEX) Drops Amid US Tariffs: Implied Volatility Hits Extreme Levels

- Market Reaction: The announcement of US reciprocal tariffs led to significantly lower market open throughout Asia-Pacific. In the US, S&P 500 futures dropped -3.5%, with the VIX spiking to 23.45.

- Impact on Japan: Japan faces a 24% tariff, with specific sectors like automobiles hit with 25%. This led to a 4.5% drop in the Nikkei 225, stabilizing at 34,600 (-3.2%).

- Volatility Increase: The Nikkei 225 VIX index jumped from previous levels in the low 20’s to rise above 38 before retreating to 32.8, indicating the 99th percentile of implied volatility.

9. Nifty Index Options Weekly (Mar 24 – 28): Sticky Implied Vol and a Tactical Hedge Ahead of Tariffs

- Weekly recap of volatility and price metrics, covering option volumes, volatility trends, the spot/implied relationship, and open interest.

- Implied vol remained stable, and we discuss why it may be sticky at current levels.

- With global weakness and the upcoming April 2 reciprocal tariffs announcement, we reiterate a tactical hedge.

10. April Global Macro Volatility: Strong Price and Vol Seasonals

- Monthly deep-dive into price and vol metrics across Global indexes and macro assets.

- In-Depth look at the current state of the markets as well as how volatility and price may unfold.

- We highlight strong seasonal trends in April, with all markets typically rising and realized vol typically coming in below implied.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HEM: Fear of Fear Itself

- US surveys indicate a fear of tariffs and DOGE, leading to a negative sentiment.

- Despite these fears, resilient labour markets suggest that concerns may be exaggerated.

- There is an expectation of reversing unnecessary easing in 2026 due to high underlying price and wage inflation.

2. US Tariff Impact Estimates

- New US tariffs ignored any notion of reciprocity, reaching shockingly substantial sizes. However, the UK was relatively fortunate in landing on the 10% minimum rate.

- Repeating 2024’s imports would raise $577bn in tariff revenue, which is worth ~3% of consumption. 70% pass-through to prices would add 2% to the level over 1-2 years.

- Negotiations need to conclude rapidly to avoid these front-loaded price rises. The EU’s likely retaliations would magnify its pain, but the US is the biggest stagflationary loser.

3. Trump’s Reciprocal Tariffs Hit Asia Hard

- The scale and scope of Trump’s reciprocal tariffs has exceeded our expectations.

- The growth outlook has unambiguously worsened across the board and will dominate inflation in Asia this year.

- We expect Asian policy rates to be reduced by an average of 100 basis points in 2025.

4. Tariff Transition Smoothing

- President Trump’s tariffs embed structural cost pressures, compounding supply chain changes and creating a stagflationary shock central banks cannot offset.

- Potential retaliation risks raising inflation expectations, constraining the extent to which monetary policy can smooth transitional pains through temporary easing.

- We still believe any dovish policy imperative is likely to be short, shallow, and reversed, with central banks forced to remain flexible and focused on shorter horizons again.

5. TRUMP’S TARIFFICATION: The Market’s Willful Ignorance

- Liberation Day marks the beginning of the Tariffication of the global trading system. The complex web of supply chains will be forced to detangle itself to find cost efficiencies.

- US companies will try to unpack the many complexities of re-sourcing products to mitigate the inflationary effects of tariffs. Domestic substitution is not a possibility in the near-term.

- US consumers will begin to see inflationary impacts of Tariffication in the coming weeks. China announced retaliatory measures that would open the door for other countries to do the same.

6. EA Disinflates March’s Excess

- Euro area inflation slightly undershot consensus expectations in March, consistent with the correlation of surprises and energy prices. Yet it was 7bps above our forecast.

- Services prices drove core inflation down to 2.4%, creating some dovish space. However, the headline outcome reversed last month’s upside to match February forecasts.

- Resilience in the real economy still justifies more cautious easing close to neutral, so we expect graduated cuts to skip April for June, but the risk of an extra cut has risen.

7. The Month Ahead: Key Events in April

- Central Bank Rate Decisions in Australia, India, and South Korea.

- Tariffs: US reciprocal tariffs effective from 2 April; secondary tariffs are now a factor.

- Holidays: Good Friday is an exchange holiday in Hong Kong, Australia, India, and the US. Several other national holidays throughout the region.

8. Investors Have that “Oh Sh#t Moment” – Part 1: Hong Kong Strategy

- That “Oh sh#t moment” has just struck many investors in US markets

- Within Hong Kong , Tech most at risk as investors take profit

- Our alternative sector selection has performed both absolutely and in relative terms

9. HEW: Yikes, At Tonto Tariff Hikes

- Severe global tariff increases have significantly impacted market sentiment, leading to lower equity prices and rate expectations. The market’s eagerness to discount ongoing US labour market resilience is considered excessive.

- The new tariff rates are set to take effect in the coming week. Any further trade conflicts could be the main macro news.

- US inflation, UK GDP, and the RBNZ are the conventional highlights, but these data may be disregarded as old news.

10. Asian Equities: India – Brace for Another Leg Down in the Near Term

- Indian equity’s recent spike overlooks near-term risks – possible cuts in consensus EPS estimates, risks arising from reciprocal tariffs and another bout of likely INR depreciation. Valuations are again expensive.

- Our analysis of sector fundamentals foretells earnings estimate cuts in most sectors. Financials, and to a lesser extent, consumer discretionary could see upgrades. Expanding trade deficit could drive INR decline.

- In the near term we are cautious about India. For country-dedicated investors we recommend increasing exposure to financials (particularly large cap private banks), select consumer discretionary, and defensives like utilities.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Tech Weekly: Delta At Nvidia GTC 2025; Foxconn EV Strategy Win; Key Semi Industry Indicators

- NVIDIA GTC 2025 Last Week — Delta Electronics Expands Role in Nvidia Ecosystem Showcasing AI-Centric Power Solutions

- Foxconn’s Huge EV Bet Pays Off: Key Mitsubishi Win Could Spark Additional Automaker Deals to Come

- Semiconductors. Key Indicator Updates, 2024 In Review, and 2025 Forecasts

2. Foxconn’s Huge EV Bet Pays Off: Key Mitsubishi Win Could Spark Additional Automaker Deals to Come

- Mitsubishi Motors plans to outsource EV production to Foxconn, signaling the most significant commercial validation of Foxconn’s MIH EV platform to date.

- While Foxconn’s AI server manufacturing is currently the company’s strongest growth driver, its EV strategy is increasingly gaining credibility as a second long-term pillar.

- Foxconn — Structural Long. We see depressed share price as buying opportunity. Mitsubishi contract win increases the probability for additional major OEM production partnership wins this year for Foxconn.

3. Silicon Box. A Sad Development & Sadly, Still A Black Box

- On September 18 2024, one of the three co-founders of Silicon Box, Dr. Sutardja, sadly passed away. An industry visionary, much loved by many. May he rest in peace.

- The company’s website still does not reflect this fact, and an interview with their Head of Business just two weeks after his passing, bizarrely doesn’t mention it at all

- With just six press releases in four years, the company is slow to communicate progress and remains vague on precisely which specific technologies they offer. Still a black box IMO

4. UMC (2303.TT; UMC.US): 1Q25 Results Could Be Upbeat, but 2Q25 Could Be a Bit Downside.

- The 1Q25 outlook is slightly affected by earthquakes, but production can resume in late 1Q25.

- The UMC 12nm project could be in vain if Intel collaborates with TSMC or if TSMC takes over Intel’s foundry service.

- UMC’s annual revenue could see a -5% year-over-year growth in 2025, but there may be a few percentages increase in wafer shipments.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NIO HK Placement – Lots of Reasons to Avoid and Only One to Invest

- NIO (9866 HK) is looking to raise around US$450m via a primary placement in Hong Kong.

- The shares haven’t done much this year or ever since they were listed.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. The Hidden Play in Hanwha’s Noisy Stake Reshuffling: Hanwha Corp’s Rights Issue

- Hanwha Corp’s chances of raising 1T KRW without a capital call are slim, likely channeling Hanwha Energy’s 1.3T KRW into Hanwha Corp intead of Hanwha Aero.

- A shareholder-allotted rights issue from Hanwha Corp looks likely, and with short-selling resumption, it sets up a clean arbitrage play with low risk before the official announcement.

- Timing is key—Hanwha’s using debt for now, but likely won’t delay long. Expect Hanwha Corp’s rights issue to follow Hanwha Aero’s, probably between June and July.

3. Revisiting Korea’s Local Rights Issue Arb Setup

- Korea’s rights issues offer a clean arb setup—track stock rights vs. spot price, with first price as a cap, and lock in predictable entry vs. exit costs.

- Aggressive locals skip hedging, betting the discount holds between final pricing and listing. History backs it, but it’s a case-by-case call—not a blanket recommendation.

- Samsung SDI and Hanwha Aerospace’s KRW 5.5T raise is massive, likely flooding stock rights into the market—prime setup for arb plays.

4. Xiaomi US$5.3bn Placement – Relatively Small, Strong Momentum but Is Expensive

- Xiaomi Corp (1810 HK) is looking to raise around US$5.3bn via selling 3% additional shares.

- The shares have done exceedingly well this year and are now trading at their all time highs.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. Ecopro Materials: Announces A Capital Raise Worth 389 Billion Won

- EcoPro Materials announced a capital raise worth 389 billion won. The company plans to issue 5.12 million new shares, representing 7.3% of its current outstanding shares (69.74 million).

- This capital raise is in the form of redeemable convertible preferred shares (RCPS). Conversion price of this RCPS is 75,974 won which is 9.9% higher than current price.

- Ecopro Materials’ share price is down 27% from 27 February 2025. We continue to remain negative on Ecopro Materials.

6. LG Electronics India IPO: It’s A Big Deal. Potential Pricing and Valuation Preview

- LG Electronics India has secured regulatory approval for its IPO, expected to raise between USD 1 to 1.5 billion.

- However, it remains unclear whether the company will delay the launch until market sentiment shows further improvement.

- LG Electronics India (123D IN) IPO is a 100% offer for sale by parent and hence the entire proceeds from the IPO will accrue to LG Electronics (066570 KS).

7. A/H Premiums and past A/H Listings Performance Data – Mixed Results but Size Matters

- Given the slew of A/H offerings in the Hong Kong IPO pipeline, in this note, we talk about the overall A/H premiums currently.

- We also had a quick look at the past A/H listing performance, including subscription rates and A/H premiums at the time of listing.

- Overall, most of the A/H listings haven’t done much in the near term, with a few exceptions.

8. Gigabyte GDR Early Look – Benefitting from the AI Server Wave, Further Scale-Up Underway

- Gigabyte Technology (2376 TT) is looking to raise up to US$395m in its upcoming global depository receipts (GDRs) offering.

- On 14th Mar 2025, Gigabyte announced that it received its board’s approval to sell upto 50m common shares via a GDR offering. The proceeds will be used for business development.

- Similar to previous GDR listings, the deal is a long drawn out process with the firm required to jump through a number of board/shareholder/regulatory approval loops.

9. Lotte Global Logistics IPO Preview

- Lotte Global Logistics is getting ready to complete its IPO in KOSPI in May 2025. IPO price range is from 11,500 won and 13,500 won.

- At the high end of the IPO price range, the expected public offering amount is 202 billion won.

- According to the bankers’ valuation, the expected market cap after the IPO is 479 billion won to 562 billion won.

10. DN Solutions IPO: Valuation Insights

- DN Solutions (298440 KS), the third-largest machining centre/turning centre machine tool manufacturer, seeks to raise US$1.1 billion in a KRX IPO.

- We previously discussed the IPO in DN Solutions IPO: The Bull Case and DN Solutions IPO: The Bear Case.

- I examine the syndicate’s valuation methodology. My analysis suggests that DN Solutions is palatable in the low end of the IPO price range.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Xiaomi (1810 HK)’s US$5bn Placement: Unfavourable Index Dynamics but Strong Momentum

- Xiaomi Corp (1810 HK) is looking to place 750m shares at a price range of HK$52.8-54.6/share, a 4.2-7.4% discount from last. That could raise up to HK$40.95bn (US$5.27bn).

- There will be limited passive buying near-term. There will be more passive buying at the end of May. Then there will be passive selling early June.

- Shorts will be hurting from the relentless move higher in the stock and there could be short covering if the stock moves lower from these levels.

2. ENN Energy (2688 HK) Privatization: Details & Index Implications

- ENN Natural Gas has made a pre-conditional proposal to privatise ENN Energy (2688 HK). For each ENN share, shareholders will receive 2.9427 ENN Natural Gas shares and HK$24.5 in cash.

- The ENN Natural Gas H-shares will be listed on the HKEX. The value received by ENN Energy shareholders depends on ENN Natural Gas stock performance and the H-share discount.

- The ENN Natural Gas (600803 CH) H-shares are likely to replace ENN Energy (2688 HK) in global indices and the Hang Seng Index (HSI INDEX).

3. Shinko Electric (6967) – Chicken and Logistics

- The Tender Offer closed end of last week. The bidder JICC-04 got 59.281mm shares. Most of what was left over – perhaps even more than 100%, was passive-owned.

- More than 100%? How does that work? It works because of how the logistics goes.

- And right now, the reason why the stock is trading well through terms is a matter of Chicken and Logistics.

4. Sun Corp (6736) – Still Cheap

- Eight months on from the Tender Offer which changed the shape of the shareholder register, Sun Corp (6736 JP) is as cheap to its main asset as it was before.

- Sun Corp is cheap to its holding in Cellebrite DI (CLBT US). How cheap depends on the form and structure of its eventual exit.

- Understanding what the options are (and the dynamics around hedging/exposure) is worthwhile.

5. ENN Energy (2688 HK): ENN Natural Gas’ Preconditional Cash/Scrip Offer

- ENN Energy (2688 HK) announced a pre-conditional privatisation from ENN Natural Gas (600803 CH)/ENN-NG comprising HK$24.50 cash per share + 2.9427 ENN-NG H Shares per ENN share.

- The appraised offer value is HK$80.00 (HK$82.35, including the 2024 dividend), which is a tad optimistic. My calculations suggest a realistic offer value range of HK$71.47-76.32.

- The offer is final. The precondition satisfaction is low-risk. A high AGM minority participation is a risk, but the scheme vote should pass as the offer terms are reasonable.

6. Seven & I Holdings (3382 JP): Uncomfortable Truths

- Seven & I Holdings (3382 JP) has published two documents to respond to misinformation and detail its “constructive engagement” with Alimentation Couche-Tard (ATD CN).

- The statements underscore the Board’s serious doubts about securing US antitrust approval. The significant discrepancies in the engagement timeline point to two parties at loggerheads.

- While the Board claims it is pursuing a dual-track process to create value, the reality is that the process is designed to hinder Couche-Tard’s offer to facilitate the restructuring plan.

7. Tokyu Corp (9005) To Lift Stake in Tokyu REIT (8957) Again – Bigger Than You Think It Is

- Today, Tokyu Corp (9005 JP) announced it would increase its stake its family REIT, buying up to 48,880 units or 5.0% of units out over the next six months.

- This comes a couple of days after Hankyu Hanshin announced the same for its REIT, discussed here. Others have done so before. Tokyu has. Others will do so going forward.

- The main reason? Squeeze the ‘share’ price higher. Get the REIT to 1.0x PNAV then stuff it with sponsor-held properties. That’s not bad. The goal is a higher price.

8. 7&I (3382) – Clarifications of Clarifications But Progress Is Apparent

- On 10 March, Seven & I Holdings (3382 JP) released a statement about its interactions with Alimentation Couche-Tard (ATD CN). The next day, ATD released its own. They didn’t match.

- The 7&i spokesperson admitted one technical point, but investors seemed to believe ATD over 7&i. On 13 March, ATD held a presentation in Tokyo. Materials? Unchanged. Earnings comments? Unchanged.

- This morning, 7&i released a document which “corrects the record regarding critical false and misleading claims about 7&i’s engagement with Alimentation Couche-Tard (ACT).” OUCH. The stock fell.

9. Fuji Soft (9749 JP) – KKR Does Deal With the Family To Squeeze Out Minorities – You Can Join Too

- KKR’s Second Tender Offer for Fuji Soft Inc (9749 JP) ended 19 February 2025 and KKR got a whopping 57.9% after Bain bowed out. It was close.

- The Nozawa founder said it would not tender. Others family members may have, but now KKR has signed a deal with Nozawa family company YK NFC, to support the squeezeout.

- Assuming, Nozawa Hiroshi’s stake and the NFC stake remain unchanged, that cements the result of the 25 April AGM. But there may be games to play.

10. Tinycap Cash-Rich Cookpad (2193) With HUGE Buyback. AGAIN

- Hugely cash-rich Cookpad Inc (2193 JP) wouldn’t hit my radar except for two things. 1) it was the target of Melco Holdings (6676 JP) chairman Maki-san a few years ago…

- And 2) they did a huge buyback last year which pumped up the stock very bigly.

- Maki-San appears long gone from the shares, but now they are doing another big buyback. Just as bigly. But there are new nuances this year.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Alibaba (9988 HK): Top Trades – Strategies That Stand Out.

- This Insight analyses Alibaba Group Holding (9988 HK) multi-leg option strategies traded over the last five trading days on the Hong Kong Exchange. Strategy highlights and volatility context are provided.

- These traders tailor structures to risk budgets and take calculated bets. With implied volatility below its median and below realized volatility, all strategies reviewed are long volatility.

- Almost 20% of all strategies are Calendar or Diagonal Spreads. Diagonal spreads can even earn premium in the current volatility environment. A live strategy is examined.

2. Hang Seng Index FAF Calculation Change: Buy The Dip!

- As reported by Travis Lundy , the Hang Seng Index (HSI INDEX) Committee changed the way float is calculated for Secondary Listings in Hang Seng indices.

- This action is expected to add US$2.7bn of buying to some names- read Travis Lundy’s insight for more details on this.

- The HSI INDEX is currently down 3 weeks, and quite OVERSOLD, buying the dip, at this point makes a lot of sense.

3. BYD (1211 HK) Profit Targets After Record-Breaking Earnings

- BYD (1211 HK) posted a record 2024 net profit of 40.25B yuan ($5.55B) as revenue surged 29% to 777B yuan ($107.2B), beating analyst forecasts of $5.47B and $105.6B.

- Notably, BYD’s revenue topped Tesla’s $97.7B reported on Jan. 30. The Chinese automaker is now among the biggest in the world.

- On March 4, our BYD’s insightcorrectly suggested to BUY the stock below 340 (now trading above 400). This insight will try to determine profit targets for the current rally.

4. BYD (1211 HK) Earnings Today: Anticipated Price Movements and Options Insights

- Today,BYD (1211 HK) is scheduled to report its annual 2024 financial results. Timing: 24 March 2025, after market close.

- Expected Price Movement: Option implied movement is above the historically recorded movement.

- Implied volatility and options strategies: Discussion of implied volatility term structure and option strategies.

5. NIFTY Outlook: Possible Breakout as Options Expiry Moves to Monday

- The NIFTY Index had rallied quite hard the week before last week, then stalled last week, however its looks like maybe is changing in its trend structure, maybe a breakout…

- However the breakout may have to wait a bit more, as the NIFTY is overbought WEEKLY according to our model: before the uptrend resumes, there will be a pullback.

- Last: as written by AceGama Advisors the WEEKLY options expiry will be moved from Thursday to Monday, starting in April 2025, impacting the market. Read their insight for detailed analysis.

6. Tata Motors: Is the Worst Finally Over? A Turnaround & Demerger Play

- The Chinese slowdown and JLR’s ICE phase-out pressure near-term margins, but Indian PV growth and EV leadership offer a strong domestic counterbalance.

- Tata Motors is demerging its Commercial Vehicle and Finance arms to sharpen focus and unlock value across its core Passenger Vehicle and JLR businesses.

- Tata Motors is transitioning from a cyclical turnaround story to a long-term structural play on India’s mobility and global EV transformation.

7. NSE NIFTY50/ Vol Update / Expiry Day Shifted to Mondays – Expect Major Changes in Vol Dynamics

- Effective 05.04.2025, Expiry for Options will be moved from Thursday to Monday. Premiums still adjusting to retroactive implementation of the technical change.

- Option markets shun additional risk premia on account of U.S. trade tensions – IVs remain subdued. Vol-state transitioned to “Low & Down” & term-structure pushed further into Contango.

- IVs were higher on the weekly open, but premiums decayed rapidly post U.S. Fed event risk. Skew has unwound its earlier compression.

8. The Beat Ideas: InterGlobe Aviation- Growth Via Fleet Expansion and International Ambitions

- InterGlobe Aviation Ltd (INDIGO IN) placed a record aircraft order and announced plans to double its size by 2030, including entry into long-haul international routes via Airbus A350s.

- This signals a shift from being a low-cost, short-haul leader to a global aviation player aiming for 40% international capacity by FY30.

- IndiGo is no longer just a domestic LCC story: its scale, global ambitions, and diversification make it a long-term structural compounder in aviation.

9. Bank Of China (3988 HK/601988 CH) Earnings on 26/3: Anticipated Price Movements and Options Insights

- Bank Of China Ltd (H) (3988 HK) /Bank of China (601988 CH) is scheduled to report its annual 2024 financial results on 26 March 2025, after market close.

- Expected Price Movement: Option implied movement is above the historically recorded movement.

- Implied Volatility, Options Strategies and Dividends: Discussion of implied volatility term structure and option strategies. Dividends are now semi-annual.

10. JD.com (9618 HK): Strategic Highlights and Market View from HKEX Top Trades

- This Insight analyses JD.com (9618 HK) option strategies traded over the last five trading days on the Hong Kong Exchange. Strategy highlights and volatility context are provided.

- Bearish strategies dominate trading activity, outnumbering bullish ones by more than 3:1, with long volatility structures and calendar/diagonal spreads being prevalent.

- Long tail events: Several strategies follow a pattern of minimal upfront cost (0.1% premium), targeting a significant payout in case of large price movements within a short timeframe.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. US Tariffs: No Fooling!

- The announcement of individual reciprocal tariff rates for US trading patterns on 2 April is a significant event for investors.

- This announcement is part of a drive to re-industrialise America.

- Despite its significance, this could merely represent the initial stages of a prolonged trade war.

2. The Week Ahead – In The Eye of The Storm

- The Fed, Bank of England, and BOJ all left rates unchanged with their own unique perspectives

- Market volatility continues with equities bouncing and the dollar rebounding

- Fed Chair Powell emphasized keeping options open and uncertainty in the economy, with no immediate rate cuts expected

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. UK: Low CPI As Seasonal Sales Extend

- UK CPI inflation slowed by 15bps to 2.84%, rounding slightly under expectations. The services rate was surprisingly resilient, and January’s upside news broadly persisted.

- Downside news from clothing and core goods prices occurred because January sales extended broadly and unusually. Postponed Spring lines should drive a March rebound.

- Headline inflation outcomes are benign enough not to threaten the BoE’s likely cut in May, but ongoing resilience still makes that the final move in our forecast.

4. UK Fiscal Smoke Over Treading Water

- Attempts to recreate fiscal headroom after slippage rely on implausible and optimistic assumptions. Further tax rises and delayed prudence are likely in the Autumn budget.

- Replacing aid resources with capital defence spending helps loosen fiscal policy inside the budgetary rules. Policy changes are relatively neutral over the next few years.

- Without corrective action, the gross financing requirement path is £18bn a year higher than in the Autumn, and almost £50bn higher than last Spring, burdening gilt issuance.

5. PMI Spring Vibe Shifts

- A resurgence in the US and UK services PMIs seems inconsistent with renewed dovish pricing that assumes activity weakness. Vibes may be throwing surveys beyond reality.

- Labour demand growth seems to be trending close to supply, signalling monetary conditions close to neutral. That is broadly the story across a broad basket of countries.

- We still believe rate pricing is too dovish for the Fed and, to a lesser extent, the BoE. Noisy survey vibes and spurious assumptions of tightness are likely to be misleading.

6. Asian Equities: What if There’s a US Recession?

- US recession chatter is back. During past recessions, US declined less than Asia. Within Asia, select consumer staples, telecommunication, energy outperformed. Surprisingly, so did Korea and Taiwan tech, HK industrials.

- Asian equity drawdown was driven more by valuation derating than by earnings decline. During every US recession, all Asian currencies depreciated and FIIs sold almost all Asian markets.

- In the event of a US recession, we think Asia would outperform US. We like attractively valued domestic-focused sectors and stocks, unless a globally linked stock is egregiously undervalued.

7. Market Movers: Key Dates at a Glance (31 March- 6 April)

- Australia: RBA rate decision on 1 April. Expect no change.

- Japan: Nikkei 225 rebalancing effective 31 March at the close.

- US reciprocal tariffs will keep everyone on their toes on 2 April.

8. Asian Equities: India – What Would FIIs and DIIs Buy and Sell?

- We analyze FIIs’ and DIIs’ buying/selling trend across sectors and their sector-wise stances relative to benchmarks to assess which sectors they would buy or sell in the near term.

- FIIs and DIIs have bought consumer discretionary and healthcare secularly. They recently started buying financials and IT, after prolonged selling. They’ve also secularly bought industrials, barring the last two quarters.

- We conclude that both FIIs and DIIs shall continue to buy financials, industrials and consumer discretionary. They would also buy healthcare and sell materials, energy, IT and consumer staples.

9. How to Trade the Momentum Reversal

- Global equity markets saw a sudden reversal in risk appetite out of the Magnificent Seven.

- While risk appetite has recovered in the U.S. equity market and a relief rally will likely continue, the jury is still out on whether the stampede into non-U.S. will continue.

- Reiterate our view that any relief rally is unlikely to be sustainable. Investors may be better served by diversifying their U.S. exposure into non-U.S. equities for the coming market cycle.

10. Abroad and at Home, Asian Politics Set For a Tough Ride Ahead

- Washington’s apparent disengagement from its European partners is troubling Asian governments who are rethinking their own foreign policy and security strategies.

- So far, the region has not been targeted by the US administration. But their persistent trade surpluses and security arrangements expose them to potentially aggressive measures.

- Domestically, political stability has deteriorated in Thailand, the Philippines, and Indonesia, distracting governments from providing effective leadership in a riskier world.