Entity | Insights | Analytics | News | Discussion | Filings | Reports |

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Tech Weekly: TSMC Preparing 5x 2nm Ramp into 2027; Altman ‘Jokes’ About Buying 100x More GPUs

- TSMC’s Most Advanced Node — 5x Growth to 200K Wafers a Month? Upcoming 2nm Node Capacity Ramp Could Be Much Bigger Than Many Think

- OpenAI’s Sam Altman ‘Jokes’ About Owning US$3 Trillion Worth of GPUs One Day…

- AI PC Delay — Nvidia-MediaTek Push AI PC Chip Launch to 2026

2. Semi Key Indicators Q2 2025: PC, Smartphone Unit Shipments, Global Semi & WFE Sales All Looking Good

- According to Gartner, PC unit shipments increased 4.1% YoY in Q225 to reach 63.2 million

- According to IDC, smartphone unit shipments grew 1% YoY in the second quarter, reaching 295.2 million units

- Global semi sales were up 20% YoY in May while SEMI now expects YoY growth in WFE spending of 7.5% in 2025 and a further 10% in 2026

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

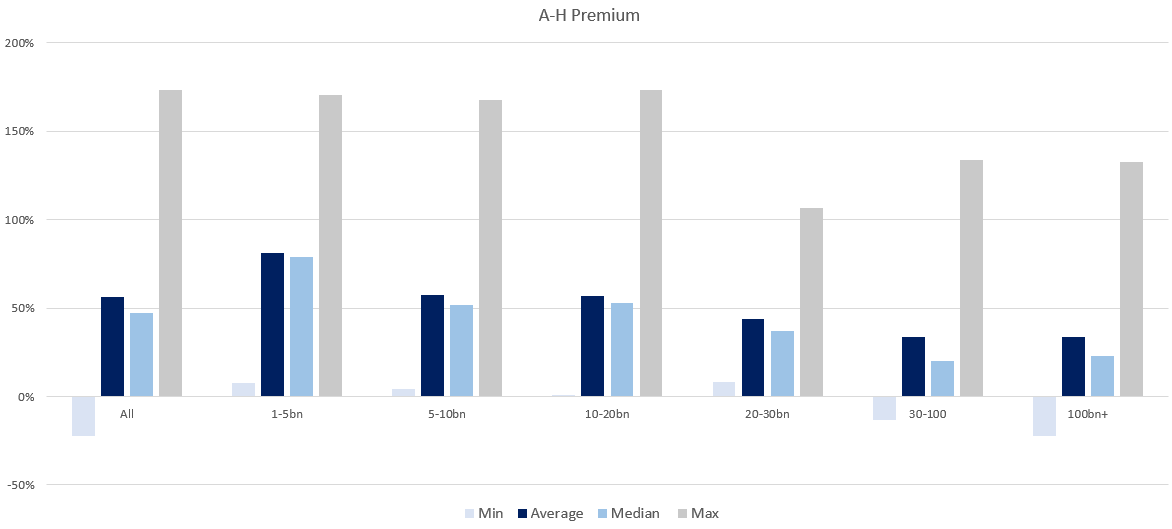

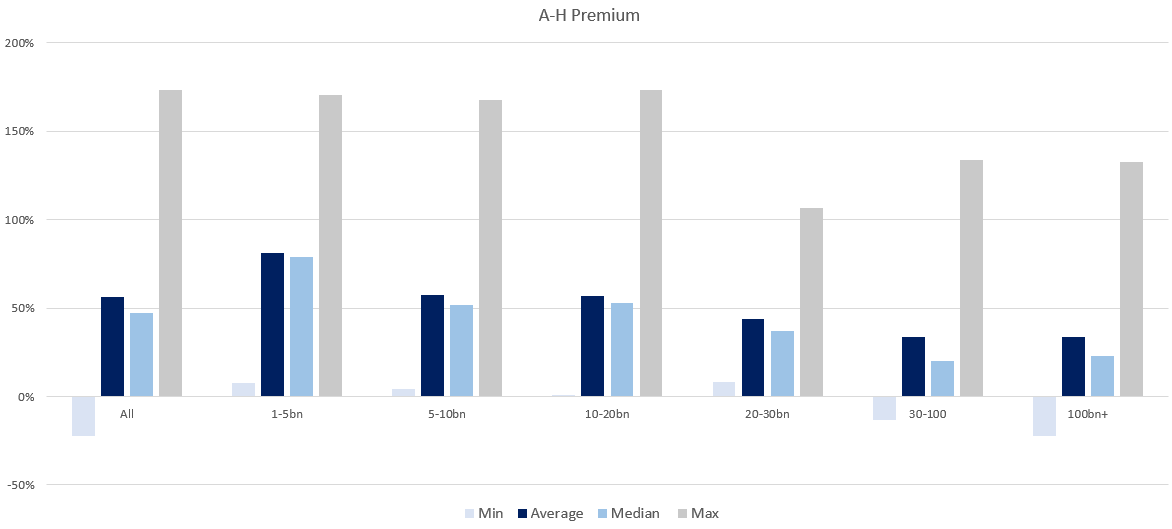

1. A/H Premiums & Recent Listings Performance-Changing Trends but Quality Matters More than the Premium

- With a spate of A/H listings already done in the first half and a lot more in the pipeline, we look at some of the trends from the recent listings.

- In this note, we will also talk about how the A/H premiums have moved since our last note in March 2025.

- Overall, recent A/H listings have somewhat reversed the trend of past A/H listings not doing much in the near term, with a few exceptions.

2. GNI Placement: Easy to Digest but Not Without Small Cap Pharma Risks

- GNI Group (2160 JP) is looking to raise around US$100m from a primary placement (after upsize).

- The deal is a small one, representing 2.4 days of the stock’s three month ADV, despite being 9.0% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

3. Everest Medicine Placement – Third Deal in the Year, Previous Ones Didn’t Do Well

- Everest Medicines (1952 HK) aims to raise around US$200m via a top-up placement.

- This will be the third placement this year for the stock, the previous two deals didn’t do well. Although the stock has bounced back a lot since.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.

4. Figma Inc (FIG): High Profile Software IPO Sets Terms, Expecting Major Attention Next Week

- Figma is offering 36.9mm shares at $25.00-$28.00 equating to a market cap of $12.2bn-$13.65b and is scheduled to debut on July 31st.

- They estimate their total revenue to increase by 39% to 41% for the three months ended June 30, 2025 compared to the three months ended June 30, 2024.

- This company is highly regarded in the software sector and we believe that there will be ample interest in this IPO.

5. Leads Biolabs (维立志生物) Trading Update

- Leads Biolabs raised HKD 1290m (USD 166m) from its global offering and will list on the Hong Kong Stock Exchange on Friday, July 24th.

- In our previous note, we looked at the company’s operation, management track records and discussed the IPO valuation.

- In this note, we provide an update for the IPO before trading debut.

6. DH (Daehan) Shipbuilding IPO Book Building Results Analysis

- DH Shipbuilding reported a solid IPO book building results analysis. The IPO price has been finalized at 50,000 won per share (high end of the IPO price range).

- At the IPO price of 50,000 won, the expected market cap will be 1.9 trillion won. DH Shipbuilding will start trading on 1 August.

- Our base case valuation of DH Shipbuilding is target price of 67,576 won per share, which represents a 35% upside to the IPO price.

7. OSL Group Placement: Momentum Is Strong but Is Opportunistic

- BC Technology Group (863 HK) is looking to raise around US$157m from a primary placement.

- The deal is a large one to digest, representing 20.2 days of the stock’s three month ADV, and 11.3% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Pine Labs Pre-IPO – The Negatives – …some Segments Slowing, Lots Unexplained

- Pine Labs is looking to raise up to US$1bn in its upcoming India IPO.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- In this note, we talk about the not-so-positive aspects of the deal.

9. ECM Weekly (21 July 2025) – Muyuan, Unisplendour, NTT, Kasumigaseki, Anthem, Leads, SBI, Ascentage

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, filings and listings have cooled off going into the general summer lull.

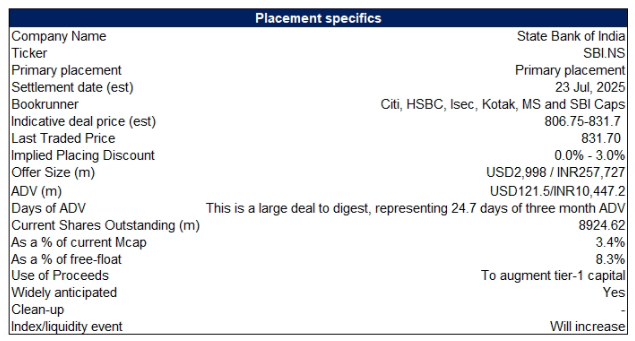

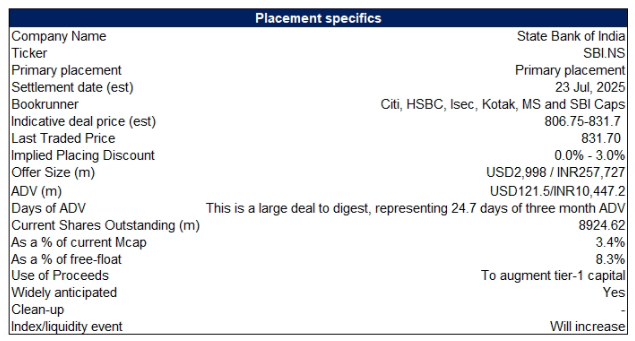

- On the placements front, State Bank Of India (SBIN IN) pulled the trigger on its long touted QIP.

10. Pine Labs Pre-IPO – The Positives – Some Segments Growing..

- Pine Labs is looking to raise up to US$1bn in its upcoming India IPO.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- In this note, we talk about the positive aspects of the deal.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

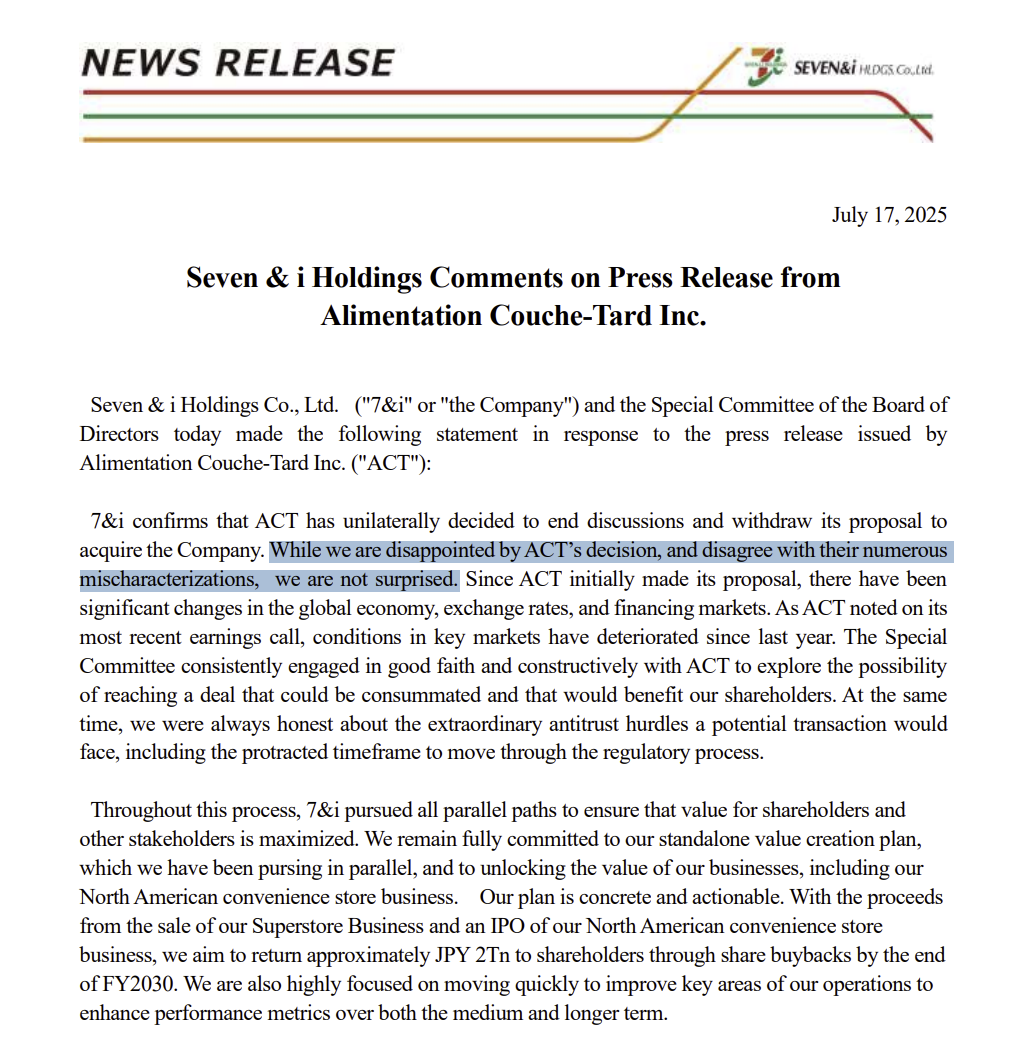

1. The Final ACT Comedy of Errors Opens the Way for Real Value to Emerge at Seven & I

- ACT’s bid for Seven & I has been withdrawn and Seven will be better off long-term because of it – although we detail here how competitors are catching up fast.

- Once York HD has been split off, the company can at last focus on its crucial local CVS operation: Japan makes up 25% of revenues but almost 50% of profits.

- The potential is real and we are bullish on the long-term value but we would have been more bullish if the former CEO Ryuichi Isaka was still on board.

2. SK Hynix Single-Stock ETF Scheduled for 3Q: Watch for a Repeat of the Samsung ETF Playbook

- When the SK Hynix ETF drops, expect meaningful physical buying shaking up supply-demand. Arb desks and alpha shops could pile in early, pushing the stock higher on flow.

- Going long Hynix near listing could pay off if demand mirrors Samsung’s—ETF flows, NAV arb, and delta hedging drove a 4% jump with a noticeable increase in program buying.

- Get in around the listing, watch flows, and take profits quickly. This is a short 2–3 day tactical play, with sharper front-running expected based on the Samsung ETF template.

3. TSI Holdings (3608) – YET ANOTHER Big Buyback, Still Good, Still Cheap, But B/S Restructuring Slow

- A bit over three years ago I re-wrote on Tsi Holdings (3608 JP). Then? EV/Revenue and EV/EBITDA of 0.03x and 0.5x respectively. I pounded the table.

- My recommended trade: “Buy the stock (preferably from cross-holders interested in selling). Buy with both hands. Buy a lot. Buy more later. Pressure the company to go private.”

- Since then, total return has been +295%. Today they announced another buyback. Tomorrow morning it gets done. Details details details!

4. Anthem Biosciences IPO: Lists Today; Index Inclusion Timing

- Anthem Biosciences raised INR 34bn (US$394m) in its IPO valuing the company at INR 320bn (US$3.7bn). The stock lists today.

- The grey market premium is INR 132/share, so the stock could list 23.2% higher than the IPO price. That will help in getting larger index flows.

- Anthem Biosciences could be added to one global index in November while the stock price gain will determine whether the stock is added to the other global index in December.

5. A/H Premium Tracker (To 18 July 2025): “Beautiful Skew” Continues Some More

- AH premia flat again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- Weeks ago I said, “It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.” Ride on.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

6. Prosus Is Elevated Vs. Tencent As The Accretion Trade Unfolds

- Since unwinding the Naspers (NPN SJ)/Prosus (PRX NA) circularity, Prosus has been selling Tencent shares, and buying back its share. Separately, Tencent is buying its shares to offset Prosus’ selling.

- Prosus’ stake in Tencent has now edged below 23%, a little over seven months since dipping below 24%.

- On an implied stub and relative value, Prosus is elevated to Tencent, suggesting an unwinding of the stub.

7. Dickson Concept (113 HK): More Minority Teeth Bared As Another Scheme Fails

- Three for three. Three low-balled Hong Kong Offers, by way of Schemes, have now lapsed over the past ten weeks.

- Both Goldlion Holdings (533 HK) and Soundwill Holdings (878 HK) spectacularly failed back in May.

- Now Dickson Concepts Intl (113 HK) has followed suit. But the vote was (much) closer than it should have been.

8. Insignia Financial (IFL AU) Accepts CC Capital’s Reduced Terms

- Insignia Financial (IFL AU), a wealth manager and previously known as IOOF, has entered into a Scheme with CC Capital at $A$4.80/share.

- That’s 56.9% premium to undisturbed (11th December 2024), 20% above Bain’s initial indicative tilt last year, but 4% below CC Capital (% Bain’s) A$5.00/share indictive Offer on the 7th March.

- Apart from the Scheme vote, CC Capital’s Offer requires a raft a regulatory approvals. The SID indicates 1H26 completion.

9. StubWorld: Japan Post Holdings (6178 JP) Is “Cheap”

- As short-term rates rise, Japan Post Bank (7182 JP)‘s perceived superior fundamentals may be leading to a short squeeze on the stock versus Japan Post Holdings (6178 JP).

- Preceding my comments on Japan Post – and Silicon Integrated Systems (2363 TT) – are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

10. Two New Tax Tweaks Set to Shake Up Korea’s Local Stock Market: Trading Tax & CGT Threshold

- Trading tax gradually dropped from 0.25% in 2020 to 0.15% in 2025, boosting volatility and short-term trades; a hike to 0.25% could cool momentum but widen arbitrage and basis spreads.

- If the major shareholder tax threshold drops to ₩1B, year-end retail dumps and Jan buybacks will return—but with less wild swings and more measured short-term fade and momentum trades.

- If the tax revamp drops end-July, expect a September Assembly push. Usually effective next January, but like 2023’s cap gains hike, changes might apply immediately in 2025.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. NIFTY50 Index Outlook Amid Ongoing Rebalance Review

- As outlined by Brian Freitas , the NIFTY Index ‘s September rebalance ends July 31st, the announcement of the changes will take place end August and implemented on September 29th.

- The index has been pulling back for 3 weeks, it’s oversold according to our model, 75% probability of reversing up this week.

- Lower support limit would be 24319, while a rally could take the index to 25642 across a couple of weeks. The rally won’t last more than 2 weeks probably.

2. HSI Index Tactical View: How Much Further Can the Rally Run?

- The Hang Seng Index (HSI INDEX) has reached new highs (25538). Our quantitative model says the index has reached a 75% probability of reversal.

- Let’s break down the model’s info: PRICE MODEL 75%, TIME MODEL 75%, combined prob. of reversal is 75%. The fact that both model’s factors are overbought is “bearish”.

- Can the index climb higher? Our detailed analysis is in the insight below, together with screenshots from the model.

3. Toyota (7203 JP) Surges 14% — A Contrarian Option Strategy

- Context: On 23 July 2025, Toyota Motor (7203 JP) surged 14.3%, driven by macro factors tied to tariffs. This Insight examines how that sharp move affected the stock’s volatility surface.

- Key Observations: Implied volatility spiked to extreme percentiles, with two-week IV hitting the 99th–100th percentile. Skew dynamics show otm calls becoming historically rich relative to puts.

- Opportunity: Elevated implied volatility and historically flat skew present an attractive setup for a zero-cost option strategy.

4. Global Markets Tactical Outlook: Week of July 21 – July 25

- A quick synoptic look at the tactical models for the key indices, stocks, commodities and bonds we cover, for the week July 21 – July 25.

- OVERSOLD: Meta (META US) , HDFC Bank (HDFCB IN) , NIFTY Index (NIFTY INDEX)

- OVERBOUGHT: Alphabet (GOOG US) , Amazon.com Inc (AMZN US) , NVIDIA Corp (NVDA US) , Taiwan Semiconductor (2330 TT) , CSI 300 Index (SHSZ300 INDEX) , KOSPI 200 (KOSPI2 INDEX)

5. India’s Energy Exchanges: Market Coupling, the Next Big Disruption

- India’s CERC has approved the implementation of Market Coupling in the DAM(Day Ahead Market) by Jan-26, with Real Time Market (RTM) coupling to follow after operational experience is gained.

- IEX currently commands 99.8% market share in both DAM and RTM. With MC, price discovery will be centralized, eroding IEX’s platform advantage and likely resulting in loss of market share.

- If MC had been implemented in FY25, IEX’s earnings would have been 20% lower. This regulatory shift poses a clear structural risk to IEX’s volume dominance and earnings growth.

6. US Stocks Earnings Tactical Outlooks: GOOG, AMZN, META, AAPL, TSLA, NVDA

- Some of the US Stocks we cover have already reported their earnings: Tesla (TSLA US) and Alphabet (GOOG US) .

- Others will report next week: Amazon.com Inc (AMZN US) , Meta (META US) , Apple (AAPL US), while NVIDIA Corp (NVDA US) will report on August 28th.

- We dive into each stock potential for upside or downside at this junction, based on tactical analysis of our quantitative trend forecast models.

7. HSBC (5 HK) Earnings on 30 July: Price Action and Option Strategies

- Context: Index heavyweight HSBC (5 HK) / HSBC (HSBA LN) is set to report Interim Results 2025 on 30 July at 12:00 HKT — during the Hong Kong trading lunch break.

- Expected Move: Historical data reveals HSBC‘s announcement-day moves are significantly larger than average, with options currently pricing in a remarkably aligned ± 2.2% implied move.

- Actionable Strategies: Understand the potential for amplified volatility and explore actionable option strategies leveraging the distinctive term structure around earnings.

8. Hong Kong Single Stock Options Weekly (July 21–25): Materials and Energy Lead, Option Volumes Surge

- Materials and Energy led the week, with single stocks in both sectors posting standout gains.

- Breadth was broad-based, and average returns among winners were unusually strong.

- Single stock option volumes surged, with pronounced Call activity mid-week.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

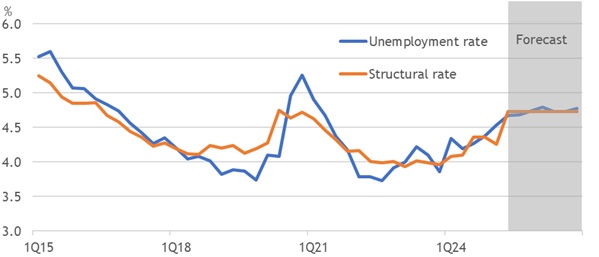

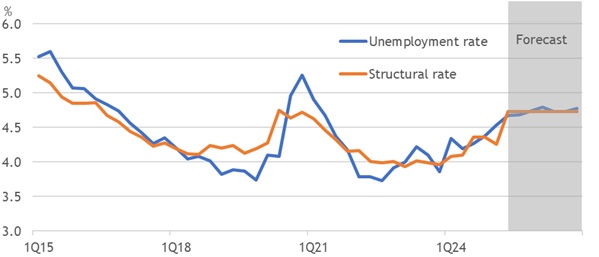

1. UK Structurally Unemployed

- Higher employment taxes can entirely explain the fall in payrolls as the tax wedge hits its highest since 1987, raising our structural unemployment rate estimate by 0.48pp.

- That could understate the structural shift amid a substantial drop in the threshold, rise in the minimum wage (jobs ban) and benefit rates. Some will go ‘inactive’ on disability.

- The unemployment rate must rise more than its natural rate to deliver disinflationary pressure sustainably. Our structural estimates suggest it won’t break excess inflation.

2. UK Fiscal Slippage Rules

- The UK’s de facto fiscal rule is slippage, with a £50bn to £100bn increase in borrowing between initial official forecasts and outcomes. 2025-26 made another slippery start.

- Politicians spend any space in the OBR forecasts, skewing surprises to higher spending. Yet tax hikes keep failing to raise the hoped revenue, motivating further increases.

- Investors should not be fooled by forecasts for consolidation when the failed strategy driving the fiscal slippage rule survives. Issuance may stay near £300bn in 2029-30.

3. US Politics: ‘As Ye Sow…’

- The Epstein files row has intensified deep splits in the MAGA movement and triggered persistent demands for accountability.

- Trump’s recent pivot towards supporting Ukraine and critical foreign policy shifts have fuelled further rifts among his traditional base.

- Despite controversies, the key midterm factor remains Trump’s economic agenda, as tariffs and fiscal changes may hit his core supporters hardest.

4. ECB: Watching the Good Place

- The ECB kept its description of the policy setting as in a good place, and wants to watch the news in the next few months. Lagarde refused to emphasise September’s meeting.

- Euro strength is depressing inflation below target in the near-term forecasts, but the ECB remains relaxed about this. It sees the outlook as broadly unchanged since June.

- We still see rolling resilience in the economy and doubt US trade policy will break it. More rate cuts are inappropriate without demand destruction, so we don’t expect any.

5. The Trade War Is Dead! Long Live the Trade War!

- Despite all of the dire headlines about tariffs on Canada, Mexico and the European Union, the only trade war that matters is effectively over. China has won.

- In the short run, economic policy uncertainty is receding but it’s not fully normalized. It’s time to adopt a risk-on posture.

- In the long run, equity investors should not expect the S&P 500, which trades at forward P/E of 22, to continue to outperform global stocks in the next expansion cycle.

6. New Barbarians Podcast | Episode #029 | Recap & Reset: Macro Shifts, Ethereum’s Spike, MicroStrat…

- Podcast has been running for almost seven months with recent guest episodes

- Discussion on recent global asset trends and market news, including inflation, Fed rate cuts, and Trump’s tariff threats

- Mention of interns from CUNY City Tech helping with macro database analysis and highlighting Ethereum’s strong performance in the market.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Potential Change in Capital Gains on Stocks & Securities Transaction Taxes: Impact on Korean Stocks

- The capital gains tax on stock sale gains and securities transaction taxes could be raised in 2H 2025, which could negatively impact the Korean stock market, especially small caps.

- Combination of higher securities transaction tax and capital gains on stock sales could result in local retail investors selling their shares in 4Q 2025, before these changes come into effect.

- Although many small caps in Korea have performed well this year, the potential changes on these two important taxes could put some damper on the recent excellent share price performances.

8. HEW: Trade Deals & Fiscal Slippage

- Market narratives were driven by US trade pacts, critically with Japan, the ECB watching data from a good place, and further evidence of UK fiscal problems.

- Tariff uncertainty eased slightly, but it is still fierce ahead of the 1 August deadline. PMIs remained resilient, and UK retail sales rebounded into growth again for Q2.

- Next week brings Fed, BoC and BoJ meetings (broadly on hold), US and euro-area GDP growth for Q2, US payrolls, euro-area unemployment and slower flash HICP data.

9. BUY/SELL/HOLD: Hong Kong Market Update (JULY 21)

- HSI poised to break 25k for first time since 2022. Next resistance 27100. Hong Kong market outperforming global markets by wide margin since our BUY was initiated in March 2024.

- Financial, materials and healthcare sectors leading the market higher as tech sector consolidates. China shares still offer the best valuation metrics in Asia.

- Alibaba Pictures (1060 HK) , renamed Damai Entertainment has seen increased analyst attention as the company becomes the Live Nation Entertainment, Inc (LYV US) of China.

10. Stay Overweight Japanese Equities

- Despite the Upper House election result we are overweight Japanese equities and a buyer of the yen.

- Business cycle indicators are positive; the profit and investment cycles in upswing. Companies are highly diversified – foreign sales account for 40% of sales and 37% of production is abroad.

- They are hedging their bets by expanding in the US and India while scaling back in China. These factors contribute to the resilience of corporate earnings growth.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. TSMC Q225. Surfing The AI Tidal Wave With Style

- TSMC reported Q225 revenues of $30.1 billion, up 44% YoY, up 17.8% QoQ and handily beating the high end of the $29.2 billion guidance.

- Full year 2025 guidance raised to 30% YoY growth, and that may still not be enough

- Resumption of H20 sales to China not yet baked into forecast, an army of ex Intel employees coming on the job market & potential Fx reversal are all possible tailwinds

2. TSMC 2Q25 Takeways: Undervalued Op Leverage and Capacity Strain Setting Up 2026 N2 Growth Suprise

- TSMC Beats, Raises, and Confirms AI Ramp Is Real, Despite FX Drag

- Conclusion — Maintain Structural Long View, 2026 Growth Likely Underappreciated

- TSMC ADR Premium Rebounds to 23.6% — US Investor Positioning Skewed Toward TSMC’s Unique AI Exposure

3. TSMC (2330.TT; TSM.US): FX Could Make an Impact; Full Year USD Revenue Raised to ~30% YoY.

- 3Q25 Guidance: Revenue: US$31.8–33.0 billion (approx. 8% QoQ growth); Gross Margin: 55.5–57.5%; Operating Margin: 45.5–47.5%.

- Despite FX headwinds, TSMC aims to maintain gross margin ≥ 53%

- Driven by strong demand in AI (including sovereign AI) and HPC; Full-year USD revenue growth outlook raised to ~30% YoY.

4. Taiwan Dual-Listings Monitor: TSMC Results Ahead; ASE Historically Rare Discount

- TSMC: +20.6% Premium; FY2Q25 Results This Week a Key Catalyst

- UMC: 0.0% Premium (Parity); Wait for More Extreme Levels Before Going Long or Short

- ASE: -0.8% Discount; Historically Rare Discount, Long the ADR Spread

5. ASML Q225 Earnings. Solid Results, Forecasting 15% Growth In 2025, Down 7% In Pre Market. But Why?

- ASML today reported second quarter revenues of €7.7 billion, bang at the top of the guided range, flat QoQ and up 23% YoY

- Guided 2025 at 15% growth (~€35 billion), a big step up in confidence from the €30-€35 billion range given last quarter

- Comments regarding uncertainty about 2026 outlook and tariff impacts likely led to the >7% sell off currently happening in pre-market trading.

6. Taiwan Tech Weekly: Intel Tapes Out New Chips at TSMC – What It Means; PC Demand Growth in Focus

- Intel Tapes Out New PC Chips on TSMC 2nm — Dual-Node Nova Lake Strategy Shows Dependence on TSMC… and Value of UMC for INTC in the Long-Term

- DRAM Memory Outlook — Nanya Results See Non-AI DRAM Demand Rebound; DDR4 Shortage Tightens, Expects Continued Strength in 2H25

- PC 2Q25: 6-7% Unit Growth YoY Is Pretty Good. 2025 Looks like a 5-6% Growth Year

7. Intel Layoffs Finally Kick Off With A Chaotic Start In Oregon

- Despite initially WARNing of 529 job cuts in Oregon, the actual number turned out to be 2,392

- Only 9% of the Oregon cuts are in management positions

- Huge cuts in technical employees across the board with a total of thirty Principal Engineers losing their jobs in Oregon alone.

8. TechChain Insights: Kinik – The Hidden Enabler Behind TSMC’s Sub-2nm Push

- We Engaged with Kinik Recently to Get Insight on Activity Strength for TSMC’s Expansion into Nodes 2nm and Below

- Diamond Tooling: Quietly Powering Advanced Logic; Kinik Recently Running at Max Capacity for Key DBU Business Segment… also at 100% for SBU Segment

- Takeaways — Kinik as a Concentrated Play on Advanced Node Transitions… Also, We Believe Signs Remain Positive for TSMC’s Recent Activity Momentum

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. SBI US$3bn QIP – No Surprises – Not the World’s Best Kept Secret

- State Bank Of India (SBIN IN) plans to raise around US$3bn via a QIP. The deal is very well flagged and we wrote on it last week.

- Although the stock has been running up a bit going into the deal and the previous deal didn’t do well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Muyuan Foods A/H Listing – Long Term Growth with Short-Term Volatility

- Muyuan Foodstuff Co Ltd A (002714 CH), a leader in the hog farming industry, aims to raise around US$2bn in its H-share listing.

- MF is a leading pork company with over 30 years of expertise in the hog farming industry.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

3. NTT DC REIT IPO Trading – Decent Demand, High Yield and Discount Should Help

- NTT DC REIT (NTTDCR SP), a data center REIT, raised around US$772m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn

- We have looked at the past performance in our earlier notes. In this note, we will talk about the trading dynamics.

4. SM Investments Placement: Large Deal to Digest

- An undisclosed seller is looking to raise US$142m via selling some/all of their stake in SM Investments (SM PM).

- The deal is a large one to digest, representing 33.1 days of the stock’s three month ADV, and 0.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. Leads Biolabs (维立志生物) IPO: A Duality Repeat?

- Leads Biolabs, a China-based clinical-stage biotechnology company, launched its IPO to raise up to US$144m via a Hong Kong listing.

- We look at the deal dynamics and compare the listing with the Duality listing.

- The deal values the companies fairly but we see strong sentiment towards quality biotech names.

6. Ascentage Pharma (6855.HK) Placement – Thoughts on The Placing Price and the Outlook

- Our forecast is sales of olverembatinib in 2025 could reach RMB500mn. APG-2575 is better than Sonrotoclax in ORR/safety profile, but global commercialization success is not simply determined by clinical data.

- Placing price of HK$68.6/share has priced in the successful licensing deal of APG-2575 to some extent, which however is not a done deal. US$1.5-2.375bn is a more reasonable valuation range.

- The big rally in biotech sector is not based on fundamental inflection point. The driving mentality behind the valuation bubble this time has a more obvious nature of “short-term gambling”.

7. ECM Weekly (14 July 2025) – Meituan, SBI, Kokusai, NTT, Daehan, Anthem, SICC, CIG, FWD

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the previous week was another busy week for listings, with mixed results.

- On the placements front, we looked at the possible placements for Meituan (3690 HK) and State Bank Of India (SBIN IN).

8. Ascentage Pharma Top-Up Placement – Past Deals Didn’t Done Well, Stock up a Lot but Sector Is Strong

- Ascentage Pharma Group Corp (6855 HK) (AP) aims to raise around US$196m via top-up placement.

- The company has undertaken a number of deals in the past, with none of the deals having done well. Although stock momentum has been strong this year.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

9. Nanjing Leads Biolabs IPO: Lead Asset Targets Niche Market; Path to Success Still Long

- Nanjing Leads Biolabs has launched HK$1.1B IPO to fund its ongoing and planned clinical development and regulatory affairs of pipeline assets. The company has fetched cornerstone investment of ~HK$ 542M.

- Lead product candidate, LBL-024 is being evaluated for extra-pulmonary neuroendocrine carcinoma. Leads Biolabs expects to file the first BLA for LBL-024 by 3Q26 and anticipate obtaining conditional approval by 2Q27.

- Positive investor sentiment toward Chinese biotech companies and near-term catalyst being Phase 3 data readout for LBL-024 in early 2026 are the main reasons to subscribe.

10. United Lab Placement – Industry Momentum Strong, Although Stock Has Run-Up Quite a Bit

- The United Laboratories International Holdings Limited (3933 HK) is looking to raise up to US$262m from a primary placement.

- The company intends to use about 60% of the proceeds to build production capacity and expand its international business, with the rest to be used for R&D purposes.

- In this note, we will talk about the placement and run the deal through our ECM framework.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 7&I (3382 JP) – Alimentation Couche-Tard Walks, Lobbing a Letter Bomb

- Alimentation Couche-Tard (ATD CN) which proposed a takeover to Seven & I Holdings (3382 JP) almost a year ago, has walked. They delivered a letter bomb on the way out.

- The letter is titled “ALIMENTATION COUCHE-TARD ANNOUNCES WITHDRAWAL OF PROPOSAL TO ACQUIRE SEVEN & I HOLDINGS DUE TO LACK OF ENGAGEMENT.” This is not the first time they have complained.

- The letter is not aimed at the 7&i Board or at ATD stakeholders. It is meant to drive a wedge between 7&i active shareholders and its management team. We’ll see.

2. [Japan Activism] Mitsui Matsushima (1518 JP) Buyback Tender – Surprising Results and Implications

- Today, Mitsui Matsushima (1518 JP) announced the results of its Buyback Tender Offer to repurchase up to 3,999,999 shares (35.8% of shares out ex-Treasury) at ¥5,000/share.

- Murakami-San owned 42% of the voting rights at announcement, then bought more on the dip just below ¥5,000/share.

- The Tender Offer Buyback was “successful” in that it bought back 3.3mm shares. But the result was FAR more interesting than I expected. Surprising Results with Surprising Implications

3. GMO Internet (4784) – Shares Appear Manipulated/Squeezed (Again), but ParentCo MUST SELL

- GMO Internet (4784 JP) was squeezed after a merger which was a Reverse Takeover followed by a ridiculous TOPIX inclusion. Then the parent tried an offering, which failed.

- The clearing price demanded was WAAAY lower so the offering was pulled. Shares fell 70%, then bounced 65%. Now 48x book and 66x EBITDA for an ISP. Super expensive. Manipulated.

- ParentCo needs to sell 90mm shares ASAP. The only clean way is through a liquidation trust to get shares lower before a larger offering.

4. Mandatory Cancellation of Existing Treasury Shares: A Historic Stock Market Event in the Making

- The bill’s side notes clearly state that the mandatory cancellation rule applies retroactively to existing treasury shares without any exemptions.

- If this passes the Assembly as-is, it’ll trigger a historic forced cancellation of treasury stock across ~1,660 companies—about three-quarters of the K-equities market.

- Watch if this punchy bill clears committee and floor without cuts. Dems plan to fast-track it Sept 1, holding the majority to push it solo, aiming for year-end rollout.

5. Merger Arb Mondays (14 Jul) – Shibaura, Topcon, Nissin, OneConnect, Insignia, PointsBet, ENN Energy

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Yichang HEC Changjiang Pharma (1558 HK), ENN Energy (2688 HK), Insignia Financial (IFL AU), Seven & I Holdings (3382 JP), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), New World Resources (NWC AU), Humm Group (HUM AU), Hainan Meilan International Airport (357 HK), Avjennings Ltd (AVJ AU).

6. [Japan M&A] Polaris MBO for DD Group (3073) – Too Light But Probably a Done Deal

- Diamond Dining (3073 JP) (DD Group) head Matsumura-san appears to be getting out in this Polaris MBO for the dining group.

- The premium is low, and the the price is probably light, but there are a couple of small things which mean it isn’t quite as light as it might look.

- But the company prints cash, so yeah, it’s light. This should probably be a bit better, but F&B is a fickle business.

7. A/H Premium Tracker (To 11 July 2025): “Beautiful Skew” Continues – BIG AH Premia Compression

- AH premia flat among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It has paid well to be long wide H discounts.

- Weeks ago I said, “It has paid to be long the H on those H/A pairs with the biggest H discounts. I would continue to ride that trend.” Ride on.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

8. ZEEKR (ZK US): Geely Auto’s Binding Offer a Done Deal

- ZEEKR (ZK US) has entered into a definitive merger agreement with Geely Auto (175 HK) at US$26.87 per ADS or 12.3 newly issued Geely shares. The cash offer increased by 4.7%.

- The proposal is conditional on regulatory approvals (low risk, as Zeekr is a subsidiary of Geely), as well as approval from Zeekr’s shareholders and Geely’s independent shareholders.

- The Zeekr shareholder vote is a formality as Geely and undertakings exceed the two-thirds voting threshold. The Geely vote is low risk due to the low takeover premium.

9. Krungthai Card (KTC TB): Buy With Both Hands As Pledged Shares Rollover

- Late last month, shares in Krungthai Card (KTC TB), XSpring Capital (XPG TB), BEC World Public (BEC TB), and The Practical Solution (TPS TB) all went limit down. Twice.

- As discussed in Krungthai Card (KTC TB): Buying Opportunity After Margin Call, Mongkol Prakitchaiwattana had pledged his shares in all four companies, reportedly leading to margin calls.

- Yesterday, the SET released an updated list of securities pledged in margin accounts. Notably, pledged shares in KTC has fallen to 3.5% of shares outstanding from 16.3% the previous month.

10. Seven & I Holdings (3382 JP): Dead Money as Couche-Tard Unsurprisingly Walks

- Couche-Tard has withdrawn its offer for Seven & I Holdings (3382 JP) by unfairly laying the entire blame on the Board.

- The Board has made credible progress, but the jury is still out on whether the Board’s plan will generate returns. Shareholders remain sceptical as the shares have underperformed the index.

- In theory, the sell-off presents a buying opportunity (My SoTP valuation is JPY 2,376). However, the shares are likely to tread water as there are no near-term catalysts.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

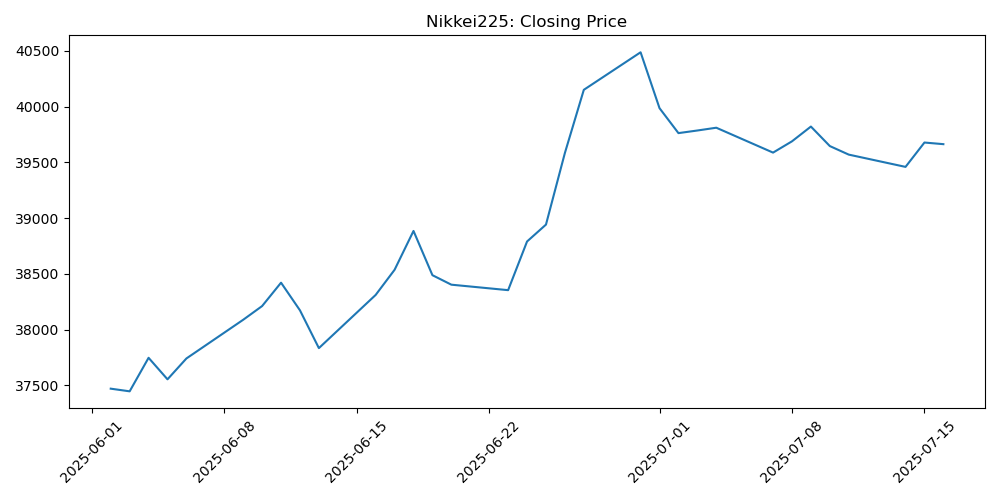

1. Nikkei225 and Election: Hedging Activity and Implieds Flag Opportunity

- Upper House elections are drawing increased scrutiny due to heightened focus on fiscal finances.

- We examine how risk is being priced across Japanese markets and in particular in Nikkei225 options.

- Volatility risk appears asymmetric, and we outline ways to mitigate or potentially profit from it.

2. Meituan (3690): Full Round-Trip, Surge in Call Volumes Provide Strong Trade Setup

- Meituan has completed a full roundtrip from its 2024 rally and is now back near key support.

- Option traders have taken notice, with a notable pickup in activity—especially for Calls.

- We outline two trade structures depending on directional or vol views.

3. BYD (1211 HK) Outlook Under Pressure as Sales Momentum Fades

- BYD (1211 HK) fell for longer than expected since our last insight was published. We said that if BYD was going to fall below 120, the trend would become bearish.

- The stock did not fall a lot, it briefly reached below our 120 support level (75% probability of reversal), but has been down for 5 weeks. It is oversold.

- The big question now is: can BYD recover and start to trend up again? Or are we going to see a small bounce from oversold levels, followed by lower prices?

4. Hong Kong Financials in Focus: Sub-Sector Option Volumes Reveal Emerging Themes

- Volume trends and sub-sector splits highlight where interest is most concentrated.

- We revisit top names that appeared prominently in last week’s active lists

- Trading patterns suggest a mix of positioning motives across Financial names.

5. Nikkei 225 Index Outlook: Bullish, Possibly Directed Past 41k

- The Nikkei 225 (NKY INDEX) bounced this week, after 2 weeks down, after previously reaching a peak at 40852, the area above 41k has been a strong barrier since 2024.

- Our model says the current Nikkei 225 trend could rise to 41k, or even above 41k.

- The index’s latest 2-week pullback was shallow and did not even reach our model’s Q2 support level, this is a bullish behavior (buy the dip).

6. Global Markets Tactical Outlook: Week of July 14 – July 19

- A quick synoptic look at the tactical models for some key indices, stocks, commodities and bonds we cover, for the week July 14 – July 19.

- The most noticeable highlights are: all US markets and stocks we cover sold off last week, apart from Amazon.com (AMZN US) , Alphabet (GOOG US) and NVIDIA Corp (NVDA US)

- In Asia, BYD (1211 HK) is very oversold, and Fast Retailing (9983 JP) is also oversold. Gold (GOLD COMDTY) and Crude Oil (CL1 COM COMDTY) start to be overbought.

7. TSMC (2330.TT) Outlook Post Strong Q2: Our Model Says “EXTREME OVERBOUGHT CONDITION”

- As reported by Patrick Liao and William Keating , Taiwan Semiconductor (2330 TT) is currently in very good shape, for multiple reasons, I invite you to read their insights.

- The problem is: the stock closed at 1155 on Friday, blowing past through the roof of what our model has identified as a very extremely overbought “Tails” move.

- We said BUY in June, and know market euphoria can defy models when sentiment takes over, but our tools consistently flag overstretched conditions — a clear caution to late-stage buyers!

8. BSE Derivative Volumes Hit by Jane Street Ban, Volatility Slump: EPS Cuts & Near-Term Downgrade

- BSE’s Option Premium ADTO in July MTD is down 25% MoM to INR 105bn amid lower market volatility and regulatory overhang from SEBI’s ban on Jane Street.

- This weakness has triggered another 6–8% volume cut assumption in the market, on top of the 4–5% volume cut in June 2025.

- BSE will face pressure in the near-term due to lower volume and valuation pressure, but long-term optimism tied to earnings if volumes normalize and reforms push investors toward cash equities.

9. GOOGL: Q2 Vol Pricing, Performance Trends, and Earnings Setup

- GOOGL is set to release Q2 earnings on Wednesday, July 23 after the close, having rallied 15.39% since Q1 results.

- Q2 has historically delivered strong average returns and the largest average absolute 1-day move.

- We explore how volatility and past earnings reactions frame expectations for the upcoming release.

10. HDFC Bank (HDFCB IN) Outlook: Any Rally From Here May End Quickly

- HDFC Bank (HDFCB IN) has been rallying strongly since early January 2025, a rally we predicted back then. After 2 weeks down, the stock this week is rising.

- However, according to our model the current uptrend pattern does not lead to long-lasting rallies, but rather to new, short-term corrections.

- The time horizon for this rally is 1-2 weeks, when this trend pattern is encountered, so we could expect the stock to rally briefly and then pull back again.