This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Chagee Holdings Limited (CHA): International Investors to Dominate the IPO Order Book

- Chagee’s order book is heavily influenced from Asian Investors as the deal is considered multiple-times oversubscribed.

- The underwriters and company came to market with a manageable size transaction and an attractive valuation.

- The geopolitical headwinds, specifically between China and the United States, is forcing many traditional IPO investors to stay on the sidelines.

2. Chagee Holdings (CHA US) IPO: Valuation Insights

- Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$382-411 million through a Nasdaq IPO.

- We previously discussed the IPO in Chagee Holdings (CHA US) IPO: The Bull Case and Chagee Holdings (CHA US) IPO: The Bear Case.

- There are four cornerstone investors. Our valuation analysis suggests Chagee is attractively valued at the IPO price range. Therefore, we would participate in the IPO.

3. Chagee IPO: Is It Worth the Risks? Peer Comparison and Valuation Analysis.

- Chagee Holdings (CHA US) ‘s IPO valuation discount to its peers, including HK-listed tea-beverage players as well as US-listed China-based coffee-beverage player, suggest a strong potential upside on listing.

- US Investor concern over impact of tariffs and caution due to lingering memories of the Luckin Coffee scandal could translate to higher risk premium for the stock.

- Expect Chagee to trade at a discount to budget beverage peers like Mixue Group (2097 HK) given its limited room for network expansion within China and likely slower overseas growth.

4. Chagee IPO: Luckin X Starbucks of Tea. Pricing, Valuation, Key Facts & Financials

- Chagee Holdings (CHA US) is offering 14.68 million shares for USD26 to USD28 each to raise upto USD411 million in its initial public offering in the US.

- Chagee’s premium branded teahouses blend traditional tea culture with modern, tech-driven service, distinctly setting itself apart from bubble tea kiosks.

- Chagee’s IPO is priced at a discount to forward valuations of recently listed (in HK) China-based freshly brewed drinks players and leading Cafe companies.

5. Giant Biogene Placement – Great Track Record but Previous Deal Didn’t Do Well

- Giant Biogene (2367 HK) aims to raise up to US$250m via a top-up placement.

- We have followed the company since listing and its recent performance has been great. Although it doesn’t seem to need the cash and the previous deal didn’t go well.

- In this note, we will run the deal through our ECM framework and talk about the recent updates.

6. China Resources Beverage IPO Lockup- Cornerstones Coming Out of Lockup Ahead of the Large PE Release

- China Resources Beverage (2460 HK) raised around US$750m in its Hong Kong IPO in October 2024. The lockup on its cornerstone investors is set to expire soon.

- China Resources Beverage manufactures and sells packaged drinking water and RTD soft beverages in China and is one of the largest players in its categories.

- In this note, we will talk about the lockup dynamics and possible placement.

7. Pre-IPO Chagee Holdings – IPO Pricing Is Attractive, But Share Price May Underperform

- Chagee is seeking up to US$411 million by offering nearly 14.7 million ADS priced between US$26 and US$28 each, with market value to reach about US$4.8-US$5.1 billion.

- Chagee is facing performance headwinds. Whether the current high growth of Chagee is sustainable in the future is uncertain. This makes us tend to be conservative in Chagee’s valuation expectations

- Based on our forecast, P/E is about 11.5-12.3x if based on 2025 net profit. Such valuation is attractive, but “valuation discount” may occur due to market turmoil and geopolitical conflicts.

8. Rigaku IPO Lockup – Large PE Investors Can Still Break Even

- Rigaku Holdings (268A JP) raised around US$750m in its Japan IPO in October 2024. The lockup on its pre-IPO investors is set to expire soon.

- Rigaku engages in developing, manufacturing, sales and servicing scientific instruments specializing in X-ray technologies.

- In this note, we will talk about the lockup dynamics and possible placement.

9. ECM Weekly (14 Apr 2025) – Suzuki, EBOS, Hengrui Pharma, Zenergy, Chagee, LG India, Huge Dental

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, we looked at the possible A/H premium for Jiangsu Hengrui Medicine (600276 CH), along with two live deals in Hong Kong .

- On the placements front, only Suzuki Motor (7269 JP)‘s shareholders were brave enough to launch a placement in the turbulent markets.

10. Duality Biotherapeutics (映恩生物) Trading Update

- Duality Biotherapeutics raised HKD 1,512m (USD 194m) from its global offering and will list on the Hong Kong Stock Exchange on Tuesday, April 14th.

- In our previous note, we looked at the company’s business lines of ADC products and analyzed its valuation.

- In this note, we provide an update for the IPO before trading debut.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. What if China ADRs Are Delisted from US Exchanges?

- We see 281 Chinese companies listed on U.S Stock Exchanges with a total market cap of US$869bn. 32 of these companies are listed on the HKEX (388 HK).

- If the rumours of Chinese stocks being delisted from U.S. Exchanges gathers steam, we could see a wave of secondary listings in Hong Kong.

- PDD Holdings, Full Truck Alliance, Vipshop Holdings, TAL Education and ZEEKR are the largest China ADRs with no HK listing and could come under pressure.

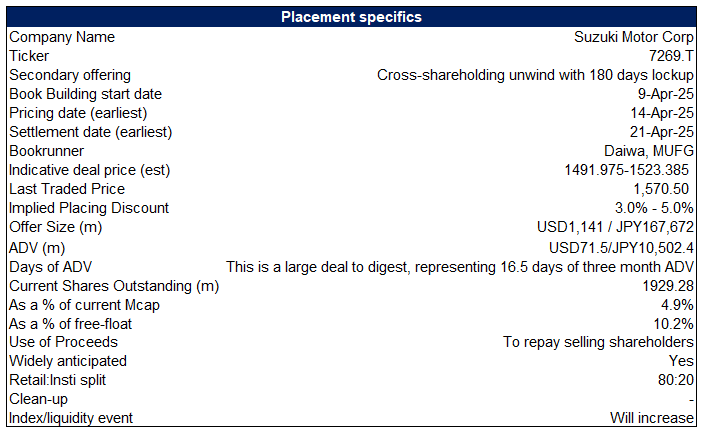

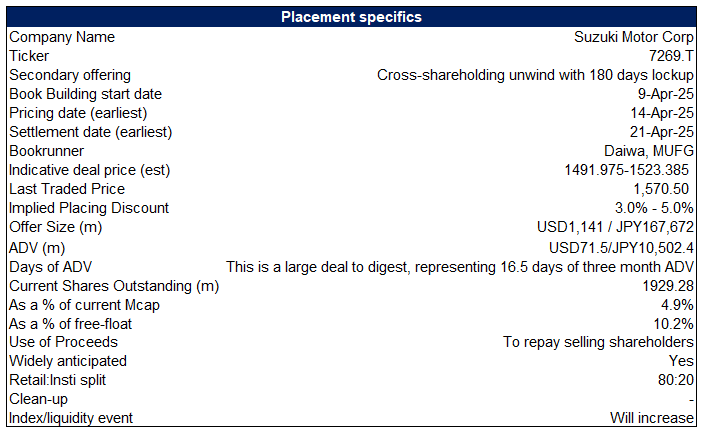

2. Suzuki Motor (7269 JP) Placement: Likely to Price Today; 7-8% Underperformance Vs Peers/TOPIX

- Tokio Marine & Nichido Fire Insurance and Sompo Japan Insurance are looking to raise US$1.2bn by offloading their entire stakes in Suzuki Motor by way of a secondary offering.

- Suzuki Motor (7269 JP) stock is flat since the announcement of the placement but has underperformed its peers and the TSE Tokyo Price Index TOPIX (TPX INDEX).

- With the placement being less than 5% of the number of shares outstanding, there is unlikely to be any immediate passive inflow which could pressure the stock.

3. The Skew in the Tsuruha-Welcia-Aeon Combination

- Tsuruha Holdings (3391 JP), Welcia Holdings (3141 JP), and Aeon Co Ltd (8267 JP) announced their deal whereby Tsuruha merges with Welcia in December, and Aeon gains control of MERGECO.

- Orbis Investments – owner of 9.7% of shares out – complained. I think with good reason. Tsuruha is trading a little expensive to the ratio, but there’s 7.5mos to go.

- Interestingly, there’s real skew on this trade. It’s not overly complicated, and it is worthwhile thinking about it.

4. “Tiny Win for Guess The Ratio” Aeon (8267) Pays a SMALL Premium for Aeon Mall (8905)

- In an announcement after the close Friday 11 April, Aeon Co Ltd (8267 JP) and AEON Mall (8905 JP) announced their merger ratio, and timing.

- The ratio is 0.65 to 1.0, meaning Aeon Mall shareholders don’t get a lot of credit for their real estate. The timing is short-dated. The AGM is end-May. Merger July1.

- This may be a tad light, but it is a done deal. Active shareholder base is almost all retail and crossholders+dom passive gets Aeon to 70%.

5. Chagee Holdings (CHA US) IPO: Global Index Inclusion Timeline

- Chagee Holdings (CHA US) is looking to raise up to US$473m in its IPO, valuing the company at up to US$5.2bn. The offering is expected to price today, list tomorrow.

- Media reports indicate that cornerstone investors have indicated demand for US$205m of the offering. There is no mention of a lock-up on those investors yet.

- The stock could be added in one global index in August (with a higher probability of inclusion in November), while inclusion in the other global index is likely in December.

6. FSS Bans Arb in Local MM Books: Identifying Opportunities from Short-Term Inefficiencies

- The FSS is banning arb trades under the MM book, requiring separate books for any arb positions to keep them distinct from MM flow.

- Most local shops lack the resources to set up a separate arb desk. Splitting teams, creating new workflows, and hiring extra staff isn’t feasible given their tight P&L.

- Building a tracker for MM dropouts could spot dislocations, as the crackdown creates short-term inefficiencies—if we’re dialed in, there’s alpha to be made.

7. Aeon Mall (8905 JP): Aeon (8267 JP)’s Share Exchange Ratio Is Set

- AEON Mall (8905 JP) announced a share exchange offer by Aeon Co Ltd (8267 JP) at 0.65 Aeon shares per Aeon Mall share, a 30.9% premium to the undisturbed price.

- The share exchange ratio is reasonable compared to historical price ratios and IFA valuation ranges. The implied offer multiple is attractive compared to peer multiples.

- Aeon’s 58.16% shareholding ensures that Aeon Mall’s vote on 22 May is low-risk. The share exchange’s effective date is 1 July.

8. TKP Corp (3479) – A Second Big Buyback In Short Order

- TKP Corporation (3479 JP) is a fascinating little company. It rents space. From people. To people. Then adds on services. Meeting, recruiting, training, seminar, banquet, party, etc rooms.

- Last year they bought control of two small businesses to add features. Revenues are up. The new FY suggests revenue growth, OP growth, and now a buyback.

- The buyback is the interesting bit. They did one last FY with interesting parameters, and Quiddity has a new tool we are trying out, so we showcase an example here.

9. Yageo Bigly Overbids Minebea (+20%) For Shibaura Elec (6957) At ¥5400

- In February Yageo Corporation (2327 TT) made an unsolicited bid for Shibaura Electronics (6957 JP) at ¥4,300/share after getting the cold shoulder for months.

- Minebea Mitsumi (6479 JP) was asked to bid, and they did a week ago, bidding ¥4,500/share. Yesterday the Shibaura CEO was in an article saying an overbid would be considered.

- Mid-Day, I boomeranged my piece, saying I thought Yageo would overbid. Today after the close, Yageo has overbid with a whopping ¥5,400/share bid, with unchanged start date of 7 May.

10. [Japan Activism] – ValueAct Agrees to Tender to KKR Topcon (7732) Tender and Join As Buyer

- Last night, Topcon Corp (7732 JP) announced that KKR had agreed a deal with ValueAct Capital who owns 14.62% of Topcon to have VAC tender shares and invest in Bidco.

- Topcon’s Special Committee saw nothing wrong with this in terms of fairness. I think that argument needs to be investigated at a broader level.

- If Bidder wants 50.1% control and expects passive to agree, and Bidder gets 50.1% to join Bidco at terms, obviously, majority of minority disappears. This is an unintended loophole.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nvidia (NVDA US) Outlook Following Surprise $5B Hit From China Chip Export Ban

- NVIDIA Corp (NVDA US) said it will take a $5.5 billion financial hit after Washington fresh restrictions on H20 AI chips designed for the Chinese market.

- The Trump Administration’s move comes as as a surprise, the U.S. now requires a special export license for these chips, but historically, no such licenses have ever been granted.

- Some estimates Nvidia may lose $10 billion in revenue, as most of the affected chips are already manufactured and now unsellable, plus the ban could benefit Chinese competitors like Huawei.

2. Time to Sell HDFC Bank? Stock Nears Record High and Slightly Overbought

- HDFC Bank (HDFCB IN) is one of those few stocks that were nearly unaffected by the recent market turmoil (-5.7% pullback, peak to bottom and now at new highs).

- Our insight in January 14th 2025 signaled a strong buy opportunity, the stock rallied +13% from there.

- Now the stock has reached its previous all time highs, and may become overbought. Long-term outlook remains positive, but a short-term pullback is possible in the next 2 weeks.

3. NIFTY 50 Tactical Outlook (Post-Easter Targets)

- The strong rebound from the crash low signals resilience in the NIFTY Index, and notably, the index appears to be staging a short-term breakout from its recent downtrend.

- Is this the start of a rally? It’s hard to say, given the current economic uncertainty—however, our model suggests the index could extend its gains for another week.

- The rally should be limited, a good profit target according to our model is between 24039 and 24496.

4. TSMC (2330.TT) Tactical Outlook Before 1Q25 Earnings Release

- Taiwan Semiconductor (TSMC) (2330 TT) has lost nearly 30% of its value since its mid-January peak—half of that decline occurred by early March, prior to Trump’s tariff announcement.

- The stock is very oversold, although it bounced off its lows last week, and reached 903 this Monday. This insight will analyze how far this rebound can go.

- Earnings will be reported on April 17. Our model suggests the stock has room to move in either direction—the results will be the catalyst. Check out our targets.

5. Nifty Index Options Weekly (Apr 07 – 11): Volatility Spikes, Skew Steepens, Hedges Reassessed

- Implied vol spiked sharply on Monday, marking one of the largest single-day moves since the pandemic.

- We discuss the move in skew and suggest a course of action for previously recommended hedges.

- The magnitude of the implied vol move is examined in the context of recent price behavior—and whether it holds.

6. TSLA Earnings: Volatility Setup and Post-Release Price Behavior

- A detailed analysis of price patterns, implied vol and the earnings implied jump in TSLA options compared to historical outcomes.

- Pre- and post-earnings price movements are examined to assess directional tendencies, patterns and magnitude.

- Price returns in the 1-month following earnings show a distinctly different pattern between beats and misses.

7. NSE NIFTY50/ Vol Update / Risk Premia Catches up with Global Counterparts in Spite of Truncated Week

- Risk premia in Nifty50 Options catches up with Global Markets as IVs spike from sub-12% to 24% – levels last seen during 2024 National Elections.

- Vol-Regime switches from “Low & Up” state to “High & Up”. Term-structure swings into Backwardation. Front-end risk premiums elevated in spite of truncated upcoming week.

- Tactical Implications: (1) Use IV-spike to flatten +ve Vega exposure. (2) Avoid -ve Gamma, Vol harvesting structures. (3) Front-end/ Back-end Calendars recommended as extreme curve inversion expected to normalize.

8. Nikkei Index Options Weekly (Apr 07 – 11): Vol Spikes, Skew Steepens, Macro Shifts Unfold

- Both Nikkei and USD/JPY re-tested levels last seen in early August, with Nikkei implied vols surging.

- Beyond tariffs, we explore what may become the dominant driver of market movements in the weeks ahead.

- Skew steepened materially; we examine how open interest at current spot levels could shape the spot-vol relationship going forward.

9. Kospi Index Options Weekly (Apr 07 – 11): Skew Shifts Steepens and Positioning Signals

- Price action was volatile this week, marked by two large moves and a notable pickup in vol of vol.

- We examine the material steepening of skew observed over the course of the week.

- USD/KRW broke its recent range, reinforcing signs that USD assets may be losing their traditional flight to quality appeal.

10. HSI Index Options Weekly (Apr 14-17): Volatility Cools, But the Floor May Hold

- A weekly recap of volatility and price metrics, including option volumes, volatility trends, the spot/implied relationship, and open interest statistics.

- The recent cooling in volatility may be more of a pause than a reversal—we explore why that might be.

- Trading activity continued to fade as the market works through the volatility of recent weeks.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK: Green Shoots For Unemployment Wilt

- Signs that statistical effects might lower the unemployment rate in the Spring have weakened, with stability at 4.4% now more likely amid stagnant underlying trends.

- Levels remain healthy and redundancies are low despite falling vacancies, suggesting resilience survives rather than thrives. Rapid wage growth is more problematic.

- Dovish hopes that excesses will break soon, aided by destructive US trade policy, keep the BoE on track to cut in May. Sterling strength also adds disinflationary space.

2. UK: Price War Dents Spring Inflation

- A supermarket price war hit food prices, slowing UK CPI inflation below the headline consensus again. Upside news in clothing was offset by downside in game prices.

- Repeating 2008’s experience would drive a game price rebound, but the food effect is more likely to persist. The median inflationary impulse should also rebound soon.

- Unit wage costs remain inconsistent with the target, while energy and water utility bills will drive a massive jump in April. We still forecast a final 25bp BoE rate cut in May.

3. US Tariffs: Of Words And Bonds

- Donald Trump’s recent policy reversal may provide an opportunity for the completion of bilateral trade agreements with certain US partners.

- However, neither China nor the EU is expected to reach an agreement soon, particularly in the current context.

- This is largely due to the evident vulnerability of America to the bond market.

4. A Game Theory Analysis of the Trade War

- No country in the world will be spared damage in a trade war.

- Both the U.S. and China have outlined positions that are little more than posturing.

- However, a game theory analysis of the relative positions indicates that the U.S. holds a weaker hand than China.

5. Atkins to Accelerate the Delisting of Chinese Stocks From the US Stock Exchanges in 2025/2026?

- Paul Atkins, the new head of U.S. SEC could accelerate the delisting of Chinese stocks from the U.S. stock exchanges.

- There are about 280 companies from mainland China that are listed in the U.S. with a combined market cap of about $880 billion.

- There could be two major reasons to accelerate this delisting (require Chinese companies to abide by US GAAP accounting and fully delist Chinese companies with ties to Chinese military).

6. Steno Signals #193 – The USD Reset Is Underway

- Morning from Copenhagen!It’s been a remarkable week—and weekend—in policy space.

- On Friday, the White House released a list of exemptions from the reciprocal tariffs (including, for example, semiconductors).

- Then, on Sunday, Trump “tweeted” that no exemptions were made, leaving Howard Lutnick once again to explain what was actually going on.

7. US Bear Market: BETWEEN DENIAL AND ANGER THERE IS “HOPE”

- The S&P bounced off its support level of 4800 and is now consolidating on investor hopes that the worst is over as volatility declines.

- As the economic numbers weaken and inflation accelerates from tariffs we expect the market to take its next leg down and enter a secular bear market.

- As the economic numbers weaken and inflation accelerates from tariffs we expect the market to take its next leg down and enter a secular bear market.

8. Trump’s End Game

- Trading Post’s top buy calls are the Philippines, India, Japan, Malaysia, Taiwan and Europe.

- Trump’s ultimate objectives are to secure fairer trading terms and stimulate inward investment—and the strategy appears to be gaining traction.

- Countries facing the highest reciprocal tariff rates, with large surpluses vis-à-vis the US and high gross exports to GDP ratios will buckle first.

9. Argentina: The First Domino How Freedom, Discipline, and Bitcoin Are Rewriting the EM Playbook

- Century of Decline, One Shock Reset: Argentina fell from 80% of US GDP to 25%—Milei is reversing it with fiscal shock therapy.

- From Chaos to Credibility: Inflation tamed, market confidence rising—first fiscal surplus in a decade.

- Decentralization, AI, and the Next Model: Tax federalism and AI governance make Argentina the first EM reform lab.

10. Estimating Downside Risk

- The S&P 500 is deeply oversold by historical standards, but it remains an open question of whether stock prices will decline further after a short-term bounce.

- Our estimate of S&P 500 downside is 3900–4500 without a recession, with strong technical support at 4800. Downside risk with a recession is 3300-3800.

- Current readings indicate elevated recession risk based on consensus policy expectations, which can change at any time.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. TSMC (2330.TT; TSM.US): Brace Yourself for the US Tariffs!

- We aim at nearly 0% growth QoQ for Taiwan Semiconductor (TSMC) – ADR (TSM US)‘s revenue in 2Q25, but US tariff can be a changing factor since April, 2025.

- Taiwan Financial Supervisory Commission is announcing on April 6th, 2025 with three temporary methods to prevent a sudden slump of Taiwan stock market today.

- Taiwan Semiconductor (TSMC) – ADR (TSM US) is taking about 39.2% of Taiwan stock market value, which is the single largest stock in Taiwan.

2. Taiwan Dual-Listings Monitor: TSMC Spread Near Short Level; ASE & ChipMOS Spreads Good Short Levels

- TSMC: +18.9% Premium; Soon at a Good Level to Short the Spread

- ASE: +6.5% Premium; Good Level to Short the Spread Given Trading Range Breakdown

- ChipMOS: +6.6% Premium; 2% And Higher Good Level to Short the Spread

3. TSMC (2330.TT; TSM.US): Brace Yourself for US Tariff! (II)

- Under the US tariffs, we have to seriously consider whether Taiwan Semiconductor (TSMC) – ADR (TSM US) can achieve 25% growth in 2025.

- We have conducted two scenario analyses and anticipate a likely loss of above 8.5% in 2025 revenue for TSMC, especially related to Apple (AAPL US).

- The stock price of Taiwan Semiconductor (TSMC) – ADR (TSM US) is expected to be somewhat reshuffled in the current US-China tariff environment.

4. TSMC Q125 Earnings Preview

- TSMC reported March 2025 revenues of NT$285.96 billion, up 10% MoM and up 46.5% YoY.

- Revenue for January through March 2025 totaled NT$839.25 billion, an increase of 41.6% YoY.

- At the forecasted exchange rate of NT$32.8 to the US$, this translates into Q125 revenues of $25.58 billion, marginally above the guided midpoint of $25.4 billion

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Suzuki Motor Placement – Not the Best Time for a US$1.15bn Deal. It Will Be a Long Week.

- Tokio Marine Holdings (8766 JP) and Sompo Holdings (8630 JP) aim to raise around US1.15bn (including over-allotment) via selling around 5% of Suzuki Motor (7269 JP).

- While Suzuki doesn’t have much direct exposure to the US markets, its shares have still corrected in line with other auto players.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

2. Suzuki Motor (7269 JP): A US$1.1 Billion Secondary Offering

- Suzuki Motor (7269 JP) has announced a secondary offering of up to 95.7 million shares (110.1 million including overallotment), worth around US$1.1 billion (US$1.3 billion including overallotment).

- Suzuki’s goal with the secondary offering is (i) to reduce cross-shareholdings and (ii) to expand and diversify the shareholder base, which should further enhance liquidity.

- Looking at recent large Japanese placements is instructive for understanding the potential offer price. The pricing date will fall between 21 and 23 April (likely 21 April).

3. Chagee IPO: Peer Comp and Thoughts on Valuation

- Chagee Holdings (CHA US) is planning to raise up to US$500m through its upcoming US IPO.

- It is a leading premium tea drinks brand, serving healthy and delicious freshly-made tea drinks.

- We have looked at the company’s past performance in our earlier notes. In this note, we discuss latest industry dynamics, conduct a quick peer comparison and discuss the company’s valuation.

4. Chagee Holdings (CHA US) IPO: The Bear Case

- Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$400-500 million through a Nasdaq IPO.

- In Chagee Holdings (CHA US) IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

- The bear case rests on unsustainable growth rates, pressure on KPIs, signs of margin pressure, increasing S&M expenses and weakening forward growth indicators.

5. Key Takeaways from the Updated Filing on Hanwha Aero’s Rights Offering

- Hanwha shot down any merger talks between Hanwha Corp and Hanwha Energy, saying they’re just going to funnel Energy’s cash straight into Hanwha Aero via a third-party allotment.

- These confirm no price manipulation for Hanwha Corp; Hanwha Energy will inject cash into Aero at market value, likely driving bullish short-term price action for both Hanwha Corp and Aero.

- Despite tighter arb opportunities, doubts remain whether Hanwha Aero can raise the remaining KRW 1.6 trillion given a volatile market and the tight timeline.

6. Samsung SDI: Rights Offering Capital Raise Amount Lowered by 14% to 1.7 Trillion Won

- Samsung SDI (006400 KS) has lowered the rights offering capital raise amount by 14% to 1.7 trillion won, mainly due to the recent carnage in the global equity markets.

- The expected rights offering price has been lowered to 146,200 won, which is 14.9% lower than current price.

- We remain negative on Samsung SDI’s rights offering capital raise mainly due to shares dilution risk. We also remain concerned that the weak demand for EVs globally could last longer.

7. Hanwha Aerospace – Lowers Rights Offering Capital Raise Amount To 2.3 Trillion Won

- On 8 April, Hanwha Aerospace (012450 KS) announced that it plans to lower its rights offering capital raise amount from 3.6 trillion won to 2.3 trillion won (US$1.6 billion).

- The remaining 1.3 trillion won will be secured through a third-party allocation paid-in capital increase targeting three companies, including Hanwha Energy, Hanwha Impact Partners, and Hanwha Energy Singapore.

- Hanwha Aerospace disclosed today that it expects sales of 30 trillion won (58% higher than consensus) and operating profit of 3 trillion won (20% higher than consensus) in 2025.

8. Chagee Holdings IPO Valuation Analysis

- Our base case valuation of Chagee Holdings is target price of $46.7 per share, representing 67% higher than the high end of the IPO price range ($28 per share).

- Our base case valuation is based on a P/E of 21.4x on our estimated net profit of 2.9 billion RMB in 2025.

- We used a very conservative valuation multiple, mainly due to the extremely high macro risks related to the ongoing tariff dispute between China and the United States.

9. Duality Biotherapeutics (映恩生物) IPO: Valuation Upside at Risk

- Duality, a China-based clinical-stage biotechnology company, launched its IPO to raise up to US$200m via a Hong Kong listing.

- We look at the deal dynamics and latest developments in the biotech sector.

- The deal initially presented upside for investors but there’s a portion of its valuation now at risk due to the latest development.

10. Suzuki Motor (7269 JP): The Current Playbook

- Since the announcement of the US$1.1 billion secondary offering, Suzuki Motor (7269 JP)’s shares have remained broadly unchanged at the undisturbed price of JPY1570.5 per share (7 April).

- It is instructive to look at recent large Japanese placements to understand the potential trading pattern. Suzuki’s share performance is the joint best among recent large placements.

- However, the shares have underperformed the Nikkei 225 index (up 7.9%). The offering will likely be priced on 14 April. The average large Japanese placement tends to generate positive returns.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Minebea Mitsumi Overbids Yageo for Shibaura Electronics (6957)

- In early February, Yageo Corporation (2327 TT) made an unsolicited bid for Shibaura Electronics (6957 JP) at ¥4,300/share. They had approached in October 2024, and continued approaches through end-January.

- Shibaura’s bankers approached Minebea Mitsumi (6479 JP) in January. Due diligence, then bids. They bid ¥4,600. Not enough said the SC. Then Trump. Then ¥4,400. Now ¥4,500 accepted 9 April.

- But Trump tariffs relief came 9 April US time. And the Offer Price is below the mid-point of ALL three different financial advisors. I think this is not done yet.

2. Aussie Arbs: Trump Tariffs And MACs

- Travis Lundy succinctly summarised the Trump Tariffs in Trump Team’s Weird Tariff Math – Not Meant to Be Negotiated. Do read his note.

- From an arb standpoint, most (all?) NBIOs will likely see a downward revision in pricing. Vote risk should also be reduced.

- Such tariffs on predominantly domestic businesses should not trigger material adverse changes (MACs) Down Under. But it is still a worthwhile project to dig a little deeper.

3. HK Merger Arb: Opportunities Amidst the Market Selloff

- The gross spreads of large HK merger arb situations have increased due to the unfortunate fallout from Trump’s trade war. The HSI closed down 13.2%.

- We assess the widening spreads of HK’s merger arb situations based on offer structure, preconditions, conditions, and other factors.

- The deals, ranked in terms of increasing deal risk, are Tam Jai, Soundwill, Vesync, Goldlion, Canvest, ESR, OneConnect, HKBN, and ENN Energy.

4. 7&I (3382) – FY24 Better, FY25 OK, Surprisingly Large Buyback

- Today, Seven & I Holdings (3382 JP) reported full-year earnings. The FY2025 guidance looks OK. Not overly exciting. Optically, it falls short, but 7&i guidance includes York only for H1.

- The basic outlines of strategy in the Presentation are unchanged from the 6 March strategy report. The company seems convinced an IPO of SEI is a good thing. I’m underwhelmed.

- The company also announced that it would bring forward ¥600bn of its planned 6-year ¥2trln buyback program, and execute it this year. That’s good.

5. China ETF Inflows & Implications: Central Huijin’s Huge Buying

- Nearly US$22bn has flowed into mainland China listed ETFs over the last 3 trading days, reversing outflows that started in mid February.

- Central Huijin has announced that it will be increasing its ETF holdings to maintain smooth operation of China’s capital markets. The rest of the National Team will be buying too.

- There are multiple implications of the huge ETF creations in a short time frame and a reversal of flows will lead to a reversion in a bunch of trades.

6. Suzuki Motor (7269 JP) Placement: Limited Index Buying & Weak Markets Could Pressure Stock

- Tokio Marine & Nichido Fire Insurance and Sompo Japan Insurance are looking to offload their entire stakes in Suzuki Motor (7269 JP) by way of a secondary offering.

- With the size of the secondary offering less than 5% of the number of shares, there could be no index buying in the short-term and that will pressure the stock.

- If the overallotment option is exercised and the seller of the shares is currently considered as non-float, there could be small passive buying in the short-term.

7. Hong Kong Arbs: (Largely) Immune From Trump Tariffs

- In Aussie Arbs: Trump Tariffs And MACs, I ran a ruler over the fifteen live deals Down Under, and how they may be affected by the Trump Tariffs.

- This insight canvasses the ongoing Hong Kong arbs and wording surrounding material adverse changes (MACs). Hong Kong MACs are typically less onerous, and lack specificity, versus Aussie arbs.

- Although the framework exists for an Offeror to enforce a MAC, I’m not aware of any evidence of this occurring under Hong Kong’s Takeovers Code.

8. Korea Short Selling: Biggest Changes in Shorts & Trade Performance

- The resumption of short selling in Korea came at a good time for investors, giving them some additional tools to manage market volatility.

- Short interest has increased from 0.17% to 0.23% of market cap for the KOSPI market and from 0.46% to 0.63% for the KOSDAR market.

- The KOSPI/KOSDAQ ratio has reverted a bit on profit taking, and the forecast index deletions have recovered a bit but should continue to see increase short interest.

9. MitCorp (8058) BIG Buyback – Share Demand Will Help Weather The Storm

- On 3 April mid-day, Mitsubishi Corp (8058 JP) announced its FY25 earnings guidance and new “Shareholder Return Strategy”, a ¥1 trillion buyback, and its “Corporate Strategy 2027” Mid-Term Management Plan.

- The FY25 forecast is for a third consecutive decline in underlying operating cashflow, but a hike in dividend from ¥100 to ¥110 and a ¥1trln share buyback, including ¥230bn tender.

- The combination of dividend and buyback should be 15% of market cap over the next 12mos. And I expect Warren Buffett will consider buying dips.

10. Abacus Storage King (ASK AU) Gets an NBIO from Ki Corp & PSA

- Abacus Storage King (ASK AU) was demerged from Abacus Property Group in 2023 and the stock has traded in a range since listing.

- Now, Ki Corp and Public Storage (PSA US) have made a conditional and non-binding proposal to take Abacus Storage King (ASK AU) private at A$1.47/share.

- The offer is a 27% premium to the last close of the stock and is higher than the price that the stock has traded at since listing.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CSI 300 Index Outlook After Trump’s Threat of 50% Tariff on China

- The Shanghai Shenzhen CSI 300 Index (SHSZ300 INDEX EQUITY) was less impacted than other indices by the global sell-off: on Monday it was down only -10% from the recent top.

- On Monday Donald Trump posted that if China does not withdraw immediately its +34% tariffs increase, the United States will impose ADDITIONAL Tariffs on China of +50%, effective April 9th!

- Although the CSI 300 Index is more insulated than other indices from global market volatility, it is not completely immune and remains vulnerable to the impact of US’s tariff threats.

2. Nikkei 225 Bounce: Setting Up for Tactical Shorts

- From Monday’s gloom to Tuesday’s euphoria, the Nikkei 225 (NKY INDEX) staged one of the strongest rebounds — but tariff risks haven’t gone away. Still there.

- Here are some tactical analysis and ideas specific for the Nikkei 225 Index to prepare for the key risk ahead: another brutal sell-off.

- The targets highlighted by our models (below) come with low reversal probabilities — ranging from just 25% to 50% — this is consistent with weak market rebound dynamics.

3. NIFTY Index Rally Outlook After Trump’s Tariffs PAUSE

- The NIFTY Index (NIFTY INDEX) post-crash bounce peaked around 4.4% before stalling—mirroring the fading rebounds seen across global indices.

- The index has yet to reach levels attractive for shorting, but with two days remaining before the weekend, any positive tariff-related news will push the index towards the targets.

- This insight highlights key price levels for initiating tactical shorts or exiting longs, depending on the tariffs scenario that, once again, changed dramatically from one day to the next.

4. Global Markets: Why This Sell-Off Is Different. UPDATE

- We revisit key cross-asset signals as traditional safe havens fail to respond in familiar ways.

- The past 8 days have delivered a combination of asset moves with few, if any, historical parallels.

- With trust in U.S. safe haven assets under pressure, we explore emerging themes and ramifications.

5. The Beat Ideas: Jindal Steel & Power, A 31000Cr Mega Capex Plan

- The company is in the final stages of commissioning its INR 31,000 crore capex plan, accompanied by strong promoter buying in recent months

- The new capacity is expected to improve margins through deeper backward integration while also expanding its value-added product mix.

- With secured fuel, captive power, and value-added downstream capacity, it is poised to emerge as an infrastructure powerhouse. A steel price recovery would further amplify gains.

6. Nifty Index Options Weekly (Apr 01 – 04): Lowest Implied Vol Amid a Global Meltdown

- Nifty remains the global market with the lowest implied volatility and has been outperforming its peers in this sell off.

- We assess where Nifty is likely to open on Monday and the expected impact on implied vol and discuss whether hedging should be considered.

- We highlight the absence of a flight-to-quality bid in this global meltdown and what that could mean for relative returns vs. the SP500.

7. HSCEI Index Options Weekly (Apr 7-11): Vol Reset, Skew Reprices, and 8,000 Strike in Focus

- Brutal start to the week, with the holiday-shortened calendar and continued global weakness weighing on Monday’s open.

- Implied vol surged early, with skew steepening and tail demand reflected in out-of-the-money Put pricing

- We highlight significant activity at the 8,000 strike and its implications for near-term spot and vol dynamics.

8. Reliance’s Campa Cola Comeback: Disrupting India’s Soft Drink Market

- Reliance Industries (RIL IN) has relaunched Campa Cola with a disruptive INR 10 price tag, targeting Bharat through regional branding, aggressive retail margins, and deep distribution.

- Campa’s revival is shaking up India’s INR 50,000 crore soft drink market, challenging Pepsi and Coke with rapid share gains and frenzied rural demand.

- This is not nostalgia, it’s Ambani’s Jio-style FMCG disruption. Expect more brand revivals, deeper pricing wars, and a new cola war driven from the grassroots.

9. Fast Retailing (9983 JP) Profit Targets After Q2 Results

- Mark Chadwick highlighted Fast Retailing (9983 JP) ‘s outlook in 2 recent insights, before and after Q2 earnings: his DCF model for this stock suggests roughly a +13% upside.

- This week the stock rallied from the crash at the start of the week, closing a bit higher than the previous week (it had closed 1 week down, CC=-1).

- Assuming the stock may rally further from here, pushed by good Q2 results, let’s have a look to our model to analyze some profit targets.

10. #1 Leadership Bytes(07-Apr-25)

- Dixon Technologies India Ltd (DIXON IN), Metropolis Healthcare Limited (METROHL IN), Hitachi Energy India (POWERIND IN) have shared major updates on expansion plans, acquisitions, order growth, and strategic shifts across sectors.

- Each company is taking strategic steps to expand market share, strengthen operations, and tap into emerging growth sectors.

- These updates highlight diverse growth strategies, from Dixon’s manufacturing expansion to Apollo’s focus on defense, suggesting a balanced approach across market leaders.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Tech Hardware and Semiconductor on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Delta Taiwan Vs. Thailand Monitor: Delta Thailand Crash Closes Gap, But Still Relatively Expensive

- Delta Thailand Has Dramatically Underperformed Delta Taiwan — Delta Thailand Now Finally Trading at a Less Extreme Level vs. Delta Taiwan

- Latest Relative Growth Profiles — Delta Taiwan Has Higher Growth Profile in 2025E

- Even After the Major Pricing Reversion Since Mid-February, Delta Thailand Remains Overvalued Relative to Delta Taiwan

2. Taiwan Dual-Listings Monitor: TSMC Spread Close to Long Level; UMC & ASE Deep Discounts

- TSMC: +14.9% Premium; Spread Has Fallen Close to Long Levels

- UMC: -2.6% Discount; Good Level to Go Long the Spread

- ASE: -3.2% Discount; Spread at Extreme Low, Good Level to Go Long

3. Intel Vision: Lip Bu Tan’s First Keynote As Intel CEO

- Rather than love, than money, than fame, give me the truth

- I intend to under promise and over deliver. I will not be satisfied until we delight you

- How long will I stay at Intel? I’m here for as long as it takes

4. Intel’s Annual Shareholder Meeting Proxy Statement Has A Few Interesting Gems

- We remain steadfast in our belief in our company’s future. That said, there are no quick fixes. We need to demonstrate consistent execution and results over a sustained period. Frank Yeary

- Intel’s ELT scored themselves a remarkable 29.7 out of 35 for their 2024 “Product Leadership” goal, despite mounting data center market share loss and Gaudi being an abject failure

- While Pat Gelsinger’s departure from Intel was labelled a “retirement” last December, the Proxy Statement refers to it as a “resignation”. Which was it?

5. Taiwan Tech Weekly: TSMC Goes ‘Taiwan Speed’ in Arizona; Phison Predicts Edge AI Flash Memory Boom

- TSMC Accelerates U.S. Expansion — New Arizona Fab to Be Built at ‘Taiwan Speed’

- Phison CEO Sees Decade-Long Boom for NAND Flash as AI Shifts to the Edge

- Delta Taiwan Vs. Thailand Monitor: Delta Thailand Crash Closes Gap, But Still Relatively Expensive

6. UMC (2303.TT; UMC.US): Merges with GFS? It Should Be a Terrific, but It Won’t Be Easy to Happen.

- Both United Microelectron Sp Adr (UMC US) and GLOBALFOUNDRIES (GFS US) saw positive reactions in their stocks following a possible merger news, despite the current instability in the stock markets.

- Although GLOBALFOUNDRIES (GFS US)‘s technology is held above 7nm, it is ahead of United Microelectron Sp Adr (UMC US), which is still certain generations above China’s current technology in general.

- If these two companies wish to merge, there are still some subjective factors that need to be considered, and it will not be easy to get approval.

This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. CATL A/H Listing – Thoughts on A/H Premium

- Contemporary Amperex Technology (CATL) (300750 CH), one of the world’s largest battery solutions providers, aims to raise at least US$5bn in its H-share listing.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance in our earlier notes. In this note, we talk about its recent updates and provide our thoughts on valuations.

2. ECM Weekly (31st Mar 2025) – Xiaomi, NIO, FCT, Gigabyte, DN Sol, Nanshan Al, Zenergy, LXJ, Veeda

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, DN Solutions (298440 KS)‘s range looks a little pricey, while Eco-Shop Marketing (ECO MY) could trade ahead of its listed peers, in our view.

- On the placements front, Xiaomi Corp (1810 HK) matched BYD (1211 HK) in size, but couldn’t do so in returns.

3. Chagee Holdings (CHA US) IPO: The Bull Case

- Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$400-500 million through a Nasdaq IPO.

- According to iResearch, as of December 31, 2024, Chagee was the largest premium freshly made tea drink brand in China by the number of stores.

- The bull case rests on a strong brand, leading market share, peer-leading revenue growth, top-tier profitability and cash generation.

4. Wuxi XDC Placement – Following Biologics Playbook, past Deals Have Been Mixed

- WuXi AppTec (2359 HK) aims to raise around US$250m via selling around 3.5% stake in WuXi XDC Cayman (2268 HK).

- WuXi XDC Cayman (WXDC) is a contract research, development, and manufacturing organization (CRDMO) focused on the global antibody drug conjugates (ADC) and broader bioconjugate market providing integrated and end-to-end services.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. Chagee Holdings Limited (CHA): Peeking at the IPO Prospectus of China’s Premium Tea Brand

- As of December 31, 2024, their network comprised 6,440 teahouses, including 6,284 located in China.

- Their net revenues increased by 844% to RMB4,640.2 million in 2023 from RMB491.7 million in 2022.

- We anticipate this company to set terms (share size, price range) and debut in the second half of April.

6. Duality Biotherapeutics (映恩生物) Pre-IPO: Valuation and the Trap

- Duality Biotherapeutics, a China-based clinical-stage biotechnology company, plans to raise up to US$250m via a Hong Kong listing.

- We look at the company’s valuation based on its core products, namely DB-1303, DB-1311, and DB-1305.

- We highlight key differences between our valuation and the broker valuation guidance.

7. Clearing up FSS Review of Samsung SDI & Hanwha Aerospace: Watch for Ramped-Up Recall Pressure

- Samsung SDI’s rights offering is locked in and even accelerated. Hanwha Aerospace awaits FSS approval, but a pullback is unlikely, with no major red flags seen by regulators.

- With a four-week gap, supply pressure eases, reducing overhang concerns. This shift in dynamics impacts stock rights pricing and is key for any arb setup.

- The wider schedule gap between deals boosts lenders’ flexibility, increasing the likelihood of a stronger share recall. This makes for a solid trade setup, targeting recall-driven price action.

8. Chagee Pre-IPO – Market Leading Growth but Showing Signs of Fatigue

- Chagee Holdings (CHA US) is planning to raise up to US$500m through its upcoming US IPO.

- Chagee is a leading premium tea drinks brand, serving healthy and delicious freshly-made tea drinks.

- In this note, we look at the firm’s past performance.

9. SmartStop Self Storage (SMA): IPO for Yield Chasers, Traditional Players on the Sidelines

- According to our sources, the deal is multiple-times oversubscribed — our sources stated around 5x.

- Self-Storage was Monday’s second best performing sub-sector (+1.8%) as the overall REIT sector (+0.7%) slightly outperformed the broader market.

- While the “typical” IPO investor may not be “enthused”, the timing for this type of deal “may” be ideal for yield-chasers.

10. Maynilad Water Services Pre-IPO – The Positives – Key Infrastructure Provider

- Maynilad Water Services (MYNLD PH) (MWS) is looking to raise at least US$633m in its upcoming Philippines IPO.

- MWS is a leading global water utility player operating the largest concession by population served within a single concession area in the Philippines and Southeast Asia (SEA), as per GlobalData.

- In this note, we talk about the positive aspects of the deal.