Receive this weekly newsletter keeping 45k+ investors in the loop

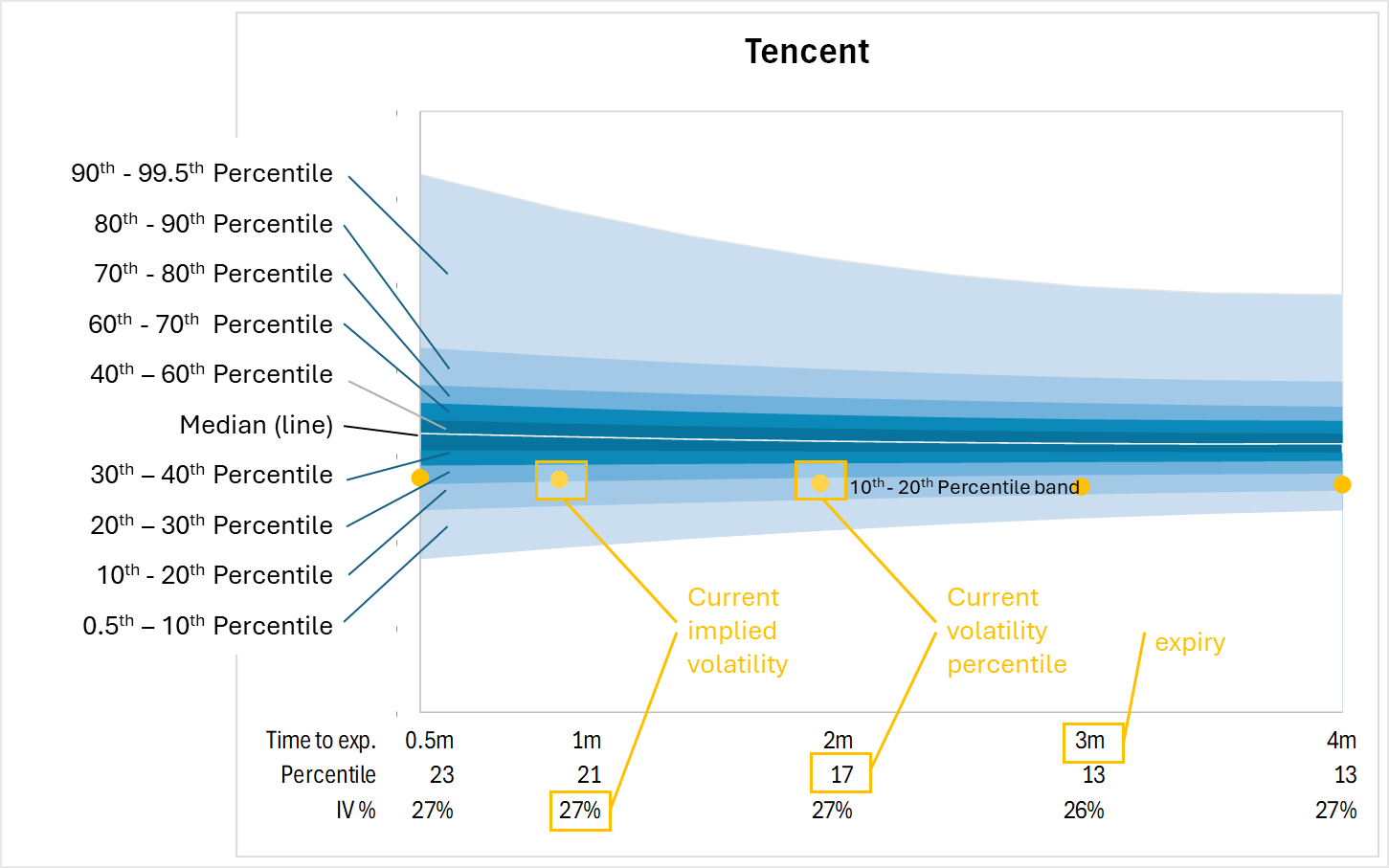

1. Volatility Cones: Spotting Opportunities in Tencent, JD.com, Ping An & More

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights: Major stocks, including Tencent (700 HK), Xiaomi (1810 HK), and Meituan (3690 HK), trade at historically cheap implied volatility. Upcoming earnings are starting to be reflected in November IV.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

2. China Mobile (941 HK): Tactical Outlook as HKBN Deal Unfolds

- As you all know China Mobile (941 HK) has strategically ramped up its ownership in HKBN Ltd (1310 HK) aiming at full control/takeover, while navigating regulatory approvals and competitive bids.

- The stock suffered a pretty big drop in the last 2 weeks, especially last week, when it reached 85.1. This week the stock started a small recovery rally.

- Our model finds China Mobile oversold (short-term) but we cannot rule out a further drop to/below 83.2 (Q3 support), the current pattern is bearish: brief rally then down again.

3. Samsung Electronics (005930 KS): Tactical Outlook and Profit Targets

- Samsung Electronics (005930 KS) has been in a downtrend for 4 weeks, but it was only mildly oversold (60% prob. of reversal last Friday, at the Close).

- After 4 weeks down, this week the stock re-started its rally, touching 71200 on Tuesday at the Close.

- This insight will try to define the short-term profit targets for this rally (spoiler: they are not far, at least from the TIME MODEL perspective…).

4. Mitsubishi Electric’s Nozomi Networks Acquisition, a Potential Catalyst

- Mitsubishi Electric’s $1 billion acquisition of Nozomi Networks is a strategic move to continue its transition from hardware manufacturing to a leading solutions provider in the expanding industrial cybersecurity market.

- This significant deal is expected to create growth and synergy by combining complementary strengths in operational technology (OT) security.

- The acquisition represents a major commitment to digital transformation, which is anticipated to have a positive impact on Mitsubishi Electric’s stock performance in the 5-10 year horizon.

5. Hang Seng Index (HSI) Profit Targets: Has The Rally Topped?

- The Hang Seng Index (HSI INDEX) has been rallying +37% since its plunge to 19260 on April 7th. It is +6% higher than its previous high in mid-March.

- The sentiment towards the index remains positive lately, and our model indicates the HSI is a bit overbought but could go higher.

- The HSI INDEX starts to be toppish around 26874 (75% prob. of reversal). Covering past that point is not a bad idea, especially if the index is up 3-4 weeks.

6. Hong Kong Single Stock Options Weekly (Sept 08 – 12): Alibaba Surge Helps Push HSI to Four-Year High

- HSI broke out to fresh four-year highs, driven by Alibaba’s surge, with broad-based gains and rising single stock option activity.

- Market breadth strengthened across both price action and single stock options flows.

- Spot-Up/Vol-Up dynamics defined the week, as sectors with strong gains also posted the largest implied vol increases.

7. Global Markets Tactical Outlook: WEEKLY Recap (Sep 8 – Sep 12)

- A synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, week September 1 – September 5. The MODEL’s SUPPORT/RESISTANCE data file is attached.

- OVERBOUGHT at the WEEKLY Close: Alphabet (GOOG US) , Taiwan Semiconductor (TSMC) (2330 TT) , Gold (GOLD COMDTY) , 10-Year US Treasuries (ZN Futures)

- OVERSOLD at the WEEKLY Close: NVIDIA Corp (NVDA US) , Samsung Electronics (005930 KS) , China Mobile (941 HK) , Softbank Group (9984 JP)

Receive this weekly newsletter keeping 45k+ investors in the loop

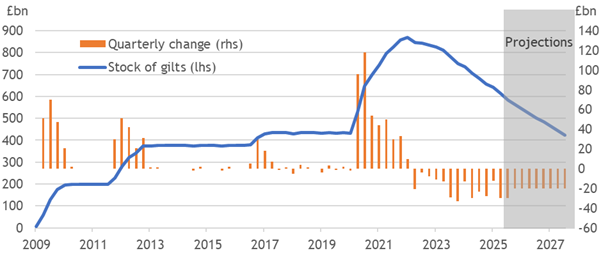

1. BoE QT: Pruning A Bad Policy

- The BoE’s annual Quantitative Tightening announcement in September should see it prune the targeted size, we expect by £20bn to £80bn, concentrated in the long-end.

- Fewer maturities in the year ahead would otherwise put too much pressure on active sales into a market that lacks appetite, especially with LDI demand disappearing.

- Pruning the size and duration delays costs crystallising by several billion a year, which the Chancellor will welcome, yet QT’s poor design remains an expensive fiscal disaster.

2. Fed: Politics Vs Fundamentals

- President Trump’s current preference for rate cuts is not unconditional. Higher-order logic suggests this would not override fundamental resilience or fairly prove “TACO”.

- Political pressure is state-dependent, with the messenger mattering more than the objective truth beneath any message. Trump’s Chair will have a stronger hand.

- Brazil suffered President Lula’s pressure, but he still supported his “Golden Boy’s” turn from dovish dissent to forceful rate hikes. Fed pricing ignores the potential for change.

3. France: Déjà Vu?

- Despite the near certainty that the Bayrou government will fall on 8 September, investors are wary, rather than spooked, reckoning that they have seen all this before.

- They are likely correct to judge that compromises will then be found, allowing the 2026 budget to be passed by a new centrist government.

- However, this would again only be putting off the day when a real crisis point is reached.

4. HEW: Crystalising Policy Divergence

- Spreads between ECB and Fed expectations widened again this week as the ECB held rates with a neutral bias while disappointing US labour market data drive dovish hopes.

- Underlying US services inflation was soft, and initial jobless claims spiked, albeit over Labor Day. We think US pricing has gone too far, and political pressure won’t dominate.

- Guidance with the Fed’s upcoming cut could start to correct that. The BoE will hold rates, after more hawkish macro news next week, and should trim its QT plan this year.

5. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (September 11)

- HSTECH index is showing increasing strength as Hong Kong continues it Secular Bull Market. Continued strong market breadth indicates both rotational buying and new investors entering the market.

- Southbound buying from mainland investors remains strong after the “Liberation Day announcement. Mainland investor volume is now 20% of total volume in the Hong Kong market.

- China Biotech and Drug sectors were hit as the U.S. administration indicated it may begin restricting import of Chinese-made drugs and to cut off the pipeline of Chinese-invented experimental drugs.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (September 10)

- The Hong Kong secular bull market continues to broaden and has broken all long term resistance levels. The HSCEI has beaten Asian and global peers over the last 18 months.

- Growth and Momentum factors have been the best performers in the HSCI year to date. The Materials and Healthcare sectors continue to show increasing strength in their relative returns.

- Cloud Village (9899 HK) had a breakout pattern from a continuation triangle after reporting a deal to stream Korean drama series to Chinese market. The company’s profits grew in 1H25.

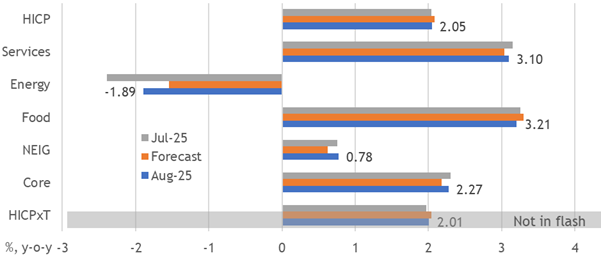

7. ECB: Balanced In The Good Place

- Staying in the ECB’s “good place” encouraged a neutral bias around its unanimous decision for no change, while being appropriately open to tackling future shocks.

- Staff inflation forecasts still undershoot the target, with recent upside news seemingly postponing passthrough rather than trimming the extent into something like our view.

- President Lagarde sounded relaxed about France’s spread widening, and the ECB did not discuss the TPI. We still expect no ECB easing against this, or further rate cuts.

8. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 12 September 2025

US producer prices softened in August, but structural factors keep inflation pressures elevated despite Fed rate cuts.

Labour market revisions show weaker US job growth, raising doubts on monthly payroll data reliability.

Japan’s GDP growth headline looks strong, but weak domestic demand and lower business spending reveal fragile fundamentals.

9. Seasonal Weakness Ahead?

- We are seeing fundamental headwinds in the form of elevated valuations and earnings uncertainty from tariffs, which won’t be visible until Q3 earnings season.

- On the other hand, the technical outlook appears relatively benign.

- Our base case calls for some choppiness ahead. We are near-term cautious, but not bearish.

10. Waller’s Gambit

- Fed Governor Chris Waller is a leading candidate to be the next Fed Chair, and the issue of Fed independence is paramount.

- Our evaluation of his economic case for rate cuts should be whether the decisions are based on sound data, theory and solid judgment.

- He has shown solid thinking on employment, but his justification for rate cuts based on the Fed’s inflation mandate is weaker and shows signs of wishful thinking.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Samsung’s Intel Gambit: A Signal of TSMC’s Widening Lead

- Samsung’s potential Intel stake highlights need for packaging know-how, not customers, and provides a hedge if its 2nm yields or production slip.

- TSMC extends lead with stable N3, on-track N2, AI packaging dominance, and customer migrations, while Samsung’s foundry share declines below 8%.

- Implications: Positive for TSMC (2330 TT), negative signal for Samsung (005930 KS), validating for Intel (INTC US) though regulatory and governance constraints remain important.

2. Nidec (6594 JP): Wait for Hard Numbers

- Nidec dropped 22% on Thursday following management’s decision to establish an independent committee to investigate accounting irregularities. It bounced back nearly 5% on Friday, but finished the week down 20%.

- In June, the Company received approval to postpone submitting its FY Mar-25 securities report until September 26. In July, it released incomplete 1Q results while postponing full disclosure.

- Without correct numbers, we can only guess at the full impact of the accounting irregularities and their effect on management.

3. Intel (INTC.US): Qualcomm CEO Has Publicly Stated that Intel’s Technology Is Still Not Competitive.

- Intel Corp (INTC US) has not given up on Intel Foundry Service (IFS), even though it currently lacks any sizable clients.

- We are puzzled as to why Intel former CEO Pat Gelsinger insisted on entering the foundry market, which has so far weakened Intel’s financials without generating meaningful returns.

- Qualcomm Inc (QCOM US) CEO has publicly stated that Intel’s manufacturing technology is still not competitive.

4. Taiwan Dual-Listings Monitor: TSMC Premium at Historically Extreme Level; ASE Bounces Off Parity

- TSMC: 26.2% Premium; Historically Extreme Level to Open Fresh Short of the Spread

- UMC: +1.0% Premium: Wait for More Extreme Level Before Going Long or Short

- ASE: +2.7% Premium; Open Fresh Longs of ADR Spread Closer to Parity

Receive this weekly newsletter keeping 45k+ investors in the loop

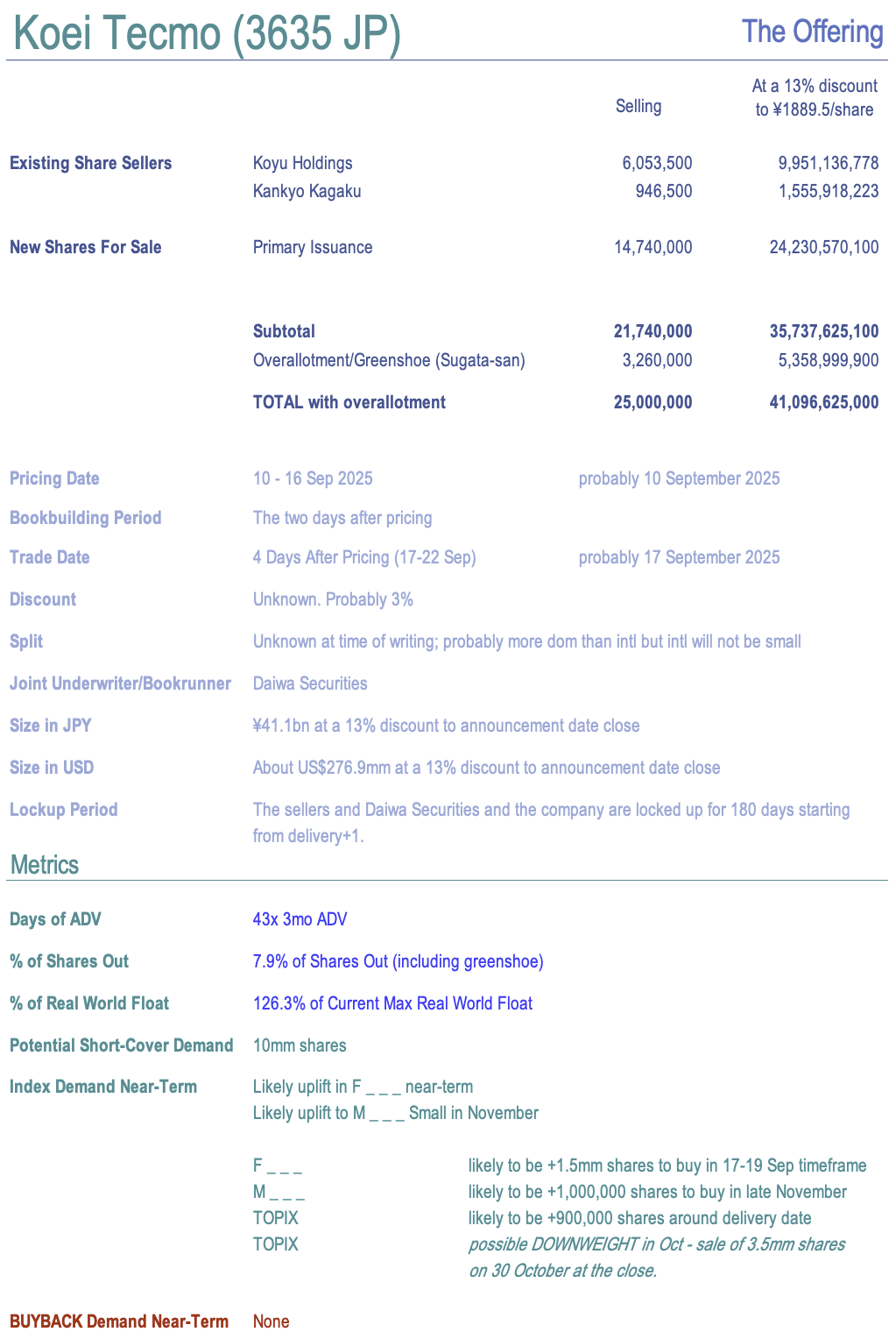

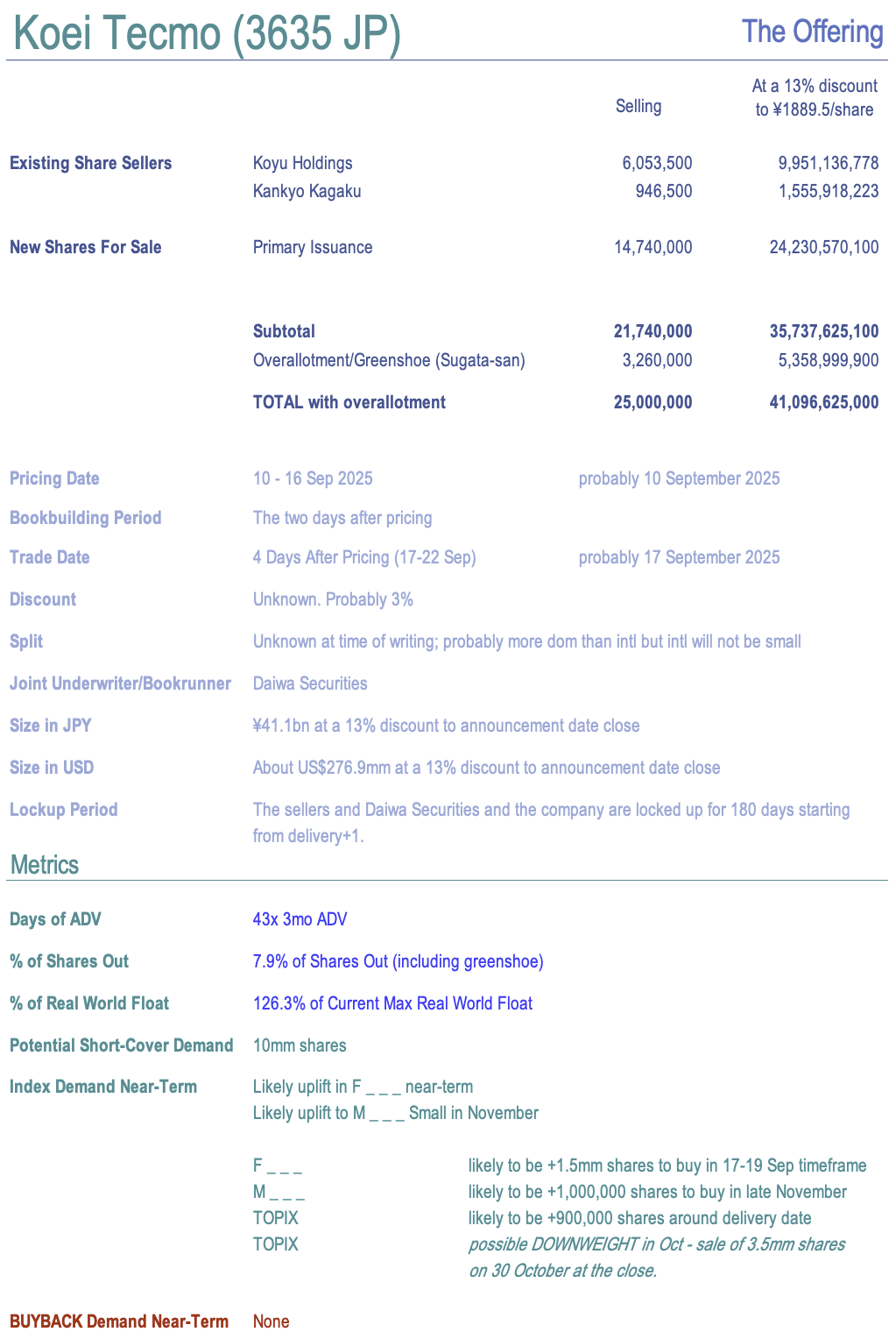

1. [Japan ECM] Koei Tecmo (3635 JP) Needs to Sell Shares To Stay in Prime ($280mm Offering)

- In December 2021, Koei Tecmo Holdings (3635 JP) announced a complex but lower-impact move to increase float share count in order to stay listed on TSE Prime.

- Scheme: buyback from two holders plus CB issuance. Unfortunately, shares did not rise enough to convert the CBs so as of March 2025, the tradable share criteria was not met.

- So now the two main holders are selling more shares and the company is diluting holders with new issuance to get float/tradable shares up with a US$280mm offering.

2. [Japan ECM] Lifedrink (2585) – Fast-Growing Beverage Seller Meets P.E. Firm Selldown

- Today post-close, Lifedrink (2585 JP) announced the Sunrise PE funds which own 22% of the company will sell their stake in a clean-up offering with pricing in 8 days.

- This offering comes 8 trading days after a new post-earnings all-time-high. At 24x ADV, the offering will increase Max Real World Float by 50+%.

- There are some index and buyback supply/demand dynamics to note. It’s a heavy offering, so bullish/bearish may be a matter of horizon.

3. Metaplanet Placement: A Look at Other Treasury Play Issuances and Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.8 days of the stock’s three month ADV, despite being 22.8% of total shares outstanding.

- In this note, we look at Metaplanet and its peers.

4. Shandong Gold Mining Placement – H-Share Running Ahead of A-Shares

- Shandong Gold Mining (1787 HK) aims to raise around US$500m via a primary placement, in order to pay down debt.

- The H-shares are now trading at all-time highs and have been performing better than the A-shares this year.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

5. Hesai Secondary HK Offering – Stock Has Been Recovering, a Look at Possible Trading Setup

- Hesai Group (HSAI US) plans to raise around US$200-300m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 31st August 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

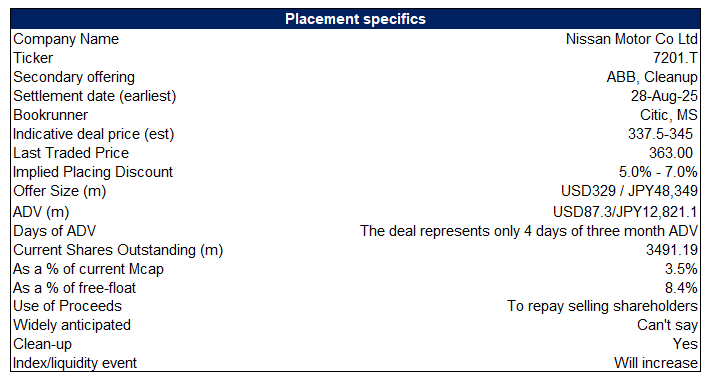

6. ECM Weekly (1 September 2025)- Nissan, Metaplanet, Indigo, Laopu, Akeso, Mixue, Aux, Orion, Chery

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of company’s appear to be lining up to launch their IPOs in the coming month.

- On the placements front, there were a number of large deals across the region.

7. Koei Tecmo Placement: Some Non-Fundamental Selling; but Weak Fundamentals

- Koei Tecmo Holdings (3635 JP) is looking to raise around US$270m from a primary and secondary placement.

- The deal is a large one to digest, representing 37.6 days of the stock’s three month ADV and 6.1% of the shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Simcere Pharma Placement – First Primary Raising, past Deals Have Been Mixed

- Simcere Pharmaceutical Group (2096 HK) is looking to raise around US$200m via a top-up placement.

- This is the first primary raising by the company since its listing. There have been a few secondary deals, with mixed results.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

9. Hesai Group H Share Listing: The Investment Case

- Hesai Group (HSAI US), a global leader in LiDAR solutions, is seeking to raise US$300 million through an H Share listing.

- On 9 February 2023, Hesai listed on the Nasdaq, raising US$190 million at US$19.00 per ADS.

- The investment case is based on a solid competitive positioning, high growth, emerging profitability, declining cash burn, and a reasonable valuation.

10. Orion Breweries IPO – Smaller Scale Warrants Discount

- Orion Breweries Limited’s (409A JT) operations span across alcoholic beverages, tourism and hotel businesses, aiming to raise ~US$126m in its Japan IPO via a mix of primary and secondary offerings.

- Orion Breweries (OBL) has a strong Okinawa market position. Share of overseas sales has been growing (~23% of FY25 revenues), while profitability has also largely been steady.

- In our previous note, we looked at the firm’s past performance. In this note, we talk about the peer comparison and IPO valuations.

Receive this weekly newsletter keeping 45k+ investors in the loop

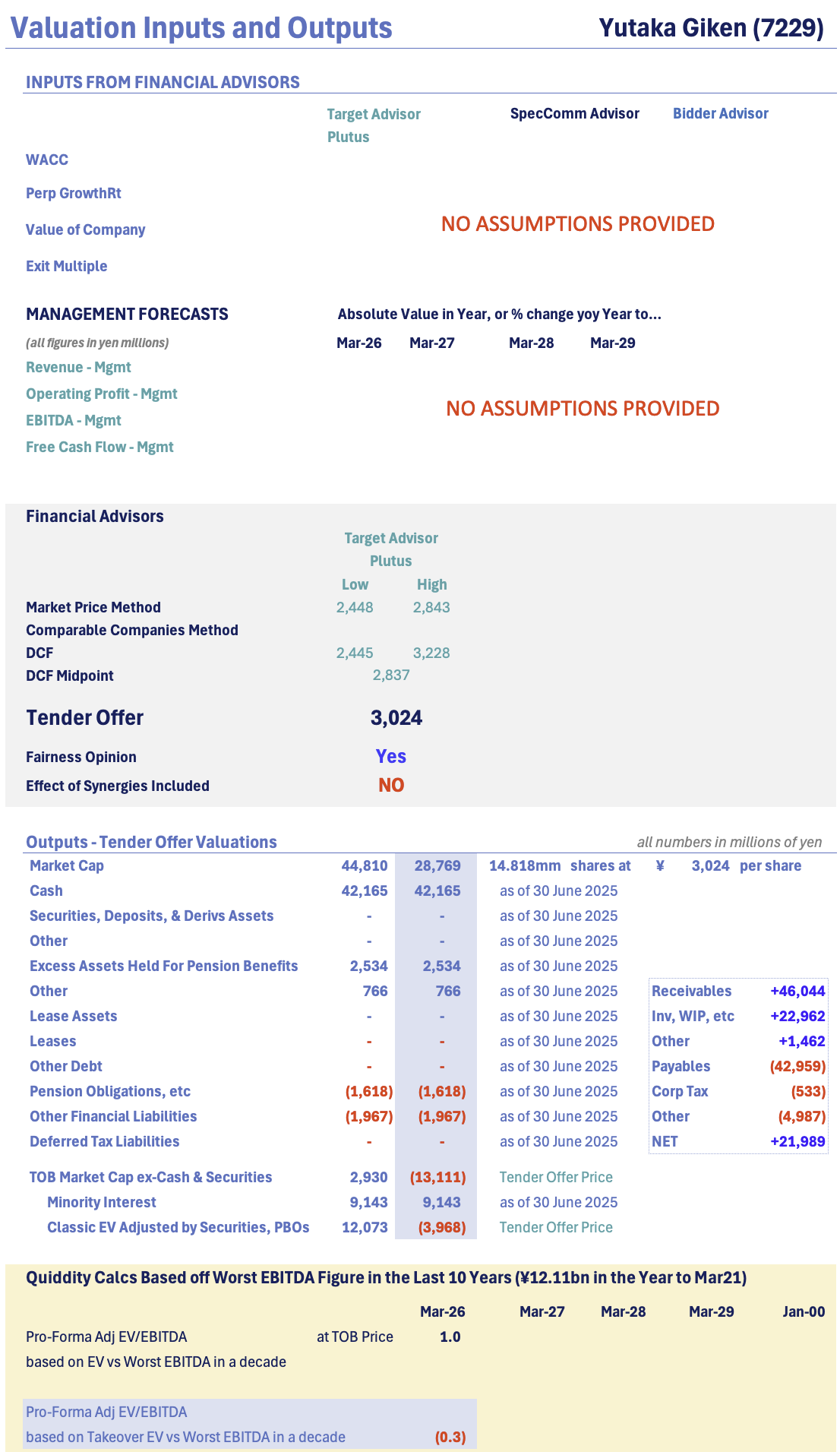

1. [Japan M&A] Yutaka Giken (7229 JP) TOB – Possibly the Most Offensively Low TOB Price I’ve Ever Seen

- Honda Motor (7267 JP) and Samvardhana Motherson International Ltd (MOTHERSO IN) have arranged to buy Honda’s 69.7%-owned subsidiary Yutaka Giken (7229 JP) in a Tender Offer.

- The transaction structure means Motherson buys Yutaka for less than net cash but even assuming Motherson pay minority TOB price for everything, TOB ex-net cash = 0.05x PBR, <1x EBITDA.

- But they are paying less. They are paying ¥12.4bn less than net cash, and getting the other ¥58bn of net assets (¥23bn inventory, the rest in hard assets) for free.

2. Holdco NAV Discount Compression Play on Korea’s Next Policy Narrative: Mandatory Tender Offers

- Korean equities are stalled; macro catalysts are absent. Street focus shifts from treasury share cancellations to next year’s mandatory tender offers, now seen as the top policy driver.

- Pre-MTO trades focus on holding companies with wide NAV discounts or low controlling stakes, front-running policy-driven re-ratings before minority shareholders capture control premiums.

- Focus on 32 Korean holding companies >KRW 500B; those with wide NAV discounts and lighter controlling stakes—SK’s holding companies, Samsung C&T, Hanwha, LG, LS—are prime re-rating plays.

3. ZEEKR (ZK US): Widening Scrip Spread Ahead Of Geely EGM Vote

- On the 15th July, Geely Auto (175 HK), China’s second-largest carmaker, firmed a cash or scrip Offer for 62.8%-held ZEEKR (ZK US), a premium Chinese electric vehicle manufacturer

- ZEEKR has traded through the cash terms US$26.87/ADS from the onset; but at a discount to the scrip terms. The scrip spread has widened recently.

- The Offer is low-balled. However, Geely’s stake plus Li Shufu (founder)’s 10.61% holdings push the Offer through. Geely’s EGM is this Friday (7th July). Li (41.34%) is required to abstain.

4. Merger Arb Mondays (01 Sep) – Dongfeng, ENN, Joy City, Kangji, Mayne, Santos, Shibaura, CareNet

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ashimori Industry (3526 JP), Carenet Inc (2150 JP), Ainsworth Game Technology (AGI AU).

5. HKBN (1310 HK): Mobile’s Offer Is Done. Now For The Back End

- China Mobile (941 HK)‘s Offer for HKBN Ltd (1310 HK) will be declared unconditional tomorrow (3rd September), the first closing date.

- As I type, 19.03% of shares out have tendered, lifting Mobile’s stake to 48.9%. Additional shares will tip in today and tomorrow, as per your typical last minute flurry.

- It is not Mobile’s intention to delist HKBN. There will be investors playing the backend on the expectation of a higher Offer down the track.

6. HKBN (1310 HK): On the Cusp of Being Declared Unconditional

- HKBN Ltd (1310 HK)’s offer from China Mobile (941 HK) is HK$5.075 with a 50% minimum acceptance condition. The first closing date is September 3.

- Based on CCASS data, including acceptances, China Mobile’s shareholding was 48.93% of outstanding shares as of September 1.

- Therefore, the offer should be declared unconditional by the first closing date. At the last close and for a September 12 payment, the gross/annualised spread is 0.5%/15.7%.

7. Pacific Industrial (7250 JP): Effissimo Rears Its Head

- Effissimo reported a 5.87% ownership ratio in Pacific Industrial (7250 JP). The average buy-in price of JPY2,235.91 per share is 9.1% above the JPY2,050 MBO offer.

- Effissimo buying significantly above terms is justifiable as the offer implied a P/B of 0.71x. Effissimo is agitating for either a bump or an opportunity to participate in the back-end.

- With the offer closing on 8 September and shares trading 16.9% above terms, the Ogawas have little choice but to revise terms.

8. Alipay: Issuing EB Worth 627 Billion Won Backed By Its Shares in Kakao Pay [A Quasi Block Deal Sale]

- Alipay (second largest shareholder of Kakaopay (377300 KS)) is issuing an overseas exchangeable bonds (EB) worth 627 billion won (backed by its shares in Kakao Pay).

- The exchange price of the EB is 54,744 won (4.5% discount to current price). Total amount of EB issue is 627 billion won ($450 million).

- This deal is basically a quasi-block deal. Alipay is trying to unload some of its stake in Kakao Pay to improve its finances.

9. Ashimori Industry (3526 JP): Murakami Outlines His Case

- Takateru Murakami, Yoshiaki Murakami’s son, has increased his Ashimori Industry (3526 JP) to an 18.36% ownership ratio at an average buy-in price of JPY4,154.28 vs. the JPY4,140 tender offer.

- Crucially, in today’s disclosure, Takateru Murakami outlines the rationale for his stake building, which centres on the book value being materially understated if certain land were revalued at market rates.

- Maintaining current terms is increasingly not a viable option. Toyoda Gosei (7282 JP) is likely to pursue a strategy of either increasing its offer or lowering the minimum acceptance condition.

10. Curator’s Cut: Arbs Go A-H, Copper Plays & China’s Property Pulse

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ Insights published over the past two weeks on Smartkarma

- In this cut, we explore A-H share trading dynamics, consider copper market dynamics and plays, and China’s bottoming/stabilizing real estate market

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

Receive this weekly newsletter keeping 45k+ investors in the loop

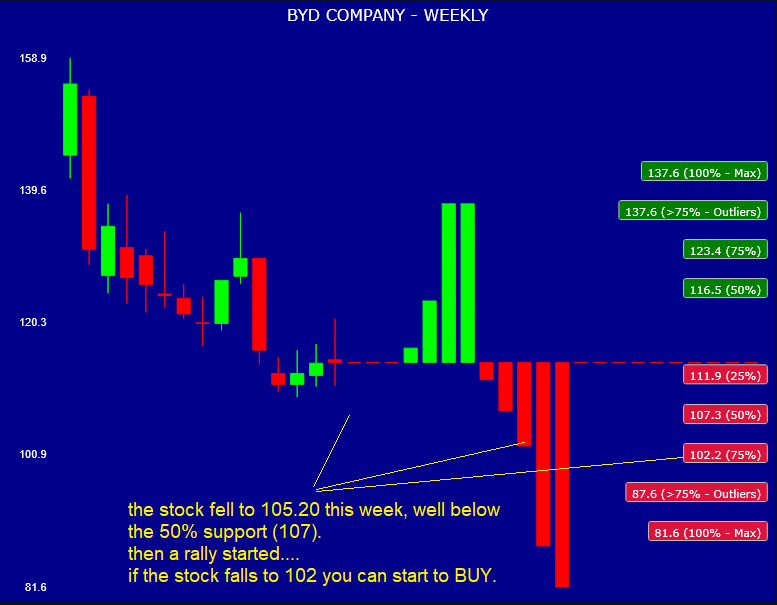

1. BYD (1211 HK) Tactical Outlook: Maybe Soon Is Time to BUY…

- In our previous insight we correctly forecasted a short-lived, 2-3 weeks relief rally for BYD (1211 HK) , followed by a new downtrend (started this week).

- The stock went into OVERSOLD territory according to our model, this week. It’s however a bit early to BUY, the stock could fall more.

- If BYD reaches 102 next week, or the following week, that would be a very good place to BUY. A catalyst could bring the stock back to 140-150.

2. Index Changes and Rate Cuts: Key Events in September 2025

- September brings heavy index rebalancing activity. Pop Mart (9992 HK) will join both the Hang Seng Index (HSI INDEX) and the Hang Seng China Enterprises Index (HSCEI INDEX).

- The Fed is widely expected to cut rates and Asia-Pac peers (BoJ, RBA, RBI) are also meeting.

- Why Read: Plan ahead and take into account known market events when making investment and trading decision.

3. Cheap Vs. Rich Volatility: What Cones Reveal in Tencent, HSBC, Meituan & More

- Context: Volatility cones provide a clear framework to evaluate whether options are trading cheap or rich.

- Highlights:Tencent (700 HK), HSBC (5 HK),Meituan (3690 HK), Ping An (2318 HK), and JD.com (9618 HK) all display historically cheap implied volatility. Read on for trade suggestions.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

4. GOLD Outlook: Still a Good Time to BUY? Or Too Late?

- Gold (GOLD COMDTY) has been flat since April but started to take off after mid-August.

- Question: from a purely tactical perspective, is it still a good time to buy Gold? The precious metal is massively overbought at the moment, according to our model.

- Our tactical forecast: Gold (GOLD COMDTY)could go a bit higher, but it is so overbought that the short-term upside is probably limited.

5. Alibaba (9988 HK): Stock Surges Post-Earnings, Options Market Reprices

- Context:Alibaba (9988 HK) reported Q1 results on 29 Aug. Despite a revenue miss, strong cloud growth and its AI chip announcement drove the stock up double digits.

- Highlight: Implied volatility deflated sharply post-earnings, with the September contract down 8.5% and back months also lower, while skew shifted down in parallel.

- Why it matters: Put the current volatility surface into context. This insight can serve as a case study of how earnings-driven repricing can inform positioning ahead of future events.

6. Global Macro Outlook (September): Cheap Vols Meet Seasonal Weakness Across Key Assets

- Macro assets reveal shifting volatility landscapes, with inexpensive implied vols, seasonal headwinds, and notable divergences across key markets.

- Seasonal pressures are turning negative, with September historically weaker, while risk-reward spreads highlight CSI300 strength and SPASX200 vulnerability.

- Implied vols remain inexpensive across most assets, with NKY, Nifty, and SPASX200 near historic lows despite shifting market dynamics.

7. Hong Kong Single Stock Options Weekly (Sep 01–05): Option Activity Eases, Speculation In Focus

- Market breadth remained weak as option activity slowed and speculation concerns lingered around speculative trading.

- Option demand cooled, led by waning interest in Calls, while heavyweights in Consumer Discretionary kept overall volumes supported.

- Trading momentum slowed, but sector heavyweights maintained dominance, with implied vols drifting lower across much of the market.

8. S&P/ASX 200 Tactical Outlook Ahead of Sep-25 Rebalance

- In our latest ASX200 insight, posted on Aug 22nd, we wrote: “The index could rally one more week (next week), that should be the end of this rally“.

- The rally ended last week, as predicted: the S&P/ASX 200 (AS51 INDEX) is falling this week, it has already reached OVERSOLD support levels according to our model.

- Attached you can find an Excel file with all the data (key supp/res level with probabilities, check row # 12), our new forecast in detailed in the insight.

9. Global Markets Tactical Outlook WEEKLY: September 1 – September 5

- A quick synoptic look at the tactical setups for the indices, stocks, commodities and bonds we cover, week September 1 – September 5. The MODEL SUPPORT/RESISTANCE data file is attached.

- OVERBOUGHT at the WEEKLY Close: Alphabet (GOOG US) , BYD (1211 HK) , S&P/ASX 200 , CSI 300 Index (SHSZ300) , Gold (GOLD COMDTY)

- OVERSOLD at the WEEKLY Close: Meta (META US) , Nasdaq-100 , NVIDIA Corp (NVDA US) , Fast Retailing (9983 JP)

Receive this weekly newsletter keeping 45k+ investors in the loop

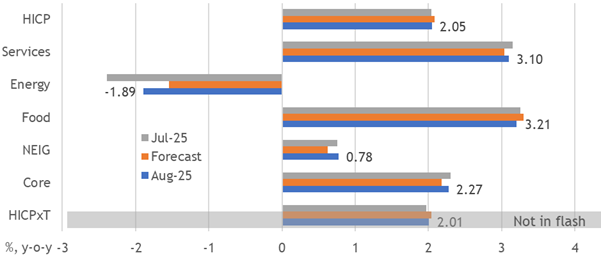

1. EA: Defying Disinflationary Narratives

- Dovish hopes for EA disinflation continue to be disappointed by resilient outcomes. The rise to 2.1% in August amid sticky core pressures is opposite to the dovish narrative.

- Euro appreciation’s disinflationary shock is being offset by domestic resilience, which was most surprising in Northern Europe. Our errors were relatively small and balanced.

- Ongoing upside surprises have defied recent consensus expectations of a drift down to 1.8%. The ECB faces broad upside news that should reassure it against cutting again.

2. Cutting After Pauses

- The BoE and Fed rarely resume cutting cycles after a pause, yet the Fed seems set to break its hold with a cut just as the BoE and ECB enter their own pauses.

- 2002-03 is the best historical parallel for the Fed, which signals potential cuts should be shallow and are likely to be reversed. Politics is no match for the fundamental need.

- Persistently excessive UK pressures should prevent the BoE from cutting in November or beyond, with a quarterly pause historically unlikely to resolve in another rate cut.

3. HEW: Pauses On And Off

- Another disappointing payroll release provides the fundamental cover needed for the Fed to end its pause with a rate cut on 17 September without being too political.

- The BoE is starting its own pause, and if it goes a quarter without cutting, historically, it’s not resumed the cycle. Its DMP survey confirmed inflation’s persistent problem.

- Another upside inflation surprise seems set to keep the ECB on hold amid record low unemployment. We also expect it to preserve its view that policy is in a good place.

4. Liz Truss on the ‘Doom Loop’ Engulfing the UK Economy

- Legacy systems can’t handle usage-based billing, slowing down product launches

- Metronome allows for quick roll out of new pricing models in minutes

- Guest interview with Liz Truss discussing economic challenges and the need for policy shifts

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. BoE Survey Says Inflation Persists

- CFOs are telling the BoE that they plan to keep raising prices by more than 3% in 2026. The BoE should take notice, as this survey’s previous warnings have proven accurate.

- Expected increases reflect the passthrough of further wage increases beyond a pace consistent with the target. They exceed even our already hawkish forecasts.

- The BoE is unlikely to realise the sharp drop in wage growth it expects by year’s end, without a shock to break the current regime, bolstering our call for no more rate cuts.

6. HEM: Politicised Policy Pricing

- Persistent inflationary pressures pared dovish guidance and pricing for the BoE and ECB, but Fed pricing is stuck.

- Blocking a rare resumption of Fed easing looks unlikely, but history suggests cuts would be shallow and reversed.

- Peer pressure is weak during a policy mistake. The BoE faces domestic problems that prevent further easing.

7. HONG KONG ALPHA PORTFOLIO (August 2025)

- Hong Kong Alpha portfolio gained 11.34% in October outperforming its benchmark and HK indexes. The portfolio’s Sharpe ratio increased to 2.91 and the beta and correlation to its benchmark decreased.

- The Hong Kong Alpha portfolio is generating significant alpha (idiosyncratic) returns since launch, with 40% of returns represented by superior stock selection, with the remaining due to sector weighting.

- At the end of August, we bought Luk Fook Holdings Intl (590 HK) for the portfolio as retail demand for gold products in mainland China increases.

8. 182: Private Credit: Hype, Hazard, or the Next Big Thing in Long-Term Growth? With Huw Van Steeni…

- Private assets, gold, and real estate are recommended for investment to recreate what our parents had financially

- Private credit is reshaping wealth portfolios, with a shift towards insurance companies funding the majority of assets in private credit

- The role of private credit has grown significantly post-financial crisis, with a focus on higher quality, lower risk assets and loans to hard assets such as infrastructure.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Everything is a bit Brown

- We often talk of people wanting things to be Black and White and being disconcerted when they realise that they are in fact always Grey, but we would extend that metaphor to the full colour spectrum.

- We want things to be clear and bright and in vivid colour, but in fact everything is, well, basically a bit brown, the colour you get when all the other paints are mixed together and thus, to us at least, it represents the current and pervading sense of muddle and confusion.

- Politically, we see Red socialists embracing Green issues as their central policy, while Greens are pursuing Red Marxism (the author James Delingpole wrote a great book about this called ‘Watermelons’ as in Green on the outside, Red on the inside. But we would just merge the two colours and get brown.)

10. We Know More Than We Can Say Precisely

- The current and expected deterioration of the underlying fiscal trend is troubling

- But the empirical and theoretical relationships between fiscal variables and longer-term interest rates are complex

- My decomposition of longer-term rates and econometric estimates can potentially add to the available research on this

Entity | Insights | Analytics | News | Discussion | Filings | Reports |

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC Premium Spike Opportunity; ASE Hard Bounce to Prem from Discount

- TSMC: +25.6% Premium: Latest Spike is Opportunity to Short the ADR Spread

- UMC: +2.0% Premium; Near Level to Go Short the ADR Spread

- ASE: +5.1% Premium; Good Level to Take Profits on Previous Long Since Parity

2. Intel (INTC.US): Intel–U.S. Government Equity Deal: Implications and Industry Perspective

- Intel has reached an agreement with the U.S. government, under which Washington will invest $8.9bn for a 9.9% equity stake in the company.

- Intel benefits from the optics of government backing, which could help sentiment and prevent downside pressure on the stock in the short term, i.e. near-term optics positive, fundamentals unchanged.

- TSMC’s Japan and Germany fabs were structured through co-investments and partnerships, with equity involvement only when tied to technology access (e.g., Sony CMOS JV).

3. Taiwan Teck Weekly: Apple Snags Over Half of TSMC’s Best Chips; Long-Reasoning AI Will Surge Compute

- Apple Secures Over Half of TSMC’s Cutting-Edge 2nm Capacity; How TSMC Anchors Apple’s Product Leadership Strategy

- NVIDIA Results Key Take-Away: Long-Reasoning AI Models Driving Massive Compute Demand

- Intel (INTC.US): Intel–U.S. Government Equity Deal: Implications and Industry Perspective

4. Taiwan Dual-Listings Monitor: TSMC Premium Remains Elevated; ASE Drops Down to Near Parity

- TSMC: +21.8% Premium; Wait for Higher Premium Before Fresh Short of the Spread

- UMC: -0.6% Discount; Wait for More Extreme ADR Spread Level

- ASE: +0.4% Premium; Good Level to Go Long the ADR Spread

5. Silergy (6415.TT): 3Q25 Revenue Flat to Slightly Up QoQ; Annual Growth May Fall Short of 20%+.

- 3Q25: Revenue flat to slightly up QoQ; GM stable at 52–54%. FY25: Prior 20%+ growth target unlikely to be achieved; weaker demand due to trade war & customer conservatism.

- No evidence of significant market share loss; instead, delayed demand.

- Automotive Ssegment continues to trend upward with new EV-related products. Competition in China is intense, especially EVs, but pricing remains rational.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nissan Motor Placement – Discount Is Enticing but Track Record and Momentum Aren’t Great

- Mercedes-Benz Pension Trust aims to raise around US$330m via selling its 3.8% stake in Nissan Motor (7201 JP).

- The discount seems enticing, however, the company’s recent share performance and longer term track record aren’t great.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Akeso Inc Placement – Another Opportunistic Raise, Mixed past Deal but Is Relatively Small

- Akeso Biopharma Inc (9926 HK) is looking to raise around US$460m from a mix of primary placement and selldown by its founders.

- Past deals in the name have been mixed, but the shares have been doing well and the deal size remains small.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

3. Laopu Gold Placement – Relatively Small Deal, past One Did Well

- What seems to be the controlling shareholder of Laopu Gold (6181 HK), aims to raise around US$250m via selling 1.6% of the company.

- The shares have done very well since its listing and the previous deal in the name did well too.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

4. Metaplanet Placement: US$1bn Punt; Dependent on Bitcoin Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.4 days of the stock’s three month ADV, despite being 23.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. MIXUE IPO Lockup – US$480m Cornerstone Lockup Release

- Mixue Group (2097 HK) raised around US$450m in its Hong Kong IPO in March 2025. The lockup on its cornerstone investors is set to expire soon.

- MIXUE Group (MIXUE) is a freshly-made drinks company providing affordable products to consumers, including freshly-made fruit drinks, tea, ice cream and coffee, typically priced at around one USD per item.

- In this note, we will talk about the lockup dynamics and possible placement.

6. Aux Electric IPO: Smallest Player but Superior Growth and Margins

- Aux Electric (2580 HK) is looking to raise up to US$460m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Aux Electric IPO (2580 HK): Valuation Insights

- Aux Electric (2580 HK) is the fifth-largest air conditioner provider globally as measured by volume. It has launched an HKEx IPO to raise up to US$462 million.

- I discussed the investment case in Aux Electric IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive.

8. Ganfeng Lithium Group Co Placement – Past Deals Record Isn’t Great but Deal Is Small

- Ganfeng Lithium (1772 HK) is looking to raise upto US$152m via a primary placement of 40m shares. There is also a concurrent CB offering for ~HKD1.3bn along with the placement.

- The company intends to use the proceeds towards repayment of loans, capacity expansion and construction, replenishment of working capital and other general corporate purposes.

- In this note, we will talk about the placement and run the deal through our ECM framework.

9. Robotis – Rights Offering of 100 Billion Won

- On 28 August, Robotis (108490 KS) announced a rights offering capital increase of 100 billion won.

- Rights offering plan is to allocate 1,349,528 new shares (10% of outstanding shares) to existing shareholders, and then conduct a public offering for general investors once forfeited shares are issued.

- The expected rights offering price is 74,100 won per share (12.8% lower than current price). We are Negative on this rights offering.

10. Interglobe Aviation (Indigo) Placement – Second US$800m+ Deal by Co-Founder This Year

- InterGlobe Aviation Ltd (INDIGO IN) co-founder, Rakesh Gangwal, aims to raise around US$802m via selling around a 3% stake in Indigo.

- He had earlier stated his intention to pare down his stake after a long drawn, and very public battle, with his co-founder Rahul Bhatia. He has sold many times before.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.