Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Tech Weekly: TSMC’s Expansion Visualized; Implications of New U.S. Investment; New HBM Memory

- TSMC’s Latest Global Expansion Plans, Visualized; Taiwan Manufacturing Will Continue to Remain One Generation Ahead of Overseas

- TSMC (2330.TT; TSM.US): Invest Further in US up to 100bn; Intel Foundry Service Gets Direct Clients.

- Memory Monitor: Nanya Tech Soared on DRAM Recovery and Custom HBM News

2. Former CEO Claims Intel Is Back & Says Can We Please Stop Talking About Breaking It Up?

- On March 1, ex Intel CEO Craig Barrett posted a rebuttal of his former board members opinion piece on the subject of the company’s future

- He claims that Intel is back, the company must not be broken up, the board should be fired and Mr. Gelsinger should be rehired to finish the job he started

- Meanwhile, Intel has put its Ohio fab on hold until the end of the decade, its German fab on hold for two years, both damning indictments of Mr Gelsinger’s strategy

3. Taiwan Dual-Listings Monitor: TSMC’s Range Declining; ASE Near Parity; ChipMOS Rare Discount

- TSMC: +18.5% Premium; Wait for Lower Premium Before Going Long

- ASE: +0.2% Premium; Near-Parity Premium is Opportunity to Long the Spread

- ChipMOS: -3% Discount; Rare Discount is Opportunity to Long the Spread

4. TSMC To Invest A Further $100 Billion In Arizona

- TSMC plans to invest $100 billion in the US to build three new fabs, two new advanced packaging facilities and establish an R&D centre, all in Arizona

- During the press conference at the White House, Mr Wei received fulsome praise from President Trump and was careful to thank him for his vision and support on multiple occasions

- The announcement lacked key details such as construction timelines and which process technologies would be deployed but it would still appear to have done the trick, at least for now.

5. TSMC Addresses U.S. Expansion Concerns: Strengthens TSMC Position & Positive for Semi Industry Capex

- TSMC just held a press conference this evening in Taiwan regarding its expanded U.S. investment plans. TSMC said it won’t impact Taiwan investments; it is actually accelerating its Taiwan investments.

- Additionally, we see TSMC’s aggressive U.S. expansion significantly weakening Intel’s ability to compete, as it removes one of Intel’s major differentiators–domestic U.S. production.

- Maintain Structural Long rating on TSMC — Expanded U.S. investment fortifies the company’s global leadership. ALSO — Positive news for semiconductor manufacturing equipment companies internationally and in Taiwan. ASML, etc.

6. TSMC (2330.TT; TSM.US): Invest Further in US up to 100bn; Intel Foundry Service Gets Direct Clients.

- On March 4th, Taiwan Semiconductor (TSMC) – ADR (TSM US) announced that the company will further increase its investment up to $100 billion in the US.

- The restructured case of Intel Corp (INTC US) has elicited different opinions, but a few companies may consider trying out Intel Foundry Service.

- Currently, we find these developments acceptable, although we view them as the result of political interference, and time will tell.

7. TSMC (2330.TT; TSM.US): TSMC Held Press Conference Regarding Further Investment of USD$100bn in US.

- TSMC Chairman Dr. CC Wei pointed out that TSMC builds production lines everywhere to meet customers’ demands. TSMC has never gone against this principle.

- On the 3rd of March, U.S. President Trump and TSMC Chairman jointly announced at the White House that TSMC would reinvest at least $100 billion in the U.S.

- Regarding concerns from the public that TSMC might gradually shift its production focus to the U.S., TSMC made it clear that this would not happen.

8. SMIC (981.HK): Speculation About the Deepseek Rumor Does Imply Continued Creative Works in the World

- There is speculation about Deepseek’s wafer manufacturing yield issue at Semiconductor Manufacturing International Corp (SMIC) (981 HK) these days.

- The potential concern serves as a signal for a hot topic within the company, carrying two underlying meanings.

- Although NVIDIA Corp (NVDA US) is making waves in AI applications, we must not overlook the potential for continued creative developments in the world, such as Deepseek’s solution.

9. MWC Barcelona Showcased The 6G Showdown: MediaTek Vs. Qualcomm in the Race for Wireless Supremacy

- The Stakes in the 6G Race: 100x Data Speeds & AI-Driven Networks

- Qualcom’s Strategy vs. Mediatek’s Gameplan to Win the 6G Battle — Takeaways from MWC 2025 in Barcelona

- Investment Takeaways: MediaTek vs. Qualcomm — Maintain Structural Long for Mediatek but Qualcomm Could Offer Near-Term Relative Value Play

10. GlobalWafers (6488.TT): An Uncertainty Exists Whether Si Wafer Is Included in US Custom Tax or Not.

- Regarding global silicon wafer market prices, Globalwafers (6488 TT) noted that the Long-Term Agreement (LTA) for 12-inch wafers primarily focuses on advanced process nodes, with prices remaining stable.

- In December 2024, Globalwafers (6488 TT) signed a final agreement with the U.S. Department of Commerce, expecting to receive a maximum subsidy of USD$406mn.

- Globalwafers (6488 TT) has not received any notifications regarding adjustments to chip policies.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BYD US$5.2bn Placement – Large Only in Absolute Size, past Deals Have Done Well

- BYD (1211 HK) is looking to raise around US$5.2bn via selling 4% additional shares.

- The company has undertaken a few deals before and they have ended up performing well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Local Brokers Sound Off on 40% IPO Lock-Up—A Major Setup for Offshore Traders

- This 40% rule will distort bookbuilding, force down-pricing, choke float post-listing, and amplify volatility.

- Offshore investors like us benefit most—cheap IPO pricing with no lock-up. Local brokers see this as a giveaway to foreign funds and pushed back hard last Friday.

- FSS won’t budge—40% lock-up is happening. If issues arise post-implementation, they might adjust later.

3. Japan Post Bank US$4bn Deal Updates – Needs to Correct More. Discount Vs Deal Performance Analysis

- Japan Post Holdings (6178 JP) (JPH) aims to sell around US$4bn worth of Japan Post Bank (7182 JP) (JPB), trimming its stake to below 50%.

- JPH had last sold around US$9bn worth of JPB shares in Mar 2023. That deal had a similar structure and it didn’t end up performing well.

- We have looked at the deal dynamics in our previous notes. In this note, we talk about updates and look at discounts vs performance for past secondary deals.

4. JX Advance Metals IPO – Digestable, but Not Really Attractive

- JX Advanced Metals (5016 JP)’s parent, ENEOS Holdings (5020 JP), is looking to raise around US$2.5bn via selling more than half of its stake in JXAM in its Japan IPO.

- JXAM engages in business activities primarily focused on the development, manufacture and sale of materials made from copper and rare metals, which are used in the semiconductor and ICT fields.

- We have covered various aspects of the deal in our previous notes. In this note, we will talk about the IPO pricing.

5. JX Advanced Metals IPO Preview

- JX Advanced Metals (5016 JP) is seeking to raise about ¥460 billion in the upcoming IPO on the Tokyo Stock Exchange. The indicative IPO price is ¥862 per share.

- The final IPO pricing will be on 10 March. JX Advanced Metals will be listed on 19 March. Eneos is selling as many as 534.9 million shares in the IPO.

- The company has a strong customer base. It is a key supplier to TSMC, Samsung, Intel, SK Hynix, and Micron for sputtering targets and high-purity metals.

6. Japan Post Bank (7182 JP) – Not Cheap Enough Vs Others, or Holdings

- The Offering of Japan Post Bank (7182 JP) is not taking place the way “the right pattern” would suggest, but last time was kind of special. This time is different.

- Last time was a “second IPO” and coincided with a US regional bank crisis. This time the offering is smaller outright, and much smaller as a portion of float.

- Pricing is Monday. It hasn’t moved much vs JPH. It needs to move more to be attractive. And there is still a bit of overhang to come.

7. Japan Post Bank (7182 JP): The Current Playbook

- Since the offer announcement, Japan Post Bank (7182 JP)/JPB’s shares have declined by 2.5%. On 3 March, JPB completed the ToSTNeT-3 buyback by acquiring 13.3 million shares for JPY20 billion.

- To understand JPB’s trading pattern, it is instructive to examine its 2023 offering, Japan Post Insurance (7181 JP)/JPI’s 2019 offering, and Japan Post Holdings (6178 JP)/ JPH’s 2021 offering.

- JPB’s shares follow the trading pattern playbook of its 2023 and JPH’s 2021 offerings, in which investors buying the offer were rewarded with positive returns at the payment date.

8. Chifeng Jilong A/H Listing: Why Not Own International Peers Instead?

- Chifeng Jilong Gold Mining (600988 CH) , a gold mining company in China, is now looking to raise up to US$419m in its H-share listing in Hong Kong.

- It operates six gold mines in Asia and Africa and has been listed on the Shenzhen Stock Exchange since 2004.

- We have covered the company and deal background in our previous notes. In this note, we talk about the IPO pricing.

9. JX Advanced Metals IPO Valuation Analysis

- On 3 March, JX Advanced Metals (5016 JP) announced that the IPO will be offered at ¥810 to ¥820 per share (down from the initial indicative price of ¥862 per share).

- Our base case valuation per share is ¥863 which is 5.8% higher than the mid-point of the expected IPO price range of ¥810 to ¥820 per share.

- Given the lack of upside, we have a Negative view of this JX Advanced Metal IPO.

10. JX Advanced Metals (5016 JP) IPO: Price Range Is Fair

- JX Advanced Metals (5016 JP) has announced an IPO price range of JPY810-820 per share, which is 6.0%-4.9% below the IPO reference price range of JPY862.

- Relevant notes – JX Advanced Metals (5016 JP) IPO: The Bull Case, JX Advanced Metals (5016 JP) IPO: The Bear Case and JX Advanced Metals (5016 JP) IPO: Valuation Insights.

- My SoTP valuation of JPY860 is modestly above the IPO price range, suggesting that the price range is fair.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 7&I (3382) – A Starting Point for the Standalone Plan – The Good, The Bad, The Ugly

- Today, partway through the day, we got a Bloomberg article suggesting a large-scale buyback was to come. Post-close, we got the full details.

- “Seven & i Holdings Announces Plan to Unlock Shareholder Value Through Leadership Changes and Transformational Capital and Business Initiatives”.

- Sale of York. Management change. Update on Special Committee work with ACT. Commitment to return ¥2trln to shareholders via buybacks by FY2030. Higher divs. IPO of 7-Eleven Inc (US).

2. 7&I (3382) Possibility of YUUUUUGE Buyback?

- Last Thurs the MBO died. Tuesday an article said the ACT deal had died. Then 7&i denied that. Yesterday an article said Bain’s York Holdings deal would be approved today.

- That meant a Board meeting which would approve receipt of ~¥700bn of cash. What to do with it?

- Just now, Bloomberg says Seven & I Holdings (3382 JP)‘s board will consider a massive buyback. THAT is the capital allocation news my last piece suggested necessary. It’s HUGE.

3. Li Ka-Ching! Cheung Kong (1 HK) Offloads Panama Ports To Blackrock

- As part of a US$22.8bn transaction, BlackRock, Global Infrastructure Partners and Terminal Investment, have agreed to buy two contentious Panama ports from Li Ka-shing’s CK Hutchison (1 HK) (CKH).

- The transaction also includes an 80% stake in CKH’s ports subsidiaries, which operate 43 ports comprising 199 berths in 23 countries.

- CKH expects cash proceeds in excess of US$19bn. CKH’s current market cap was – at the time of deal – also ~US$19bn.

4. Toyota’s New Shareholder Benefit Program – Either a Bribe for Retail or Odd Advertising

- Today, Toyota Motor (7203 JP) announced a new Shareholder Benefit Program (株主優待 or kabunushiyutai). Often these programs are designed to give small unknown companies a way to build shareholder awareness/loyalty.

- Toyota, needless to say, is not a small, unknown company building awareness. So this is a bribe or inducement to own shares or get people to use higher value product.

- This is not a great look, and not great for shareholders. It smells of Toyota trying to buy votes as crossholders sell. But below we look at the math.

5. Seven & I Holdings (3382 JP): Shares Under Pressure as Rumours Swirl

- Seven & I Holdings (3382 JP) denied a Yomiuri article that the Board has decided not to accept an Alimentation Couche-Tard (ATD CN) bid in favour of the restructuring plan.

- Despite the Board’s assertions that it is still having constructive discussions with Couche-Tard, its actions suggest otherwise.

- Couche-Tard remains interested but faces increasing roadblocks. The valuation is undemanding but the news flow is unlikely to support a rerating in the near-term.

6. Japan Post Bank US$4bn Placement Updates-Performing Similar to Its Last. Past Large Deals Comparison

- Japan Post Holdings (6178 JP) (JPH) aims to sell around US$4bn worth of Japan Post Bank (7182 JP) (JPB), trimming its stake to below 50%.

- JPH had last sold around US$9bn worth of JPB shares in Mar 2023. That deal had a similar structure and it didn’t end up performing well.

- We have looked at the deal dynamics in our previous note. In this note, we talk about the updates since then.

7. A/H Premium Tracker (To 28 Feb 2025): AH Premia Continue to Fall; Expect Widening

- AH Premia continue to fall. Spread curve torsion reverses again with narrow premia trades seeing Hs perform the best.

- Warning signs are starting to flash on spreads. This week I have the biggest week of changes recommended that I have ever had. By a long ways.

- This week threatens to be a very strange week geopolitically. Being smaller in crowded trades is probably a good thing.

8. Biggest Gray Area in Korea’s Short-Selling Overhaul: What Should TRS Clients Do?

- If brokers let shorts exceed borrow, TRS end investors risk getting caught in the legal crossfire.

- Some TRS players are setting up short-book systems and reg numbers proactively, ensuring brokers share borrow data to stay ahead of any compliance risks.

- With most illegal shorts tied to TRS, and TRS dominating the market, the FSS will likely introduce TRS-specific rules rather than granting exemptions.

9. Seven & I Holdings (3382 JP): Board’s Plan to Unlock Value Is a Stop-Gap Measure

- The Seven & I Holdings (3382 JP) Board announced a plan to unlock and distribute significant value to shareholders.

- The initial excitement focused on the positives of leadership changes, US Assets IPO, a higher-than-expected valuation for the Superstore Business and a considerable buyback.

- The negatives of a long-dated buyback, inevitable rejection of the Couche-Tard offer, an uncertain US Assets IPO and ongoing HoldCo discount suggest the initial excitement will fizzle out.

10. OneConnect Financial (6638 HK/OCFT US): Ping An’s Fair NBIO

- Dual-Listed OneConnect Financial Technology (6638 HK/OCFT US), a digital retail banking/commercial banking/ digital insurance play, has announced a non-binding proposal from Ping An, OneConnect’s controlling shareholder with 32.12%.

- Ping An is offering, by way of a Scheme, HK$2.068/share, or US$7.98/ADS, a 72.33% premium to last close, and a 131.66% premium to the 30-day average. The price is final.

- What now? Back in OneConnect’s boards’ court whether to engage or not. Which they should. No competing Offer will emerge.

Receive this weekly newsletter keeping 45k+ investors in the loop

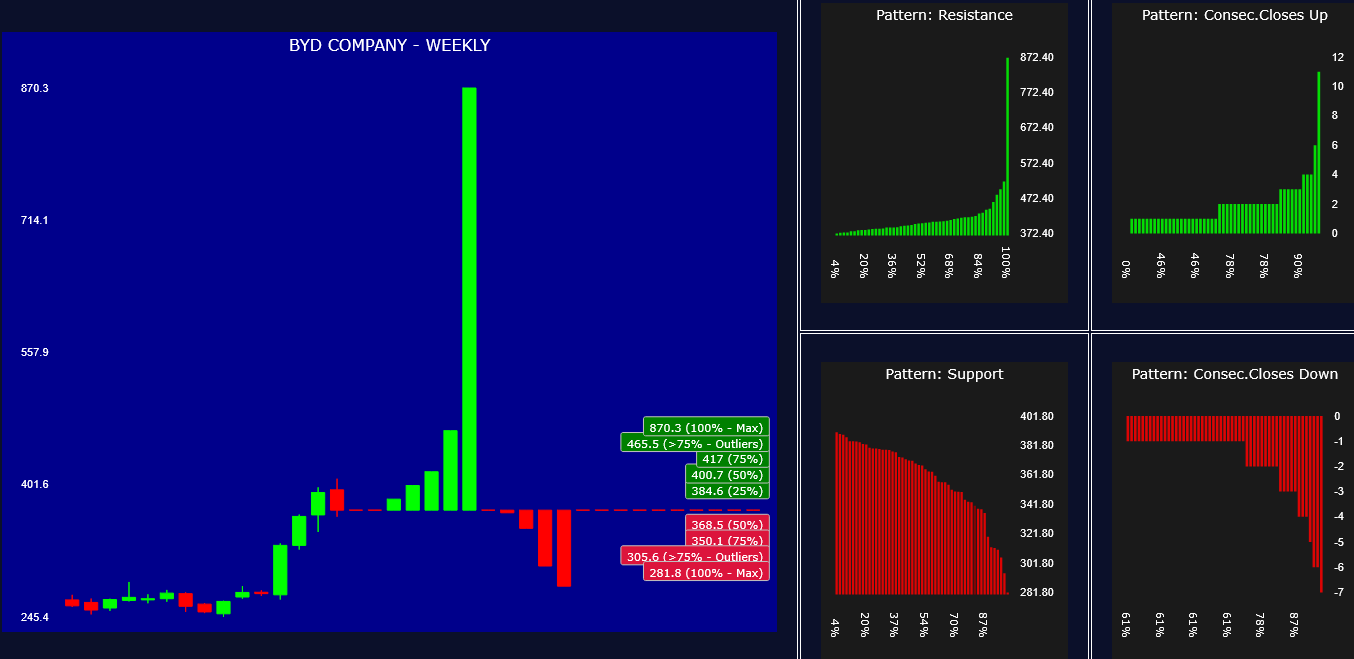

1. BYD (1211 HK) Placement: Tactical Buy Opportunity in Key Support Zone

- As recently written by Brian Freitas and Sumeet Singh , BYD (1211 HK) is placing new shares on the market at at a price range of HK$333-345/share.

- The stock today dropped to roughly 340 and it’s oversold WEEKLY according to our models. Buying here, at this price, should bear fruit in coming weeks. More details below.

- We cannot yet predict the profit targets because our model needs the WEEKLY Close for this week, to do that. We will update this information when it becomes available.

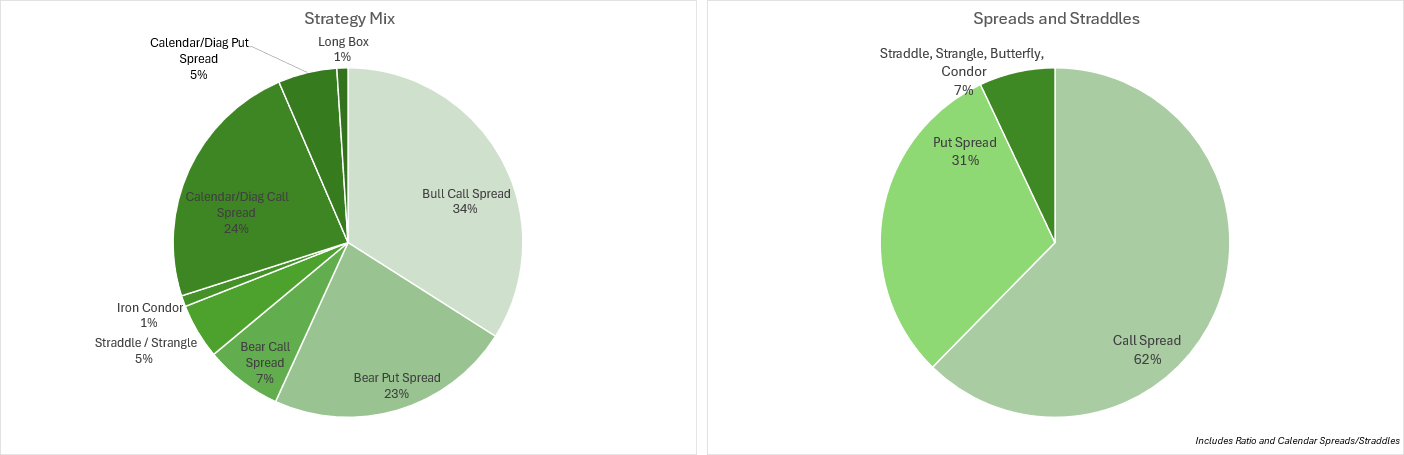

2. JD.com (9618 HK) FY Earnings on 6 March: Divergence Between Option-Implied And Historic Move

- JD.com (9618 HK) upcoming Q4 and Full Year 2024 results announcement on 6 March historically triggers significant stock volatility, with full-year announcements causing 12-14% price movements.

- Options market pricing implies a 9.4% post-announcement move (up or down), which is less than previous full-year announcement reactions but nearly double the average quarterly announcement impact.

- Long Straddle positions break even at 9.2% price movements, appearing expensive compared to quarterly announcement history but potentially profitable based on full-year announcement patterns.

3. Hong Kong Single Stock Options Weekly (Feb 24 – 28): Broad Deterioration

- Broad based weakness, less than ½ of optionable stocks were up on the week with the average size of losses larger than average size of gains.

- Total single stock Put option volume the highest in the past 4 months pushing the Put/Call ratio to a local extreme.

- Laggards from the rally holding on, rally leaders broadly weak.

4. META: The Last of the Mohicans Standing – A Buy Opportunity

- All but one of the Magnificent 7 stocks have seen their rallies collapse, breaking their long-term uptrends. The lone exception? Meta Platforms (META US).

- Mark Zuckerberg’s company is the only Magnificent 7 stock that has pulled back yet may still be holding its uptrend intact.

- Our model has identified a tactical BUY opportunity in the support price area around 640. Keep reading for the details…

5. The Beat Ideas: Laurus Labs

- The company is expected to see multiple capacity expansions coming online in FY26, with ramp-up occurring throughout FY26 and FY27 onwards.

- Currently, execution challenges and unavoidable delays have impacted the company’s revenue and margin trajectory, resulting in depressed margins on a short-term basis.

- As new projects come online and product ramp-ups occur, it expects revenue and margin expansion, ultimately reflecting in the bottom line due to the increased gross block & new products.

6. Alibaba (9988 HK): Trends in CALL Strikes and Open Interest Visualized in Animation and Charts

- While Alibaba Group Holding (9988 HK) rallied, lower in-the-money calls were closed, realizing gains, while higher out-of-the-money strikes gained popularity.

- The median strike price lagged the sharp increase in stock price. The median strike currently stands at 107.50.

- With 81% of March calls currently in-the-money and higher strikes trading at premium implied volatility, active trading is expected in the 150-170 strike range.

7. Alibaba (9988 HK): Trends in PUT Strikes and Open Interest Visualized in Animation and Charts

- As Alibaba Group Holding (9988 HK) rallied, put strike distribution remained largely unchanged with median strikes only rising from 80 to 85, pushing protection increasingly deep out-of-the-money.

- With most puts now deep out-of-the-money, active trading is expected in the 120-140 strike range.

- The deep out-of-the-money put strikes trade at a significant premium to at the money implied volatility. The 130 strikes trade below, offering an opportunity for an effective hedge.

8. The HSI PUT: Hedging Strategies for an Overextended Rally

- The HSI INDEX has been defying gravity, recently. It is up more than 30% from its most recent low.

- In our previous, Jan. 11th insight we highlighted very precisely the support zone (18.8k-17.5k) from where the index was poised to resume its rally (the bottom was printed at 18671).

- Our models are currently indicating a very overbought condition. Leveraging the information relayed by Gaudenz Schneider in a recent insight, we think a “HSI PUT” could make sense here.

9. NIFTY Set for a Modest Rally from Current Lows

- Our latest insight on the NIFTY Index (NIFTY INDEX) recognized the possibility of obstacles against a rally from the index’s lows.

- The index has fallen for another 2 weeks from there, now it is very oversold and a relief rally could begin this week or the next.

- Profit targets for this relief rally are in the 23100 area, but unfortunately the forecast is maximum 3 weeks up, not really a bullish pattern…

10. Hang Seng Index (HSI): Trends in PUT Strikes and Open Interest Visualized in Animation and Charts

- Hang Seng Index (HSI INDEX) put options show concentrated positioning at the 19,000 and 20,000 strike levels.

- Traders continue to establish new positions approximately 15%-20% below current market levels, suggesting protection against major market corrections rather than minor pullbacks. The focus is on near-term risk.

- Implied volatility has remained stable at 25-30% over the past two weeks, consistent with a broadly sideways movement in the index itself.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Ray Dalio on the Coming Crisis in US Debt

- Ray Dalio, founder of Bridgewater and author, discusses big numbers and debt cycles in a social and political context

- Tracy and Joe host a podcast episode with Ray Dalio, known for his insights on finance and the invention of the chicken nugget

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. From Gene Hackman to Bitcoin: Signals, Sell-Offs, and Discipline | The New Barbarians #010

- Episode 10 of New Barbarians podcast covers recent events and discusses Gene Hackman’s passing

- Mark Connors shares insights on investors seeking certainty and compares them to characters in Gene Hackman’s movies

- Trump’s statements on Truth social and implications for the crypto market are analyzed, drawing parallels to themes of integrity and leadership in Hoosiers.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. The US Bear Market: Stage One – DENIAL

- After several months of a technical top-consolidation, the US market is entering a bear market. The piercing of the Magnificent-7 bubble will continue to drive selling pressure in the market.

- Inflation pressures will tie the Fed’s hands to bail out the market with another Fed Put. Another market bailout would cost much more than the $5 trillion COVID bailout.

- The administration’s policy sequencing is pushing inflation expectations higher as the immediate tariff implementation supersedes other anti-inflationary policies, which will take longer to implement.

4. HONG KONG ALPHA PORTFOLIO (February 2025)

- HK Alpha Portfolio returned 13.58% in February and outperformed the benchmark by 7.68%. The portfolio has outperformed Hong Kong indexes by 5.16% to 11.48% since its inception on 10/01/24.

- About 50% of the portfolio’s excess returns have been from alpha generation. The portfolio had no exposure to Real Estate, Energy, or Utilities.

- At month-end we sold AAC Technologies Holdings (2018 HK) , Trip.com Group (9961 HK) , MINISO Group Holding (9896 HK) , and trimmed Xiaomi Corp (1810 HK) .

5. 2025 Global Investment Strategy

- Last year 70% of the calls made money. This year we make another 43 investment recommendations, global, US, Europe, Japan and 8 Asian countries.

- Our prediction that Bitcoin will become a US reserve asset under Trump is already playing out.

- Stock market volatility will persist, with diverging performance and subdued gains compared with 2024. Our top picks are the US, Japan, Taiwan, Korea and India and selectively China.

6. ECB: Meaningfully Less Restrictive

- The ECB’s sixth 25bp deposit rate cut to 2.5% was unsurprising, and its characterisation of policy as meaningfully less restrictive leaned towards our relatively hawkish view.

- Policy rates may already be close to neutral. Looser fiscal policy plans also pressure monetary policy to follow a tighter path than would otherwise have been necessary.

- We still expect the ECB to hold rates in April, which is no longer a controversial call. A final 25bp ECB cut in June remains in our outlook (BoE cuts in May and Fed on hold).

7. The Drill – Geopolitical Tensions Are Easing, Not Escalating

- Hello everyone, and welcome back to our weekly editorial on geopolitics, commodities, and macro.

- While there hasn’t been much news on the commodity front since last week, we have a bunch of moving parts on the geopolitical scene—last Friday’s heated (and unplanned) Zelensky/Trump debate, the subsequent removal of all military aid targeting Ukraine, and now Trump trying his best to get all counterparts and allies to block any partnerships with China.

- While this was already evident earlier this week, when the administration urged Mexico to impose tariffs on China to avoid US tariffs, today’s reports of Putin acting as the middleman in the Iran nuclear deal were not something anyone had on their bingo cards.

8. HEM: Pausing Policy Easing

- Central banks are advised to slow, pause, or stop reducing rates due to rising inflation and labour costs.

- Inflation is unexpectedly increasing, and labour costs are exceeding target-consistent levels.

- Monetary policy is almost neutral according to activity trends, but rate hikes in 2026 could counteract unnecessary easing.

9. Steno Signals #187 – Remember August & September 2024? Tariffs are to blame

- Friday’s bizarre scenes in the Oval Office will take some time to digest for all involved counterparties.

- I don’t feel in a position to judge either side, but I will use this analysis to assess the ramifications of the event.

- As a disclaimer, remember that I am European!Trump’s argument that the U.S. pays too much to the rest of the world is, in many ways, entirely correct—but also quite banal.

10. HEW: Political Blunderbuss

- Shot from Trump’s blunderbuss is hitting sentiment and risk appetite yet the hard data remain resilient. Europe waking up on defence punched markets more in hope than reality, but hawkish inflation and ECB news helped create room to close our bullish call.

- Next week’s US inflation data are the scheduled global highlight, along with the Bank of Canada likely pausing its cutting cycle. We also await UK GDP data confirming resilience inconsistent with the dovish panic at February’s BoE meeting.

- Note: Smartkarma is now the sole distributor of our research, so clients will only receive all other research from Smartkarma (queries to [email protected]).

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Taiwan Dual-Listings Monitor: TSMC Spread Falls From Elevated Level; UMC & ASE Discount Opportunity

- TSMC: +17.2% Premium; Wait for Lower Levels Before Going Long

- UMC: -1.9% Discount; Can Consider Going Long the Spread at Current Level

- ASE: -0.6% Discount; Discount is Opportunity to Long the Spread

2. LITE ON Comments Signal Continued Strength in Cloud/AIOT Ahead of Upcoming Nvidia Results

- Lite On Signals for Continued Strength in Cloud/AIOT Ahead of Upcoming Nvidia Results

- Lite On’s 1Q25E Outlook Was Positive and Did Not Indicate A Near-Term Slowdown

- Industry Take-Aways — Still No Signs of Acceleration on PC/Consumer… However Signals Cloud/AIoT Demand Healthy

3. NVIDIA Q425 Beats, Raises, Market Yawns, Then Vomits. A Lake Wobegon Moment Perhaps?

- Q425 revenues were a record $39.3 billion, up 78% YoY, up 12% QoQ, handily beating the guided midpoint of $37.5 billion. It was NVIDIA’s eight consecutive quarter of sequential growth.

- After taking an overnight break to consider its options, the markets then positively vomited on NVIDIA, sending its share price down 8.5% on Thursday

- Jensen presents a utopian, Lake Wobegon-esque vision of all pervasive AI but in reality the pace of AI adoption will ultimately be determined by the pace of AI revenue generation

4. Microsoft CEO On AI CapEx: Show Me The Money!

- Microsoft dominated the technology news cycle recently on the back of a report by a TD Cowen analyst that the company is cancelling data centre leases in the US

- Dwarkesh Patel’s podcast with Microsoft CEO Satya Nadella last week provided a fascinating insight into his thinking when it comes to AI compute build out, AI winners & losers etc.

- Mr Nadella’s approach to AI compute build out has always been a pragmatic “show me the money and I’ll build some more compute” approach. Now we better understand why.

5. Taiwan Tech Weekly: Trump’s New China Chip Restrictions; Foxconn & Honda Alliance?; TSMC & Intel

- Trump Adminstration Gearing Up to Further Restrict China’s Access to Chip Technology — Could Restrict Servicing of Existing Equipment

- Foxconn and Honda: Could This Be a New Alliance in EV Manufacturing?

- TSMC (2330.TT; TSM.US): Will TSMC Work on Intel Foundry Services? There Are Three Paradoxes…

6. Intel Former Board Members Warn Against Rumoured TSMC Takeover Of Intel Foundry

- Four former, long term Intel board members yesterday warned against any plans to have TSMC take over Intel Foundry, their second time weighing in on the future of the company

- They posit that TSMC is under pressure from the US Administration with Taiwan security being used as a bargaining chip

- They’re not wrong in their assertions that it would be a terrible idea, both for the US and for TSMC, but these are days where anything can happen. Let’s see

7. Memory Monitor: Nanya Tech Soared on DRAM Recovery and Custom HBM News

- Nanya Tech Soared in February on DRAM Recovery and Custom HBM News

- Nanya’s Custom HBM Strategy & the Positive DRAM Market Outlook

- Memory Monitor Universe: SK Hynix & Micron Still Have Strong FY2025E Expected Growth; Nanya Tech Still Negative

8. ChipMOS Results Shows Signs of a Shifting Semiconductor Market; Precarious Multiples: Underperform

- ChipMOS Revenue Growth for the 2024, but a Weak Fourth Quarter; Gross Margin Hammered

- ChipMOS Sees Relative Weakness in Displays, Smartphones / Areas of Strength: Automotive and OLED

- Underperform Rating — Falling Utilization and Conservative Capex Signal OSAT Industry Challenges

9. What Do Detailed 2024 Semi Stats Tell Us?

- Despite the chip market’s 19% overall 2024 Y/Y increase, the only real growth was in semiconductors for AI applications. A turn in the AI business could cause a collapse.

- Outside of AI, growth was significantly more modest at 4.8%, which is good compared to the industry’s historical growth rate of 3.9%, but is nowhere near the 19% overall number.

- The US’ trade sanctions appear to be having some impact on chip shipments to China vs. the Americas, but this may be an illusion.

10. Vanguard (5347.TT): In 1Q25, Both Sales and GM Will Increase. The Current Inventory Is Healthy.

- 1Q25 Shipment estimates are up 8-10%. The ASP is expected to decrease by 4-6% QoQ and the gross margin. GM is projected to be 29-31%, showing a 1.3% increase QoQ.

- The worldwide inventory level is currently healthy. Automotive inventory levels are improving, and Vanguard anticipates moderate growth in the semiconductor industry for 2025.

- VSMC’s construction will proceed according to the current plan. The project is currently slightly ahead of schedule. Sampling is planned for 2026, with mass production expected to begin in 2027.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Japan Post Bank (7182) – Report of ¥600bn Offer Would Lead to Index Flows, and a New Future

- On 22-February-2023 a Reuters suggested JPH (6178) had “started talks” to sell a big stake in JP Bank (7182). Five days later they announced a complicated deal discussed here.

- Today, an article suggests Japan Post Holdings (6178 JP) will sell ¥600bn in Japan Post Bank (7182 JP) to get ownership below 50% (as with JPI). A buyback might appear.

- JPB has issued a “there’s smoke” release. Like last time. Expected unwind of known overhang means minimal surprise here. The question is whether they could surprise (big buyback? capital plan?).

2. Japan Post Bank (7182) – Missed Opportunity Leaves Likely Shadow Overhang

- The Offering comes in lighter than expected. The buyback is smaller than expected. The resultant overhang is larger than expected.

- The index flows around the delivery date are well-understood. They are what they are.

- Shareholder structure is such that this is not quite a new IPO but needs a lot of new shareholders. BUT… there is one redeeming feature one should not ignore.

3. Japan Post Bank (7182 JP): A US$4.2 Billion Secondary Offering

- Japan Post Bank (7182 JP) has announced a secondary offering of up to 416.1 million shares (including overallotment), worth around US$4.2 billion.

- The offering includes a ToSTNeT-3 and an on-market buyback. Including the overallotment, Japan Post Holdings (6178 JP) will reduce its stake from 61.50% to 50.00% of voting rights.

- Understanding the potential offer price requires looking at JPH’s past sales and recent large Japanese placements. The pricing date is likely 10 March.

4. We Doctor Holdings IPO Preview: Explosive Growth and Narrowing Losses, The Right Time for an IPO

- We Doctor Holdings, a top-tier provider of AI-enabled medical services and digital platform which connects hospitals, doctors, and pharmacies, plans to go public in Hong Kong.

- We Doctor Holdings has raised ~$1.5B to date from investors, including Tencent, 5Y Capital, Goldman Sachs, Hillhouse Capital, AIA, and Qiming Venture Partners, among others.

- The Hangzhou-based healthtech company has delivered explosive revenue growth of 107% y/y for the six months ended Jun-24.

5. Japan Post Bank US$4bn Placement – Smaller Deal, Similar Structure, Might Yield Similar Results

- Japan Post Holdings (6178 JP) (JPH) aims to sell around US$4bn worth of Japan Post Bank (7182 JP) (JPB), trimming its stake to below 50%.

- JPH had last sold around US$9bn worth of JPB shares in Mar 2023. That deal had a similar structure and it didn’t end up performing well.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

6. Japan Post Bank (7182 JP): Japan Post Holding (6178 JP)’s Rumoured Offering

- Reuters reports that Japan Post Holdings (6178 JP) (JPH) is planning to sell shares in Japan Post Bank (7182 JP) (JPB), which could total some JPY600 billion (US$4.0 billion).

- The potential offering would align with JPH’s stated goal of reducing its equity interest in JPB to 50% or less by FY 2025.

- The potential offering is relatively smaller than JPB’s 2023 offering. Compared to its peers, JPB’s valuation remains undemanding.

7. Korea FSS Shakes Up Rights Offerings – Special Review Rule Now Live

- With this new rule, the FSS is flagging shaky rights offerings early, signaling a likely correction request—and often, the first step toward the deal getting axed.

- Spot the red flags early and use the window before the FSS drops the hammer to position for a reversal play.

- The FSS’s early notice makes a reversal likely as traders bet on the deal getting nuked after the initial disclosure drop.

8. JX Advance Metals IPO: Business Transformation Underway

- JX Advance Metals, a unit of Japanese oil giant ENEOS plans to list on the Tokyo Stock Exchange. ENEOS will sell down a part of its stake and raise US$3.0bn.

- Having split from the parent ENEOS, JX Advanced Metals (5016 JP) is still on a business transformation and the company’s earnings show cyclicality.

- The company’s earnings declined in FY03/2024, however, 9MFY03/2025 results show that earnings are on a recovery driven by improving demand coupled with structural reforms undertaken by the company.

9. Premier Energies US$825m IPO Lockup – The Largest Seller in the IPO Is Sitting on 48x Gains

- Premier Energies raised around US$337m after pricing the deal at the top end of the range in Sep 2024. Its IPO linked lockup is set to expire soon.

- Premier Energies is a manufacturer of solar photovoltaic (PV) cells, and solar modules. It also executes engineering, procurement, and construction (EPC) projects and provides follow-up operation and maintenance (O&M) services

- In this note, we will talk about the lockup dynamics and possible placement.

10. Pre-IPO MIXUE Group (2097.HK) – The IPO Is Attractively Priced

- MIXUE’s valuation should be higher than peers such as Guming and Baicha Baidao Industrial. A comfortable valuation range is 18-20 P/E, higher than peers. So, the IPO pricing is attractive.

- 2024 full-year net profit is HK$4.8 billion.Net profit could reach HK$5.7 billion (up 19% YoY), HK$6.6 billion (up 16% YoY), HK$7.6 billion (up 15% YoY) in 2025, 2026, 2027, respectively.

- Since Nongfu Spring’s revenue scale/net profit margin is higher than MIXUE, MIXUE’s valuation should be lower than Nongfu Spring. Investors need to be alert to the post-IPO performance growth pressure.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 7&I (3382) – MBO Off, SC “Engaging Constructively with ACT”, Skepticism Higher, Questions And More

- The MBO is off. Itochu Corp (8001 JP) has apparently not been able to agree with Ito-san on board composition/representation and management control. That the MBO is off isn’t surprising.

- 7&i says they “continue to engage constructively with ACT and alternate proposals but news articles suggest that almost 6mos after proposing an NDA, ACT still haven’t had access to financials.

- The shares are off hard today to a level below where ACT’s first bid was considered “not even worth discussing”. There will be questions at the AGM and before.

2. 7&I (3382) – Bain Gets York Holdings with a Surprising Price, And We Approach Deal Deadlines

- Over the weekend, the Nikkei and Jiji reported the 7&i Board met Saturday and decided Bain would have preferred negotiating rights to buy York Holdings. They bid “over ¥700bn.”

- That’s a trifle lower than the ¥1.2trn Reuters reported (on Christmas Day) Bain bid but details aren’t known. Proper structuring would get the vast majority to 7&i in post-tax cash.

- For 7&i to decide by the AGM (which could be contentious), they need time to debate. Bids are likely needed in 3wks. In the meantime, “Trump Risk” lurks.

3. Seven & I Holdings (3382 JP): A Potential Derailing of the MBO

- Bloomberg reports that the MBO is stalling due to disagreements within the consortium over who will control Seven & I Holdings (3382 JP) after it is privatised.

- The Nikkei reported that Itochu Corp (8001 JP) was set to withdraw from the MBO consortium. Along with CP ALL PCL (CPALL TB)’s non-participation, the MBO’s financing is in trouble.

- An Alimentation Couche-Tard (ATD CN) bid remains in play but has issues. While progressing, the Board’s restructuring plan fails to prove a credible alternative.

4. Japan Post Bank (7182 JP): Another BIG Offering of US$4bn Expected; Overhang Will Be Removed

- Media reports indicate that Japan Post Holdings (6178 JP) could sell JPY 600bn (US$4.02bn) of Japan Post Bank (7182 JP) with the announcement coming as early as this week.

- The selldown is driven by Japan Post Holdings (6178 JP) needing to reduce its holding in Japan Post Bank (7182 JP) to 50% or lower by March 2026.

- Passive index trackers will buy around 11.4% of the offering at the time of settlement of the placement shares with the balance being bought in January 2026.

5. Korea: Short Selling Is Back in March; Trade Ideas

- Since short selling was banned in November 2023, short interest has plunged in Korea as shorts were covered. Markets have not done much over the last 16 months though.

- Foreign investor holdings have dropped from 32.05% in July to 28.57%. The top 25 stocks bought by foreign investors outperformed the top 25 stocks sold by 128% in 16 months.

- There will be trade opportunities across indices, pref/ords, index migrations and deletions, potential market upgrades and overvalued stocks being sold.

6. Seven & I Restructures but Discontent Rises Among Franchisees and Customers

- York HD is due to take over operation of all group business except Seven Eleven at the end of February and press reports suggest Bain’s bid has been accepted.

- All of which is fine but this leaves Seven Eleven Japan which is struggling against rivals. Even franchise owners are becoming more critical.

- A recent survey by Nikkei also suggested that consumers are increasingly favouring Lawson and Familymart and 30% visited Seven Eleven stores less frequently in 2024. This is a big problem.

7. JPH Launches “MBO” (LBO with SARs for Family/Execs) For Trucker Tonami Holdings (9070). Too Cheap.

- Yesterday, Japan Post Holdings (6178 JP) announced an MBO for Tonami Holdings (9070 JP) whereby the family/execs will stay on. JPH will own 99.97%, the execs/family 0.03%.

- This deal is yet another in a line of logistics deals dating back the last 2+ years where the premium has been quite big. This time is +74%.

- But this is not overly expensive. Makes me go hmmmm…

8. CICC (3908 HK) & China Galaxy (6881 HK): The Next Mega Brokerage Merger

- Reportedly, China International Capital Corporation (3908 HK) and China Galaxy Securities (6881 HK), two of China’s leading state-backed brokerages, intend to merge via a share swap, forming China’s third-largest broker.

- This report/rumour arrives shortly after the successful merger of Guotai Junan Securities (2611 HK) (GJS) and Haitong Securities (6837 HK).

- As with GJS/Haitong, expect a Merger by Absorption structure, and that Galaxy (or CICC?) issue new A and H shares to the target. I’d be picking up CICC shares here.

9. Nidec Says It Won’t Raise Price on Makino (6135)

- Nidec Corp (6594 JP) released a multi-page document regarding its bid for Makino Milling Machine Co (6135 JP) yesterday.

- It talked a bit about the back-and-forth with Makino, and gave Nidec’s side of the story. Makino has been making their side public too. A meeting is due early March.

- In the document, there was a line suggesting Nidec won’t raise price even against a counteroffer. They didn’t need to say that. The question is what Makino will do.

10. Merger Arb Mondays (24 Feb) – Seven & I, Proto, Tam Jai, Pentamaster, Vesync, Canvest, Domain

- We summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Seven & I Holdings (3382 JP), Smart Share Global (EM US), Tam Jai International (2217 HK), Vesync (2148 HK), ESR Group (1821 HK), Goldlion Holdings (533 HK).

- Lowest spreads: Makino Milling Machine Co (6135 JP), Shibaura Electronics (6957 JP), Millennium & Copthorne Hotels Nz (MCK NZ), Domain Holdings Australia (DHG AU), Avjennings Ltd (AVJ AU).

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tencent (700 HK): Top Trades: Strategies That Stand Out

- This Insight analyses Tencent (700 HK)tailor-made option strategies traded over the last five trading days on the Hong Kong Exchange. Strategy highlights and volatility context are provided.

- These traders tailor structures to risk budgets and take calculated bets. Diagonal call spreads are popular, many self-financing (0% premium). This strategy can play the 18 March earnings date.

- Call spreads can indicate where bullish traders see limits to the upside. The most bullish trade suggests a peak of up to 710 HKD by the end of March.

2. Tencent (700 HK) – Surging Price, Strikes, and Volatility. A Novel Look with an Animated Chart

- Tencent (700 HK) has surged 33.5% over the past 30 days, with its spot price outpacing the slow adjustment of call option strikes, shifting most contracts from out-of-the-money to in-the-money.

- The current concentration of in-the-money calls hints at active trading and potential strike adjustments ahead, amplified by upcoming events like the 19 March earnings.

- This analysis features a novel animated chart of option open interest distribution offering a dynamic visual of market behavior.

3. Xiaomi: 3 Option Hedges for Extreme Price & Volatility Environment

- Xiaomi has had a remarkable rally, ranking at the 99th percentile for all previous 1-month price changes.

- Implied vols have surged along with price with 1M, 2M and 3M implied vols all ranking above the 95th over the past 4 years.

- We recommend how to manage risk and positioning given the extreme price and implied vol dynamics.

4. China Mobile (941 HK) Pullback Offers a Tactical Re-Entry Opportunity

- In our last insight covering China Mobile (941 HK) we said the stock was overbought. It made a sharp pullback last week that may turn into a good BUY opportunity.

- Support levels to buy range from 79.1 to 76.4, assuming this pullback is a buy-the-dip scenario, something we will discuss in this insight.

- If the stock resumes its rally, the next WEEKLY profit targets will be between 82.64 and 84.4.

5. Nikkei Index Options Weekly (Feb 17 – 21): USD/JPY at Inflection Point

- The 150 level on USD/JPY seems to be an area of heightened interest. We see potential for greater disparity of Nikkei returns below this level.

- Nikkei 1-month implied vol is at the 17th percentile; while not currently monetizing, caution is warranted on short vol positions as USD/JPY vol trends higher.

- Call volume dropped sharply vs total volume, with Puts outpacing Calls every day this week.

6. NVIDIA (NVDA US) Support and Resistance Targets Post-Earnings

- NVIDIA Corp (NVDA US) will release its earnings at the end of today’s US session. This insight offers a quick view of possible support and resistance for derivatives traders.

- The stock is currently mildly oversold, aroud 50% probability of reversal according to our quantitative PRICE model and about 78% probability of reversal according to our quantitative TIME model.

- WEEKLY TACTICAL TARGETS: buy below 125 (with room to go to 92 if the earnings are disappointing) and sell above 147 (the limit should be 161).

7. HSCEI Index Options Weekly (Feb 24-28): Shifting Sentiment

- Put trading as a percentage of total volume continues to increase and coupled with a shift in the skew highlights changing sentiment.

- Volatile price action this week with Wednesday and Friday both moving ~3.50%.

- Implied and historic volatilities were all up on the week and seasonal setup over next two weeks not favorble.

8. Where Is the Nasdaq 100 Headed Next?

- The Nasdaq-100 INDEX started to pull back last week, this is the second week down in a row and the index is very oversold according to our tactical model.

- The DAILY model signals extreme oversold conditions, a reversal is imminent. The WEEKLY model is also oversold but still leaves room for further downside…

- A possible scenario is a DAILY bounce (1 or 2 days up) followed by more WEEKLY downside (another 1-2 weeks down). This insight wil analyze only the WEEKLY model.

9. Hong Kong Single Stock Options Weekly (February 17 – 21): Option Volumes Surge as Rally Narrows

- Mixed bag with narrowing participation, widening distribution of returns but with the highest total option volume since November.

- Option volumes over the past 2 weeks are 80% higher than the prior 3-month average.

- Implied vols weaker across the board with 9 of 11 sectors seeing softer implieds.

10. Kospi Index Options Weekly (Feb 17 – 21): Hedge Considerations as Rally Stalls at 350

- After eight consecutive days of gains, the Kospi rally paused in the last two sessions, closing just above 350.

- The 350 area aligns with several key levels from the past three years.

- For those looking to hedge recent gains, we recommend two preferred hedge strategies.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. EA Resilience Is Perfunctory Problem

- Crashing US surveys in 2025 have looked idiosyncratic, as spurious exaggeration of exceptionalism ends. The ESI corroborates the PMI’s resilience in the euro area.

- Price expectations have been trending further above long-run averages without a one-off shock, suggesting European policy is too loose for this stage of the economic cycle.

- EA unemployment remains lower than a year ago, inconsistent with tight monetary conditions. We still see the ECB’s last cut in June, much sooner than the market prices.

2. Warren Buffett’s Increased Stakes in Japanese Trading Houses – Impact on Korean Trading Companies

- In this insight, we discuss how Buffett’s increased stakes in Japanese trading companies could positively impact Korean trading companies.

- In addition, we look back at the past five years and compare how the major Korean trading companies have performed relative to their Japanese counterparts.

- In Korea, we believe that the following 5 major Korean trading companies (POSCO International, Hanwha Corp, LX International, Samsung Corp, and Hyundai Corp) could continue to outperform the market.

3. Steno Signals #186 – The year of the weak USD is upon us

- I wanted to get the German election results before releasing my weekly editorial, and as far as I can judge, we are talking about a middle-of-the-road outcome, which should be seen as a net positive for European assets for now.

- CDU (Conservatives) and SPD (Social Democrats) will be able to form a GroKo (Grand Coalition) with 328 mandates, which is a coalition that could likely find some common ground around spending more and removing the debt brake, at least temporarily.

- A permanent removal of the debt brake will require the backing of an additional party.

4. What Is NPS Buying and Selling in the Korean Stock Market in 2025 So Far?

- KOSPI and KOSDAQ are up 10.2% and 14%, respectively YTD, outperforming S&P 500 is up 2.2% in the same period. so far.

- One of the big drivers of higher share prices of Korean stock market this year has been the strong net buying by the NPS.

- Some of the major stocks that have been net purchased by the NPS so far this year include Samsung Electronics, SK Hynix, LG Energy Solution, Hyundai E&C, and Samsung Biologics.

5. Asian Equities: Asia’s Robust Dividend Yielders

- In today’s uncertain scenario, cash is king. Moreover, the high US treasury yields, which had rendered a dividend yield strategy relatively unattractive, are beginning to decline again.

- In addition to considering today’s dividend yields, we think it’s also imperative to take into account companies’ future earnings potential to assess future dividend stability.

- Screening companies with at least 6% forward dividend yield and 5% forecast EPS CAGR over next 2 years, we arrive at our basket of 23 dividend yielders, 13 from HK/China.

6. Over the Horizon: A Review of Thematic Trends

- Our most prominent theme over the last year has been to BUY HK/China markets. We are still very bullish on these SECULAR BULL markets.

- We have been Bullish on gold and discussed the asymmetry of its price movements given the global tightening starting in 2021/22. Gold will continues to benefit from negative real rates.

- We have been Bearish on Japan since publishing Technically Speaking: Japan Meets Resistance and Hong Kong Finally Breaks Downtrend on April 2, 2024. We also remain bearish on India.

7. The Other Risk to World Trade: China’s Mercantilism

- While America’s restrictions threaten the global trading order, China’s outdated, export-reliant model is culpable, too. In exporting its overcapacity, China behaves like a small, open economy, but it is not.

- Given its size, China’s export surges produce outsized effects, triggering protectionist responses. China’s friends in the Global South are scrambling to defend their domestic industries, and not just the West.

- Until China finds a way to recycle its surpluses into investments in other countries, trading partners will suffer the downsides of import competition without any offsets, thus worsening trade tensions.

8. The Week Ahead – Risk Sentiment Intact, For Now

- Peace hopes are higher and tariff fears have subsided for now

- China hosting summit with tech entrepreneurs could boost economy

- Markets becoming complacent over Trump’s policies, uncertainty remains on future developments

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Here Are My Top Macro Ideas

- The first 5 weeks of the year have seen international equities outperforming the S&P 500: European and Chinese stocks have rallied harder than US stock indexes, and certain emerging markets like Chile or Poland are doing even better.

- My main thesis for the first half of the year remains to be positioned with an ‘’International Risk Parity’’ portfolio: long US bonds, and long stocks around the world.

The chart above shows that the US growth exceptionalism might be over. The Aggregate Income Growth series is a great proxy for nominal growth in real time: it includes private sector job creation, workweek hours, and wage growth – effectively reflecting the growth rate of nominal income US workers are bringing home.

10. The Case for Europe

- Europe is outperforming the US in terms of stock market performance this year

- Valuations in the US are high, while Europe is trading at a historic discount

- Expectations for US companies are high, while Europe’s expectations are low, leading to potential momentum shifts between the two regions

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.